Key Insights

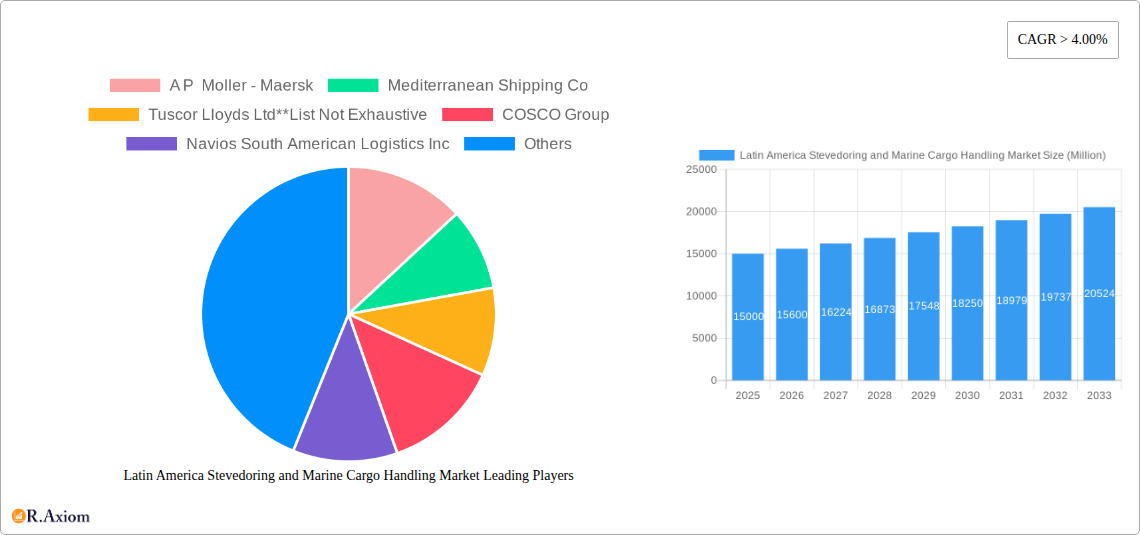

The Latin American stevedoring and marine cargo handling market is poised for significant expansion, projected to grow at a compound annual growth rate (CAGR) of 4% from 2025 to 2033. The market size was valued at approximately $1.12 billion in the base year 2024. This growth is fueled by increasing global trade, particularly with Asia and Europe, driving demand for efficient port operations in key economies like Brazil, Argentina, and Mexico. Ongoing investments in port infrastructure modernization and expansion are enhancing handling capacity and reducing congestion. The trend towards larger container vessels necessitates advanced stevedoring services and cargo handling technologies, further supporting market growth. While challenges such as fluctuating commodity prices and potential infrastructural bottlenecks exist, the market outlook remains optimistic, with containerized cargo handling presenting substantial opportunities due to the global rise in containerized trade. Major players like A.P. Moller-Maersk, Mediterranean Shipping Company (MSC), and COSCO are actively consolidating their positions, fostering competition and innovation.

Latin America Stevedoring and Marine Cargo Handling Market Market Size (In Billion)

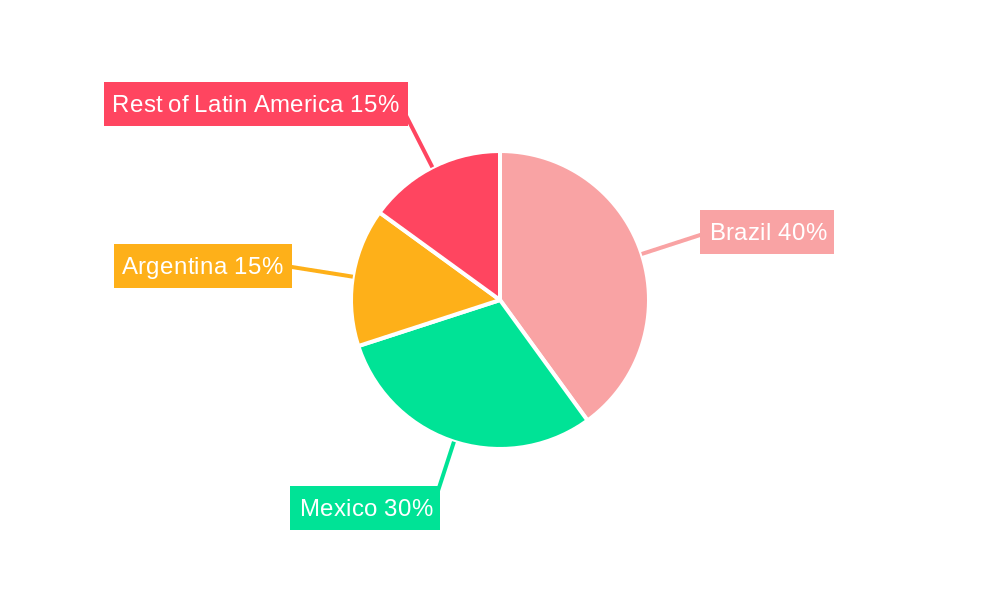

Brazil's substantial port infrastructure and its role as a major exporter of agricultural products and raw materials are key drivers of market growth. Mexico's strategic location near the United States positions it as a vital logistics hub, attracting considerable investment in port facilities and related services. Argentina also contributes to overall market growth, despite some economic headwinds. Other Latin American nations are expected to experience increased activity through regional trade and economic development. The "Others" segment in both type and cargo categories offers opportunities for specialized niche players. Sustained growth will be propelled by technological investments, port capacity expansion, and the escalating demand for efficient and reliable cargo handling solutions across the region. Businesses should monitor regulatory changes and navigate regional economic fluctuations to maximize opportunities in this evolving market.

Latin America Stevedoring and Marine Cargo Handling Market Company Market Share

Latin America Stevedoring and Marine Cargo Handling Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Latin America Stevedoring and Marine Cargo Handling Market, covering the period from 2019 to 2033. It offers invaluable insights for industry stakeholders, investors, and businesses seeking to understand the market's dynamics, growth opportunities, and challenges. The report leverages rigorous research methodologies and data analysis to present a clear and actionable picture of the market landscape. With a focus on key players such as A.P. Moller-Maersk, Mediterranean Shipping Co, COSCO Group, and others, this report is essential for strategic decision-making.

Latin America Stevedoring and Marine Cargo Handling Market Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities within the Latin American stevedoring and marine cargo handling market. The market is moderately concentrated, with a few major players holding significant market share. However, the presence of numerous smaller, regional players indicates a competitive landscape. Innovation is driven by the need for increased efficiency, automation, and sustainable practices.

- Market Concentration: The top five players account for approximately xx% of the market share in 2025.

- Innovation Drivers: Technological advancements in automation (e.g., automated guided vehicles, robotic systems), improved port infrastructure, and digitalization of logistics processes are key drivers.

- Regulatory Frameworks: Varying regulations across Latin American countries impact operational efficiency and investment decisions. Streamlining customs procedures and harmonizing regulations are critical for market growth.

- Product Substitutes: While limited direct substitutes exist, improvements in intermodal transport and alternative logistics solutions exert some pressure.

- End-User Trends: Growing e-commerce and demand for faster delivery times are influencing the demand for efficient stevedoring and cargo handling services.

- M&A Activities: The past five years have witnessed xx M&A deals, valued at approximately $xx Million, primarily focused on expanding geographical reach and service capabilities.

Latin America Stevedoring and Marine Cargo Handling Market Industry Trends & Insights

The Latin American stevedoring and marine cargo handling market is experiencing robust growth, driven by increasing trade volumes, infrastructural developments, and economic expansion across the region. The market is projected to register a CAGR of xx% during the forecast period (2025-2033), reaching a market value of $xx Million by 2033. Technological advancements, such as automation and digitalization, are significantly influencing operational efficiency and reducing costs. The market is also witnessing a shift towards larger vessel sizes, requiring investments in port infrastructure and specialized equipment. Competitive dynamics are shaped by price competition, service quality, and operational efficiency. Market penetration of automated systems is expected to increase from xx% in 2025 to xx% by 2033.

Dominant Markets & Segments in Latin America Stevedoring and Marine Cargo Handling Market

Brazil, Mexico, and Argentina are the dominant markets in Latin America, contributing a combined xx% of the total market value in 2025.

- Brazil: Dominance is driven by its large economy, significant port infrastructure, and substantial import/export activities. Key drivers include government investments in port modernization and growing agricultural exports.

- Mexico: Strong economic ties with the US and growing manufacturing sector fuel market growth. Improved infrastructure and proximity to major US markets contribute to its dominance.

- Argentina: While facing economic challenges, Argentina's agricultural exports and some industrial activities support the market. However, its growth is comparatively slower than Brazil and Mexico.

- Rest of Latin America: This segment shows promising growth potential, driven by increasing regional trade and investments in port infrastructure. However, challenges include limited infrastructure in some countries.

By Cargo Type: Containerized cargo dominates the market, accounting for approximately xx% of the total volume in 2025, followed by bulk cargo and other cargo types.

By Service Type: Stevedoring services represent the largest segment, driven by the high volume of cargo handled at ports.

Latin America Stevedoring and Marine Cargo Handling Market Product Developments

Recent product innovations focus on improving efficiency, safety, and sustainability. This includes the adoption of automated guided vehicles (AGVs), improved cargo handling equipment, and the implementation of digital solutions for tracking and managing cargo. These developments aim to enhance operational efficiency, reduce costs, and improve supply chain transparency. The market fit for these innovations is strong, driven by the increasing demand for faster and more reliable cargo handling services.

Report Scope & Segmentation Analysis

This report segments the Latin America Stevedoring and Marine Cargo Handling Market by:

- Type: Stevedoring, Cargo and handling transportation, Others. Stevedoring is the largest segment, experiencing a CAGR of xx% during the forecast period.

- Cargo Type: Bulk Cargo, Containerized Cargo, Other Cargo. Containerized cargo holds the largest market share due to the rise in global trade.

- Country: Brazil, Argentina, Mexico, Rest of Latin America. Brazil is the leading country, followed by Mexico and Argentina.

Key Drivers of Latin America Stevedoring and Marine Cargo Handling Market Growth

The market's growth is driven by several factors:

- Rising Trade Volumes: Increasing global trade and intra-regional trade within Latin America are key drivers.

- Infrastructure Development: Government investments in port infrastructure and modernization projects are boosting capacity.

- Economic Growth: Economic expansion in major Latin American economies is fueling demand for efficient cargo handling services.

Challenges in the Latin America Stevedoring and Marine Cargo Handling Market Sector

Several challenges hinder market growth:

- Inadequate Infrastructure: Limited port capacity and outdated infrastructure in some regions constrain growth.

- Bureaucracy and Regulations: Complex customs procedures and regulatory hurdles increase operational costs and delays.

- Security Concerns: Security threats such as cargo theft and piracy pose significant challenges.

Emerging Opportunities in Latin America Stevedoring and Marine Cargo Handling Market

Emerging opportunities include:

- Automation and Digitalization: Implementing advanced technologies to improve efficiency and reduce costs.

- Sustainable Practices: Adopting eco-friendly practices to minimize environmental impact.

- Specialized Cargo Handling: Catering to the growing demand for handling specialized cargo types.

Leading Players in the Latin America Stevedoring and Marine Cargo Handling Market Market

- A.P. Moller - Maersk

- Mediterranean Shipping Co

- Tuscor Lloyds Ltd

- COSCO Group

- Navios South American Logistics Inc

- Latin American Cargo

- ONE (Ocean Network Express)

- Hapag-Lloyd

- UWL Inc

- CMA CGM Group

Key Developments in Latin America Stevedoring and Marine Cargo Handling Market Industry

- May 2022: Jumbo Maritime awarded Fugro a contract for positioning and metocean services for a new FPS in the US Gulf of Mexico. This highlights the growing demand for specialized services in offshore projects, indirectly impacting the market through related logistics.

- May 2022: Brazil signed an agreement with ten countries to expedite customs procedures. This significantly improves efficiency and reduces transit times for goods, positively impacting the market.

Strategic Outlook for Latin America Stevedoring and Marine Cargo Handling Market Market

The Latin American stevedoring and marine cargo handling market presents significant growth potential driven by continued economic expansion, infrastructure development, and technological advancements. Companies focusing on innovation, operational efficiency, and sustainable practices are well-positioned to capitalize on emerging opportunities. The market is expected to witness a consolidation phase, with larger players acquiring smaller companies to enhance their market share and geographical reach. The increasing focus on digitalization and automation will further shape the future of the market.

Latin America Stevedoring and Marine Cargo Handling Market Segmentation

-

1. Type

- 1.1. Stevedoring

- 1.2. Cargo and handling transportation

- 1.3. Others

-

2. Cargo Type

- 2.1. Bulk Cargo

- 2.2. Containerized Cargo

- 2.3. Other Cargo

Latin America Stevedoring and Marine Cargo Handling Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Stevedoring and Marine Cargo Handling Market Regional Market Share

Geographic Coverage of Latin America Stevedoring and Marine Cargo Handling Market

Latin America Stevedoring and Marine Cargo Handling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. Digital transformation and technology adoption is likely to drive the market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Stevedoring

- 5.1.2. Cargo and handling transportation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Bulk Cargo

- 5.2.2. Containerized Cargo

- 5.2.3. Other Cargo

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 A P Moller - Maersk

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mediterranean Shipping Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tuscor Lloyds Ltd**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 COSCO Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Navios South American Logistics Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Latin American Cargo

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ONE (Ocean Network Express)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hapag-Lloyd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 UWL Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CMA CGM Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 A P Moller - Maersk

List of Figures

- Figure 1: Latin America Stevedoring and Marine Cargo Handling Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Stevedoring and Marine Cargo Handling Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Stevedoring and Marine Cargo Handling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Latin America Stevedoring and Marine Cargo Handling Market Revenue billion Forecast, by Cargo Type 2020 & 2033

- Table 3: Latin America Stevedoring and Marine Cargo Handling Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Latin America Stevedoring and Marine Cargo Handling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Latin America Stevedoring and Marine Cargo Handling Market Revenue billion Forecast, by Cargo Type 2020 & 2033

- Table 6: Latin America Stevedoring and Marine Cargo Handling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Brazil Latin America Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Argentina Latin America Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Chile Latin America Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Colombia Latin America Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Latin America Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Peru Latin America Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Venezuela Latin America Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Ecuador Latin America Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Bolivia Latin America Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Paraguay Latin America Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Stevedoring and Marine Cargo Handling Market?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the Latin America Stevedoring and Marine Cargo Handling Market?

Key companies in the market include A P Moller - Maersk, Mediterranean Shipping Co, Tuscor Lloyds Ltd**List Not Exhaustive, COSCO Group, Navios South American Logistics Inc, Latin American Cargo, ONE (Ocean Network Express), Hapag-Lloyd, UWL Inc, CMA CGM Group.

3. What are the main segments of the Latin America Stevedoring and Marine Cargo Handling Market?

The market segments include Type, Cargo Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.12 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

Digital transformation and technology adoption is likely to drive the market growth.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

May 2022: Jumbo Maritime has awarded Fugro a positioning and metocean services contract to help guide the safe transport and installation of a new floating production system (FPS) for Vito, a deepwater development in the US Gulf of Mexico.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Stevedoring and Marine Cargo Handling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Stevedoring and Marine Cargo Handling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Stevedoring and Marine Cargo Handling Market?

To stay informed about further developments, trends, and reports in the Latin America Stevedoring and Marine Cargo Handling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence