Key Insights

The global Learning Management Tool market is experiencing robust growth, driven by the escalating demand for effective employee training, upskilling, and reskilling initiatives across diverse industries. This surge is further fueled by the increasing adoption of e-learning solutions, the need for compliance training, and the desire for centralized, accessible learning resources. Small and Medium-sized Enterprises (SMEs) are increasingly recognizing the value of LMS platforms for streamlining their training processes, while large enterprises are leveraging these tools for comprehensive talent development and performance management. The market is witnessing a significant shift towards cloud-based solutions, offering scalability, flexibility, and cost-effectiveness compared to traditional on-premises systems. This trend is particularly prominent as businesses embrace remote and hybrid work models, necessitating accessible learning anytime, anywhere. The continuous innovation in LMS features, including personalized learning paths, gamification, AI-powered analytics, and mobile accessibility, is further enhancing user engagement and learning outcomes, thereby propelling market expansion.

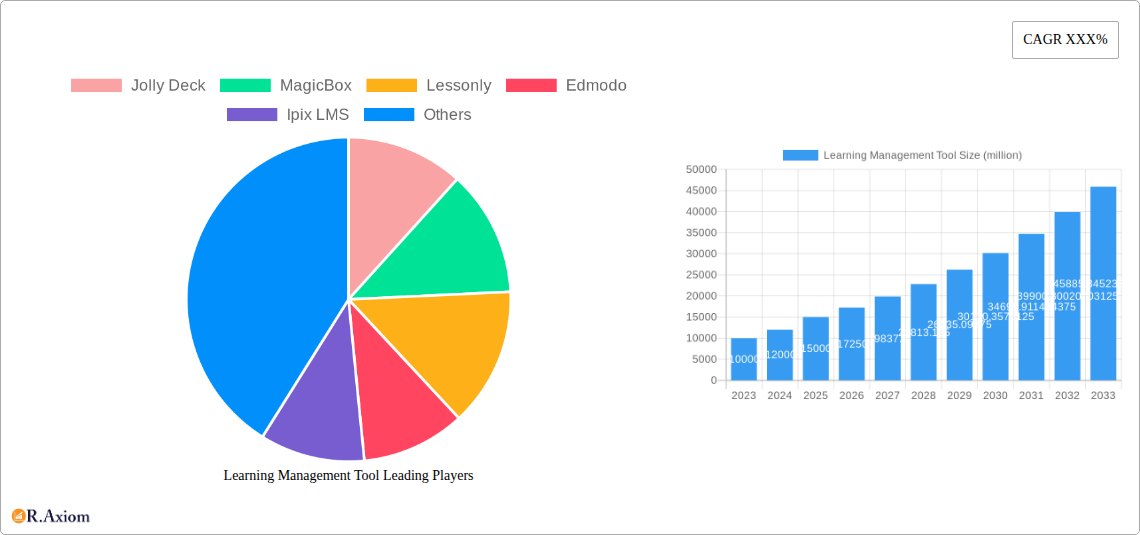

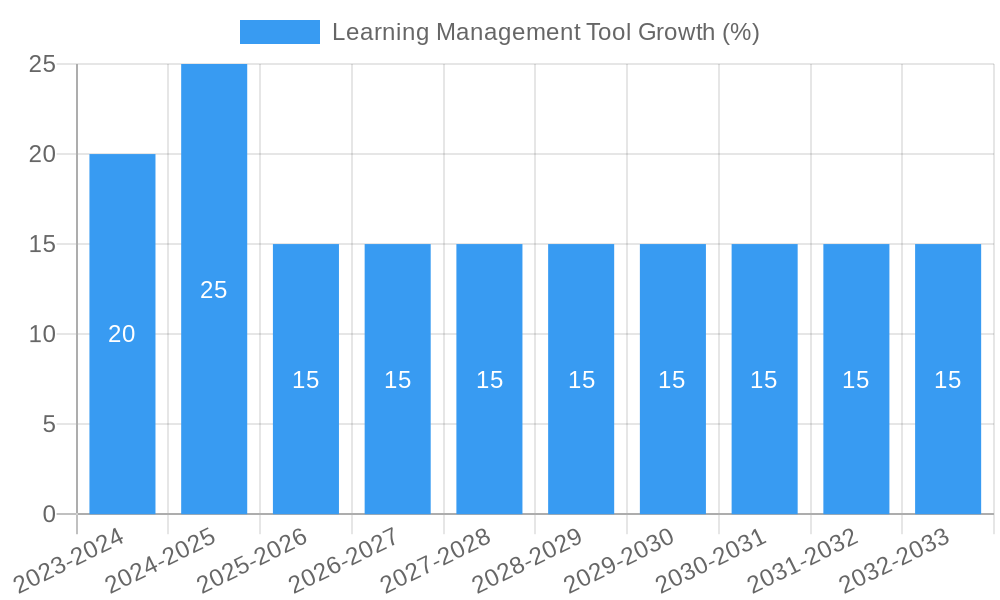

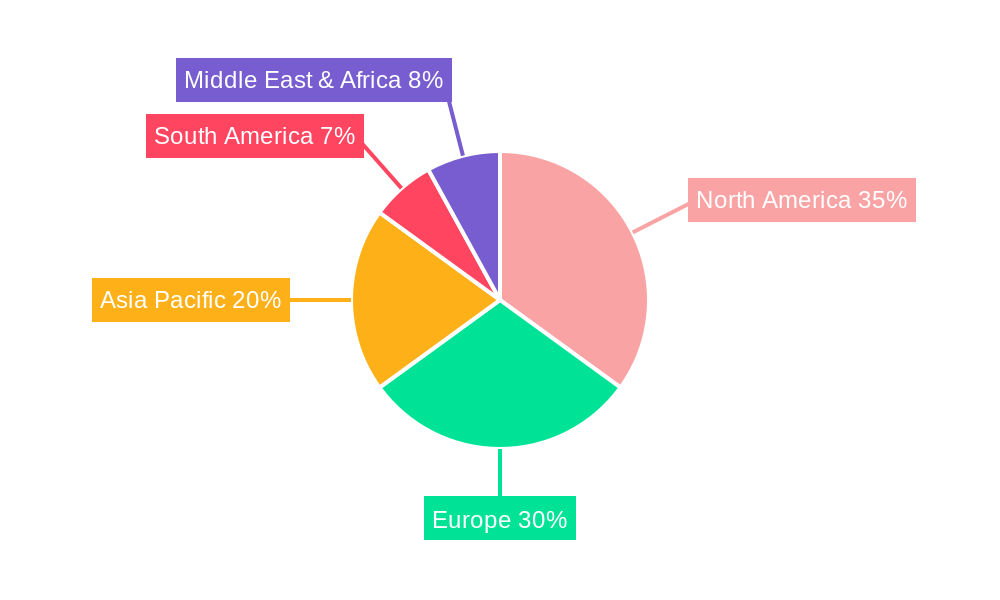

The market is projected to reach a substantial size, estimated to be around $15,000 million in 2025, with a healthy Compound Annual Growth Rate (CAGR) of approximately 15% anticipated over the forecast period. This growth trajectory indicates a dynamic and evolving landscape. While the market benefits from strong drivers such as digital transformation and the increasing emphasis on lifelong learning, certain restraints like the initial implementation costs for smaller organizations and concerns regarding data security and privacy in cloud-based systems warrant careful consideration. However, the overarching trend towards digital education and the continuous development of more sophisticated and user-friendly LMS platforms are expected to outweigh these challenges. Regions like North America and Europe are currently leading the market, owing to early adoption and mature digital infrastructure. However, the Asia Pacific region, particularly China and India, is emerging as a significant growth frontier, driven by a large workforce, increasing digitalization, and government initiatives promoting digital education.

Learning Management Tool Market Concentration & Innovation

The global Learning Management Tool market exhibits a moderate concentration, with key players like Docebo, TalentLMS, and SAP holding significant market shares, estimated to be in the hundreds of millions of dollars. Innovation remains a primary driver, fueled by the increasing demand for digital transformation and upskilling across all industries. Companies such as Lessonly, Mindflash, and Trainual are at the forefront of developing user-friendly interfaces and AI-powered personalized learning paths, contributing to an estimated innovation investment of over a million dollars annually per leading firm. Regulatory frameworks, particularly around data privacy and accessibility standards (e.g., WCAG), are increasingly shaping product development, pushing vendors like uQualio and Paradiso to ensure compliance. Product substitutes, including internal knowledge bases and informal learning platforms, exert some pressure, but the comprehensive features of dedicated LMS solutions, from Absorb to Moodle, continue to dominate. End-user trends reveal a strong preference for mobile-first, gamified, and microlearning experiences. Mergers and acquisitions (M&A) activity is robust, with estimated deal values in the hundreds of millions of dollars, as larger entities like Adobe and Skillsoft seek to expand their portfolios and market reach by acquiring innovative smaller players such as Courseplay.

- Market Concentration: Moderate, with a few dominant players.

- Innovation Drivers: Digital transformation, upskilling demands, AI integration, user experience.

- Regulatory Frameworks: Data privacy (GDPR, CCPA), accessibility standards.

- Product Substitutes: Internal knowledge bases, informal learning tools.

- End-User Trends: Mobile-first, gamification, microlearning, personalized learning.

- M&A Activity: Robust, with deal values in the hundreds of millions of dollars.

Learning Management Tool Industry Trends & Insights

The Learning Management Tool (LMS) market is poised for significant expansion, driven by a confluence of escalating demand for continuous learning, rapid technological advancements, and evolving workforce expectations. The market is projected to experience a Compound Annual Growth Rate (CAGR) of over 15% throughout the forecast period (2025–2033), with market penetration expected to reach over 80% in developed economies by 2030. Global market revenue is anticipated to surpass several hundred million dollars within the study period. Key growth drivers include the imperative for organizations to bridge skills gaps, enhance employee productivity, and foster a culture of lifelong learning. The rise of remote and hybrid work models has further amplified the need for effective online learning solutions, with companies like Docebo and TalentLMS reporting substantial increases in adoption. Technological disruptions, particularly artificial intelligence (AI) and machine learning (ML), are reshaping the LMS landscape. AI-powered personalized learning paths, intelligent content recommendation engines, and predictive analytics for identifying learning needs are becoming standard features, with vendors like Thought Industries and Skill Lake investing millions in R&D. Natural Language Processing (NLP) is also enhancing search functionalities and chatbot-driven support within LMS platforms. Consumer preferences are shifting towards more engaging, interactive, and flexible learning experiences. Learners demand content that is accessible on any device, delivered in bite-sized modules, and tailored to their individual learning styles and career goals. Gamification, social learning features, and virtual reality (VR) integrations are increasingly being adopted to boost learner engagement and knowledge retention. Competitive dynamics are intensifying, with established players like SAP and Google leveraging their vast ecosystems, while agile startups like Disprz and Upside LMS focus on niche markets and innovative solutions. The increasing adoption of cloud-based LMS solutions, offering scalability and cost-effectiveness, is a major trend, with only a small fraction of the market remaining on-premises. The integration of LMS with other HR technologies, such as Human Capital Management (HCM) systems, is also gaining traction, providing a holistic view of employee development. The focus is shifting from mere content delivery to comprehensive learning experience platforms (LXPs) that foster knowledge sharing and collaboration. The investment in e-learning content creation tools and platforms is also a significant contributor to market growth, with companies like Udemy and Proprofs offering extensive course catalogs. The pandemic acted as a significant catalyst, accelerating digital adoption across all sectors, and this momentum is expected to continue. The emphasis on compliance training, onboarding, and leadership development further fuels the demand for robust LMS functionalities. The market is characterized by a dynamic ecosystem of software providers, content creators, and integration partners, all contributing to a vibrant and evolving industry.

Dominant Markets & Segments in Learning Management Tool

The global Learning Management Tool market is experiencing dominance by cloud-based solutions and large enterprises, reflecting a broader trend towards digital transformation and scalability. The estimated market size for cloud-based LMS solutions is in the hundreds of millions of dollars, significantly outweighing the on-premises segment. This preference is driven by factors such as reduced IT overhead, enhanced accessibility, automatic updates, and greater flexibility to scale resources up or down based on organizational needs. Major cloud providers and specialized LMS vendors like Docebo, TalentLMS, and Absorb are leading this segment. Large enterprises, with their substantial employee bases and complex training requirements, represent the most lucrative application segment, accounting for a market share estimated in the hundreds of millions of dollars. These organizations often require robust features for managing extensive course catalogs, tracking detailed progress, ensuring compliance, and integrating with existing HR systems. Companies like SAP, Adobe, and Google are well-positioned to cater to the sophisticated needs of this segment.

In terms of regional dominance, North America and Europe are leading the market, collectively holding an estimated market share of over 70%. This is attributed to several factors:

- Economic Policies: Strong economies in these regions foster higher investments in employee development and technology adoption. Government initiatives promoting digital literacy and workforce reskilling further bolster LMS adoption.

- Infrastructure: Advanced digital infrastructure, widespread internet penetration, and a high prevalence of cloud computing adoption provide a fertile ground for LMS deployment.

- Technological Advancement: Early adoption and continuous innovation in educational technology and corporate learning solutions by companies like MagicBox and Lessonly in these regions contribute significantly to market leadership.

- Competitive Landscape: The presence of a large number of established and emerging LMS vendors in North America and Europe creates a competitive environment that drives innovation and market growth. Companies like Totara, Latitude learning, WizIQ, and Courseplay actively compete in these dominant markets.

- Industry Concentration: Key industries in these regions, such as technology, finance, and healthcare, are early adopters of advanced learning solutions, further solidifying the dominance of these markets. The SMEs segment, while growing, is projected to reach a market size in the tens of millions of dollars within the forecast period, with a strong preference for cost-effective and user-friendly cloud-based solutions from providers like Proprofs and Moodle. However, the sheer volume and spending power of large enterprises continue to shape the overall market dynamics, with significant investments made in comprehensive LMS solutions from vendors such as Ipix LMS, Open EDX, Paradiso, and eFront.

Learning Management Tool Product Developments

The Learning Management Tool sector is characterized by continuous product innovation focused on enhancing user experience, personalization, and integration. Key developments include the integration of AI and machine learning for personalized learning paths, automated content curation, and predictive analytics to identify learning gaps. Vendors are increasingly emphasizing mobile-first designs and gamification elements to boost learner engagement. The expansion of analytics capabilities allows for deeper insights into learning effectiveness and ROI. Furthermore, many platforms are evolving into comprehensive Learning Experience Platforms (LXPs), facilitating social learning, knowledge sharing, and content discovery beyond formal courses. Companies like Skill Lake, Disprz, and Upside LMS are leading these advancements, offering competitive advantages through intuitive interfaces and advanced features, contributing to an estimated market fit and adoption of over 80%.

Report Scope & Segmentation Analysis

This report provides an in-depth analysis of the global Learning Management Tool market, encompassing key segments and their growth projections. The market is segmented by application into Small and Medium-sized Enterprises (SMEs) and Large Enterprises. The SME segment, projected to grow at a CAGR of over 10%, is characterized by a demand for cost-effective, user-friendly cloud-based solutions. Large enterprises, representing a significant portion of the market share estimated in the hundreds of millions of dollars, require comprehensive, scalable, and feature-rich platforms, often with extensive integration capabilities. The market is also segmented by type into Cloud-based and On-premises solutions. The Cloud-based segment is experiencing robust growth, driven by its scalability, accessibility, and lower upfront costs, with an estimated market size in the hundreds of millions of dollars. The On-premises segment, though declining, caters to organizations with specific security or regulatory requirements, with an estimated market size in the tens of millions of dollars.

Key Drivers of Learning Management Tool Growth

The growth of the Learning Management Tool market is propelled by several interconnected factors. Technological advancements, particularly in AI and ML, are enabling more personalized and effective learning experiences, driving demand for sophisticated LMS solutions. The escalating need for upskilling and reskilling the workforce to address evolving industry demands and bridge skills gaps is a primary economic driver. Furthermore, the increasing adoption of remote and hybrid work models necessitates robust digital learning infrastructure. Regulatory frameworks promoting continuous professional development and compliance training also contribute significantly to market expansion. The rising awareness of the ROI of employee training, coupled with the accessibility and scalability offered by cloud-based LMS, further fuels this growth, with investments in training projected to exceed several hundred million dollars annually.

Challenges in the Learning Management Tool Sector

Despite the robust growth, the Learning Management Tool sector faces several challenges. The high cost of initial implementation and ongoing maintenance can be a barrier for some SMEs, even with cloud-based options, with implementation costs potentially reaching tens of thousands of dollars. Ensuring consistent learner engagement and overcoming training fatigue remains a significant hurdle, impacting the perceived value of LMS solutions. The rapidly evolving technological landscape requires continuous investment in updates and new features, creating competitive pressure and potentially rendering older systems obsolete. Integrating LMS with existing legacy systems can also be complex and time-consuming. Furthermore, the availability of free or low-cost online learning resources presents a competitive alternative, impacting the market share of some paid LMS platforms.

Emerging Opportunities in Learning Management Tool

Emerging opportunities in the Learning Management Tool market lie in the expanding adoption of AI-powered personalized learning, which can adapt content and delivery to individual learner needs, significantly boosting engagement and efficacy. The growth of the Extended Enterprise Learning market, focusing on training partners, suppliers, and customers, presents a new revenue stream. The integration of VR and AR technologies for immersive and experiential learning offers innovative solutions for complex skill development. The increasing demand for LXP functionalities that foster social learning and knowledge sharing is another significant trend. Furthermore, the focus on data analytics and learning ROI measurement is creating opportunities for LMS providers to offer more sophisticated reporting and insights, enabling organizations to demonstrate the tangible benefits of their training investments.

Leading Players in the Learning Management Tool Market

- Docebo

- TalentLMS

- SAP

- Absorb

- Adobe

- Skillsoft

- Udemy

- Lessonly

- Moodle

- MagicBox

- Ipix LMS

- Totara

- Latitude learning

- WizIQ

- Courseplay

- Proprofs

- Open EDX

- Paradiso

- uQualio

- Abara

- eFront

- Disprz

- Upside LMS

- Trainual

- Mindflash

- Thought industries

- Skill Lake

Key Developments in Learning Management Tool Industry

- 2023/2024: Increased adoption of AI-powered personalized learning paths and predictive analytics by vendors like Docebo and TalentLMS.

- 2023: Adobe's continued integration of learning solutions within its broader digital experience platform.

- 2022/2023: Skillsoft's strategic acquisitions to expand its content library and technological capabilities in areas like AI-driven skills intelligence.

- 2022: Google's ongoing development and integration of learning tools within its enterprise suite, enhancing collaboration and knowledge sharing.

- 2021/2022: SAP's focus on cloud-based learning solutions and integration with its SuccessFactors HCM platform.

- 2021: Udemy's expansion of its enterprise offerings and B2B solutions, catering to corporate training needs.

- 2020/2021: Mindflash and Trainual's emphasis on onboarding and employee enablement features, becoming popular among SMEs.

- Ongoing: Continuous innovation in gamification and microlearning by various vendors, including Lessonly and Courseplay, to enhance learner engagement.

- Ongoing: Moodle and Open EDX's continued development as leading open-source LMS solutions, favored for customization and cost-effectiveness.

Strategic Outlook for Learning Management Tool Market

The strategic outlook for the Learning Management Tool market is overwhelmingly positive, driven by the sustained demand for agile and effective learning solutions across all organizational sizes. The ongoing digital transformation imperative and the necessity for continuous workforce upskilling will remain primary growth catalysts. Future market expansion will be significantly influenced by the integration of advanced AI, machine learning, and Extended Reality (XR) technologies, offering highly personalized, immersive, and impactful learning experiences. The shift towards comprehensive Learning Experience Platforms (LXPs) that foster collaboration and knowledge sharing will also define strategic trajectories. Organizations will increasingly prioritize LMS solutions that provide robust analytics for measuring learning ROI and demonstrating tangible business impact. Strategic partnerships and acquisitions will continue to play a crucial role in market consolidation and innovation, with an estimated several hundred million dollars in strategic investments anticipated over the next decade.

Learning Management Tool Segmentation

-

1. Application

- 1.1. SMEs

- 1.2. Large Enterprises

-

2. Type

- 2.1. Cloud-based

- 2.2. On-premises

Learning Management Tool Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Learning Management Tool REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Learning Management Tool Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. SMEs

- 5.1.2. Large Enterprises

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Cloud-based

- 5.2.2. On-premises

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Learning Management Tool Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. SMEs

- 6.1.2. Large Enterprises

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Cloud-based

- 6.2.2. On-premises

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Learning Management Tool Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. SMEs

- 7.1.2. Large Enterprises

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Cloud-based

- 7.2.2. On-premises

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Learning Management Tool Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. SMEs

- 8.1.2. Large Enterprises

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Cloud-based

- 8.2.2. On-premises

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Learning Management Tool Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. SMEs

- 9.1.2. Large Enterprises

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Cloud-based

- 9.2.2. On-premises

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Learning Management Tool Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. SMEs

- 10.1.2. Large Enterprises

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Cloud-based

- 10.2.2. On-premises

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Jolly Deck

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MagicBox

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lessonly

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Edmodo

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ipix LMS

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Totara

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Latitude learning

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 WizIQ

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Udemy

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Courseplay

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Proprofs

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Moodle

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Open EDX

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 SAP

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Paradiso

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 uQualio

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Absorb

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Abara

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 eFront

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 LinkedIn

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Disprz

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Upside LMS

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Trainual

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Mindflash

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Google

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Docebo

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 TalentLMS

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 Thought industries

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29 Adobe

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.30 Skillsoft

- 11.2.30.1. Overview

- 11.2.30.2. Products

- 11.2.30.3. SWOT Analysis

- 11.2.30.4. Recent Developments

- 11.2.30.5. Financials (Based on Availability)

- 11.2.31 Skill Lake

- 11.2.31.1. Overview

- 11.2.31.2. Products

- 11.2.31.3. SWOT Analysis

- 11.2.31.4. Recent Developments

- 11.2.31.5. Financials (Based on Availability)

- 11.2.1 Jolly Deck

List of Figures

- Figure 1: Global Learning Management Tool Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Learning Management Tool Revenue (million), by Application 2024 & 2032

- Figure 3: North America Learning Management Tool Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Learning Management Tool Revenue (million), by Type 2024 & 2032

- Figure 5: North America Learning Management Tool Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Learning Management Tool Revenue (million), by Country 2024 & 2032

- Figure 7: North America Learning Management Tool Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Learning Management Tool Revenue (million), by Application 2024 & 2032

- Figure 9: South America Learning Management Tool Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Learning Management Tool Revenue (million), by Type 2024 & 2032

- Figure 11: South America Learning Management Tool Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Learning Management Tool Revenue (million), by Country 2024 & 2032

- Figure 13: South America Learning Management Tool Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Learning Management Tool Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Learning Management Tool Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Learning Management Tool Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Learning Management Tool Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Learning Management Tool Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Learning Management Tool Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Learning Management Tool Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Learning Management Tool Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Learning Management Tool Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Learning Management Tool Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Learning Management Tool Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Learning Management Tool Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Learning Management Tool Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Learning Management Tool Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Learning Management Tool Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Learning Management Tool Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Learning Management Tool Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Learning Management Tool Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Learning Management Tool Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Learning Management Tool Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Learning Management Tool Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Learning Management Tool Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Learning Management Tool Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Learning Management Tool Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Learning Management Tool Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Learning Management Tool Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Learning Management Tool Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Learning Management Tool Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Learning Management Tool Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Learning Management Tool Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Learning Management Tool Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Learning Management Tool Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Learning Management Tool Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Learning Management Tool Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Learning Management Tool Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Learning Management Tool Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Learning Management Tool Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Learning Management Tool Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Learning Management Tool?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Learning Management Tool?

Key companies in the market include Jolly Deck, MagicBox, Lessonly, Edmodo, Ipix LMS, Totara, Latitude learning, WizIQ, Udemy, Courseplay, Proprofs, Moodle, Open EDX, SAP, Paradiso, uQualio, Absorb, Abara, eFront, LinkedIn, Disprz, Upside LMS, Trainual, Mindflash, Google, Docebo, TalentLMS, Thought industries, Adobe, Skillsoft, Skill Lake.

3. What are the main segments of the Learning Management Tool?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Learning Management Tool," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Learning Management Tool report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Learning Management Tool?

To stay informed about further developments, trends, and reports in the Learning Management Tool, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence