Key Insights

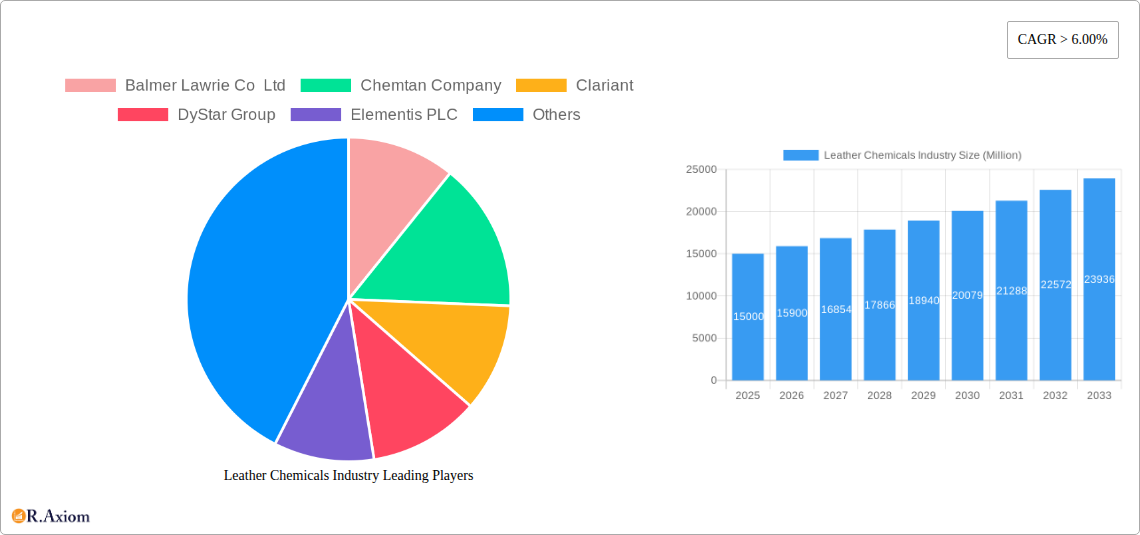

The global leather chemicals market is experiencing robust growth, driven by increasing demand from the footwear, apparel, and automotive industries. A Compound Annual Growth Rate (CAGR) exceeding 6% from 2019 to 2033 signifies a significant expansion, with the market expected to reach substantial value by 2033. This growth is fueled by several factors, including the rising global population and increasing disposable incomes leading to greater consumer spending on leather goods. Furthermore, advancements in leather processing technologies and the development of eco-friendly and sustainable leather chemicals are contributing to market expansion. Key segments within the market likely include tanning agents, retanning agents, dyeing agents, and finishing agents, each contributing to the overall growth trajectory. The competitive landscape is marked by both established multinational corporations and smaller regional players, highlighting the opportunities for both consolidation and innovation within the industry. While specific regional data is not provided, it is reasonable to assume significant market presence in regions with established leather manufacturing hubs like Asia, particularly India and China, as well as regions with strong consumer demand for leather goods, such as Europe and North America. The continued growth potential is tempered by factors such as stringent environmental regulations and fluctuations in raw material prices, requiring companies to adopt sustainable practices and efficient supply chain management strategies to maintain profitability and competitiveness.

Leather Chemicals Industry Market Size (In Billion)

The presence of major players like Balmer Lawrie, Clariant, and Stahl International BV indicates a high level of industry maturity and competition. These companies’ ongoing investments in research and development are likely focused on creating more sustainable and high-performance leather chemicals. The market is also likely seeing increased demand for specialized chemicals catering to specific leather types and applications, further driving innovation. Future growth will depend on factors such as the adoption of new technologies, changes in consumer preferences (e.g., toward vegan leather alternatives, although this remains a niche sector), and global economic conditions. However, the overall outlook for the leather chemicals market remains positive, with strong potential for continued expansion throughout the forecast period.

Leather Chemicals Industry Company Market Share

Leather Chemicals Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Leather Chemicals Industry, offering valuable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market dynamics, growth drivers, challenges, and emerging opportunities, providing actionable intelligence for strategic decision-making. The report projects a market size of xx Million by 2033, showcasing significant growth potential.

Leather Chemicals Industry Market Concentration & Innovation

The Leather Chemicals industry exhibits a moderately concentrated market structure, with several multinational corporations and specialized companies holding significant market share. Key players such as Clariant, Lanxess, and Stahl International BV account for a combined xx% of the market, while smaller, regional players compete fiercely for niche segments. Innovation is driven by the increasing demand for sustainable and high-performance leather chemicals, coupled with stringent environmental regulations.

- Market Share: Clariant (xx%), Lanxess (xx%), Stahl International BV (xx%), Others (xx%).

- M&A Activity: The industry has witnessed several mergers and acquisitions in recent years, primarily focused on expanding product portfolios and geographical reach. Total M&A deal value over the historical period (2019-2024) is estimated at xx Million. Key drivers for M&A include access to new technologies, expansion into new markets, and vertical integration within the supply chain.

- Regulatory Frameworks: Stringent environmental regulations, particularly concerning the use of hazardous chemicals, are shaping industry innovation and driving the development of eco-friendly alternatives. The ZDHC MRSL (Manufacturing Restricted Substances List) plays a significant role in guiding responsible chemical sourcing and usage.

- Product Substitutes: The emergence of bio-based and recycled materials presents a growing challenge to traditional leather chemicals, demanding continuous innovation and adaptation to maintain market share.

- End-User Trends: The increasing preference for sustainable and ethically sourced leather products influences the demand for eco-friendly leather chemicals.

- Innovation Drivers: Growing demand for improved leather quality, enhanced durability, and environmentally friendly processing methods.

Leather Chemicals Industry Industry Trends & Insights

The Leather Chemicals industry is experiencing steady growth, driven by increasing global leather production and a rising demand for high-quality leather goods. The market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors: a growing middle class in developing economies, rising disposable incomes leading to increased consumer spending on luxury and fashion goods, and technological advancements in leather processing techniques.

Technological disruptions, such as the adoption of advanced chemical formulations and efficient manufacturing processes, are enhancing the quality and performance of leather products. Consumer preferences are shifting towards sustainable and ethically produced leather, prompting manufacturers to adopt eco-friendly practices and develop greener chemical alternatives. The competitive landscape is characterized by intense competition among established players and the emergence of new entrants offering innovative solutions. Market penetration of sustainable leather chemicals is gradually increasing, driven by regulatory pressures and consumer demand.

Dominant Markets & Segments in Leather Chemicals Industry

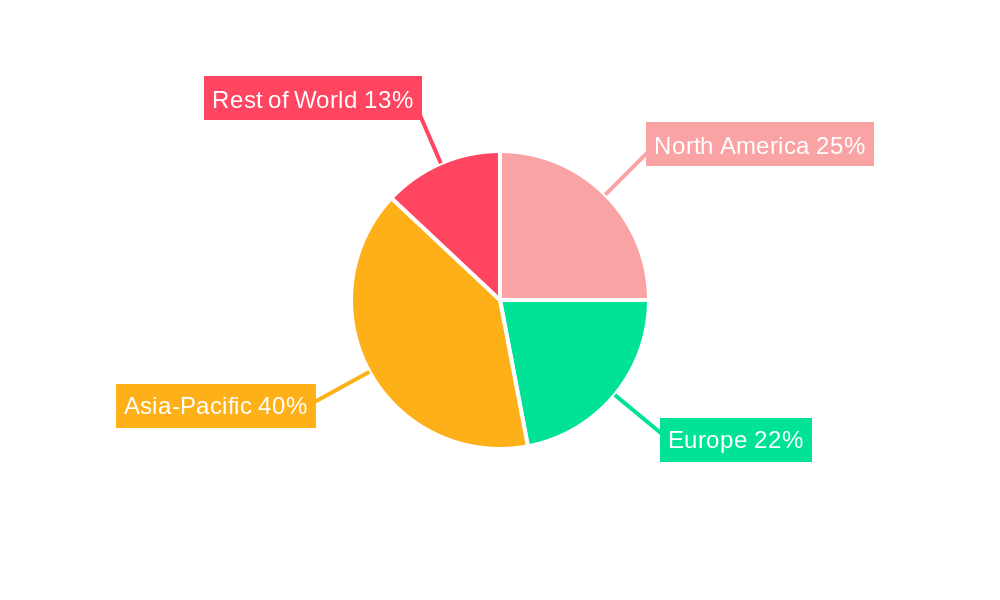

The Asia-Pacific region dominates the global leather chemicals market, driven by the significant concentration of leather manufacturing activities in countries like China, India, and Vietnam. China remains the largest market, accounting for xx% of the global demand in 2025.

Key Drivers of China's Dominance:

- Large and growing leather industry.

- Abundant raw material supply.

- Favorable government policies supporting manufacturing.

- Extensive infrastructure for leather processing and trade.

Other Significant Markets: Europe and North America also represent significant markets for leather chemicals, driven by high consumer demand for high-quality leather goods and the presence of established leather manufacturers. Growth in these regions is influenced by factors such as changing consumer preferences, economic growth, and technological advancements. However, the market share of these regions is comparatively smaller than that of Asia-Pacific, with Europe representing xx% and North America representing xx% of the global market in 2025.

Leather Chemicals Industry Product Developments

Recent product innovations in the leather chemicals industry have focused on developing sustainable and high-performance products that meet the evolving needs of the leather industry. This includes the introduction of bio-based alternatives to traditional chemicals, improved wet-end chemicals that enhance leather quality, and the development of innovative finishing agents that improve leather durability and appearance. These advancements are driven by the need to comply with environmental regulations and meet consumer demand for eco-friendly products. The market is witnessing a shift towards water-based and solvent-free formulations to minimize environmental impact.

Report Scope & Segmentation Analysis

This report segments the leather chemicals market based on various factors including chemical type (retanning agents, finishing agents, dyeing agents, etc.), application (garment leather, automotive leather, furniture leather, etc.), and geography (North America, Europe, Asia-Pacific, etc.). Each segment provides granular analysis of the market size, growth potential, and competitive landscape.

- By Chemical Type: Retanning agents are projected to be the largest segment by value, driven by their critical role in leather production. The finishing agents segment is experiencing considerable growth due to increasing demand for high-quality leather finishes.

- By Application: The garment leather segment accounts for the largest share in terms of consumption volume. The automotive leather segment is showing significant growth potential due to rising vehicle production globally.

- By Geography: The Asia-Pacific region is expected to remain the largest market throughout the forecast period.

Key Drivers of Leather Chemicals Industry Growth

The Leather Chemicals industry's growth is driven by several key factors:

- Technological advancements: The development of eco-friendly and high-performance leather chemicals is driving growth.

- Economic growth: Rising disposable incomes and increased consumer spending on leather products fuel market expansion.

- Stringent environmental regulations: Growing awareness of environmental concerns is pushing manufacturers to adopt more sustainable chemical solutions. For example, the ZDHC MRSL encourages the use of environmentally responsible leather chemicals.

Challenges in the Leather Chemicals Industry Sector

The Leather Chemicals industry faces several challenges including:

- Stringent environmental regulations: Compliance with increasingly strict environmental regulations requires significant investments in R&D and new technologies. The non-compliance with these regulations may lead to financial penalties.

- Supply chain disruptions: Global supply chain disruptions can impact the availability of raw materials and increase production costs.

- Intense competition: The competitive landscape is intense, with several established players vying for market share. This competition forces the businesses to implement efficient cost-cutting measures and aggressive marketing strategies.

Emerging Opportunities in Leather Chemicals Industry

Several emerging opportunities exist within the Leather Chemicals industry:

- Growing demand for sustainable leather chemicals: The increasing consumer preference for eco-friendly products creates significant opportunities for manufacturers offering sustainable alternatives.

- Expansion into emerging markets: Rapid economic growth in several emerging economies presents a significant opportunity for market expansion.

- Technological innovations: The ongoing development of new technologies, such as bio-based chemicals, offers opportunities for growth and innovation.

Leading Players in the Leather Chemicals Industry Market

- Balmer Lawrie Co Ltd

- Chemtan Company

- Clariant

- DyStar Group

- Elementis PLC

- Indofil Industries Ltd

- Lanxess

- Papertex Specialty Chemicals Pvt Ltd

- Schill Seilacher GmbH Co

- Stahl International BV

- TASA Group International

- TEXAPEL

- Zschimmer Schwarz Co KG

Key Developments in Leather Chemicals Industry Industry

- October 2022: Chem-MAP announced that Texapel received ZDHC Level 3 certification for its leather chemicals. This signifies a commitment to sustainability and aligns with the industry's growing focus on environmental responsibility.

- January 2023: LANXESS and TotalEnergies partnered to supply bio-circular styrene, enhancing the sustainability of leather chemical production and offering customers eco-friendly raw materials.

Strategic Outlook for Leather Chemicals Industry Market

The Leather Chemicals industry is poised for continued growth, driven by the increasing demand for high-quality leather products and the rising adoption of sustainable practices. The focus on developing innovative, eco-friendly solutions will be crucial for success. Companies that invest in R&D, adopt sustainable manufacturing practices, and strategically expand into emerging markets are expected to gain a competitive advantage. The market shows immense potential for growth in the coming years, driven by a combination of economic development, technological advancements, and an increasing awareness of environmental sustainability.

Leather Chemicals Industry Segmentation

-

1. Product Type

- 1.1. Tanning and Dyeing Chemicals

- 1.2. Beam House Chemicals

- 1.3. Finishing Chemicals

-

2. End-user Industry

- 2.1. Footwear

- 2.2. Furniture

- 2.3. Automotive

- 2.4. Textile & Fashion

- 2.5. Other End-user Industries

Leather Chemicals Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Spain

- 3.6. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Leather Chemicals Industry Regional Market Share

Geographic Coverage of Leather Chemicals Industry

Leather Chemicals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Footwear and Textile Industries in Asia-Pacific; Increasing Demand for Automotive Upholstery

- 3.3. Market Restrains

- 3.3.1. Growing Footwear and Textile Industries in Asia-Pacific; Increasing Demand for Automotive Upholstery

- 3.4. Market Trends

- 3.4.1. Textile Industry to Witness Higher Potential Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Leather Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Tanning and Dyeing Chemicals

- 5.1.2. Beam House Chemicals

- 5.1.3. Finishing Chemicals

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Footwear

- 5.2.2. Furniture

- 5.2.3. Automotive

- 5.2.4. Textile & Fashion

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Asia Pacific Leather Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Tanning and Dyeing Chemicals

- 6.1.2. Beam House Chemicals

- 6.1.3. Finishing Chemicals

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Footwear

- 6.2.2. Furniture

- 6.2.3. Automotive

- 6.2.4. Textile & Fashion

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. North America Leather Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Tanning and Dyeing Chemicals

- 7.1.2. Beam House Chemicals

- 7.1.3. Finishing Chemicals

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Footwear

- 7.2.2. Furniture

- 7.2.3. Automotive

- 7.2.4. Textile & Fashion

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Leather Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Tanning and Dyeing Chemicals

- 8.1.2. Beam House Chemicals

- 8.1.3. Finishing Chemicals

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Footwear

- 8.2.2. Furniture

- 8.2.3. Automotive

- 8.2.4. Textile & Fashion

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Leather Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Tanning and Dyeing Chemicals

- 9.1.2. Beam House Chemicals

- 9.1.3. Finishing Chemicals

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Footwear

- 9.2.2. Furniture

- 9.2.3. Automotive

- 9.2.4. Textile & Fashion

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East Leather Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Tanning and Dyeing Chemicals

- 10.1.2. Beam House Chemicals

- 10.1.3. Finishing Chemicals

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Footwear

- 10.2.2. Furniture

- 10.2.3. Automotive

- 10.2.4. Textile & Fashion

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Saudi Arabia Leather Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Tanning and Dyeing Chemicals

- 11.1.2. Beam House Chemicals

- 11.1.3. Finishing Chemicals

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Footwear

- 11.2.2. Furniture

- 11.2.3. Automotive

- 11.2.4. Textile & Fashion

- 11.2.5. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Balmer Lawrie Co Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Chemtan Company

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Clariant

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 DyStar Group

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Elementis PLC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Indofil Industries Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Lanxess

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Papertex Specialty Chemicals Pvt Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Schill Seilacher GmbH Co

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Stahl International BV

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 TASA Group International

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 TEXAPEL

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Zschimmer Schwarz Co KG*List Not Exhaustive

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Balmer Lawrie Co Ltd

List of Figures

- Figure 1: Global Leather Chemicals Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Leather Chemicals Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: Asia Pacific Leather Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Asia Pacific Leather Chemicals Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Leather Chemicals Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Leather Chemicals Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific Leather Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Leather Chemicals Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 9: North America Leather Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: North America Leather Chemicals Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: North America Leather Chemicals Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Leather Chemicals Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Leather Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Leather Chemicals Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Europe Leather Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Leather Chemicals Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Europe Leather Chemicals Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Leather Chemicals Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Leather Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Leather Chemicals Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: South America Leather Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Leather Chemicals Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: South America Leather Chemicals Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Leather Chemicals Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Leather Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Leather Chemicals Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: Middle East Leather Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East Leather Chemicals Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 29: Middle East Leather Chemicals Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East Leather Chemicals Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East Leather Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Saudi Arabia Leather Chemicals Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 33: Saudi Arabia Leather Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: Saudi Arabia Leather Chemicals Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 35: Saudi Arabia Leather Chemicals Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 36: Saudi Arabia Leather Chemicals Industry Revenue (undefined), by Country 2025 & 2033

- Figure 37: Saudi Arabia Leather Chemicals Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Leather Chemicals Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Leather Chemicals Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Leather Chemicals Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Leather Chemicals Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Global Leather Chemicals Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Leather Chemicals Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: India Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Japan Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: South Korea Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Leather Chemicals Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 13: Global Leather Chemicals Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Leather Chemicals Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United States Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Mexico Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Leather Chemicals Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 19: Global Leather Chemicals Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Leather Chemicals Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Germany Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Italy Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: France Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Spain Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Global Leather Chemicals Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 28: Global Leather Chemicals Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 29: Global Leather Chemicals Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Brazil Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Argentina Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Rest of South America Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Global Leather Chemicals Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 34: Global Leather Chemicals Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Leather Chemicals Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Global Leather Chemicals Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 37: Global Leather Chemicals Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 38: Global Leather Chemicals Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 39: South Africa Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Leather Chemicals Industry?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the Leather Chemicals Industry?

Key companies in the market include Balmer Lawrie Co Ltd, Chemtan Company, Clariant, DyStar Group, Elementis PLC, Indofil Industries Ltd, Lanxess, Papertex Specialty Chemicals Pvt Ltd, Schill Seilacher GmbH Co, Stahl International BV, TASA Group International, TEXAPEL, Zschimmer Schwarz Co KG*List Not Exhaustive.

3. What are the main segments of the Leather Chemicals Industry?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Footwear and Textile Industries in Asia-Pacific; Increasing Demand for Automotive Upholstery.

6. What are the notable trends driving market growth?

Textile Industry to Witness Higher Potential Growth.

7. Are there any restraints impacting market growth?

Growing Footwear and Textile Industries in Asia-Pacific; Increasing Demand for Automotive Upholstery.

8. Can you provide examples of recent developments in the market?

January 2023: LANXESS and TotalEnergies entered into a cooperation on the supply of bio-circular styrene. By partnering with TotalEnergies, the company can offer its customers sustainable solutions and raw materials with a low carbon footprint.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Leather Chemicals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Leather Chemicals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Leather Chemicals Industry?

To stay informed about further developments, trends, and reports in the Leather Chemicals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence