Key Insights

The Sri Lankan hospitality sector is projected for substantial growth, driven by a thriving tourism sector, increased foreign investment, and a growing domestic travel market. The industry is anticipated to experience a Compound Annual Growth Rate (CAGR) of 6.89%. Key growth drivers include government initiatives promoting tourism through infrastructure development and streamlined visa processes, attracting more international visitors. Rising disposable incomes and a preference for experiential travel among locals are also fueling domestic demand. The market size, estimated at 503.2 million in the base year of 2025, is expected to expand significantly with ongoing hotel developments and renovations.

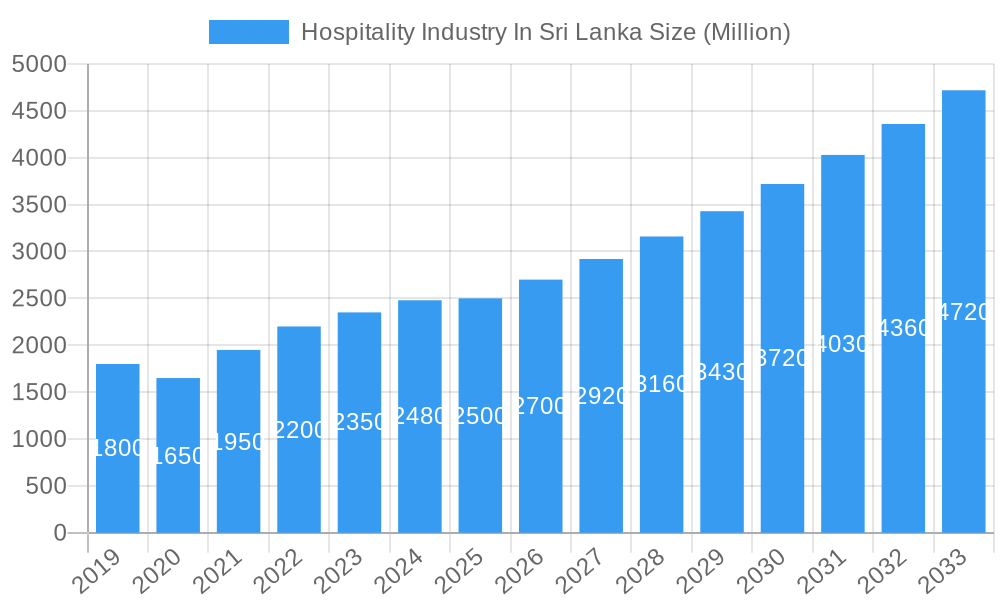

Hospitality Industry In Sri Lanka Market Size (In Million)

Emerging trends like eco-tourism, wellness retreats, and the integration of technology in guest services are shaping the industry, presenting diverse opportunities. However, potential economic volatility, global travel uncertainties, and the need for workforce upskilling pose challenges. Supply chain disruptions and climate change impacts on natural attractions also require strategic mitigation. Market segmentation reveals a dynamic landscape, with "Chain Hotels" and "Independent Hotels" maintaining dominant shares. The growth of "Service Apartments" and "Budget and Economy Hotels" indicates a diversification of offerings. "Mid and Upper-mid-scale Hotels" will continue to attract a large traveler segment, while "Luxury Hotels" will offer premium experiences and contribute significantly to market value. Leading players like Cinnamon Hotels & Resorts, Jetwing Hotels, and Marriott International Inc. are investing in innovation to capture market share and enhance the hospitality experience.

Hospitality Industry In Sri Lanka Company Market Share

This report provides an in-depth analysis of the Sri Lankan hospitality industry, covering market dynamics, growth drivers, challenges, and future potential. The analysis spans the historical period (2019–2024), the base year (2025), and a forecast period extending to 2033. It is an essential resource for understanding the evolving Sri Lankan tourism and hospitality landscape, exploring key segments, burgeoning opportunities, and identifying leading players in the Sri Lankan hotel market and Sri Lankan resort industry.

Hospitality Industry In Sri Lanka Market Concentration & Innovation

The Hospitality Industry in Sri Lanka exhibits a moderate level of market concentration. While major players like Jetwing Hotels, Cinnamon Hotels & Resorts, and Marriott International Inc. hold significant market share, a substantial portion of the market is comprised of independent hotels and boutique establishments, fostering a dynamic competitive environment. Innovation in the sector is primarily driven by the pursuit of enhanced guest experiences, sustainable tourism practices, and the adoption of digital technologies. Regulatory frameworks, while evolving, aim to promote investment and streamline operations. The threat of product substitutes, such as alternative vacation destinations and evolving travel preferences, necessitates continuous adaptation. End-user trends are increasingly focused on experiential travel, wellness tourism, and eco-friendly accommodations, pushing industry players to diversify their offerings. Mergers and acquisitions (M&A) activity, while not at peak levels, are anticipated to see an uptick as larger entities seek to expand their footprint and leverage economies of scale. Anticipated M&A deal values in the coming years are projected to reach several hundred million dollars, indicating consolidation opportunities.

Hospitality Industry In Sri Lanka Industry Trends & Insights

The Hospitality Industry in Sri Lanka is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 8% to 10% over the forecast period. This upward trajectory is underpinned by several key trends and insights. A primary growth driver is the rebound in international tourist arrivals following recent global challenges, coupled with strategic government initiatives to promote Sri Lanka as a premier tourist destination. Technological disruptions are transforming guest services, with an increasing adoption of AI-powered chatbots for customer service, contactless check-in/check-out systems, and personalized digital marketing strategies. Consumer preferences are shifting towards unique, authentic experiences, with a growing demand for cultural immersion, adventure tourism, and wellness retreats. This necessitates a move beyond traditional offerings. The competitive dynamics are intensifying, with both local and international brands vying for market share. Chain hotels are expanding their presence, while independent hotels are focusing on niche markets and personalized services to differentiate themselves. Market penetration of branded hotels is expected to increase, particularly in the mid-scale and luxury segments, as both domestic and international investment flows into the sector. The integration of technology in operational efficiency, such as revenue management systems and smart room technology, is becoming crucial for competitive advantage. The emphasis on sustainable tourism practices is no longer a niche trend but a core expectation for a growing segment of travelers, influencing hotel design, operational choices, and marketing.

Dominant Markets & Segments in Hospitality Industry In Sri Lanka

The Hospitality Industry in Sri Lanka showcases distinct dominance across various markets and segments, driven by a confluence of economic policies, infrastructure development, and evolving consumer demands.

- Luxury Hotels: This segment is a significant contributor to the industry's revenue and global perception. Prime locations in Colombo, coastal areas like Galle and Mirissa, and the cultural triangle are hotspots for luxury offerings.

- Key Drivers: High-net-worth individuals, a growing segment of international travelers seeking premium experiences, and high-end business tourism.

- Dominance Analysis: Major international brands like Shangri-La Hotels and Resorts, InterContinental Hotels & Resorts, and Anantara Hotels Resorts & Spa, alongside established local players, are investing heavily in luxury properties. These hotels offer unparalleled service, exclusive amenities, and prime locations, commanding higher Average Daily Rates (ADRs). Their dominance is further bolstered by strong marketing efforts targeting global luxury travel markets.

- Mid and Upper-mid-scale Hotels: This segment is experiencing rapid expansion, catering to a broader spectrum of travelers, including families, couples, and business travelers seeking value without compromising on quality.

- Key Drivers: Increasing disposable incomes, the growth of domestic tourism, and the accessibility offered by brands like Cinnamon Hotels & Resorts and Ramada (by Wyndham hotels & resorts).

- Dominance Analysis: This segment is characterized by a healthy mix of chain hotels and well-managed independent properties. Courtyard by Marriott Colombo's recent opening exemplifies the investment in this segment. These hotels are strategically located in both urban centers and popular tourist destinations, offering a balance of comfort, modern amenities, and competitive pricing. Their growth is vital for accommodating the increasing volume of tourists.

- Chain Hotels: The presence of global and regional hotel chains is a significant indicator of the industry's maturity and appeal to international investors.

- Key Drivers: Brand recognition, established operational standards, loyalty programs, and access to international distribution channels.

- Dominance Analysis: Brands like Marriott International Inc., Wyndham Hotels & Resorts, and IHG are actively expanding their portfolios. Their dominance lies in their ability to offer consistent quality and service across multiple properties, attracting a reliable stream of international and domestic guests. This segment is crucial for institutionalizing hospitality standards within the country.

- Independent Hotels: These establishments contribute significantly to the unique character and diversity of Sri Lanka's hospitality offering.

- Key Drivers: Niche market focus, personalized service, and unique cultural experiences.

- Dominance Analysis: While individual independent hotels may have smaller market shares, collectively they represent a substantial portion of the accommodation landscape, particularly in boutique and heritage properties. Their flexibility allows them to adapt quickly to emerging trends and cater to specific traveler interests, often providing a more authentic local experience.

Hospitality Industry In Sri Lanka Product Developments

Product development in the Hospitality Industry in Sri Lanka is increasingly focused on enhancing guest experiences through technology and sustainability. Innovations include the introduction of smart room features for personalized comfort, seamless digital check-in/check-out processes, and AI-driven concierge services. Furthermore, there's a growing emphasis on sustainable tourism products, such as eco-lodges, farm-to-table dining experiences, and carbon-neutral operations, appealing to environmentally conscious travelers. These developments aim to create a competitive advantage by offering unique, personalized, and responsible travel options that align with global trends and market demands.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Hospitality Industry in Sri Lanka across key segments.

- Chain Hotels: Forecasted to capture a significant market share, driven by international brand expansion and consistent service delivery.

- Independent Hotels: Expected to maintain a strong presence, catering to niche markets and offering unique cultural experiences, with steady growth.

- Service Apartments: Projected for robust growth, particularly in urban centers, driven by long-stay business travelers and families seeking home-like amenities.

- Budget and Economy Hotels: Poised for sustained demand from backpackers and price-sensitive travelers, with moderate expansion in strategic locations.

- Mid and Upper-mid-scale Hotels: Anticipated to be the fastest-growing segment, attracting a broad demographic with a demand for quality and value.

- Luxury Hotels: Expected to see steady growth, driven by premium leisure and business tourism, focusing on exclusive experiences and world-class service.

Key Drivers of Hospitality Industry In Sri Lanka Growth

The Hospitality Industry in Sri Lanka is propelled by several key growth drivers. The government's strategic focus on promoting tourism through favorable policies and infrastructure development, including airport upgrades and road networks, is paramount. The inherent natural beauty and rich cultural heritage of Sri Lanka act as a perennial attraction for international tourists. A growing global interest in sustainable and experiential travel further boosts the sector. Technological advancements in booking platforms and digital marketing are enhancing reach and accessibility for businesses. Moreover, a recovering global economy and increased disposable incomes among target demographics are fueling travel demand.

Challenges in the Hospitality Industry In Sri Lanka Sector

Despite its potential, the Hospitality Industry in Sri Lanka faces several challenges. Geopolitical instability and economic fluctuations in the region can deter international arrivals and impact investor confidence. Regulatory hurdles and the need for further streamlining of business processes can slow down development. Supply chain disruptions, particularly for imported goods and specialized services, can affect operational efficiency and cost management. Intense competition from established and emerging destinations globally exerts pressure on pricing and service standards. The skills gap in certain specialized areas of hospitality management also presents a challenge, necessitating investment in training and development.

Emerging Opportunities in Hospitality Industry In Sri Lanka

The Hospitality Industry in Sri Lanka is ripe with emerging opportunities. The untapped potential in niche tourism segments like wellness and medical tourism presents lucrative avenues for growth. The increasing demand for eco-tourism and community-based tourism initiatives offers a chance to develop sustainable and socially responsible ventures. Leveraging digital platforms for personalized marketing and direct bookings can reduce reliance on intermediaries and improve profit margins. Furthermore, exploring untapped regions beyond traditional tourist hotspots can diversify offerings and attract new traveler segments. The development of integrated tourism products, combining accommodation with cultural experiences, adventure activities, and culinary tours, is another significant opportunity.

Leading Players in the Hospitality Industry In Sri Lanka Market

- Jetwing Hotels

- Cinnamon Hotels & Resorts

- Amaya Resorts & Spa

- Ramada (by Wyndham hotels & resorts)

- InterContinental Hotels & Resorts

- Yoho Lanka (Pvt) Ltd

- Anatara Hotels Resorts & Spa

- Amari Galle

- Tangerine Group of Hotel

- Shangri-La Hotels and Resorts

- Mariott International Inc

Key Developments in Hospitality Industry In Sri Lanka Industry

- Apr 2023: Cinnamon Hotels & Resorts debuted at Arabian Travel Market 2023, aiming to showcase Sri Lanka's offerings to Middle Eastern and international travelers.

- Jan 2023: Courtyard by Marriott Colombo opened, a luxury hotel in Colombo featuring an outdoor swimming pool, fitness center, and a restaurant serving Chinese cuisine.

Strategic Outlook for Hospitality Industry In Sri Lanka Market

The strategic outlook for the Hospitality Industry in Sri Lanka is optimistic, focusing on capitalizing on its inherent strengths and addressing current challenges. Continued investment in infrastructure and targeted marketing campaigns are crucial for attracting a diverse range of international and domestic tourists. Embracing sustainable tourism practices will not only appeal to environmentally conscious travelers but also ensure the long-term viability of the sector. Diversifying tourism products to include niche segments like wellness, adventure, and cultural immersion will broaden the market appeal. Furthermore, fostering public-private partnerships and encouraging technological adoption will drive innovation and enhance operational efficiencies, positioning Sri Lanka for sustained growth in the global tourism landscape.

Hospitality Industry In Sri Lanka Segmentation

-

1. Type

- 1.1. Chain Hotels

- 1.2. Independent Hotels

-

2. Segment

- 2.1. Service Apartments

- 2.2. Budget and Economy Hotels

- 2.3. Mid and Upper-mid-scale Hotels

- 2.4. Luxury Hotels

Hospitality Industry In Sri Lanka Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hospitality Industry In Sri Lanka Regional Market Share

Geographic Coverage of Hospitality Industry In Sri Lanka

Hospitality Industry In Sri Lanka REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Tourism industry; Increase in the Number of Hotel Projects and Investments

- 3.3. Market Restrains

- 3.3.1. Sustainability and Competition Threaten Industry Success

- 3.4. Market Trends

- 3.4.1. Increase in the Number of SLTDA Registered Accommodation is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hospitality Industry In Sri Lanka Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chain Hotels

- 5.1.2. Independent Hotels

- 5.2. Market Analysis, Insights and Forecast - by Segment

- 5.2.1. Service Apartments

- 5.2.2. Budget and Economy Hotels

- 5.2.3. Mid and Upper-mid-scale Hotels

- 5.2.4. Luxury Hotels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hospitality Industry In Sri Lanka Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Chain Hotels

- 6.1.2. Independent Hotels

- 6.2. Market Analysis, Insights and Forecast - by Segment

- 6.2.1. Service Apartments

- 6.2.2. Budget and Economy Hotels

- 6.2.3. Mid and Upper-mid-scale Hotels

- 6.2.4. Luxury Hotels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Hospitality Industry In Sri Lanka Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Chain Hotels

- 7.1.2. Independent Hotels

- 7.2. Market Analysis, Insights and Forecast - by Segment

- 7.2.1. Service Apartments

- 7.2.2. Budget and Economy Hotels

- 7.2.3. Mid and Upper-mid-scale Hotels

- 7.2.4. Luxury Hotels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Hospitality Industry In Sri Lanka Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Chain Hotels

- 8.1.2. Independent Hotels

- 8.2. Market Analysis, Insights and Forecast - by Segment

- 8.2.1. Service Apartments

- 8.2.2. Budget and Economy Hotels

- 8.2.3. Mid and Upper-mid-scale Hotels

- 8.2.4. Luxury Hotels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Hospitality Industry In Sri Lanka Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Chain Hotels

- 9.1.2. Independent Hotels

- 9.2. Market Analysis, Insights and Forecast - by Segment

- 9.2.1. Service Apartments

- 9.2.2. Budget and Economy Hotels

- 9.2.3. Mid and Upper-mid-scale Hotels

- 9.2.4. Luxury Hotels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Hospitality Industry In Sri Lanka Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Chain Hotels

- 10.1.2. Independent Hotels

- 10.2. Market Analysis, Insights and Forecast - by Segment

- 10.2.1. Service Apartments

- 10.2.2. Budget and Economy Hotels

- 10.2.3. Mid and Upper-mid-scale Hotels

- 10.2.4. Luxury Hotels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Jetwing Hotels

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cinnamon Hotels & Resorts

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Amaya Resorts & Spa

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ramada (by Wyndham hotels & resorts)**List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 InterContinental Hotels & Resorts

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Yoho Lanka (Pvt) Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Anatara Hotels Resorts & Spa

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Amari Galle

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tangerine Group of Hotel

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Shangri-La Hotels and Resorts

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mariott International Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Jetwing Hotels

List of Figures

- Figure 1: Global Hospitality Industry In Sri Lanka Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Hospitality Industry In Sri Lanka Revenue (million), by Type 2025 & 2033

- Figure 3: North America Hospitality Industry In Sri Lanka Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Hospitality Industry In Sri Lanka Revenue (million), by Segment 2025 & 2033

- Figure 5: North America Hospitality Industry In Sri Lanka Revenue Share (%), by Segment 2025 & 2033

- Figure 6: North America Hospitality Industry In Sri Lanka Revenue (million), by Country 2025 & 2033

- Figure 7: North America Hospitality Industry In Sri Lanka Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Hospitality Industry In Sri Lanka Revenue (million), by Type 2025 & 2033

- Figure 9: South America Hospitality Industry In Sri Lanka Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Hospitality Industry In Sri Lanka Revenue (million), by Segment 2025 & 2033

- Figure 11: South America Hospitality Industry In Sri Lanka Revenue Share (%), by Segment 2025 & 2033

- Figure 12: South America Hospitality Industry In Sri Lanka Revenue (million), by Country 2025 & 2033

- Figure 13: South America Hospitality Industry In Sri Lanka Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Hospitality Industry In Sri Lanka Revenue (million), by Type 2025 & 2033

- Figure 15: Europe Hospitality Industry In Sri Lanka Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Hospitality Industry In Sri Lanka Revenue (million), by Segment 2025 & 2033

- Figure 17: Europe Hospitality Industry In Sri Lanka Revenue Share (%), by Segment 2025 & 2033

- Figure 18: Europe Hospitality Industry In Sri Lanka Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Hospitality Industry In Sri Lanka Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Hospitality Industry In Sri Lanka Revenue (million), by Type 2025 & 2033

- Figure 21: Middle East & Africa Hospitality Industry In Sri Lanka Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa Hospitality Industry In Sri Lanka Revenue (million), by Segment 2025 & 2033

- Figure 23: Middle East & Africa Hospitality Industry In Sri Lanka Revenue Share (%), by Segment 2025 & 2033

- Figure 24: Middle East & Africa Hospitality Industry In Sri Lanka Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Hospitality Industry In Sri Lanka Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Hospitality Industry In Sri Lanka Revenue (million), by Type 2025 & 2033

- Figure 27: Asia Pacific Hospitality Industry In Sri Lanka Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Hospitality Industry In Sri Lanka Revenue (million), by Segment 2025 & 2033

- Figure 29: Asia Pacific Hospitality Industry In Sri Lanka Revenue Share (%), by Segment 2025 & 2033

- Figure 30: Asia Pacific Hospitality Industry In Sri Lanka Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific Hospitality Industry In Sri Lanka Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Type 2020 & 2033

- Table 2: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Segment 2020 & 2033

- Table 3: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Type 2020 & 2033

- Table 5: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Segment 2020 & 2033

- Table 6: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Type 2020 & 2033

- Table 11: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Segment 2020 & 2033

- Table 12: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Type 2020 & 2033

- Table 17: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Segment 2020 & 2033

- Table 18: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Type 2020 & 2033

- Table 29: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Segment 2020 & 2033

- Table 30: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Type 2020 & 2033

- Table 38: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Segment 2020 & 2033

- Table 39: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Country 2020 & 2033

- Table 40: China Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hospitality Industry In Sri Lanka?

The projected CAGR is approximately 6.89%.

2. Which companies are prominent players in the Hospitality Industry In Sri Lanka?

Key companies in the market include Jetwing Hotels, Cinnamon Hotels & Resorts, Amaya Resorts & Spa, Ramada (by Wyndham hotels & resorts)**List Not Exhaustive, InterContinental Hotels & Resorts, Yoho Lanka (Pvt) Ltd, Anatara Hotels Resorts & Spa, Amari Galle, Tangerine Group of Hotel, Shangri-La Hotels and Resorts, Mariott International Inc.

3. What are the main segments of the Hospitality Industry In Sri Lanka?

The market segments include Type, Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 503.2 million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Tourism industry; Increase in the Number of Hotel Projects and Investments.

6. What are the notable trends driving market growth?

Increase in the Number of SLTDA Registered Accommodation is Driving the Market.

7. Are there any restraints impacting market growth?

Sustainability and Competition Threaten Industry Success.

8. Can you provide examples of recent developments in the market?

Apr 2023: Hailing from the idyllic shores and boundless horizon of the Indian Ocean, Cinnamon Hotels & Resorts is set to offer Middle Eastern and international travelers the best of Sri Lanka as they debut at Arabian Travel Market 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hospitality Industry In Sri Lanka," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hospitality Industry In Sri Lanka report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hospitality Industry In Sri Lanka?

To stay informed about further developments, trends, and reports in the Hospitality Industry In Sri Lanka, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence