Key Insights

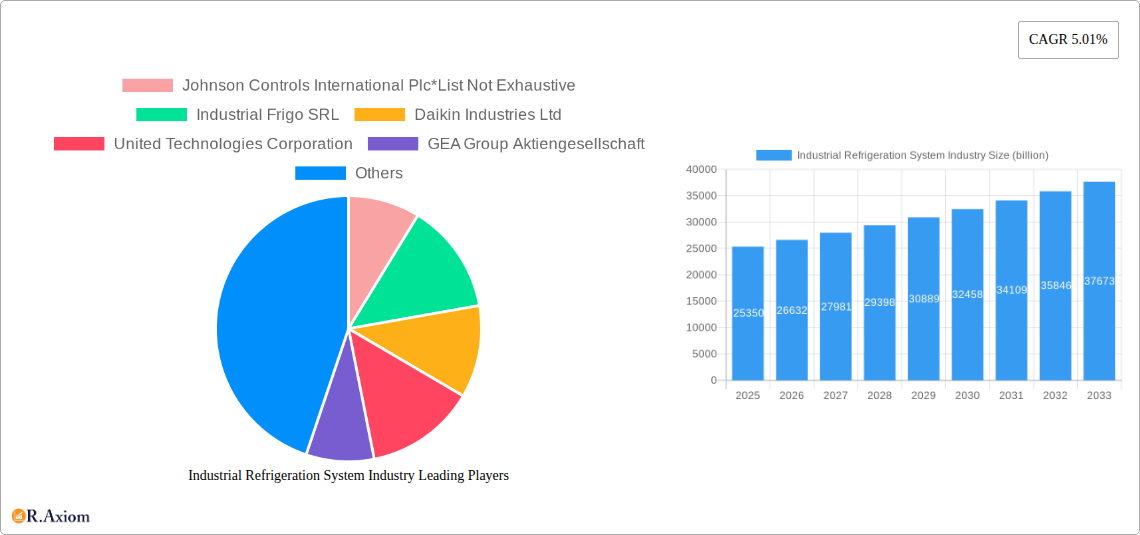

The global Industrial Refrigeration System market is poised for substantial growth, projected to reach an estimated $25.35 billion in 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.01% through 2033. This expansion is largely driven by the increasing demand for sophisticated cooling solutions across a spectrum of industries, most notably Food & Beverages, Chemicals & Pharmaceuticals, and Oil & Gas. The imperative for maintaining product integrity, extending shelf life, and adhering to stringent regulatory standards in these sectors fuels the adoption of advanced refrigeration technologies. Key growth enablers include the rising need for energy-efficient systems, the shift towards environmentally friendly refrigerants like CO2 and ammonia, and the continuous innovation in control systems that optimize performance and reduce operational costs. Furthermore, the expanding industrial base in emerging economies, particularly in the Asia Pacific region, is creating significant new opportunities for market players.

Industrial Refrigeration System Industry Market Size (In Billion)

Despite the positive outlook, certain factors could temper growth. The high initial investment costs associated with industrial refrigeration systems, coupled with the ongoing complexity of managing refrigerant compliance and environmental regulations, present considerable challenges. However, the industry is actively addressing these by developing more cost-effective and sustainable solutions. Technological advancements, such as the integration of IoT for remote monitoring and predictive maintenance, are also enhancing operational efficiency and system reliability, mitigating some of these restraints. The market is characterized by a dynamic competitive landscape, with established global players and emerging regional manufacturers vying for market share through product innovation, strategic partnerships, and geographical expansion. The ongoing focus on sustainability and operational excellence will continue to shape the evolution of the industrial refrigeration system market in the coming years.

Industrial Refrigeration System Industry Company Market Share

Industrial Refrigeration System Industry Market Concentration & Innovation

The industrial refrigeration system market, valued at approximately $55.8 billion in 2025, exhibits a moderate to high concentration, with major players like Johnson Controls International Plc, Daikin Industries Ltd, and GEA Group Aktiengesellschaft holding significant market shares. Innovation in this sector is primarily driven by the increasing demand for energy-efficient and environmentally friendly refrigeration solutions. Key innovation areas include the development of natural refrigerants such as ammonia and CO2, advanced control systems for optimized performance, and the integration of IoT for remote monitoring and predictive maintenance. Regulatory frameworks, particularly those aimed at phasing out high global warming potential (GWP) refrigerants, are also a significant catalyst for innovation. Product substitutes, while present in some niche applications, are not a major threat to the core industrial refrigeration market due to the specialized needs of industrial processes. End-user trends show a strong preference for scalable, reliable, and low-maintenance systems, particularly within the booming food & beverages and chemicals & pharmaceuticals sectors. Mergers and acquisition activities are moderate, with deal values often in the hundreds of millions to billions of dollars, focusing on consolidating market presence and acquiring advanced technological capabilities. For instance, strategic acquisitions aim to bolster portfolios in specialized equipment like advanced compressors or cutting-edge control solutions.

Industrial Refrigeration System Industry Industry Trends & Insights

The global industrial refrigeration system market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.2% from 2025 to 2033, reaching an estimated market size of over $80 billion by the end of the forecast period. This robust expansion is fueled by several key market growth drivers. The escalating demand for cold chain infrastructure, particularly in emerging economies, to support the burgeoning food & beverages industry and the pharmaceutical sector's need for vaccine and drug storage, is a primary catalyst. Technological disruptions are rapidly reshaping the landscape. The shift towards natural refrigerants like ammonia and CO2, driven by stringent environmental regulations and a growing corporate sustainability focus, is a significant trend. These refrigerants offer lower GWP and are more energy-efficient in many applications. Advanced automation and digital technologies, including the Internet of Things (IoT) and artificial intelligence (AI), are being increasingly integrated into industrial refrigeration systems. These innovations enable real-time monitoring, predictive maintenance, energy optimization, and enhanced operational efficiency, leading to reduced downtime and operational costs. Consumer preferences are indirectly influencing the market by demanding higher quality and longer shelf-life products, which in turn necessitates more sophisticated and reliable refrigeration solutions. The competitive dynamics are characterized by intense R&D efforts, strategic partnerships, and a focus on providing comprehensive service and support to end-users. Companies are differentiating themselves through energy efficiency ratings, compliance with environmental standards, and the ability to offer customized solutions for diverse industrial applications. The increasing adoption of modular and scalable refrigeration systems is also a notable trend, allowing businesses to adapt their cooling capacities to fluctuating demands without significant capital overhauls.

Dominant Markets & Segments in Industrial Refrigeration System Industry

The Food & Beverages application segment is a dominant force within the industrial refrigeration system industry, driven by an ever-increasing global demand for processed foods, frozen goods, and beverages requiring stringent temperature control throughout their lifecycle. This segment is expected to continue its leadership through 2033, supported by economic policies promoting agricultural output and food processing infrastructure development, especially in Asia-Pacific and Latin America. Within the Equipment segmentation, Compressors represent the largest sub-segment. Their critical role in driving the refrigeration cycle makes them indispensable. The dominance of compressors is underpinned by ongoing innovation in screw, scroll, and centrifugal compressor technologies, focusing on higher efficiency and variable speed drives. For Refrigerants, while HFCs still hold a significant share due to established infrastructure, Ammonia and CO2 are experiencing rapid growth. Ammonia's excellent thermodynamic properties and low cost make it a favored choice for large-scale industrial applications, particularly in food processing and cold storage, despite its safety considerations. CO2, with its near-zero GWP, is gaining traction, especially in supermarkets and smaller industrial facilities, driven by regulatory pressures and its favorable environmental profile. The Chemicals & Pharmaceuticals application sector is another high-growth area, driven by the critical need for precise temperature control in the production and storage of pharmaceuticals, vaccines, and various chemicals. Stringent quality control and regulatory compliance in these industries necessitate highly reliable and sophisticated refrigeration systems. The Oil & Gas sector also represents a substantial application, particularly for process cooling and natural gas liquefaction, where robust and specialized refrigeration solutions are paramount.

Industrial Refrigeration System Industry Product Developments

Product developments in the industrial refrigeration system market are sharply focused on enhancing energy efficiency, reducing environmental impact, and improving operational intelligence. Innovations include the wider adoption of variable speed drives in compressors for optimized cooling output and reduced energy consumption. The development of advanced heat exchangers and condensers, utilizing optimized materials and designs, further boosts efficiency. Smart control systems, leveraging IoT capabilities, are increasingly being integrated, allowing for remote monitoring, diagnostics, and predictive maintenance, thereby minimizing downtime and operational costs. The shift towards natural refrigerants like ammonia and CO2 is driving the design of new system components that are compatible with these substances, ensuring safety and optimal performance. These developments provide a competitive advantage by meeting stringent environmental regulations and lowering the total cost of ownership for end-users.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Industrial Refrigeration System Industry, segmented by Equipment, Refrigerant, and Application. The Equipment segmentation includes detailed analysis of Compressors, Condensers, Evaporators, Controls, and Others, with projected market sizes and growth rates for each sub-segment. Refrigerant segmentation covers Ammonia, CO2, and HFC, detailing their adoption trends, market penetration, and future outlook. The Application segmentation offers in-depth insights into Food & Beverages, Chemicals & Pharmaceuticals, and Oil & Gas sectors, outlining their specific refrigeration needs, market sizes, and growth drivers. Competitive dynamics within each segment are thoroughly examined to provide a holistic market overview.

Key Drivers of Industrial Refrigeration System Industry Growth

The industrial refrigeration system industry's growth is propelled by several key factors. Technological advancements in energy-efficient compressors, advanced control systems, and the adoption of natural refrigerants are major drivers. Economic growth and the expansion of cold chain logistics globally, particularly in emerging markets, are significantly boosting demand. Furthermore, stringent environmental regulations mandating the phase-out of high GWP refrigerants are compelling industries to invest in newer, more sustainable cooling technologies, thereby fueling innovation and market expansion. The increasing global population and rising disposable incomes also contribute to higher demand for perishable goods and pharmaceuticals, directly impacting the need for robust industrial refrigeration.

Challenges in the Industrial Refrigeration System Industry Sector

Despite robust growth, the industrial refrigeration system industry faces several challenges. High initial investment costs for advanced and energy-efficient systems can be a barrier for some small and medium-sized enterprises. Strict regulatory compliance regarding refrigerant handling, safety, and environmental impact requires continuous adaptation and can add to operational complexity. Supply chain disruptions and the availability of specialized components can also pose challenges, impacting project timelines and costs. Furthermore, the shortage of skilled labor for installation, maintenance, and repair of complex systems can hinder efficient operations and widespread adoption of new technologies. Competitive pressures and the need for continuous innovation also demand significant R&D investment.

Emerging Opportunities in Industrial Refrigeration System Industry

The industrial refrigeration system industry is ripe with emerging opportunities. The increasing global focus on sustainability and reducing carbon footprints is driving demand for natural refrigerants like ammonia and CO2, creating significant market potential for related systems and services. The growth of e-commerce and the demand for faster delivery of perishable goods are spurring investments in advanced cold chain logistics and temperature-controlled warehousing. The pharmaceutical industry's expanding needs for vaccine storage and temperature-sensitive drug manufacturing present a growing segment. Additionally, digitalization and IoT integration offer opportunities for developing smart, connected refrigeration systems that provide enhanced data analytics, predictive maintenance, and remote management capabilities, leading to optimized operational efficiency.

Leading Players in the Industrial Refrigeration System Industry Market

Johnson Controls International Plc Industrial Frigo SRL Daikin Industries Ltd United Technologies Corporation GEA Group Aktiengesellschaft Danfoss Ingersoll Rand Plc Emerson Electric Dover Corporation Star Refrigeration Ltd BITZER Kühlmaschinenbau GmbH

Key Developments in Industrial Refrigeration System Industry Industry

- 2023: Increased focus on developing ammonia-based refrigeration solutions for large-scale industrial applications, driven by environmental regulations.

- 2023: Significant investments in R&D for CO2 refrigeration systems for their near-zero GWP and suitability in various food retail and industrial settings.

- 2022: Introduction of advanced compressor technologies with variable speed drives leading to substantial energy savings for end-users.

- 2022: Expansion of IoT integration in refrigeration controls, enabling remote diagnostics and predictive maintenance to minimize downtime.

- 2021: Strategic mergers and acquisitions by major players to expand their portfolio of energy-efficient and sustainable refrigeration solutions.

- 2020: Growing adoption of modular refrigeration systems offering flexibility and scalability for diverse industrial needs.

Strategic Outlook for Industrial Refrigeration System Industry Market

The strategic outlook for the industrial refrigeration system market is highly positive, characterized by sustained growth driven by increasing demand for efficient, sustainable, and digitally integrated cooling solutions. The ongoing shift towards natural refrigerants, coupled with advancements in control technologies and IoT integration, presents significant opportunities for market expansion. Investments in cold chain infrastructure, particularly in developing economies, and the stringent regulatory landscape will continue to be major growth catalysts. Companies that focus on innovation, energy efficiency, and comprehensive service offerings are well-positioned to capitalize on the evolving needs of diverse industrial sectors, ensuring long-term market leadership and profitability.

Industrial Refrigeration System Industry Segmentation

-

1. Equipment

- 1.1. Compressors

- 1.2. Condensers

- 1.3. Evaporators

- 1.4. Controls

- 1.5. Others

-

2. Refrigerant

- 2.1. Ammonia

- 2.2. CO2

- 2.3. HFC

-

3. Application

- 3.1. Food & Beverages

- 3.2. Chemicals & Pharmaceuticals

- 3.3. Oil & Gas

Industrial Refrigeration System Industry Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. UK

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacfic

- 4. Latin America

- 5. Middle East

Industrial Refrigeration System Industry Regional Market Share

Geographic Coverage of Industrial Refrigeration System Industry

Industrial Refrigeration System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising food and beverages processing industry; Introduction of advanced technologies such as innovative IoT-enabled monitoring solutions

- 3.3. Market Restrains

- 3.3.1. ; High cost of development

- 3.4. Market Trends

- 3.4.1. Oil and Gas industry to witness significant growth in forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Refrigeration System Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 5.1.1. Compressors

- 5.1.2. Condensers

- 5.1.3. Evaporators

- 5.1.4. Controls

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Refrigerant

- 5.2.1. Ammonia

- 5.2.2. CO2

- 5.2.3. HFC

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Food & Beverages

- 5.3.2. Chemicals & Pharmaceuticals

- 5.3.3. Oil & Gas

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 6. North America Industrial Refrigeration System Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 6.1.1. Compressors

- 6.1.2. Condensers

- 6.1.3. Evaporators

- 6.1.4. Controls

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Refrigerant

- 6.2.1. Ammonia

- 6.2.2. CO2

- 6.2.3. HFC

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Food & Beverages

- 6.3.2. Chemicals & Pharmaceuticals

- 6.3.3. Oil & Gas

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 7. Europe Industrial Refrigeration System Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 7.1.1. Compressors

- 7.1.2. Condensers

- 7.1.3. Evaporators

- 7.1.4. Controls

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Refrigerant

- 7.2.1. Ammonia

- 7.2.2. CO2

- 7.2.3. HFC

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Food & Beverages

- 7.3.2. Chemicals & Pharmaceuticals

- 7.3.3. Oil & Gas

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 8. Asia Pacific Industrial Refrigeration System Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 8.1.1. Compressors

- 8.1.2. Condensers

- 8.1.3. Evaporators

- 8.1.4. Controls

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Refrigerant

- 8.2.1. Ammonia

- 8.2.2. CO2

- 8.2.3. HFC

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Food & Beverages

- 8.3.2. Chemicals & Pharmaceuticals

- 8.3.3. Oil & Gas

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 9. Latin America Industrial Refrigeration System Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Equipment

- 9.1.1. Compressors

- 9.1.2. Condensers

- 9.1.3. Evaporators

- 9.1.4. Controls

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Refrigerant

- 9.2.1. Ammonia

- 9.2.2. CO2

- 9.2.3. HFC

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Food & Beverages

- 9.3.2. Chemicals & Pharmaceuticals

- 9.3.3. Oil & Gas

- 9.1. Market Analysis, Insights and Forecast - by Equipment

- 10. Middle East Industrial Refrigeration System Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Equipment

- 10.1.1. Compressors

- 10.1.2. Condensers

- 10.1.3. Evaporators

- 10.1.4. Controls

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Refrigerant

- 10.2.1. Ammonia

- 10.2.2. CO2

- 10.2.3. HFC

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Food & Beverages

- 10.3.2. Chemicals & Pharmaceuticals

- 10.3.3. Oil & Gas

- 10.1. Market Analysis, Insights and Forecast - by Equipment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Johnson Controls International Plc*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Industrial Frigo SRL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Daikin Industries Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 United Technologies Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GEA Group Aktiengesellschaft

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Danfoss

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ingersoll Rand Plc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Emerson Electric

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dover Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Star Refrigeration Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 BITZER Kühlmaschinenbau GmbH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Johnson Controls International Plc*List Not Exhaustive

List of Figures

- Figure 1: Global Industrial Refrigeration System Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Industrial Refrigeration System Industry Revenue (billion), by Equipment 2025 & 2033

- Figure 3: North America Industrial Refrigeration System Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 4: North America Industrial Refrigeration System Industry Revenue (billion), by Refrigerant 2025 & 2033

- Figure 5: North America Industrial Refrigeration System Industry Revenue Share (%), by Refrigerant 2025 & 2033

- Figure 6: North America Industrial Refrigeration System Industry Revenue (billion), by Application 2025 & 2033

- Figure 7: North America Industrial Refrigeration System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Industrial Refrigeration System Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Industrial Refrigeration System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Industrial Refrigeration System Industry Revenue (billion), by Equipment 2025 & 2033

- Figure 11: Europe Industrial Refrigeration System Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 12: Europe Industrial Refrigeration System Industry Revenue (billion), by Refrigerant 2025 & 2033

- Figure 13: Europe Industrial Refrigeration System Industry Revenue Share (%), by Refrigerant 2025 & 2033

- Figure 14: Europe Industrial Refrigeration System Industry Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Industrial Refrigeration System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Industrial Refrigeration System Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Industrial Refrigeration System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Industrial Refrigeration System Industry Revenue (billion), by Equipment 2025 & 2033

- Figure 19: Asia Pacific Industrial Refrigeration System Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 20: Asia Pacific Industrial Refrigeration System Industry Revenue (billion), by Refrigerant 2025 & 2033

- Figure 21: Asia Pacific Industrial Refrigeration System Industry Revenue Share (%), by Refrigerant 2025 & 2033

- Figure 22: Asia Pacific Industrial Refrigeration System Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: Asia Pacific Industrial Refrigeration System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Industrial Refrigeration System Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Industrial Refrigeration System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Industrial Refrigeration System Industry Revenue (billion), by Equipment 2025 & 2033

- Figure 27: Latin America Industrial Refrigeration System Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 28: Latin America Industrial Refrigeration System Industry Revenue (billion), by Refrigerant 2025 & 2033

- Figure 29: Latin America Industrial Refrigeration System Industry Revenue Share (%), by Refrigerant 2025 & 2033

- Figure 30: Latin America Industrial Refrigeration System Industry Revenue (billion), by Application 2025 & 2033

- Figure 31: Latin America Industrial Refrigeration System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: Latin America Industrial Refrigeration System Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Latin America Industrial Refrigeration System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Industrial Refrigeration System Industry Revenue (billion), by Equipment 2025 & 2033

- Figure 35: Middle East Industrial Refrigeration System Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 36: Middle East Industrial Refrigeration System Industry Revenue (billion), by Refrigerant 2025 & 2033

- Figure 37: Middle East Industrial Refrigeration System Industry Revenue Share (%), by Refrigerant 2025 & 2033

- Figure 38: Middle East Industrial Refrigeration System Industry Revenue (billion), by Application 2025 & 2033

- Figure 39: Middle East Industrial Refrigeration System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East Industrial Refrigeration System Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East Industrial Refrigeration System Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Refrigeration System Industry Revenue billion Forecast, by Equipment 2020 & 2033

- Table 2: Global Industrial Refrigeration System Industry Revenue billion Forecast, by Refrigerant 2020 & 2033

- Table 3: Global Industrial Refrigeration System Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Industrial Refrigeration System Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Industrial Refrigeration System Industry Revenue billion Forecast, by Equipment 2020 & 2033

- Table 6: Global Industrial Refrigeration System Industry Revenue billion Forecast, by Refrigerant 2020 & 2033

- Table 7: Global Industrial Refrigeration System Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Industrial Refrigeration System Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: US Industrial Refrigeration System Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Industrial Refrigeration System Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Industrial Refrigeration System Industry Revenue billion Forecast, by Equipment 2020 & 2033

- Table 12: Global Industrial Refrigeration System Industry Revenue billion Forecast, by Refrigerant 2020 & 2033

- Table 13: Global Industrial Refrigeration System Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Industrial Refrigeration System Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: Germany Industrial Refrigeration System Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: France Industrial Refrigeration System Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: UK Industrial Refrigeration System Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Industrial Refrigeration System Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Industrial Refrigeration System Industry Revenue billion Forecast, by Equipment 2020 & 2033

- Table 20: Global Industrial Refrigeration System Industry Revenue billion Forecast, by Refrigerant 2020 & 2033

- Table 21: Global Industrial Refrigeration System Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global Industrial Refrigeration System Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 23: China Industrial Refrigeration System Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: India Industrial Refrigeration System Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Industrial Refrigeration System Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacfic Industrial Refrigeration System Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Global Industrial Refrigeration System Industry Revenue billion Forecast, by Equipment 2020 & 2033

- Table 28: Global Industrial Refrigeration System Industry Revenue billion Forecast, by Refrigerant 2020 & 2033

- Table 29: Global Industrial Refrigeration System Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 30: Global Industrial Refrigeration System Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Global Industrial Refrigeration System Industry Revenue billion Forecast, by Equipment 2020 & 2033

- Table 32: Global Industrial Refrigeration System Industry Revenue billion Forecast, by Refrigerant 2020 & 2033

- Table 33: Global Industrial Refrigeration System Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Industrial Refrigeration System Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Refrigeration System Industry?

The projected CAGR is approximately 5.01%.

2. Which companies are prominent players in the Industrial Refrigeration System Industry?

Key companies in the market include Johnson Controls International Plc*List Not Exhaustive, Industrial Frigo SRL, Daikin Industries Ltd, United Technologies Corporation, GEA Group Aktiengesellschaft, Danfoss, Ingersoll Rand Plc, Emerson Electric, Dover Corporation, Star Refrigeration Ltd, BITZER Kühlmaschinenbau GmbH.

3. What are the main segments of the Industrial Refrigeration System Industry?

The market segments include Equipment, Refrigerant, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.35 billion as of 2022.

5. What are some drivers contributing to market growth?

; Rising food and beverages processing industry; Introduction of advanced technologies such as innovative IoT-enabled monitoring solutions.

6. What are the notable trends driving market growth?

Oil and Gas industry to witness significant growth in forecast period.

7. Are there any restraints impacting market growth?

; High cost of development.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Refrigeration System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Refrigeration System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Refrigeration System Industry?

To stay informed about further developments, trends, and reports in the Industrial Refrigeration System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence