Key Insights

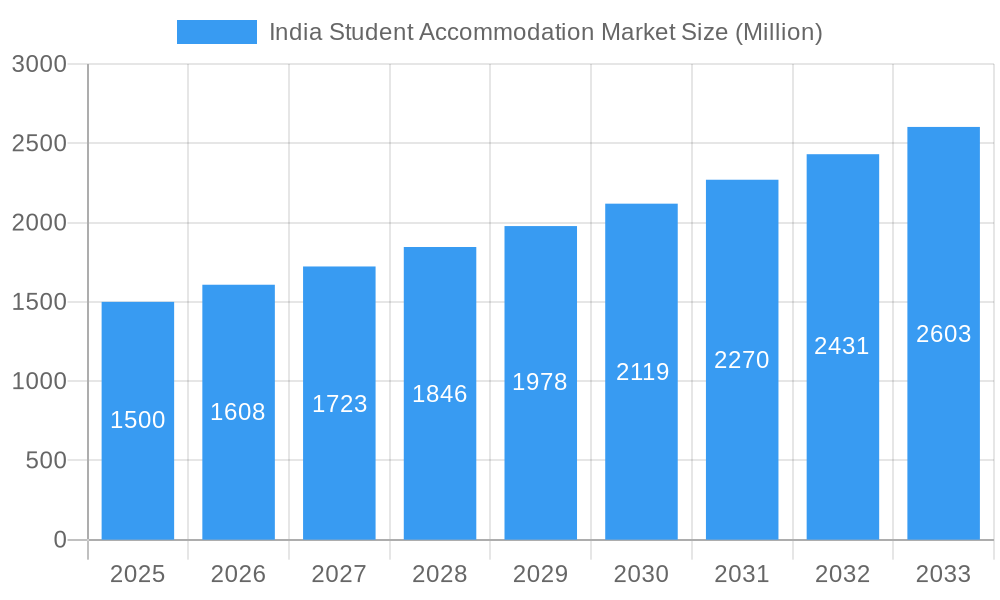

The Indian student accommodation market is experiencing robust growth, fueled by increasing urbanization, rising student populations, and a preference for managed accommodations offering amenities beyond basic shelter. The market, valued at approximately ₹X million (estimated based on provided CAGR and market trends) in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 7.20% from 2025 to 2033. This expansion is driven by several factors: the escalating demand for convenient, safe, and well-equipped student housing; the burgeoning numbers of students pursuing higher education in major metropolitan areas; and the increasing disposable incomes of middle-class families. Key segments within this market include PG accommodations, PBSA (Purpose-Built Student Accommodation), studio apartments, and on/off-campus housing, with Wi-Fi, laundry, utilities, dishwashers, and parking among the most sought-after amenities. Competition is intensifying among established players like NestAway, Zolo Stays, Stanza Living, and newer entrants, prompting innovation in service offerings and targeted marketing strategies to cater to diverse student needs and preferences across regions like North, South, East, and West India.

India Student Accommodation Market Market Size (In Billion)

The regional distribution of the market reflects the concentration of educational institutions and student populations. While precise regional breakdowns are not provided, we can expect significant market share to be held by regions with prominent universities and colleges. The forecast period (2025-2033) presents significant opportunities for further growth, driven by continued investments in infrastructure, technological advancements enhancing operational efficiencies, and the increasing adoption of online platforms for booking and managing student accommodation. This market's future hinges on successfully addressing challenges such as consistent regulatory frameworks and ensuring the availability of affordable, high-quality housing options across different regions to meet the evolving needs of a growing and diverse student population in India. Further research into specific regional data and pricing structures would refine these insights.

India Student Accommodation Market Company Market Share

India Student Accommodation Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning India Student Accommodation Market, covering the period 2019-2033. With a focus on market size, segmentation, key players, and future trends, this report is an essential resource for investors, industry stakeholders, and anyone seeking to understand this dynamic sector. The report leverages extensive research to offer actionable insights and forecast the market's trajectory through 2033, using 2025 as the base and estimated year.

India Student Accommodation Market Concentration & Innovation

The Indian student accommodation market is characterized by a moderately concentrated landscape, with a few major players like NestAway, Zolo Stays, and Stanza Living holding significant market share. However, the market also features numerous smaller players and startups, leading to a competitive environment. Innovation is driven by technological advancements, particularly in online booking platforms, property management systems, and smart home technologies. Regulatory frameworks, while evolving, are generally supportive of the sector’s growth. Product substitutes, such as traditional PG accommodations, are gradually losing traction due to the improved amenities and services offered by organized players. End-user trends show a growing preference for organized, professionally managed accommodations that offer safety, convenience, and a community feel. Mergers and acquisitions (M&A) activity has been significant, with deal values estimated at xx Million in 2024. Major players are consolidating their market presence through strategic acquisitions, aiming for broader geographical reach and enhanced service offerings. Market share data indicates that the top 5 players collectively hold approximately xx% of the market. Furthermore, the increasing demand for premium services is driving innovation in amenities and service offerings.

India Student Accommodation Market Industry Trends & Insights

The Indian student accommodation market is experiencing robust growth, driven by several factors. The rising number of students pursuing higher education, coupled with increasing urbanization and the migration of students from smaller towns and cities to major metropolitan areas, is fueling demand. Technological disruptions, such as online booking platforms and smart home integrations, are enhancing convenience and transparency for students. Consumer preferences are shifting towards organized, professionally managed accommodations that offer a range of amenities and services beyond basic shelter. The market's CAGR during the historical period (2019-2024) was approximately xx%, and it is projected to reach xx% during the forecast period (2025-2033). This growth is further propelled by a growing preference for co-living spaces among students prioritizing community building and affordability. The market penetration of organized players is still relatively low, providing significant scope for future expansion. Competitive dynamics are intense, with players vying for market share through strategic pricing, service enhancements, and targeted marketing campaigns.

Dominant Markets & Segments in India Student Accommodation Market

The major metropolitan areas of India, including Mumbai, Delhi, Bangalore, and Chennai, dominate the student accommodation market. These cities boast a large student population and a robust infrastructure supporting higher education institutions. Within the segments:

By Service Type: Wi-Fi is almost universally provided, while laundry and utilities show high demand, contributing significantly to revenue streams. Dishwasher and parking facilities, though less prevalent, are gaining popularity in premium segments.

By Type: PG (Paying Guest) accommodations still hold a significant market share, particularly in the budget segment. However, PBSA (Purpose-Built Student Accommodation) and studio apartments are gaining traction rapidly, driven by demand for more modern and comfortable living spaces. On-campus housing is limited in availability, and off-campus housing consequently represents a larger market.

Key drivers in dominant regions include factors like economic growth, which boosts disposable incomes and parental spending on student accommodation, and a supportive regulatory environment. Established educational hubs enjoy higher concentration of students and increased demand. The rapid urbanization further leads to an increase in the need for accommodation facilities.

India Student Accommodation Market Product Developments

Recent product innovations focus on enhancing the student experience through technology integration. Smart home features, online booking and payment systems, and community-building initiatives are key features. These innovative offerings provide a competitive advantage by attracting students seeking convenient, safe, and technologically advanced living spaces. Companies are adapting their offerings to diverse student needs, including budget-conscious options and premium, fully-furnished accommodations. This focus on market fit and technological advancements is key to maintaining a competitive edge.

Report Scope & Segmentation Analysis

This report segments the India Student Accommodation Market by service type (Wi-Fi, Laundry, Utilities, Dishwasher, Parking) and accommodation type (PG, PBSA, Studio Apartment, Live-in On-Campus Housing, Live-in Off-Campus Housing). Each segment is analyzed for its growth potential, market size, and competitive dynamics. Growth projections vary significantly across segments, with PBSA and studio apartments expected to experience the highest growth rates. The market size for each segment is estimated based on detailed analysis of current market trends and future projections. Competitive intensity also varies across segments, with the premium segments attracting more intense competition.

Key Drivers of India Student Accommodation Market Growth

Several factors drive the growth of the India Student Accommodation Market. The increasing number of students pursuing higher education is a primary driver, as is the rising disposable income of the middle class, enabling higher spending on better accommodation. Government initiatives supporting higher education and urbanization also contribute significantly to market growth. Technological advancements such as online booking and property management systems improve efficiency and customer experience.

Challenges in the India Student Accommodation Market Sector

The sector faces challenges, including a shortage of affordable, quality accommodation in major cities, leading to price inflation. Regulatory hurdles, such as licensing and zoning regulations, can also hinder growth. Supply chain issues related to construction materials and skilled labor can impact development timelines and costs. Furthermore, intense competition among established players and emerging startups exerts downward pressure on profitability.

Emerging Opportunities in India Student Accommodation Market

Several opportunities exist, including expanding into smaller cities and towns with growing student populations. The integration of technology, such as AI-powered property management systems and IoT devices for enhanced security, presents opportunities for innovation and improved efficiency. Catering to specific student needs, such as those with disabilities or international students, offers scope for niche market development.

Leading Players in the India Student Accommodation Market

- NestAway

- Zolo Stays

- Stanza Living

- Your-Space

- Placio

- StayAbode

- Weroom

- OYO Life

- CoHo

Key Developments in India Student Accommodation Market Industry

- Jan 2023: Zolo Stays launched a new premium property in Bangalore.

- May 2022: NestAway acquired a smaller competitor, expanding its market share.

- Oct 2021: Stanza Living secured significant funding to fuel expansion plans.

- Further developments will be included in the final report.

Strategic Outlook for India Student Accommodation Market

The Indian Student Accommodation Market presents significant growth potential. Continued urbanization, a rising student population, and increasing demand for quality accommodation will drive expansion. Strategic investments in technology, service enhancements, and strategic acquisitions will be crucial for sustained success. The market is expected to continue its robust growth trajectory for the foreseeable future, driven by evolving student needs and ongoing technological advancements.

India Student Accommodation Market Segmentation

-

1. Service Type

- 1.1. Wi-Fi

- 1.2. Laundry

- 1.3. Utilities

- 1.4. Dishwasher

- 1.5. Parking

-

2. Type

- 2.1. PG

- 2.2. PBSA

- 2.3. Studio Apartment

- 2.4. Live in On-Campus Housing

- 2.5. Live in Off-Campus Housing

India Student Accommodation Market Segmentation By Geography

- 1. India

India Student Accommodation Market Regional Market Share

Geographic Coverage of India Student Accommodation Market

India Student Accommodation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of Education Sector; Rising Demand for Quality Accomodation

- 3.3. Market Restrains

- 3.3.1. Enrolment Fluctuations

- 3.4. Market Trends

- 3.4.1. Urbanization Helping to Grow the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Student Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Wi-Fi

- 5.1.2. Laundry

- 5.1.3. Utilities

- 5.1.4. Dishwasher

- 5.1.5. Parking

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. PG

- 5.2.2. PBSA

- 5.2.3. Studio Apartment

- 5.2.4. Live in On-Campus Housing

- 5.2.5. Live in Off-Campus Housing

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NestAway

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Zolo Stays

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Stanza Living

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Your-Space

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Placio

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 StayAbode

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Weroom**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 OYO Life

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CoHo

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 NestAway

List of Figures

- Figure 1: India Student Accommodation Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India Student Accommodation Market Share (%) by Company 2025

List of Tables

- Table 1: India Student Accommodation Market Revenue undefined Forecast, by Service Type 2020 & 2033

- Table 2: India Student Accommodation Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: India Student Accommodation Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: India Student Accommodation Market Revenue undefined Forecast, by Service Type 2020 & 2033

- Table 5: India Student Accommodation Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: India Student Accommodation Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Student Accommodation Market?

The projected CAGR is approximately 5.04%.

2. Which companies are prominent players in the India Student Accommodation Market?

Key companies in the market include NestAway, Zolo Stays, Stanza Living, Your-Space, Placio, StayAbode, Weroom**List Not Exhaustive, OYO Life, CoHo.

3. What are the main segments of the India Student Accommodation Market?

The market segments include Service Type, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growth of Education Sector; Rising Demand for Quality Accomodation.

6. What are the notable trends driving market growth?

Urbanization Helping to Grow the Market.

7. Are there any restraints impacting market growth?

Enrolment Fluctuations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Student Accommodation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Student Accommodation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Student Accommodation Market?

To stay informed about further developments, trends, and reports in the India Student Accommodation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence