Key Insights

The Indonesia Metal Packaging Market is projected to reach $3 billion by 2024, exhibiting a Compound Annual Growth Rate (CAGR) of 3.45%. This growth is primarily driven by robust consumer demand for packaged goods, particularly within the food and beverage sector, fueled by a rising middle class and a preference for convenient, long-shelf-life products. The paint and chemical industries also contribute significantly, leveraging metal containers for their superior protection and durability. The industrial sector's need for secure packaging for bulk goods and raw materials further underpins consistent market demand. Key product segments include food and beverage cans, bulk containers, and shipping barrels & drums, alongside essential caps and closures.

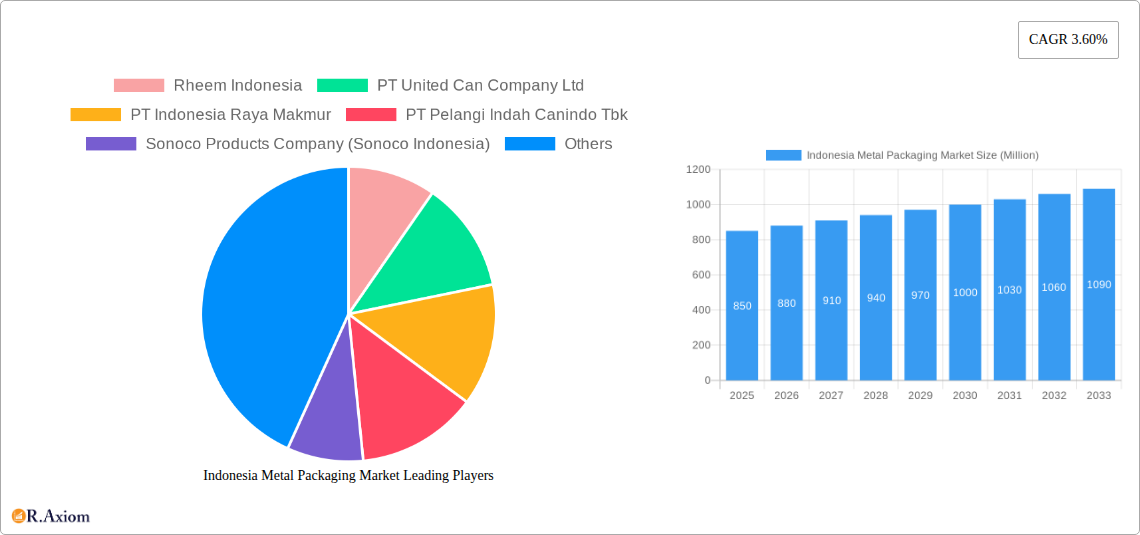

Indonesia Metal Packaging Market Market Size (In Billion)

Sustainable packaging solutions, emphasizing recyclable aluminum and steel, are a key market trend. Manufacturers are focusing on innovative designs and lightweighting to enhance environmental credentials and reduce material usage. However, fluctuating raw material prices for aluminum and steel present a cost challenge, alongside intense competition from established and emerging players. Despite these restraints, Indonesia's large population and developing manufacturing base offer significant opportunities. Leading companies such as PT United Can Company Ltd, Crown Holdings Inc, and Sonoco Products Company (Sonoco Indonesia) are actively engaged in innovation and market expansion. Strategic focus on keywords like "Indonesia metal packaging," "aluminum cans," "steel drums," and "food packaging solutions" is vital for enhancing online visibility and market penetration.

Indonesia Metal Packaging Market Company Market Share

Indonesia Metal Packaging Market: A Comprehensive Analysis (2019–2033)

This in-depth report provides a detailed analysis of the Indonesia Metal Packaging Market, covering the period from 2019 to 2033, with a base and estimated year of 2025. It examines market dynamics, key players, trends, and opportunities within this vital sector. With a focus on aluminum cans, steel cans, food cans, beverage cans, aerosol cans, bulk containers, shipping barrels & drums, and caps & closures, this report is an indispensable resource for industry stakeholders seeking to understand and navigate the Indonesian metal packaging landscape.

Indonesia Metal Packaging Market Market Concentration & Innovation

The Indonesia Metal Packaging Market exhibits a moderate level of market concentration, with a few prominent players holding significant market share, alongside a number of smaller, specialized manufacturers. Innovation within the sector is primarily driven by the demand for enhanced sustainability, improved product shelf-life, and aesthetic appeal. Key innovation areas include the development of lighter-weight metal packaging, advanced barrier coatings for improved food preservation, and eco-friendly manufacturing processes. Regulatory frameworks, such as those pertaining to food safety, recycling initiatives, and import/export regulations, play a crucial role in shaping market strategies and product development. Product substitutes, including rigid and flexible plastics, glass, and paperboard packaging, present ongoing competition, necessitating continuous improvement in the performance and cost-effectiveness of metal packaging solutions. End-user trends, particularly the growing preference for convenient and on-the-go consumption, are influencing the demand for specific packaging formats like beverage cans and single-serve food cans. Mergers and Acquisitions (M&A) activities, while not rampant, are strategic in nature, often aimed at consolidating market presence, expanding product portfolios, or acquiring innovative technologies. For instance, acquisitions of smaller regional players or niche technology providers by larger corporations can significantly alter market dynamics and increase concentration. M&A deal values can range from tens of millions to hundreds of millions of US Dollars, depending on the size and strategic importance of the target company.

- Market Share of Leading Players: Key players like PT United Can Company Ltd and Crown Holdings Inc hold substantial market shares, estimated to be between 15-25% each.

- Innovation Focus Areas: Sustainability, lightweighting, advanced coatings, and efficient manufacturing processes.

- Regulatory Impact: Food safety standards, recycling mandates, and waste management policies significantly influence product design and material choices.

- M&A Trends: Strategic acquisitions for market consolidation and technology integration.

Indonesia Metal Packaging Market Industry Trends & Insights

The Indonesia Metal Packaging Market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.5% over the forecast period. This expansion is fueled by a confluence of factors, including the burgeoning Indonesian economy, a rapidly growing middle class with increasing disposable income, and evolving consumer preferences for convenience and premium products. The beverage sector, particularly the demand for carbonated soft drinks, juices, and alcoholic beverages, remains a primary growth driver, with beverage cans constituting a significant portion of the market. Similarly, the food packaging segment is witnessing sustained demand for metal cans, driven by the need for extended shelf-life and protection for a wide array of food products, from processed meats and seafood to fruits and vegetables.

Technological disruptions are playing an increasingly vital role. Advancements in metal decorating and printing technologies are enabling manufacturers to offer more visually appealing and customizable packaging, enhancing brand differentiation and consumer appeal. The adoption of high-speed filling and sealing lines is also boosting efficiency for end-users, further solidifying the position of metal packaging. Consumer preferences are shifting towards sustainable and recyclable packaging solutions, which plays to the inherent strengths of metal. While plastic packaging remains a strong competitor, the environmental consciousness of Indonesian consumers is growing, leading to a renewed appreciation for the recyclability of aluminum and steel.

Competitive dynamics within the market are characterized by both price-based competition and innovation-led differentiation. Manufacturers are investing in research and development to optimize material usage, reduce production costs, and introduce value-added features. The paint and chemical industry also presents a significant market for metal packaging, particularly for drums and pails, due to their durability and safety features. The industrial sector, encompassing automotive and general manufacturing, further contributes to the demand for robust metal containers for shipping and storage. Market penetration for metal packaging solutions in Indonesia is already high in certain segments like beverages, but there is ample room for growth in other end-user verticals and emerging product categories. The market penetration rate for beverage cans is estimated to be over 70%, while for food cans, it stands at approximately 50%.

Dominant Markets & Segments in Indonesia Metal Packaging Market

Within the Indonesia Metal Packaging Market, several segments and end-user verticals demonstrate significant dominance, driven by specific economic, demographic, and industry-specific factors.

Material Dominance:

- Aluminum: Dominates the beverage can segment due to its lightweight properties, excellent recyclability, and premium appeal. The growing demand for beverages in convenient single-serving formats further bolsters its position. The market share of aluminum in beverage cans is estimated to be over 85%.

- Steel: Remains a critical material for a wide range of applications, including food cans, aerosol cans, and shipping barrels & drums. Its strength, durability, and cost-effectiveness make it the preferred choice for applications requiring robust containment and protection. The market share of steel in food cans is approximately 70%.

Product Type Dominance:

- Cans: This category, encompassing food cans, beverage cans, and aerosol cans, represents the largest segment by volume and value.

- Beverage Cans: Driven by the rapidly expanding beverage industry and consumer preference for on-the-go consumption.

- Food Cans: Essential for preserving a wide range of food products, catering to the growing demand for processed and convenience foods.

- Aerosol Cans: Crucial for personal care products, household items, and industrial applications.

- Shipping Barrels & Drums: A vital segment for the paint & chemical and industrial sectors, offering secure and durable storage and transportation solutions. The demand for these products is closely tied to manufacturing output and logistics activities.

End-user Vertical Dominance:

- Beverage: This is the most dominant end-user vertical, driven by the large population, rising disposable incomes, and increasing consumption of packaged beverages. The penetration of metal beverage cans in this sector is exceptionally high, estimated at over 85%.

- Food: The second-largest end-user vertical, benefiting from the growing processed food market, increasing urbanization, and the demand for convenient meal solutions. The market penetration of metal food cans is significant, estimated at around 70%.

- Paint & Chemical: A substantial market for metal packaging, particularly drums and pails, due to the need for safe and robust containment of hazardous and non-hazardous materials. The market size for this segment is estimated to be around $XXX Million.

- Industrial: Encompasses a broad range of applications, including automotive lubricants, industrial oils, and general manufacturing, where durable metal packaging is essential for product integrity and safety during transport and storage.

Key Drivers of Dominance:

- Economic Policies: Government initiatives promoting domestic manufacturing and industrial growth directly impact the demand for metal packaging across various sectors.

- Infrastructure Development: Improved logistics and transportation networks facilitate the efficient distribution of packaged goods, boosting demand for containers.

- Consumer Lifestyles: The rise of the middle class and changing dietary habits fuel the demand for packaged food and beverages, major consumers of metal packaging.

- Product Safety and Shelf-Life Requirements: The inherent protective qualities of metal packaging are critical for maintaining the quality and safety of food, beverages, and chemical products.

Indonesia Metal Packaging Market Product Developments

Product developments in the Indonesia Metal Packaging Market are focused on enhancing functionality, sustainability, and aesthetic appeal. Innovations include the introduction of thinner gauge aluminum and steel for reduced material consumption and lower weight, leading to cost savings and a smaller environmental footprint. Advanced internal coatings are being developed to improve barrier properties, extending the shelf-life of food and beverage products and preventing interactions between the product and the metal. Furthermore, advancements in printing and decorating technologies allow for higher-quality graphics and branding on metal cans, catering to the growing demand for visually appealing packaging that stands out on retail shelves. The development of easier-to-open closures and ergonomic designs also enhances user convenience.

Report Scope & Segmentation Analysis

This report segments the Indonesia Metal Packaging Market based on material, product type, and end-user vertical.

- Material: The market is divided into Aluminum and Steel. Aluminum packaging is projected to grow at a CAGR of approximately 6.0% due to its increasing adoption in the beverage sector. Steel packaging is expected to grow at a CAGR of around 5.0%, driven by demand in food, industrial, and chemical applications.

- Product Type: Key segments include Cans (further categorized into Food Cans, Beverage Cans, and Aerosol Cans), Bulk Containers, Shipping Barrels & Drums, Caps & Closures, and Other Product Types. The Cans segment is expected to dominate, with beverage cans leading the growth. Shipping barrels & drums are projected to witness steady growth owing to industrial expansion.

- End-user Vertical: The market is analyzed across Beverage, Food, Paint & Chemical, Industrial, and Other End-users Verticals. The Beverage sector is expected to remain the largest contributor, followed by the Food sector. The Paint & Chemical and Industrial sectors are also anticipated to show significant growth, driven by manufacturing activities and infrastructure development.

Key Drivers of Indonesia Metal Packaging Market Growth

The Indonesia Metal Packaging Market is propelled by several key growth drivers. The robust economic growth and rising disposable incomes of the Indonesian population are leading to increased consumption of packaged goods, particularly beverages and processed foods. The expanding middle class is opting for convenient and premium products, directly boosting the demand for metal packaging. Furthermore, government initiatives supporting industrialization and manufacturing development are creating a sustained need for reliable and durable packaging solutions for a wide range of products, from chemicals to consumer goods. Technological advancements in metal can production, including lightweighting and improved printing capabilities, are enhancing the attractiveness and competitiveness of metal packaging. The inherent recyclability of aluminum and steel aligns with growing environmental consciousness, positioning metal as a sustainable packaging choice.

- Economic Growth & Rising Disposable Incomes: Fueling consumer spending on packaged goods.

- Industrialization & Manufacturing Expansion: Driving demand for industrial and chemical packaging.

- Technological Advancements: Improving efficiency, sustainability, and aesthetics of metal packaging.

- Recyclability & Sustainability Trends: Enhancing the appeal of metal packaging.

Challenges in the Indonesia Metal Packaging Market Sector

Despite its strong growth trajectory, the Indonesia Metal Packaging Market faces certain challenges. The price volatility of raw materials, particularly aluminum and steel, can impact manufacturing costs and profit margins for producers. Competition from alternative packaging materials, such as plastics and flexible packaging, remains a constant threat, especially in certain consumer segments where cost and convenience are paramount. Stringent environmental regulations related to waste management and recycling, while promoting sustainability, can also lead to increased compliance costs for manufacturers. Furthermore, supply chain disruptions, as witnessed globally, can affect the availability and timely delivery of raw materials and finished products, potentially hindering production and distribution. The capital-intensive nature of metal packaging manufacturing requires significant investment in advanced machinery and infrastructure, which can be a barrier for new entrants.

- Raw Material Price Volatility: Impacting production costs and profitability.

- Competition from Alternative Packaging Materials: Sustained pressure from plastics and flexibles.

- Stringent Environmental Regulations: Increasing compliance costs.

- Supply Chain Disruptions: Affecting material availability and logistics.

Emerging Opportunities in Indonesia Metal Packaging Market

The Indonesia Metal Packaging Market presents several exciting emerging opportunities. The growing demand for sustainable and recyclable packaging solutions offers a significant advantage for metal. Innovations in lightweighting and enhanced recyclability can further strengthen this position. The expansion of the e-commerce sector is creating new opportunities for durable and secure shipping packaging, where metal drums and containers can play a crucial role. The increasing demand for premium and artisanal food and beverage products is driving the need for aesthetically appealing and high-quality metal packaging, including decorative cans and specialty closures. Furthermore, the development of smart packaging technologies, such as embedded sensors for product tracking and condition monitoring, represents a future growth avenue. Opportunities also lie in catering to niche markets within the food and beverage sector, such as ready-to-drink coffee, dairy-based beverages, and specialized health foods.

- Growth in Sustainable & Recyclable Packaging: Leveraging metal's inherent eco-friendly attributes.

- E-commerce Growth: Demand for robust and secure shipping solutions.

- Premium & Artisanal Product Packaging: Opportunities for aesthetically enhanced metal cans.

- Smart Packaging Technologies: Potential for value-added features and data integration.

Leading Players in the Indonesia Metal Packaging Market Market

- Rheem Indonesia

- PT United Can Company Ltd

- PT Indonesia Raya Makmur

- PT Pelangi Indah Canindo Tbk

- Sonoco Products Company (Sonoco Indonesia)

- PT Cometa Can Corporation

- Crown Holdings Inc

- PT Indonesia Multi Colour Printing

- P T New Red & White

- ATP Group

Key Developments in Indonesia Metal Packaging Market Industry

- December 2022: PT Rheem Indonesia started its business in steel drums manufacturing, later expanding into plastic drums and jerry cans to meet evolving industry demands. The company continually upgrades its manufacturing facilities and product quality to cater to the lubricant and chemical (specialty and general) industries.

- December 2022: In response to the growing demand for high-quality printing, a company recently installed a new state-of-the-art metal decorating facility alongside its existing metal cans and closures manufacturing. This facility, equipped with a multi-color metal printing press capable of producing over 10,000 sheets per hour, enhances service offerings to the food, beverage, cosmetics, and other sectors.

Strategic Outlook for Indonesia Metal Packaging Market Market

The strategic outlook for the Indonesia Metal Packaging Market is exceptionally positive, driven by sustained economic expansion, a growing consumer base, and increasing demand for convenience and quality. Key growth catalysts include the continued rise of the beverage and food processing industries, necessitating a higher volume of metal packaging solutions. The government's focus on boosting domestic manufacturing and industrial output will further solidify the market for industrial and chemical packaging. Embracing technological advancements in production efficiency, material innovation (e.g., lighter-weight alloys), and enhanced printing capabilities will be crucial for maintaining a competitive edge. Strategic collaborations, mergers, and acquisitions are likely to shape the market landscape, enabling companies to expand their product portfolios and geographical reach. Furthermore, a strong emphasis on sustainability and circular economy principles, through improved recyclability and reduced environmental impact, will be paramount for long-term success and market leadership in Indonesia.

Indonesia Metal Packaging Market Segmentation

-

1. Material

- 1.1. Aluminum

- 1.2. Steel

-

2. Product Type

-

2.1. Cans

- 2.1.1. Food Cans

- 2.1.2. Beverage Cans

- 2.1.3. Aerosol Cans

- 2.2. Bulk Containers

- 2.3. Shipping Barrels & Drums

- 2.4. Caps & Closures

- 2.5. Other Product Types

-

2.1. Cans

-

3. End-user Vertical

- 3.1. Beverage

- 3.2. Food

- 3.3. Paint & Chemical

- 3.4. Industrial

- 3.5. Other End-users Verticals

Indonesia Metal Packaging Market Segmentation By Geography

- 1. Indonesia

Indonesia Metal Packaging Market Regional Market Share

Geographic Coverage of Indonesia Metal Packaging Market

Indonesia Metal Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Convenience Food; Higher Recycling Rates Coupled with Higher End-user Manufacturing Demand in Indonesia

- 3.3. Market Restrains

- 3.3.1. Availability of Alternative Packaging Solutions

- 3.4. Market Trends

- 3.4.1. Growing Demand for Convenience Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Metal Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Aluminum

- 5.1.2. Steel

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Cans

- 5.2.1.1. Food Cans

- 5.2.1.2. Beverage Cans

- 5.2.1.3. Aerosol Cans

- 5.2.2. Bulk Containers

- 5.2.3. Shipping Barrels & Drums

- 5.2.4. Caps & Closures

- 5.2.5. Other Product Types

- 5.2.1. Cans

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Beverage

- 5.3.2. Food

- 5.3.3. Paint & Chemical

- 5.3.4. Industrial

- 5.3.5. Other End-users Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rheem Indonesia

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PT United Can Company Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Indonesia Raya Makmur

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Pelangi Indah Canindo Tbk

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sonoco Products Company (Sonoco Indonesia)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Cometa Can Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Crown Holdings Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Indonesia Multi Colour Printing

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 P T New Red & White

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ATP Grou

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rheem Indonesia

List of Figures

- Figure 1: Indonesia Metal Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Indonesia Metal Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Metal Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 2: Indonesia Metal Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Indonesia Metal Packaging Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 4: Indonesia Metal Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Indonesia Metal Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 6: Indonesia Metal Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Indonesia Metal Packaging Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 8: Indonesia Metal Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Metal Packaging Market?

The projected CAGR is approximately 3.45%.

2. Which companies are prominent players in the Indonesia Metal Packaging Market?

Key companies in the market include Rheem Indonesia, PT United Can Company Ltd, PT Indonesia Raya Makmur, PT Pelangi Indah Canindo Tbk, Sonoco Products Company (Sonoco Indonesia), PT Cometa Can Corporation, Crown Holdings Inc, PT Indonesia Multi Colour Printing, P T New Red & White, ATP Grou.

3. What are the main segments of the Indonesia Metal Packaging Market?

The market segments include Material, Product Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 3 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Convenience Food; Higher Recycling Rates Coupled with Higher End-user Manufacturing Demand in Indonesia.

6. What are the notable trends driving market growth?

Growing Demand for Convenience Food.

7. Are there any restraints impacting market growth?

Availability of Alternative Packaging Solutions.

8. Can you provide examples of recent developments in the market?

December 2022: PT Rheem Indonesia started its business in steel drums manufacturing. To date, the company has expanded into plastic drums and jerry cans to cope with industry demands and changes by constantly upgrading its manufacturing facility and plant and product quality and service with which it is catering to lubricant and chemical (specialty and general) industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Metal Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Metal Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Metal Packaging Market?

To stay informed about further developments, trends, and reports in the Indonesia Metal Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence