Key Insights

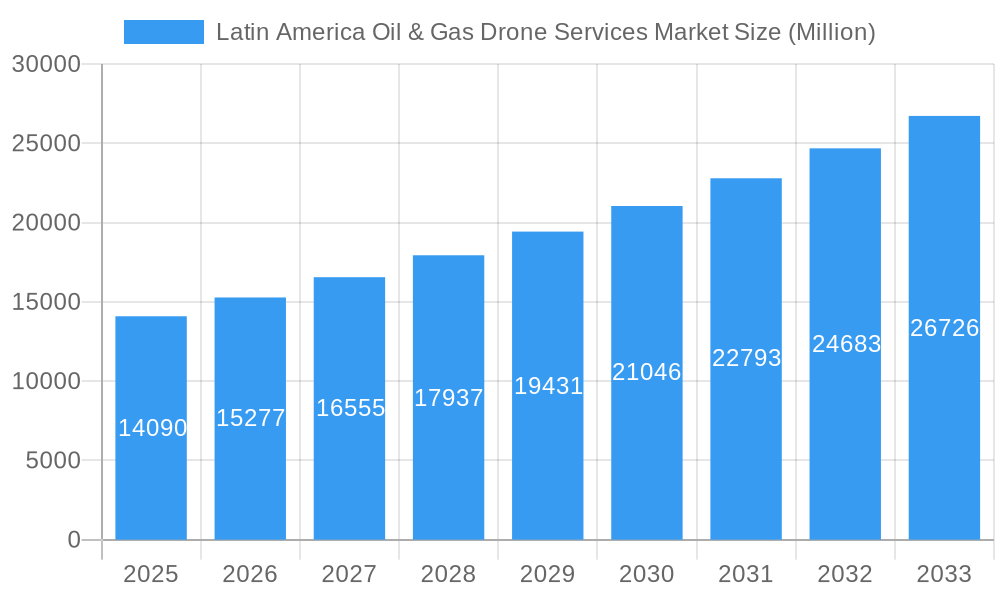

The Latin America Oil & Gas Drone Services Market is poised for substantial expansion, projected to reach USD 14.09 billion in 2025. This growth is propelled by a robust Compound Annual Growth Rate (CAGR) of 8.52% over the forecast period of 2025-2033. The escalating need for enhanced operational efficiency, improved safety protocols, and cost reduction within the oil and gas sector are the primary catalysts for this upward trajectory. Drones offer advanced aerial inspection capabilities for pipelines, refineries, and exploration sites, providing real-time data and reducing the risks associated with traditional manual surveys. The increasing adoption of cutting-edge drone technology, coupled with favorable regulatory frameworks evolving across the region, will further fuel market penetration. Key drivers include the demand for advanced surveying and inspection solutions, the necessity for remote monitoring in challenging terrains, and the drive towards digital transformation in the energy industry.

Latin America Oil & Gas Drone Services Market Market Size (In Billion)

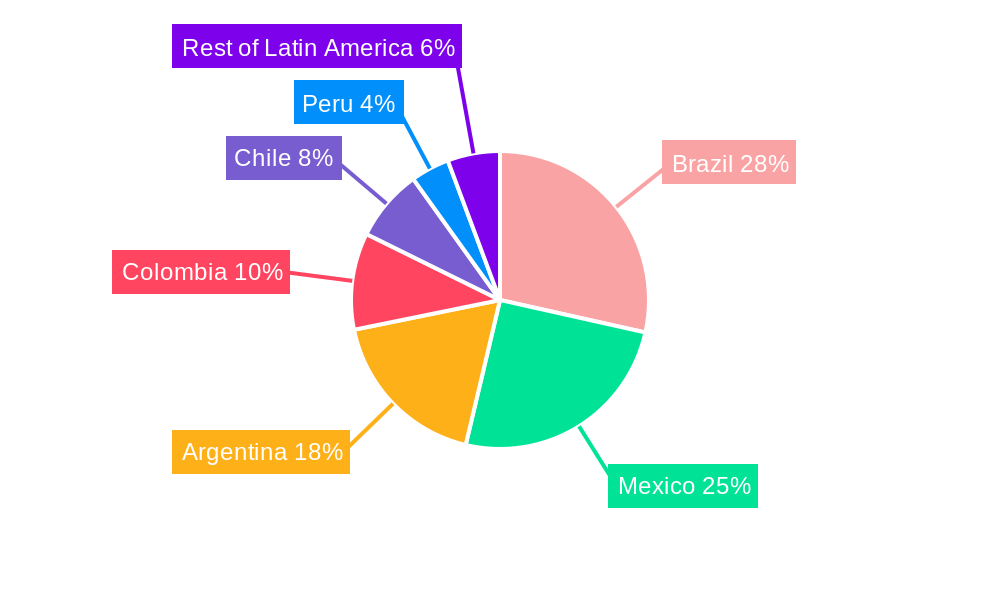

Geographically, the market is experiencing dynamic shifts, with countries like Brazil, Mexico, and Argentina emerging as significant hubs for drone service adoption in the oil and gas industry. These nations are actively investing in modernizing their energy infrastructure, leading to increased demand for specialized drone services. Emerging trends such as the integration of artificial intelligence (AI) and machine learning (ML) with drone data analytics are set to revolutionize how inspections and monitoring are conducted, offering predictive maintenance insights and optimizing resource allocation. While the market exhibits strong growth potential, challenges such as the initial investment costs for drone technology and the need for skilled personnel to operate and maintain these systems, alongside evolving regulatory landscapes, may present moderate restraints. Nevertheless, the overarching benefits in terms of safety, efficiency, and data accuracy position the Latin America Oil & Gas Drone Services Market for sustained and significant growth.

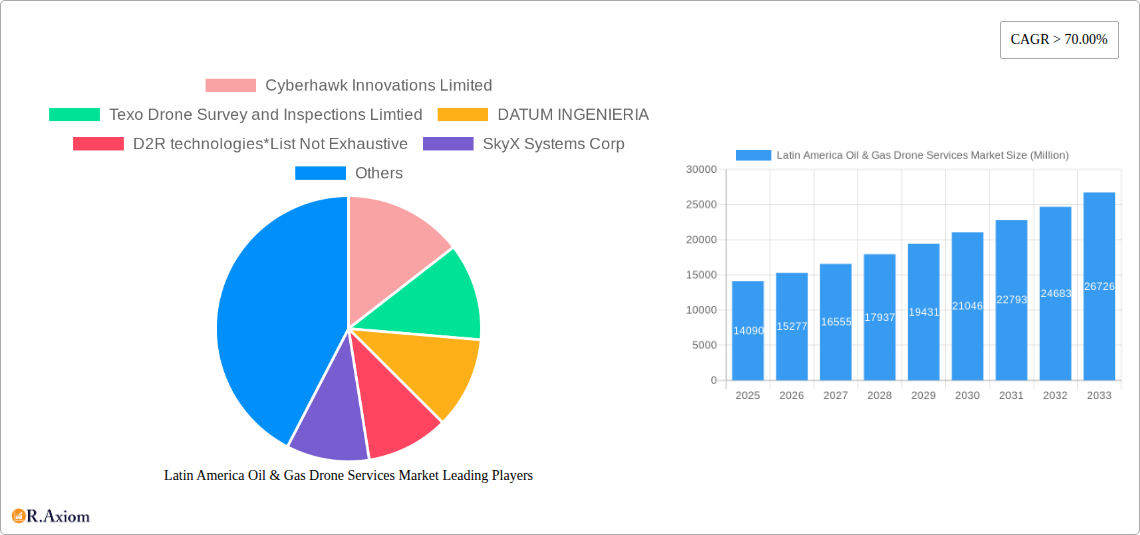

Latin America Oil & Gas Drone Services Market Company Market Share

This in-depth market research report provides a thorough analysis of the Latin America Oil & Gas Drone Services Market, encompassing market size, share, trends, drivers, challenges, and future outlook. Covering the historical period of 2019–2024, base year 2025, and a forecast period from 2025 to 2033, this report equips industry stakeholders with actionable insights for strategic decision-making. The report delves into the intricate dynamics of drone adoption for oil and gas operations across key Latin American regions, highlighting technological advancements, regulatory impacts, and competitive landscapes.

Latin America Oil & Gas Drone Services Market Market Concentration & Innovation

The Latin America Oil & Gas Drone Services Market is characterized by a dynamic concentration, with a mix of established players and emerging innovators driving market evolution. Innovation is primarily fueled by the increasing demand for enhanced safety, operational efficiency, and cost reduction in oil and gas exploration, production, and maintenance. Key innovation drivers include the development of advanced sensor technologies for detailed data capture, improved AI and machine learning algorithms for data analysis, and the integration of drones with other digital technologies like IoT and cloud platforms. Regulatory frameworks are gradually evolving to accommodate the widespread use of drones, though regional variations persist, impacting market entry and operational deployment. Product substitutes, such as traditional manned aviation for inspections and ground-based manual surveys, are being steadily displaced by the cost-effectiveness and superior data quality offered by drone services. End-user trends are heavily influenced by a growing emphasis on predictive maintenance, environmental monitoring, and asset integrity management. Merger and acquisition (M&A) activities are anticipated to play a significant role in consolidating the market, with estimated M&A deal values projected to reach $5.2 billion by 2033, as larger companies seek to acquire specialized drone capabilities and expand their service portfolios. Companies like Cyberhawk Innovations Limited and Texo Drone Survey and Inspections Limited are at the forefront of these innovations.

Latin America Oil & Gas Drone Services Market Industry Trends & Insights

The Latin America Oil & Gas Drone Services Market is poised for robust growth, driven by a confluence of technological advancements, economic imperatives, and increasing regulatory support. The market is projected to expand at a compound annual growth rate (CAGR) of approximately 18.5% during the forecast period, reaching an estimated market size of $7.8 billion by 2033. This significant expansion is underpinned by the oil and gas industry's continuous pursuit of operational efficiencies and enhanced safety protocols. Technological disruptions, such as the miniaturization of high-resolution cameras, LiDAR sensors, and thermal imaging capabilities, are enabling drones to perform increasingly sophisticated tasks, from detailed pipeline inspections and flare stack surveys to the monitoring of offshore platforms and remote well sites. Artificial intelligence (AI) and machine learning are revolutionizing data analysis, allowing for faster and more accurate identification of potential issues, thereby facilitating predictive maintenance and reducing downtime. Consumer preferences are shifting towards comprehensive, integrated drone service solutions that offer end-to-end data management and reporting. The competitive dynamics are intensifying, with both established drone service providers and oil and gas majors investing in in-house drone capabilities. Market penetration is steadily increasing as more companies recognize the tangible benefits of drone technology in terms of cost savings, risk mitigation, and environmental compliance. The ability to conduct inspections in hazardous or difficult-to-access areas without human intervention is a major catalyst for adoption. Furthermore, the growing emphasis on ESG (Environmental, Social, and Governance) initiatives is driving the demand for drone services for environmental monitoring, such as leak detection and emissions tracking. The integration of drone data with digital twins of oil and gas assets is another emerging trend that promises to further enhance asset management and operational oversight, pushing the market towards a more data-driven and proactive approach.

Dominant Markets & Segments in Latin America Oil & Gas Drone Services Market

Brazil is emerging as the dominant market within the Latin America Oil & Gas Drone Services sector, driven by its extensive offshore oil and gas operations and significant onshore exploration activities. The country's substantial oil reserves and the presence of major national and international oil companies necessitate advanced technological solutions for efficient and safe asset management.

- Brazil: Key drivers for Brazil's dominance include:

- Vast Offshore Exploration: Brazil's pre-salt discoveries have led to a massive expansion of offshore infrastructure, requiring extensive drone services for inspection, maintenance, and monitoring of deep-water platforms, pipelines, and subsea assets.

- Economic Policies & Investment: Supportive government policies and sustained investment in the oil and gas sector, particularly by Petrobras, encourage the adoption of cutting-edge technologies like drone services to optimize production and reduce operational costs.

- Infrastructure Development: The sheer scale of Brazil's oil and gas infrastructure demands efficient inspection and maintenance solutions, which drones are ideally suited to provide, especially in remote or challenging terrains.

- Technological Adoption: Brazilian oil and gas companies are increasingly open to adopting innovative technologies to enhance safety and efficiency, making them early adopters of advanced drone capabilities.

Mexico, while a significant player, follows Brazil in market size. Its mature onshore oil fields and ongoing efforts to revitalize the energy sector contribute to a steady demand for drone services. However, the pace of technological adoption and the scale of new project developments are somewhat less pronounced compared to Brazil.

Argentina's oil and gas sector, particularly the Vaca Muerta shale formation, presents substantial growth opportunities. The unique geographical challenges and the need for efficient monitoring of extensive pipeline networks and well pads are driving the adoption of drone technology.

The Rest of Latin America, encompassing countries like Colombia, Peru, and Ecuador, exhibits a growing interest in drone services. These regions, with their developing oil and gas industries and increasing focus on operational safety and environmental compliance, represent a segment with considerable untapped potential. Growth in these areas will be fueled by increasing exploration activities and the need to optimize existing infrastructure.

Latin America Oil & Gas Drone Services Market Product Developments

Product developments in the Latin America Oil & Gas Drone Services Market are centered on enhancing data acquisition capabilities and analytical precision. Innovations include the integration of advanced sensors such as hyperspectral cameras for detecting minute chemical leaks and AI-powered object recognition software for automated defect identification on pipelines and structures. Long-endurance drones with enhanced flight times are also being developed to cover larger operational areas, reducing the need for frequent battery changes. These developments offer a significant competitive advantage by providing higher resolution data, faster processing times, and more comprehensive insights into asset health and environmental conditions, directly addressing the industry's need for cost-effective and efficient surveillance.

Report Scope & Segmentation Analysis

This report meticulously segments the Latin America Oil & Gas Drone Services Market across key geographical areas.

- Mexico: The Mexican market is characterized by established onshore fields and ongoing efforts to modernize the energy sector. Drone services are crucial for pipeline integrity management and the inspection of aging infrastructure, with projected growth driven by increased investment in upstream operations.

- Brazil: As the largest market, Brazil's extensive offshore and onshore operations necessitate comprehensive drone solutions for platform inspections, subsea asset monitoring, and exploration support. Strong regulatory support and significant industry investment are key growth enablers.

- Argentina: The Vaca Muerta shale formation is a significant driver for drone adoption in Argentina, particularly for monitoring extensive pipeline networks and well sites in challenging terrains. Growth projections are robust due to the ongoing development of unconventional resources.

- Rest of Latin America: This segment includes countries like Colombia, Peru, and Ecuador, where developing oil and gas industries are increasingly recognizing the benefits of drone technology for safety, efficiency, and environmental monitoring, presenting substantial untapped growth potential.

Key Drivers of Latin America Oil & Gas Drone Services Market Growth

Several factors are propelling the growth of the Latin America Oil & Gas Drone Services Market.

- Enhanced Safety and Risk Mitigation: Drones enable inspections in hazardous environments, reducing human exposure to risks associated with working at heights, in confined spaces, or in areas with potential for explosions.

- Cost Optimization and Efficiency Gains: Drones offer a more cost-effective alternative to traditional inspection methods, significantly reducing operational downtime, labor costs, and the need for expensive manned aviation.

- Technological Advancements: The continuous improvement in drone hardware, including advanced sensors (LiDAR, thermal, multi-spectral) and longer flight endurance, allows for more detailed and comprehensive data collection.

- Environmental Monitoring and Compliance: Increasing regulatory pressure and corporate sustainability goals are driving the demand for drone services for leak detection, emissions monitoring, and environmental impact assessments.

Challenges in the Latin America Oil & Gas Drone Services Market Sector

Despite the robust growth, the Latin America Oil & Gas Drone Services Market faces several challenges.

- Regulatory Hurdles: Evolving and sometimes inconsistent aviation regulations across different Latin American countries can create complexities for drone operators, impacting operational scalability and requiring extensive compliance efforts.

- Data Security and Management: The vast amounts of data generated by drones require secure storage, processing, and management solutions, posing challenges in terms of infrastructure and cybersecurity.

- Skilled Workforce Shortage: A lack of adequately trained drone pilots, data analysts, and maintenance technicians can hinder the widespread adoption and efficient utilization of drone services.

- Integration with Existing Systems: Seamlessly integrating drone-generated data with existing oil and gas asset management systems and workflows can be technically challenging and require significant investment.

Emerging Opportunities in Latin America Oil & Gas Drone Services Market

The Latin America Oil & Gas Drone Services Market presents numerous emerging opportunities.

- Predictive Maintenance and AI Integration: The increasing use of AI and machine learning with drone data for predictive maintenance is a significant growth area, allowing for proactive identification of potential equipment failures.

- Expansion into Offshore Wind Farms: As Latin America diversifies its energy portfolio, drone services are finding new applications in the inspection and maintenance of offshore wind turbines.

- Digital Twin Technology: The synergy between drone data and digital twin platforms offers advanced asset management and simulation capabilities, creating new service opportunities.

- Unconventional Resource Development: The continued exploration and development of shale gas and oil in regions like Vaca Muerta will drive sustained demand for specialized drone inspection and monitoring services.

Leading Players in the Latin America Oil & Gas Drone Services Market Market

- Cyberhawk Innovations Limited

- Texo Drone Survey and Inspections Limtied

- DATUM INGENIERIA

- D2R technologies

- SkyX Systems Corp

Key Developments in Latin America Oil & Gas Drone Services Market Industry

- January 2024: Cyberhawk Innovations Limited expanded its service offerings in Brazil, focusing on advanced pipeline inspection capabilities for offshore assets.

- October 2023: Texo Drone Survey and Inspections Limited secured a multi-year contract with a major oil producer in Mexico for comprehensive asset integrity monitoring.

- June 2023: D2R technologies partnered with a regional energy company in Argentina to implement drone-based safety surveillance for remote well sites.

- March 2023: SkyX Systems Corp introduced its extended-range drone platform, specifically designed for large-scale infrastructure monitoring in Latin America.

- December 2022: DATUM INGENIERIA enhanced its data analytics capabilities by integrating AI-powered defect recognition software for oil and gas infrastructure inspections.

Strategic Outlook for Latin America Oil & Gas Drone Services Market Market

The strategic outlook for the Latin America Oil & Gas Drone Services Market is highly positive, driven by an increasing demand for enhanced operational efficiency, safety, and environmental compliance within the region's vital oil and gas sector. Continued investment in advanced drone technologies, coupled with favorable regulatory environments and the burgeoning need for predictive maintenance, will fuel substantial market expansion. Opportunities abound in the integration of AI for data analytics, the expansion of services to offshore wind energy, and the development of sophisticated digital twin solutions. Companies that can offer comprehensive, end-to-end drone service solutions, backed by robust data security and skilled personnel, will be best positioned for sustained growth and market leadership in this dynamic landscape.

Latin America Oil & Gas Drone Services Market Segmentation

- 1. Mexico

- 2. Brazil

- 3. Argentina

- 4. Rest of Latin America

Latin America Oil & Gas Drone Services Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Oil & Gas Drone Services Market Regional Market Share

Geographic Coverage of Latin America Oil & Gas Drone Services Market

Latin America Oil & Gas Drone Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Automobiles4.; The Government Policy Regarding Pollution Emission Control Parameters

- 3.3. Market Restrains

- 3.3.1. The Technological Limitations of Air Filters

- 3.4. Market Trends

- 3.4.1. Brazil to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Oil & Gas Drone Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mexico

- 5.2. Market Analysis, Insights and Forecast - by Brazil

- 5.3. Market Analysis, Insights and Forecast - by Argentina

- 5.4. Market Analysis, Insights and Forecast - by Rest of Latin America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Mexico

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cyberhawk Innovations Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Texo Drone Survey and Inspections Limtied

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DATUM INGENIERIA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 D2R technologies*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SkyX Systems Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Cyberhawk Innovations Limited

List of Figures

- Figure 1: Latin America Oil & Gas Drone Services Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Latin America Oil & Gas Drone Services Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Oil & Gas Drone Services Market Revenue undefined Forecast, by Mexico 2020 & 2033

- Table 2: Latin America Oil & Gas Drone Services Market Volume K Unit Forecast, by Mexico 2020 & 2033

- Table 3: Latin America Oil & Gas Drone Services Market Revenue undefined Forecast, by Brazil 2020 & 2033

- Table 4: Latin America Oil & Gas Drone Services Market Volume K Unit Forecast, by Brazil 2020 & 2033

- Table 5: Latin America Oil & Gas Drone Services Market Revenue undefined Forecast, by Argentina 2020 & 2033

- Table 6: Latin America Oil & Gas Drone Services Market Volume K Unit Forecast, by Argentina 2020 & 2033

- Table 7: Latin America Oil & Gas Drone Services Market Revenue undefined Forecast, by Rest of Latin America 2020 & 2033

- Table 8: Latin America Oil & Gas Drone Services Market Volume K Unit Forecast, by Rest of Latin America 2020 & 2033

- Table 9: Latin America Oil & Gas Drone Services Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 10: Latin America Oil & Gas Drone Services Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Latin America Oil & Gas Drone Services Market Revenue undefined Forecast, by Mexico 2020 & 2033

- Table 12: Latin America Oil & Gas Drone Services Market Volume K Unit Forecast, by Mexico 2020 & 2033

- Table 13: Latin America Oil & Gas Drone Services Market Revenue undefined Forecast, by Brazil 2020 & 2033

- Table 14: Latin America Oil & Gas Drone Services Market Volume K Unit Forecast, by Brazil 2020 & 2033

- Table 15: Latin America Oil & Gas Drone Services Market Revenue undefined Forecast, by Argentina 2020 & 2033

- Table 16: Latin America Oil & Gas Drone Services Market Volume K Unit Forecast, by Argentina 2020 & 2033

- Table 17: Latin America Oil & Gas Drone Services Market Revenue undefined Forecast, by Rest of Latin America 2020 & 2033

- Table 18: Latin America Oil & Gas Drone Services Market Volume K Unit Forecast, by Rest of Latin America 2020 & 2033

- Table 19: Latin America Oil & Gas Drone Services Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: Latin America Oil & Gas Drone Services Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Brazil Latin America Oil & Gas Drone Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Brazil Latin America Oil & Gas Drone Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Argentina Latin America Oil & Gas Drone Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Argentina Latin America Oil & Gas Drone Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Chile Latin America Oil & Gas Drone Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Chile Latin America Oil & Gas Drone Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Colombia Latin America Oil & Gas Drone Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Colombia Latin America Oil & Gas Drone Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Mexico Latin America Oil & Gas Drone Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Mexico Latin America Oil & Gas Drone Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Peru Latin America Oil & Gas Drone Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Peru Latin America Oil & Gas Drone Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Venezuela Latin America Oil & Gas Drone Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Venezuela Latin America Oil & Gas Drone Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Ecuador Latin America Oil & Gas Drone Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Ecuador Latin America Oil & Gas Drone Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Bolivia Latin America Oil & Gas Drone Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Bolivia Latin America Oil & Gas Drone Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Paraguay Latin America Oil & Gas Drone Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Paraguay Latin America Oil & Gas Drone Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Oil & Gas Drone Services Market?

The projected CAGR is approximately 15.5%.

2. Which companies are prominent players in the Latin America Oil & Gas Drone Services Market?

Key companies in the market include Cyberhawk Innovations Limited, Texo Drone Survey and Inspections Limtied, DATUM INGENIERIA, D2R technologies*List Not Exhaustive, SkyX Systems Corp.

3. What are the main segments of the Latin America Oil & Gas Drone Services Market?

The market segments include Mexico, Brazil, Argentina, Rest of Latin America.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Automobiles4.; The Government Policy Regarding Pollution Emission Control Parameters.

6. What are the notable trends driving market growth?

Brazil to Dominate the Market.

7. Are there any restraints impacting market growth?

The Technological Limitations of Air Filters.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Oil & Gas Drone Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Oil & Gas Drone Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Oil & Gas Drone Services Market?

To stay informed about further developments, trends, and reports in the Latin America Oil & Gas Drone Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence