Key Insights

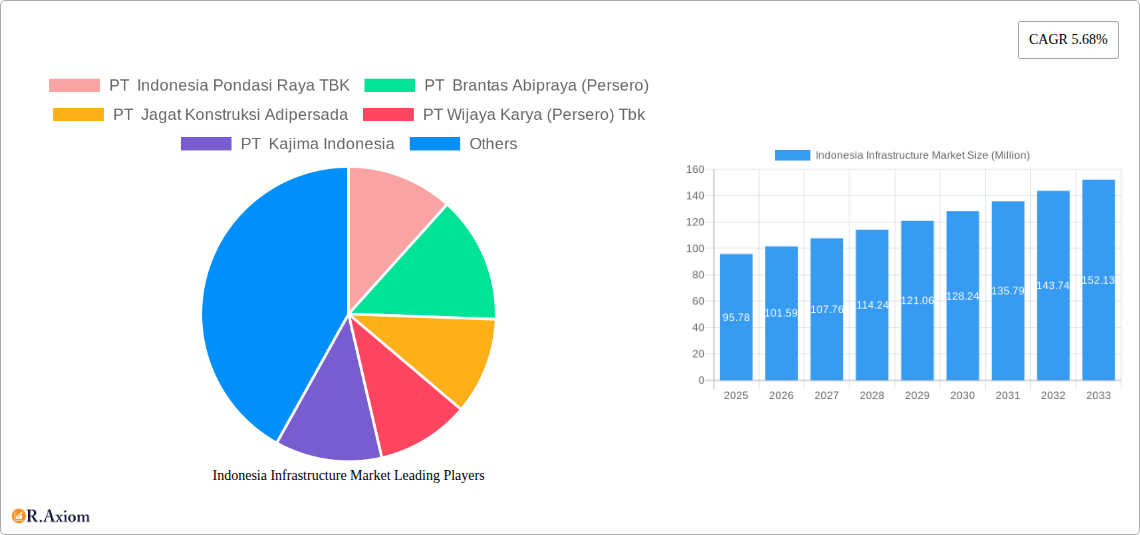

The Indonesian infrastructure market, valued at $95.78 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.68% from 2025 to 2033. This expansion is driven by several key factors. Government initiatives aimed at improving connectivity and bolstering economic development through large-scale infrastructure projects are a significant catalyst. Increasing urbanization and a burgeoning middle class fuel demand for improved transportation, utilities, and social infrastructure. Furthermore, strategic investments in manufacturing and resource extraction sectors necessitate upgrading related infrastructure. Key players such as PT Indonesia Pondasi Raya TBK, PT Brantas Abipraya (Persero), and PT Wijaya Karya (Persero) Tbk are actively shaping the market landscape through their participation in these projects. Competition is expected to remain intense, requiring companies to demonstrate strong project management capabilities and adapt to evolving regulatory requirements.

Indonesia Infrastructure Market Market Size (In Million)

However, challenges persist. The market's growth trajectory may be influenced by factors such as fluctuating commodity prices impacting investment decisions, potential delays caused by complex bureaucratic processes, and the need for consistent funding to support large-scale projects. Despite these restraints, the long-term outlook remains positive, driven by the Indonesian government's commitment to infrastructure development as a cornerstone of its economic strategy. The segmentation of the market into social, transportation, extraction, manufacturing, and utilities infrastructure reflects the diverse needs driving market growth and allows for targeted investment strategies. This diversity ensures resilience against potential shocks within any single sector. Continued economic growth and strategic government support will be crucial in realizing the full potential of the Indonesian infrastructure market over the forecast period.

Indonesia Infrastructure Market Company Market Share

Indonesia Infrastructure Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Indonesia Infrastructure Market, covering the period from 2019 to 2033. It offers invaluable insights for investors, industry stakeholders, and government agencies seeking to understand the market's dynamics, growth opportunities, and challenges. The report leverages extensive data analysis and incorporates recent industry developments to provide a robust forecast for the future. The base year for this report is 2025, with a forecast period extending to 2033.

Study Period: 2019-2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025-2033 Historical Period: 2019-2024

Indonesia Infrastructure Market Market Concentration & Innovation

The Indonesian infrastructure market exhibits a moderately concentrated structure, with several large players dominating various segments. Market share is highly dynamic, influenced by government projects and M&A activity. Key players such as PT Wijaya Karya (Persero) Tbk, PT Adhi Karya (Persero) TBK, and PT Jasa Marga (Persero) TBK hold significant market share in specific segments like transportation infrastructure. However, a considerable number of smaller, specialized firms compete vigorously in niche areas.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the overall market is estimated at xx, indicating a moderately concentrated market.

- M&A Activity: In recent years, M&A activity has been moderate, with deal values totaling approximately xx Million in the last five years. Consolidation is expected to increase in the coming years, driven by the need for larger firms to undertake mega-projects.

- Innovation Drivers: Government initiatives promoting technological advancements, such as the adoption of sustainable and smart infrastructure solutions, are driving innovation. The increasing adoption of Building Information Modeling (BIM) and digital twins is transforming project management and construction processes.

- Regulatory Framework: While the Indonesian government actively promotes infrastructure development, the regulatory landscape can be complex, affecting project timelines and investment decisions. Streamlining regulatory approvals and promoting transparency are crucial for sustained growth.

- Product Substitutes: The emergence of alternative materials and construction technologies is creating substitution opportunities, particularly in areas where cost-effectiveness and sustainability are prioritized.

- End-User Trends: The increasing urbanization and rising middle class are driving demand for improved infrastructure, particularly in transportation, utilities, and social infrastructure segments.

Indonesia Infrastructure Market Industry Trends & Insights

The Indonesian infrastructure market is poised for robust growth, driven by government investments in large-scale projects and increasing private sector participation. The Compound Annual Growth Rate (CAGR) is projected at xx% during the forecast period (2025-2033). Market penetration of advanced technologies remains relatively low, offering significant growth potential. Key market trends include:

- Government Spending: Significant government investment in infrastructure development programs remains the primary growth driver.

- Private Sector Participation: Increasing involvement of private companies through Public-Private Partnerships (PPPs) is accelerating project implementation.

- Technological Disruptions: The adoption of digital technologies such as BIM, IoT sensors, and advanced construction equipment is improving efficiency and project management.

- Sustainability Focus: A growing emphasis on environmentally friendly construction practices and the use of sustainable materials is shaping the market.

- Competitive Dynamics: Intense competition among established players and the emergence of new entrants drive innovation and service improvements.

Dominant Markets & Segments in Indonesia Infrastructure Market

The transportation infrastructure segment dominates the Indonesian infrastructure market, driven by large-scale projects aimed at improving connectivity and reducing congestion in major cities. Java, as the most populous island, represents the largest market, followed by Sumatra and other regions experiencing rapid urbanization.

- Transportation Infrastructure: This segment is characterized by significant government investment in roads, railways, airports, and seaports. The ongoing development of high-speed rail projects significantly contributes to market growth.

- Social Infrastructure: Increasing urbanization drives demand for healthcare, education, and housing infrastructure, fostering steady growth in this segment.

- Utilities Infrastructure: Growth in electricity generation and distribution, alongside improvements to water management systems, contribute to the expansion of this segment.

- Extraction Infrastructure: Growth in this segment is largely driven by Indonesia's mining and energy sectors.

- Manufacturing Infrastructure: This sector experiences steady growth, primarily fueled by increasing industrialization and foreign direct investment.

Key drivers include favorable government policies, supportive regulations, and growing private sector investment. However, challenges such as land acquisition issues, environmental concerns, and financing constraints may impact the pace of development in certain segments.

Indonesia Infrastructure Market Product Developments

Recent product innovations focus on enhancing efficiency, sustainability, and resilience in infrastructure projects. This includes the adoption of prefabricated construction methods, advanced materials such as high-performance concrete, and smart infrastructure solutions incorporating IoT sensors for real-time monitoring and predictive maintenance. These innovations improve project timelines and reduce overall project costs, enhancing market competitiveness. The focus on smart cities initiatives further propels the development and adoption of technologically advanced infrastructure solutions.

Report Scope & Segmentation Analysis

This report comprehensively segments the Indonesia infrastructure market by infrastructure type:

- Social Infrastructure: This segment includes hospitals, schools, and housing projects. The market size is projected to reach xx Million by 2033, with a CAGR of xx%. Competition is driven by government tenders and private sector investments.

- Transportation Infrastructure: Encompassing roads, railways, airports, and ports, this segment is projected to reach xx Million by 2033, with a CAGR of xx%. Major players dominate this segment, often involving significant government investment and PPP models.

- Extraction Infrastructure: This covers infrastructure related to mining and energy extraction. The market size is estimated at xx Million in 2025, growing to xx Million by 2033 at a CAGR of xx%. Competition is concentrated around large-scale projects.

- Manufacturing Infrastructure: This includes factories, industrial parks, and related facilities. The market size is estimated at xx Million in 2025, projected to reach xx Million by 2033, with a CAGR of xx%. Growth is closely linked to manufacturing sector expansion.

- Utilities Infrastructure: This segment covers electricity, water, and gas infrastructure. The market is expected to reach xx Million by 2033, growing at a CAGR of xx%. Private and state-owned enterprises heavily influence this sector.

Key Drivers of Indonesia Infrastructure Market Growth

Several factors fuel the growth of Indonesia's infrastructure market:

- Government Initiatives: The Indonesian government's commitment to substantial infrastructure development, through programs like the National Medium-Term Development Plan (RPJMN), acts as a primary growth driver.

- Economic Growth: Indonesia's ongoing economic expansion directly fuels demand for enhanced infrastructure to support industrialization and urbanization.

- Foreign Direct Investment (FDI): Inflow of FDI plays a crucial role in financing and executing large-scale infrastructure projects.

- Technological Advancements: Embracing new technologies leads to improved project efficiency and cost-effectiveness.

Challenges in the Indonesia Infrastructure Market Sector

Despite the significant growth potential, several challenges hinder the market's development:

- Land Acquisition: Complex land acquisition processes and disputes often cause significant project delays and cost overruns. This accounts for an estimated xx% delay in project completion.

- Regulatory Hurdles: Navigating complex regulations and obtaining necessary permits can prove challenging and time-consuming.

- Financing Constraints: Securing adequate funding for large-scale projects remains a considerable obstacle for both private and public entities.

- Skills Gaps: A shortage of skilled labor in specific areas can impact project execution timelines and quality.

Emerging Opportunities in Indonesia Infrastructure Market

The Indonesian infrastructure market presents exciting emerging opportunities:

- Smart City Initiatives: Increasing demand for smart city solutions creates opportunities for technology providers.

- Sustainable Infrastructure: Growing focus on green infrastructure projects creates demand for sustainable materials and technologies.

- Private Sector Partnerships: Public-private partnerships (PPPs) continue to offer significant opportunities for private sector participation.

- Regional Development: Investment in infrastructure outside Java presents significant growth potential.

Leading Players in the Indonesia Infrastructure Market Market

- PT Wijaya Karya (Persero) Tbk

- PT Adhi Karya (Persero) TBK

- PT Jasa Marga (Persero) TBK

- PT Indonesia Pondasi Raya TBK

- PT Brantas Abipraya (Persero)

- PT Jagat Konstruksi Adipersada

- PT Kajima Indonesia

- PT Total Inti Persada

- PT Hutama Karya (Persero)

- PT Nusantara Infrastructure Tbk

Key Developments in Indonesia Infrastructure Market Industry

- December 2022: The Japan Bank for International Cooperation (JBIC) signed an MOU with PT Pupuk Indonesia (Persero) to promote cooperation in hydrogen and ammonia fuel sources, boosting the potential for green infrastructure development.

- April 2023: Reservoir Link Energy Bhd's agreement with PT Unilever Oleo Chemical Indonesia for a new wastewater treatment plant highlights the increasing focus on sustainable infrastructure solutions.

Strategic Outlook for Indonesia Infrastructure Market Market

The Indonesian infrastructure market offers substantial long-term growth prospects, fueled by consistent government support, robust economic growth, and increasing private sector participation. The focus on sustainable and technologically advanced solutions will further drive innovation and market expansion. Addressing challenges related to land acquisition, regulatory frameworks, and financing will be crucial for realizing the market's full potential. The government's continued investment in large-scale projects and the growing adoption of PPP models are set to transform the country's infrastructure landscape over the forecast period.

Indonesia Infrastructure Market Segmentation

-

1. Infrastructure Segment

- 1.1. Social Infrastructure

- 1.2. Transportation Infrastructure

- 1.3. Extraction Infrastructure

- 1.4. Manufacturing Infrastructure

- 1.5. Utilities Infrastructure

Indonesia Infrastructure Market Segmentation By Geography

- 1. Indonesia

Indonesia Infrastructure Market Regional Market Share

Geographic Coverage of Indonesia Infrastructure Market

Indonesia Infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.68% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Growing urbanisation in the countries4.; Increasing support of private sector to meet infrastructural growth in various sectors such as water

- 3.2.2 energy

- 3.2.3 transportation

- 3.2.4 and communications

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of quality and quantity of infrastructure

- 3.4. Market Trends

- 3.4.1. Increase in Value of Civil Construction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure Segment

- 5.1.1. Social Infrastructure

- 5.1.2. Transportation Infrastructure

- 5.1.3. Extraction Infrastructure

- 5.1.4. Manufacturing Infrastructure

- 5.1.5. Utilities Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure Segment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PT Indonesia Pondasi Raya TBK

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PT Brantas Abipraya (Persero)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Jagat Konstruksi Adipersada

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Wijaya Karya (Persero) Tbk

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT Kajima Indonesia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Total Inti Persad**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Hutama Karya (Persero)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Nusantara Infrastructure Tbk

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PT Jasa Marga (Persero) TBK

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Adhi Karya (Persero) TBK

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 PT Indonesia Pondasi Raya TBK

List of Figures

- Figure 1: Indonesia Infrastructure Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Infrastructure Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Infrastructure Market Revenue Million Forecast, by Infrastructure Segment 2020 & 2033

- Table 2: Indonesia Infrastructure Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Indonesia Infrastructure Market Revenue Million Forecast, by Infrastructure Segment 2020 & 2033

- Table 4: Indonesia Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Infrastructure Market?

The projected CAGR is approximately 5.68%.

2. Which companies are prominent players in the Indonesia Infrastructure Market?

Key companies in the market include PT Indonesia Pondasi Raya TBK, PT Brantas Abipraya (Persero), PT Jagat Konstruksi Adipersada, PT Wijaya Karya (Persero) Tbk, PT Kajima Indonesia, PT Total Inti Persad**List Not Exhaustive, PT Hutama Karya (Persero), PT Nusantara Infrastructure Tbk, PT Jasa Marga (Persero) TBK, PT Adhi Karya (Persero) TBK.

3. What are the main segments of the Indonesia Infrastructure Market?

The market segments include Infrastructure Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 95.78 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing urbanisation in the countries4.; Increasing support of private sector to meet infrastructural growth in various sectors such as water. energy. transportation. and communications.

6. What are the notable trends driving market growth?

Increase in Value of Civil Construction.

7. Are there any restraints impacting market growth?

4.; Lack of quality and quantity of infrastructure.

8. Can you provide examples of recent developments in the market?

December 2022: The Japan Bank for International Cooperation (JBIC) signed a memorandum of understanding (MOU) with PT Pupuk Indonesia (Persero). The objectives of the MOU include promoting cooperation in sectors that use hydrogen and ammonia as fuel sources. JBIC aims to accelerate the structuring of projects for developing the supply chain of hydrogen and ammonia as a fuel source. The signing of the MOU will also promote multiple initiatives, including the Asia Zero Emissions Community (AZEC) Concept, through, for example, securing the production bases and supply chain of hydrogen and ammonia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Infrastructure Market?

To stay informed about further developments, trends, and reports in the Indonesia Infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence