Key Insights

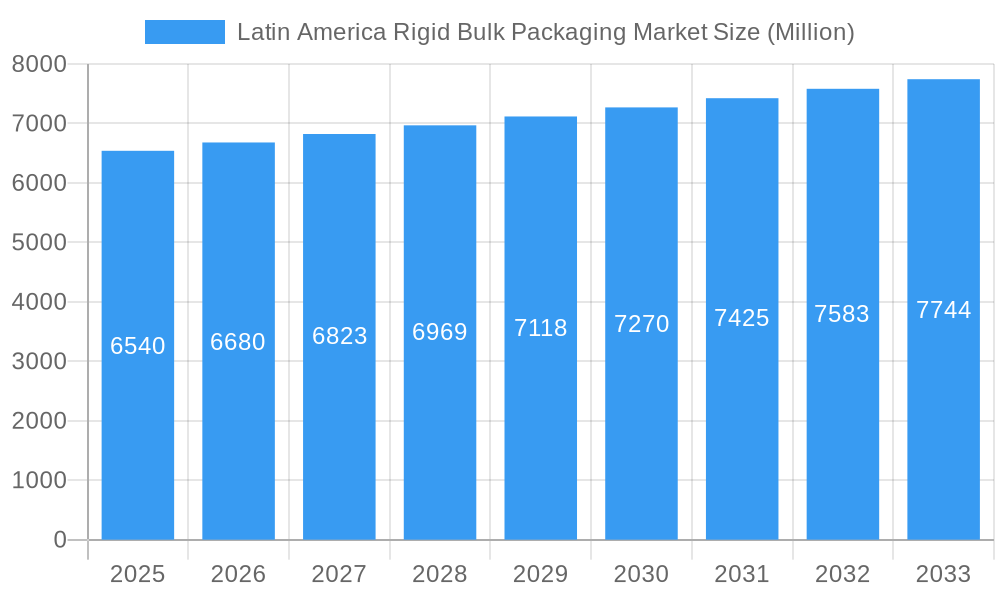

The Latin America rigid bulk packaging market, valued at $6.54 billion in 2025, is projected to experience steady growth, driven by the expansion of the food and beverage, pharmaceutical, and chemical industries across the region. Increasing demand for efficient and safe transportation and storage of goods, coupled with a rising focus on sustainable packaging solutions, are key growth catalysts. Brazil and Mexico represent significant market shares, fueled by robust industrial activity and growing consumer spending. The market is segmented by product type (industrial bulk containers, drums, pails, etc.), end-user industry, and material (plastic, metal, wood). Plastic packaging dominates due to its cost-effectiveness and versatility, while a gradual shift towards sustainable alternatives like biodegradable materials is anticipated. However, fluctuating raw material prices and stringent regulatory compliance requirements present challenges to market expansion. Competition among established players like Greif Inc., Mauser Packaging Solutions, and ALPLA Group is intense, driving innovation and cost optimization strategies. The projected Compound Annual Growth Rate (CAGR) of 2.22% from 2025 to 2033 suggests a consistent, albeit moderate, growth trajectory. Growth will be influenced by factors such as economic stability in key Latin American markets, infrastructure development, and evolving consumer preferences. Further penetration into smaller Latin American countries beyond Brazil and Mexico also presents significant potential for growth in the coming years.

Latin America Rigid Bulk Packaging Market Market Size (In Billion)

The market's segmentation offers opportunities for specialized players. For instance, companies focusing on sustainable and eco-friendly packaging solutions are likely to experience accelerated growth, driven by increased environmental consciousness. Similarly, companies catering to specific end-user industries with unique packaging needs (e.g., specialized pharmaceutical packaging) can achieve competitive advantages. The market's growth will necessitate continued investment in manufacturing capacity and logistics infrastructure to meet the expanding demand across diverse segments and geographies. Future growth projections will also depend on governmental regulations and policies that influence material sourcing and waste management practices.

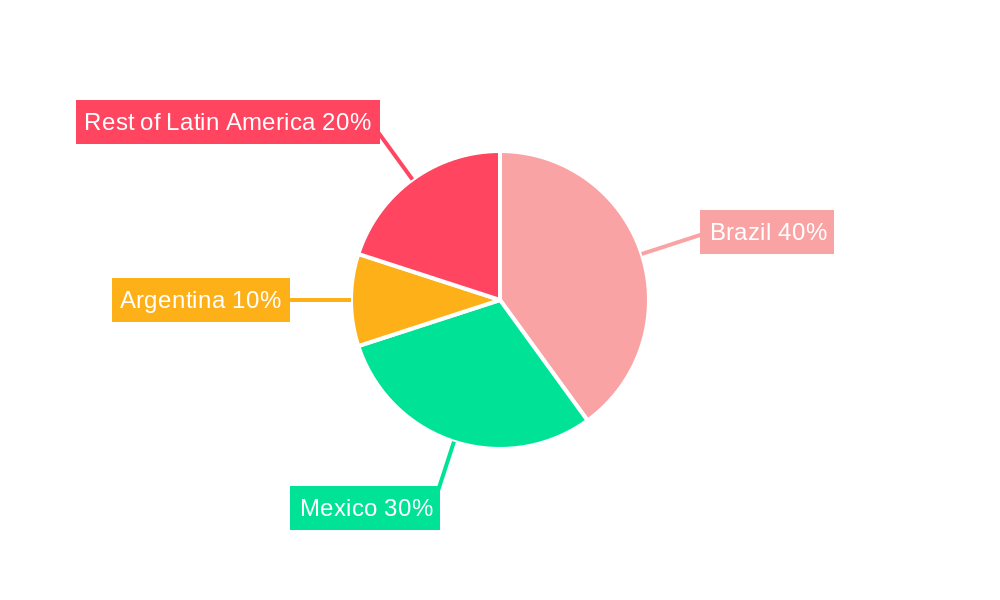

Latin America Rigid Bulk Packaging Market Company Market Share

This comprehensive report provides an in-depth analysis of the Latin America Rigid Bulk Packaging Market, offering valuable insights for stakeholders across the value chain. The study covers the period 2019-2033, with 2025 as the base year and a forecast period extending to 2033. The report segments the market by product type, end-user industry, country, and material, providing a granular understanding of market dynamics and growth potential. Key players such as Monoflo International, The Dow Chemical Company, Schutz Elsa S A de C V, Greif Inc, ORBIS Corporation, Rheem Chilena SpA, Mauser Packaging Solutions, and ALPLA Group are profiled, highlighting their strategies and market positions.

Latin America Rigid Bulk Packaging Market Market Concentration & Innovation

The Latin America rigid bulk packaging market exhibits a moderately consolidated structure, with a few major players holding significant market share. The exact market share for each player varies by segment but generally, the top 5 companies hold approximately xx% of the overall market. Innovation within the sector is driven by the increasing demand for sustainable packaging solutions, stringent regulatory requirements, and the need for improved efficiency in supply chains. Key innovation areas include the development of lightweight, reusable, and recyclable packaging materials, advancements in material science, and the adoption of smart packaging technologies.

The regulatory landscape plays a crucial role in shaping market dynamics. Governments in Latin America are increasingly implementing regulations focused on reducing environmental impact, promoting recycling, and ensuring product safety. This leads to both challenges and opportunities for companies operating in this market. Product substitutes, such as flexible packaging, pose a competitive threat, especially for certain applications. However, the robust nature and protection offered by rigid bulk packaging maintains significant demand across several industries. End-user trends, particularly a move towards more sustainable and efficient packaging practices, significantly influence market growth. M&A activities in the Latin American rigid bulk packaging market have been moderate. While precise deal values are not publicly available for all transactions, several strategic acquisitions have been observed in the last five years, primarily focused on expanding regional presence and product portfolios, with an estimated total value of xx Million.

Latin America Rigid Bulk Packaging Market Industry Trends & Insights

The Latin America rigid bulk packaging market is experiencing robust growth, driven by the expanding industrial and manufacturing sectors across the region. The market’s Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was approximately xx%, and is projected to reach xx% during the forecast period (2025-2033). This growth is fueled by several key factors: increasing demand from the food and beverage, pharmaceutical and chemical industries; rising e-commerce activities demanding enhanced packaging solutions; and a growing focus on improved supply chain management and logistics.

Technological disruptions are impacting the market through the adoption of automated packaging systems, improved material science resulting in lighter and stronger containers, and the implementation of smart packaging solutions to enhance product traceability and reduce spoilage. Consumer preferences are shifting towards sustainable packaging materials, placing pressure on manufacturers to incorporate recycled content and eco-friendly design principles. Competitive dynamics are shaped by factors such as pricing strategies, product differentiation, and the ability to meet evolving customer needs. Market penetration of innovative packaging solutions remains relatively low in some parts of the region, presenting a significant growth opportunity.

Dominant Markets & Segments in Latin America Rigid Bulk Packaging Market

By Country: Brazil and Mexico are the dominant markets in Latin America for rigid bulk packaging, accounting for a combined xx% of the total market volume. Brazil’s larger industrial base and strong agricultural sector drive high demand, while Mexico benefits from its proximity to the US market and a growing manufacturing sector.

By Product: Industrial bulk containers represent the largest segment by volume, owing to their versatility and suitability for a wide range of applications across various industries. Drums and pails also hold significant market share, driven by their established use in chemical and food sectors.

By End-user Industry: The food and beverage industry is the leading end-user for rigid bulk packaging in Latin America, owing to strict hygiene requirements and the need to preserve product integrity. The industrial and chemical sectors also contribute significantly, demanding robust packaging to ensure safe handling of various materials.

By Material: Plastic remains the most widely used material for rigid bulk packaging in Latin America, due to its cost-effectiveness, versatility, and lightweight properties. However, the growing demand for sustainable solutions is driving increased adoption of recycled materials and other eco-friendly alternatives.

Key Drivers for Dominance:

- Brazil: Strong industrial base, large agricultural sector, favorable government policies promoting industrial growth.

- Mexico: Proximity to the US market, expanding manufacturing sector, foreign direct investment in the packaging industry.

- Industrial Bulk Containers: Versatility for diverse applications, suitability for various industries, cost-effectiveness.

- Food and Beverage: Strict hygiene requirements, need for product preservation, high volume of packaged goods.

- Plastic: Cost-effectiveness, versatility, ease of manufacturing, lightweight.

Latin America Rigid Bulk Packaging Market Product Developments

Recent product innovations have focused on developing lightweight, durable, and sustainable rigid bulk packaging solutions. Manufacturers are increasingly incorporating recycled materials, exploring biodegradable alternatives, and implementing designs to minimize material usage. Technological advancements such as improved barrier properties and smart packaging features are enhancing product protection and traceability. These innovations provide competitive advantages by improving efficiency, reducing costs, and enhancing brand appeal with environmentally conscious consumers. The market fit for these products is strong, particularly in industries with stringent sustainability targets.

Report Scope & Segmentation Analysis

This report segments the Latin America rigid bulk packaging market by:

By Product: Industrial Bulk Containers, Drums, Pails, Bulk Boxes, Other Bulk Containers (Growth projections and market sizes vary significantly across these segments; detailed figures are available in the full report).

By End-user Industry: Food, Beverage, Industrial, Pharmaceutical and Chemical, Other End-user Industries (Market dynamics and competitive intensity differ considerably by end-use sector).

By Country: Brazil, Mexico (Brazil and Mexico are the leading countries, but other countries in Latin America are also analyzed with region-specific growth rates).

By Material: Plastic, Metal, Wood, Other Materials (Market share and growth trajectories are influenced by material properties, sustainability concerns, and cost factors).

Key Drivers of Latin America Rigid Bulk Packaging Market Growth

The growth of the Latin American rigid bulk packaging market is propelled by several factors: the burgeoning industrial sector, especially in key countries like Brazil and Mexico, creates significant demand for robust packaging solutions. Rising e-commerce activities necessitate effective and protective packaging for goods transportation. Government regulations promoting sustainability and reduced environmental impact also drive innovation in eco-friendly packaging materials. Finally, improvements in logistics and supply chain management further increase the need for efficient and reliable bulk packaging solutions.

Challenges in the Latin America Rigid Bulk Packaging Market Sector

The Latin American rigid bulk packaging market faces several challenges. Fluctuations in raw material prices impact profitability, and logistical complexities and infrastructure limitations can cause supply chain disruptions. Stringent environmental regulations necessitate increased investment in sustainable packaging solutions, while competition from both domestic and international players increases pressure on pricing. Economic instability in certain regions can also dampen overall demand. These factors combine to create a dynamic and complex market environment.

Emerging Opportunities in Latin America Rigid Bulk Packaging Market

Several emerging opportunities exist within the Latin American rigid bulk packaging market. The growing emphasis on sustainability presents opportunities for manufacturers offering eco-friendly packaging solutions using recycled materials or biodegradable alternatives. Expansion into niche markets, such as specialized packaging for pharmaceuticals and sensitive goods, creates promising growth avenues. Technological advancements such as smart packaging and automated packaging lines offer further avenues for growth and competitive differentiation.

Leading Players in the Latin America Rigid Bulk Packaging Market Market

- Monoflo International

- The Dow Chemical Company (Dow Chemical Company)

- Schutz Elsa S A de C V

- Greif Inc (Greif Inc)

- ORBIS Corporation (ORBIS Corporation)

- Rheem Chilena SpA

- Mauser Packaging Solutions (Mauser Packaging Solutions)

- ALPLA Group (ALPLA Group)

Key Developments in Latin America Rigid Bulk Packaging Market Industry

September 2023: Mauser Packaging Solutions expands IBC production in Toluca, Mexico, enhancing its regional capacity for UN-certified composite IBCs. This signifies a significant investment in the Mexican market and strengthens their position in the IBC segment.

June 2022: Greif, Inc. launches high-performance industrial cans in Brazil, targeting various sectors including agrochemicals and beverages. The lighter weight design improves efficiency in transportation and storage, highlighting innovation focused on cost reduction and sustainability.

Strategic Outlook for Latin America Rigid Bulk Packaging Market Market

The Latin America rigid bulk packaging market holds substantial future potential. Continued industrial growth, increasing demand for sustainable packaging, and technological advancements will drive market expansion. Companies focusing on innovation, sustainability, and efficient supply chain management are poised to benefit the most. The focus on regional economic growth and infrastructure development presents significant growth opportunities for both established and new market entrants.

Latin America Rigid Bulk Packaging Market Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Metal

- 1.3. Wood

- 1.4. Other Materials

-

2. Product

- 2.1. Industrial Bulk Containers

- 2.2. Drums

- 2.3. Pails

- 2.4. Bulk Boxes

- 2.5. Other Bulk Containers

-

3. End-user Industry

- 3.1. Food

- 3.2. Beverage

- 3.3. Industrial

- 3.4. Pharmaceutical and Chemical

- 3.5. Other End-user Industries

Latin America Rigid Bulk Packaging Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Rigid Bulk Packaging Market Regional Market Share

Geographic Coverage of Latin America Rigid Bulk Packaging Market

Latin America Rigid Bulk Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Food and Agricultural Exports from Latin America4.; Construction and Infrastructural Activity Aids Market Growth

- 3.3. Market Restrains

- 3.3.1. 4.; Severe Inflation and Increased Price of Raw Material May Dent the Market Growth

- 3.4. Market Trends

- 3.4.1. Robust Food and Beverage Production Aids the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Rigid Bulk Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Metal

- 5.1.3. Wood

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Industrial Bulk Containers

- 5.2.2. Drums

- 5.2.3. Pails

- 5.2.4. Bulk Boxes

- 5.2.5. Other Bulk Containers

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Industrial

- 5.3.4. Pharmaceutical and Chemical

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Monoflo International

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Dow Chemical Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Schutz Elsa S A de C V

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Greif Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ORBIS Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rheem Chilena SpA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mauser Packaging Solutions

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ALPLA Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Monoflo International

List of Figures

- Figure 1: Latin America Rigid Bulk Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Rigid Bulk Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Rigid Bulk Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Latin America Rigid Bulk Packaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 3: Latin America Rigid Bulk Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Latin America Rigid Bulk Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Latin America Rigid Bulk Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Latin America Rigid Bulk Packaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 7: Latin America Rigid Bulk Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Latin America Rigid Bulk Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Brazil Latin America Rigid Bulk Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Argentina Latin America Rigid Bulk Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Chile Latin America Rigid Bulk Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Colombia Latin America Rigid Bulk Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Latin America Rigid Bulk Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Peru Latin America Rigid Bulk Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Venezuela Latin America Rigid Bulk Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Ecuador Latin America Rigid Bulk Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Bolivia Latin America Rigid Bulk Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Paraguay Latin America Rigid Bulk Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Rigid Bulk Packaging Market?

The projected CAGR is approximately 2.22%.

2. Which companies are prominent players in the Latin America Rigid Bulk Packaging Market?

Key companies in the market include Monoflo International, The Dow Chemical Company, Schutz Elsa S A de C V, Greif Inc, ORBIS Corporation, Rheem Chilena SpA, Mauser Packaging Solutions, ALPLA Group.

3. What are the main segments of the Latin America Rigid Bulk Packaging Market?

The market segments include Material, Product, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.54 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Food and Agricultural Exports from Latin America4.; Construction and Infrastructural Activity Aids Market Growth.

6. What are the notable trends driving market growth?

Robust Food and Beverage Production Aids the Market.

7. Are there any restraints impacting market growth?

4.; Severe Inflation and Increased Price of Raw Material May Dent the Market Growth.

8. Can you provide examples of recent developments in the market?

September 2023 - Mauser Packaging Solutions expanded its production capabilities recently through investments in the manufacture of composite intermediate bulk containers (IBCs) in its Toluca, Mexico facility. A new line focused on IBC cage production was installed in the facility to support the manufacturing of UN-certified 275-gallon composite IBCs in the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Rigid Bulk Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Rigid Bulk Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Rigid Bulk Packaging Market?

To stay informed about further developments, trends, and reports in the Latin America Rigid Bulk Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence