Key Insights

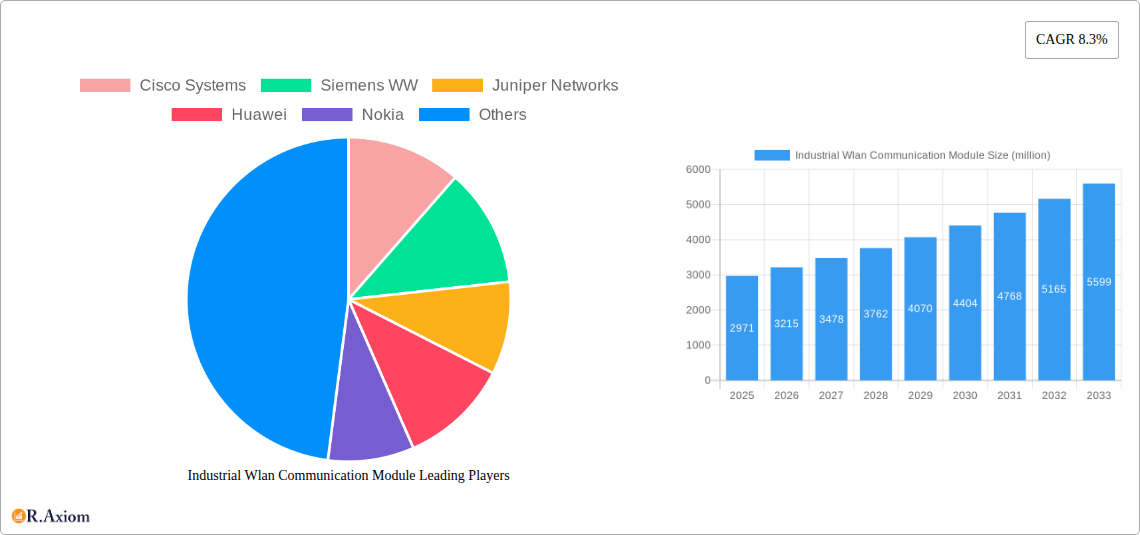

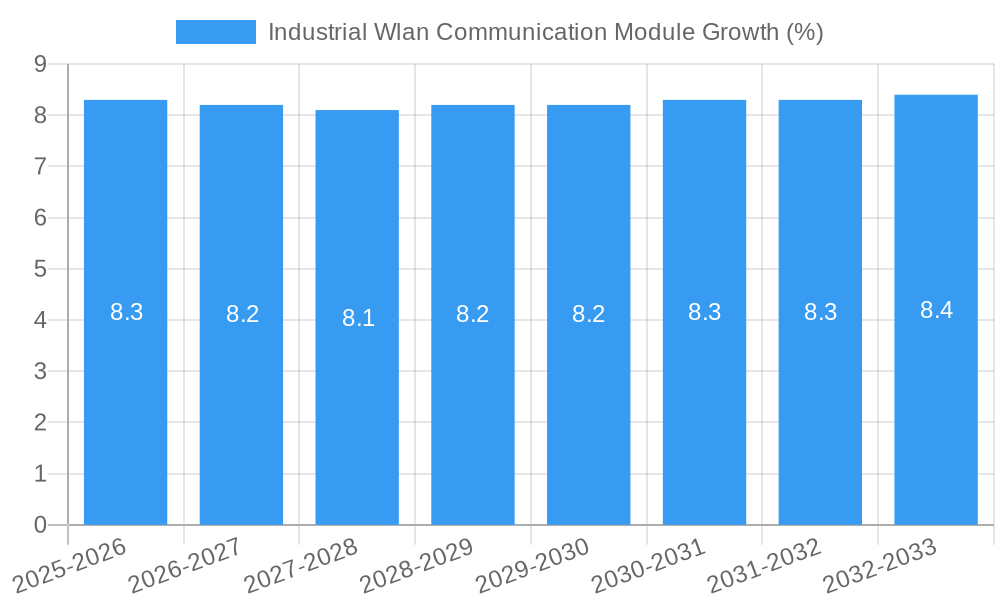

The Industrial WLAN Communication Module market is poised for significant expansion, projected to reach a substantial valuation of approximately USD 2,971 million. This growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 8.3%, indicating robust adoption and innovation within the sector. The increasing demand for real-time data, enhanced connectivity, and the growing implementation of Industry 4.0 technologies across various sectors are primary growth drivers. Specifically, the Manufacturing Industry, a cornerstone of industrial automation, is a major contributor, leveraging industrial WLAN for improved operational efficiency, predictive maintenance, and seamless integration of smart devices. The Oil and Gas sector, with its often remote and hazardous operational environments, benefits immensely from reliable wireless communication for monitoring and control, while the Transportation industry is increasingly adopting these modules for fleet management, logistics, and enhanced safety features. The dominance of IEEE 802.11ac standards, known for their higher throughput and lower latency, is expected to continue, with a gradual but steady integration of newer standards as they mature.

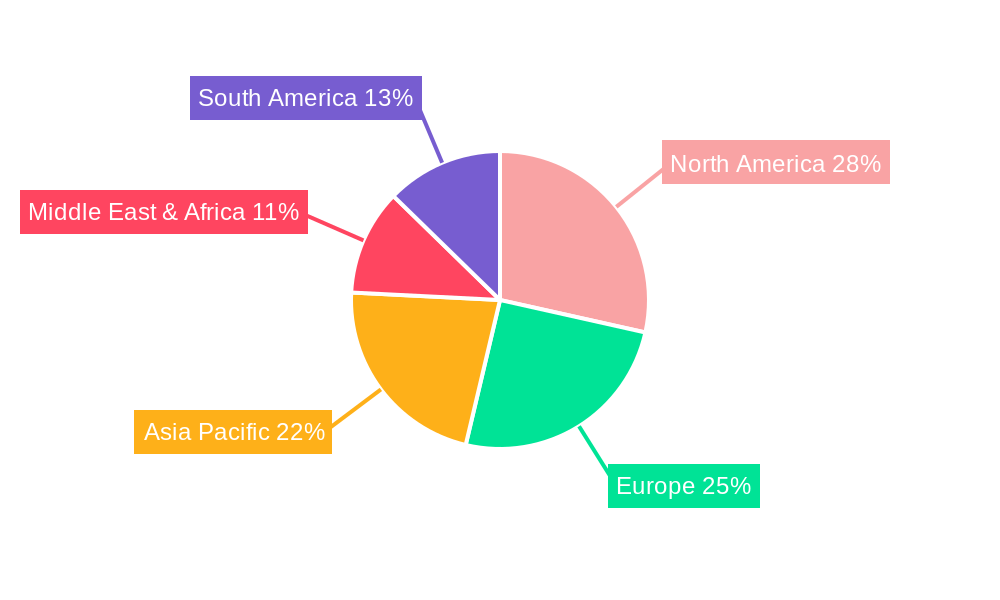

The market's upward trajectory is further supported by ongoing technological advancements in wireless communication, including improved security protocols and increased bandwidth capabilities, which are crucial for the demanding industrial environment. The forecast period, spanning from 2025 to 2033, anticipates sustained momentum as more enterprises embrace digital transformation. While the market presents immense opportunities, certain restraints, such as the initial cost of deployment and the need for robust cybersecurity measures, need to be strategically addressed by market players. However, the undeniable benefits of enhanced operational visibility, remote monitoring, and increased automation are strong incentives for overcoming these challenges. The geographical landscape is diverse, with North America and Europe leading in adoption due to their mature industrial infrastructures and early embrace of digital technologies. Asia Pacific, with its rapidly growing manufacturing base and increasing investments in smart factories, is expected to be a key growth region in the coming years, presenting significant untapped potential for industrial WLAN communication modules.

Here's the SEO-optimized, detailed report description for Industrial WLAN Communication Modules:

Industrial Wlan Communication Module Market Concentration & Innovation

The Industrial WLAN Communication Module market is characterized by a moderate to high level of concentration, with key players like Cisco Systems, Siemens WW, Juniper Networks, Huawei, Nokia, HPE, CommScope, Phoenix Contact, Dell, and ZTE Corporation vying for significant market share. Innovation is a critical differentiator, driven by the increasing demand for reliable, high-speed wireless connectivity in harsh industrial environments. Key innovation drivers include the development of more robust hardware capable of withstanding extreme temperatures and vibrations, enhanced cybersecurity features to protect critical infrastructure, and the integration of AI/ML for predictive maintenance and network optimization. Regulatory frameworks, while aiming to standardize safety and interoperability, can also present challenges in rapid adoption. Product substitutes, such as wired industrial Ethernet solutions, continue to exist but are increasingly being displaced by the flexibility and scalability offered by industrial WLAN. End-user trends are strongly leaning towards digitalization, Industry 4.0 initiatives, and the Internet of Things (IoT), propelling the need for advanced wireless solutions. Mergers and acquisitions (M&A) are anticipated to play a role in consolidating market power, with potential deal values in the hundreds of millions to billions of dollars, as companies seek to expand their product portfolios and geographic reach. The market share distribution among the top five players is estimated to be over 60 million. M&A deal values are projected to reach xx million over the forecast period.

Industrial Wlan Communication Module Industry Trends & Insights

The industrial WLAN communication module market is poised for substantial growth, driven by the relentless march of digital transformation across various industrial sectors. The estimated Compound Annual Growth Rate (CAGR) for this market is a robust xx%, projected to continue throughout the forecast period of 2025–2033. This growth is fueled by several interconnected trends. Firstly, the widespread adoption of Industry 4.0 and smart factory initiatives is creating an insatiable demand for seamless, high-bandwidth wireless connectivity to enable real-time data acquisition, control, and automation. Manufacturing industries, in particular, are leading this charge, seeking to optimize production lines, improve operational efficiency, and enhance product quality through wireless networks. Secondly, the increasing deployment of Industrial IoT (IIoT) devices necessitates reliable and secure wireless communication modules that can operate in challenging environments. These devices, ranging from sensors and actuators to robotic arms and autonomous guided vehicles (AGVs), generate vast amounts of data that need to be transmitted wirelessly for analysis and decision-making.

Technological advancements are further accelerating market penetration. The evolution from IEEE 802.11n to IEEE 802.11ac and now the emerging IEEE 802.11ax (Wi-Fi 6/6E) standards is providing significant improvements in speed, latency, capacity, and spectral efficiency, crucial for demanding industrial applications. These next-generation standards offer better performance in dense environments and support a higher number of connected devices, addressing a key bottleneck in previous generations. Cybersecurity remains a paramount concern, and manufacturers are embedding advanced security protocols and features into their industrial WLAN modules to protect against cyber threats and ensure the integrity of industrial operations.

Consumer preferences, or rather end-user demands in the industrial context, are shifting towards solutions that offer greater flexibility, scalability, and ease of deployment. Wired solutions, while robust, often lack the agility required for dynamic industrial environments where reconfigurations and expansions are common. Industrial WLAN modules provide this much-needed flexibility, enabling faster deployment and reducing installation costs. The competitive landscape is dynamic, with established networking giants like Cisco Systems, Siemens WW, and Juniper Networks competing fiercely with specialized industrial automation companies like Phoenix Contact. Companies like Huawei and ZTE Corporation are also significant players, particularly in certain geographic markets. Strategic partnerships and alliances are becoming increasingly common as companies collaborate to offer integrated solutions and expand their market reach. The overall market penetration is expected to grow from an estimated xx% in the base year of 2025 to xx% by the end of the forecast period, signifying a substantial uptake of these critical communication modules.

Dominant Markets & Segments in Industrial Wlan Communication Module

The Industrial WLAN Communication Module market exhibits distinct regional and segment-specific dominance. Globally, North America and Europe currently represent the largest markets, driven by advanced industrial infrastructure, significant investments in Industry 4.0, and stringent regulatory requirements for operational efficiency and safety. Within these regions, the Manufacturing Industry segment emerges as the most dominant application. This is directly attributable to the ongoing digital transformation in automotive, electronics, and general manufacturing, where wireless connectivity is indispensable for robotics, automation, real-time production monitoring, and quality control. For instance, the adoption of AGVs for material handling and automated assembly lines in automotive plants relies heavily on stable and high-throughput industrial WLAN.

The Oil and Gas sector also presents a significant and growing market. The inherent challenges of deploying wired networks in remote and hazardous locations, such as offshore platforms and refineries, make industrial WLAN an ideal solution. Wireless modules enable real-time data acquisition from sensors monitoring well performance, pipeline integrity, and environmental conditions, enhancing safety and operational efficiency. Government initiatives promoting energy independence and optimizing resource extraction further bolster this segment.

The Transportation sector, encompassing logistics, ports, and intelligent transportation systems (ITS), is another key driver. Wireless communication is vital for tracking assets, managing fleet operations, enabling smart traffic management, and facilitating communication within intelligent vehicles. The need for robust connectivity in dynamic environments, such as train yards and busy logistics hubs, positions industrial WLAN as a critical technology.

In terms of technology type, the IEEE 802.11ac standard currently holds a dominant position due to its balanced offering of speed, range, and cost-effectiveness for a wide array of industrial applications. It provides a substantial upgrade over older standards, meeting the demands of most modern industrial connectivity needs. However, the adoption of IEEE 802.11ax (Wi-Fi 6/6E) is rapidly gaining momentum, particularly in high-density environments and applications requiring extremely low latency and higher capacity, such as advanced automation and critical control systems. Its market penetration is projected to significantly increase throughout the forecast period. While IEEE 802.11 a/b/g standards still exist in legacy systems, their market share is diminishing as industries upgrade to more advanced and efficient wireless technologies. The overall market size for industrial WLAN communication modules is projected to reach xx billion USD by 2033.

Key drivers for dominance in the Manufacturing Industry include substantial R&D investments in automation (estimated at xx million USD annually), government incentives for smart factory adoption (e.g., tax credits), and the presence of major manufacturing hubs. In Oil and Gas, drivers include stringent safety regulations necessitating wireless monitoring in hazardous zones (cost reduction of approx. xx% compared to wired infrastructure), and the need for remote asset management. For Transportation, key drivers are the growth in e-commerce demanding efficient logistics (leading to xx% increase in logistics automation), and smart city initiatives.

Industrial Wlan Communication Module Product Developments

Product development in the industrial WLAN communication module sector is focused on enhancing ruggedness, security, and performance. Innovations include modules designed for extreme temperature ranges (-40°C to +85°C), high vibration resistance, and ingress protection (IP67/IP68 ratings) to withstand harsh industrial environments. Advanced cybersecurity features, such as WPA3 enterprise, secure boot, and encrypted data transmission, are becoming standard. Furthermore, the integration of newer Wi-Fi standards like IEEE 802.11ax (Wi-Fi 6/6E) is a key trend, offering higher throughput, lower latency, and improved capacity for demanding applications like real-time machine control and high-definition video surveillance. Edge computing capabilities are also being integrated into some modules, allowing for local data processing and reducing reliance on centralized cloud infrastructure. These developments provide a significant competitive advantage by enabling reliable and secure wireless connectivity in previously inaccessible or challenging industrial settings, directly supporting Industry 4.0 initiatives.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global Industrial WLAN Communication Module market, segmented by application and type. The application segments include the Manufacturing Industry, projected to hold a market share of xx% by 2033, driven by automation and IIoT deployments. The Oil and Gas segment is expected to reach xx% market share, propelled by the need for remote monitoring and safety in hazardous environments. The Transportation segment is forecasted to capture xx% of the market, fueled by logistics and smart infrastructure growth. The Others segment, encompassing areas like mining, utilities, and healthcare, is expected to contribute xx% to the market.

In terms of type, the IEEE 802.11ac segment is anticipated to maintain a significant market presence, estimated at xx% by 2033, offering a robust balance of performance and cost. The IEEE 802.11n segment, while still relevant, is projected to decline to xx% as newer standards gain traction. The IEEE 802.11a/b/g segments are expected to represent a smaller, declining portion of the market. The emerging IEEE 802.11ax (Wi-Fi 6/6E) standard is poised for rapid growth, capturing an estimated xx% of the market by 2033, particularly in high-performance industrial applications. The total market size is projected to reach xx billion USD by 2033, with a CAGR of xx% during the forecast period. Competitive dynamics vary across segments, with specialized providers dominating certain niches.

Key Drivers of Industrial Wlan Communication Module Growth

The industrial WLAN communication module market's growth is underpinned by several critical drivers. The primary catalyst is the accelerating adoption of Industry 4.0 and IIoT. This paradigm shift necessitates robust, flexible, and scalable wireless connectivity for automation, real-time data analytics, and smart manufacturing processes. For example, the integration of AI-powered predictive maintenance systems in factories relies heavily on continuous data streams enabled by high-performance WLAN. Secondly, the increasing demand for operational efficiency and cost reduction across industries pushes for wireless solutions that are easier to deploy and reconfigure than wired alternatives, potentially reducing installation costs by xx%. Thirdly, advancements in wireless technologies, particularly the evolution to Wi-Fi 6/6E and beyond, offer higher speeds, lower latency, and increased capacity, meeting the evolving demands of complex industrial applications. Finally, stringent safety regulations in sectors like Oil & Gas and Mining mandate wireless monitoring in hazardous environments, driving the adoption of ruggedized industrial WLAN modules.

Challenges in the Industrial Wlan Communication Module Sector

Despite the robust growth prospects, the industrial WLAN communication module sector faces several challenges. Interference in industrial environments from heavy machinery, electrical noise, and a high density of devices can degrade wireless signal quality and reliability, necessitating advanced interference mitigation techniques. Cybersecurity threats remain a significant concern, as compromised industrial networks can lead to operational disruptions, data breaches, and safety hazards, requiring continuous investment in robust security solutions. Regulatory compliance and standardization across different regions and industries can be complex, slowing down product development and market entry. Furthermore, supply chain disruptions, as witnessed in recent years, can impact component availability and lead times, affecting production and pricing. The high upfront cost of deploying advanced industrial WLAN infrastructure can also be a barrier for smaller enterprises. Quantifiable impacts include potential project delays of up to xx months due to supply chain issues.

Emerging Opportunities in Industrial Wlan Communication Module

The industrial WLAN communication module market is ripe with emerging opportunities. The expansion of 5G integration with Wi-Fi 6E opens avenues for hybrid wireless networks offering unparalleled performance and reliability for critical industrial applications. The growing adoption of Edge Computing within industrial settings creates demand for WLAN modules capable of supporting local data processing, reducing latency and cloud dependency. Furthermore, the increasing focus on sustainability and energy efficiency in industrial operations presents an opportunity for WLAN solutions that enable smart energy management and optimize resource utilization. The digitalization of sectors like agriculture (smart farming) and warehousing automation presents new markets for industrial WLAN. The development of specialized WLAN solutions for specific harsh environments (e.g., underground mining, chemical plants) also offers a lucrative niche.

Leading Players in the Industrial Wlan Communication Module Market

- Cisco Systems

- Siemens WW

- Juniper Networks

- Huawei

- Nokia

- HPE

- CommScope

- Phoenix Contact

- Dell

- ZTE Corporation

Key Developments in Industrial Wlan Communication Module Industry

- 2024 January: Launch of new industrial-grade Wi-Fi 6E modules offering enhanced cybersecurity and extended temperature range.

- 2023 September: Major player announces strategic partnership to integrate 5G and Wi-Fi 6E for industrial IoT applications.

- 2023 March: Release of ruggedized WLAN modules with improved resistance to dust and water ingress for demanding outdoor environments.

- 2022 December: Significant investment in R&D for AI-driven network optimization in industrial WLAN solutions.

- 2022 June: Acquisition of a specialized industrial networking firm by a leading technology provider to expand product portfolio.

- 2021 November: Introduction of industrial WLAN solutions with built-in edge computing capabilities.

Strategic Outlook for Industrial Wlan Communication Module Market

The strategic outlook for the industrial WLAN communication module market remains exceptionally positive, driven by ongoing technological advancements and the relentless push towards industrial digitalization. Future growth will be significantly fueled by the increasing adoption of Wi-Fi 6/6E standards and the potential convergence with 5G technologies, offering unparalleled performance for mission-critical applications. Investments in robust cybersecurity features will remain a top priority for manufacturers to address evolving threats. The expanding IIoT ecosystem, coupled with the demand for real-time data and automation, will continue to drive the need for reliable and scalable wireless connectivity. Emerging opportunities in edge computing and sustainable industrial practices present further avenues for innovation and market expansion. Companies that focus on developing ruggedized, secure, and high-performance industrial WLAN solutions tailored to specific industry needs will be well-positioned for sustained success in this dynamic market.

Industrial Wlan Communication Module Segmentation

-

1. Application

- 1.1. Manufacturing Industry

- 1.2. Oil and Gas

- 1.3. Transportation

- 1.4. Others

-

2. Type

- 2.1. IEEE 802.11 ac

- 2.2. IEEE 802.11 n

- 2.3. IEEE 802.11 a/b/g

Industrial Wlan Communication Module Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Industrial Wlan Communication Module REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.3% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Wlan Communication Module Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Manufacturing Industry

- 5.1.2. Oil and Gas

- 5.1.3. Transportation

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. IEEE 802.11 ac

- 5.2.2. IEEE 802.11 n

- 5.2.3. IEEE 802.11 a/b/g

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Industrial Wlan Communication Module Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Manufacturing Industry

- 6.1.2. Oil and Gas

- 6.1.3. Transportation

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. IEEE 802.11 ac

- 6.2.2. IEEE 802.11 n

- 6.2.3. IEEE 802.11 a/b/g

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Industrial Wlan Communication Module Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Manufacturing Industry

- 7.1.2. Oil and Gas

- 7.1.3. Transportation

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. IEEE 802.11 ac

- 7.2.2. IEEE 802.11 n

- 7.2.3. IEEE 802.11 a/b/g

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Industrial Wlan Communication Module Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Manufacturing Industry

- 8.1.2. Oil and Gas

- 8.1.3. Transportation

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. IEEE 802.11 ac

- 8.2.2. IEEE 802.11 n

- 8.2.3. IEEE 802.11 a/b/g

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Industrial Wlan Communication Module Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Manufacturing Industry

- 9.1.2. Oil and Gas

- 9.1.3. Transportation

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. IEEE 802.11 ac

- 9.2.2. IEEE 802.11 n

- 9.2.3. IEEE 802.11 a/b/g

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Industrial Wlan Communication Module Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Manufacturing Industry

- 10.1.2. Oil and Gas

- 10.1.3. Transportation

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. IEEE 802.11 ac

- 10.2.2. IEEE 802.11 n

- 10.2.3. IEEE 802.11 a/b/g

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Cisco Systems

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Siemens WW

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Juniper Networks

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Huawei

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nokia

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 HPE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CommScope

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Phoenix Contact

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dell

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ZTE Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Cisco Systems

List of Figures

- Figure 1: Global Industrial Wlan Communication Module Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Industrial Wlan Communication Module Revenue (million), by Application 2024 & 2032

- Figure 3: North America Industrial Wlan Communication Module Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Industrial Wlan Communication Module Revenue (million), by Type 2024 & 2032

- Figure 5: North America Industrial Wlan Communication Module Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Industrial Wlan Communication Module Revenue (million), by Country 2024 & 2032

- Figure 7: North America Industrial Wlan Communication Module Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Industrial Wlan Communication Module Revenue (million), by Application 2024 & 2032

- Figure 9: South America Industrial Wlan Communication Module Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Industrial Wlan Communication Module Revenue (million), by Type 2024 & 2032

- Figure 11: South America Industrial Wlan Communication Module Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Industrial Wlan Communication Module Revenue (million), by Country 2024 & 2032

- Figure 13: South America Industrial Wlan Communication Module Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Industrial Wlan Communication Module Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Industrial Wlan Communication Module Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Industrial Wlan Communication Module Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Industrial Wlan Communication Module Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Industrial Wlan Communication Module Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Industrial Wlan Communication Module Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Industrial Wlan Communication Module Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Industrial Wlan Communication Module Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Industrial Wlan Communication Module Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Industrial Wlan Communication Module Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Industrial Wlan Communication Module Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Industrial Wlan Communication Module Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Industrial Wlan Communication Module Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Industrial Wlan Communication Module Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Industrial Wlan Communication Module Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Industrial Wlan Communication Module Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Industrial Wlan Communication Module Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Industrial Wlan Communication Module Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Industrial Wlan Communication Module Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Industrial Wlan Communication Module Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Industrial Wlan Communication Module Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Industrial Wlan Communication Module Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Industrial Wlan Communication Module Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Industrial Wlan Communication Module Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Industrial Wlan Communication Module Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Industrial Wlan Communication Module Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Industrial Wlan Communication Module Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Industrial Wlan Communication Module Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Industrial Wlan Communication Module Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Industrial Wlan Communication Module Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Industrial Wlan Communication Module Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Industrial Wlan Communication Module Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Industrial Wlan Communication Module Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Industrial Wlan Communication Module Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Industrial Wlan Communication Module Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Industrial Wlan Communication Module Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Industrial Wlan Communication Module Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Industrial Wlan Communication Module Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Wlan Communication Module?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the Industrial Wlan Communication Module?

Key companies in the market include Cisco Systems, Siemens WW, Juniper Networks, Huawei, Nokia, HPE, CommScope, Phoenix Contact, Dell, ZTE Corporation.

3. What are the main segments of the Industrial Wlan Communication Module?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2971 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Wlan Communication Module," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Wlan Communication Module report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Wlan Communication Module?

To stay informed about further developments, trends, and reports in the Industrial Wlan Communication Module, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence