Key Insights

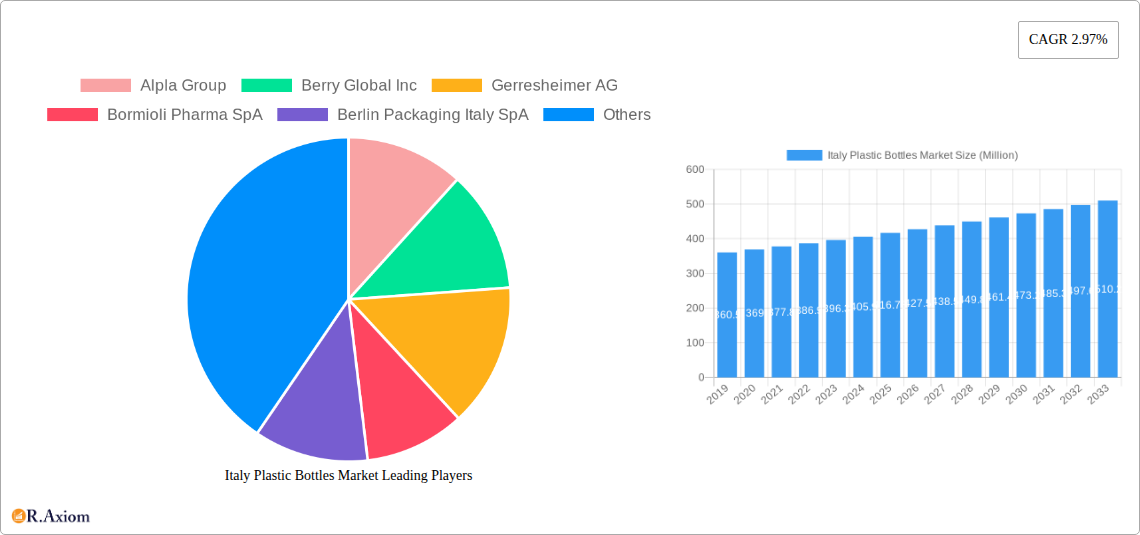

The Italian plastic bottles market is poised for steady growth, projected to reach 416.78 million in value by 2025. This expansion is underpinned by a compound annual growth rate (CAGR) of 2.97% over the forecast period. While specific drivers are not detailed, the market's trajectory is likely influenced by the persistent demand from key end-user industries such as food and beverage, pharmaceuticals, and personal care. The beverage sector, in particular, with its sub-segments of bottled water, carbonated soft drinks, and juices, represents a significant consumer of plastic bottles, a trend expected to continue. Furthermore, the increasing adoption of technologically advanced and sustainable packaging solutions by manufacturers will also contribute to market buoyancy.

Italy Plastic Bottles Market Market Size (In Million)

The market's growth, however, will need to navigate inherent restraints that could temper its full potential. These might include evolving regulatory landscapes concerning plastic usage and waste management, growing consumer preference for sustainable alternatives, and potential fluctuations in raw material prices, especially for resins like Polyethylene (PE), Polyethylene Terephthalate (PET), and Polypropylene (PP). Established players like Alpla Group and Berry Global Inc. are expected to maintain significant market presence, while emerging players could leverage innovation in sustainable materials or specialized packaging to capture niche segments. The strategic focus on the Italian market by these companies highlights its importance within the broader European packaging landscape.

Italy Plastic Bottles Market Company Market Share

This in-depth report provides a detailed analysis of the Italy Plastic Bottles Market, encompassing market size, growth trends, competitive landscape, and future projections. Covering the study period from 2019 to 2033, with a base year of 2025, this report offers actionable insights for stakeholders navigating the dynamic Italian plastic packaging sector. Our forecast period extends from 2025 to 2033, building upon historical data from 2019-2024.

Italy Plastic Bottles Market Market Concentration & Innovation

The Italy Plastic Bottles Market exhibits a moderate level of market concentration, with a blend of large multinational corporations and agile domestic players driving innovation. Key innovation drivers include the increasing demand for sustainable packaging solutions, advancements in recycling technologies, and the pursuit of lighter, more durable plastic bottle designs. Regulatory frameworks, such as EU directives on plastic waste and national recycling targets, significantly influence product development and market entry strategies. The threat of product substitutes, including glass bottles and paper-based packaging, is a constant consideration for manufacturers. End-user trends, particularly the growing preference for convenience and single-use formats in the beverage and personal care sectors, shape product demand. Merger and acquisition (M&A) activities, while not rampant, are strategic moves aimed at consolidating market share, acquiring innovative technologies, and expanding product portfolios. For instance, acquisitions of smaller, specialized plastic converters by larger groups aim to achieve economies of scale and enhance R&D capabilities. While specific M&A deal values for the Italian market are proprietary, global trends suggest significant investments in companies focusing on recycled content and advanced manufacturing processes. Market share distribution varies across segments, with established players holding significant portions of the PET bottle market for beverages.

Italy Plastic Bottles Market Industry Trends & Insights

The Italy Plastic Bottles Market is poised for steady growth, driven by several interconnected trends. A significant growth driver is the burgeoning demand for convenient and portable packaging across various end-user industries. The beverage sector, particularly bottled water and juices, continues to be a dominant force, fueled by increasing consumer awareness of hydration and the demand for on-the-go consumption. Technological disruptions are revolutionizing the production of plastic bottles. Innovations in polymer science are leading to the development of thinner-walled yet equally robust bottles, reducing material usage and environmental impact. Furthermore, advancements in high-speed injection molding and blow molding technologies are enhancing manufacturing efficiency and lowering production costs. Consumer preferences are shifting demonstrably towards sustainable and eco-friendly packaging. This includes a rising demand for bottles made from recycled plastics (rPET), as well as a growing interest in biodegradable or compostable alternatives, though their market penetration for rigid packaging like bottles remains nascent. The competitive dynamics within the market are characterized by a pursuit of cost optimization, product differentiation through design and functionality, and an increasing focus on circular economy principles. Companies are investing heavily in R&D to improve the recyclability of their products and to incorporate higher percentages of post-consumer recycled (PCR) content. The market penetration of recycled content in plastic bottles is steadily increasing, driven by both consumer demand and regulatory mandates. The Compound Annual Growth Rate (CAGR) for the Italian plastic bottles market is projected to be approximately 3.5% to 4.5% over the forecast period, reflecting a healthy expansion driven by these evolving trends. The increasing adoption of lightweighting techniques in bottle design is also contributing to market growth by reducing raw material consumption and transportation costs.

Dominant Markets & Segments in Italy Plastic Bottles Market

The Polyethylene Terephthalate (PET) resin segment is the undisputed leader within the Italy Plastic Bottles Market, driven by its exceptional clarity, strength, and recyclability, making it the preferred choice for beverage packaging.

- PET Dominance Drivers:

- Food & Beverage Industry: This sector is the primary consumer of PET bottles, particularly for bottled water, carbonated soft drinks (CSDs), and juices. The clarity of PET allows consumers to visually assess product quality, a critical factor in these segments. The lightweight nature of PET also reduces transportation costs and environmental impact.

- Bottled Water: The sustained consumer trend towards healthy hydration and the convenience of ready-to-drink formats solidify bottled water's position as a major driver for PET bottle demand.

- Carbonated Soft Drinks: The ability of PET to withstand the pressure of carbonation without compromising structural integrity makes it ideal for CSDs. The ongoing demand for sugary and diet soft drinks continues to fuel PET bottle consumption.

- Juices and Energy Drinks: The increasing popularity of functional beverages and a growing health-conscious consumer base contribute to the demand for PET bottles in these sub-segments.

- Regulatory Support for Recycling: Italy, like other EU nations, has robust regulations supporting PET recycling, which further encourages its use due to its established recycling infrastructure.

The Food and Beverage end-user industries collectively represent the largest market share for plastic bottles in Italy. This dominance is underpinned by several factors:

- Ubiquitous Consumption: Food and beverages are staple consumption goods, ensuring a constant and high-volume demand for their packaging.

- Shelf-Life Extension: Plastic bottles, particularly PET, offer excellent barrier properties, contributing to extended product shelf-life, which is crucial for food and beverage preservation.

- Consumer Convenience: The portability and resealability of plastic bottles align perfectly with modern lifestyles, making them the packaging of choice for on-the-go consumption.

- Economic Significance: The food and beverage sector is a cornerstone of the Italian economy, directly translating into substantial demand for packaging solutions.

Within the broader Beverage segment, Bottled Water and Carbonated Soft Drinks command the largest market share due to their high consumption volumes. Pharmaceuticals and Personal Care and Toiletries also represent significant end-user industries. The pharmaceutical sector demands high levels of purity, chemical resistance, and tamper-evident features, often utilizing specialized PET or HDPE bottles. The personal care and toiletries market, encompassing products like shampoos, lotions, and detergents, favors aesthetically pleasing and functional designs, with HDPE and PP being common materials.

The Other Beverages sub-segment, which includes alcoholic beverages like wine and spirits in certain formats, and non-alcoholic alternatives, also contributes to the demand, although glass remains a dominant material for traditional wine and spirits packaging. Household Chemicals, Paints and Coatings, and Industrial applications also utilize plastic bottles, with HDPE and PP being prevalent due to their chemical resistance and durability. However, these segments generally represent smaller shares compared to food and beverages.

Italy Plastic Bottles Market Product Developments

Product development in the Italy Plastic Bottles Market is largely focused on enhancing sustainability and functionality. Innovations include the increasing incorporation of recycled PET (rPET) to meet consumer and regulatory demand for eco-friendly packaging. Lightweighting techniques are being adopted to reduce material consumption without compromising strength. Advanced barrier technologies are being integrated into PET bottles to extend shelf life for sensitive products. Furthermore, the development of unique bottle shapes and designs, coupled with improved dispensing mechanisms, enhances user experience and brand differentiation across segments like personal care and beverages.

Report Scope & Segmentation Analysis

This report comprehensively segments the Italy Plastic Bottles Market by Resin Type and End-user Industry.

Resin Segmentation:

- Polyethylene Terephthalate (PET): Expected to witness robust growth, driven by the beverage industry's demand for clarity and recyclability.

- Polyethylene (PE): Primarily High-Density Polyethylene (HDPE), will continue to be a strong contender in household chemicals, personal care, and certain beverage applications due to its chemical resistance and durability.

- Polypropylene (PP): Will see steady demand from food, personal care, and industrial applications, benefiting from its good chemical resistance and heat stability.

- Other Resins: Encompasses materials like Polyvinyl Chloride (PVC) and Polystyrene (PS) in niche applications, with their market share remaining relatively small.

End-user Industry Segmentation:

- Food: A major segment, with demand driven by the need for safe, convenient, and shelf-stable packaging solutions.

- Beverage: The largest segment, encompassing:

- Bottled Water: Continued strong growth due to health consciousness and convenience.

- Carbonated Soft Drinks: Sustained demand, with a growing interest in smaller, single-serve formats.

- Alcoholic Beverages: Niche growth in certain spirit and ready-to-drink (RTD) categories.

- Juices and Energy Drinks: Expanding rapidly due to health and wellness trends.

- Other Beverages: Including dairy alternatives and functional drinks.

- Pharmaceuticals: High-value segment requiring stringent quality and safety standards.

- Personal Care and Toiletries: Driven by innovation in product design and functionality.

- Industrial: Consistent demand from chemical and lubricant manufacturers.

- Household Chemicals: Driven by the need for robust and chemically resistant packaging.

- Paints and Coatings: Specific requirements for barrier properties and chemical compatibility.

- Other End-user Industries: Including niche applications.

Key Drivers of Italy Plastic Bottles Market Growth

Several key factors are propelling the growth of the Italy Plastic Bottles Market. The increasing consumer preference for convenience and single-use formats in beverages, personal care, and household products is a primary driver. Technological advancements in manufacturing processes, leading to lighter, stronger, and more cost-effective bottles, are also significant. Furthermore, growing environmental awareness and regulatory pushes towards sustainability, such as increased recycled content mandates and extended producer responsibility schemes, are fostering innovation in rPET and other eco-friendly solutions. The expansion of the food and beverage industry, particularly the bottled water and juice segments, directly translates into higher demand for plastic bottles.

Challenges in the Italy Plastic Bottles Market Sector

Despite its growth trajectory, the Italy Plastic Bottles Market faces several challenges. Increasing regulatory scrutiny and potential bans on single-use plastics in certain applications pose a significant threat. Volatile raw material prices, predominantly linked to crude oil, can impact manufacturing costs and profitability. The growing competition from alternative packaging materials, such as glass and paper-based solutions, requires continuous innovation and cost-effectiveness. Furthermore, challenges in plastic waste management and recycling infrastructure, particularly in ensuring high collection and effective recycling rates for all types of plastic, remain a persistent concern.

Emerging Opportunities in Italy Plastic Bottles Market

The Italy Plastic Bottles Market is ripe with emerging opportunities. The growing demand for high-barrier PET bottles for food and beverage applications to extend shelf life presents a significant avenue. The expansion of the market for rPET, fueled by corporate sustainability goals and consumer preference, offers substantial growth potential for manufacturers with advanced recycling capabilities. The development of innovative dispensing and closure systems for enhanced consumer convenience and product differentiation is another key opportunity. Moreover, the penetration of plastic bottles in emerging end-user segments and the adoption of advanced manufacturing technologies like AI-driven process optimization can unlock new efficiencies and market shares.

Leading Players in the Italy Plastic Bottles Market Market

- Alpla Group

- Berry Global Inc

- Gerresheimer AG

- Bormioli Pharma SpA

- Berlin Packaging Italy SpA

- Valgroup Italia SRL

- Daunia Plast SpA

- Verve SpA

- Plastopiave SRL

- Vetronaviglio SRL

Key Developments in Italy Plastic Bottles Market Industry

- February 2024: Parmalat launched its inaugural certified white rPET bottle for UHT milk, incorporating 50% recycled plastic. This initiative, spearheaded by Parmalat's R&D team in partnership with Dentis Recycling Italy, saw an investment of EUR 21 million (USD 23.06 million) and established three new production lines. Notably, two of these lines are situated at Parmalat's flagship facility in Collecchio. At the end of its life cycle, each UHT milk bottle can be recycled and reintegrated into the production system, thereby generating new value for consumers, businesses, and the environment.

- May 2023: Sagra, a brand under the Salov SpA Group, introduced innovative r-PET bottles. These bottles, crafted from 100% recycled plastic, are specifically designed for Sagra's range of seed oils. The new sustainable plastic, derived entirely from recycling other bottles, champions eco-friendliness and upholds traditional bottles' quality, safety, and user-friendliness.

Strategic Outlook for Italy Plastic Bottles Market Market

The strategic outlook for the Italy Plastic Bottles Market is characterized by a strong emphasis on sustainability, innovation, and circular economy principles. Manufacturers that invest in advanced recycling technologies and increase the use of rPET will be well-positioned for future success. Collaboration across the value chain, from resin producers to brand owners and recyclers, will be crucial for addressing challenges related to plastic waste management. The market will continue to be shaped by evolving consumer preferences for convenience and eco-friendly packaging, alongside stringent regulatory frameworks. Companies that can offer customized solutions, superior product performance, and a clear commitment to environmental responsibility will thrive in this dynamic landscape.

Italy Plastic Bottles Market Segmentation

-

1. Resin

- 1.1. Polyethylene (PE)

- 1.2. Polyethylene Terephthalate (PET)

- 1.3. Polypropylene (PP)

- 1.4. Other Re

-

2. End-user Industry

- 2.1. Food

-

2.2. Beverage**

- 2.2.1. Bottled Water

- 2.2.2. Carbonated Soft Drinks

- 2.2.3. Alcoholic Beverages

- 2.2.4. Juices and Energy Drinks

- 2.2.5. Other Beverages

- 2.3. Pharmaceuticals

- 2.4. Personal Care and Toiletries

- 2.5. Industrial

- 2.6. Household Chemicals

- 2.7. Paints and Coatings

- 2.8. Other End-user Industries

Italy Plastic Bottles Market Segmentation By Geography

- 1. Italy

Italy Plastic Bottles Market Regional Market Share

Geographic Coverage of Italy Plastic Bottles Market

Italy Plastic Bottles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Lightweight Packaging Methods; Changing Demographic and Lifestyle Factors

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of Lightweight Packaging Methods; Changing Demographic and Lifestyle Factors

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Beverages Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Plastic Bottles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 5.1.1. Polyethylene (PE)

- 5.1.2. Polyethylene Terephthalate (PET)

- 5.1.3. Polypropylene (PP)

- 5.1.4. Other Re

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.2. Beverage**

- 5.2.2.1. Bottled Water

- 5.2.2.2. Carbonated Soft Drinks

- 5.2.2.3. Alcoholic Beverages

- 5.2.2.4. Juices and Energy Drinks

- 5.2.2.5. Other Beverages

- 5.2.3. Pharmaceuticals

- 5.2.4. Personal Care and Toiletries

- 5.2.5. Industrial

- 5.2.6. Household Chemicals

- 5.2.7. Paints and Coatings

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Alpla Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Berry Global Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gerresheimer AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bormioli Pharma SpA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Berlin Packaging Italy SpA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Valgroup Italia SRL

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Daunia Plast SpA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Verve SpA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Plastopiave SRL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vetronaviglio SRL7 2 Heat Map Analysis7 3 Competitor Analysis - Emerging vs Established Player

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Alpla Group

List of Figures

- Figure 1: Italy Plastic Bottles Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Italy Plastic Bottles Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Plastic Bottles Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 2: Italy Plastic Bottles Market Volume Million Forecast, by Resin 2020 & 2033

- Table 3: Italy Plastic Bottles Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Italy Plastic Bottles Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 5: Italy Plastic Bottles Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Italy Plastic Bottles Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: Italy Plastic Bottles Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 8: Italy Plastic Bottles Market Volume Million Forecast, by Resin 2020 & 2033

- Table 9: Italy Plastic Bottles Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Italy Plastic Bottles Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 11: Italy Plastic Bottles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Italy Plastic Bottles Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Plastic Bottles Market?

The projected CAGR is approximately 2.97%.

2. Which companies are prominent players in the Italy Plastic Bottles Market?

Key companies in the market include Alpla Group, Berry Global Inc, Gerresheimer AG, Bormioli Pharma SpA, Berlin Packaging Italy SpA, Valgroup Italia SRL, Daunia Plast SpA, Verve SpA, Plastopiave SRL, Vetronaviglio SRL7 2 Heat Map Analysis7 3 Competitor Analysis - Emerging vs Established Player.

3. What are the main segments of the Italy Plastic Bottles Market?

The market segments include Resin, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 416.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Lightweight Packaging Methods; Changing Demographic and Lifestyle Factors.

6. What are the notable trends driving market growth?

Increasing Demand from the Beverages Segment.

7. Are there any restraints impacting market growth?

Increasing Adoption of Lightweight Packaging Methods; Changing Demographic and Lifestyle Factors.

8. Can you provide examples of recent developments in the market?

February 2024: Parmalat, the Italian dairy giant, launched its inaugural certified white rPET bottle for UHT milk, incorporating 50% recycled plastic. This initiative, spearheaded by Parmalat's R&D team in partnership with Dentis Recycling Italy, saw an investment of EUR 21 million (USD 23.06 million) and established three new production lines. Notably, two of these lines are situated at Parmalat's flagship facility in Collecchio. At the end of its life cycle, each UHT milk bottle can be recycled and reintegrated into the production system, thereby generating new value for consumers, businesses, and the environment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Plastic Bottles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Plastic Bottles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Plastic Bottles Market?

To stay informed about further developments, trends, and reports in the Italy Plastic Bottles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence