Key Insights

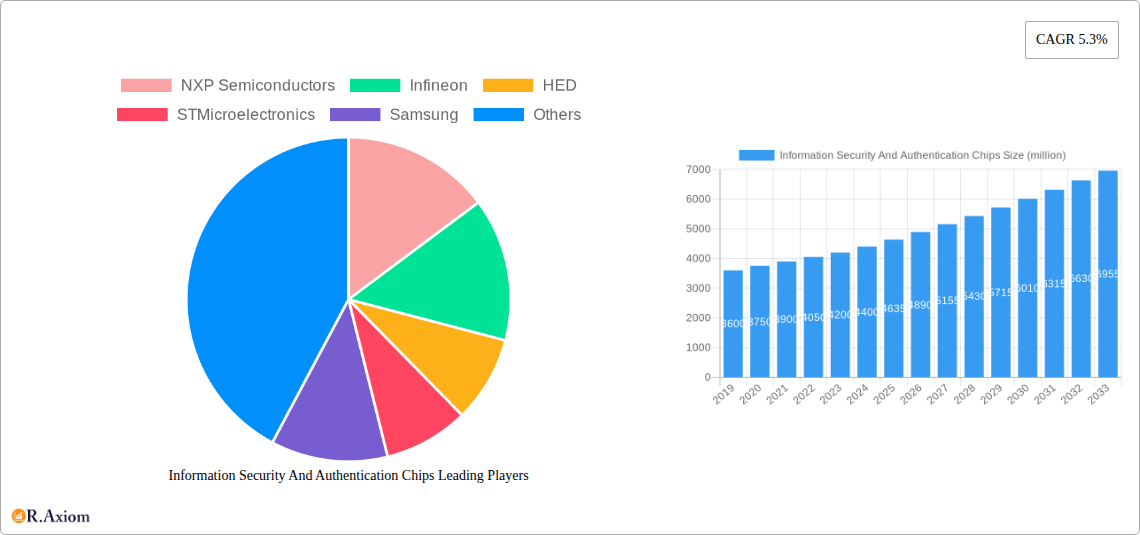

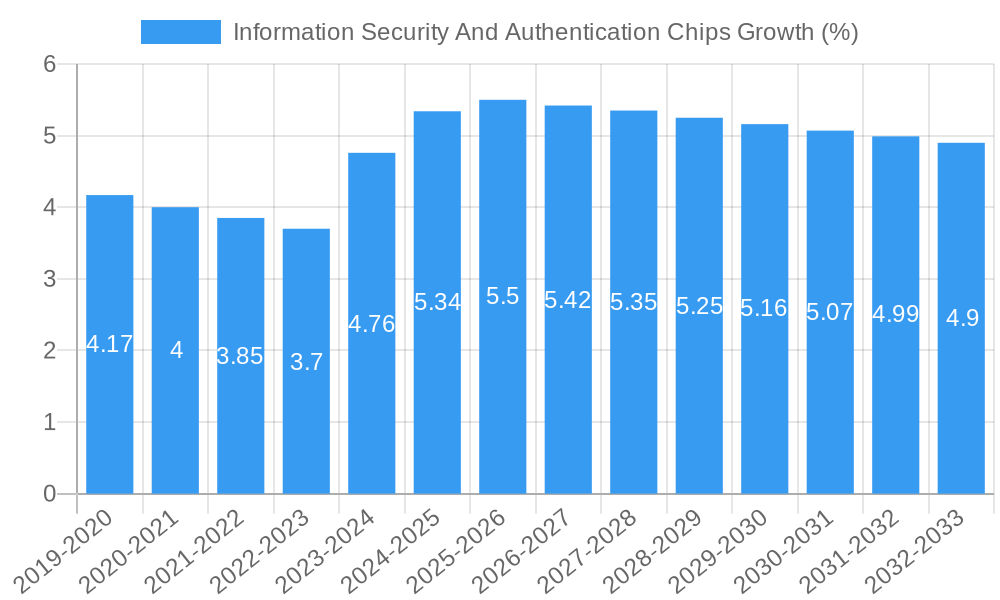

The global market for Information Security and Authentication Chips is poised for substantial growth, projected to reach USD 4,635 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.3% expected through 2033. This expansion is fueled by an escalating demand for secure data handling and robust authentication mechanisms across an increasingly digitized world. Key market drivers include the pervasive rise in cyber threats, necessitating advanced security solutions embedded directly into hardware. The escalating adoption of IoT devices, smart payment systems, and secure cloud infrastructure further amplifies the need for specialized security and authentication chips that can provide on-chip encryption, secure element functionality, and tamper-proof storage. Consequently, the market will witness significant innovation in chip types, with advancements in Logic Encryption ICs and Storage ICs catering to these evolving security demands.

The market's dynamism is further shaped by emerging trends such as the integration of AI and machine learning for threat detection within authentication chips, and the increasing use of biometric authentication technologies. These advancements are driving growth in critical application segments like Communications, BFSI (Banking, Financial Services, and Insurance), and Government and Defense, where data integrity and user verification are paramount. While the market presents a promising outlook, certain restraints, such as the high development costs associated with advanced security chips and the ongoing global semiconductor supply chain complexities, could pose challenges. However, strategic investments in R&D and efforts to diversify manufacturing capabilities are expected to mitigate these issues, ensuring sustained market expansion and innovation in providing foundational security for our digital future.

This comprehensive report provides an in-depth analysis of the global Information Security And Authentication Chips market, covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033. It delves into market concentration, innovation drivers, industry trends, dominant segments, product developments, growth drivers, challenges, emerging opportunities, and key players shaping this critical sector. The report offers actionable insights for industry stakeholders, investors, and technology providers navigating the evolving landscape of secure chip solutions.

Information Security And Authentication Chips Market Concentration & Innovation

The Information Security And Authentication Chips market exhibits moderate to high concentration, with key players like NXP Semiconductors, Infineon, STMicroelectronics, and Samsung holding significant market share, estimated at over 70% combined. Innovation is primarily driven by the escalating demand for robust data protection across burgeoning sectors such as IoT, BFSI, and government. Advanced cryptographic algorithms, secure element architectures, and physical unclonable functions (PUFs) are at the forefront of technological advancements. Regulatory frameworks, including GDPR, CCPA, and emerging cybersecurity standards, are significant innovation catalysts, compelling chip manufacturers to integrate enhanced security features. Product substitutes, while present in the form of software-based security solutions, are increasingly being augmented or replaced by dedicated hardware security modules (HSMs) and secure microcontrollers. End-user trends highlight a growing preference for embedded security, reducing reliance on external security measures. Mergers and acquisitions (M&A) activity is notable, with an estimated total deal value of over $500 million in the historical period, reflecting consolidation and strategic acquisitions of specialized security IP and technology firms to bolster competitive offerings.

Information Security And Authentication Chips Industry Trends & Insights

The Information Security And Authentication Chips industry is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 18.5% from 2025 to 2033. This expansion is fueled by an increasing pervasiveness of connected devices, a parallel surge in sophisticated cyber threats, and a global emphasis on data privacy and integrity. Technological disruptions are a constant, with the continuous evolution of AI-driven security analytics, quantum-resistant cryptography, and advanced biometric authentication technologies influencing chip design and functionality. Consumer preferences are shifting towards seamless and invisible security, demanding solutions that offer high levels of protection without compromising user experience or device performance. This is particularly evident in the widespread adoption of secure boot processes, hardware-encrypted storage, and tamper-resistant architectures across a vast array of electronic products. Competitive dynamics are characterized by intense R&D investments, strategic partnerships between chip manufacturers and software security providers, and a race to secure intellectual property in areas like secure enclave technologies and advanced encryption standards. Market penetration is deepening across diverse applications, from safeguarding critical infrastructure and financial transactions to enabling secure access for remote workforces and enhancing the trustworthiness of consumer electronics. The estimated market size for information security and authentication chips is projected to surpass $20 billion by 2025.

Dominant Markets & Segments in Information Security And Authentication Chips

The Information Security And Authentication Chips market is witnessing significant dominance from the BFSI (Banking, Financial Services, and Insurance) and Communications segments. In the BFSI sector, the critical need for secure transaction processing, fraud prevention, and customer data protection drives substantial demand for high-security chips. Regulatory compliance mandates, such as PCI DSS, further propel the adoption of advanced authentication and encryption ICs. Economic policies supporting digital transformation and the increasing prevalence of mobile banking and digital payment systems are key drivers. The Communications segment, encompassing mobile devices, network infrastructure, and IoT communication modules, relies heavily on secure authentication chips for device identity, secure data transmission, and network integrity. The proliferation of 5G technology and the massive expansion of IoT devices further amplify this demand.

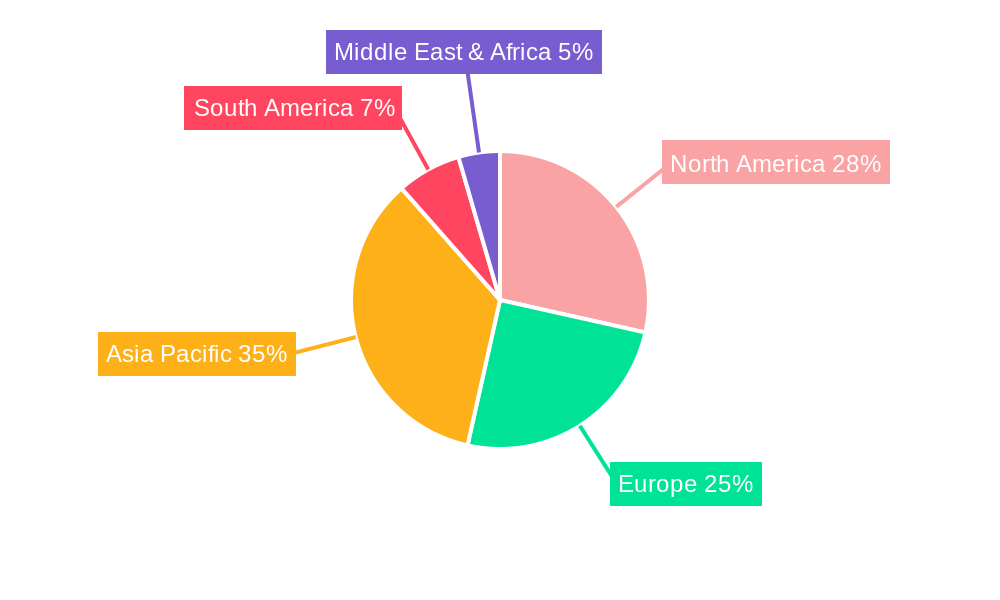

Geographically, North America and Europe currently lead the market due to established regulatory frameworks, high adoption rates of advanced technologies, and the presence of major financial institutions and telecommunications companies. However, the Asia Pacific region is emerging as a significant growth engine, driven by a burgeoning manufacturing base for electronics, rapid digitalization across industries, and government initiatives promoting cybersecurity.

Within the chip types:

- Storage ICs with integrated security features, such as secure flash memory and encrypted SSD controllers, are experiencing robust growth due to data-at-rest security requirements.

- Logic Encryption ICs are crucial for protecting intellectual property embedded within hardware designs and ensuring the integrity of complex digital systems.

- CPU ICs with built-in security enclaves and trusted execution environments are becoming standard in premium devices and enterprise solutions, offering a hardware root of trust for sensitive operations.

- Other specialized security chips, including hardware security modules (HSMs) and secure microcontrollers, cater to niche but critical applications requiring the highest levels of assurance.

Information Security And Authentication Chips Product Developments

Product developments in the Information Security And Authentication Chips market are characterized by the integration of sophisticated hardware security modules (HSMs) into general-purpose processors, enhancing secure boot capabilities and tamper resistance. Innovations are focused on delivering ultra-low-power, highly secure solutions for the rapidly expanding IoT ecosystem, including secure element chips designed for constrained environments. Competitive advantages are being carved out through the implementation of advanced cryptographic acceleration engines, secure key management services, and robust physical security features that protect against side-channel attacks and hardware tampering. Technological trends emphasize the development of AI-powered threat detection at the hardware level and the adoption of post-quantum cryptography readiness in new chip architectures, ensuring long-term security in an evolving threat landscape.

Report Scope & Segmentation Analysis

This report segmentations encompass a detailed analysis of the Information Security And Authentication Chips market across various applications and chip types.

Application Segments:

- Communications: This segment includes chips for mobile devices, network infrastructure, and IoT modules, with projected market sizes of over $6 billion by 2025. Growth is driven by 5G deployment and IoT expansion.

- BFSI: Covering financial transactions, identity verification, and data protection in banking and insurance, this segment is expected to reach over $5 billion by 2025. Strong regulatory compliance and digital banking trends fuel its growth.

- Government and Defense: This segment includes secure communication, critical infrastructure protection, and defense systems, with a projected market size of over $3 billion by 2025. High security requirements and government spending are key drivers.

- Transportation: This segment encompasses automotive security, secure access, and payment systems, projected to reach over $2 billion by 2025. The rise of connected and autonomous vehicles is a significant factor.

- Others: This includes consumer electronics, industrial automation, and healthcare, with a combined projected market size of over $4 billion by 2025. Diversified adoption across various consumer and industrial applications drives growth.

Type Segments:

- Storage IC: Secure memory solutions for data at rest protection.

- Logic Encryption IC: For intellectual property protection and system integrity.

- CPU IC: Processors with integrated security features and secure enclaves.

- Other: Specialized security chips like HSMs and secure microcontrollers.

Key Drivers of Information Security And Authentication Chips Growth

The Information Security And Authentication Chips market is propelled by several interconnected factors. The escalating volume and sophistication of cyber threats worldwide necessitate hardware-level security to protect sensitive data and critical infrastructure. Growing regulatory mandates for data privacy and cybersecurity, such as GDPR and NIS2, compel businesses and device manufacturers to implement robust security solutions. The rapid expansion of the Internet of Things (IoT) ecosystem, with billions of connected devices, creates a vast attack surface requiring individual device authentication and secure communication. Furthermore, the increasing adoption of digital technologies across all sectors, including BFSI, healthcare, and government, amplifies the demand for secure transaction processing and identity management.

Challenges in the Information Security And Authentication Chips Sector

Despite the strong growth trajectory, the Information Security And Authentication Chips sector faces several challenges. Increasingly complex threat landscapes require continuous innovation and substantial R&D investment to stay ahead of evolving cyberattacks. Supply chain disruptions, exacerbated by geopolitical tensions and component shortages, can impact production timelines and costs. Stringent and evolving regulatory compliance across different regions adds complexity and can necessitate significant product redesigns. High development costs and long design cycles for specialized security chips also present a barrier to entry for new players. Additionally, the need for standardization and interoperability across diverse security architectures remains a challenge, hindering seamless integration in heterogeneous environments.

Emerging Opportunities in Information Security And Authentication Chips

Emerging opportunities in the Information Security And Authentication Chips market are abundant, driven by technological advancements and new application areas. The burgeoning IoT security market, particularly in industrial IoT (IIoT) and smart cities, presents a vast opportunity for low-power, high-security chips. The development of post-quantum cryptography-ready chips is a critical emerging trend, preparing for the future threat landscape posed by quantum computing. Furthermore, the increasing demand for secure hardware for AI/ML applications, including embedded AI inference and secure data training, opens new avenues. The growth of digital identity solutions and the demand for secure personal data management in consumer devices also represent significant untapped potential. The integration of biometric authentication at the hardware level offers enhanced user experience and security.

Leading Players in the Information Security And Authentication Chips Market

- NXP Semiconductors

- Infineon

- HED

- STMicroelectronics

- Samsung

- Unigroup Guoxin Microelectronics Co., Ltd.

- Shanghai Fudan Microelectronics Group Co., Ltd.

- Microchip

- Datang Telecom Technology Co.,Ltd.

- Nations Technologies Inc.

- Giantec Semiconductor Corporation.

Key Developments in Information Security And Authentication Chips Industry

- 2024: Launch of new secure microcontrollers with enhanced anti-tampering features for industrial IoT applications.

- 2024: Major player announces strategic acquisition of a specialized PUF technology firm to bolster its physical security offerings.

- 2023: Introduction of next-generation secure element chips for 5G infrastructure, offering advanced cryptographic acceleration.

- 2023: Significant investment in R&D for quantum-resistant cryptographic solutions for future-proofing hardware security.

- 2022: Expansion of secure storage solutions to cater to the growing data privacy needs of the healthcare sector.

- 2022: Release of updated secure boot processors designed for automotive applications, enhancing vehicle cybersecurity.

- 2021: Increased focus on developing energy-efficient secure chips for battery-powered IoT devices.

- 2020: Strategic partnerships formed to integrate hardware security modules into cloud-based security platforms.

- 2019: Introduction of advanced encryption logic ICs designed to protect intellectual property in advanced semiconductor manufacturing.

Strategic Outlook for Information Security And Authentication Chips Market

- 2024: Launch of new secure microcontrollers with enhanced anti-tampering features for industrial IoT applications.

- 2024: Major player announces strategic acquisition of a specialized PUF technology firm to bolster its physical security offerings.

- 2023: Introduction of next-generation secure element chips for 5G infrastructure, offering advanced cryptographic acceleration.

- 2023: Significant investment in R&D for quantum-resistant cryptographic solutions for future-proofing hardware security.

- 2022: Expansion of secure storage solutions to cater to the growing data privacy needs of the healthcare sector.

- 2022: Release of updated secure boot processors designed for automotive applications, enhancing vehicle cybersecurity.

- 2021: Increased focus on developing energy-efficient secure chips for battery-powered IoT devices.

- 2020: Strategic partnerships formed to integrate hardware security modules into cloud-based security platforms.

- 2019: Introduction of advanced encryption logic ICs designed to protect intellectual property in advanced semiconductor manufacturing.

Strategic Outlook for Information Security And Authentication Chips Market

The strategic outlook for the Information Security And Authentication Chips market is highly positive, driven by an ever-increasing reliance on digital technologies and the persistent evolution of cyber threats. Future growth will be propelled by the continued expansion of IoT, the demand for ultra-secure automotive systems, and the critical need for robust data protection in BFSI and government sectors. Investments in research and development, particularly in areas like post-quantum cryptography, secure AI hardware, and advanced physical unclonable functions, will be crucial for maintaining competitive advantage. Strategic collaborations and potential M&A activities will continue to shape the market landscape, enabling companies to acquire specialized expertise and expand their product portfolios. The increasing maturity of regulatory frameworks worldwide will further solidify the importance of hardware-based security, creating sustained demand for innovative and reliable information security and authentication chips.

Information Security And Authentication Chips Segmentation

-

1. Application

- 1.1. Communications

- 1.2. BFSI

- 1.3. Government and Defense

- 1.4. Transportation

- 1.5. Others

-

2. Type

- 2.1. Storage IC

- 2.2. Logic encryption IC

- 2.3. CPU IC

- 2.4. Other

Information Security And Authentication Chips Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Information Security And Authentication Chips REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.3% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Information Security And Authentication Chips Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communications

- 5.1.2. BFSI

- 5.1.3. Government and Defense

- 5.1.4. Transportation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Storage IC

- 5.2.2. Logic encryption IC

- 5.2.3. CPU IC

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Information Security And Authentication Chips Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Communications

- 6.1.2. BFSI

- 6.1.3. Government and Defense

- 6.1.4. Transportation

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Storage IC

- 6.2.2. Logic encryption IC

- 6.2.3. CPU IC

- 6.2.4. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Information Security And Authentication Chips Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Communications

- 7.1.2. BFSI

- 7.1.3. Government and Defense

- 7.1.4. Transportation

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Storage IC

- 7.2.2. Logic encryption IC

- 7.2.3. CPU IC

- 7.2.4. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Information Security And Authentication Chips Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Communications

- 8.1.2. BFSI

- 8.1.3. Government and Defense

- 8.1.4. Transportation

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Storage IC

- 8.2.2. Logic encryption IC

- 8.2.3. CPU IC

- 8.2.4. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Information Security And Authentication Chips Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Communications

- 9.1.2. BFSI

- 9.1.3. Government and Defense

- 9.1.4. Transportation

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Storage IC

- 9.2.2. Logic encryption IC

- 9.2.3. CPU IC

- 9.2.4. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Information Security And Authentication Chips Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Communications

- 10.1.2. BFSI

- 10.1.3. Government and Defense

- 10.1.4. Transportation

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Storage IC

- 10.2.2. Logic encryption IC

- 10.2.3. CPU IC

- 10.2.4. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 NXP Semiconductors

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Infineon

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 HED

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 STMicroelectronics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Samsung

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Unigroup Guoxin Microelectronics Co. Ltd.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Shanghai Fudan Microelectronics Group Co. Ltd.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Microchip

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Datang Telecom Technology Co.Ltd.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nations Technologies Inc.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Giantec Semiconductor Corporation.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 NXP Semiconductors

List of Figures

- Figure 1: Global Information Security And Authentication Chips Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Information Security And Authentication Chips Revenue (million), by Application 2024 & 2032

- Figure 3: North America Information Security And Authentication Chips Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Information Security And Authentication Chips Revenue (million), by Type 2024 & 2032

- Figure 5: North America Information Security And Authentication Chips Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Information Security And Authentication Chips Revenue (million), by Country 2024 & 2032

- Figure 7: North America Information Security And Authentication Chips Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Information Security And Authentication Chips Revenue (million), by Application 2024 & 2032

- Figure 9: South America Information Security And Authentication Chips Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Information Security And Authentication Chips Revenue (million), by Type 2024 & 2032

- Figure 11: South America Information Security And Authentication Chips Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Information Security And Authentication Chips Revenue (million), by Country 2024 & 2032

- Figure 13: South America Information Security And Authentication Chips Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Information Security And Authentication Chips Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Information Security And Authentication Chips Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Information Security And Authentication Chips Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Information Security And Authentication Chips Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Information Security And Authentication Chips Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Information Security And Authentication Chips Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Information Security And Authentication Chips Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Information Security And Authentication Chips Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Information Security And Authentication Chips Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Information Security And Authentication Chips Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Information Security And Authentication Chips Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Information Security And Authentication Chips Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Information Security And Authentication Chips Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Information Security And Authentication Chips Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Information Security And Authentication Chips Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Information Security And Authentication Chips Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Information Security And Authentication Chips Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Information Security And Authentication Chips Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Information Security And Authentication Chips Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Information Security And Authentication Chips Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Information Security And Authentication Chips Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Information Security And Authentication Chips Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Information Security And Authentication Chips Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Information Security And Authentication Chips Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Information Security And Authentication Chips Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Information Security And Authentication Chips Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Information Security And Authentication Chips Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Information Security And Authentication Chips Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Information Security And Authentication Chips Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Information Security And Authentication Chips Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Information Security And Authentication Chips Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Information Security And Authentication Chips Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Information Security And Authentication Chips Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Information Security And Authentication Chips Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Information Security And Authentication Chips Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Information Security And Authentication Chips Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Information Security And Authentication Chips Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Information Security And Authentication Chips Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Information Security And Authentication Chips?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the Information Security And Authentication Chips?

Key companies in the market include NXP Semiconductors, Infineon, HED, STMicroelectronics, Samsung, Unigroup Guoxin Microelectronics Co., Ltd., Shanghai Fudan Microelectronics Group Co., Ltd., Microchip, Datang Telecom Technology Co.,Ltd., Nations Technologies Inc., Giantec Semiconductor Corporation..

3. What are the main segments of the Information Security And Authentication Chips?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4635 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Information Security And Authentication Chips," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Information Security And Authentication Chips report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Information Security And Authentication Chips?

To stay informed about further developments, trends, and reports in the Information Security And Authentication Chips, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence