Key Insights

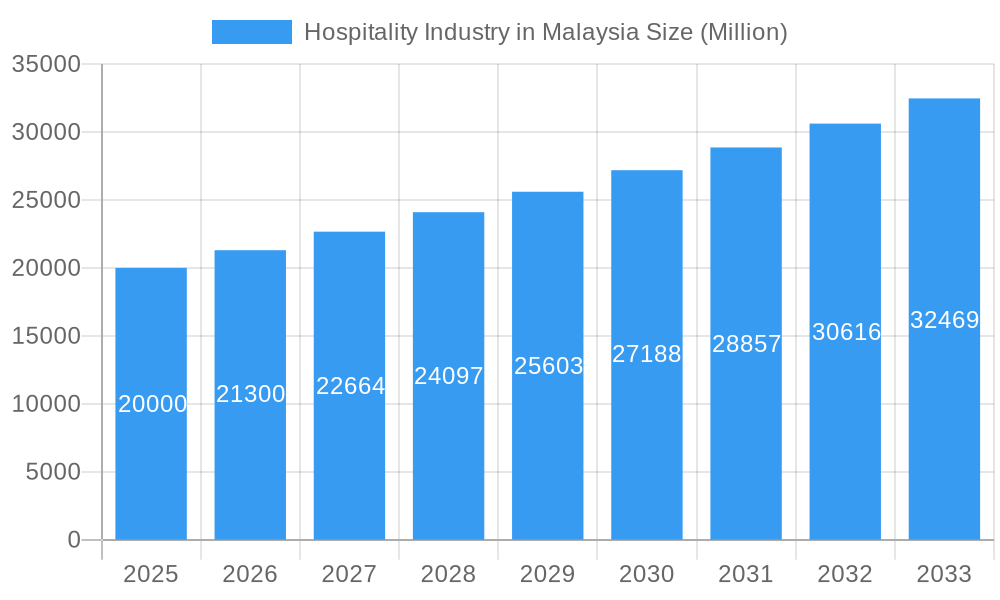

Malaysia's hospitality industry is poised for significant expansion, with an estimated market size of $1.31 billion in 2024. The sector is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.2% from 2024 to 2033. This growth is primarily propelled by Malaysia's robust tourism sector, enhanced by increasing international and domestic travel. Additionally, rising disposable incomes are stimulating domestic tourism and leisure spending. Government support for tourism infrastructure and hospitality investments further bolsters market expansion. Key market segments include hotel type (chain vs. independent) and hotel class (budget, mid-scale, luxury, and serviced apartments), with luxury and mid-scale segments anticipated to lead growth due to escalating demand for premium experiences.

Hospitality Industry in Malaysia Market Size (In Billion)

Despite a promising outlook, the industry contends with challenges. Intense competition from established international and domestic hotel chains pressures pricing and profitability. Global economic volatility and geopolitical events can affect tourist influx and investment. Emerging sustainability concerns and the adoption of eco-friendly practices are increasingly influencing consumer decisions and regulatory frameworks. Strategic investments in technology, brand differentiation, and sustainability are crucial for navigating this competitive environment, meeting evolving consumer demands, and ensuring sustained profitability.

Hospitality Industry in Malaysia Company Market Share

Hospitality Industry in Malaysia: Market Concentration, Innovation & Future Growth (2019-2033)

This comprehensive report provides a detailed analysis of the Malaysian hospitality industry, covering market dynamics, competitive landscape, key players, and future growth prospects from 2019 to 2033. The study period spans 2019-2024 (Historical Period), with 2025 as the Base Year and Estimated Year, and a Forecast Period of 2025-2033. This report is invaluable for investors, industry stakeholders, and strategic decision-makers seeking a deep understanding of this dynamic sector.

Hospitality Industry in Malaysia Market Concentration & Innovation

The Malaysian hospitality market exhibits a moderately concentrated structure, with a few large international and domestic players holding significant market share. While precise market share figures for each company are unavailable without specific data, the dominance of chains like Marriott International Inc, Accor SA, and Hilton Worldwide is evident. Smaller, independent hotels account for a substantial portion of the market, particularly in niche segments. Innovation is driven by increasing demand for unique experiences, technological advancements (e.g., online booking platforms, smart hotel technologies), and evolving consumer preferences. Regulatory frameworks, while generally supportive of tourism, influence operational costs and expansion plans. The market sees relatively low substitution, with the main alternatives being private accommodations like Airbnbs and homestays. M&A activity has been moderate, with deal values averaging xx Million in recent years (2019-2024).

- Market Concentration: Moderately concentrated, dominated by international and local chains.

- Innovation Drivers: Technological advancements, evolving consumer preferences, unique experiences.

- Regulatory Framework: Supportive of tourism, impacting operational costs.

- Product Substitutes: Private accommodations (Airbnbs, homestays).

- M&A Activity: Moderate, with average deal values of xx Million (2019-2024).

- End-User Trends: Increasing demand for personalized experiences, sustainable practices, and tech integration.

Hospitality Industry in Malaysia Industry Trends & Insights

The Malaysian hospitality industry has witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), driven primarily by robust tourism growth and increasing domestic travel. Market penetration of chain hotels remains high, particularly in urban areas. However, the growth has been uneven across segments, with the budget and economy hotel segments experiencing the highest growth due to rising affordability and an influx of budget-conscious tourists. Technological disruptions, particularly in online booking and hotel management systems, are transforming operational efficiencies and customer engagement. Consumer preferences are shifting towards personalized services, unique experiences, and sustainable tourism practices. Competitive dynamics are intense, with existing players focusing on brand differentiation, service excellence, and strategic alliances.

Dominant Markets & Segments in Hospitality Industry in Malaysia

The Kuala Lumpur region dominates the Malaysian hospitality market, driven by its status as the nation's capital, major business hub, and a significant tourist destination. Strong economic policies, developed infrastructure, and extensive air connectivity significantly contribute to this dominance.

- By Type: Chain hotels hold a larger market share compared to independent hotels, benefiting from brand recognition and established distribution networks.

- By Segment: The budget and economy hotel segment is the fastest-growing, followed by the mid-scale segment, driven by a larger middle-class population and increasing preference for affordable yet comfortable options. Luxury hotels remain a niche segment, attracting high-spending tourists. Service apartments appeal to extended-stay travelers and business professionals.

The economic policies promoting tourism, continuous infrastructure development (especially transportation and connectivity), and ongoing investments in attractions and entertainment have significantly bolstered the hospitality sector in Kuala Lumpur, making it the most dominant segment.

Hospitality Industry in Malaysia Product Developments

Recent product innovations focus on enhanced customer experiences through technology integration (e.g., mobile check-in, personalized services). Sustainable practices are gaining traction, with hotels incorporating eco-friendly designs and operations. The competitive advantage lies in providing unique experiences, personalized services, and leveraging technology for seamless operations. This includes integrating smart hotel systems, providing high-speed internet, and offering personalized digital services.

Report Scope & Segmentation Analysis

This report segments the Malaysian hospitality market by:

Type: Chain Hotels (xx Million market size in 2025, xx% CAGR 2025-2033), Independent Hotels (xx Million market size in 2025, xx% CAGR 2025-2033). Competitive dynamics are characterized by brand loyalty (chain hotels) versus unique offerings (independent hotels).

Segment: Budget and Economy Hotels (xx Million market size in 2025, xx% CAGR 2025-2033), Mid and Upper Mid-Scale Hotels (xx Million market size in 2025, xx% CAGR 2025-2033), Luxury Hotels (xx Million market size in 2025, xx% CAGR 2025-2033), Service Apartments (xx Million market size in 2025, xx% CAGR 2025-2033). Competition is fierce in each segment, driven by pricing strategies, amenities, and location.

Key Drivers of Hospitality Industry in Malaysia Growth

The Malaysian hospitality industry's growth is driven by several factors:

- Economic Growth: Rising disposable incomes and a growing middle class fuel domestic tourism.

- Government Initiatives: Tourism promotion campaigns and infrastructure development stimulate growth.

- Technological Advancements: Online booking platforms and smart hotel technologies enhance efficiency and customer experience.

Challenges in the Hospitality Industry in Malaysia Sector

Challenges include:

- Intense Competition: Pressure from both international and domestic chains.

- Labor Shortages: Difficulty in attracting and retaining skilled hospitality professionals.

- Economic Volatility: Global economic downturns can impact tourism spending. These factors negatively affect occupancy rates and revenue streams, particularly impacting smaller independent hotels.

Emerging Opportunities in Hospitality Industry in Malaysia

Emerging opportunities include:

- Sustainable Tourism: Growing demand for eco-friendly accommodations.

- Experiential Travel: Offering unique and personalized experiences to attract tourists.

- Technology Adoption: Leveraging AI and data analytics for better operational efficiency and customer service.

Leading Players in the Hospitality Industry in Malaysia Market

- Swiss-Garden International

- Sunway Hotels & Resorts

- Genting Group

- Shangri-La Hotels and Resorts

- Hilton Worldwide

- Hotel Seri Malaysia

- Tune Hotels

- Marriott International Inc

- Accor SA

- Berjaya Hotels & Resorts

Key Developments in Hospitality Industry in Malaysia Industry

- June 2022: Le Meridien Petaling Jaya opens, adding 300 rooms and enhancing the mid-scale segment.

- July 2021: Marriott International announces plans for Fairfield Kuala Lumpur and Four Points by Sheraton Desaru, increasing capacity in budget and mid-scale segments.

Strategic Outlook for Hospitality Industry in Malaysia Market

The Malaysian hospitality industry presents significant growth potential, driven by continued tourism growth, infrastructure development, and technological innovation. Focus on sustainable practices, unique experiences, and technological integration will be key to success. The industry's future hinges on adapting to evolving consumer preferences, managing operational costs, and effectively leveraging technology to enhance customer experience and operational efficiencies.

Hospitality Industry in Malaysia Segmentation

-

1. Type

- 1.1. Chain Hotels

- 1.2. Independent Hotels

-

2. Segment

- 2.1. Budget and Economy Hotels

- 2.2. Mid and Upper Mid-Scale Hotels

- 2.3. Luxury Hotels

- 2.4. Service Apartments

Hospitality Industry in Malaysia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hospitality Industry in Malaysia Regional Market Share

Geographic Coverage of Hospitality Industry in Malaysia

Hospitality Industry in Malaysia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Tourism in the United Arab Emirates Bolsters the Growth in Hospitality Sector; The Rise in the Mice Industry in the United Arab Emirates Drives the Hospitality Sector

- 3.3. Market Restrains

- 3.3.1. High Rentals in the United Arab Emirates Pose a Restraint to the Hospitality Sector

- 3.4. Market Trends

- 3.4.1. Smart Tourism in Malaysia to Offer Lucrative Growth Prospects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hospitality Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chain Hotels

- 5.1.2. Independent Hotels

- 5.2. Market Analysis, Insights and Forecast - by Segment

- 5.2.1. Budget and Economy Hotels

- 5.2.2. Mid and Upper Mid-Scale Hotels

- 5.2.3. Luxury Hotels

- 5.2.4. Service Apartments

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hospitality Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Chain Hotels

- 6.1.2. Independent Hotels

- 6.2. Market Analysis, Insights and Forecast - by Segment

- 6.2.1. Budget and Economy Hotels

- 6.2.2. Mid and Upper Mid-Scale Hotels

- 6.2.3. Luxury Hotels

- 6.2.4. Service Apartments

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Hospitality Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Chain Hotels

- 7.1.2. Independent Hotels

- 7.2. Market Analysis, Insights and Forecast - by Segment

- 7.2.1. Budget and Economy Hotels

- 7.2.2. Mid and Upper Mid-Scale Hotels

- 7.2.3. Luxury Hotels

- 7.2.4. Service Apartments

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Hospitality Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Chain Hotels

- 8.1.2. Independent Hotels

- 8.2. Market Analysis, Insights and Forecast - by Segment

- 8.2.1. Budget and Economy Hotels

- 8.2.2. Mid and Upper Mid-Scale Hotels

- 8.2.3. Luxury Hotels

- 8.2.4. Service Apartments

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Hospitality Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Chain Hotels

- 9.1.2. Independent Hotels

- 9.2. Market Analysis, Insights and Forecast - by Segment

- 9.2.1. Budget and Economy Hotels

- 9.2.2. Mid and Upper Mid-Scale Hotels

- 9.2.3. Luxury Hotels

- 9.2.4. Service Apartments

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Hospitality Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Chain Hotels

- 10.1.2. Independent Hotels

- 10.2. Market Analysis, Insights and Forecast - by Segment

- 10.2.1. Budget and Economy Hotels

- 10.2.2. Mid and Upper Mid-Scale Hotels

- 10.2.3. Luxury Hotels

- 10.2.4. Service Apartments

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Swiss - Garden International

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sunway Hotels& Resorts

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 6 COMPETITVE INTELLIGENCE6 1 Market Concentration Overview6 2 Company profiles

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Genting Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Shangri-la Hotels and Resorts

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hilton Worldwide

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hotel Seri Malaysia**List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tune Hotels

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Marriott International Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Accor SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Berjaya Hotels & Resorts

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Swiss - Garden International

List of Figures

- Figure 1: Global Hospitality Industry in Malaysia Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Hospitality Industry in Malaysia Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Hospitality Industry in Malaysia Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Hospitality Industry in Malaysia Revenue (billion), by Segment 2025 & 2033

- Figure 5: North America Hospitality Industry in Malaysia Revenue Share (%), by Segment 2025 & 2033

- Figure 6: North America Hospitality Industry in Malaysia Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Hospitality Industry in Malaysia Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Hospitality Industry in Malaysia Revenue (billion), by Type 2025 & 2033

- Figure 9: South America Hospitality Industry in Malaysia Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Hospitality Industry in Malaysia Revenue (billion), by Segment 2025 & 2033

- Figure 11: South America Hospitality Industry in Malaysia Revenue Share (%), by Segment 2025 & 2033

- Figure 12: South America Hospitality Industry in Malaysia Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Hospitality Industry in Malaysia Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Hospitality Industry in Malaysia Revenue (billion), by Type 2025 & 2033

- Figure 15: Europe Hospitality Industry in Malaysia Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Hospitality Industry in Malaysia Revenue (billion), by Segment 2025 & 2033

- Figure 17: Europe Hospitality Industry in Malaysia Revenue Share (%), by Segment 2025 & 2033

- Figure 18: Europe Hospitality Industry in Malaysia Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Hospitality Industry in Malaysia Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Hospitality Industry in Malaysia Revenue (billion), by Type 2025 & 2033

- Figure 21: Middle East & Africa Hospitality Industry in Malaysia Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa Hospitality Industry in Malaysia Revenue (billion), by Segment 2025 & 2033

- Figure 23: Middle East & Africa Hospitality Industry in Malaysia Revenue Share (%), by Segment 2025 & 2033

- Figure 24: Middle East & Africa Hospitality Industry in Malaysia Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Hospitality Industry in Malaysia Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Hospitality Industry in Malaysia Revenue (billion), by Type 2025 & 2033

- Figure 27: Asia Pacific Hospitality Industry in Malaysia Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Hospitality Industry in Malaysia Revenue (billion), by Segment 2025 & 2033

- Figure 29: Asia Pacific Hospitality Industry in Malaysia Revenue Share (%), by Segment 2025 & 2033

- Figure 30: Asia Pacific Hospitality Industry in Malaysia Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Hospitality Industry in Malaysia Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Segment 2020 & 2033

- Table 3: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Segment 2020 & 2033

- Table 6: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Segment 2020 & 2033

- Table 12: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Segment 2020 & 2033

- Table 18: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Type 2020 & 2033

- Table 29: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Segment 2020 & 2033

- Table 30: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Type 2020 & 2033

- Table 38: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Segment 2020 & 2033

- Table 39: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hospitality Industry in Malaysia?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Hospitality Industry in Malaysia?

Key companies in the market include Swiss - Garden International, Sunway Hotels& Resorts, 6 COMPETITVE INTELLIGENCE6 1 Market Concentration Overview6 2 Company profiles, Genting Group, Shangri-la Hotels and Resorts, Hilton Worldwide, Hotel Seri Malaysia**List Not Exhaustive, Tune Hotels, Marriott International Inc, Accor SA, Berjaya Hotels & Resorts.

3. What are the main segments of the Hospitality Industry in Malaysia?

The market segments include Type, Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.31 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Tourism in the United Arab Emirates Bolsters the Growth in Hospitality Sector; The Rise in the Mice Industry in the United Arab Emirates Drives the Hospitality Sector.

6. What are the notable trends driving market growth?

Smart Tourism in Malaysia to Offer Lucrative Growth Prospects.

7. Are there any restraints impacting market growth?

High Rentals in the United Arab Emirates Pose a Restraint to the Hospitality Sector.

8. Can you provide examples of recent developments in the market?

In June 2022, LE MERIDIEN Hotels & Resorts opened Le Meridien Petaling Jaya in Petaling Jaya featuring a mid-century modern design with European accents. This new hotel offers 300 stylish, modern rooms with unique dining options and exclusive hotel-guest events.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hospitality Industry in Malaysia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hospitality Industry in Malaysia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hospitality Industry in Malaysia?

To stay informed about further developments, trends, and reports in the Hospitality Industry in Malaysia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence