Key Insights

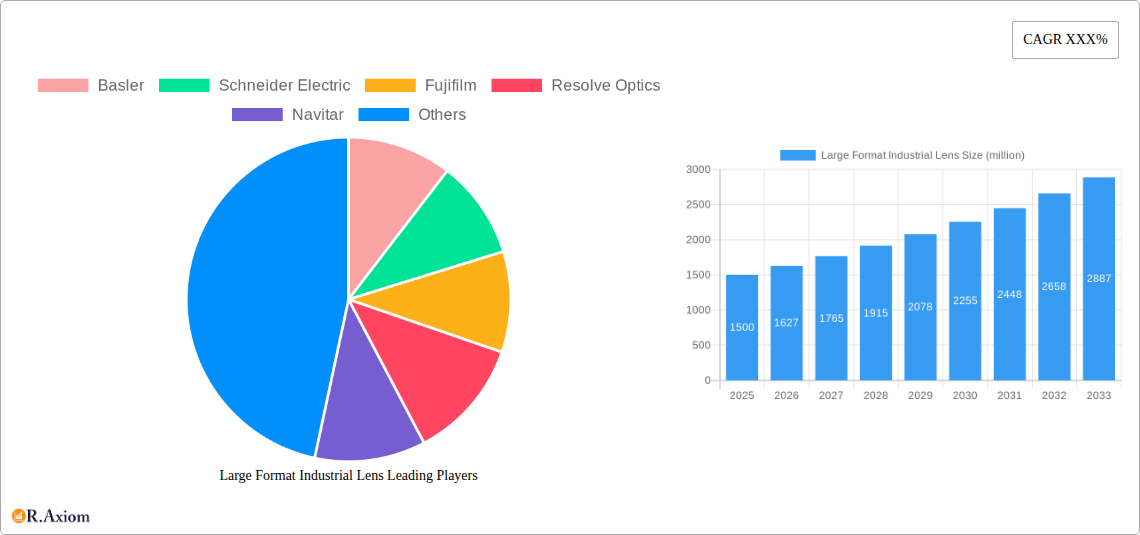

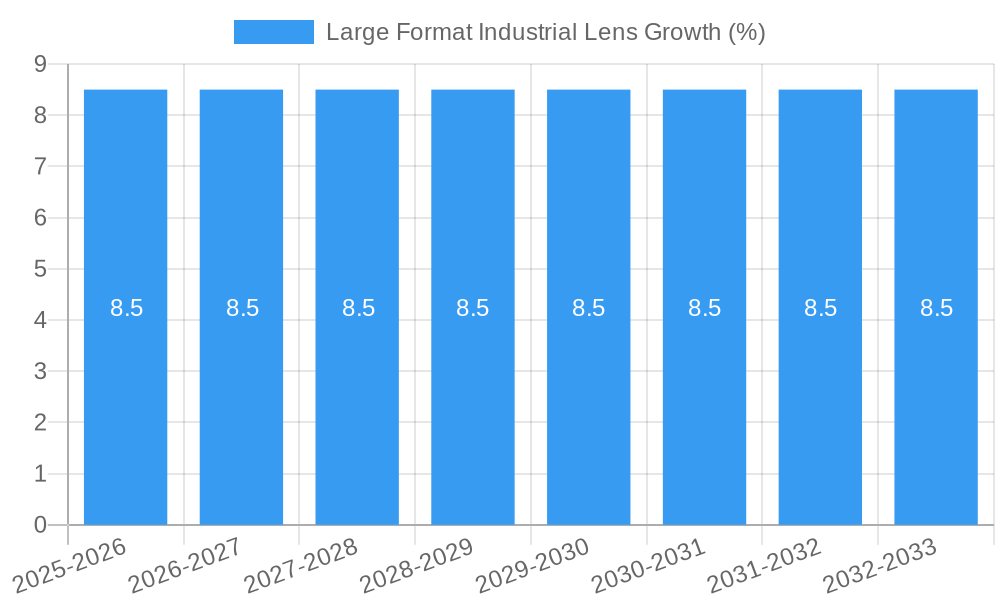

The global Large Format Industrial Lens market is poised for substantial growth, projected to reach an estimated market size of approximately $1,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 8.5% forecasted through 2033. This expansion is primarily fueled by the escalating demand for advanced imaging solutions across a multitude of industrial applications. Key growth drivers include the burgeoning adoption of machine vision systems for quality control, automation, and defect detection in manufacturing, where larger sensor formats are increasingly becoming the norm for capturing intricate details. Furthermore, the growing sophistication of security monitoring systems, encompassing everything from sophisticated surveillance to critical infrastructure protection, also necessitates high-resolution, large-format lenses capable of covering wider fields of view. The scientific research sector, too, contributes significantly, leveraging these lenses for detailed imaging in microscopy, astronomy, and various laboratory experiments.

The market's trajectory is further shaped by several emerging trends. The miniaturization and enhanced performance of imaging sensors are compelling manufacturers to develop equally advanced large-format lenses that can fully exploit these capabilities. There's a discernible shift towards lenses offering superior optical performance, including higher resolution, reduced distortion, and enhanced spectral transmission, to meet the exacting standards of modern industrial processes. Innovations in lens design and materials are also playing a crucial role, enabling lighter, more compact, and more durable solutions. However, the market is not without its challenges. The high cost associated with advanced optical manufacturing and the need for specialized expertise can act as a restraint for smaller players. Additionally, rapid technological advancements necessitate continuous investment in research and development, which can strain resources. Despite these hurdles, the pervasive integration of AI and machine learning with machine vision, coupled with increasing automation across industries, points towards a sustained and vigorous growth phase for the Large Format Industrial Lens market.

Here is a detailed, SEO-optimized report description for the Large Format Industrial Lens market:

Large Format Industrial Lens Market Concentration & Innovation

The Large Format Industrial Lens market exhibits a moderate to high concentration, with key players like Basler, Schneider Electric, Fujifilm, Resolve Optics, Navitar, VS Technology, Panavision, Cooke Optics, Computar, Nikon, Daheng Imaging, CHIOPT, CYUN YI TECHNOLOGY, MindVision, Luster LightTech, YVSION, ZLKC OPTICAL, Qingdao LaserOptec, HUIRONG IDEAS, and CST competing for significant market share. Innovation is a primary driver, fueled by advancements in imaging resolution, sensor technology, and miniaturization, leading to the development of lenses with wider apertures and superior optical performance. Regulatory frameworks, particularly those related to industrial safety, quality control, and data security, indirectly influence lens design and adoption. Product substitutes, while limited in highly specialized industrial applications, can emerge from advancements in alternative imaging technologies or integrated camera-lens systems. End-user trends are pushing towards higher throughput inspection, more sophisticated machine vision algorithms, and increased demand for robust solutions in security monitoring and scientific research. Merger and acquisition (M&A) activities, with estimated deal values in the tens of millions, are strategically focused on acquiring advanced optical technologies, expanding geographic reach, and consolidating market presence. These activities are shaping the competitive landscape and accelerating the pace of innovation within the industry.

Large Format Industrial Lens Industry Trends & Insights

The Large Format Industrial Lens market is poised for substantial growth, driven by an escalating demand for high-resolution imaging across diverse industrial applications. The Industrial Inspection segment, a cornerstone of this market, is witnessing an unprecedented surge as manufacturers globally adopt stringent quality control measures and automated defect detection systems. This is directly correlated with the increasing complexity of manufactured goods and the need for meticulous, high-speed inspection. The Machine Vision sector is a primary growth catalyst, experiencing a Compound Annual Growth Rate (CAGR) of approximately 7.5% over the forecast period. This growth is fueled by the integration of AI and deep learning algorithms, which require increasingly sophisticated optics to capture the necessary image data for intelligent analysis. The adoption of large format lenses is expanding market penetration in areas previously underserved by traditional imaging solutions, enabling broader fields of view and higher detail capture.

Technological disruptions are constantly reshaping the market. Innovations in lens design, such as improved coatings for enhanced light transmission and reduced distortion, along with the development of specialized lens types like telecentric lenses for metrology applications, are critical. The proliferation of higher resolution sensors in industrial cameras necessitates complementary high-performance optics, creating a symbiotic growth relationship. Consumer preferences, though indirectly influencing the industrial lens market, are reflected in the demand for end products that require advanced manufacturing and quality assurance, thereby driving the need for superior industrial imaging.

Competitive dynamics are intensifying as established players invest heavily in research and development while new entrants emerge with disruptive technologies. The global market size for large format industrial lenses is projected to reach upwards of 2.5 billion USD by the end of the forecast period, with significant contributions from regions embracing Industry 4.0 principles. Market penetration is projected to rise from an estimated 30% in the base year to over 45% by 2033, indicating a broad adoption across various industrial verticals. The increasing complexity of industrial processes and the need for precise data acquisition for automation and predictive maintenance are fundamental drivers propelling this market forward. Furthermore, the growing adoption of large format industrial lenses in specialized scientific research fields, such as astronomy and microscopy, adds another layer of demand and innovation.

Dominant Markets & Segments in Large Format Industrial Lens

The Industrial Inspection segment stands as the dominant application within the Large Format Industrial Lens market, driven by stringent quality control mandates across automotive, electronics, pharmaceuticals, and food and beverage industries. The increasing demand for high-throughput, automated inspection systems to detect minute defects and ensure product consistency fuels the adoption of large format lenses capable of capturing expansive fields of view with exceptional detail.

Key drivers for the dominance of Industrial Inspection include:

- Economic Policies: Government initiatives promoting advanced manufacturing and automation, such as Industry 4.0, directly incentivize the adoption of sophisticated inspection technologies. For example, in regions with a strong manufacturing base like Germany and China, there's a significant push for quality assurance.

- Infrastructure Development: The expansion of smart factories and automated production lines requires robust and precise imaging solutions, with large format lenses being crucial for comprehensive coverage.

- Technological Advancements: The development of higher resolution sensors and AI-powered defect analysis algorithms necessitates lenses that can deliver the required optical performance and information density.

In terms of lens interfaces, the F Interface commands a significant market share due to its long-standing prevalence and wide compatibility with established camera systems. However, the K Interface is rapidly gaining traction, particularly in newer machine vision applications, offering improved performance and robustness for demanding industrial environments.

The Machine Vision segment is a close second in market dominance, driven by the need for intelligent automation in robotics, assembly lines, and logistics. The ability of large format lenses to provide a wide field of view with minimal distortion is critical for object recognition, guidance, and data acquisition in these dynamic environments. The increasing integration of AI and deep learning in machine vision systems further amplifies the demand for high-quality imagery that large format lenses can provide.

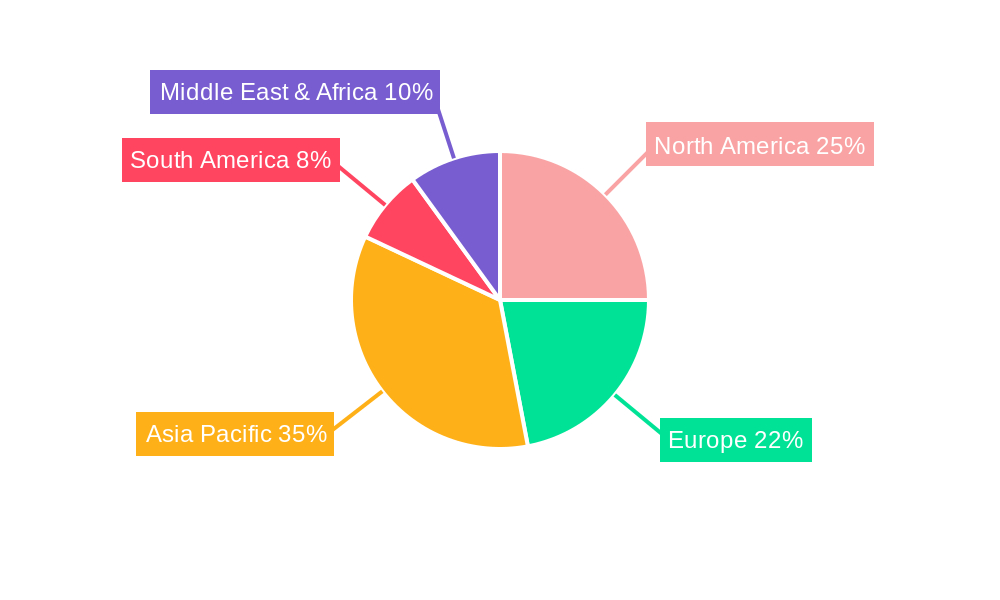

Leading regions contributing to this dominance include:

- Asia-Pacific: China, in particular, is a major hub for manufacturing and technological innovation, driving substantial demand for industrial lenses. Investments in smart manufacturing and the presence of a vast electronics production ecosystem make it a key market.

- North America: The US market benefits from strong R&D investments in AI and automation, alongside a robust automotive and aerospace sector that relies heavily on advanced inspection and machine vision.

- Europe: Germany's leadership in industrial automation and stringent quality standards create a consistent demand for high-performance industrial lenses.

Large Format Industrial Lens Product Developments

Product developments in the Large Format Industrial Lens market are characterized by a relentless pursuit of enhanced optical performance, increased durability, and broader application suitability. Innovations focus on achieving higher resolution capabilities, wider apertures for low-light conditions, and reduced optical aberrations for unparalleled image fidelity. Applications are expanding beyond traditional industrial inspection to sophisticated scientific research requiring high-precision imaging, advanced security monitoring systems, and specialized applications in the medical imaging field. The competitive advantage lies in offering lenses that are not only technically superior but also cost-effective and readily adaptable to diverse camera platforms and integration challenges.

Report Scope & Segmentation Analysis

This report segments the Large Format Industrial Lens market by Application and Type. The Application segmentation includes: Industrial Inspection, which is projected to hold a market share of over 40% due to its critical role in quality control and automation; Machine Vision, expected to grow at a CAGR of approximately 7.5% driven by AI integration; Security Monitoring, with a steady growth rate fueled by the need for comprehensive surveillance; Scientific Research, a niche but high-value segment with specialized optical demands; and Others, encompassing emerging applications. The Type segmentation focuses on lens interfaces: K Interface, a rapidly adopting standard for new systems; and F Interface, a historically dominant and widely compatible interface. Growth projections for each segment are detailed within the report, along with their respective market sizes and competitive dynamics.

Key Drivers of Large Format Industrial Lens Growth

The growth of the Large Format Industrial Lens market is propelled by several key factors. Technologically, advancements in sensor resolution and sensitivity are demanding optics capable of capturing finer details and performing well in challenging lighting. Economically, the widespread adoption of Industry 4.0 principles and automation across manufacturing sectors necessitates sophisticated machine vision and inspection systems, directly driving lens demand. Regulatory frameworks promoting product quality and safety also play a crucial role. For instance, stringent automotive quality standards necessitate advanced inspection technologies, increasing the need for high-performance industrial lenses. The growing investment in AI and machine learning further amplifies the demand for high-fidelity imaging solutions.

Challenges in the Large Format Industrial Lens Sector

The Large Format Industrial Lens sector faces several challenges that can impede growth. Supply chain disruptions, particularly for specialized optical components and raw materials, can lead to production delays and increased costs. Intense competition from both established manufacturers and emerging players, especially from Asia, puts pressure on pricing and profit margins. Furthermore, the rapid pace of technological change requires significant R&D investment, posing a challenge for smaller companies. Regulatory hurdles related to export controls and product certifications can also create barriers to market entry and expansion, impacting market penetration for new entrants.

Emerging Opportunities in Large Format Industrial Lens

Emerging opportunities within the Large Format Industrial Lens market are abundant. The burgeoning field of advanced robotics and autonomous systems presents a significant opportunity, as these applications require precise and reliable vision systems. The growing demand for defect detection in the 3D printing industry, as well as in the burgeoning semiconductor manufacturing sector, offers substantial growth potential. Furthermore, the increasing use of industrial lenses in augmented reality (AR) and virtual reality (VR) applications for industrial training and maintenance is opening new avenues. The expansion of smart city initiatives and advanced surveillance technologies also presents a growing market for high-performance imaging solutions.

Leading Players in the Large Format Industrial Lens Market

Basler Schneider Electric Fujifilm Resolve Optics Navitar VS Technology Panavision Cooke Optics Computar Nikon Daheng Imaging CHIOPT CYUN YI TECHNOLOGY MindVision Luster LightTech YVSION ZLKC OPTICAL Qingdao LaserOptec HUIRONG IDEAS CST

Key Developments in Large Format Industrial Lens Industry

- 2023/04: Basler launches new advanced industrial cameras with enhanced sensor technology, driving demand for complementary large format lenses.

- 2022/11: Fujifilm announces significant investment in its optical lens division, focusing on high-performance industrial applications.

- 2022/07: Resolve Optics introduces a new line of custom large format lenses for specialized scientific imaging applications.

- 2021/10: Schneider Electric acquires a prominent machine vision components supplier, strengthening its integrated solutions offering.

- 2021/05: Navitar expands its product portfolio with new telecentric lenses for precision metrology.

- 2020/12: VS Technology enhances its manufacturing capacity for large format lenses to meet growing demand.

- 2020/03: Computar introduces a new series of ultra-high resolution lenses for demanding industrial inspection tasks.

Strategic Outlook for Large Format Industrial Lens Market

The strategic outlook for the Large Format Industrial Lens market is exceptionally positive, fueled by continuous technological advancements and the pervasive integration of automation across global industries. The increasing demand for higher resolution, faster imaging, and more robust optical solutions in sectors like automotive manufacturing, electronics, and pharmaceuticals will act as primary growth catalysts. The expanding use of AI and machine learning in industrial processes further necessitates sophisticated imaging capabilities, creating fertile ground for innovative lens designs. Strategic partnerships, R&D investments in next-generation optical technologies, and geographic expansion into emerging industrial hubs will be crucial for players aiming to capitalize on the substantial future market potential and seize emerging opportunities in specialized applications.

Large Format Industrial Lens Segmentation

-

1. Application

- 1.1. Industrial Inspection

- 1.2. Machine Vision

- 1.3. Security Monitoring

- 1.4. Scientific Research

- 1.5. Others

-

2. Type

- 2.1. K Interface

- 2.2. F Interface

Large Format Industrial Lens Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Large Format Industrial Lens REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Large Format Industrial Lens Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Industrial Inspection

- 5.1.2. Machine Vision

- 5.1.3. Security Monitoring

- 5.1.4. Scientific Research

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. K Interface

- 5.2.2. F Interface

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Large Format Industrial Lens Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Industrial Inspection

- 6.1.2. Machine Vision

- 6.1.3. Security Monitoring

- 6.1.4. Scientific Research

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. K Interface

- 6.2.2. F Interface

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Large Format Industrial Lens Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Industrial Inspection

- 7.1.2. Machine Vision

- 7.1.3. Security Monitoring

- 7.1.4. Scientific Research

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. K Interface

- 7.2.2. F Interface

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Large Format Industrial Lens Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Industrial Inspection

- 8.1.2. Machine Vision

- 8.1.3. Security Monitoring

- 8.1.4. Scientific Research

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. K Interface

- 8.2.2. F Interface

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Large Format Industrial Lens Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Industrial Inspection

- 9.1.2. Machine Vision

- 9.1.3. Security Monitoring

- 9.1.4. Scientific Research

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. K Interface

- 9.2.2. F Interface

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Large Format Industrial Lens Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Industrial Inspection

- 10.1.2. Machine Vision

- 10.1.3. Security Monitoring

- 10.1.4. Scientific Research

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. K Interface

- 10.2.2. F Interface

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Basler

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Schneider Electric

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fujifilm

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Resolve Optics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Navitar

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 VS Technology

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Panavision

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cooke Optics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Computar

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nikon

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Daheng Imaging

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 CHIOPT

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 CYUN YI TECHNOLOGY

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 MindVision

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Luster LightTech

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 YVSION

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 ZLKC OPTICAL

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Qingdao LaserOptec

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 HUIRONG IDEAS

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 CST

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Basler

List of Figures

- Figure 1: Global Large Format Industrial Lens Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Large Format Industrial Lens Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Large Format Industrial Lens Revenue (million), by Application 2024 & 2032

- Figure 4: North America Large Format Industrial Lens Volume (K), by Application 2024 & 2032

- Figure 5: North America Large Format Industrial Lens Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Large Format Industrial Lens Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Large Format Industrial Lens Revenue (million), by Type 2024 & 2032

- Figure 8: North America Large Format Industrial Lens Volume (K), by Type 2024 & 2032

- Figure 9: North America Large Format Industrial Lens Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Large Format Industrial Lens Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Large Format Industrial Lens Revenue (million), by Country 2024 & 2032

- Figure 12: North America Large Format Industrial Lens Volume (K), by Country 2024 & 2032

- Figure 13: North America Large Format Industrial Lens Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Large Format Industrial Lens Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Large Format Industrial Lens Revenue (million), by Application 2024 & 2032

- Figure 16: South America Large Format Industrial Lens Volume (K), by Application 2024 & 2032

- Figure 17: South America Large Format Industrial Lens Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Large Format Industrial Lens Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Large Format Industrial Lens Revenue (million), by Type 2024 & 2032

- Figure 20: South America Large Format Industrial Lens Volume (K), by Type 2024 & 2032

- Figure 21: South America Large Format Industrial Lens Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Large Format Industrial Lens Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Large Format Industrial Lens Revenue (million), by Country 2024 & 2032

- Figure 24: South America Large Format Industrial Lens Volume (K), by Country 2024 & 2032

- Figure 25: South America Large Format Industrial Lens Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Large Format Industrial Lens Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Large Format Industrial Lens Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Large Format Industrial Lens Volume (K), by Application 2024 & 2032

- Figure 29: Europe Large Format Industrial Lens Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Large Format Industrial Lens Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Large Format Industrial Lens Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Large Format Industrial Lens Volume (K), by Type 2024 & 2032

- Figure 33: Europe Large Format Industrial Lens Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Large Format Industrial Lens Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Large Format Industrial Lens Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Large Format Industrial Lens Volume (K), by Country 2024 & 2032

- Figure 37: Europe Large Format Industrial Lens Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Large Format Industrial Lens Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Large Format Industrial Lens Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Large Format Industrial Lens Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Large Format Industrial Lens Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Large Format Industrial Lens Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Large Format Industrial Lens Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Large Format Industrial Lens Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Large Format Industrial Lens Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Large Format Industrial Lens Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Large Format Industrial Lens Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Large Format Industrial Lens Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Large Format Industrial Lens Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Large Format Industrial Lens Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Large Format Industrial Lens Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Large Format Industrial Lens Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Large Format Industrial Lens Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Large Format Industrial Lens Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Large Format Industrial Lens Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Large Format Industrial Lens Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Large Format Industrial Lens Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Large Format Industrial Lens Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Large Format Industrial Lens Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Large Format Industrial Lens Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Large Format Industrial Lens Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Large Format Industrial Lens Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Large Format Industrial Lens Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Large Format Industrial Lens Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Large Format Industrial Lens Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Large Format Industrial Lens Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Large Format Industrial Lens Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Large Format Industrial Lens Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Large Format Industrial Lens Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Large Format Industrial Lens Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Large Format Industrial Lens Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Large Format Industrial Lens Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Large Format Industrial Lens Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Large Format Industrial Lens Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Large Format Industrial Lens Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Large Format Industrial Lens Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Large Format Industrial Lens Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Large Format Industrial Lens Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Large Format Industrial Lens Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Large Format Industrial Lens Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Large Format Industrial Lens Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Large Format Industrial Lens Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Large Format Industrial Lens Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Large Format Industrial Lens Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Large Format Industrial Lens Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Large Format Industrial Lens Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Large Format Industrial Lens Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Large Format Industrial Lens Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Large Format Industrial Lens Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Large Format Industrial Lens Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Large Format Industrial Lens Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Large Format Industrial Lens Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Large Format Industrial Lens Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Large Format Industrial Lens Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Large Format Industrial Lens Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Large Format Industrial Lens Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Large Format Industrial Lens Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Large Format Industrial Lens Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Large Format Industrial Lens Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Large Format Industrial Lens Volume K Forecast, by Country 2019 & 2032

- Table 81: China Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Large Format Industrial Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Large Format Industrial Lens Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Large Format Industrial Lens?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Large Format Industrial Lens?

Key companies in the market include Basler, Schneider Electric, Fujifilm, Resolve Optics, Navitar, VS Technology, Panavision, Cooke Optics, Computar, Nikon, Daheng Imaging, CHIOPT, CYUN YI TECHNOLOGY, MindVision, Luster LightTech, YVSION, ZLKC OPTICAL, Qingdao LaserOptec, HUIRONG IDEAS, CST.

3. What are the main segments of the Large Format Industrial Lens?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Large Format Industrial Lens," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Large Format Industrial Lens report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Large Format Industrial Lens?

To stay informed about further developments, trends, and reports in the Large Format Industrial Lens, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence