Key Insights

The In-Mold Label (IML) market is projected for substantial expansion, driven by the escalating demand for superior, durable labeling solutions across multiple industries. With a projected Compound Annual Growth Rate (CAGR) of 3.42% from a market size of 3.8 billion in the base year 2024, through 2033, the market demonstrates robust momentum. Key growth factors include the increasing preference for visually appealing and functional packaging in the food and beverage sector, the cosmetics industry's pursuit of innovative labeling, and the pharmaceutical sector's requirement for tamper-evident and informative labels. Furthermore, the shift towards lightweight and sustainable packaging materials enhances IML adoption, offering a cost-effective and environmentally conscious alternative to conventional methods. Despite potential challenges such as raw material price volatility and the need for specialized equipment, the market outlook remains optimistic, fueled by consumer demand for convenient and attractive packaging. The food and beverage segment currently leads, followed by cosmetics and pharmaceuticals, with other end-user industries showing promising growth potential. Leading industry players are actively driving innovation and market penetration through strategic product expansion and geographical reach.

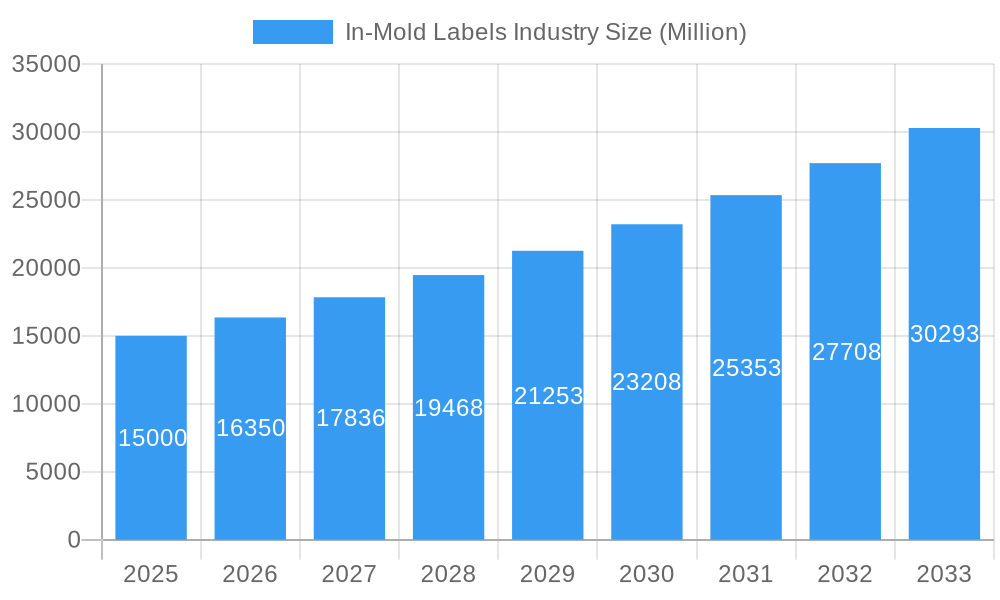

In-Mold Labels Industry Market Size (In Billion)

Geographically, the IML market aligns with global economic trends. While North America and Europe represent established markets, the Asia-Pacific region is poised for rapid growth due to increasing industrialization and rising consumer expenditure. Latin America and the Middle East & Africa offer developing market opportunities. The competitive environment features a blend of large multinational corporations and smaller regional entities, emphasizing product differentiation, technological advancements, and strategic alliances for market leadership. The forecast period (2025-2033) anticipates continued expansion, propelled by emerging technologies, sustainable practices, and evolving consumer expectations for enhanced product packaging experiences, fostering ongoing innovation in specialized IML solutions.

In-Mold Labels Industry Company Market Share

In-Mold Labels Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the In-Mold Labels (IML) industry, offering invaluable insights for stakeholders seeking to understand market dynamics, growth opportunities, and competitive landscapes. The study covers the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033. The report's findings are based on rigorous research and analysis, incorporating data from various sources and industry experts. The global IML market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

In-Mold Labels Industry Market Concentration & Innovation

The In-Mold Labels industry exhibits a moderately concentrated market structure, with several major players holding significant market share. CCL Industries, Multi-Color Corporation, and Huhtamaki Group are among the leading companies, collectively accounting for an estimated xx% of the global market in 2025. However, several smaller players and regional specialists contribute to the overall market diversity.

Market Concentration Metrics (2025 Estimates):

- Top 3 Players Market Share: xx%

- Top 5 Players Market Share: xx%

- Herfindahl-Hirschman Index (HHI): xx

Innovation Drivers:

- Advancements in IML technology, including improved printing techniques and material science.

- Growing demand for sustainable and eco-friendly IML solutions.

- Increasing adoption of automation and digital printing technologies for enhanced efficiency and customization.

Regulatory Frameworks and M&A Activities:

The industry faces various regulatory frameworks concerning material safety and environmental impact. M&A activity has been moderate, with deal values averaging xx Million in recent years. Consolidation is expected to continue as larger players seek to expand their market presence and product portfolios.

In-Mold Labels Industry Industry Trends & Insights

The In-Mold Labels market is experiencing robust growth, driven by several key factors. The increasing demand for aesthetically appealing and durable packaging across various industries is a significant catalyst. Technological advancements such as improved printing technologies, the introduction of sustainable materials, and the automation of production processes have further boosted market expansion. Consumer preferences for convenience and product information directly on the packaging also contribute significantly.

Market Growth Drivers:

- Rising demand for customized packaging solutions.

- Increased adoption of IML technology across various end-user industries.

- Growing preference for sustainable and recyclable packaging materials.

- Expansion of e-commerce and related packaging needs.

The global market for In-Mold Labels is predicted to grow at a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching a projected market size of xx Million by 2033. Market penetration within specific end-user segments, particularly in the food and beverage sector, is expected to increase substantially over the forecast period.

Dominant Markets & Segments in In-Mold Labels Industry

The North American region currently holds a significant share of the global In-Mold Labels market, driven by strong demand from the food and beverage, cosmetics, and pharmaceutical sectors. This dominance is attributed to factors such as robust economic growth, well-established manufacturing infrastructure, and high consumer spending on packaged goods.

Key Drivers of North American Dominance:

- High disposable income and consumer spending.

- Advanced packaging technology infrastructure.

- Strong demand from major end-user industries.

- Favorable regulatory environment for the use of IML technology.

Segment Analysis:

- Food & Beverage: This segment constitutes the largest share of the market due to the high volume of food and beverage products utilizing IML technology. The demand is driven by the need for high-quality, durable, and aesthetically appealing packaging for products.

- Cosmetics: The cosmetics industry is witnessing increased demand for IML solutions due to the need for attractive and durable packaging that enhances product presentation.

- Pharmaceuticals: The pharmaceutical sector relies on tamper-evident and secure packaging. IML provides a suitable solution for protecting sensitive medication, thus driving market growth in this segment.

- Other End-user Industries: Other sectors, such as household goods, industrial products, and electronics, use IML for packaging various items. This segment presents incremental opportunities for market expansion.

Europe and Asia-Pacific also show promising growth, particularly in emerging economies with developing packaging industries.

In-Mold Labels Industry Product Developments

Recent innovations in In-Mold Labels technology have focused on enhancing durability, sustainability, and aesthetics. New materials with improved barrier properties are being developed to extend shelf life and improve product protection. Advancements in printing techniques, including high-resolution digital printing, allow for greater customization and intricate designs. These innovations have increased the competitive advantages of IML over traditional labeling methods, leading to wider adoption across different industries.

Report Scope & Segmentation Analysis

This report segments the In-Mold Labels market by end-user industry: Food & Beverage, Cosmetics, Pharmaceuticals, and Other End-user Industries. Each segment exhibits different growth trajectories and competitive landscapes. The Food & Beverage segment is expected to maintain its dominance, driven by strong consumer demand and high production volumes. The Cosmetics segment demonstrates significant growth potential due to the emphasis on visually appealing and innovative packaging. Pharmaceuticals and Other End-user Industries are also exhibiting steady growth, driven by diverse applications and increasing adoption of IML technology. The report provides detailed market size estimations, growth projections, and competitive analysis for each segment.

Key Drivers of In-Mold Labels Industry Growth

Several factors contribute to the growth of the In-Mold Labels market. Technological advancements, such as the introduction of high-resolution digital printing and sustainable materials, enhance the appeal and functionality of IML labels. Economic growth, particularly in developing economies, fuels increased consumer spending on packaged goods. Furthermore, favorable regulatory frameworks that support the adoption of eco-friendly packaging further boost market expansion.

Challenges in the In-Mold Labels Industry Sector

The In-Mold Labels industry faces certain challenges, including fluctuations in raw material prices and the increasing complexity of regulatory compliance requirements. Supply chain disruptions can impact production and increase costs. Intense competition among established players and new entrants presents a challenge for maintaining profitability and market share. These factors can collectively affect the overall market growth and profitability of individual businesses.

Emerging Opportunities in In-Mold Labels Industry

The In-Mold Labels market presents several opportunities. The growing demand for sustainable and recyclable packaging creates opportunities for manufacturers to develop eco-friendly solutions. Expansion into new markets, particularly in developing economies, promises substantial growth potential. Technological advancements, such as the adoption of smart packaging and RFID integration, could further enhance the functionality and value proposition of IML labels.

Leading Players in the In-Mold Labels Industry Market

- Taghleef Industries Inc

- Inland Packaging (Inland Label and Marketing Services LLC)

- John Herrod & Associates

- Smyth Companies LLC

- Fort Dearborn Company

- CCL Industries

- Multi-Color Corporation

- Aspasie Inc

- General Press Corporation

- Huhtamaki Group *List Not Exhaustive

Key Developments in In-Mold Labels Industry Industry

- 2022 Q4: CCL Industries announced a significant investment in a new high-speed IML production facility.

- 2023 Q1: Multi-Color Corporation launched a new range of sustainable IML labels made from recycled materials.

- 2023 Q2: Huhtamaki Group acquired a smaller IML label manufacturer, expanding its market reach.

- 2024 Q1: Fort Dearborn Company introduced a new digital printing technology for enhanced IML customization. (Further specific developments need to be added based on actual data)

Strategic Outlook for In-Mold Labels Industry Market

The In-Mold Labels market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and the increasing demand for innovative packaging solutions. Opportunities exist in developing sustainable materials, expanding into new applications, and leveraging digital technologies to enhance IML label functionality. The industry is expected to witness further consolidation through mergers and acquisitions as companies strive to gain a competitive edge in the global market.

In-Mold Labels Industry Segmentation

-

1. End-User Industries

- 1.1. Food & Beverage

- 1.2. Cosmetics

- 1.3. Pharmaceuticals

- 1.4. Other End-user Industries

In-Mold Labels Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

In-Mold Labels Industry Regional Market Share

Geographic Coverage of In-Mold Labels Industry

In-Mold Labels Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Appealing and Good Asthetics; The rising Need to Withstand Temperature Fluctuations; Increased Consumption of Frozen Containerized Foods

- 3.3. Market Restrains

- 3.3.1. Tedious Mold Production Process; Interoperability Issues

- 3.4. Market Trends

- 3.4.1. Food & Beverage Industry is Expected to Hold the largest Share.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global In-Mold Labels Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User Industries

- 5.1.1. Food & Beverage

- 5.1.2. Cosmetics

- 5.1.3. Pharmaceuticals

- 5.1.4. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-User Industries

- 6. North America In-Mold Labels Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-User Industries

- 6.1.1. Food & Beverage

- 6.1.2. Cosmetics

- 6.1.3. Pharmaceuticals

- 6.1.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End-User Industries

- 7. Europe In-Mold Labels Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-User Industries

- 7.1.1. Food & Beverage

- 7.1.2. Cosmetics

- 7.1.3. Pharmaceuticals

- 7.1.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End-User Industries

- 8. Asia Pacific In-Mold Labels Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-User Industries

- 8.1.1. Food & Beverage

- 8.1.2. Cosmetics

- 8.1.3. Pharmaceuticals

- 8.1.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End-User Industries

- 9. Latin America In-Mold Labels Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-User Industries

- 9.1.1. Food & Beverage

- 9.1.2. Cosmetics

- 9.1.3. Pharmaceuticals

- 9.1.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End-User Industries

- 10. Middle East and Africa In-Mold Labels Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-User Industries

- 10.1.1. Food & Beverage

- 10.1.2. Cosmetics

- 10.1.3. Pharmaceuticals

- 10.1.4. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by End-User Industries

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Taghleef Industries Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Inland Packaging (Inland Label and Marketing Services LLC)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 John Herrod & Associates

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Smyth Companies LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fort Dearborn Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CCL Industries

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Multi-Color Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aspasie Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 General Press Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Huhtamaki Group*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Taghleef Industries Inc

List of Figures

- Figure 1: Global In-Mold Labels Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America In-Mold Labels Industry Revenue (billion), by End-User Industries 2025 & 2033

- Figure 3: North America In-Mold Labels Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 4: North America In-Mold Labels Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America In-Mold Labels Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe In-Mold Labels Industry Revenue (billion), by End-User Industries 2025 & 2033

- Figure 7: Europe In-Mold Labels Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 8: Europe In-Mold Labels Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe In-Mold Labels Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific In-Mold Labels Industry Revenue (billion), by End-User Industries 2025 & 2033

- Figure 11: Asia Pacific In-Mold Labels Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 12: Asia Pacific In-Mold Labels Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific In-Mold Labels Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America In-Mold Labels Industry Revenue (billion), by End-User Industries 2025 & 2033

- Figure 15: Latin America In-Mold Labels Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 16: Latin America In-Mold Labels Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America In-Mold Labels Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa In-Mold Labels Industry Revenue (billion), by End-User Industries 2025 & 2033

- Figure 19: Middle East and Africa In-Mold Labels Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 20: Middle East and Africa In-Mold Labels Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa In-Mold Labels Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global In-Mold Labels Industry Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 2: Global In-Mold Labels Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global In-Mold Labels Industry Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 4: Global In-Mold Labels Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global In-Mold Labels Industry Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 6: Global In-Mold Labels Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global In-Mold Labels Industry Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 8: Global In-Mold Labels Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global In-Mold Labels Industry Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 10: Global In-Mold Labels Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global In-Mold Labels Industry Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 12: Global In-Mold Labels Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the In-Mold Labels Industry?

The projected CAGR is approximately 3.42%.

2. Which companies are prominent players in the In-Mold Labels Industry?

Key companies in the market include Taghleef Industries Inc, Inland Packaging (Inland Label and Marketing Services LLC), John Herrod & Associates, Smyth Companies LLC, Fort Dearborn Company, CCL Industries, Multi-Color Corporation, Aspasie Inc, General Press Corporation, Huhtamaki Group*List Not Exhaustive.

3. What are the main segments of the In-Mold Labels Industry?

The market segments include End-User Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Appealing and Good Asthetics; The rising Need to Withstand Temperature Fluctuations; Increased Consumption of Frozen Containerized Foods.

6. What are the notable trends driving market growth?

Food & Beverage Industry is Expected to Hold the largest Share..

7. Are there any restraints impacting market growth?

Tedious Mold Production Process; Interoperability Issues.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "In-Mold Labels Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the In-Mold Labels Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the In-Mold Labels Industry?

To stay informed about further developments, trends, and reports in the In-Mold Labels Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence