Key Insights

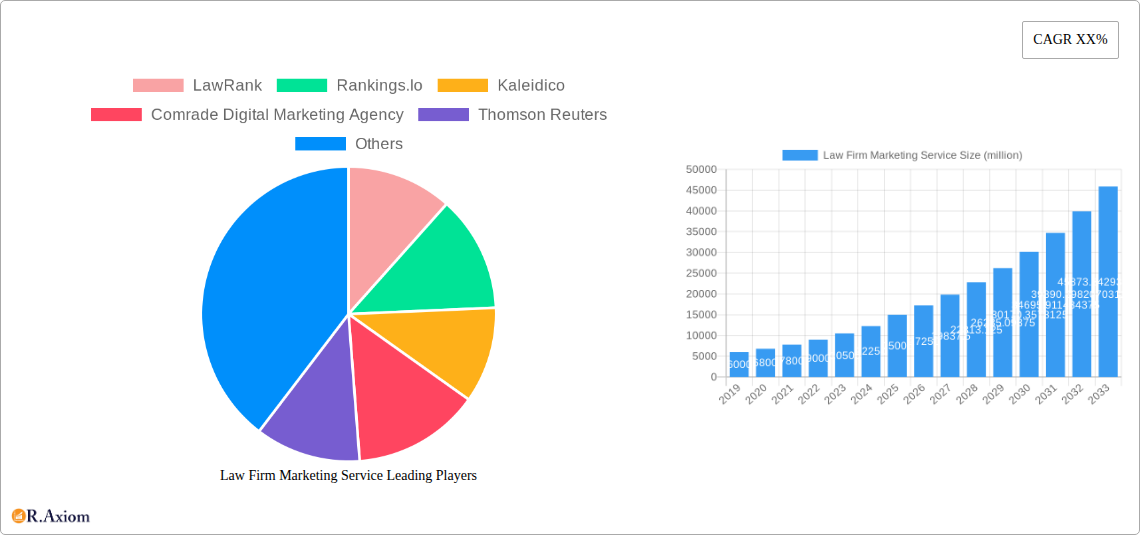

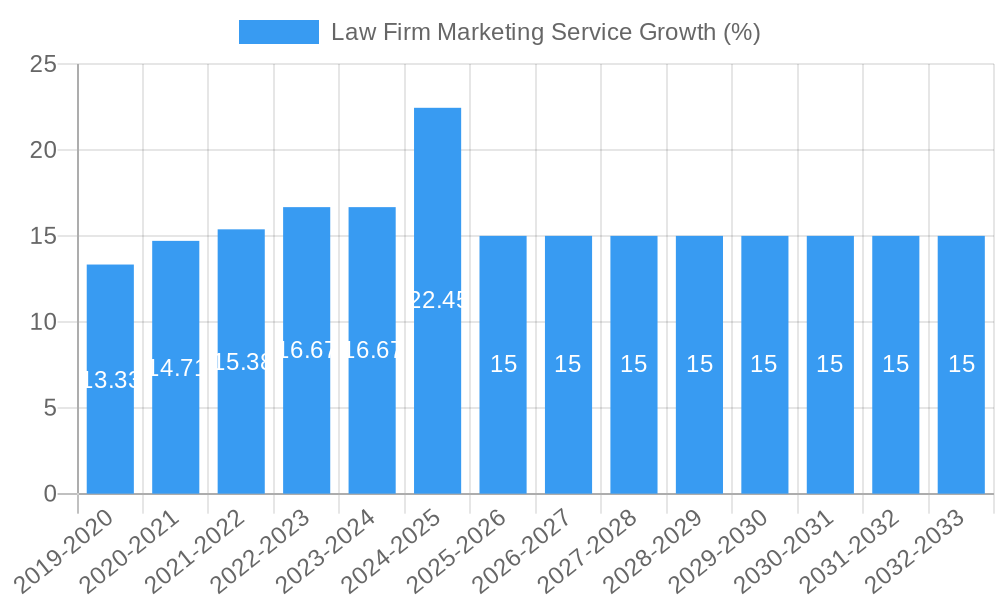

The global Law Firm Marketing Service market is experiencing robust expansion, projected to reach an estimated $15,000 million by 2025 and grow at a Compound Annual Growth Rate (CAGR) of 15% through 2033. This significant surge is driven by an increasing need for law firms to establish a strong online and offline presence in a highly competitive legal landscape. Key drivers include the escalating digitalization of legal services, the growing emphasis on client acquisition and retention, and the necessity for specialized marketing strategies tailored to different legal practice areas. The market is witnessing a pronounced shift towards integrated marketing approaches, combining digital strategies like Search Engine Optimization (SEO), Pay-Per-Click (PPC) advertising, social media marketing, and content creation with traditional offline methods such as networking events, print advertising, and direct mail. This holistic approach is crucial for law firms to effectively reach their target clientele, build brand reputation, and differentiate themselves from competitors. The rise of virtual consultations and remote legal services further accentuates the importance of sophisticated digital marketing capabilities.

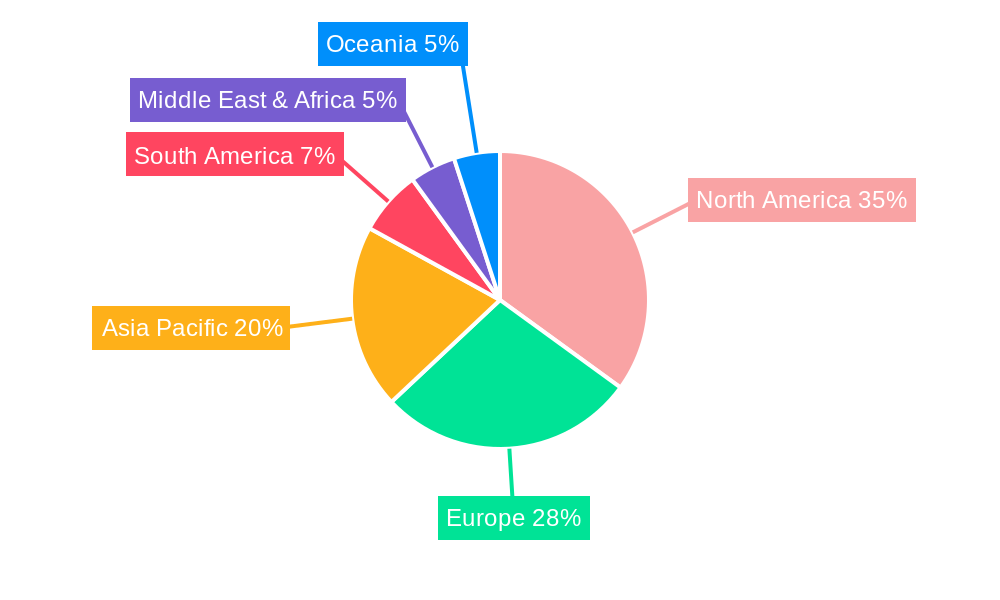

Further analysis reveals that while various segments are contributing to this growth, Business Law Firms and Personal Injury Law Firms represent significant contributors due to their substantial marketing budgets and the high volume of potential clients. The market is not without its restraints, however. The cost of sophisticated marketing campaigns, the challenge of measuring ROI accurately for certain strategies, and the ever-evolving regulatory landscape concerning legal advertising can pose hurdles. Despite these challenges, the overarching trend of professionalization in legal marketing, supported by specialized agencies like LawRank, Scorpion, and Thomson Reuters, is expected to propel the market forward. Emerging markets in Asia Pacific and the Middle East & Africa are also showing promising growth potential, driven by increasing access to legal services and the adoption of modern marketing practices. The forecast period anticipates sustained innovation in marketing technologies and strategies, including AI-powered tools for client engagement and data analytics, further shaping the future of law firm marketing services.

Law Firm Marketing Service Market Concentration & Innovation

The Law Firm Marketing Service market exhibits a moderate concentration, with a blend of large, established players and a significant number of specialized agencies vying for market share. Innovation is a critical differentiator, driven by the constant evolution of digital marketing technologies and the increasing demand for measurable ROI. Key innovation drivers include the adoption of AI-powered analytics for lead generation, sophisticated CRM systems tailored for legal practices, and the development of hyper-personalized client outreach strategies. Regulatory frameworks, while primarily focused on legal practice ethics, indirectly influence marketing by dictating permissible advertising methods and client solicitation. Product substitutes are abundant, ranging from in-house marketing teams to DIY online tools, but specialized law firm marketing services offer a distinct advantage in expertise and efficiency. End-user trends point towards a growing reliance on digital channels, with potential clients increasingly seeking legal counsel online. M&A activities are present, with larger agencies acquiring smaller, niche providers to expand service offerings and geographic reach. For instance, M&A deal values in the broader marketing services sector, which law firm marketing is a part of, can reach hundreds of millions. Key market share leaders are emerging from a competitive landscape.

Law Firm Marketing Service Industry Trends & Insights

The global Law Firm Marketing Service market is experiencing robust expansion, projected to witness a compound annual growth rate (CAGR) of approximately 12.5% during the forecast period of 2025–2033. This growth is underpinned by several interconnected trends and insights. The increasing digitalization of client acquisition is paramount; law firms, regardless of their specialty, recognize the necessity of a strong online presence to connect with potential clients. This includes investing in search engine optimization (SEO) for law firms, pay-per-click (PPC) advertising tailored for legal services, and sophisticated content marketing strategies designed to establish thought leadership. Technological disruptions are continually reshaping the landscape. Artificial intelligence (AI) is being leveraged for predictive analytics in client behavior, automated lead nurturing, and personalized marketing campaigns. Furthermore, advancements in data analytics allow firms to meticulously track campaign performance, optimize spending, and demonstrate tangible return on investment, a key metric for budget-conscious firms. Consumer preferences are also evolving. Potential clients are no longer passively seeking legal services; they actively research, compare, and vet law firms online. This necessitates a transparent, accessible, and engaging online brand presence. The rise of online reviews, social proof, and client testimonials further amplifies the importance of reputation management. Competitive dynamics are intensifying, with law firms of all sizes actively seeking to differentiate themselves. This has led to increased demand for specialized marketing services that cater to specific legal practice areas, such as personal injury law firm marketing or business law firm marketing. The market penetration of integrated marketing approaches, combining online and offline strategies, is also on the rise, offering a holistic approach to client engagement. The estimated market size for law firm marketing services is expected to reach over $20 million by 2025.

Dominant Markets & Segments in Law Firm Marketing Service

The Online Marketing segment is currently the most dominant within the Law Firm Marketing Service market, driven by the pervasive shift in client behavior towards digital information gathering. Within the Application segment, Personal Injury Law Firm marketing services represent a significant portion of the market. This dominance is attributed to several key drivers, including the high volume of cases, the often urgent nature of these needs, and the direct correlation between effective online visibility and client acquisition. For instance, economic policies that encourage consumer protection and personal well-being indirectly bolster the demand for personal injury legal services and, consequently, their marketing. The widespread availability of internet access and the increasing reliance on search engines to find immediate solutions to problems make online marketing an indispensable tool for personal injury attorneys.

The Business Law Firm segment also exhibits strong growth, fueled by the complexities of corporate law and the need for ongoing legal counsel for businesses. This segment benefits from consistent demand as businesses navigate regulatory compliance, contractual agreements, and strategic growth. Infrastructure development, both physical and digital, supports business expansion, which in turn requires legal support and marketing efforts to attract and retain corporate clients. Criminal Defense Law Firm marketing, while often subject to stricter ethical guidelines, also represents a substantial segment, driven by the continuous need for legal representation.

The dominance of Online Marketing is further amplified by its measurable impact. Services like SEO for law firms, PPC advertising, and social media marketing allow for precise tracking of leads and conversions, appealing to firms that prioritize tangible results. This segment is further segmented by Integrated Marketing, which combines online and offline efforts for a comprehensive client acquisition strategy. While Offline Marketing channels like traditional advertising and networking still play a role, their impact is increasingly augmented and measured through digital counterparts. The market penetration of online marketing is projected to continue its upward trajectory, solidifying its leading position.

Law Firm Marketing Service Product Developments

Recent product developments in Law Firm Marketing Service focus on enhancing automation, data analytics, and client personalization. Innovations include AI-driven content generation tools that help law firms create engaging blog posts and social media updates, as well as advanced CRM platforms that streamline lead management and client communication. These developments offer a significant competitive advantage by improving efficiency and the ability to target potential clients with precision. The emphasis is on delivering measurable outcomes and optimizing marketing spend for legal practices.

Report Scope & Segmentation Analysis

This report analyzes the Law Firm Marketing Service market across key application segments: Business Law Firm, Personal Injury Law Firm, Criminal Defense Law Firm, and Others. It also examines the market by marketing type: Online Marketing, Offline Marketing, and Integrated Marketing. Each segment is projected to experience varying growth rates, with Online Marketing and Personal Injury Law Firm marketing anticipated to lead in market size and expansion. Competitive dynamics within each segment are characterized by specialized service providers and evolving client acquisition strategies.

Key Drivers of Law Firm Marketing Service Growth

The growth of the Law Firm Marketing Service sector is propelled by several key drivers. Firstly, the increasing digitalization of client research and decision-making processes compels law firms to invest heavily in online marketing. Secondly, technological advancements, particularly in AI and data analytics, enable more effective targeting and measurable campaign results, proving the ROI of marketing investments. Economic growth and the corresponding increase in business transactions and individual legal needs also contribute significantly. Furthermore, evolving regulatory landscapes, while sometimes posing challenges, also create opportunities for specialized marketing expertise.

Challenges in the Law Firm Marketing Service Sector

The Law Firm Marketing Service sector faces several challenges that can impede growth. Strict ethical and regulatory compliance requirements for legal advertising can limit marketing strategies and increase complexity. Supply chain issues are less prominent in this service-based industry, but the reliance on technology vendors can present potential disruptions. Competitive pressures are immense, with a crowded market of agencies vying for a finite client base. Overcoming client skepticism regarding the effectiveness of marketing investments and demonstrating a clear, quantifiable return on investment remains a persistent hurdle. The cost of advanced marketing technologies can also be a barrier for smaller firms.

Emerging Opportunities in Law Firm Marketing Service

Emerging opportunities in the Law Firm Marketing Service market lie in leveraging new technologies and catering to evolving client preferences. The increasing adoption of AI for personalized client outreach and predictive analytics presents a significant avenue for innovation. The growing demand for niche legal services, such as data privacy law or cryptocurrency law, creates opportunities for specialized marketing strategies. Furthermore, the focus on client experience and retention is leading to increased demand for integrated marketing solutions that build long-term relationships. The expansion of video marketing and virtual consultations also offers new channels for client engagement.

Leading Players in the Law Firm Marketing Service Market

- LawRank

- Rankings.Io

- Kaleidico

- Comrade Digital Marketing Agency

- Thomson Reuters

- ILawyer Marketing

- Uptime Legal Systems

- ONE400

- Law Firm Marketing Pros

- Grow Law Firm

- LegalScapes

- NOMOS Marketing

- Scorpion

- MileMark Media, LLC

Key Developments in Law Firm Marketing Service Industry

- 2023/10: Increased adoption of AI-powered chatbots for initial client consultations, improving response times and lead qualification.

- 2024/02: Launch of advanced analytics dashboards offering real-time ROI tracking for digital marketing campaigns.

- 2024/06: Consolidation within the market with several acquisitions of smaller, specialized agencies by larger marketing firms.

- 2024/11: Growing emphasis on video marketing content, including client testimonials and firm overviews, to enhance client trust.

- 2025/01: Introduction of sophisticated CRM integrations designed to better manage the client journey from initial contact to case resolution.

Strategic Outlook for Law Firm Marketing Service Market

The strategic outlook for the Law Firm Marketing Service market is highly optimistic, driven by the undeniable shift towards digital client acquisition and the continuous evolution of marketing technologies. Firms that embrace data-driven strategies, leverage AI for personalization, and offer integrated online and offline marketing solutions will be best positioned for success. The increasing demand for measurable results and demonstrable ROI will continue to shape the services offered, pushing innovation in lead generation and client conversion. Strategic partnerships and a deep understanding of niche legal segments will also be crucial for sustained growth and competitive advantage.

Law Firm Marketing Service Segmentation

-

1. Application

- 1.1. Business Law Firm

- 1.2. Personal Injury Law Firm

- 1.3. Criminal Defense Law Firm

- 1.4. Others

-

2. Types

- 2.1. Online Marketing

- 2.2. Offline Marketing

- 2.3. Integrated Marketing

Law Firm Marketing Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Law Firm Marketing Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Law Firm Marketing Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Business Law Firm

- 5.1.2. Personal Injury Law Firm

- 5.1.3. Criminal Defense Law Firm

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Online Marketing

- 5.2.2. Offline Marketing

- 5.2.3. Integrated Marketing

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Law Firm Marketing Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Business Law Firm

- 6.1.2. Personal Injury Law Firm

- 6.1.3. Criminal Defense Law Firm

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Online Marketing

- 6.2.2. Offline Marketing

- 6.2.3. Integrated Marketing

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Law Firm Marketing Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Business Law Firm

- 7.1.2. Personal Injury Law Firm

- 7.1.3. Criminal Defense Law Firm

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Online Marketing

- 7.2.2. Offline Marketing

- 7.2.3. Integrated Marketing

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Law Firm Marketing Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Business Law Firm

- 8.1.2. Personal Injury Law Firm

- 8.1.3. Criminal Defense Law Firm

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Online Marketing

- 8.2.2. Offline Marketing

- 8.2.3. Integrated Marketing

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Law Firm Marketing Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Business Law Firm

- 9.1.2. Personal Injury Law Firm

- 9.1.3. Criminal Defense Law Firm

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Online Marketing

- 9.2.2. Offline Marketing

- 9.2.3. Integrated Marketing

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Law Firm Marketing Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Business Law Firm

- 10.1.2. Personal Injury Law Firm

- 10.1.3. Criminal Defense Law Firm

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Online Marketing

- 10.2.2. Offline Marketing

- 10.2.3. Integrated Marketing

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 LawRank

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rankings.Io

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kaleidico

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Comrade Digital Marketing Agency

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thomson Reuters

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ILawyer Marketing

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Uptime Legal Systems

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ONE400

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Law Firm Marketing Pros

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Grow Law Firm

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 LegalScapes

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 NOMOS Marketing

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Scorpion

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 MileMark Media

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 LLC

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 LawRank

List of Figures

- Figure 1: Global Law Firm Marketing Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Law Firm Marketing Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Law Firm Marketing Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Law Firm Marketing Service Revenue (million), by Types 2024 & 2032

- Figure 5: North America Law Firm Marketing Service Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Law Firm Marketing Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Law Firm Marketing Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Law Firm Marketing Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Law Firm Marketing Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Law Firm Marketing Service Revenue (million), by Types 2024 & 2032

- Figure 11: South America Law Firm Marketing Service Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Law Firm Marketing Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Law Firm Marketing Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Law Firm Marketing Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Law Firm Marketing Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Law Firm Marketing Service Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Law Firm Marketing Service Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Law Firm Marketing Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Law Firm Marketing Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Law Firm Marketing Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Law Firm Marketing Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Law Firm Marketing Service Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Law Firm Marketing Service Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Law Firm Marketing Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Law Firm Marketing Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Law Firm Marketing Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Law Firm Marketing Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Law Firm Marketing Service Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Law Firm Marketing Service Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Law Firm Marketing Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Law Firm Marketing Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Law Firm Marketing Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Law Firm Marketing Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Law Firm Marketing Service Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Law Firm Marketing Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Law Firm Marketing Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Law Firm Marketing Service Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Law Firm Marketing Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Law Firm Marketing Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Law Firm Marketing Service Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Law Firm Marketing Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Law Firm Marketing Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Law Firm Marketing Service Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Law Firm Marketing Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Law Firm Marketing Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Law Firm Marketing Service Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Law Firm Marketing Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Law Firm Marketing Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Law Firm Marketing Service Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Law Firm Marketing Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Law Firm Marketing Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Law Firm Marketing Service?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Law Firm Marketing Service?

Key companies in the market include LawRank, Rankings.Io, Kaleidico, Comrade Digital Marketing Agency, Thomson Reuters, ILawyer Marketing, Uptime Legal Systems, ONE400, Law Firm Marketing Pros, Grow Law Firm, LegalScapes, NOMOS Marketing, Scorpion, MileMark Media, LLC.

3. What are the main segments of the Law Firm Marketing Service?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Law Firm Marketing Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Law Firm Marketing Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Law Firm Marketing Service?

To stay informed about further developments, trends, and reports in the Law Firm Marketing Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence