Key Insights

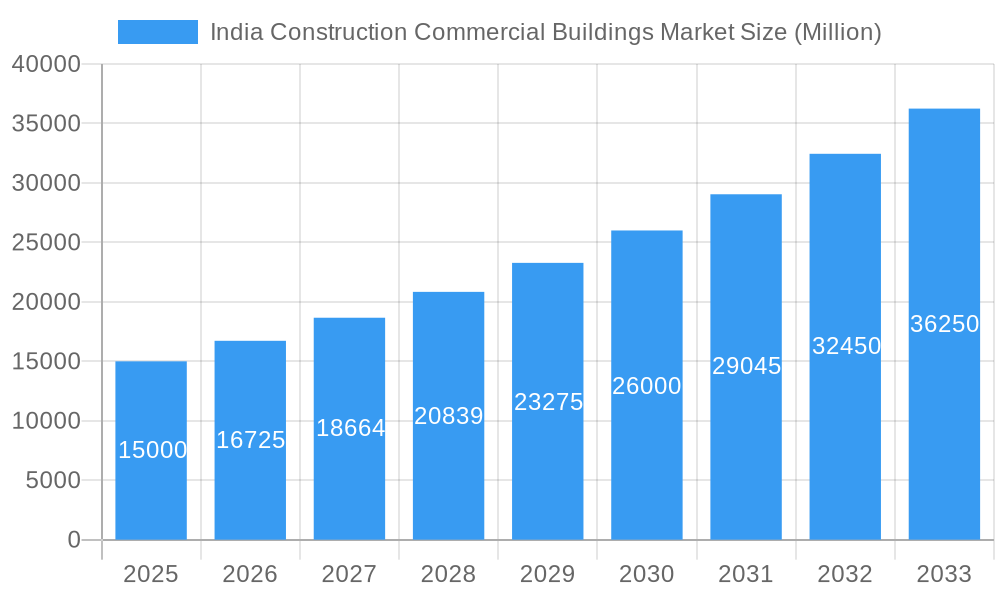

India's Commercial Building Construction Market is set for significant expansion, projected between 2025 and 2033. Driven by a robust Compound Annual Growth Rate (CAGR) of 12.1%, this growth is fueled by increasing urbanization, a rising middle class, and the expansion of the IT and BPO sectors, creating demand for modern commercial spaces. Government initiatives for infrastructure and smart cities further bolster this positive trajectory. Key market segments include office, retail, and hospitality construction. The market size was estimated at 13891.51 million in the base year 2023, with further substantial growth anticipated. Major competitors like Punjab Chemi Plants Limited, DLF Ltd, and Omaxe Ltd are driving innovation and competitive pricing.

India Construction Commercial Buildings Market Market Size (In Billion)

Despite growth potential, challenges such as land acquisition complexities, regulatory hurdles, and material cost fluctuations may pose restraints. However, India's economic growth and sustained demand for commercial infrastructure present a positive long-term outlook. Developers adopting sustainable building practices and addressing environmental concerns will be crucial. Market consolidation is expected as larger players expand portfolios, intensifying competition.

India Construction Commercial Buildings Market Company Market Share

This comprehensive report analyzes the India Commercial Building Construction Market from 2019 to 2033, focusing on 2025. It offers critical insights into market dynamics, growth drivers, challenges, and emerging opportunities for investors and stakeholders.

India Construction Commercial Buildings Market Concentration & Innovation

The Indian commercial construction market exhibits a moderately concentrated landscape, with a few large players holding significant market share. The top 10 players account for approximately xx% of the market, as of 2025. However, a significant number of smaller firms also participate, particularly in regional markets. Innovation is driven by the need to improve efficiency, sustainability, and cost-effectiveness. This is reflected in the adoption of prefabricated construction methods, Building Information Modeling (BIM) technology, and smart building solutions. Regulatory frameworks, such as building codes and environmental regulations, significantly influence construction practices. The market witnesses considerable M&A activity, with deal values exceeding xx Million in 2024. Product substitutes, such as repurposing existing structures, are gaining traction, especially in urban areas. End-user trends indicate a growing preference for sustainable and energy-efficient buildings.

- Market Concentration: Top 10 players hold xx% market share (2025).

- M&A Activity: Deal values exceeded xx Million in 2024.

- Innovation Drivers: Prefabrication, BIM, smart building technologies, sustainable materials.

- Regulatory Influence: Building codes, environmental regulations.

- Product Substitutes: Repurposing existing buildings.

India Construction Commercial Buildings Market Industry Trends & Insights

The India Construction Commercial Buildings Market is experiencing robust growth, driven by rapid urbanization, rising disposable incomes, and increasing demand for commercial spaces. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%. Technological disruptions, such as the adoption of 3D printing and automation, are enhancing efficiency and productivity. Consumer preferences are shifting toward sustainable and technologically advanced buildings, pushing developers to incorporate green building certifications and smart building features. Competitive dynamics are intense, with firms competing on cost, quality, speed, and innovation. Market penetration of sustainable building materials is steadily increasing, estimated at xx% in 2025.

Dominant Markets & Segments in India Construction Commercial Buildings Market

The Office Building Construction segment is currently the dominant sector within the India Construction Commercial Buildings Market, capturing the largest market share. This is driven by the burgeoning IT sector, expanding businesses, and increasing demand for co-working spaces. However, the Retail and Hospitality Construction segments are also experiencing significant growth, fueled by rising consumer spending and tourism.

- Office Building Construction:

- Key Drivers: IT sector growth, expanding businesses, co-working spaces.

- Market share: xx% (2025)

- Retail Construction:

- Key Drivers: Rising consumer spending, growth of e-commerce, increased mall development.

- Market share: xx% (2025)

- Hospitality Construction:

- Key Drivers: Growth of tourism, increasing business travel, demand for luxury hotels.

- Market share: xx% (2025)

- Institutional Construction:

- Key Drivers: Government spending on infrastructure, growing education sector.

- Market share: xx% (2025)

- Others:

- Key Drivers: Diversified demand for specialized commercial spaces

- Market share: xx% (2025)

The major regions driving this growth are the major metropolitan areas including Mumbai, Delhi-NCR, Bengaluru, and Hyderabad, due to their robust economies and favorable regulatory environments.

India Construction Commercial Buildings Market Product Developments

Recent product developments focus on incorporating sustainable materials, enhancing energy efficiency, and integrating smart building technologies. This includes the use of prefabricated components, modular construction, and the implementation of IoT-enabled systems for building management. Competitive advantages are being gained through superior design, construction speed, cost optimization, and sustainable practices.

Report Scope & Segmentation Analysis

This report segments the India Construction Commercial Buildings Market by end-use: Office Building Construction, Retail Construction, Hospitality Construction, Institutional Construction, and Others. Each segment’s growth projections, market size (in Million), and competitive dynamics are analyzed in detail. Office Building Construction is the largest segment, followed by Retail Construction, with significant growth potential predicted for all segments.

Key Drivers of India Construction Commercial Buildings Market Growth

The market's growth is propelled by several factors. Rapid urbanization and rising population density are creating a huge demand for commercial spaces. The growth of the IT and ITeS sectors is fueling demand for office spaces. Government initiatives promoting infrastructure development and smart cities are creating favorable conditions for market expansion. Moreover, increasing foreign direct investment (FDI) is contributing significantly to market growth.

Challenges in the India Construction Commercial Buildings Market Sector

The sector faces challenges including land acquisition issues, complex regulatory approvals, fluctuating material prices, and skilled labor shortages. These constraints contribute to project delays and increased costs. Competition among developers also puts downward pressure on margins. The impact of these challenges is estimated to reduce the market growth by approximately xx% annually.

Emerging Opportunities in India Construction Commercial Buildings Market

Emerging opportunities include the adoption of green building practices, the integration of smart technologies, and the growth of the co-working and flex-office spaces. Demand for sustainable, energy-efficient, and technologically advanced buildings presents significant opportunities for innovation and growth. The development of specialized commercial spaces such as data centers and healthcare facilities is also creating new avenues.

Leading Players in the India Construction Commercial Buildings Market Market

- Punjab Chemi Plants Limited (PCP International Ltd)

- Delhi Land And Finance Limited (DLF Ltd)

- Omaxe Ltd

- Unitech Group

- Oberoi Reality Ltd

- B L Kashyap and Sons Limited (BLK Ltd)

- NBCC Limited

- Sobha Limited

- Bharti Realty Ltd

- Prestige Group

Key Developments in India Construction Commercial Buildings Market Industry

- Jan 2023: DLF Ltd announced a major expansion project in Gurugram.

- May 2024: New building codes were implemented across multiple states.

- Oct 2024: A significant merger occurred between two mid-sized construction companies.

Strategic Outlook for India Construction Commercial Buildings Market Market

The future of the India Construction Commercial Buildings Market is promising, with sustained growth projected for the foreseeable future. The increasing focus on sustainable practices and technological advancements will shape the market's trajectory. Strategic partnerships, technological integration, and efficient project management will be crucial for success. The market is well-positioned to capitalize on the ongoing economic growth and urbanization within India.

India Construction Commercial Buildings Market Segmentation

-

1. End Use

- 1.1. Office Building Construction

- 1.2. Retail Construction

- 1.3. Hospitality Construction

- 1.4. Institutional Construction

- 1.5. Others

India Construction Commercial Buildings Market Segmentation By Geography

- 1. India

India Construction Commercial Buildings Market Regional Market Share

Geographic Coverage of India Construction Commercial Buildings Market

India Construction Commercial Buildings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives Promoting Affordable Housing; Economic Growth and Rising Disposable Incomes

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Labor; Fluctuating Construction Materials Costs

- 3.4. Market Trends

- 3.4.1. Growth in Commercial Space Market unaffected

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Construction Commercial Buildings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End Use

- 5.1.1. Office Building Construction

- 5.1.2. Retail Construction

- 5.1.3. Hospitality Construction

- 5.1.4. Institutional Construction

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by End Use

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Punjab Chemi Plants Limited (PCP International Ltd)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Delhi Land And Finance Limited (DLF Ltd )

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Omaxe Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Unitech Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Oberoi Reality Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 B L Kashyap and Sons Limited (BLK Ltd )

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NBCC Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sobha Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bharti Realty Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Prestige Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Punjab Chemi Plants Limited (PCP International Ltd)

List of Figures

- Figure 1: India Construction Commercial Buildings Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Construction Commercial Buildings Market Share (%) by Company 2025

List of Tables

- Table 1: India Construction Commercial Buildings Market Revenue million Forecast, by End Use 2020 & 2033

- Table 2: India Construction Commercial Buildings Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: India Construction Commercial Buildings Market Revenue million Forecast, by End Use 2020 & 2033

- Table 4: India Construction Commercial Buildings Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Construction Commercial Buildings Market?

The projected CAGR is approximately 12.1%.

2. Which companies are prominent players in the India Construction Commercial Buildings Market?

Key companies in the market include Punjab Chemi Plants Limited (PCP International Ltd), Delhi Land And Finance Limited (DLF Ltd ), Omaxe Ltd, Unitech Group, Oberoi Reality Ltd, B L Kashyap and Sons Limited (BLK Ltd ), NBCC Limited, Sobha Limited, Bharti Realty Ltd, Prestige Group.

3. What are the main segments of the India Construction Commercial Buildings Market?

The market segments include End Use.

4. Can you provide details about the market size?

The market size is estimated to be USD 13891.51 million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives Promoting Affordable Housing; Economic Growth and Rising Disposable Incomes.

6. What are the notable trends driving market growth?

Growth in Commercial Space Market unaffected.

7. Are there any restraints impacting market growth?

Shortage of Skilled Labor; Fluctuating Construction Materials Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Construction Commercial Buildings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Construction Commercial Buildings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Construction Commercial Buildings Market?

To stay informed about further developments, trends, and reports in the India Construction Commercial Buildings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence