Key Insights

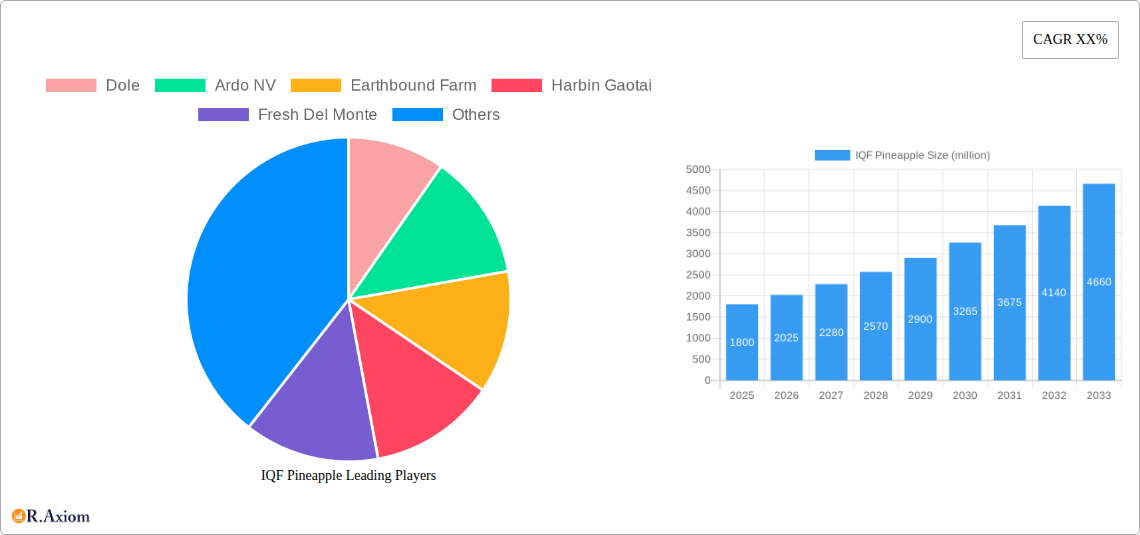

The IQF (Individually Quick Frozen) pineapple market is poised for significant expansion, projected to reach an estimated market size of $1,800 million by 2025. This growth is driven by increasing consumer demand for convenient, healthy, and versatile food products. The rising popularity of tropical fruits in processed forms, coupled with their nutritional benefits, acts as a powerful catalyst. Furthermore, the expanding applications of IQF pineapple across various sectors, including retail (frozen fruits for home consumption), foodservice (restaurants, cafes, and hotels seeking consistent quality and reduced preparation time), and industrial uses (ingredients for beverages, yogurts, and baked goods), are bolstering market momentum. Key growth drivers include the growing global middle class with higher disposable incomes, a greater emphasis on healthy eating and the inclusion of fruits in daily diets, and advancements in freezing technology that preserve the taste, texture, and nutritional value of pineapples.

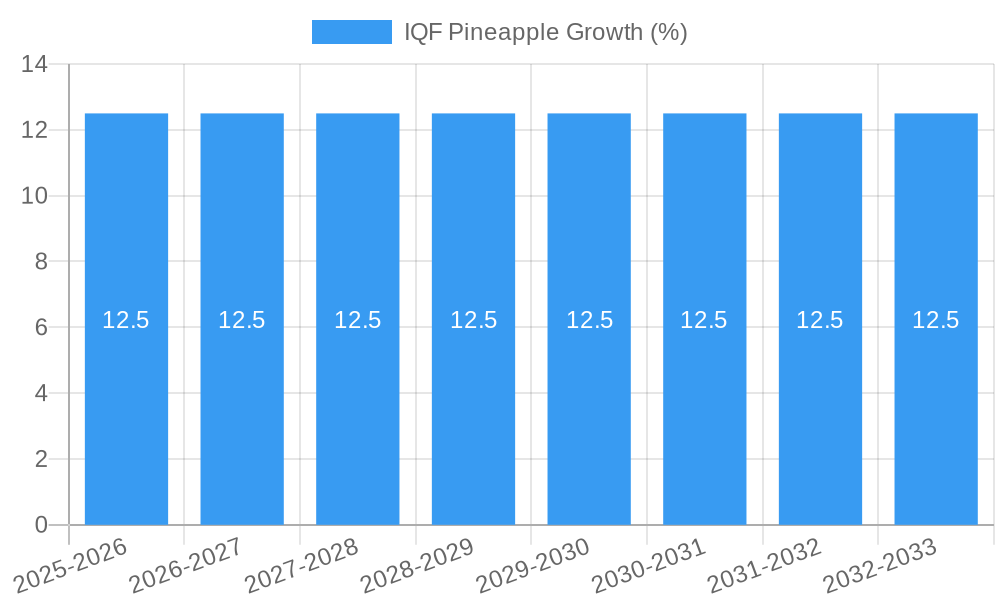

The market is expected to witness a Compound Annual Growth Rate (CAGR) of 12.5% from 2025 to 2033, signaling robust and sustained expansion. Key trends shaping this market include the burgeoning demand for IQF pineapple in ready-to-eat meals and snacks, the increasing adoption of frozen fruits in health-conscious diets as an alternative to fresh, which can be seasonal, and the growing preference for IQF due to its longer shelf life and reduced spoilage compared to fresh or canned alternatives. However, certain restraints may temper this growth, such as the volatile prices of raw pineapples influenced by weather patterns and agricultural yields, and the initial high capital investment required for setting up IQF processing facilities. Despite these challenges, the market is characterized by innovation in packaging and product development, with companies like Dole and Fresh Del Monte leading the charge in offering diverse IQF pineapple formats and value-added products. The Asia Pacific region, particularly China and India, is anticipated to emerge as a significant growth hub due to its large population, increasing urbanization, and rising disposable incomes.

This comprehensive report delves into the rapidly expanding IQF Pineapple Market, offering in-depth analysis and actionable insights for industry stakeholders. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this study provides a detailed examination of market dynamics, competitive landscapes, and future growth trajectories. The report leverages high-traffic keywords such as "IQF Pineapple," "frozen pineapple," "individually quick frozen," "fruit processing," "food industry trends," and "tropical fruit market" to maximize search visibility and engagement. We analyze market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities, supported by extensive data and expert analysis.

IQF Pineapple Market Concentration & Innovation

The IQF Pineapple market exhibits a moderate concentration, with several key players driving innovation and market expansion. The market share of the top five companies is estimated to be over 60% in the base year of 2025, with significant contributions from global leaders like Dole, Fresh Del Monte, and Ardo NV. Innovation is primarily fueled by advancements in freezing technology, leading to improved product quality and extended shelf life. Regulatory frameworks concerning food safety and import/export regulations play a crucial role in shaping market access and operational strategies. Key innovation drivers include the demand for convenience foods, the growing popularity of healthy snacking, and the increasing application of IQF pineapple in various food and beverage products. Product substitutes, such as other frozen fruits or canned pineapple, present a moderate competitive threat, but the superior texture and quality of IQF pineapple maintain its distinct market position. End-user trends are shifting towards value-added products and sustainable sourcing. Mergers and acquisitions (M&A) activities are anticipated to remain a strategic tool for market consolidation and geographical expansion, with estimated M&A deal values in the hundreds of millions of dollars annually over the forecast period.

IQF Pineapple Industry Trends & Insights

The IQF Pineapple industry is poised for substantial growth, driven by an escalating global demand for convenient, healthy, and high-quality food products. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025–2033. This growth is underpinned by several key factors. Firstly, the increasing consumer preference for natural and minimally processed foods directly benefits the IQF pineapple sector, as the IQF process preserves the fruit's nutritional value and natural flavor better than many other preservation methods. Secondly, the booming foodservice industry, including restaurants, hotels, and catering services, is a significant market penetrator, demanding bulk quantities of consistently high-quality IQF pineapple for use in a wide array of dishes, from tropical fruit salads and smoothies to savory Asian cuisine and desserts. Thirdly, the burgeoning retail sector, particularly the frozen food aisles of supermarkets, is experiencing increased demand for IQF pineapple as consumers seek convenient ingredients for home cooking and healthy snacking options. Technological disruptions in freezing technology, such as advanced cryogenic freezing and optimized airflow systems, are leading to enhanced product quality, reduced moisture loss, and longer shelf life, further boosting market appeal. Competitive dynamics are characterized by both global giants and emerging regional players, each vying for market share through product innovation, strategic pricing, and robust distribution networks. The penetration of IQF pineapple in emerging economies is also on the rise, fueled by improving cold chain infrastructure and rising disposable incomes, leading to greater accessibility and acceptance of frozen food products. Sustainability and traceability are also becoming increasingly important consumer considerations, pushing manufacturers to adopt more ethical and environmentally friendly production practices.

Dominant Markets & Segments in IQF Pineapple

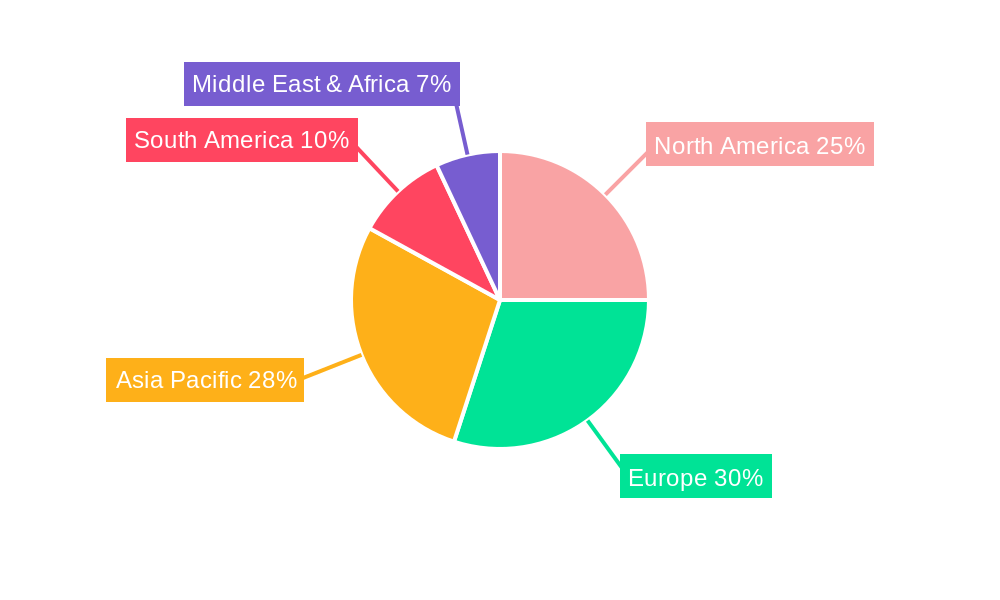

The global IQF Pineapple market is characterized by regional dominance and segment-specific growth patterns. Asia Pacific, particularly China and Southeast Asian nations, is emerging as a dominant region due to its significant pineapple cultivation capacity and growing domestic consumption. Economic policies supporting agricultural exports and substantial investments in processing infrastructure in countries like Thailand and the Philippines are key drivers. The Retail segment is projected to hold the largest market share, driven by increasing consumer demand for convenient, healthy, and ready-to-use ingredients for home consumption. The accessibility of IQF pineapple in frozen food aisles across major supermarket chains worldwide, coupled with effective marketing strategies highlighting its versatility and health benefits, fuels this dominance. The Chunks type segment is anticipated to be the most significant, catering to a broad range of applications from fruit salads and desserts to beverages and as a pizza topping. Its ease of use and versatility make it a preferred choice for both retail and foodservice consumers.

Dominant Region (Asia Pacific):

- Key Drivers: Extensive pineapple cultivation, favorable government policies for agricultural exports, increasing disposable incomes, and growing adoption of frozen foods.

- Market Share: Expected to account for over 35% of the global market by 2025.

- Infrastructural Development: Investments in advanced cold chain logistics and processing facilities.

Dominant Application Segment (Retail):

- Key Drivers: Growing consumer preference for convenience, healthy eating trends, and increased availability in supermarkets.

- Market Share: Estimated to represent over 45% of the total market in 2025.

- Consumer Behavior: Demand for ready-to-eat and easy-to-prepare meal components.

Dominant Type Segment (Chunks):

- Key Drivers: Versatility in culinary applications, ease of handling, and preference for textural consistency in various food preparations.

- Market Share: Forecasted to capture over 55% of the IQF pineapple type market.

- Product Innovation: Continued development of pre-portioned and marinated IQF pineapple chunks.

IQF Pineapple Product Developments

Product development in the IQF Pineapple market is witnessing a focus on enhancing convenience, expanding applications, and improving nutritional profiles. Innovations include the introduction of pre-portioned IQF pineapple pieces for single-serving meals and snacks, as well as the development of marinated or flavored IQF pineapple varieties to cater to evolving consumer tastes and specific culinary needs. Companies are also investing in R&D to optimize the texture and sensory attributes of IQF pineapple, ensuring it maintains its appeal when used in cooked dishes or beverages. Furthermore, there is a growing emphasis on value-added IQF pineapple products, such as IQF pineapple mixed with other tropical fruits, to offer diversified and convenient fruit blends to consumers and the foodservice industry. These developments provide a significant competitive advantage by meeting niche market demands and offering differentiated products.

Report Scope & Segmentation Analysis

This report offers a granular analysis of the IQF Pineapple market across key segmentation dimensions, encompassing Applications and Types. The Study Period is from 2019 to 2033, with 2025 as the base and estimated year, and the forecast period spanning 2025–2033.

Application Segments:

- Retail: This segment is projected to witness robust growth, driven by increasing consumer demand for convenient and healthy food options. Market size in 2025 is estimated at over 2,500 million dollars. Competitive dynamics include strong brand presence and extensive distribution networks.

- Foodservice: This segment is expected to maintain its significant market share, fueled by the consistent demand from restaurants, hotels, and catering services. Market size in 2025 is estimated at over 1,800 million dollars. Key growth drivers include the need for consistent quality and bulk supply.

- Industrial: This segment encompasses the use of IQF pineapple in processed food manufacturing. Market size in 2025 is estimated at over 700 million dollars. Growth here is linked to the expanding processed food industry.

Type Segments:

- Chunks: This is the dominant type, with a market size in 2025 estimated at over 3,500 million dollars. Its versatility makes it suitable for a wide range of applications.

- Dices: This segment is growing, particularly for specific culinary uses where smaller pieces are preferred. Market size in 2025 is estimated at over 1,200 million dollars.

- Others: This segment includes purees, slices, and other specialized forms. Market size in 2025 is estimated at over 300 million dollars.

Key Drivers of IQF Pineapple Growth

The growth of the IQF Pineapple market is propelled by a confluence of technological, economic, and consumer-driven factors. The increasing global demand for healthy and natural food products is a primary driver, as IQF processing preserves the nutritional integrity and fresh taste of pineapple. Technologically, advancements in individually quick freezing (IQF) techniques have significantly improved product quality, extending shelf life and maintaining texture, making it a preferred alternative to fresh or canned pineapple. Economically, rising disposable incomes in emerging markets are increasing consumer purchasing power and their willingness to spend on premium frozen fruits. Furthermore, the convenience factor associated with IQF pineapple, requiring minimal preparation for consumers and foodservice operators alike, is a major growth catalyst. The growing popularity of plant-based diets and veganism also contributes, as pineapple is a staple in many vegan recipes and smoothies.

Challenges in the IQF Pineapple Sector

Despite the promising growth trajectory, the IQF Pineapple sector faces several challenges. Fluctuations in raw material prices and availability, influenced by weather patterns and agricultural output, can impact production costs and supply stability. Intense competition from other frozen fruit varieties and traditional preservation methods exerts pressure on pricing and market share. Stringent regulatory requirements and varying import/export policies across different countries can create logistical hurdles and increase compliance costs. Maintaining cold chain integrity throughout the supply chain is critical and can be challenging, especially in regions with underdeveloped infrastructure, leading to potential quality degradation. Furthermore, consumer perception and education regarding the benefits and quality of frozen produce, compared to fresh, can still be a barrier in some markets.

Emerging Opportunities in IQF Pineapple

Emerging opportunities in the IQF Pineapple sector are centered around innovation, market expansion, and evolving consumer preferences. The growing demand for value-added and convenience-driven products presents an opportunity for manufacturers to develop pre-cut, marinated, or flavored IQF pineapple options. The expansion of e-commerce platforms for grocery delivery provides a new channel for reaching consumers directly, particularly for frozen goods. Untapped markets in developing economies with growing middle classes and increasing awareness of healthy eating habits offer significant potential for market penetration. Furthermore, the increasing popularity of tropical fruit blends and smoothie mixes creates an opportunity for IQF pineapple to be a key component in such convenient, ready-to-blend products. There is also a growing interest in sustainable sourcing and ethical production practices, which can be leveraged as a competitive advantage.

Leading Players in the IQF Pineapple Market

- Dole

- Ardo NV

- Earthbound Farm

- Harbin Gaotai

- Fresh Del Monte

- SunOpta

- Tropical Paradise Fruits Co.

- Siam Inter Sweet Co., Ltd.

- Qingdao Elitefoods Co., Ltd.

Key Developments in IQF Pineapple Industry

- 2023/09: Dole introduces a new range of IQF pineapple products with enhanced packaging for extended shelf life and improved consumer appeal.

- 2023/05: Ardo NV expands its IQF fruit processing capacity by investing in new freezing technology to meet growing global demand.

- 2023/01: Fresh Del Monte announces strategic partnerships to strengthen its supply chain and distribution network for IQF fruits in Asian markets.

- 2022/11: SunOpta focuses on developing sustainable sourcing initiatives for IQF pineapple, emphasizing ethical farming practices and reduced environmental impact.

- 2022/07: Qingdao Elitefoods Co., Ltd. launches innovative IQF pineapple diced products tailored for the foodservice industry, offering increased convenience and cost-effectiveness.

Strategic Outlook for IQF Pineapple Market

The strategic outlook for the IQF Pineapple market remains highly positive, driven by sustained global demand for convenient, healthy, and high-quality fruit products. Key growth catalysts include the continued expansion of the foodservice and retail sectors, particularly in emerging economies, and the ongoing innovation in freezing technologies that enhance product quality and shelf-life. Companies that can effectively leverage product diversification, focus on sustainable sourcing, and capitalize on evolving consumer preferences for ready-to-eat and plant-based options will be well-positioned for success. Strategic investments in optimizing supply chains, enhancing cold chain logistics, and building strong brand presence will be crucial for capturing market share and ensuring long-term profitability in this dynamic and growing market.

IQF Pineapple Segmentation

-

1. Application

- 1.1. Retail

- 1.2. Foodservice

- 1.3. Industrial

-

2. Types

- 2.1. Chunks

- 2.2. Dices

- 2.3. Others

IQF Pineapple Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

IQF Pineapple REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global IQF Pineapple Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Retail

- 5.1.2. Foodservice

- 5.1.3. Industrial

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Chunks

- 5.2.2. Dices

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America IQF Pineapple Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Retail

- 6.1.2. Foodservice

- 6.1.3. Industrial

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Chunks

- 6.2.2. Dices

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America IQF Pineapple Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Retail

- 7.1.2. Foodservice

- 7.1.3. Industrial

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Chunks

- 7.2.2. Dices

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe IQF Pineapple Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Retail

- 8.1.2. Foodservice

- 8.1.3. Industrial

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Chunks

- 8.2.2. Dices

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa IQF Pineapple Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Retail

- 9.1.2. Foodservice

- 9.1.3. Industrial

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Chunks

- 9.2.2. Dices

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific IQF Pineapple Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Retail

- 10.1.2. Foodservice

- 10.1.3. Industrial

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Chunks

- 10.2.2. Dices

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Dole

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ardo NV

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Earthbound Farm

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Harbin Gaotai

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fresh Del Monte

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SunOpta

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tropical Paradise Fruits Co.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Siam Inter Sweet Co.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ltd.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Qingdao Elitefoods Co.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ltd.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Dole

List of Figures

- Figure 1: Global IQF Pineapple Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America IQF Pineapple Revenue (million), by Application 2024 & 2032

- Figure 3: North America IQF Pineapple Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America IQF Pineapple Revenue (million), by Types 2024 & 2032

- Figure 5: North America IQF Pineapple Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America IQF Pineapple Revenue (million), by Country 2024 & 2032

- Figure 7: North America IQF Pineapple Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America IQF Pineapple Revenue (million), by Application 2024 & 2032

- Figure 9: South America IQF Pineapple Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America IQF Pineapple Revenue (million), by Types 2024 & 2032

- Figure 11: South America IQF Pineapple Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America IQF Pineapple Revenue (million), by Country 2024 & 2032

- Figure 13: South America IQF Pineapple Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe IQF Pineapple Revenue (million), by Application 2024 & 2032

- Figure 15: Europe IQF Pineapple Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe IQF Pineapple Revenue (million), by Types 2024 & 2032

- Figure 17: Europe IQF Pineapple Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe IQF Pineapple Revenue (million), by Country 2024 & 2032

- Figure 19: Europe IQF Pineapple Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa IQF Pineapple Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa IQF Pineapple Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa IQF Pineapple Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa IQF Pineapple Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa IQF Pineapple Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa IQF Pineapple Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific IQF Pineapple Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific IQF Pineapple Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific IQF Pineapple Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific IQF Pineapple Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific IQF Pineapple Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific IQF Pineapple Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global IQF Pineapple Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global IQF Pineapple Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global IQF Pineapple Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global IQF Pineapple Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global IQF Pineapple Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global IQF Pineapple Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global IQF Pineapple Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global IQF Pineapple Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global IQF Pineapple Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global IQF Pineapple Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global IQF Pineapple Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global IQF Pineapple Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global IQF Pineapple Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global IQF Pineapple Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global IQF Pineapple Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global IQF Pineapple Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global IQF Pineapple Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global IQF Pineapple Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global IQF Pineapple Revenue million Forecast, by Country 2019 & 2032

- Table 41: China IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific IQF Pineapple Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the IQF Pineapple?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the IQF Pineapple?

Key companies in the market include Dole, Ardo NV, Earthbound Farm, Harbin Gaotai, Fresh Del Monte, SunOpta, Tropical Paradise Fruits Co., Siam Inter Sweet Co., Ltd., Qingdao Elitefoods Co., Ltd..

3. What are the main segments of the IQF Pineapple?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "IQF Pineapple," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the IQF Pineapple report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the IQF Pineapple?

To stay informed about further developments, trends, and reports in the IQF Pineapple, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence