Key Insights

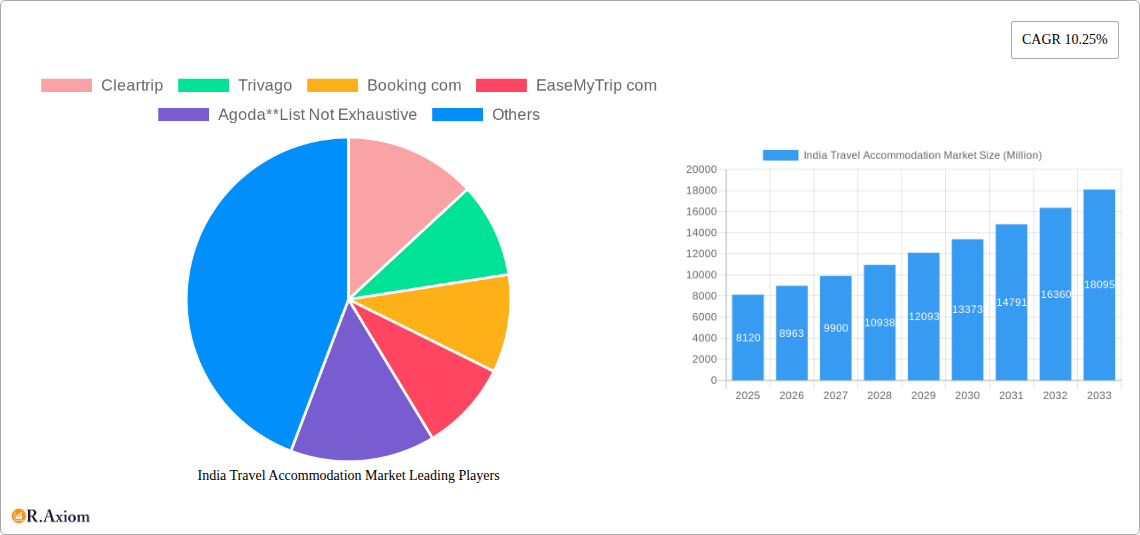

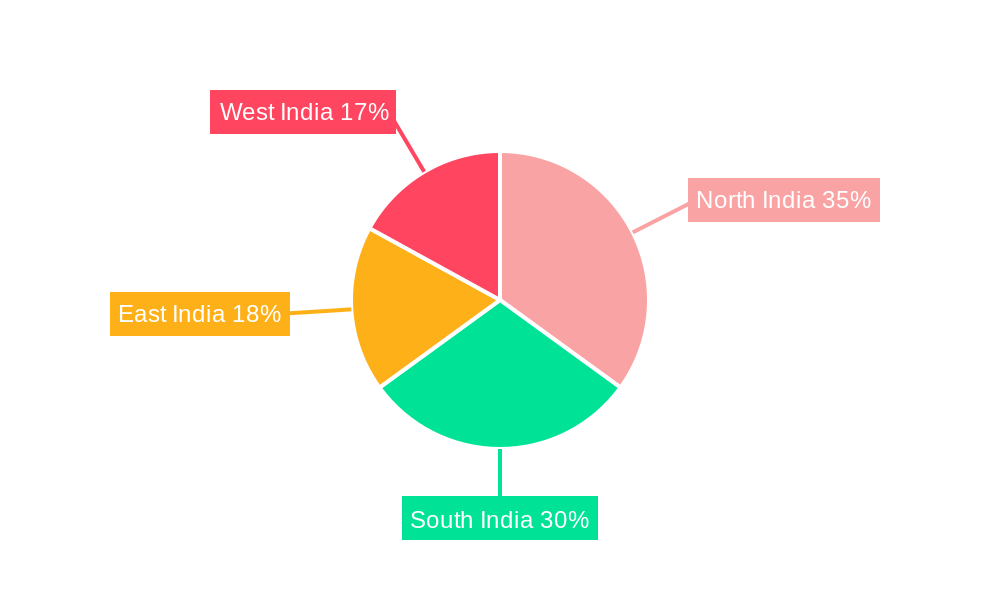

The India travel accommodation market, valued at $8.12 billion in 2025, is projected to experience robust growth, driven by a burgeoning middle class, rising disposable incomes, and a growing preference for online travel booking platforms. The market's Compound Annual Growth Rate (CAGR) of 10.25% from 2025 to 2033 signifies significant expansion potential. Key growth drivers include increased domestic and international tourism, improved infrastructure, and the rising popularity of budget-friendly travel options. The market is segmented by platform (mobile applications and websites) and booking mode (third-party online portals and direct/captive portals), with mobile applications experiencing faster growth due to increased smartphone penetration. Major players like MakeMyTrip, Goibibo, Cleartrip, Booking.com, and OYO Rooms are intensely competing, leading to innovative offerings and competitive pricing. Regional variations exist, with North and South India currently dominating the market share, but consistent growth is anticipated across all regions (North, South, East, and West India) due to focused infrastructure development and tourism promotion initiatives.

India Travel Accommodation Market Market Size (In Billion)

The market's growth trajectory is further influenced by several trends. The increasing adoption of online travel agencies (OTAs) and metasearch engines like Trivago simplifies the booking process and exposes consumers to a wider range of options. The rise of budget-friendly accommodation options, including homestays and budget hotels, caters to price-sensitive travellers. However, factors like fluctuating fuel prices, seasonal variations in demand, and potential economic downturns could pose challenges to market growth. Nevertheless, the long-term outlook for the India travel accommodation market remains positive, with substantial opportunities for both established players and emerging businesses. The market's evolution will be shaped by technological advancements, evolving consumer preferences, and the government's initiatives to boost tourism.

India Travel Accommodation Market Company Market Share

India Travel Accommodation Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India travel accommodation market, covering the period 2019-2033. It offers valuable insights into market dynamics, key players, emerging trends, and future growth prospects, equipping stakeholders with actionable intelligence for strategic decision-making. The report utilizes data from the historical period (2019-2024), the base year (2025), and forecasts up to the estimated year 2033. The market size is expressed in Millions throughout the report.

India Travel Accommodation Market Market Concentration & Innovation

The Indian travel accommodation market exhibits a moderately concentrated landscape, dominated by a few major players alongside numerous smaller competitors. Market share data for 2024 suggests MakeMyTrip and Goibibo hold a significant portion (XX%), followed by Booking.com (XX%), OYO Rooms (XX%), and Cleartrip (XX%). However, the market is characterized by intense competition, driven by technological innovation and aggressive marketing strategies.

Several factors influence market concentration:

- Technological advancements: The adoption of mobile applications, AI-powered booking platforms, and voice-assisted services are reshaping the competitive landscape, favoring tech-savvy players.

- Regulatory frameworks: Government regulations concerning online travel agencies and data privacy impact market operations. Changes in these regulations could significantly alter the competitive dynamics.

- Product substitution: The rise of alternative accommodation options such as homestays and vacation rentals offers substitutes to traditional hotels and impacts market concentration.

- End-user trends: Increasing preference for personalized travel experiences, value-for-money deals, and seamless online booking processes influence player strategies and market shares.

- M&A activities: Consolidation through mergers and acquisitions (M&A) has occurred, although deal values have varied. For example, a hypothetical deal in 2023 involving two mid-sized players resulted in a combined entity valued at approximately xx Million. Further M&A activity is anticipated to further shape market concentration.

India Travel Accommodation Market Industry Trends & Insights

The Indian travel accommodation market is experiencing robust growth, driven by factors such as rising disposable incomes, increased domestic and international tourism, and the expanding middle class. The market's Compound Annual Growth Rate (CAGR) during 2019-2024 was approximately xx%, and projections suggest a CAGR of xx% during 2025-2033. Market penetration of online travel booking platforms has significantly increased, exceeding xx% in 2024.

Technological disruptions, such as the rise of mobile booking apps and AI-powered travel planning tools, are significantly impacting consumer behavior. Consumers increasingly prefer personalized travel recommendations and seamless booking experiences. Competitive dynamics are characterized by intense price wars, loyalty programs, and strategic partnerships to expand market reach. The increasing popularity of budget-friendly accommodations and the growth of the experiential travel segment continue to shape market trends. The overall growth is influenced by fluctuations in the economy and seasonal travel patterns.

Dominant Markets & Segments in India Travel Accommodation Market

- Leading Region/Segment: While precise market share data is not available for every region, major metropolitan areas like Mumbai, Delhi, and Bangalore demonstrate strong dominance within the market.

By Platform:

- Mobile Applications: This segment is the fastest-growing, driven by smartphone penetration and consumer preference for mobile-first experiences. Key drivers include ease of access, convenience, and personalized offers.

- Website: While still significant, website bookings are witnessing slower growth compared to mobile apps due to the increasing preference for on-the-go booking.

By Mode of Booking:

- Third-Party Online Portals: This segment dominates the market due to extensive reach, user-friendly interfaces, competitive pricing, and a wide selection of accommodation options. Ease of comparison and various payment options further drive this segment's popularity.

- Direct/Captive Portals: Hotel chains and individual properties are increasingly focusing on direct bookings through their websites and apps, aiming to increase margins and foster customer loyalty. However, this segment faces challenges in terms of visibility and reach compared to the third-party portals. Improved user experience and innovative features are being employed to close this gap.

India Travel Accommodation Market Product Developments

The market is witnessing significant product innovations focused on enhancing user experience, personalization, and value-added services. This includes AI-powered chatbots for customer service, voice-assisted booking, virtual reality tours of accommodations, personalized travel recommendations, and integrated booking platforms that combine flights, accommodations, and activities. These innovations cater to evolving consumer preferences and enhance the overall travel planning and booking process, increasing customer satisfaction.

Report Scope & Segmentation Analysis

This report segments the Indian travel accommodation market by platform (mobile application and website) and mode of booking (third-party online portals and direct/captive portals). Each segment is analyzed in terms of its market size, growth projections, and competitive dynamics. Growth projections for each segment vary based on several factors including economic conditions and technological advancements. The competitive landscape within each segment is characterized by intense competition and dynamic market share shifts.

Key Drivers of India Travel Accommodation Market Growth

Several factors contribute to the market's growth:

- Rising disposable incomes: India's expanding middle class has more disposable income for leisure travel and accommodation.

- Technological advancements: User-friendly mobile apps and online booking platforms enhance accessibility and convenience.

- Government initiatives: Government policies promoting tourism infrastructure development further boost the industry.

Challenges in the India Travel Accommodation Market Sector

The sector faces challenges such as:

- Infrastructure limitations: Inadequate infrastructure in certain regions restricts travel and accommodation availability.

- Seasonality: Tourist flows are often seasonal, leading to fluctuating demand and revenue streams.

- Competitive pressures: The market's high competitiveness necessitates continuous innovation and cost optimization.

Emerging Opportunities in India Travel Accommodation Market

Emerging opportunities include:

- Expansion into tier 2 and tier 3 cities: Untapped potential exists in less developed regions.

- Growth of niche tourism: Special interest tourism, like adventure or wellness tourism, presents unique opportunities.

- Adoption of sustainable practices: Eco-friendly accommodations and travel options are gaining traction.

Leading Players in the India Travel Accommodation Market Market

- Cleartrip

- Trivago

- Booking.com

- EaseMyTrip.com

- Agoda

- OYO Rooms

- IRCTC

- Goibibo

- MakeMyTrip.com

Key Developments in India Travel Accommodation Market Industry

- February 2024: EaseMyTrip launched its 10th offline retail outlet, expanding its reach beyond online platforms.

- February 2024: EaseMyTrip partnered with Zaggle for integrated travel and expense management solutions.

- May 2023: MakeMyTrip integrated Microsoft's voice-assisted booking technology for travel planning in Indian languages.

Strategic Outlook for India Travel Accommodation Market Market

The Indian travel accommodation market holds significant future potential, driven by continued economic growth, increasing tourism, and technological innovation. The sector's evolution will be shaped by players’ ability to adapt to changing consumer preferences, leverage technology for enhanced user experience, and maintain a competitive edge in a rapidly evolving landscape. Further growth will be influenced by the nation's infrastructure development and government policies supporting the tourism sector.

India Travel Accommodation Market Segmentation

-

1. Platform

- 1.1. Mobile Application

- 1.2. Website

-

2. Mode of Booking

- 2.1. Third Party Online Portals

- 2.2. Direct/Captive Portals

India Travel Accommodation Market Segmentation By Geography

- 1. India

India Travel Accommodation Market Regional Market Share

Geographic Coverage of India Travel Accommodation Market

India Travel Accommodation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rise in the Number of Travel Bloggers Is Promoting Tourism Driving the Market's Growth; Rising Number of Hotels

- 3.2.2 Resorts

- 3.2.3 and Airbnb Options for Consumers Driving the Market's Growth

- 3.3. Market Restrains

- 3.3.1. Difficulty in Handling Customer Queries and Cancellation Policies; High Convenience Fees Impacting the Market's Growth

- 3.4. Market Trends

- 3.4.1. Rising Growth of Digital Payments Is Boosting the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Travel Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Mobile Application

- 5.1.2. Website

- 5.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 5.2.1. Third Party Online Portals

- 5.2.2. Direct/Captive Portals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cleartrip

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Trivago

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Booking com

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 EaseMyTrip com

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Agoda**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 OYO Rooms

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IRCTC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Goibibo

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MakeMyTrip com

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Cleartrip

List of Figures

- Figure 1: India Travel Accommodation Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Travel Accommodation Market Share (%) by Company 2025

List of Tables

- Table 1: India Travel Accommodation Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 2: India Travel Accommodation Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 3: India Travel Accommodation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Travel Accommodation Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 5: India Travel Accommodation Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 6: India Travel Accommodation Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Travel Accommodation Market?

The projected CAGR is approximately 10.25%.

2. Which companies are prominent players in the India Travel Accommodation Market?

Key companies in the market include Cleartrip, Trivago, Booking com, EaseMyTrip com, Agoda**List Not Exhaustive, OYO Rooms, IRCTC, Goibibo, MakeMyTrip com.

3. What are the main segments of the India Travel Accommodation Market?

The market segments include Platform, Mode of Booking.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Number of Travel Bloggers Is Promoting Tourism Driving the Market's Growth; Rising Number of Hotels. Resorts. and Airbnb Options for Consumers Driving the Market's Growth.

6. What are the notable trends driving market growth?

Rising Growth of Digital Payments Is Boosting the Growth of the Market.

7. Are there any restraints impacting market growth?

Difficulty in Handling Customer Queries and Cancellation Policies; High Convenience Fees Impacting the Market's Growth.

8. Can you provide examples of recent developments in the market?

February 2024: India’s biggest online travel tech platform, EaseMyTrip, opened its first offline retail outlet in the state of Madhya Pradesh, Indore. This is the 10th offline store launched under the brand's franchise model, which is a testament to its commitment to efficiently serving its customers online and offline. The new offline store is aimed at reaching out to its offline customers who are looking for a personalized meet-and-greet experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Travel Accommodation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Travel Accommodation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Travel Accommodation Market?

To stay informed about further developments, trends, and reports in the India Travel Accommodation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence