Key Insights

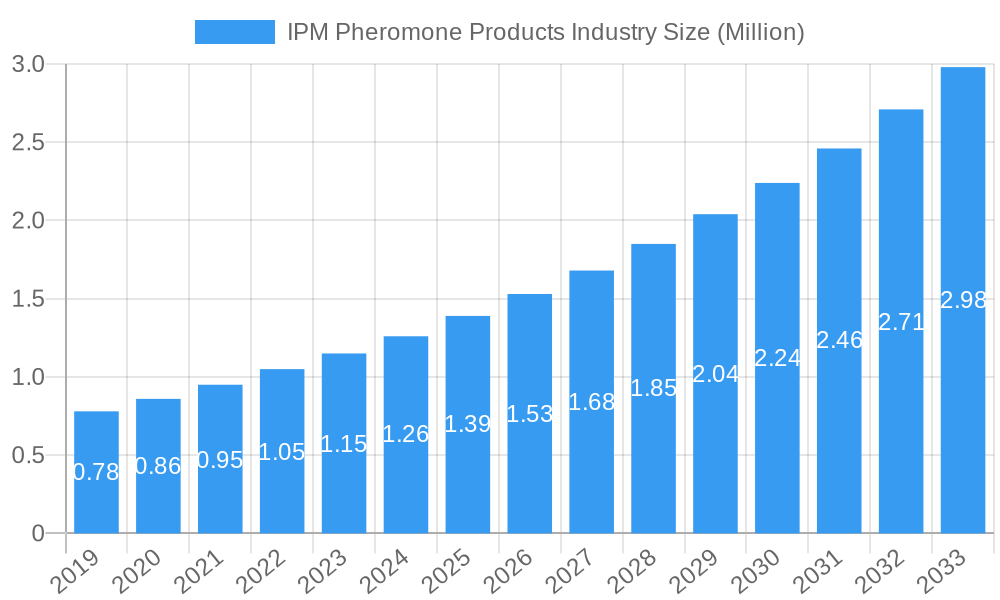

The global Integrated Pest Management (IPM) pheromone products market is poised for significant expansion, projected to reach an estimated USD 1.02 million in 2025 and exhibiting a robust Compound Annual Growth Rate (CAGR) of 10.50% through 2033. This burgeoning market is primarily propelled by the increasing global demand for sustainable and eco-friendly agricultural practices. Growing awareness among farmers and consumers regarding the detrimental effects of conventional chemical pesticides on human health and the environment is a critical driver. The adoption of IPM strategies, which prioritize biological and behavioral control methods like pheromones, is on an upward trajectory. These pheromones, used for mating disruption, monitoring, and mass trapping, offer a highly specific and targeted approach to pest control, minimizing harm to beneficial insects and reducing the risk of pesticide resistance. Furthermore, supportive government initiatives and regulatory frameworks promoting organic farming and reduced chemical input are fostering market growth. The demand is further bolstered by advancements in pheromone synthesis and delivery technologies, leading to more effective and cost-efficient solutions for a wider range of pests.

IPM Pheromone Products Industry Market Size (In Million)

The market's growth is also influenced by evolving agricultural landscapes, including the expansion of high-value crop cultivation where precise pest management is paramount. The segmentation of the IPM pheromone products market, encompassing production, consumption, import/export dynamics, and price trends, reveals a dynamic interplay of supply and demand. Production analysis indicates a steady increase in manufacturing capabilities to meet rising demand. Consumption analysis highlights the growing adoption of pheromone-based solutions across diverse agricultural regions. Import and export analyses showcase the global nature of this market, with significant cross-border trade driven by specialized product offerings and regional pest pressures. Price trend analysis suggests a stabilization and potential decrease in per-unit costs as production scales up and technological efficiencies are realized. Key players are actively investing in research and development to introduce innovative products and expand their global footprint, anticipating sustained growth across major agricultural economies in North America, Europe, and Asia Pacific.

IPM Pheromone Products Industry Company Market Share

Here is a detailed, SEO-optimized report description for the IPM Pheromone Products Industry:

IPM Pheromone Products Industry Market Concentration & Innovation

The IPM Pheromone Products Industry is characterized by a dynamic market concentration driven by significant innovation. Key players like Russell IPM, Suterr, Syngenta Bioline, Pacific Biocontrol Corporation, ISCA Technologies, Shin-Etsu, Hercon Environmental, Sumi Agro France, Isagro, and BASF SE are actively shaping the landscape. Innovation in pheromone synthesis, formulation, and delivery systems is a primary growth catalyst, with companies investing heavily in R&D to develop more effective and sustainable pest management solutions. Regulatory frameworks, particularly concerning pesticide use and environmental impact, are increasingly favoring biologically-based solutions like pheromones, thereby influencing market entry and product approval. Product substitutes, primarily traditional chemical pesticides, face mounting pressure from stringent regulations and growing consumer demand for organic and residue-free produce. End-user trends show a clear shift towards Integrated Pest Management (IPM) strategies, where pheromones play a crucial role in monitoring and mating disruption. Mergers and acquisitions (M&A) activities, with estimated deal values in the hundreds of millions, are strategically consolidating market share and expanding technological capabilities. For instance, recent M&A activities are projected to reach USD 200 Million in value, reflecting the industry's drive towards consolidation. This strategic consolidation aims to leverage R&D synergies and broaden market reach. The industry's competitive intensity is moderate to high, with established players and emerging innovators vying for market dominance.

IPM Pheromone Products Industry Industry Trends & Insights

The IPM Pheromone Products Industry is poised for substantial growth, driven by a confluence of factors including increasing global demand for sustainable agriculture, stricter regulations on synthetic pesticides, and rising consumer awareness regarding food safety and environmental impact. The market is projected to witness a robust Compound Annual Growth Rate (CAGR) of approximately 8.5% over the study period from 2019 to 2033. This growth is underpinned by the inherent advantages of pheromone-based pest control, such as species specificity, low environmental impact, and the absence of harmful residues, making them a preferred choice for organic farming and conventional agriculture seeking to reduce chemical inputs. Technological disruptions are playing a pivotal role, with advancements in synthetic pheromone production, bio-pesticide formulations, and smart delivery systems enhancing efficacy and application convenience. Innovations in nano-encapsulation and controlled-release technologies are extending pheromone longevity and improving their performance in diverse climatic conditions. Consumer preferences are increasingly leaning towards 'clean label' products and food grown with minimal chemical intervention, directly fueling the adoption of IPM strategies and, by extension, pheromone products. Competitive dynamics are evolving, with established agrochemical giants strategically entering or expanding their pheromone portfolios through acquisitions and R&D collaborations. This intensified competition encourages further innovation and cost optimization, ultimately benefiting end-users. Market penetration of pheromone products, currently estimated at 15% of the total pest control market, is expected to rise significantly as awareness and accessibility increase. The ongoing shift from broad-spectrum chemical pesticides to targeted, environmentally friendly solutions is a fundamental trend reshaping the industry's trajectory. The market's expansion is also supported by government initiatives promoting sustainable agricultural practices and reducing reliance on hazardous chemicals.

Dominant Markets & Segments in IPM Pheromone Products Industry

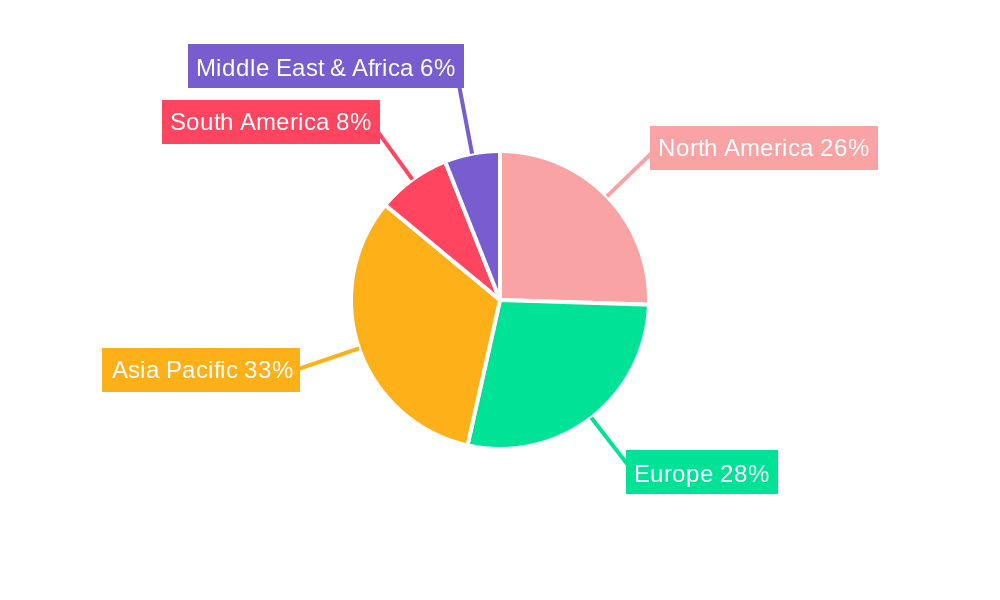

The IPM Pheromone Products Industry exhibits distinct dominance across various regions and market segments.

Production Analysis: Asia-Pacific, particularly China and India, dominates pheromone production due to lower manufacturing costs and a strong chemical manufacturing base. The region is estimated to contribute over 40% of global pheromone active ingredient production. Key drivers include government support for the chemical industry and a large skilled workforce.

Consumption Analysis: Europe and North America are the leading consumption markets, driven by stringent regulations on pesticide use, a high prevalence of organic farming, and advanced agricultural infrastructure. These regions account for an estimated 35% and 25% of global consumption, respectively. Economic policies favoring sustainable agriculture and strong consumer demand for residue-free produce are significant drivers.

Import Market Analysis (Value & Volume): The import market is heavily influenced by countries with advanced agricultural sectors but limited indigenous pheromone manufacturing capabilities. Europe, with its significant organic farming footprint and high demand for specialized pest control, represents a major import market, accounting for roughly 30% of global pheromone product imports. The volume of imports is substantial, reflecting the widespread adoption of mating disruption and monitoring techniques.

Export Market Analysis (Value & Volume): China is the dominant exporter, supplying a significant portion of the global demand for pheromone active ingredients and finished products. Its competitive pricing and production capacity make it a key player. North America also demonstrates strong export capabilities, particularly for niche, high-value pheromone formulations and technologies. The export value is projected to reach USD 700 Million by 2025.

Price Trend Analysis: Price trends are influenced by the complexity of pheromone synthesis, production volumes, and raw material costs. While initial synthesis can be costly, economies of scale are driving down prices, making pheromone solutions more competitive with traditional pesticides. The average price per kilogram of pheromone active ingredient is estimated to be around USD 300, with variations based on specific compounds and purity levels. Fluctuations in raw material prices and energy costs can impact these trends, but the overall trajectory is towards greater affordability.

IPM Pheromone Products Industry Product Developments

Product developments in the IPM Pheromone Products Industry are focused on enhancing efficacy, user-friendliness, and environmental compatibility. Innovations include novel slow-release formulations, such as microencapsulation and diffusion dispensers, which extend product life and optimize pheromone dispersal in field conditions. The development of synergistic blends of pheromones and semiochemicals for broader pest control spectrums and resistance management is also a key trend. Furthermore, advancements in species-specific pheromone synthesis are leading to highly targeted solutions that minimize impact on beneficial insects. Companies are also developing integrated monitoring systems that combine pheromone lures with digital tracking technologies for real-time pest assessment. These developments aim to provide growers with more precise, cost-effective, and sustainable pest management tools.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the IPM Pheromone Products Industry, covering the study period from 2019–2033, with a base year of 2025 and a forecast period extending to 2033. The segmentation encompasses: Production Analysis: Examining the geographical distribution and volume of pheromone manufacturing. Consumption Analysis: Profiling the demand for pheromone products across various end-user segments and geographies. Import Market Analysis (Value & Volume): Quantifying the inflow of pheromone products into different countries. Export Market Analysis (Value & Volume): Assessing the outflow of pheromone products from manufacturing hubs. Price Trend Analysis: Tracking historical, current, and projected price movements of pheromone products. Growth projections for key segments are detailed, with market sizes estimated in the billions of dollars, and competitive dynamics are analyzed for each.

Key Drivers of IPM Pheromone Products Industry Growth

Several key drivers are propelling the growth of the IPM Pheromone Products Industry. The increasing global emphasis on sustainable agriculture and the demand for organic produce significantly boosts the adoption of pheromone-based pest management. Stringent government regulations on the use of synthetic pesticides, aiming to protect human health and the environment, create a favorable market for safer alternatives. Technological advancements in pheromone synthesis and formulation are leading to more effective and cost-efficient products, increasing their accessibility to a wider range of farmers. The rising awareness among growers about the benefits of Integrated Pest Management (IPM) strategies, including reduced crop damage and improved product quality, further fuels market expansion.

Challenges in the IPM Pheromone Products Industry Sector

Despite robust growth, the IPM Pheromone Products Industry faces several challenges. Regulatory hurdles for new product approvals can be time-consuming and costly, slowing down market entry. The relatively higher initial cost of some pheromone products compared to conventional chemical pesticides can be a barrier for price-sensitive farmers, especially in developing economies. Supply chain complexities, including the sourcing of specific raw materials and maintaining product stability during transportation, pose logistical challenges. Furthermore, the availability of effective substitutes, particularly broad-spectrum chemical pesticides that are often cheaper and more familiar to users, continues to exert competitive pressure. Educating end-users about the efficacy and proper application of pheromone products is also an ongoing challenge.

Emerging Opportunities in IPM Pheromone Products Industry

Emerging opportunities in the IPM Pheromone Products Industry are diverse and promising. The expanding global organic food market presents a substantial avenue for growth, as pheromones are integral to organic pest management. The development of new pheromone formulations for a wider range of target pests and crops, especially in developing regions with a high pest burden, offers significant potential. Integration with digital agriculture technologies, such as smart traps and data analytics platforms, creates opportunities for precision pest management. Furthermore, growing consumer demand for residue-free produce across conventional agriculture is driving the adoption of pheromone-based monitoring and control. Strategic partnerships and collaborations between pheromone manufacturers and agrochemical companies can accelerate product development and market penetration.

Leading Players in the IPM Pheromone Products Industry Market

- Russell IPM

- Suterr

- Syngenta Bioline

- Pacific Biocontrol Corporation

- ISCA Technologies

- Shin-Etsu

- Hercon Environmental

- Sumi Agro France

- Isagro

- BASF SE

Key Developments in IPM Pheromone Products Industry Industry

- 2024/01: Syngenta Bioline launched a new mating disruption product for a key fruit pest, enhancing efficacy and duration of protection.

- 2023/08: ISCA Technologies announced a significant investment in R&D for novel semiochemical blends, aiming to broaden pest control applications.

- 2022/11: Russell IPM expanded its manufacturing capacity in Europe to meet growing demand for sustainable pest solutions.

- 2021/05: Pacific Biocontrol Corporation acquired a specialized pheromone synthesis technology, strengthening its product portfolio.

- 2020/03: Shin-Etsu Chemical introduced advanced slow-release dispenser technology for enhanced pheromone efficacy in challenging climates.

Strategic Outlook for IPM Pheromone Products Industry Market

The strategic outlook for the IPM Pheromone Products Industry remains highly optimistic, driven by the persistent global shift towards sustainable and environmentally responsible agricultural practices. Continued innovation in pheromone synthesis, formulation, and delivery systems will be crucial for maintaining competitive advantage and expanding market reach. The increasing adoption of precision agriculture technologies presents a significant opportunity to integrate pheromone-based solutions into comprehensive pest management strategies. Furthermore, favorable regulatory environments and growing consumer demand for safe, residue-free food products will continue to underpin market growth. Strategic collaborations, product diversification, and expansion into emerging markets are key strategies for players aiming to capitalize on the substantial future potential of this vital industry.

IPM Pheromone Products Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

IPM Pheromone Products Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

IPM Pheromone Products Industry Regional Market Share

Geographic Coverage of IPM Pheromone Products Industry

IPM Pheromone Products Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Decreasing Per Capita Arable Land; Increased Demand for Food

- 3.3. Market Restrains

- 3.3.1. High Initial Investments; Requirement of Precision Agriculture

- 3.4. Market Trends

- 3.4.1. Strong Demand for High-Value Crops

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global IPM Pheromone Products Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America IPM Pheromone Products Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America IPM Pheromone Products Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe IPM Pheromone Products Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa IPM Pheromone Products Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific IPM Pheromone Products Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Russell IPM

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Suterr

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Syngenta Bioline

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pacific Biocontrol Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ISCA Technologies

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Shin-Etsu

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hercon Environmental

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sumi Agro France

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Isagro

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BASF SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Russell IPM

List of Figures

- Figure 1: Global IPM Pheromone Products Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America IPM Pheromone Products Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America IPM Pheromone Products Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America IPM Pheromone Products Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America IPM Pheromone Products Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America IPM Pheromone Products Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America IPM Pheromone Products Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America IPM Pheromone Products Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America IPM Pheromone Products Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America IPM Pheromone Products Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America IPM Pheromone Products Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America IPM Pheromone Products Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America IPM Pheromone Products Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America IPM Pheromone Products Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America IPM Pheromone Products Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America IPM Pheromone Products Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America IPM Pheromone Products Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America IPM Pheromone Products Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America IPM Pheromone Products Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America IPM Pheromone Products Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America IPM Pheromone Products Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America IPM Pheromone Products Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America IPM Pheromone Products Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America IPM Pheromone Products Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America IPM Pheromone Products Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe IPM Pheromone Products Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe IPM Pheromone Products Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe IPM Pheromone Products Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe IPM Pheromone Products Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe IPM Pheromone Products Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe IPM Pheromone Products Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe IPM Pheromone Products Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe IPM Pheromone Products Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe IPM Pheromone Products Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe IPM Pheromone Products Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe IPM Pheromone Products Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe IPM Pheromone Products Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa IPM Pheromone Products Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa IPM Pheromone Products Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa IPM Pheromone Products Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa IPM Pheromone Products Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa IPM Pheromone Products Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa IPM Pheromone Products Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa IPM Pheromone Products Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa IPM Pheromone Products Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa IPM Pheromone Products Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa IPM Pheromone Products Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa IPM Pheromone Products Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa IPM Pheromone Products Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific IPM Pheromone Products Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific IPM Pheromone Products Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific IPM Pheromone Products Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific IPM Pheromone Products Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific IPM Pheromone Products Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific IPM Pheromone Products Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific IPM Pheromone Products Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific IPM Pheromone Products Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific IPM Pheromone Products Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific IPM Pheromone Products Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific IPM Pheromone Products Industry Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific IPM Pheromone Products Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global IPM Pheromone Products Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global IPM Pheromone Products Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global IPM Pheromone Products Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global IPM Pheromone Products Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global IPM Pheromone Products Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global IPM Pheromone Products Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global IPM Pheromone Products Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global IPM Pheromone Products Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global IPM Pheromone Products Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global IPM Pheromone Products Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global IPM Pheromone Products Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global IPM Pheromone Products Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global IPM Pheromone Products Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global IPM Pheromone Products Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global IPM Pheromone Products Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global IPM Pheromone Products Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global IPM Pheromone Products Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global IPM Pheromone Products Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global IPM Pheromone Products Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global IPM Pheromone Products Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global IPM Pheromone Products Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global IPM Pheromone Products Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global IPM Pheromone Products Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global IPM Pheromone Products Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global IPM Pheromone Products Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global IPM Pheromone Products Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global IPM Pheromone Products Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global IPM Pheromone Products Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global IPM Pheromone Products Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global IPM Pheromone Products Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global IPM Pheromone Products Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global IPM Pheromone Products Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global IPM Pheromone Products Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global IPM Pheromone Products Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global IPM Pheromone Products Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global IPM Pheromone Products Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific IPM Pheromone Products Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the IPM Pheromone Products Industry?

The projected CAGR is approximately 10.50%.

2. Which companies are prominent players in the IPM Pheromone Products Industry?

Key companies in the market include Russell IPM, Suterr, Syngenta Bioline, Pacific Biocontrol Corporation, ISCA Technologies, Shin-Etsu, Hercon Environmental, Sumi Agro France, Isagro, BASF SE.

3. What are the main segments of the IPM Pheromone Products Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Decreasing Per Capita Arable Land; Increased Demand for Food.

6. What are the notable trends driving market growth?

Strong Demand for High-Value Crops.

7. Are there any restraints impacting market growth?

High Initial Investments; Requirement of Precision Agriculture.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "IPM Pheromone Products Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the IPM Pheromone Products Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the IPM Pheromone Products Industry?

To stay informed about further developments, trends, and reports in the IPM Pheromone Products Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence