Key Insights

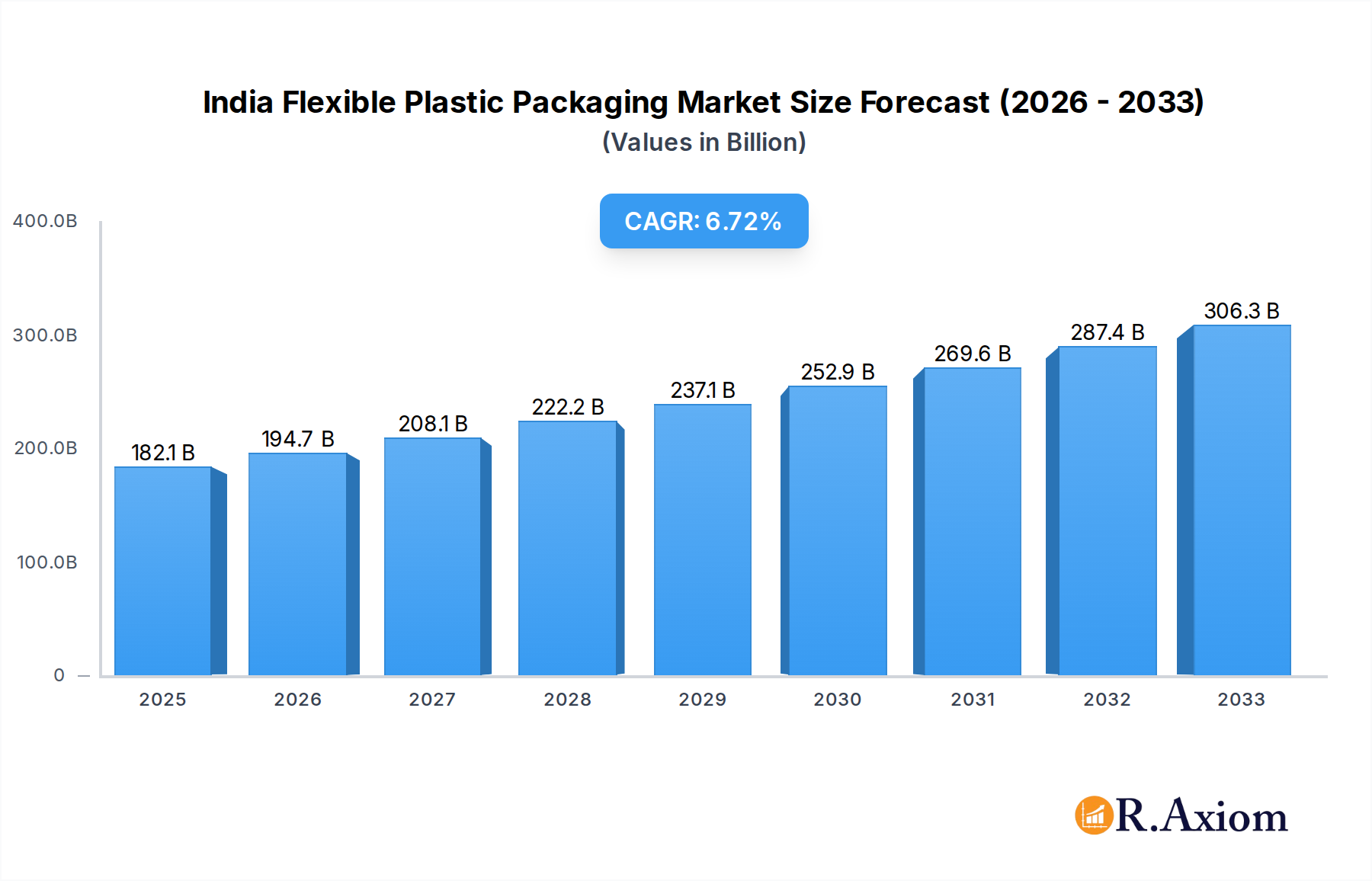

The Indian flexible plastic packaging market is poised for robust expansion, driven by escalating consumer demand, a burgeoning middle class, and increasing urbanization. With a projected market size of USD 182.07 billion in 2025 and an impressive CAGR of 6.9%, the sector is set to witness significant growth throughout the forecast period (2025-2033). Key drivers fueling this surge include the expanding food and beverage industry, the growing need for efficient and safe medical and pharmaceutical packaging, and the rising popularity of personal care and household products. The convenience, cost-effectiveness, and superior barrier properties of flexible plastic packaging make it the preferred choice across these diverse end-user segments. Material types like Polyethene (PE) and Bi-oriented Polypropylene (BOPP) are expected to dominate due to their versatility and cost-efficiency, while product types such as pouches and films and wraps will continue to lead in terms of adoption.

India Flexible Plastic Packaging Market Market Size (In Billion)

The market's growth trajectory is further supported by supportive government initiatives promoting manufacturing and consumption, alongside technological advancements in packaging solutions offering enhanced shelf-life, portability, and aesthetic appeal. While challenges such as increasing environmental concerns and regulatory pressures regarding plastic waste persist, ongoing innovation in biodegradable and recyclable materials, coupled with evolving consumer preferences for sustainable packaging, presents a significant opportunity for market players. The competitive landscape is characterized by the presence of major global and domestic players like Amcor Plc, Berry Global Inc, and Uflex Limited, who are actively investing in expanding their production capacities and product portfolios to cater to the dynamic Indian market. The Indian market is expected to be a significant contributor to the overall growth of the flexible plastic packaging industry.

India Flexible Plastic Packaging Market Company Market Share

This comprehensive report offers an in-depth analysis of the India Flexible Plastic Packaging Market, a dynamic sector poised for significant growth driven by evolving consumer demands, technological advancements, and a burgeoning economy. Covering the period from 2019 to 2033, with a base year of 2025, this research provides critical insights into market dynamics, segmentation, key players, and future trends. We explore the market's trajectory, focusing on material types, product categories, and end-user industries, offering actionable intelligence for stakeholders seeking to capitalize on opportunities within this vital market.

India Flexible Plastic Packaging Market Market Concentration & Innovation

The India Flexible Plastic Packaging Market exhibits a moderate level of market concentration, with a mix of large multinational corporations and robust domestic players vying for market share. Innovation is a key differentiator, driven by the increasing demand for sustainable, functional, and aesthetically appealing packaging solutions. Companies are heavily investing in research and development to introduce advanced barrier properties, enhanced recyclability, and biodegradable alternatives. Regulatory frameworks, while evolving, play a crucial role in shaping market dynamics, with a growing emphasis on plastic waste management and Extended Producer Responsibility (EPR). Product substitutes, such as rigid packaging and paper-based alternatives, are present but often fall short in terms of flexibility, cost-effectiveness, and barrier performance for many applications. End-user trends are largely dictated by the growth in the food and beverage, medical, and personal care sectors, each with specific packaging requirements. Mergers and acquisitions (M&A) are a significant strategy for market expansion and technology acquisition. For instance, the acquisition of Phoenix Flexibles by Amcor PLC in August 2023, generating approximately USD 20 million in revenue from flexible packaging for food, home care, and personal care, underscores the ongoing consolidation and strategic growth plays. The market is projected to witness a value of over USD 15 billion by 2025, with M&A deals expected to continue shaping the competitive landscape.

India Flexible Plastic Packaging Market Industry Trends & Insights

The India Flexible Plastic Packaging Market is experiencing robust growth, fueled by a confluence of factors. The escalating disposable income and urbanization across India are driving increased consumption of packaged goods, particularly in the food and beverage, personal care, and healthcare sectors, which are major consumers of flexible plastic packaging. E-commerce expansion is another significant catalyst, demanding lightweight, durable, and protective packaging solutions for efficient logistics and product integrity during transit. Technological disruptions are evident in the adoption of advanced printing techniques, high-barrier films, and intelligent packaging solutions that offer enhanced shelf-life and consumer engagement. Consumer preferences are shifting towards convenience, sustainability, and premiumization, pushing manufacturers to develop innovative packaging designs and materials that are not only functional but also environmentally responsible. The competitive dynamics are intensifying, with companies focusing on product differentiation, cost optimization, and expanding their geographical reach within India. The market penetration of flexible packaging is expected to continue its upward trajectory, with an estimated Compound Annual Growth Rate (CAGR) of XX% during the forecast period. Key growth drivers include the rising demand for ready-to-eat meals, processed foods, and hygienic personal care products. The adoption of advanced materials like BOPP and specialized films with superior barrier properties is also contributing to market expansion. The market size is projected to reach USD XX billion by 2033.

Dominant Markets & Segments in India Flexible Plastic Packaging Market

Within the India Flexible Plastic Packaging Market, the Food industry stands out as the dominant end-user segment. This dominance is driven by the sheer size of India's population, the increasing preference for processed and convenience foods, and the critical need for effective packaging to ensure food safety, extend shelf life, and maintain product quality. Within the food segment, sub-categories like Candy & Confectionery, Frozen Foods, Dairy Products, and Dry Foods are significant contributors due to their high volume consumption and specific packaging requirements.

- Material Type Dominance: Polyethene (PE), particularly Low-Density Polyethene (LDPE) and High-Density Polyethene (HDPE), is the most widely used material due to its excellent flexibility, sealability, and cost-effectiveness. Bi-oriented Polypropylene (BOPP) films are also gaining prominence, especially for their clarity, strength, and printability, making them ideal for packaging snacks, confectionery, and fresh produce.

- Product Type Leadership: Pouches and Bags represent the leading product types, offering versatility in terms of size, shape, and functionality. Stand-up pouches, retort pouches, and zipper pouches are in high demand across various end-user industries. Films and Wraps, essential for product protection and branding, also constitute a substantial market share.

- End-User Industry Dominance:

- Food: This sector's dominance is fueled by a growing middle class with increased purchasing power, a burgeoning retail infrastructure, and a strong preference for convenient and hygienic food options. The demand for attractive and informative packaging to differentiate products in a crowded marketplace further propels this segment. Key drivers include the rise of organized retail and the increasing penetration of packaged food in Tier 2 and Tier 3 cities.

- Beverage: While the beverage sector is significant, its growth is somewhat moderated by the preference for rigid packaging for certain categories like carbonated drinks. However, flexible packaging finds extensive use in pouches for juices, flavored milk, and other non-carbonated beverages.

- Medical and Pharmaceutical: This segment is a high-value contributor, demanding sterile, tamper-evident, and highly functional packaging solutions for medicines, medical devices, and diagnostic kits. The stringent regulatory requirements and the need for product integrity are key drivers.

- Personal Care and Household Care: Growing awareness of hygiene, coupled with the increasing availability of branded products, drives demand for flexible packaging in this sector, particularly for soaps, detergents, shampoos, and cosmetics.

The Food sector's dominance is further reinforced by government initiatives aimed at improving food processing and reducing wastage, which directly translate into a higher demand for advanced flexible packaging solutions. The Material Type dominance of PE and BOPP is attributed to their balance of performance characteristics and cost-effectiveness, making them suitable for a wide range of applications and price points. The market size for the Food segment is estimated to be over USD 8 billion in 2025.

India Flexible Plastic Packaging Market Product Developments

Product innovation in the India Flexible Plastic Packaging Market is largely focused on enhancing sustainability, functionality, and consumer appeal. Companies are developing advanced multi-layer films with improved barrier properties to extend product shelf life and reduce food spoilage. The introduction of recyclable and compostable flexible packaging solutions is a significant trend, driven by environmental concerns and regulatory pressures. Innovations in printing technologies, such as high-definition gravure and flexographic printing, enable vibrant graphics and enhanced branding capabilities, offering a competitive advantage. The development of smart packaging features, including spoilage indicators and tamper-evident seals, is also gaining traction, particularly in the pharmaceutical and food sectors. These developments aim to meet the evolving demands for convenience, safety, and eco-friendliness, thereby capturing a larger market share.

Report Scope & Segmentation Analysis

This report meticulously segments the India Flexible Plastic Packaging Market across Material Type, Product Type, and End-User Industry.

- Material Type: The market is analyzed based on Polyethene (PE), Bi-oriented Polypropylene (BOPP), Cast Polypropylene (CPP), Polyvinyl Chloride (PVC), Ethylene Vinyl Alcohol (EVOH), and Other Materials. PE is expected to maintain its lead due to its versatility, while BOPP will witness substantial growth driven by its application in high-graphic packaging. The market size for PE is projected to be over USD 7 billion in 2025.

- Product Type: Key segments include Pouches, Bags, Films and Wraps, and Other Product Types (Blister Packs, Liners, etc.). Pouches and Bags are anticipated to dominate due to their widespread use in food and beverage packaging. The market size for Pouches is estimated at USD 5 billion in 2025.

- End-User Industry: The analysis covers Food (Candy & Confectionery, Frozen Foods, Fresh Produce, Dairy Products, Dry Foods, Meat, Poultry, And Seafood, Pet Food, Other Food), Beverage, Medical and Pharmaceutical, Personal Care and Household Care, and Other End-User Industries. The Food segment is projected to be the largest, with an estimated market size of USD 8 billion in 2025, followed by Beverage and Personal Care. The Medical and Pharmaceutical segment is expected to exhibit strong growth due to increasing healthcare expenditure.

Key Drivers of India Flexible Plastic Packaging Market Growth

Several factors are propelling the growth of the India Flexible Plastic Packaging Market. The rising population and increasing disposable incomes are leading to higher consumption of packaged goods across various sectors, particularly food and beverages. The rapid urbanization and the expansion of organized retail channels are creating a greater demand for packaged products that offer convenience and longer shelf life. Furthermore, the growing awareness among consumers about hygiene and product safety is driving the adoption of sealed and protected packaging. The Indian government's focus on developing the food processing industry and promoting exports also contributes significantly to market expansion. Technological advancements in packaging materials and manufacturing processes are enabling the creation of innovative, cost-effective, and sustainable solutions.

Challenges in the India Flexible Plastic Packaging Market Sector

Despite the robust growth prospects, the India Flexible Plastic Packaging Market faces several challenges. The fluctuating prices of raw materials, primarily crude oil derivatives, can impact profit margins and pricing strategies. Stringent environmental regulations concerning plastic waste management and a growing public outcry against single-use plastics pose significant hurdles, necessitating investment in sustainable alternatives and recycling infrastructure. Supply chain disruptions, particularly in logistics and distribution, can affect timely delivery and increase operational costs. The presence of unorganized players offering lower-priced, often lower-quality products, creates intense price competition. Moreover, the lack of adequate recycling infrastructure and public awareness regarding plastic waste segregation can hinder the adoption of circular economy models.

Emerging Opportunities in India Flexible Plastic Packaging Market

The India Flexible Plastic Packaging Market presents numerous emerging opportunities for stakeholders. The increasing demand for sustainable and eco-friendly packaging solutions, such as biodegradable and compostable plastics, offers a significant avenue for innovation and market differentiation. The growth of e-commerce continues to drive the need for lightweight, durable, and protective packaging for online retail. The expansion of the food processing industry and the growing popularity of convenience foods and ready-to-eat meals are creating sustained demand for flexible packaging. Advancements in barrier technology are enabling the packaging of a wider range of products, including those with extended shelf-life requirements. The pharmaceutical and medical sectors, with their increasing demand for specialized and sterile packaging, also represent a high-growth opportunity. Furthermore, the potential for growth in rural and semi-urban markets, as disposable incomes rise, is substantial.

Leading Players in the India Flexible Plastic Packaging Market Market

- Amcor Plc

- Berry Global Inc

- Mondi PLC

- Sealed Air Corporation

- Sonoco Products Company

- Uflex Limited

- Jindal Polyfilms Ltd

- Huhtamaki Oyj

- Polyplex Corporation Limited

- Constantia Flexibles GmbH

Key Developments in India Flexible Plastic Packaging Market Industry

- March 2024: UFlex Limited is slated to participate in Aahar 2024, an international food and hospitality fair, to showcase its advanced flexible packaging solutions, including food-grade pouches and WPP bags tailored for the food industry.

- August 2023: Amcor PLC acquired Phoenix Flexibles, a Gujarat-based company with annual revenues of approximately USD 20 million from flexible packaging for food, home care, and personal care applications, thereby expanding Amcor’s presence in the Indian market.

Strategic Outlook for India Flexible Plastic Packaging Market Market

The strategic outlook for the India Flexible Plastic Packaging Market is exceptionally positive, driven by sustained demand from a growing population and a rapidly expanding economy. Key growth catalysts include the increasing adoption of sustainable packaging solutions, catering to both consumer preferences and regulatory mandates. The continuous evolution of the food processing, e-commerce, and healthcare sectors will further bolster demand for innovative and functional packaging. Strategic investments in advanced manufacturing technologies, material science research, and expanding distribution networks will be crucial for market players to maintain a competitive edge. Collaborations and partnerships aimed at developing and implementing circular economy models for plastic packaging will also be vital for long-term success and environmental stewardship. The market is expected to witness a significant expansion, driven by a combination of organic growth and strategic acquisitions, aiming to address the diverse and evolving needs of Indian consumers and industries. The market is projected to reach over USD 15 billion by 2025, with continuous growth anticipated beyond.

India Flexible Plastic Packaging Market Segmentation

-

1. Material Type

- 1.1. Polyethene (PE)

- 1.2. Bi-oriented Polypropylene (BOPP)

- 1.3. Cast Polypropylene (CPP)

- 1.4. Polyvinyl Chloride (PVC)

- 1.5. Ethylene Vinyl Alcohol (EVOH)

- 1.6. Other Ma

-

2. Product Type

- 2.1. Pouches

- 2.2. Bags

- 2.3. Films and Wraps

- 2.4. Other Product Types (Blister Packs, Liners, etc)

-

3. End-User Industry

-

3.1. Food

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Fo

- 3.2. Beverage

- 3.3. Medical and Pharmaceutical

- 3.4. Personal Care and Household Care

- 3.5. Other En

-

3.1. Food

India Flexible Plastic Packaging Market Segmentation By Geography

- 1. India

India Flexible Plastic Packaging Market Regional Market Share

Geographic Coverage of India Flexible Plastic Packaging Market

India Flexible Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth for Lightweight and On-the-Go Consumption; Rise in Super and Hypermarkets in the Country

- 3.3. Market Restrains

- 3.3.1. Growth for Lightweight and On-the-Go Consumption; Rise in Super and Hypermarkets in the Country

- 3.4. Market Trends

- 3.4.1. Rise in Lightweight and On The Go Consumption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Flexible Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Polyethene (PE)

- 5.1.2. Bi-oriented Polypropylene (BOPP)

- 5.1.3. Cast Polypropylene (CPP)

- 5.1.4. Polyvinyl Chloride (PVC)

- 5.1.5. Ethylene Vinyl Alcohol (EVOH)

- 5.1.6. Other Ma

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Pouches

- 5.2.2. Bags

- 5.2.3. Films and Wraps

- 5.2.4. Other Product Types (Blister Packs, Liners, etc)

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Fo

- 5.3.2. Beverage

- 5.3.3. Medical and Pharmaceutical

- 5.3.4. Personal Care and Household Care

- 5.3.5. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amcor Plc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Berry Global Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mondi PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sealed Air Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sonoco Products Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Uflex Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jindal Polyfilms Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Huhtamaki Oyj

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Polyplex Corporation Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Constantia Flexibles GmbH*List Not Exhaustive 7 2 Heat Map Analysi

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Amcor Plc

List of Figures

- Figure 1: India Flexible Plastic Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Flexible Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: India Flexible Plastic Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: India Flexible Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: India Flexible Plastic Packaging Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 4: India Flexible Plastic Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: India Flexible Plastic Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: India Flexible Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: India Flexible Plastic Packaging Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 8: India Flexible Plastic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Flexible Plastic Packaging Market?

The projected CAGR is approximately 6.9%.

2. Which companies are prominent players in the India Flexible Plastic Packaging Market?

Key companies in the market include Amcor Plc, Berry Global Inc, Mondi PLC, Sealed Air Corporation, Sonoco Products Company, Uflex Limited, Jindal Polyfilms Ltd, Huhtamaki Oyj, Polyplex Corporation Limited, Constantia Flexibles GmbH*List Not Exhaustive 7 2 Heat Map Analysi.

3. What are the main segments of the India Flexible Plastic Packaging Market?

The market segments include Material Type, Product Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 182.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth for Lightweight and On-the-Go Consumption; Rise in Super and Hypermarkets in the Country.

6. What are the notable trends driving market growth?

Rise in Lightweight and On The Go Consumption.

7. Are there any restraints impacting market growth?

Growth for Lightweight and On-the-Go Consumption; Rise in Super and Hypermarkets in the Country.

8. Can you provide examples of recent developments in the market?

March 2024: UFlex Limited, India's premier multinational specializing in flexible packaging, planned to appear at Aahar 2024, a renowned international food and hospitality fair. Aahar, synonymous with the food and hospitality sector, provides an ideal stage for UFlex to unveil its cutting-edge flexible packaging solutions. At the exhibition, UFlex's flexible packaging division will present a diverse range of food-grade pouches and WPP bags, each boasting a suite of tailored features designed to meet the dynamic needs of the food industry.August 2023: Amcor PLC, a global leader in developing and producing responsible packaging solutions, acquired Phoenix Flexibles. This will expand Amcor’s capacity in the high-growth Indian market. Phoenix Flexibles has one plant in Gujarat, India. The business generates annual revenue of approximately USD 20 million from the sale of flexible packaging for food, home care, and personal care applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Flexible Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Flexible Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Flexible Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the India Flexible Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence