Key Insights

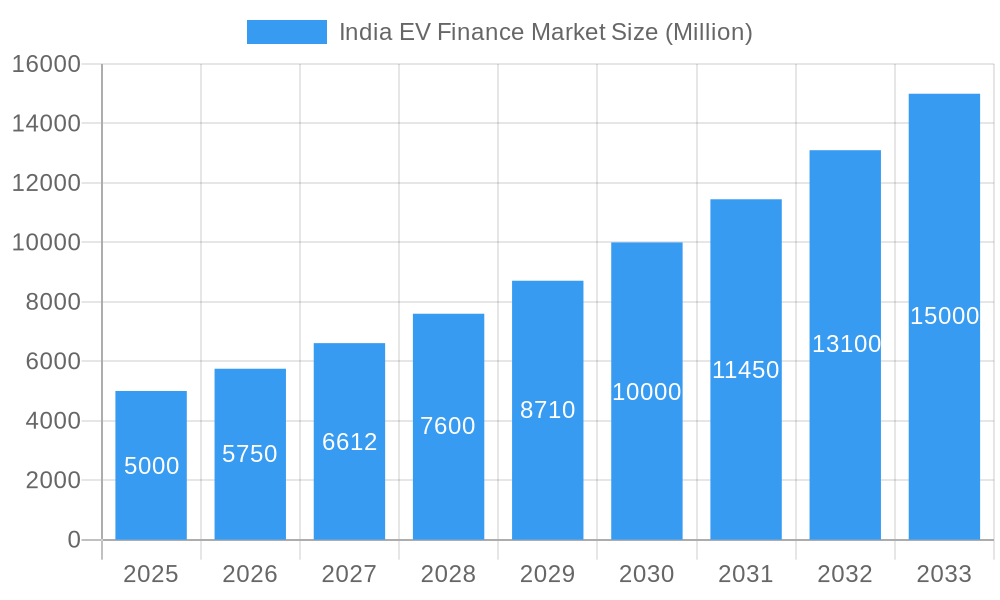

India's Electric Vehicle (EV) finance market is poised for substantial expansion, driven by escalating EV adoption and robust government support. With an estimated current market size of $2.37 billion and a projected Compound Annual Growth Rate (CAGR) of 15.4% from 2025 to 2033, this sector represents a prime investment avenue. Key growth catalysts include government initiatives like subsidies and infrastructure development, rising fuel costs, and heightened environmental consciousness among consumers. The market is diversified by vehicle type (passenger cars, commercial vehicles, two-wheelers, three-wheelers), financing source (OEMs, banks, credit unions, financial institutions), and vehicle condition (new and used). Leading financial institutions such as State Bank of India, ICICI Bank, Union Bank of India, Poonawalla Fincorp, and Shriram Transport Finance Company are actively shaping the competitive landscape by offering compelling financing solutions. Regional growth disparities are anticipated, with areas exhibiting higher EV adoption rates likely to lead expansion. Nevertheless, challenges persist, including the higher initial cost of EVs, insufficient charging infrastructure in select regions, and the necessity for specialized financial products aligning with EV lifecycles and technology. The market's future trajectory will be contingent upon sustained government incentives, infrastructure enhancements, and advancements in battery and charging technologies.

India EV Finance Market Market Size (In Billion)

The accelerated growth in India's EV finance market is predominantly fueled by the surge in demand for electric two-wheelers and passenger cars, segments anticipated to lead throughout the forecast period. The increasing availability of varied financing options from banks, Non-Banking Financial Companies (NBFCs), and OEMs is further propelling this expansion. While significant opportunities exist, critical considerations involve managing risks associated with nascent technologies and upholding responsible lending practices to ensure sustainable market development. The growth of the used EV finance segment is also expected to contribute significantly to the market's evolving dynamics.

India EV Finance Market Company Market Share

India EV Finance Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the burgeoning India EV Finance Market, encompassing market size, segmentation, key players, industry trends, and future growth prospects. The report covers the period from 2019 to 2033, with a focus on the estimated year 2025 and a forecast period extending to 2033. This in-depth analysis is crucial for stakeholders including investors, financial institutions, OEMs, and EV manufacturers seeking to capitalize on the rapidly expanding Indian electric vehicle market.

India EV Finance Market Market Concentration & Innovation

This section analyzes the competitive landscape of the India EV Finance Market, focusing on market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. The market exhibits a moderately concentrated structure, with key players like State Bank of India, ICICI Bank, and Axis Bank holding significant market share. However, the increasing participation of non-bank financial companies (NBFCs) like Poonawalla Fincorp and Shriram Transport Finance is intensifying competition.

Market Share (Estimated 2025):

- State Bank of India: 25%

- ICICI Bank: 18%

- Axis Bank: 15%

- Others: 42%

Innovation Drivers: The market is driven by technological advancements in battery technology, charging infrastructure, and EV financing products. Government initiatives promoting EV adoption and favorable regulatory frameworks further fuel innovation.

Regulatory Frameworks: The Indian government's focus on electric mobility through various subsidies and policies has created a conducive environment for market growth. However, evolving regulatory changes pose both opportunities and challenges for market players.

Product Substitutes: While EVs are gaining traction, internal combustion engine (ICE) vehicles remain a significant substitute, influencing financing choices.

End-User Trends: Rising consumer awareness of environmental concerns and government incentives are boosting demand for EVs, driving growth in the finance sector.

M&A Activities: The past five years have witnessed several strategic partnerships and collaborations between banks, NBFCs, and OEMs. While precise M&A deal values are not publicly available for all transactions, the total value of such deals is estimated at approximately xx Million in the last five years. These activities are reshaping the competitive landscape.

India EV Finance Market Industry Trends & Insights

The India EV Finance Market is experiencing robust growth, driven by increasing EV adoption, supportive government policies, and improving charging infrastructure. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%, propelled by factors like:

- Government Incentives: Subsidies and tax benefits for EV purchases significantly reduce upfront costs, making them more accessible to consumers.

- Technological Advancements: Improvements in battery technology, range, and charging infrastructure are increasing EV appeal.

- Rising Fuel Prices: The increasing cost of petrol and diesel fuels makes EVs a more economically viable option.

- Environmental Concerns: Growing awareness of environmental pollution and climate change are driving consumer preference towards cleaner transportation.

- Urbanization: The rapid urbanization in India fuels the demand for efficient and sustainable transportation solutions.

Market penetration of EVs is still relatively low compared to ICE vehicles, but it is expected to increase significantly by 2033, reaching an estimated xx% market share. This surge will drive substantial growth in the EV finance sector. The competitive landscape is characterized by both traditional banks and emerging fintech players vying for market share through innovative financing schemes and customer-centric services.

Dominant Markets & Segments in India EV Finance Market

Dominant Segments:

- By Type: The new vehicle segment dominates the market, accounting for xx% of the total market value in 2025. The used EV market is still nascent but shows significant growth potential.

- By Source Type: Banks currently hold the largest market share in EV financing, followed by OEMs and NBFCs. The contribution of credit unions and other financial institutions remains relatively small but is anticipated to grow.

- By Vehicle Type: Two-wheelers are the dominant segment, owing to their affordability and widespread use. Passenger cars and commercial vehicles are also experiencing significant growth, particularly in urban areas. The three-wheeler segment, largely driven by commercial applications, presents a growing opportunity.

Key Drivers:

- Economic Policies: Government incentives and subsidies are key drivers for all segments.

- Infrastructure: Expanding charging infrastructure is crucial, particularly for passenger cars and commercial vehicles.

- Technological Advancements: Battery technology improvements are driving down costs and increasing range, impacting all segments.

- Consumer Preferences: Growing environmental consciousness, especially among urban populations, favors two-wheelers and passenger cars.

India EV Finance Market Product Developments

The EV finance market is witnessing continuous product innovation, with lenders offering customized financing plans, including leasing, hire-purchase, and loans tailored to different EV types. Financial institutions are also integrating technological advancements to streamline the lending process, leveraging digital platforms and data analytics for improved risk assessment and customer experience. The integration of AI and machine learning is transforming credit scoring and fraud detection in EV financing, driving efficiency and enhancing risk management. These innovations aim to cater to diverse customer needs and stimulate wider EV adoption.

Report Scope & Segmentation Analysis

By Type: The report segments the market into New Vehicles and Used Vehicles. Growth is primarily driven by the new vehicle segment, with used vehicles expected to show faster growth in the coming years. Competitive dynamics are characterized by banks and NBFCs vying for market share.

By Source Type: The report segments the market by source type including OEMs, Banks, Credit Unions, and Financial Institutions. Banks currently dominate, but OEM financing is gaining traction. Credit Unions and other financial institutions hold smaller market shares but offer potential for growth.

By Vehicle Type: The market is further segmented into Passenger Cars, Commercial Vehicles, Two-Wheelers, and Three-Wheelers. Two-wheelers dominate due to affordability, while passenger car and commercial vehicle segments are growing rapidly. Three-wheelers are an increasingly important niche.

Key Drivers of India EV Finance Market Growth

The growth of the India EV Finance Market is fueled by a confluence of factors. Government initiatives such as the Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles (FAME) scheme are providing strong impetus. The declining cost of batteries and technological advancements are making EVs increasingly affordable and attractive. Furthermore, rising fuel prices and growing environmental concerns are encouraging consumer adoption of electric vehicles, thereby driving demand for related financing solutions.

Challenges in the India EV Finance Market Sector

Several challenges hinder the growth of the India EV Finance Market. These include the high upfront cost of EVs, limited awareness among consumers about available financing options, and the nascent stage of development of the used EV market. Furthermore, concerns about battery lifespan and charging infrastructure availability may influence customer adoption rates. Finally, potential regulatory hurdles and evolving lending norms present ongoing challenges for financial institutions.

Emerging Opportunities in India EV Finance Market

The India EV Finance Market presents numerous opportunities. The burgeoning used EV market is expected to see significant growth, creating new avenues for financing solutions. The expansion of charging infrastructure will further accelerate EV adoption. Moreover, innovative financing models like battery leasing and subscription services could increase EV accessibility. Finally, partnerships between financial institutions and OEMs are creating synergistic opportunities to drive market growth.

Leading Players in the India EV Finance Market Market

- Union Bank of India

- Karur Vysya Bank

- ICICI Bank

- Tata Motors

- State Bank of India

- Axis Bank

- Poonawalla Fincorp Limited (Formerly Magma Fincorp Limited)

- IDFC FIRST Bank

- Shriram Transport Finance Company (STFC)

Key Developments in India EV Finance Market Industry

- June 2022: Ather Energy partnered with State Bank of India to offer financing options for electric two-wheelers.

- August 2022: Tata Motors and State Bank of India launched an Electronic Dealer Finance solution (e-DFS) for Tata EV dealers.

- October 2022: BYD India and ICICI Bank signed an MOU to offer financing solutions to BYD dealers and customers.

- November 2022: Shriram Transport Finance Company partnered with Euler Motors to finance electric three-wheeler cargo vehicles.

Strategic Outlook for India EV Finance Market Market

The India EV Finance Market is poised for significant growth, driven by continued government support, technological advancements, and increasing consumer preference for sustainable transportation. The expansion of the used EV market and the emergence of innovative financing models will further accelerate market expansion. The strategic partnerships between financial institutions and OEMs will play a crucial role in shaping the future landscape, creating a dynamic and rapidly evolving market brimming with opportunities.

India EV Finance Market Segmentation

-

1. Type

- 1.1. New Vehicles

- 1.2. Used Vehicles

-

2. Source Type

- 2.1. OEMs

- 2.2. Banks

- 2.3. Credit Unions

- 2.4. Financial Institutions

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

- 3.3. Two-Wheelers

- 3.4. Three-Wheelers

India EV Finance Market Segmentation By Geography

- 1. India

India EV Finance Market Regional Market Share

Geographic Coverage of India EV Finance Market

India EV Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of 2-wheelers across the Globe

- 3.3. Market Restrains

- 3.3.1. Rise in demand of Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Rising Penetration of Electric Vehicles in India to Spur Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India EV Finance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. New Vehicles

- 5.1.2. Used Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Source Type

- 5.2.1. OEMs

- 5.2.2. Banks

- 5.2.3. Credit Unions

- 5.2.4. Financial Institutions

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.3.3. Two-Wheelers

- 5.3.4. Three-Wheelers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Union Bank of India

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Karur Vysya Ban

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ICICI Bank

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tata Motors

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 State Bank of India

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Axis Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Poonawalla Fincorp Limited (Formerly Magma Fincorp Limited)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IDFC FIRST Bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shriram Transport Finance Company (STFC)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Union Bank of India

List of Figures

- Figure 1: India EV Finance Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India EV Finance Market Share (%) by Company 2025

List of Tables

- Table 1: India EV Finance Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: India EV Finance Market Revenue billion Forecast, by Source Type 2020 & 2033

- Table 3: India EV Finance Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: India EV Finance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: India EV Finance Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: India EV Finance Market Revenue billion Forecast, by Source Type 2020 & 2033

- Table 7: India EV Finance Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 8: India EV Finance Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India EV Finance Market?

The projected CAGR is approximately 15.4%.

2. Which companies are prominent players in the India EV Finance Market?

Key companies in the market include Union Bank of India, Karur Vysya Ban, ICICI Bank, Tata Motors, State Bank of India, Axis Bank, Poonawalla Fincorp Limited (Formerly Magma Fincorp Limited), IDFC FIRST Bank, Shriram Transport Finance Company (STFC).

3. What are the main segments of the India EV Finance Market?

The market segments include Type, Source Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.37 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of 2-wheelers across the Globe.

6. What are the notable trends driving market growth?

Rising Penetration of Electric Vehicles in India to Spur Market Growth.

7. Are there any restraints impacting market growth?

Rise in demand of Electric Vehicles.

8. Can you provide examples of recent developments in the market?

November 2022: Shriram Transport Finance Co. (STFC) tied up with Euler Motors (Euler) to finance electric 3-wheeler cargo vehicles for last-mile logistics solutions. The partnership is in line with the objective of a green and sustainable future that Shriram embarked upon in 2022. STFC has witnessed the rising demand for e-commerce and logistics-related vehicles and the rising need for their financing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India EV Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India EV Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India EV Finance Market?

To stay informed about further developments, trends, and reports in the India EV Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence