Key Insights

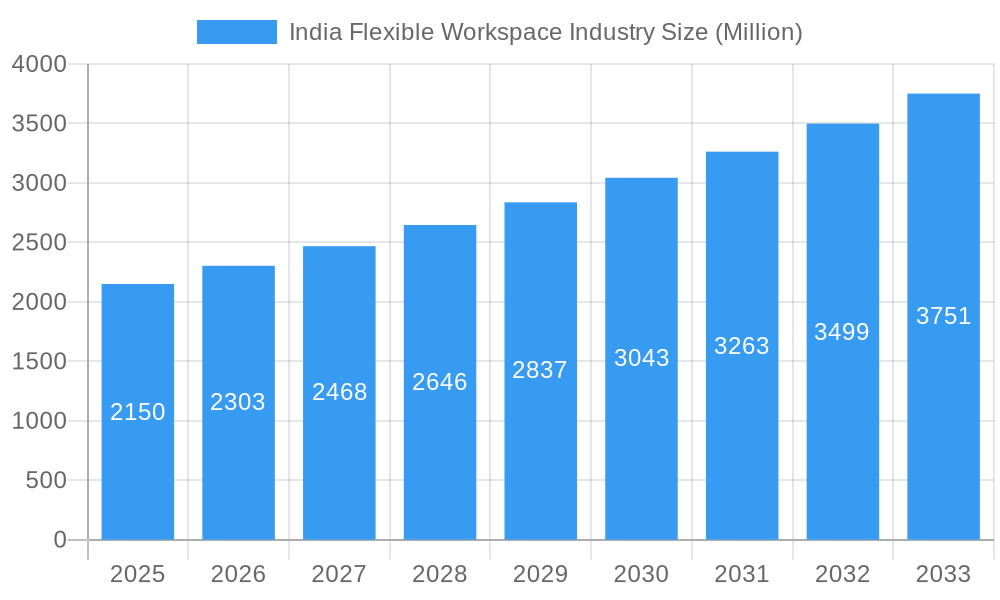

The India flexible workspace market, valued at $2.15 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 7.05% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning IT and telecommunications sector, coupled with the rising popularity of remote work and hybrid work models, fuels significant demand for flexible office solutions. Furthermore, the increasing preference for cost-effective and scalable workspace solutions among startups and SMEs significantly contributes to market growth. Bangalore, Mumbai, Delhi, and Hyderabad are leading the market, reflecting the concentration of major industries and a large workforce in these metropolitan areas. The market is segmented into private offices, coworking spaces, and virtual offices, with coworking spaces currently experiencing the most rapid growth due to their affordability and collaborative environments. This growth, however, faces certain challenges. Real estate costs in major cities and competition among numerous operators remain significant obstacles. Despite these restraints, the long-term outlook remains positive, driven by India's continued economic growth and the evolving needs of the modern workforce.

India Flexible Workspace Industry Market Size (In Billion)

The market's segmentation by end-user (IT & Telecommunications, Media & Entertainment, Retail & Consumer Goods, and Others) highlights the diverse range of industries adopting flexible workspaces. The geographical segmentation into North, South, East, and West India reveals significant regional variations in market size and growth, with South India, particularly Bangalore, currently dominating due to its strong IT presence. Major players like WeWork, Smartworks, and IndiQube are actively shaping the market landscape through expansion strategies and innovative service offerings. The increasing adoption of technology within flexible workspaces, such as smart building solutions and virtual office platforms, is further driving market growth and efficiency. Future growth will depend on factors such as infrastructure development, government policies supporting flexible work arrangements, and the overall economic climate.

India Flexible Workspace Industry Company Market Share

This detailed report provides a comprehensive analysis of the India flexible workspace industry, covering market size, segmentation, key players, growth drivers, challenges, and future opportunities. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report leverages extensive primary and secondary research to offer actionable insights for industry stakeholders.

India Flexible Workspace Industry Market Concentration & Innovation

The Indian flexible workspace market is experiencing rapid growth, driven by increasing urbanization, a burgeoning startup ecosystem, and the adoption of hybrid work models. Market concentration is moderate, with several large players and numerous smaller operators vying for market share. WeWork, Smartworks, and IndiQube are among the leading players, although their exact market share values are proprietary information. However, estimations put WeWork's market share in the xx% range, while Smartworks and IndiQube hold a significant but smaller percentage each. The market exhibits a dynamic competitive landscape, characterized by frequent mergers and acquisitions (M&A). Recent M&A deals, though specific values aren't publicly available, have involved significant investments, suggesting a consolidation trend within the sector.

- Innovation Drivers: Technological advancements (e.g., smart office solutions, booking platforms), evolving workspace design, and flexible contract options.

- Regulatory Frameworks: Government initiatives promoting entrepreneurship and ease of doing business indirectly support the industry's growth. However, specific regulations related to flexible workspaces are still evolving.

- Product Substitutes: Traditional leased office spaces remain a primary competitor, although the flexible workspace market is capturing increasing market share.

- End-User Trends: A growing preference for flexible and cost-effective work arrangements across diverse sectors.

- M&A Activities: Consolidation is likely to continue, fueled by the demand for scale and expansion capabilities.

India Flexible Workspace Industry Industry Trends & Insights

The Indian flexible workspace market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors:

- Rising Demand for Flexible Workspaces: The increasing adoption of hybrid work models, particularly post-pandemic, has significantly boosted the demand for flexible office spaces.

- Technological Disruptions: The integration of technology into workspace management, including booking systems, access control, and smart building technologies, enhances the user experience and drives efficiency.

- Shifting Consumer Preferences: Businesses, particularly startups and SMEs, are increasingly choosing flexible workspaces due to their cost-effectiveness, scalability, and enhanced productivity.

- Competitive Dynamics: The market is characterized by intense competition, with both established players and new entrants continuously vying for market share. This leads to innovation and value-added services.

- Market Penetration: The penetration rate of flexible workspaces in India is still relatively low compared to mature markets, indicating significant potential for future growth.

Dominant Markets & Segments in India Flexible Workspace Industry

While data for precise market share breakdown by city and segment is unavailable, based on observation and reporting, Mumbai, Bangalore, and Delhi are considered the dominant markets due to their strong IT sectors and concentration of businesses. Hyderabad and Pune also show significant growth.

- By Type: Coworking offices dominate the market in terms of volume, though Private Offices are commanding higher average revenue per desk. Virtual offices are also growing but constitute a smaller segment.

- By End User: The IT and Telecommunications sector is the largest end-user segment, followed by Media and Entertainment and Retail & Consumer Goods.

- By City: Mumbai, Bangalore, and Delhi currently exhibit the highest concentration of flexible workspace providers.

Key Drivers:

- Strong economic growth and a thriving startup ecosystem.

- Well-developed infrastructure and connectivity in major metropolitan areas.

- Favorable government policies supporting entrepreneurship and digitalization.

Dominance Analysis: The concentration of IT companies and startups in major metropolitan areas drives the demand for flexible workspace solutions in those cities. The availability of suitable real estate, infrastructure, and talent pool also contribute to market dominance.

India Flexible Workspace Industry Product Developments

The industry is witnessing continuous product innovation, with a focus on enhanced technological integration, improved workspace design, and customized solutions catering to specific business needs. This includes smart office technologies, flexible membership plans, and community-building initiatives aimed at fostering collaboration and productivity. The competitive advantage lies in offering a combination of flexible pricing, convenient location, and enhanced amenities.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Indian flexible workspace market based on the following segmentation:

- By Type: Private Offices, Coworking Offices, Virtual Offices (Growth projections and market size estimates are available for each segment).

- By End User: IT and Telecommunications, Media and Entertainment, Retail and Consumer Goods, Other End Users (Competitive dynamics and growth projections are detailed for each end-user segment).

- By City: Delhi, Mumbai, Bangalore, Hyderabad, Pune, Rest of India (Market size and growth projections for each city, along with competitive analyses).

Key Drivers of India Flexible Workspace Industry Growth

The growth of the Indian flexible workspace industry is driven by several key factors:

- Technological advancements: Smart office technologies and integrated platforms enhance efficiency and user experience.

- Economic growth: India's thriving economy fuels the growth of businesses and the demand for flexible workspace solutions.

- Government initiatives: Supportive policies promoting entrepreneurship and ease of doing business create a favorable environment.

Challenges in the India Flexible Workspace Industry Sector

The industry faces challenges such as:

- High real estate costs in major cities: This impacts profitability and expansion plans.

- Competition from traditional office spaces: Traditional leases continue to be a significant competitor.

- Regulatory uncertainties: Evolving regulations might impose challenges for operational efficiency.

Emerging Opportunities in India Flexible Workspace Industry

Emerging opportunities include:

- Expansion into tier-2 and tier-3 cities: Untapped potential in smaller cities offers expansion opportunities.

- Focus on niche segments: Catering to specific industry requirements and offering specialized services.

- Adoption of sustainable practices: Environmentally conscious businesses are seeking green office spaces.

Leading Players in the India Flexible Workspace Industry Market

- Spring House Coworking

- Mumbai Coworking

- Smartworks

- Skootr

- WeWork

- Innov

- IndiQube

- Goodworks

- 91Springboard

- Awfis

Key Developments in India Flexible Workspace Industry Industry

- August 2023: WeWork India opened its 50th location in India, a 54,000 sq ft space with 700 desks in New Delhi's Eldeco Centre – its first in that city.

- June 2023: WeWork India leased over 100,000 sq ft in Hyderabad's Raheja Mindspace, creating a new facility with over 1,500 seats.

Strategic Outlook for India Flexible Workspace Industry Market

The Indian flexible workspace market is poised for sustained growth, driven by ongoing urbanization, technological advancements, and the increasing adoption of hybrid work models. The market’s future potential is considerable, particularly in expanding into less saturated markets and offering specialized solutions. Strategic partnerships, technological innovation, and efficient operations will be crucial for success.

India Flexible Workspace Industry Segmentation

-

1. Type

- 1.1. Private Officees

- 1.2. Coworking Offices

- 1.3. Virtual Offices

-

2. End User

- 2.1. IT and Telecommunications

- 2.2. Media and Entertainment

- 2.3. Retail and Consumer Goods

- 2.4. Other End Users

-

3. City

- 3.1. Delhi

- 3.2. Mumbai

- 3.3. Bangalore

- 3.4. Hyderabad

- 3.5. Pune

- 3.6. Rest of India

India Flexible Workspace Industry Segmentation By Geography

- 1. India

India Flexible Workspace Industry Regional Market Share

Geographic Coverage of India Flexible Workspace Industry

India Flexible Workspace Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Change in Work Culture; Increase in Foreign Investment

- 3.3. Market Restrains

- 3.3.1. High Competition and Saturation; Lease Flexibility

- 3.4. Market Trends

- 3.4.1. Increasing Number of Startups and Freelancers in the Country To Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Flexible Workspace Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Private Officees

- 5.1.2. Coworking Offices

- 5.1.3. Virtual Offices

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT and Telecommunications

- 5.2.2. Media and Entertainment

- 5.2.3. Retail and Consumer Goods

- 5.2.4. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by City

- 5.3.1. Delhi

- 5.3.2. Mumbai

- 5.3.3. Bangalore

- 5.3.4. Hyderabad

- 5.3.5. Pune

- 5.3.6. Rest of India

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Spring House Coworking**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mumbai Coworking

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Smartworks

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Skootr

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 WeWork

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Innov

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IndiQube

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Goodworks

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 91Springboard

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Awfis

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Spring House Coworking**List Not Exhaustive

List of Figures

- Figure 1: India Flexible Workspace Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Flexible Workspace Industry Share (%) by Company 2025

List of Tables

- Table 1: India Flexible Workspace Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Flexible Workspace Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: India Flexible Workspace Industry Revenue Million Forecast, by City 2020 & 2033

- Table 4: India Flexible Workspace Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: India Flexible Workspace Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: India Flexible Workspace Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 7: India Flexible Workspace Industry Revenue Million Forecast, by City 2020 & 2033

- Table 8: India Flexible Workspace Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Flexible Workspace Industry?

The projected CAGR is approximately 7.05%.

2. Which companies are prominent players in the India Flexible Workspace Industry?

Key companies in the market include Spring House Coworking**List Not Exhaustive, Mumbai Coworking, Smartworks, Skootr, WeWork, Innov, IndiQube, Goodworks, 91Springboard, Awfis.

3. What are the main segments of the India Flexible Workspace Industry?

The market segments include Type, End User, City.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.15 Million as of 2022.

5. What are some drivers contributing to market growth?

Change in Work Culture; Increase in Foreign Investment.

6. What are the notable trends driving market growth?

Increasing Number of Startups and Freelancers in the Country To Drive the Market.

7. Are there any restraints impacting market growth?

High Competition and Saturation; Lease Flexibility.

8. Can you provide examples of recent developments in the market?

August 2023: WeWork India has opened a new office in New Delhi, their 50th location in the country, and it's their first foray into the city. The property, Eldeco Centre, is designed to meet the needs of businesses and has 700 desks. It's their seventh location in the city, and they've leased 54,000 square feet of office space.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Flexible Workspace Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Flexible Workspace Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Flexible Workspace Industry?

To stay informed about further developments, trends, and reports in the India Flexible Workspace Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence