Key Insights

The Latin American biochar market is experiencing robust growth, driven by increasing demand for sustainable agricultural practices and a growing awareness of environmental concerns. The region's substantial agricultural sector, coupled with government initiatives promoting sustainable land management, fuels this expansion. The market's Compound Annual Growth Rate (CAGR) exceeding 6% from 2019 to 2024 indicates a significant upward trajectory, projected to continue through 2033. Key applications include soil amendment in agriculture and animal farming, enhancing soil fertility and carbon sequestration. Pyrolysis and gasification systems dominate the technology segment, leveraging the region's abundant biomass resources. Brazil, Argentina, and Mexico are leading market contributors, reflecting their larger agricultural outputs and established bioenergy sectors. However, challenges remain, including high initial investment costs associated with biochar production facilities and a need for greater awareness among farmers regarding biochar's benefits. Further market penetration hinges on overcoming these hurdles through government subsidies, educational initiatives, and strategic partnerships between technology providers and agricultural stakeholders.

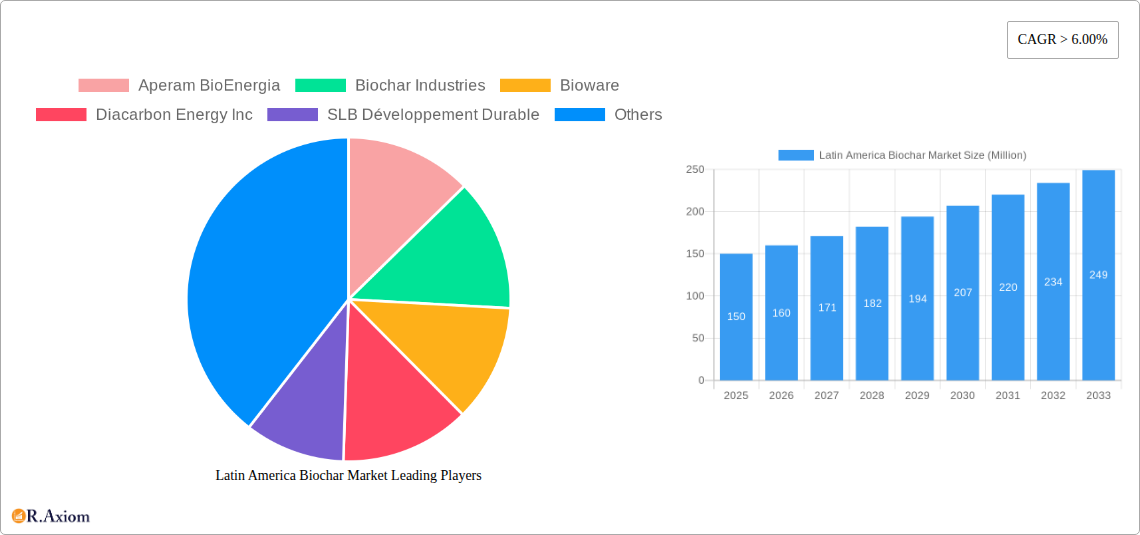

Latin America Biochar Market Market Size (In Million)

The forecast period (2025-2033) anticipates continued expansion driven by increasing awareness of biochar's environmental benefits and its potential to mitigate climate change through carbon sequestration. The diverse applications across agriculture, animal farming, metallurgy, and industrial uses offer multiple avenues for growth. While the "Other Technologies" and "Other Applications" segments hold potential, their expansion will depend on technological advancements and market acceptance. Competition is expected to intensify, with both established players and new entrants vying for market share. Companies will focus on developing cost-effective production methods and tailored solutions to meet the specific needs of different applications and regions. Success will rely on effective marketing strategies, collaborative partnerships, and technological innovation to maximize the market's potential.

Latin America Biochar Market Company Market Share

Latin America Biochar Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Latin America biochar market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's dynamics, growth drivers, challenges, and future potential. The report uses Million for all values.

Latin America Biochar Market Concentration & Innovation

This section analyzes the competitive landscape of the Latin American biochar market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The market is currently characterized by a moderately fragmented structure with several key players vying for market share. Larger companies, such as ArcelorMittal BioFlorestas and Aperam BioEnergia, hold significant shares due to their established production capabilities and distribution networks. However, smaller, more agile companies are driving innovation through the development of advanced biochar production technologies and niche applications.

- Market Share: ArcelorMittal BioFlorestas holds an estimated xx% market share, followed by Aperam BioEnergia with xx%. Smaller players contribute to the remaining xx%.

- M&A Activity: While major M&A activity in the Latin American biochar market remains relatively low, we project approximately xx Million in deal value over the forecast period driven by consolidation amongst smaller players.

- Innovation Drivers: Growing demand for sustainable solutions in agriculture and industrial processes is a significant innovation driver. This is further boosted by government incentives and regulations promoting renewable energy and carbon sequestration.

- Regulatory Frameworks: Varying regulations across Latin American countries influence biochar production and application. Harmonization of standards is expected to foster market growth.

- Product Substitutes: Traditional fertilizers and industrial carbon sources pose competition. However, biochar's environmental benefits and increasing cost-effectiveness are gaining market share.

- End-user Trends: The agriculture sector is a primary end-user, with rising demand driven by enhanced soil health and improved crop yields. Furthermore, industrial applications are gaining traction due to biochar's potential for carbon capture and material enhancement.

Latin America Biochar Market Industry Trends & Insights

The Latin America biochar market exhibits robust growth, driven by factors such as increasing environmental awareness, government support for sustainable practices, and the expanding agricultural and industrial sectors. The market is experiencing significant technological advancements in biochar production, leading to higher efficiency and lower costs. Consumer preferences are shifting towards eco-friendly solutions, further fueling market expansion. Competitive dynamics are influenced by the entry of new players and technological innovation.

- CAGR: The market is projected to register a CAGR of xx% during the forecast period (2025-2033).

- Market Penetration: Biochar penetration in the agriculture sector is estimated at xx% in 2025, projected to reach xx% by 2033.

- Market Growth Drivers: Strong governmental support for sustainable agriculture, increasing awareness of environmental benefits, and rising demand for soil amendment solutions are key growth drivers.

- Technological Disruptions: Advancements in pyrolysis and gasification technologies are significantly reducing production costs and enhancing biochar quality.

Dominant Markets & Segments in Latin America Biochar Market

Brazil is currently the dominant market in Latin America for biochar, driven by large-scale agricultural activities and government initiatives supporting sustainable development. Within the technology segment, pyrolysis holds the largest market share due to its relative cost-effectiveness and established infrastructure. The agricultural application segment dominates, owing to biochar's significant benefits for soil health and crop productivity.

- Leading Region: Brazil

- Dominant Technology: Pyrolysis

- Leading Application: Agriculture

Key Drivers for Brazil's Dominance:

- Large agricultural sector with high demand for soil amendments.

- Government policies promoting sustainable agriculture and renewable energy.

- Established infrastructure for biomass processing.

Segment Analysis:

- Technology: Pyrolysis dominates due to cost-effectiveness and existing infrastructure; Gasification systems are growing, offering higher energy efficiency and syngas production; Other technologies represent a niche market with specialized applications.

- Application: Agriculture holds the largest market share driven by soil improvement and crop yield enhancement; Animal farming is a growing segment due to biochar's odor control and improved livestock health; Metallurgy and industrial applications are emerging, leveraging biochar's unique material properties; Other applications include water treatment and carbon sequestration projects.

Latin America Biochar Market Product Developments

Recent product innovations focus on optimizing biochar production processes to improve quality, reduce costs, and expand application versatility. Companies are developing specialized biochar formulations for specific applications, such as enhanced nutrient delivery in agriculture or improved material properties in industrial uses. This emphasis on tailored solutions is improving market fit and creating competitive advantages.

Report Scope & Segmentation Analysis

This report segments the Latin American biochar market by technology (Pyrolysis, Gasification Systems, Other Technologies) and application (Agriculture, Animal Farming, Metallurgy, Industrial Uses, Other Applications). Each segment’s growth projections, market sizes, and competitive dynamics are analyzed in detail.

Key Drivers of Latin America Biochar Market Growth

The market's growth is driven by several factors: increasing environmental concerns leading to demand for carbon sequestration solutions, the growing agricultural sector needing soil improvement, and government policies supporting sustainable practices. Technological advancements, such as improved pyrolysis systems, also contribute to cost reduction and increased efficiency.

Challenges in the Latin America Biochar Market Sector

Challenges include the high initial investment costs for biochar production facilities, inconsistent quality standards across different producers, and the need for greater awareness among end-users about biochar’s benefits. Furthermore, the development of robust supply chains and efficient distribution networks remains crucial.

Emerging Opportunities in Latin America Biochar Market

Opportunities lie in expanding biochar applications beyond agriculture, such as in industrial materials and water treatment. The development of innovative biochar production technologies and the creation of standardized quality control measures will open new market avenues.

Leading Players in the Latin America Biochar Market Market

- Aperam BioEnergia

- Biochar Industries

- Bioware

- Diacarbon Energy Inc

- SLB Développement Durable

- Genesis Industries

- Full Circle Biochar

- ArcelorMittal BioFlorestas

- PACIFIC Biochar

Key Developments in Latin America Biochar Market Industry

- December 2021: Brazilian miner Vale SA announced its plan to replace mineral coal with biochar in its iron ore pellet factories, initially using 100% biochar in tests. This significant development signals a major shift in the industrial application of biochar.

- April 2021: Verra, under its Verified Carbon Standard (VCS) program, collaborated with FORLIANCE, BiocharWorks, and the South Pole to develop a standardized biochar accounting system, enhancing the market's credibility and potential for carbon credit generation. This strengthens the environmental impact and economic viability of biochar production.

Strategic Outlook for Latin America Biochar Market Market

The Latin America biochar market is poised for significant growth driven by increasing environmental awareness, supportive government policies, and technological advancements. Further expansion into new applications and regions will create substantial opportunities for existing and new market players. Companies investing in research and development, sustainable production practices, and robust supply chains are well-positioned to benefit from this market's dynamic growth trajectory.

Latin America Biochar Market Segmentation

-

1. Technology

- 1.1. Pyrolysis

- 1.2. Gasification Systems

- 1.3. Other Technologies

-

2. Application

- 2.1. Agriculture

- 2.2. Animal Farming

- 2.3. Metallurgy

- 2.4. Industrial Uses

- 2.5. Other Applications

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Mexico

- 3.4. Rest of Latin America

Latin America Biochar Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Mexico

- 4. Rest of Latin America

Latin America Biochar Market Regional Market Share

Geographic Coverage of Latin America Biochar Market

Latin America Biochar Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand from Agriculture Sector; Increasing Applications for Plant Growth and Development

- 3.3. Market Restrains

- 3.3.1. Risk of Contamination and Soil Erosion; High Prices of Biochar and Lack of Awareness

- 3.4. Market Trends

- 3.4.1. Blooming Demand in the Metallurgy Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Biochar Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Pyrolysis

- 5.1.2. Gasification Systems

- 5.1.3. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Agriculture

- 5.2.2. Animal Farming

- 5.2.3. Metallurgy

- 5.2.4. Industrial Uses

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Mexico

- 5.3.4. Rest of Latin America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Mexico

- 5.4.4. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Brazil Latin America Biochar Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Pyrolysis

- 6.1.2. Gasification Systems

- 6.1.3. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Agriculture

- 6.2.2. Animal Farming

- 6.2.3. Metallurgy

- 6.2.4. Industrial Uses

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Mexico

- 6.3.4. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Argentina Latin America Biochar Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Pyrolysis

- 7.1.2. Gasification Systems

- 7.1.3. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Agriculture

- 7.2.2. Animal Farming

- 7.2.3. Metallurgy

- 7.2.4. Industrial Uses

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Mexico

- 7.3.4. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Mexico Latin America Biochar Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Pyrolysis

- 8.1.2. Gasification Systems

- 8.1.3. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Agriculture

- 8.2.2. Animal Farming

- 8.2.3. Metallurgy

- 8.2.4. Industrial Uses

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Mexico

- 8.3.4. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Rest of Latin America Latin America Biochar Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Pyrolysis

- 9.1.2. Gasification Systems

- 9.1.3. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Agriculture

- 9.2.2. Animal Farming

- 9.2.3. Metallurgy

- 9.2.4. Industrial Uses

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Argentina

- 9.3.3. Mexico

- 9.3.4. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Aperam BioEnergia

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Biochar Industries

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Bioware

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Diacarbon Energy Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 SLB Développement Durable

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Genesis Industries

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Full Circle Biochar

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 ArcelorMittal BioFlorestas

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 PACIFIC Biochar

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Aperam BioEnergia

List of Figures

- Figure 1: Latin America Biochar Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Latin America Biochar Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Biochar Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 2: Latin America Biochar Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 3: Latin America Biochar Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Latin America Biochar Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: Latin America Biochar Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: Latin America Biochar Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 7: Latin America Biochar Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Latin America Biochar Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Latin America Biochar Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 10: Latin America Biochar Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 11: Latin America Biochar Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Latin America Biochar Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 13: Latin America Biochar Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 14: Latin America Biochar Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 15: Latin America Biochar Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Latin America Biochar Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: Latin America Biochar Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 18: Latin America Biochar Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 19: Latin America Biochar Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Latin America Biochar Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 21: Latin America Biochar Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 22: Latin America Biochar Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: Latin America Biochar Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Latin America Biochar Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Latin America Biochar Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 26: Latin America Biochar Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 27: Latin America Biochar Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 28: Latin America Biochar Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 29: Latin America Biochar Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: Latin America Biochar Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 31: Latin America Biochar Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Latin America Biochar Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: Latin America Biochar Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 34: Latin America Biochar Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 35: Latin America Biochar Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 36: Latin America Biochar Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 37: Latin America Biochar Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 38: Latin America Biochar Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 39: Latin America Biochar Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: Latin America Biochar Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Biochar Market?

The projected CAGR is approximately 9.74%.

2. Which companies are prominent players in the Latin America Biochar Market?

Key companies in the market include Aperam BioEnergia, Biochar Industries, Bioware, Diacarbon Energy Inc, SLB Développement Durable, Genesis Industries, Full Circle Biochar, ArcelorMittal BioFlorestas, PACIFIC Biochar.

3. What are the main segments of the Latin America Biochar Market?

The market segments include Technology, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Demand from Agriculture Sector; Increasing Applications for Plant Growth and Development.

6. What are the notable trends driving market growth?

Blooming Demand in the Metallurgy Industry.

7. Are there any restraints impacting market growth?

Risk of Contamination and Soil Erosion; High Prices of Biochar and Lack of Awareness.

8. Can you provide examples of recent developments in the market?

December 2021: Brazilian miner Vale SA is replacing mineral coal with biochar created from vegetation. Tests with 100% biochar content are planned for next year. Vale now intends to investigate the feasibility of replacing all of the coal used in its iron ore pellet factories with biochar.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Biochar Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Biochar Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Biochar Market?

To stay informed about further developments, trends, and reports in the Latin America Biochar Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence