Key Insights

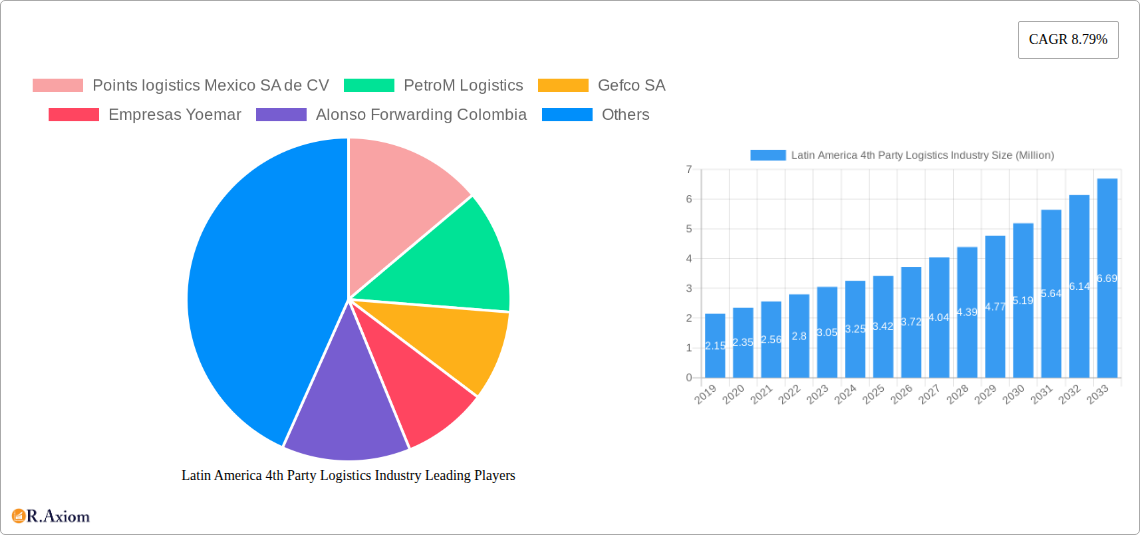

The Latin America 4th Party Logistics (4PL) market is poised for robust expansion, projected to reach a substantial USD 3.42 million by 2025 and grow at a Compound Annual Growth Rate (CAGR) of 8.79%. This dynamic growth is propelled by an increasing demand for integrated supply chain solutions across key industries, including Fast-Moving Consumer Goods (FMCG), Retail, Fashion and Lifestyle, and Technology. Businesses are increasingly recognizing the strategic advantage of outsourcing their entire logistics management to 4PL providers, who offer end-to-end visibility, optimization, and control over their supply chains. The shift towards digital platforms and advanced technologies is a significant driver, enabling greater efficiency, transparency, and responsiveness in logistics operations. Furthermore, the growing complexity of global supply chains and the need for greater agility in responding to market fluctuations are compelling companies to adopt 4PL models for streamlined operations and cost-effectiveness. The adoption of the Lead Logistics Provider (LLP) and Solution Integrator Model are expected to dominate market segments, reflecting the industry's move towards more sophisticated and collaborative logistics partnerships.

Latin America 4th Party Logistics Industry Market Size (In Million)

The market's trajectory is further bolstered by the increasing adoption of advanced technologies such as AI, IoT, and blockchain, which are transforming how logistics are managed and executed. These innovations are instrumental in enhancing predictive analytics, real-time tracking, and inventory management, thereby minimizing operational inefficiencies and improving customer satisfaction. While the market is characterized by strong growth potential, certain factors may present challenges. These include the initial investment costs associated with implementing sophisticated 4PL solutions, the need for skilled talent to manage complex integrated systems, and the inherent complexities in managing diverse supply chain networks across different regions and industries. However, the significant benefits of improved supply chain visibility, reduced operational costs, and enhanced strategic decision-making are expected to outweigh these restraints, driving sustained adoption of 4PL services across Latin America. Leading companies like Kuehne + Nagel, Deutsche Post DHL, and Points Logistics Mexico are actively shaping the market landscape through strategic investments and innovative service offerings, catering to the evolving needs of end-users like FMCG, Retail, and Technology sectors.

Latin America 4th Party Logistics Industry Company Market Share

This comprehensive report provides an in-depth analysis of the Latin America 4th Party Logistics (4PL) industry, covering the period from 2019 to 2033. With the base year set at 2025, the report offers detailed insights into market trends, growth drivers, dominant segments, competitive landscapes, and future opportunities. Leveraging high-traffic keywords such as "Latin America 4PL," "4th Party Logistics Mexico," "Logistics Solutions Colombia," "Supply Chain Management Latin America," and "Digital Logistics LATAM," this report is designed to enhance search visibility and engage key industry stakeholders, including logistics providers, end-users, investors, and policymakers. The analysis includes market size estimations, CAGR projections, and a detailed examination of key players and their strategic initiatives.

Latin America 4th Party Logistics Industry Market Concentration & Innovation

The Latin America 4th Party Logistics industry is characterized by a dynamic and evolving market concentration, influenced by a growing number of specialized providers and an increasing demand for integrated supply chain solutions. Innovation drivers include the pervasive adoption of digital technologies, the need for enhanced supply chain visibility, and the pursuit of operational efficiency. Regulatory frameworks across Latin American nations, while varied, are increasingly conducive to the growth of 4PL services, focusing on trade facilitation and logistics infrastructure development. Product substitutes, such as traditional 3PL models and in-house logistics management, are gradually being superseded by the comprehensive, technology-driven approach offered by 4PL providers. End-user trends highlight a strong preference for flexible, scalable, and data-driven logistics solutions across sectors like FMCG, Retail, Fashion, and Technology. Mergers & Acquisitions (M&A) activities are on the rise, indicating a trend towards consolidation and strategic partnerships. For instance, recent M&A deal values in the LATAM logistics sector are estimated to be in the range of $50 Million to $200 Million, reflecting a burgeoning investor interest. Key companies are actively engaging in strategic acquisitions to expand their service offerings and geographical reach.

Latin America 4th Party Logistics Industry Industry Trends & Insights

The Latin America 4th Party Logistics industry is poised for significant growth, driven by a confluence of factors including expanding e-commerce penetration, increasing demand for optimized supply chains, and the ongoing digital transformation across the region. The projected Compound Annual Growth Rate (CAGR) for the 4PL market in Latin America is an impressive 12% for the forecast period of 2025–2033. Market penetration is rapidly increasing as businesses recognize the strategic advantages of outsourcing their entire logistics management to specialized 4PL providers. Technological disruptions are at the forefront, with the integration of Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), and blockchain technology revolutionizing supply chain visibility, predictive analytics, and last-mile delivery optimization. Consumer preferences are shifting towards faster delivery times, greater transparency, and more personalized logistics services, compelling 4PL providers to innovate and adapt their offerings. Competitive dynamics are intensifying, with established global players and agile regional specialists vying for market share. The growing complexity of global supply chains, coupled with unique regional challenges such as infrastructure development and regulatory variations, further amplifies the need for sophisticated 4PL solutions. The market size for Latin America 4PL services is estimated to reach $35 Billion by 2025, with substantial growth anticipated in the coming years.

Dominant Markets & Segments in Latin America 4th Party Logistics Industry

The Latin America 4th Party Logistics industry exhibits distinct dominance across various regions and segments, driven by economic policies, infrastructure development, and evolving end-user demands. Brazil and Mexico currently represent the largest markets for 4PL services, owing to their substantial economies, robust manufacturing sectors, and significant e-commerce growth.

Operating Models:

- Lead Logistics Provider (LLP): This model is highly prevalent, with companies seeking single-point-of-contact solutions for managing their entire supply chain. The market size for LLP services in Latin America is projected to exceed $15 Billion by 2025.

- Key Drivers: Reduced operational complexity, cost savings through optimized resource allocation, and improved supply chain efficiency.

- Solution Integrator Model: This model focuses on designing and implementing bespoke logistics solutions tailored to specific client needs.

- Key Drivers: Increasing demand for customized supply chain strategies to address unique business challenges and capitalize on market opportunities.

- Digital Platform Solutions Provider (4PL): The adoption of technology-driven platforms is rapidly gaining traction, offering enhanced visibility, data analytics, and automation.

- Key Drivers: The growing imperative for real-time tracking, predictive capabilities, and seamless integration of various logistics functions.

End-Users:

- FMCG (Fast-Moving Consumer Goods) and Retail: These sectors are major adopters of 4PL services due to their high-volume, time-sensitive product flows and extensive distribution networks. The combined market size for FMCG and Retail 4PL solutions is estimated at $10 Billion in 2025.

- Key Drivers: Need for efficient inventory management, just-in-time delivery, and effective handling of promotional demands.

- Fashion and Lifestyle (Apparel, Footwear): This segment benefits from 4PL solutions that manage complex inventory, seasonal demands, and intricate return logistics.

- Key Drivers: Agile supply chain responsiveness to fashion trends, efficient cross-border movements, and robust reverse logistics.

- Reefer: The demand for temperature-controlled logistics is growing, particularly for perishable goods and pharmaceuticals, making 4PL providers crucial.

- Key Drivers: Stringent regulatory requirements for cold chain integrity, risk mitigation for sensitive cargo, and specialized handling expertise.

- Technology (Consumer Electronics, Home Appliances): This sector relies on 4PL for managing complex product lifecycles, high-value inventory, and efficient last-mile delivery.

- Key Drivers: Need for secure warehousing, timely product launches, and managing the increasing volume of returns.

- Other End-Users: Includes industries like automotive, industrial goods, and healthcare, all seeking integrated logistics management.

Latin America 4th Party Logistics Industry Product Developments

Product developments in the Latin America 4th Party Logistics industry are heavily focused on leveraging advanced technologies to enhance supply chain performance. Innovations include the development of AI-powered route optimization software, IoT-enabled real-time tracking and condition monitoring systems for sensitive cargo, and blockchain solutions for increased transparency and security in transactions. Predictive analytics platforms are gaining prominence, enabling proactive identification of potential disruptions and optimized inventory management. The competitive advantage stems from these technological advancements, offering clients unparalleled visibility, reduced lead times, minimized waste, and improved overall operational resilience. The market fit is demonstrated by the increasing demand for integrated digital platforms that streamline complex logistics operations, offering a competitive edge in dynamic market environments.

Report Scope & Segmentation Analysis

The scope of this report encompasses the comprehensive landscape of the Latin America 4th Party Logistics industry. The market is segmented by Operating Model and End-User, providing granular insights into each sub-sector.

- Operating Models: This includes the Lead Logistics Provider (LLP), Solution Integrator Model, and Digital Platform Solutions Provider (4PL) segments. Growth projections for the Digital Platform Solutions Provider segment are particularly robust, with an estimated CAGR of 15% from 2025–2033, reflecting the increasing digitalization of supply chains. The market size for the LLP model is substantial, projected at $16 Billion by 2025, driven by its comprehensive service offering.

- End-Users: Key end-user segments analyzed include FMCG (Fast-Moving Consumer Goods), Retail, Fashion and Lifestyle (Apparel, Footwear), Reefer (Temperature-Controlled Logistics), Technology (Consumer Electronics, Home Appliances), and Other End-Users. The FMCG and Retail segments are expected to continue leading in terms of market share, with a projected market size of $11 Billion in 2025, due to their consistent high demand for efficient logistics. The Reefer segment is projected for strong growth due to increasing trade in perishables and pharmaceuticals, with an estimated CAGR of 13%. Competitive dynamics within each segment are shaped by the specific needs and service expectations of the respective industries.

Key Drivers of Latin America 4th Party Logistics Industry Growth

The growth of the Latin America 4th Party Logistics industry is propelled by several key drivers. Technologically, the widespread adoption of digitalization, including AI, IoT, and blockchain, is enhancing supply chain efficiency and visibility. Economically, the burgeoning e-commerce market and increasing cross-border trade are creating a significant demand for sophisticated logistics management. Regulatory factors, such as government initiatives to improve trade infrastructure and streamline customs procedures, are also playing a crucial role. For example, initiatives promoting trade facilitation in countries like Chile and Peru are directly contributing to the expansion of 4PL services. The increasing complexity of global supply chains further necessitates the expertise and integrated solutions offered by 4PL providers to navigate these challenges effectively.

Challenges in the Latin America 4th Party Logistics Industry Sector

Despite robust growth prospects, the Latin America 4th Party Logistics industry faces several challenges. Regulatory hurdles and varying legal frameworks across different countries can create complexities for cross-border operations. Infrastructure limitations, particularly in certain regions, can impact transit times and delivery reliability. Intense competition from both established global players and emerging local providers can put pressure on pricing and margins. Furthermore, the scarcity of skilled logistics talent and the need for continuous investment in technology to stay competitive pose significant challenges. Supply chain disruptions, whether due to geopolitical events, natural disasters, or labor disputes, require agile and resilient strategies from 4PL providers, demanding substantial contingency planning and risk management capabilities. The estimated impact of these challenges can lead to increased operational costs by up to 8% and slower adoption rates in certain niche markets.

Emerging Opportunities in Latin America 4th Party Logistics Industry

Emerging opportunities in the Latin America 4th Party Logistics industry are abundant, driven by evolving market dynamics and technological advancements. The increasing demand for sustainable logistics solutions presents a significant opportunity for 4PL providers to implement eco-friendly transportation and warehousing practices. The growth of specialized e-commerce niches, such as the "gig economy" logistics and direct-to-consumer (DTC) models, requires tailored 4PL solutions. Furthermore, the expansion of nearshoring and reshoring trends in the region creates new logistical demands that 4PL providers can effectively address. The ongoing digital transformation offers opportunities to develop and deploy advanced analytics and AI-driven platforms for predictive supply chain management, optimizing inventory and reducing waste. The growing middle class and increasing disposable income across Latin America also fuel demand for a wider range of goods, necessitating more efficient and responsive logistics networks.

Leading Players in the Latin America 4th Party Logistics Industry Market

- Points Logistics Mexico SA de CV

- PetroM Logistics

- Gefco SA

- Empresas Yoemar

- Alonso Forwarding Colombia

- Logifashion

- Kuehne + Nagel

- Compass

- Belog Integrated Logistics Solutions

- Deutsche Post DHL

- XP Logistica

- EFL Global

- New Transport Applications (NTA)

(List Not Exhaustive)

Key Developments in Latin America 4th Party Logistics Industry Industry

- October 2022: EFL Global significantly expanded its footprint in Latin America by opening a new office and facility in San José, Costa Rica. This facility offers comprehensive warehouse services, including temperature-controlled, dangerous goods, and high-value cargo storage, alongside multimodal transportation options and customs processing.

- September 2022: DHL Supply Chain acquired New Transport Applications (NTA), a specialist in pharmaceutical and healthcare logistics with over 20 years of experience in Mexico. NTA serves more than 80 clients, specializing in temperature-controlled storage and transportation, strengthening DHL's position in this high-potential sector.

Strategic Outlook for Latin America 4th Party Logistics Industry Market

The strategic outlook for the Latin America 4th Party Logistics industry is exceptionally positive, driven by ongoing economic growth, rapid digitalization, and evolving consumer expectations. The increasing demand for integrated supply chain solutions, coupled with the imperative for operational efficiency and resilience, positions 4PL providers for substantial growth. Strategic investments in technology, such as AI, IoT, and data analytics, will be crucial for staying competitive and offering value-added services. Partnerships and collaborations will also play a vital role in expanding market reach and enhancing service portfolios. The focus on sustainability and the development of greener logistics solutions will open new avenues for growth. Overall, the future market potential is immense, driven by the continuous need for businesses to optimize their supply chains in an increasingly complex and dynamic global environment.

Latin America 4th Party Logistics Industry Segmentation

-

1. Operating Model

- 1.1. Lead Logistics Provider (LLP)

- 1.2. Solution Integrator Model

- 1.3. Digital Platform Solutions Provider (4PL)

-

2. End-User

- 2.1. FMCG (Fa

- 2.2. Retail (

- 2.3. Fashion and Lifestyle (Apparel, Footwear)

- 2.4. Reefer (

- 2.5. Technology (Consumer Electronics, Home Appliances)

- 2.6. Other End-Users

Latin America 4th Party Logistics Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America 4th Party Logistics Industry Regional Market Share

Geographic Coverage of Latin America 4th Party Logistics Industry

Latin America 4th Party Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The Rise in Demand for Outsourcing Pharmaceutical Warehousing Services4.; Increasing Need for Pharmaceutical Products

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Efficient Logistics Support4.; Stringent Government Regulations

- 3.4. Market Trends

- 3.4.1. Growth in technology integration driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America 4th Party Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Operating Model

- 5.1.1. Lead Logistics Provider (LLP)

- 5.1.2. Solution Integrator Model

- 5.1.3. Digital Platform Solutions Provider (4PL)

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. FMCG (Fa

- 5.2.2. Retail (

- 5.2.3. Fashion and Lifestyle (Apparel, Footwear)

- 5.2.4. Reefer (

- 5.2.5. Technology (Consumer Electronics, Home Appliances)

- 5.2.6. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Operating Model

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Points logistics Mexico SA de CV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PetroM Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gefco SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Empresas Yoemar

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alonso Forwarding Colombia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Logifashion

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kuehne + Nagel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Compass

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Belog Integrated Logistics Solutions

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Deutsche Post DHL

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 XPLogistica**List Not Exhaustive 6 3 Other Companies (Overview/Key Information

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Points logistics Mexico SA de CV

List of Figures

- Figure 1: Latin America 4th Party Logistics Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America 4th Party Logistics Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America 4th Party Logistics Industry Revenue Million Forecast, by Operating Model 2020 & 2033

- Table 2: Latin America 4th Party Logistics Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Latin America 4th Party Logistics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Latin America 4th Party Logistics Industry Revenue Million Forecast, by Operating Model 2020 & 2033

- Table 5: Latin America 4th Party Logistics Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Latin America 4th Party Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Brazil Latin America 4th Party Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Argentina Latin America 4th Party Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Chile Latin America 4th Party Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Colombia Latin America 4th Party Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Latin America 4th Party Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Peru Latin America 4th Party Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Venezuela Latin America 4th Party Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Ecuador Latin America 4th Party Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Bolivia Latin America 4th Party Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Paraguay Latin America 4th Party Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America 4th Party Logistics Industry?

The projected CAGR is approximately 8.79%.

2. Which companies are prominent players in the Latin America 4th Party Logistics Industry?

Key companies in the market include Points logistics Mexico SA de CV, PetroM Logistics, Gefco SA, Empresas Yoemar, Alonso Forwarding Colombia, Logifashion, Kuehne + Nagel, Compass, Belog Integrated Logistics Solutions, Deutsche Post DHL, XPLogistica**List Not Exhaustive 6 3 Other Companies (Overview/Key Information.

3. What are the main segments of the Latin America 4th Party Logistics Industry?

The market segments include Operating Model, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.42 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; The Rise in Demand for Outsourcing Pharmaceutical Warehousing Services4.; Increasing Need for Pharmaceutical Products.

6. What are the notable trends driving market growth?

Growth in technology integration driving the market.

7. Are there any restraints impacting market growth?

4.; Lack of Efficient Logistics Support4.; Stringent Government Regulations.

8. Can you provide examples of recent developments in the market?

October 2022: EFL Global has increased its footprint in Latin America by opening a brand-new office and facility in Costa Rica's capital, San José. The facility will provide warehouse services, and multimodal transportation options, including ground, air, and ocean freight. Aside from warehouse alternatives with temperature-controlled, dangerous goods, and high-value cargo storage options, this new facility will also offer customs processing services, value-added services, and warehousing capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America 4th Party Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America 4th Party Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America 4th Party Logistics Industry?

To stay informed about further developments, trends, and reports in the Latin America 4th Party Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence