Key Insights

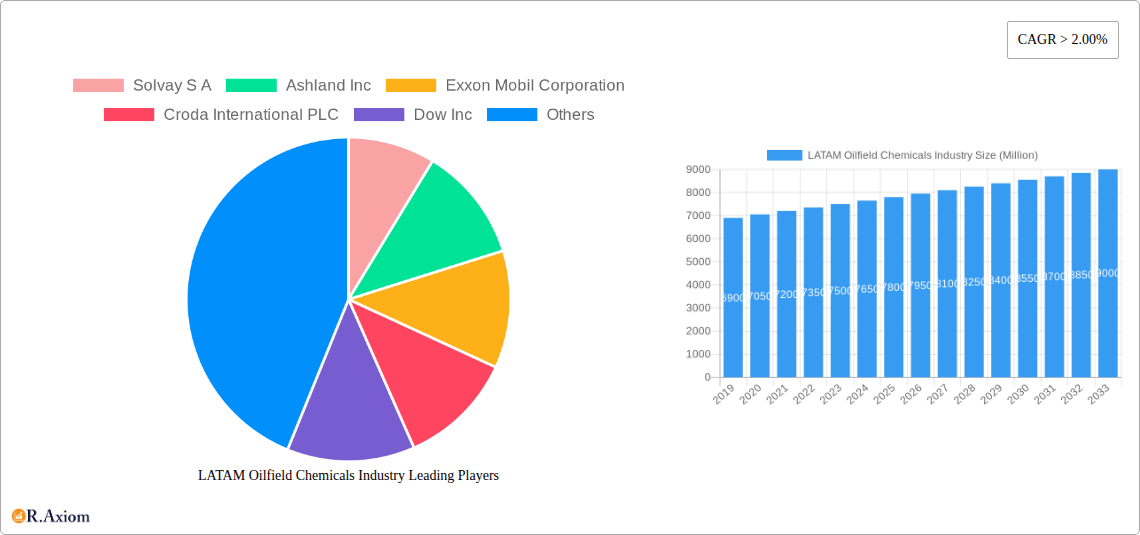

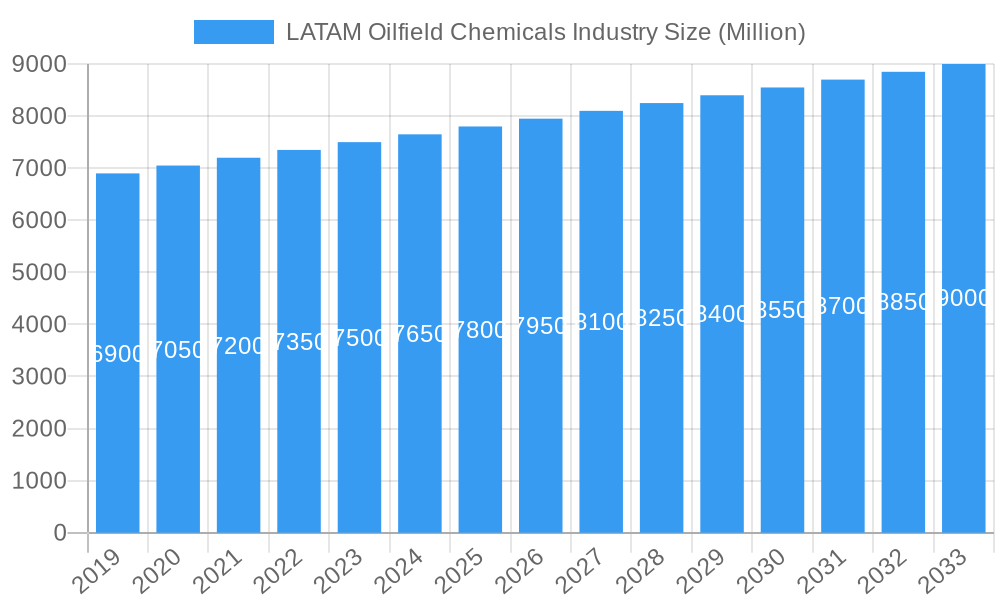

The Latin American oilfield chemicals market is projected to reach $8,000 million by 2025, expanding at a CAGR of 2.8% through 2033. This growth is driven by increased upstream activities, hydrocarbon demand, and investments in exploration and production. Key growth catalysts include the adoption of Enhanced Oil Recovery (EOR) techniques in mature fields within Brazil and Mexico, and strong demand for production chemicals like corrosion inhibitors, scale inhibitors, biocides, and surfactants to ensure operational efficiency and asset integrity in diverse environments. The study covers 2019-2033, with 2025 as the base year.

LATAM Oilfield Chemicals Industry Market Size (In Billion)

Market segmentation by chemical type and application highlights significant demand for biocides, corrosion and scale inhibitors, and surfactants, crucial for preventing operational disruptions and enhancing hydrocarbon recovery. Dominant applications include production, EOR, and drilling & cementing. While environmental regulations and oil price volatility pose challenges, technological advancements in chemical formulations and strategic integrated solutions from major players like Schlumberger, Halliburton, and Baker Hughes are expected to mitigate these. Regional performance will be significantly influenced by investments in Brazil, Mexico, and Colombia's oil and gas sectors.

LATAM Oilfield Chemicals Industry Company Market Share

This report provides an in-depth analysis of the LATAM Oilfield Chemicals Industry, offering insights into market dynamics, growth drivers, challenges, and future opportunities. Covering 2019-2024 historically, with a base year of 2025 and a forecast to 2033, it is an essential resource for stakeholders navigating the evolving oilfield chemical solutions landscape in Latin America. The analysis includes key segments, leading players, technological advancements, and strategic developments.

LATAM Oilfield Chemicals Industry Market Concentration & Innovation

The LATAM Oilfield Chemicals Industry exhibits a moderate to high level of market concentration, with a few major global players dominating a significant portion of the market share. Solvay S.A., Ashland Inc., Exxon Mobil Corporation, Croda International PLC, Dow Inc., Weatherford International Plc, BASF SE, Huntsman International LLC, Baker Hughes Company, Halliburton, Ecolab Inc., Petrolab Industrial E Comercial Ltda, Schlumberger Limited, and Clariant AG are key entities driving this market. Innovation is a critical differentiator, with companies investing heavily in research and development to create more efficient, environmentally friendly, and high-performance chemical solutions. This includes the development of advanced polymers for Enhanced Oil Recovery (EOR) and specialized biocides for combating microbial contamination in reservoirs. Regulatory frameworks in LATAM countries are increasingly focused on environmental protection and safety standards, influencing product development and market entry strategies. For instance, stringent regulations on chemical discharge are pushing for biodegradable and low-toxicity formulations. Product substitutes, while present, often lack the tailored performance characteristics required for specific oilfield applications, reinforcing the demand for specialized chemicals. End-user trends are shifting towards solutions that optimize production efficiency, reduce operational costs, and minimize environmental impact, directly influencing R&D priorities. Mergers and acquisitions (M&A) activity, while not always publicly disclosed with specific values in LATAM, are strategic moves by larger companies to acquire specialized technologies, expand market reach, or consolidate their position. For example, acquisitions of smaller, innovative chemical service providers by global giants are common to integrate cutting-edge solutions. The market is poised for further evolution as demand for sustainable and advanced chemical treatments intensifies.

LATAM Oilfield Chemicals Industry Industry Trends & Insights

The LATAM Oilfield Chemicals Industry is experiencing robust growth, driven by several intertwined trends. A primary growth driver is the sustained demand for crude oil and natural gas in the region, necessitating efficient exploration, production, and processing operations. This directly fuels the demand for a wide array of oilfield chemicals crucial for maintaining asset integrity and maximizing hydrocarbon recovery. Technological disruptions are significantly reshaping the industry, with a notable rise in the adoption of digital solutions for chemical management, real-time monitoring of chemical performance, and predictive maintenance. This enables operators to optimize chemical dosages, reduce waste, and enhance overall operational efficiency. Consumer preferences are increasingly leaning towards sustainable and eco-friendly chemical solutions. Companies are responding by developing "green" chemicals with lower toxicity profiles, improved biodegradability, and reduced environmental footprints. This shift is not only driven by regulatory pressures but also by growing corporate social responsibility initiatives and investor demand for sustainable practices. The competitive dynamics within the LATAM market are characterized by intense rivalry among global and regional players. Companies are vying for market share through product innovation, strategic partnerships, and competitive pricing. The CAGR for the LATAM Oilfield Chemicals Industry is projected to be in the range of 4.5% to 5.5% over the forecast period, reflecting its strong growth potential. Market penetration of advanced chemical solutions, particularly in EOR and well stimulation applications, is expected to increase as operators seek to maximize output from mature fields and explore challenging reservoirs. The increasing focus on operational efficiency and cost reduction further solidifies the importance of effective oilfield chemical treatments. The industry's ability to adapt to these evolving trends will be crucial for sustained success.

Dominant Markets & Segments in LATAM Oilfield Chemicals Industry

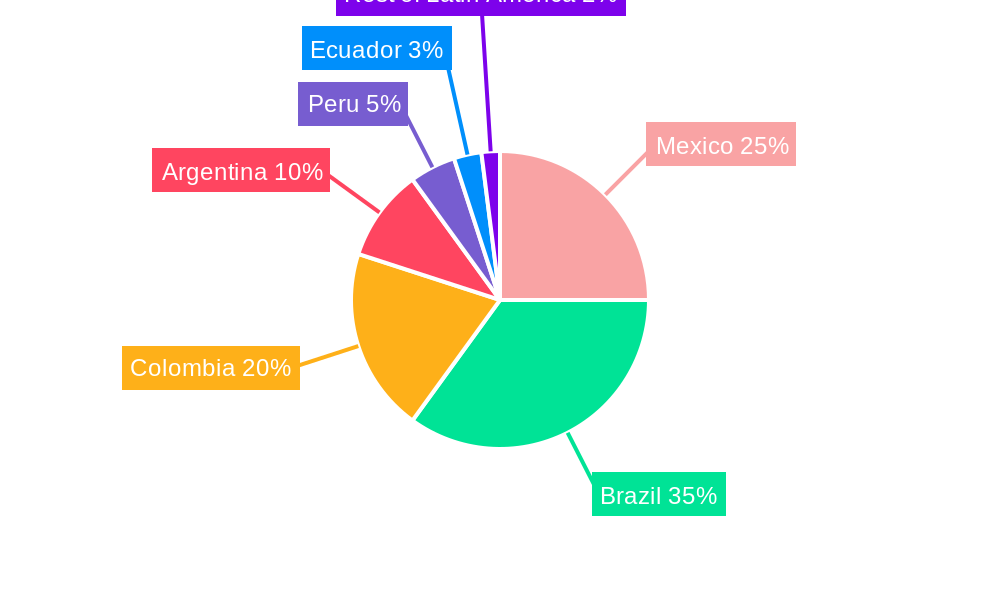

The LATAM Oilfield Chemicals Industry is characterized by distinct regional dominance and segment-specific growth. Brazil stands out as a dominant market within Latin America, owing to its significant offshore oil reserves and extensive deepwater exploration activities, particularly in the pre-salt fields. This drives substantial demand for a wide spectrum of specialized chemicals. Economically, Brazil's status as a major oil producer and exporter underpins its leading position. Infrastructure development, including port facilities and chemical supply chains, further supports its market leadership.

Within the Chemical Type segmentation, Polymers represent a dominant segment, primarily due to their critical role in Enhanced Oil Recovery (EOR) techniques, which are increasingly employed to boost production from mature fields in LATAM. The demand for advanced polymers that improve sweep efficiency and reduce water cut is substantial. Surfactants are also a significant segment, vital for demulsification and improving oil recovery in various production scenarios.

In terms of Application, Production emerges as the largest and most dominant application segment. This encompasses a broad range of chemical needs throughout the operational lifecycle, from flow assurance and asset integrity to optimizing hydrocarbon recovery. Enhanced Oil Recovery (EOR) is another rapidly growing application, directly correlating with the increased focus on maximizing output from existing reservoirs. The economic imperative to extract more oil from these fields makes EOR chemical solutions indispensable.

Key Drivers for Brazil's Dominance:

- Vast offshore oil reserves, particularly pre-salt.

- Government policies supporting oil and gas exploration and production.

- Significant investments in upstream infrastructure.

- Presence of major national and international oil companies.

Dominance of Polymers in Chemical Type:

- Crucial for Enhanced Oil Recovery (EOR) methods.

- Development of high-performance polymers for improved sweep efficiency.

- Increasing application in water management and drilling fluids.

Dominance of Production in Application:

- Essential for flow assurance and operational integrity.

- Wide range of chemicals required for daily production activities.

- Directly tied to the overall health and output of oilfields.

The interplay between these dominant segments and regions highlights the critical role of tailored chemical solutions in driving the LATAM oil and gas sector forward.

LATAM Oilfield Chemicals Industry Product Developments

Product development in the LATAM Oilfield Chemicals Industry is sharply focused on enhancing operational efficiency, environmental sustainability, and cost-effectiveness. Companies are innovating in areas such as low-salinity EOR polymers that improve oil recovery with reduced chemical usage and environmental impact. Advancements in intelligent corrosion inhibitors, which dynamically adapt to changing well conditions, are crucial for extending the lifespan of infrastructure and preventing costly downtime. Furthermore, the development of advanced demulsifiers capable of efficiently separating oil and water even in challenging emulsion types is a key area of innovation. These product developments are driven by the need to meet stringent environmental regulations and the ongoing pursuit of optimizing hydrocarbon extraction from complex reservoirs. The competitive advantage lies in offering solutions that provide superior performance, lower toxicity, and greater operational flexibility.

Report Scope & Segmentation Analysis

This report meticulously analyzes the LATAM Oilfield Chemicals Industry across various segmentation dimensions. The Chemical Type segmentation includes Biocides, crucial for preventing microbial contamination and reservoir souring; Corrosion and Scale Inhibitors, vital for asset integrity and preventing flow assurance issues; Demulsifiers, essential for separating oil and water during production; Polymers, key for Enhanced Oil Recovery and drilling fluid optimization; and Surfactants, used in a variety of applications including EOR and well stimulation. The Application segmentation covers Drilling and Cementing, for well construction and integrity; Enhanced Oil Recovery (EOR), aimed at maximizing production from mature fields; Production, encompassing all chemicals used during the extraction phase; Well Stimulation, to improve reservoir flow; and Workover and Completion, for well maintenance and repair. Each segment is analyzed with projected market sizes and growth rates, considering the competitive landscape and technological advancements within each specific area.

Key Drivers of LATAM Oilfield Chemicals Industry Growth

The growth of the LATAM Oilfield Chemicals Industry is propelled by several fundamental factors. Firstly, the region's substantial hydrocarbon reserves and ongoing exploration and production activities, particularly in offshore and unconventional plays, create a continuous demand for chemical solutions. Secondly, the increasing emphasis on maximizing recovery from mature fields through techniques like Enhanced Oil Recovery (EOR) directly fuels the need for specialized polymers and surfactants. Thirdly, evolving regulatory landscapes, pushing for more environmentally friendly and sustainable chemical practices, are driving innovation in the development of "green" chemicals and biodegradable formulations. Technological advancements in chemical formulation and application technologies, such as smart chemicals and real-time monitoring, also contribute significantly by enhancing efficiency and reducing operational costs.

Challenges in the LATAM Oilfield Chemicals Industry Sector

Despite robust growth, the LATAM Oilfield Chemicals Industry faces several significant challenges. Regulatory hurdles and varying environmental standards across different countries can complicate market entry and product standardization. Supply chain disruptions, exacerbated by logistical complexities in remote operational areas and global events, can lead to increased costs and delayed project timelines. Intense price competition from both global and local players can squeeze profit margins, particularly for commoditized chemical products. Furthermore, the declining availability of easily accessible oil reserves necessitates the exploration and production of more challenging, unconventional resources, which often require highly specialized and expensive chemical treatments. The economic and political volatility in some LATAM countries can also impact investment decisions and overall market stability, posing a significant restraint on growth.

Emerging Opportunities in LATAM Oilfield Chemicals Industry

The LATAM Oilfield Chemicals Industry is ripe with emerging opportunities. The increasing focus on decarbonization and sustainable energy practices presents an opportunity for companies to develop and market chemicals that reduce the environmental footprint of oil and gas operations, such as low-toxicity drilling fluids and CO2 capture chemicals. The growing adoption of digital technologies and the Industrial Internet of Things (IIoT) in the oilfield creates a demand for intelligent chemical solutions that can be monitored and optimized remotely, leading to greater efficiency and cost savings. Furthermore, the exploration of frontier basins and unconventional resources in regions like Argentina's Vaca Muerta shale formation offers substantial potential for novel chemical applications. The demand for specialized chemicals for water management and produced water treatment is also a growing area, driven by increasing water scarcity and stricter environmental regulations.

Leading Players in the LATAM Oilfield Chemicals Industry Market

- Solvay S A

- Ashland Inc

- Exxon Mobil Corporation

- Croda International PLC

- Dow Inc

- Weatherford International Plc

- BASF SE

- Huntsman International LLC

- Baker Hughes Company

- Halliburton

- Ecolab Inc

- Petrolab Industrial E Comercial Ltda

- Schlumberger Limited

- Clariant AG

Key Developments in LATAM Oilfield Chemicals Industry Industry

- August 2022: Baker Hughes expanded its presence in Asia by establishing a new oilfield services chemicals manufacturing facility in Singapore, allowing for manufacturing optimization and faster delivery of fit-for-purpose chemical solutions. The 40,000-square-meter facility will manufacture, store, and distribute chemical solutions for the upstream, midstream, downstream, and adjacent industries.

- March 2022: Halliburton opened The Halliburton Chemical Reaction Plant, the first of its kind in Saudi Arabia, producing a wide range of specialty oilfield chemicals for the entire oil and gas value chain. The facility expands Halliburton's manufacturing footprint in the Eastern Hemisphere and strengthens the company's ability to serve Middle Eastern customers' chemical needs.

Strategic Outlook for LATAM Oilfield Chemicals Industry Market

The strategic outlook for the LATAM Oilfield Chemicals Industry is one of cautious optimism and significant growth potential. The increasing demand for energy, coupled with the region's vast hydrocarbon resources, will continue to drive the need for sophisticated chemical solutions. Key growth catalysts include the sustained investment in offshore exploration and production, the implementation of advanced Enhanced Oil Recovery techniques, and the ongoing development of unconventional resources. Companies that focus on innovation, particularly in the realm of sustainable and environmentally responsible chemical technologies, will be well-positioned for success. Strategic partnerships and acquisitions will remain crucial for expanding market reach and technological capabilities. The industry's ability to adapt to evolving regulatory environments and embrace digital transformation will be paramount in shaping its future trajectory and capitalizing on emerging opportunities.

LATAM Oilfield Chemicals Industry Segmentation

-

1. Chemical Type

- 1.1. Biocide

- 1.2. Corrosion and Scale Inhibitor

- 1.3. Demulsifier

- 1.4. Polymer

- 1.5. Surfactant

- 1.6. Other Chemical Types

-

2. Application

- 2.1. Drilling and Cementing

- 2.2. Enhanced Oil Recovery

- 2.3. Production

- 2.4. Well Stimulation

- 2.5. Workover and Completion

LATAM Oilfield Chemicals Industry Segmentation By Geography

- 1. Mexico

- 2. Brazil

- 3. Colombia

- 4. Argentina

- 5. Peru

- 6. Ecuador

- 7. Rest of Latin America

LATAM Oilfield Chemicals Industry Regional Market Share

Geographic Coverage of LATAM Oilfield Chemicals Industry

LATAM Oilfield Chemicals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Offshore activities in Brazil

- 3.2.2 Mexico & Argentina

- 3.3. Market Restrains

- 3.3.1. Downfall of Venezuela Economy

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Drilling and Cementing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. LATAM Oilfield Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 5.1.1. Biocide

- 5.1.2. Corrosion and Scale Inhibitor

- 5.1.3. Demulsifier

- 5.1.4. Polymer

- 5.1.5. Surfactant

- 5.1.6. Other Chemical Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Drilling and Cementing

- 5.2.2. Enhanced Oil Recovery

- 5.2.3. Production

- 5.2.4. Well Stimulation

- 5.2.5. Workover and Completion

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.3.2. Brazil

- 5.3.3. Colombia

- 5.3.4. Argentina

- 5.3.5. Peru

- 5.3.6. Ecuador

- 5.3.7. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6. Mexico LATAM Oilfield Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6.1.1. Biocide

- 6.1.2. Corrosion and Scale Inhibitor

- 6.1.3. Demulsifier

- 6.1.4. Polymer

- 6.1.5. Surfactant

- 6.1.6. Other Chemical Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Drilling and Cementing

- 6.2.2. Enhanced Oil Recovery

- 6.2.3. Production

- 6.2.4. Well Stimulation

- 6.2.5. Workover and Completion

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7. Brazil LATAM Oilfield Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7.1.1. Biocide

- 7.1.2. Corrosion and Scale Inhibitor

- 7.1.3. Demulsifier

- 7.1.4. Polymer

- 7.1.5. Surfactant

- 7.1.6. Other Chemical Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Drilling and Cementing

- 7.2.2. Enhanced Oil Recovery

- 7.2.3. Production

- 7.2.4. Well Stimulation

- 7.2.5. Workover and Completion

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8. Colombia LATAM Oilfield Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8.1.1. Biocide

- 8.1.2. Corrosion and Scale Inhibitor

- 8.1.3. Demulsifier

- 8.1.4. Polymer

- 8.1.5. Surfactant

- 8.1.6. Other Chemical Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Drilling and Cementing

- 8.2.2. Enhanced Oil Recovery

- 8.2.3. Production

- 8.2.4. Well Stimulation

- 8.2.5. Workover and Completion

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9. Argentina LATAM Oilfield Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9.1.1. Biocide

- 9.1.2. Corrosion and Scale Inhibitor

- 9.1.3. Demulsifier

- 9.1.4. Polymer

- 9.1.5. Surfactant

- 9.1.6. Other Chemical Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Drilling and Cementing

- 9.2.2. Enhanced Oil Recovery

- 9.2.3. Production

- 9.2.4. Well Stimulation

- 9.2.5. Workover and Completion

- 9.1. Market Analysis, Insights and Forecast - by Chemical Type

- 10. Peru LATAM Oilfield Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Chemical Type

- 10.1.1. Biocide

- 10.1.2. Corrosion and Scale Inhibitor

- 10.1.3. Demulsifier

- 10.1.4. Polymer

- 10.1.5. Surfactant

- 10.1.6. Other Chemical Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Drilling and Cementing

- 10.2.2. Enhanced Oil Recovery

- 10.2.3. Production

- 10.2.4. Well Stimulation

- 10.2.5. Workover and Completion

- 10.1. Market Analysis, Insights and Forecast - by Chemical Type

- 11. Ecuador LATAM Oilfield Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Chemical Type

- 11.1.1. Biocide

- 11.1.2. Corrosion and Scale Inhibitor

- 11.1.3. Demulsifier

- 11.1.4. Polymer

- 11.1.5. Surfactant

- 11.1.6. Other Chemical Types

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Drilling and Cementing

- 11.2.2. Enhanced Oil Recovery

- 11.2.3. Production

- 11.2.4. Well Stimulation

- 11.2.5. Workover and Completion

- 11.1. Market Analysis, Insights and Forecast - by Chemical Type

- 12. Rest of Latin America LATAM Oilfield Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Chemical Type

- 12.1.1. Biocide

- 12.1.2. Corrosion and Scale Inhibitor

- 12.1.3. Demulsifier

- 12.1.4. Polymer

- 12.1.5. Surfactant

- 12.1.6. Other Chemical Types

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Drilling and Cementing

- 12.2.2. Enhanced Oil Recovery

- 12.2.3. Production

- 12.2.4. Well Stimulation

- 12.2.5. Workover and Completion

- 12.1. Market Analysis, Insights and Forecast - by Chemical Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Solvay S A

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Ashland Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Exxon Mobil Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Croda International PLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Dow Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Weatherford International Plc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 BASF SE

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Huntsman International LLC

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Baker Hughes Company

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Halliburton

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Ecolab Inc

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Petrolab Industrial E Comercial Ltda

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Schlumberger Limited

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Clariant AG

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.1 Solvay S A

List of Figures

- Figure 1: LATAM Oilfield Chemicals Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: LATAM Oilfield Chemicals Industry Share (%) by Company 2025

List of Tables

- Table 1: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Chemical Type 2020 & 2033

- Table 2: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Chemical Type 2020 & 2033

- Table 3: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Application 2020 & 2033

- Table 4: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Region 2020 & 2033

- Table 6: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Chemical Type 2020 & 2033

- Table 8: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Chemical Type 2020 & 2033

- Table 9: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Application 2020 & 2033

- Table 10: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Country 2020 & 2033

- Table 12: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Chemical Type 2020 & 2033

- Table 14: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Chemical Type 2020 & 2033

- Table 15: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Application 2020 & 2033

- Table 16: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 17: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Country 2020 & 2033

- Table 18: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 19: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Chemical Type 2020 & 2033

- Table 20: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Chemical Type 2020 & 2033

- Table 21: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Application 2020 & 2033

- Table 22: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 23: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Country 2020 & 2033

- Table 24: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Chemical Type 2020 & 2033

- Table 26: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Chemical Type 2020 & 2033

- Table 27: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Application 2020 & 2033

- Table 28: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 29: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Country 2020 & 2033

- Table 30: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 31: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Chemical Type 2020 & 2033

- Table 32: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Chemical Type 2020 & 2033

- Table 33: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Application 2020 & 2033

- Table 34: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 35: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Country 2020 & 2033

- Table 36: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 37: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Chemical Type 2020 & 2033

- Table 38: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Chemical Type 2020 & 2033

- Table 39: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Application 2020 & 2033

- Table 40: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 41: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Country 2020 & 2033

- Table 42: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 43: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Chemical Type 2020 & 2033

- Table 44: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Chemical Type 2020 & 2033

- Table 45: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Application 2020 & 2033

- Table 46: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 47: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Country 2020 & 2033

- Table 48: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LATAM Oilfield Chemicals Industry?

The projected CAGR is approximately 2.8%.

2. Which companies are prominent players in the LATAM Oilfield Chemicals Industry?

Key companies in the market include Solvay S A, Ashland Inc, Exxon Mobil Corporation, Croda International PLC, Dow Inc, Weatherford International Plc, BASF SE, Huntsman International LLC, Baker Hughes Company, Halliburton, Ecolab Inc, Petrolab Industrial E Comercial Ltda, Schlumberger Limited, Clariant AG.

3. What are the main segments of the LATAM Oilfield Chemicals Industry?

The market segments include Chemical Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2758.4 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Offshore activities in Brazil. Mexico & Argentina.

6. What are the notable trends driving market growth?

Increasing Demand from the Drilling and Cementing Segment.

7. Are there any restraints impacting market growth?

Downfall of Venezuela Economy.

8. Can you provide examples of recent developments in the market?

August 2022: Baker Hughes expanded its presence in Asia by establishing a new oilfield services chemicals manufacturing facility in Singapore, allowing for manufacturing optimization and faster delivery of fit-for-purpose chemical solutions. The 40,000-square-meter facility will manufacture, store, and distribute chemical solutions for the upstream, midstream, downstream, and adjacent industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LATAM Oilfield Chemicals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LATAM Oilfield Chemicals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LATAM Oilfield Chemicals Industry?

To stay informed about further developments, trends, and reports in the LATAM Oilfield Chemicals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence