Key Insights

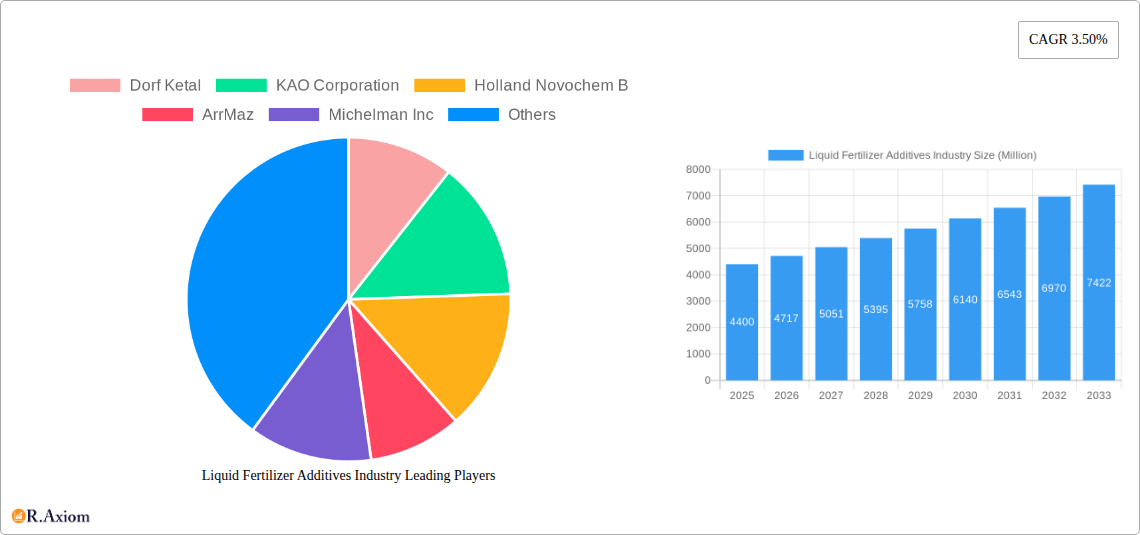

The global Liquid Fertilizer Additives market is poised for significant expansion, projected to reach USD 4.4 billion in 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 7.1% through 2033. This upward trajectory is primarily fueled by the increasing demand for enhanced crop yields and improved nutrient uptake efficiency in agriculture. Modern farming practices are increasingly adopting liquid fertilizers due to their ease of application, precise nutrient delivery, and reduced environmental impact compared to granular alternatives. Consequently, the market for additives that further optimize these benefits, such as solubility enhancers, stabilizers, anti-foaming agents, and micronutrient chelates, is experiencing substantial growth. The emphasis on sustainable agriculture and food security, especially in rapidly developing economies, acts as a potent driver for this market. Furthermore, advancements in formulation technology are leading to the development of more sophisticated and effective liquid fertilizer additives, catering to specific crop needs and soil conditions.

Liquid Fertilizer Additives Industry Market Size (In Billion)

The market's growth is further supported by evolving agricultural policies and a growing awareness among farmers regarding the economic and environmental advantages of using advanced fertilization techniques. However, challenges such as fluctuating raw material prices and the need for extensive research and development to create novel additive solutions may present some hurdles. Nonetheless, the overarching trend towards precision agriculture and the continuous need to maximize arable land productivity are expected to outweigh these restraints. Key players like BASF SE, Clariant International Ltd, and KAO Corporation are actively investing in innovation and strategic partnerships to capture a larger share of this expanding market. The Asia Pacific region, driven by its large agricultural base and increasing adoption of modern farming technologies, is anticipated to be a major growth engine for liquid fertilizer additives.

Liquid Fertilizer Additives Industry Company Market Share

Liquid Fertilizer Additives Industry Market Concentration & Innovation

The global liquid fertilizer additives market is characterized by moderate to high concentration, with a significant portion of the market share held by a few leading players. Innovation is a key differentiator, driven by the increasing demand for enhanced nutrient efficiency, reduced environmental impact, and improved crop yields. Companies are investing heavily in research and development to create novel additive formulations that address specific agricultural challenges, such as soil degradation and water scarcity. Regulatory frameworks, particularly those concerning environmental sustainability and food safety, play a crucial role in shaping product development and market entry. The threat of product substitutes, while present in the form of solid fertilizer alternatives and traditional agricultural practices, is mitigated by the inherent advantages of liquid fertilizers, including ease of application and targeted nutrient delivery. End-user trends are increasingly leaning towards precision agriculture, requiring sophisticated additive solutions that enable customized nutrient management. Mergers and acquisitions (M&A) are active in this sector, with recent deals valued in the hundreds of billions of dollars, reflecting the strategic importance of consolidating market presence and technological capabilities. Key M&A activities are driven by the desire to expand product portfolios and gain access to new geographical markets.

- Market Share Dominance: A few key players collectively command over 60% of the global market share.

- M&A Deal Values: Recent strategic acquisitions have seen deal values averaging in the hundreds of billions of dollars.

- Innovation Focus: Development of bio-based additives, controlled-release technologies, and micronutrient encapsulation.

- Regulatory Influence: Compliance with environmental standards like REACH and EPA guidelines is paramount.

- End-User Demand: Growing preference for sustainable farming practices and digitally integrated agricultural solutions.

Liquid Fertilizer Additives Industry Industry Trends & Insights

The liquid fertilizer additives industry is poised for substantial growth, projected to expand at a compound annual growth rate (CAGR) of approximately 6.5% over the study period. This upward trajectory is fueled by a confluence of critical market growth drivers. Firstly, the global agricultural sector's continuous pursuit of enhanced food production to meet the demands of a burgeoning population is a primary catalyst. Liquid fertilizer additives play a pivotal role in maximizing nutrient uptake by crops, leading to improved yields and more efficient land utilization. Secondly, the increasing adoption of precision agriculture technologies is creating a fertile ground for advanced additive solutions. Farmers are leveraging data-driven approaches to tailor nutrient application, thereby requiring specialized additives that offer controlled release, enhanced solubility, and targeted delivery of essential nutrients. This trend is further propelled by the development of smart farming systems and sensor technologies.

Technological disruptions are also significantly shaping the industry landscape. The development of novel chemistries, including biostimulants and bio-fertilizers, is gaining momentum. These innovative products not only enhance nutrient availability but also improve soil health and plant resilience, aligning with the growing global emphasis on sustainable agriculture. Furthermore, advancements in nanotechnology are enabling the creation of encapsulated additives that provide precise and sustained nutrient release, minimizing wastage and environmental pollution. Consumer preferences are increasingly shifting towards sustainably produced food, which directly influences agricultural practices and, consequently, the demand for environmentally friendly fertilizer additives. This includes a preference for additives that reduce greenhouse gas emissions associated with fertilizer production and application.

The competitive dynamics within the liquid fertilizer additives market are intense, characterized by both organic growth strategies and strategic collaborations. Companies are focusing on expanding their product portfolios to cater to a diverse range of crops and soil types. The market penetration of specialized liquid fertilizer additives is steadily increasing, particularly in developed agricultural economies where resource efficiency and environmental stewardship are high priorities. Emerging economies, with their rapidly modernizing agricultural sectors, also present significant untapped potential. The market is witnessing a growing emphasis on water-soluble additives, as they are easier to handle, blend, and apply through irrigation systems, further driving market expansion. The integration of digital platforms for product recommendation and application optimization is also becoming a key competitive advantage. The overall market penetration for specialized liquid fertilizer additives is projected to reach XX% by the end of the forecast period.

Dominant Markets & Segments in Liquid Fertilizer Additives Industry

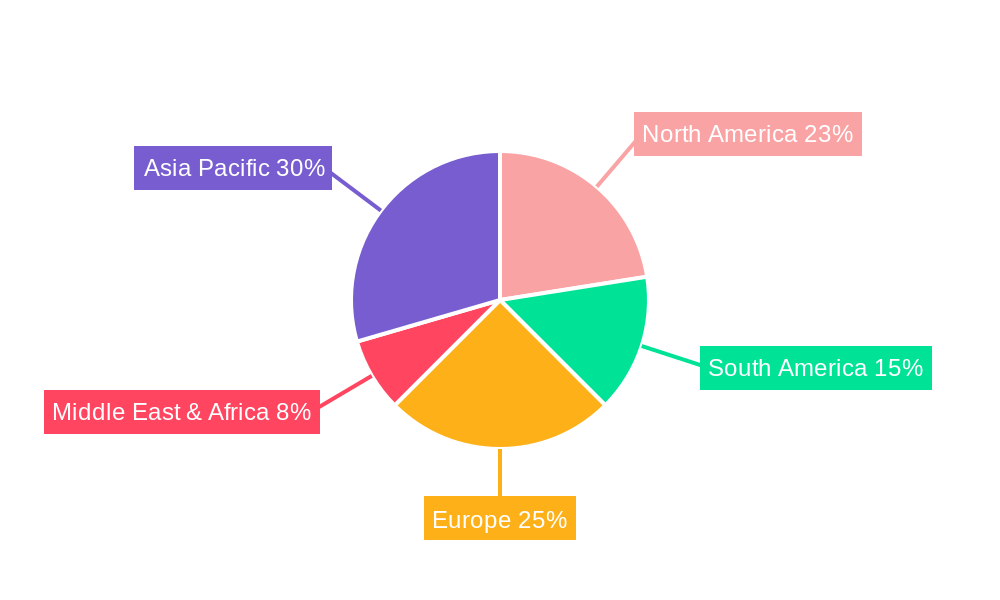

The global liquid fertilizer additives market exhibits distinct regional dominance and segment leadership across various analytical dimensions.

Production Analysis:

North America and Europe currently lead in the production of liquid fertilizer additives, driven by robust agricultural sectors, advanced manufacturing capabilities, and significant investments in research and development. The United States, in particular, boasts a highly developed agricultural infrastructure and a strong emphasis on innovation in crop enhancement.

- Key Drivers of Production Dominance:

- Advanced Agricultural Infrastructure: Well-established farming practices and high adoption rates of modern agricultural inputs.

- Technological Innovation: Strong R&D investment by leading chemical and agricultural companies.

- Supportive Government Policies: Initiatives promoting agricultural efficiency and sustainability.

- Skilled Workforce: Availability of a technically proficient labor force for specialized manufacturing.

Asia Pacific is emerging as a significant production hub, with countries like China and India rapidly expanding their manufacturing capacities due to growing domestic demand and cost-competitive production environments.

Consumption Analysis:

North America and Europe also represent the largest consumption markets for liquid fertilizer additives, owing to the high value placed on crop yield optimization and sustainable farming practices. The increasing adoption of precision agriculture and the need to address soil nutrient depletion in these regions further bolster consumption.

- Key Drivers of Consumption Dominance:

- High Crop Yield Requirements: Demand for maximizing output from arable land.

- Adoption of Precision Agriculture: Integration of advanced technologies for efficient nutrient management.

- Environmental Regulations: Growing awareness and regulatory push towards sustainable agricultural practices.

- Market Sophistication: Farmers' willingness to invest in value-added agricultural inputs.

The Asia Pacific region is witnessing the fastest consumption growth, driven by its vast agricultural landmass, increasing population, and the push for modernizing farming techniques to enhance food security.

Import Market Analysis (Value & Volume):

Developed economies in North America and Europe are significant importers of specialized liquid fertilizer additives, often seeking advanced formulations and proprietary technologies not readily available domestically. The import market is valued at an estimated $XX billion and comprises XX million tons annually.

- Key Drivers of Import Dominance:

- Access to Niche Technologies: Sourcing of specialized additives with unique performance characteristics.

- Product Variety: Demand for a wide range of additives for diverse crop types and growing conditions.

- Supply Chain Gaps: Addressing localized production limitations or specific ingredient sourcing needs.

Export Market Analysis (Value & Volume):

Countries with strong manufacturing bases and technological prowess, such as the United States, Germany, and China, are major exporters of liquid fertilizer additives. The export market is valued at approximately $XX billion and involves the trade of XX million tons annually.

- Key Drivers of Export Dominance:

- Competitive Pricing: Offering cost-effective solutions to global markets.

- Product Quality & Innovation: Delivering high-performance and novel additive formulations.

- Global Distribution Networks: Established channels for reaching international customers.

Price Trend Analysis:

The price trend analysis reveals a steady upward movement in the cost of liquid fertilizer additives, largely influenced by raw material costs, technological advancements, and increasing demand. The average global price is estimated at $XX per ton.

- Key Drivers of Price Trends:

- Raw Material Volatility: Fluctuations in the cost of key chemical precursors.

- R&D Investment: Recovery of costs associated with developing and commercializing innovative products.

- Supply and Demand Dynamics: Balancing market demand with production capacities.

- Regulatory Compliance Costs: Expenses associated with meeting stringent environmental and safety standards.

Liquid Fertilizer Additives Industry Product Developments

The liquid fertilizer additives market is characterized by a continuous stream of product innovations designed to enhance crop performance and sustainability. Key developments include advanced chelating agents that improve micronutrient availability in challenging soil conditions, biodegradable coating technologies for controlled nutrient release, and novel biostimulants derived from natural sources that boost plant resilience and nutrient uptake. These innovations offer significant competitive advantages by addressing specific agricultural pain points, such as nutrient deficiencies and the environmental impact of conventional fertilizers. Furthermore, the development of water-soluble additives compatible with fertigation systems is gaining traction, simplifying application and increasing efficacy. The market fit for these products is strong, driven by the global demand for increased agricultural productivity and more sustainable farming practices.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global liquid fertilizer additives market, encompassing Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis. The market is segmented by product type, application, and region.

- Product Type Segmentation: This includes chelating agents, biostimulants, anti-foaming agents, humic acids, and others. Growth projections for this segment are driven by advancements in bio-based additives and specialized chelates, with an estimated market size of $XX billion by 2033.

- Application Segmentation: Key applications span cereals, fruits & vegetables, pulses & oilseeds, and turf & ornamental. The cereals segment is expected to dominate, supported by global food demand, with a projected market size of $XX billion.

- Regional Segmentation: The report analyzes North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific is anticipated to exhibit the highest growth rate due to its expanding agricultural sector.

Key Drivers of Liquid Fertilizer Additives Industry Growth

The liquid fertilizer additives industry's growth is propelled by several key drivers. The escalating global population and the consequent demand for increased food production necessitate more efficient agricultural practices, where these additives play a crucial role in maximizing crop yields. Advancements in agricultural technology, particularly the widespread adoption of precision farming and smart irrigation systems, create a demand for sophisticated additives that enable targeted nutrient delivery and controlled release. Furthermore, a growing global consciousness towards environmental sustainability and the need to minimize the ecological footprint of agriculture are driving the demand for eco-friendly and efficient fertilizer solutions. Supportive government policies promoting sustainable agriculture and research into novel additive formulations further bolster the industry's expansion.

Challenges in the Liquid Fertilizer Additives Industry Sector

Despite robust growth prospects, the liquid fertilizer additives industry faces several challenges. Stringent regulatory frameworks concerning chemical usage and environmental impact can pose significant hurdles for product development and market entry, leading to increased compliance costs and longer approval times. Fluctuations in the prices of raw materials, which are often derived from petrochemicals or mined minerals, can impact profitability and product pricing. The presence of established, albeit less sophisticated, solid fertilizer alternatives and traditional farming methods presents a competitive restraint. Furthermore, supply chain disruptions, particularly in sourcing specialized raw materials or distributing finished products globally, can affect market availability and cost-effectiveness. The limited awareness and adoption of advanced additives in some developing agricultural regions also present a challenge to market penetration.

Emerging Opportunities in Liquid Fertilizer Additives Industry

Emerging opportunities in the liquid fertilizer additives industry are abundant, driven by innovation and evolving market demands. The development and commercialization of bio-based and biodegradable additives derived from renewable resources present a significant opportunity to align with sustainability trends. The increasing focus on soil health and regenerative agriculture is creating a demand for additives that not only enhance nutrient availability but also improve soil structure and microbial activity. The expansion of precision agriculture globally offers a fertile ground for smart additive solutions that integrate with digital farming platforms, enabling real-time application and performance monitoring. Furthermore, untapped markets in developing economies with rapidly modernizing agricultural sectors represent substantial growth potential.

Leading Players in the Liquid Fertilizer Additives Industry Market

- Dorf Ketal

- KAO Corporation

- Holland Novochem B

- ArrMaz

- Michelman Inc

- Clariant International Ltd

- Corteva Agriscience

- Koch Agronomic Services LLC

- BASF SE

Key Developments in Liquid Fertilizer Additives Industry Industry

- 2023/08: Launch of a new line of biodegradable chelating agents designed to improve micronutrient availability in arid soils.

- 2023/05: Acquisition of a specialty biostimulant manufacturer by a major agrochemical company to expand its sustainable product portfolio.

- 2023/01: Development of advanced encapsulation technology for controlled release of nitrogen fertilizers, reducing environmental losses.

- 2022/11: Strategic partnership formed between a chemical producer and an agricultural technology firm to integrate liquid fertilizer additives with digital farming platforms.

- 2022/06: Introduction of a novel anti-foaming agent specifically formulated for liquid fertilizer blending operations, improving efficiency and safety.

Strategic Outlook for Liquid Fertilizer Additives Industry Market

The strategic outlook for the liquid fertilizer additives industry is overwhelmingly positive, driven by its critical role in addressing global food security and sustainability challenges. Future growth will be catalyzed by continued innovation in bio-based additives, smart formulations for precision agriculture, and solutions that enhance soil health. The increasing integration of digital technologies will further unlock market potential by enabling data-driven application and performance optimization. Companies that focus on developing environmentally friendly products, expanding their reach into emerging markets, and fostering strategic collaborations will be well-positioned for sustained success in this dynamic and growing industry. The market's trajectory indicates a strong demand for sophisticated, efficient, and sustainable agricultural inputs.

Liquid Fertilizer Additives Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Liquid Fertilizer Additives Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Liquid Fertilizer Additives Industry Regional Market Share

Geographic Coverage of Liquid Fertilizer Additives Industry

Liquid Fertilizer Additives Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs

- 3.3. Market Restrains

- 3.3.1. Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers

- 3.4. Market Trends

- 3.4.1. Rising Demand for Urea is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Liquid Fertilizer Additives Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Liquid Fertilizer Additives Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Liquid Fertilizer Additives Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Liquid Fertilizer Additives Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Liquid Fertilizer Additives Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Liquid Fertilizer Additives Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dorf Ketal

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 KAO Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Holland Novochem B

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ArrMaz

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Michelman Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Clariant International Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Corteva Agriscience

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Koch Agronomic Services LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BASF SE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Dorf Ketal

List of Figures

- Figure 1: Global Liquid Fertilizer Additives Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Liquid Fertilizer Additives Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 3: North America Liquid Fertilizer Additives Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Liquid Fertilizer Additives Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 5: North America Liquid Fertilizer Additives Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Liquid Fertilizer Additives Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Liquid Fertilizer Additives Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Liquid Fertilizer Additives Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Liquid Fertilizer Additives Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Liquid Fertilizer Additives Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Liquid Fertilizer Additives Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Liquid Fertilizer Additives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Liquid Fertilizer Additives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Liquid Fertilizer Additives Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 15: South America Liquid Fertilizer Additives Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Liquid Fertilizer Additives Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 17: South America Liquid Fertilizer Additives Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Liquid Fertilizer Additives Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Liquid Fertilizer Additives Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Liquid Fertilizer Additives Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Liquid Fertilizer Additives Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Liquid Fertilizer Additives Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Liquid Fertilizer Additives Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Liquid Fertilizer Additives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Liquid Fertilizer Additives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Liquid Fertilizer Additives Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 27: Europe Liquid Fertilizer Additives Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Liquid Fertilizer Additives Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Liquid Fertilizer Additives Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Liquid Fertilizer Additives Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Liquid Fertilizer Additives Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Liquid Fertilizer Additives Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Liquid Fertilizer Additives Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Liquid Fertilizer Additives Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Liquid Fertilizer Additives Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Liquid Fertilizer Additives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 37: Europe Liquid Fertilizer Additives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Liquid Fertilizer Additives Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Liquid Fertilizer Additives Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Liquid Fertilizer Additives Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Liquid Fertilizer Additives Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Liquid Fertilizer Additives Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Liquid Fertilizer Additives Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Liquid Fertilizer Additives Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Liquid Fertilizer Additives Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Liquid Fertilizer Additives Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Liquid Fertilizer Additives Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Liquid Fertilizer Additives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 49: Middle East & Africa Liquid Fertilizer Additives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Liquid Fertilizer Additives Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Liquid Fertilizer Additives Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Liquid Fertilizer Additives Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Liquid Fertilizer Additives Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Liquid Fertilizer Additives Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Liquid Fertilizer Additives Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Liquid Fertilizer Additives Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Liquid Fertilizer Additives Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Liquid Fertilizer Additives Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Liquid Fertilizer Additives Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Liquid Fertilizer Additives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 61: Asia Pacific Liquid Fertilizer Additives Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: United States Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Canada Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Mexico Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: Brazil Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Argentina Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Germany Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: France Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Italy Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Spain Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Russia Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Benelux Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Nordics Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: Turkey Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Israel Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: GCC Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: North Africa Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: South Africa Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Liquid Fertilizer Additives Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 58: China Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 59: India Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: Japan Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 61: South Korea Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 63: Oceania Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Liquid Fertilizer Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Liquid Fertilizer Additives Industry?

The projected CAGR is approximately 7.1%.

2. Which companies are prominent players in the Liquid Fertilizer Additives Industry?

Key companies in the market include Dorf Ketal, KAO Corporation, Holland Novochem B, ArrMaz, Michelman Inc, Clariant International Ltd, Corteva Agriscience, Koch Agronomic Services LLC, BASF SE.

3. What are the main segments of the Liquid Fertilizer Additives Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs.

6. What are the notable trends driving market growth?

Rising Demand for Urea is Driving the Market.

7. Are there any restraints impacting market growth?

Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Liquid Fertilizer Additives Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Liquid Fertilizer Additives Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Liquid Fertilizer Additives Industry?

To stay informed about further developments, trends, and reports in the Liquid Fertilizer Additives Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence