Key Insights

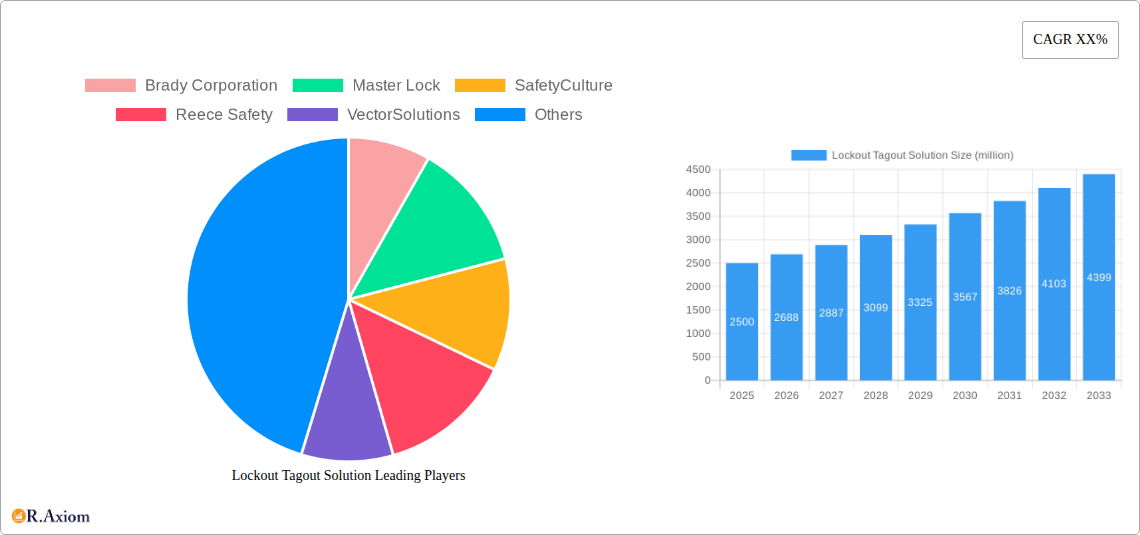

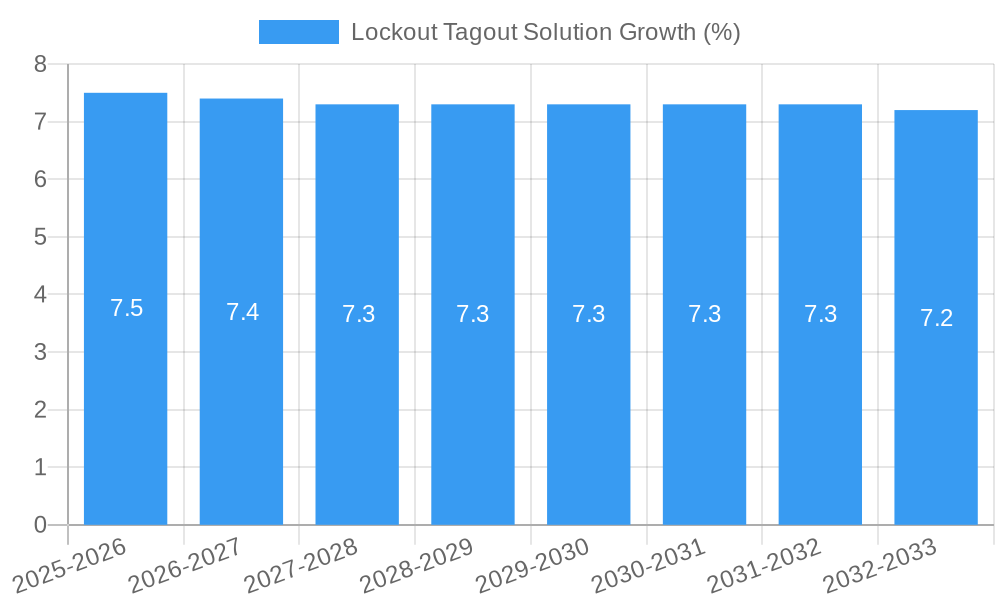

The global Lockout Tagout (LOTO) Solution market is poised for robust expansion, estimated to reach approximately $2.5 billion in 2025 and projected to grow at a Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This significant growth is primarily fueled by an escalating emphasis on workplace safety regulations and a proactive approach to preventing accidents across industries. The increasing adoption of stringent safety standards and compliance mandates globally is compelling businesses to invest in effective LOTO procedures and solutions. Furthermore, the rising complexity of industrial machinery and processes necessitates comprehensive safety protocols, driving the demand for advanced LOTO equipment and software. The construction sector is a leading contributor to this market, driven by its inherently hazardous operations and stringent safety oversight. The chemical and food industries also represent significant segments, where accidental energy release can have catastrophic consequences.

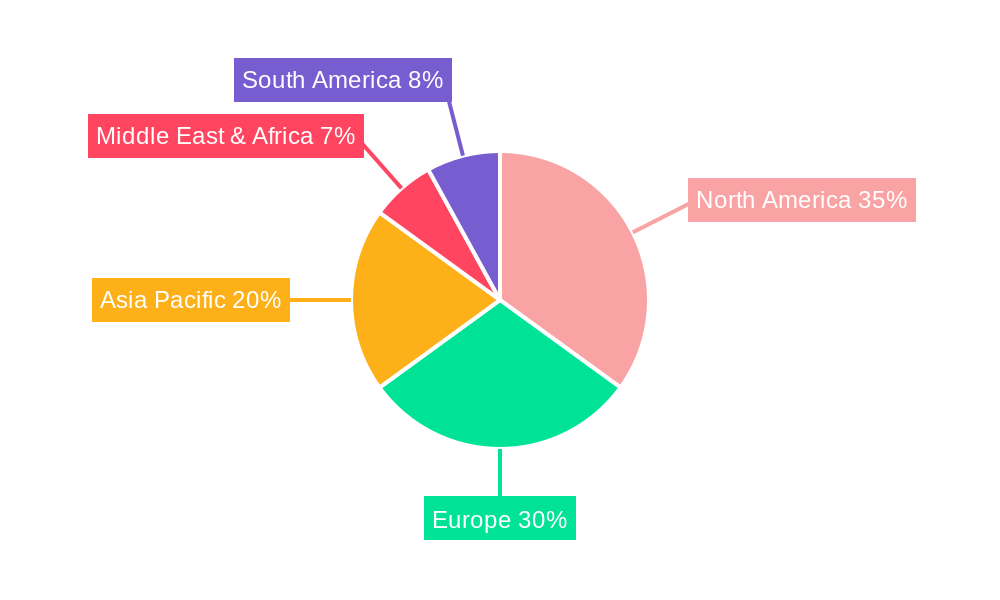

The market's growth is further bolstered by technological advancements in LOTO solutions, including the development of smart lockout devices, digital tag management systems, and integrated safety software platforms. These innovations enhance the efficiency, traceability, and compliance of LOTO procedures, making them more appealing to businesses. However, the market faces certain restraints, such as the initial cost of implementing comprehensive LOTO systems and the potential resistance to change in established safety practices within some organizations. The increasing awareness about the financial and human costs of workplace accidents, coupled with the availability of scalable and integrated LOTO solutions, are expected to mitigate these challenges. Geographically, North America and Europe are anticipated to dominate the market due to well-established safety regulations and high industrial activity. The Asia Pacific region, however, is expected to witness the fastest growth, driven by rapid industrialization and a growing focus on worker safety.

This in-depth report offers a detailed examination of the global Lockout Tagout (LOTO) solution market, providing critical insights into its current landscape, future trajectory, and the strategic imperatives for stakeholders. Covering the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033, this analysis delves into market concentration, industry trends, dominant segments, product developments, and key growth drivers. The report is designed for industry professionals seeking to understand market dynamics, identify emerging opportunities, and formulate robust growth strategies in the evolving safety and compliance sector.

Lockout Tagout Solution Market Concentration & Innovation

The Lockout Tagout solution market exhibits a moderate to high concentration, with a significant portion of market share held by leading players such as Brady Corporation, SafetyCulture, and Rockwell Automation. Innovation is a key differentiator, driven by the increasing demand for integrated safety management systems and the adoption of digital solutions. Regulatory frameworks, including OSHA standards in the United States and equivalent global mandates, are continuously shaping product development and market penetration. Product substitutes, primarily manual LOTO procedures and less sophisticated safety devices, are gradually being displaced by advanced equipment and software solutions that offer enhanced traceability and compliance management. End-user trends are leaning towards smart LOTO devices, IoT integration for real-time monitoring, and cloud-based software platforms that streamline lockout procedures and safety audits across multiple facilities. Merger and acquisition (M&A) activities are prevalent, with deals often involving established safety equipment providers acquiring innovative software companies or specialized LOTO solution developers to expand their product portfolios and market reach. For instance, recent M&A transactions have seen aggregate deal values exceeding one million dollars, signifying a strong consolidation trend aimed at capturing a larger share of the growing LOTO market. Key innovation drivers include the need for improved worker safety, reduced downtime, and enhanced regulatory compliance, pushing companies to invest heavily in R&D. The estimated market value for M&A activities within the LOTO sector is projected to surpass one million dollars annually, with significant strategic acquisitions expected to redefine market leadership.

Lockout Tagout Solution Industry Trends & Insights

The global Lockout Tagout solution market is experiencing robust growth, propelled by a confluence of factors including escalating industrial safety regulations, a heightened awareness of worker protection, and the accelerating digital transformation across industries. The Compound Annual Growth Rate (CAGR) for the LOTO market is estimated to be between 8% and 10% over the forecast period (2025-2033), reflecting a substantial expansion driven by both new market entrants and existing players investing in advanced solutions. Market penetration is steadily increasing, particularly in emerging economies where industrialization and manufacturing activities are on the rise, coupled with the implementation of stricter safety protocols.

Technological disruptions are at the forefront of this growth. The integration of the Internet of Things (IoT) in LOTO devices allows for real-time monitoring, automated lockout status updates, and remote management, significantly enhancing operational efficiency and safety compliance. Smart LOTO systems, incorporating features like RFID tagging, GPS tracking, and cloud connectivity, are becoming standard offerings. Software solutions, including specialized LOTO management platforms and integrated safety management systems, are gaining traction as they offer centralized control, digital record-keeping, and simplified audit trails, reducing the administrative burden associated with compliance.

Consumer preferences are shifting towards comprehensive, end-to-end safety solutions rather than standalone products. Businesses are seeking integrated platforms that can manage not only LOTO procedures but also other aspects of workplace safety, such as training, incident reporting, and risk assessment. The demand for user-friendly interfaces, mobile accessibility, and robust data analytics capabilities is also on the rise, enabling safety managers to make informed decisions and proactively address potential hazards.

Competitive dynamics are characterized by intense innovation and strategic partnerships. Companies are differentiating themselves through product features, technological advancements, and the ability to offer customized solutions tailored to specific industry needs. The market is witnessing a healthy interplay between established industry giants and agile startups, fostering an environment of continuous improvement and competitive pricing. The overall market size is projected to reach several million dollars by 2033, with significant investments expected in research and development to meet evolving safety standards and technological advancements. The trend towards digitalization and automation in safety management is a defining characteristic of the current LOTO industry landscape, promising sustained growth and innovation.

Dominant Markets & Segments in Lockout Tagout Solution

The global Lockout Tagout solution market is characterized by diverse regional dominance and segment penetration. North America, particularly the United States, currently holds the largest market share, primarily driven by stringent regulatory enforcement by agencies like OSHA and a mature industrial base with a strong emphasis on worker safety. The Automobile Industry within the United States represents a significant segment, investing heavily in LOTO solutions to prevent unexpected machinery startup during maintenance and servicing. This segment alone accounts for an estimated market value exceeding one hundred million dollars annually in the US.

The Construction sector is a pivotal driver of LOTO solution adoption globally. Its inherent risks associated with heavy machinery, complex equipment, and dynamic worksites necessitate robust safety protocols. Countries with significant infrastructure development projects, such as China and India, are witnessing a surge in demand for LOTO equipment and software to ensure compliance with evolving safety standards. Economic policies promoting infrastructure development and construction growth directly correlate with increased LOTO market penetration in these regions, with an estimated market size in this segment projected to reach several million dollars by 2033.

The Chemical industry, known for its hazardous processes and materials, is another key segment with a high demand for sophisticated LOTO solutions. Stringent safety regulations and the potential for catastrophic accidents make proactive hazard control paramount. Companies are investing in advanced LOTO equipment and comprehensive software systems to manage complex lockout procedures and ensure compliance with international safety standards. The market for LOTO solutions in the chemical sector is estimated to be in the range of hundreds of millions of dollars, with a steady growth trajectory.

In the Food Industry, LOTO solutions are crucial for preventing accidental machine startup during cleaning, maintenance, and repair, ensuring food safety and preventing contamination. The increasing automation in food processing plants further accentuates the need for reliable LOTO systems. The global market for LOTO solutions in the food industry is projected to grow, with a significant portion of this growth driven by investments in advanced equipment and software for better compliance and operational efficiency, reaching a market value of tens of millions of dollars.

The Automobile Industry continues to be a strong consumer of LOTO solutions due to its extensive use of automated machinery and complex assembly lines. The focus on worker safety and reducing production downtime during maintenance operations makes LOTO a critical component of their safety management systems. The adoption of advanced LOTO technologies, including smart locks and digital platforms, is a key trend.

The Electronics Industry also represents a significant segment, particularly with the increasing complexity of manufacturing equipment and the need for precise safety protocols during intricate assembly and testing processes. The demand for specialized LOTO devices and integrated software for managing these procedures is growing steadily.

In terms of Types, Equipment remains the dominant segment, encompassing padlocks, hasps, lockout devices, and tags. However, the Software segment is experiencing rapid growth. This includes LOTO management software, digital lockout procedures, mobile apps for compliance tracking, and integrated safety management systems. The shift towards digital solutions is driven by the need for better record-keeping, audit trails, and real-time compliance monitoring. The software segment is expected to grow at a higher CAGR than the equipment segment, with its market size projected to reach hundreds of millions of dollars by 2033.

Lockout Tagout Solution Product Developments

Recent product developments in the Lockout Tagout solution market focus on enhancing efficiency, connectivity, and user-friendliness. Innovations include the introduction of smart LOTO devices with integrated RFID or Bluetooth technology, enabling seamless tracking and auditability of lockout status. Companies are also developing cloud-based software platforms that facilitate digital lockout procedure creation, deployment, and real-time monitoring, offering enhanced traceability and compliance management. Competitive advantages are being gained through the integration of AI for predictive maintenance alerts and the development of robust, durable equipment suitable for harsh industrial environments. These developments aim to reduce downtime, improve worker safety, and simplify compliance with evolving regulatory standards.

Report Scope & Segmentation Analysis

The Lockout Tagout solution market is segmented across various applications and types to provide a granular analysis of market dynamics.

Application Segments:

- Construction: This segment encompasses LOTO solutions used in building and infrastructure projects, characterized by heavy machinery and dynamic work environments. Growth projections indicate a steady increase driven by global infrastructure investments. The market size for LOTO in construction is substantial, estimated in the hundreds of millions of dollars.

- Chemical: Critical for managing hazardous processes, this segment demands highly reliable and robust LOTO solutions. Market growth is driven by stringent regulations and the inherent risks. The market size is significant, estimated in the hundreds of millions of dollars.

- Food Industry: Focused on preventing contamination and ensuring worker safety during maintenance of food processing equipment. Growth is fueled by increasing automation and food safety standards. The market size is in the tens of millions of dollars.

- Automobile Industry: Characterized by complex machinery and assembly lines, this segment relies heavily on integrated LOTO solutions for efficient maintenance and safety. The market size is considerable, in the hundreds of millions of dollars.

- Electronics Industry: Demands precise safety protocols for intricate manufacturing processes. Growth is tied to the increasing complexity of electronic manufacturing equipment. The market size is in the tens of millions of dollars.

- Others: This segment includes various industrial applications not explicitly listed, such as manufacturing, energy, and mining, contributing significantly to the overall market.

Types Segments:

- Equipment: This encompasses physical LOTO devices like locks, hasps, tags, and specialized machinery lockout tools. It remains a foundational segment with consistent demand. The market size is in the hundreds of millions of dollars.

- Software: This segment includes LOTO management platforms, digital lockout apps, and integrated safety management systems. It is experiencing rapid growth due to digital transformation initiatives and the need for enhanced compliance tracking. The market size is projected to reach hundreds of millions of dollars by 2033.

Key Drivers of Lockout Tagout Solution Growth

Several key factors are propelling the growth of the Lockout Tagout solution market. Foremost is the increasing stringency of occupational safety regulations worldwide. Regulatory bodies like OSHA (Occupational Safety and Health Administration) in the US and similar organizations globally mandate robust LOTO procedures to prevent accidents and protect workers from hazardous energy sources. This drives demand for both basic and advanced LOTO equipment and software.

Secondly, the growing emphasis on worker safety and the reduction of workplace accidents is a significant catalyst. Companies are recognizing the financial and human cost of industrial accidents, leading to increased investment in safety solutions. This includes proactive measures like comprehensive LOTO implementation to minimize risks.

Thirdly, technological advancements and the digitization of safety management are transforming the market. The adoption of smart LOTO devices, IoT integration, and cloud-based software platforms offers enhanced traceability, real-time monitoring, and simplified compliance management. This innovation attracts businesses looking for more efficient and effective safety solutions.

Finally, the expansion of industrial sectors and manufacturing activities, particularly in emerging economies, is creating new markets for LOTO solutions. As industries grow, the need for compliant and safe operational practices intensifies, driving demand for LOTO products and services.

Challenges in the Lockout Tagout Solution Sector

Despite strong growth, the Lockout Tagout solution sector faces several challenges. Lack of awareness and inadequate training among workers and management in some regions can hinder the proper implementation and effectiveness of LOTO procedures. This can lead to non-compliance and increased accident risks.

Cost considerations, particularly for advanced digital solutions and comprehensive software packages, can be a barrier for small and medium-sized enterprises (SMEs) with limited budgets. While the long-term benefits of improved safety are clear, the initial investment can be a restraint.

Integration complexities with existing enterprise resource planning (ERP) or other safety management systems can pose challenges for businesses looking to adopt new LOTO software solutions. Ensuring seamless data flow and interoperability is crucial for maximizing the value of these systems.

Furthermore, evolving regulatory landscapes and the need for continuous adaptation to new safety standards require ongoing investment in product development and training, which can strain resources for some companies. Supply chain disruptions, though less prominent now, can still impact the availability of specific LOTO equipment, affecting project timelines and operational continuity.

Emerging Opportunities in Lockout Tagout Solution

The Lockout Tagout solution market is ripe with emerging opportunities driven by technological advancements and evolving industry needs. The increasing adoption of the Industrial Internet of Things (IIoT) presents a significant opportunity for smart LOTO devices that can communicate wirelessly, providing real-time status updates and automated lockout confirmations. This connectivity enhances efficiency and reduces the risk of human error.

The growing demand for integrated safety management platforms offers a chance for companies to provide end-to-end solutions that encompass LOTO, permit-to-work systems, training management, and incident reporting. This holistic approach appeals to businesses seeking comprehensive safety oversight.

The expansion of emerging markets in Asia, Africa, and Latin America, characterized by rapid industrialization and increasing regulatory focus on safety, presents substantial untapped potential for LOTO solution providers. Tailoring solutions to meet the specific needs and regulatory environments of these regions will be key.

The development of AI-powered analytics for predictive safety presents another frontier. LOTO solutions that can analyze historical data to predict potential hazards or identify areas of non-compliance will offer significant value to organizations aiming for proactive safety management.

Leading Players in the Lockout Tagout Solution Market

- Brady Corporation

- Master Lock

- SafetyCulture

- Reece Safety

- VectorSolutions

- Rockwell Automation

- CONFORMiT

- Socket & See

- EyevexSafety

- Arco

- JJ Keller

- IMEC Technologies

- Locksafe

- Miles Data

- Jabac

- ABUS padlocks

- Total Lockout

- Lotomaster

- Sphera

- Lockout Tagout Safety

- Globalite Safety Solution

- GOARC

- Pro-Lock

- SafeTE

Key Developments in Lockout Tagout Solution Industry

- 2023 (Q3): Brady Corporation launched an enhanced suite of digital LOTO solutions, integrating cloud-based software with smart lockout devices, aiming to improve compliance and efficiency in complex industrial settings.

- 2023 (Q4): SafetyCulture acquired a specialized LOTO software provider to bolster its offerings in digital safety management and expand its global reach within the construction and manufacturing sectors.

- 2024 (Q1): Rockwell Automation partnered with a leading IoT platform provider to develop next-generation connected LOTO systems, offering real-time diagnostics and remote monitoring capabilities.

- 2024 (Q2): Master Lock introduced a new range of heavy-duty, weather-resistant LOTO padlocks designed for extreme environmental conditions, expanding its product portfolio for the oil and gas industry.

- 2024 (Q3): VectorSolutions announced significant enhancements to its LOTO training modules, incorporating gamification and VR simulations to improve engagement and knowledge retention for industrial workers.

- 2024 (Q4): CONFORMiT unveiled an updated version of its LOTO management software, featuring advanced AI-driven risk assessment tools and seamless integration with leading ERP systems.

Strategic Outlook for Lockout Tagout Solution Market

The strategic outlook for the Lockout Tagout solution market is exceptionally positive, driven by an unwavering commitment to industrial safety and the pervasive digital transformation across all sectors. The increasing global focus on worker well-being, coupled with ever-evolving regulatory mandates, will continue to be the primary growth catalysts. Companies that invest in smart, connected LOTO solutions, offering integrated digital platforms that enhance traceability, compliance, and operational efficiency, will be best positioned for success. The expansion into emerging markets, coupled with a strategic approach to understanding and catering to local regulatory requirements and industry-specific needs, will unlock significant new revenue streams. Furthermore, strategic partnerships and potential M&A activities focused on acquiring innovative technologies or expanding market reach will shape the competitive landscape. The market's trajectory points towards a future where LOTO is not just a compliance requirement but an integral, technologically advanced component of a proactive and comprehensive industrial safety ecosystem, guaranteeing sustained growth and innovation for years to come.

Lockout Tagout Solution Segmentation

-

1. Application

- 1.1. Construction

- 1.2. Chemical

- 1.3. Food Industry

- 1.4. Automobile Industry

- 1.5. Electronics Industry

- 1.6. Others

-

2. Types

- 2.1. Equipment

- 2.2. Software

Lockout Tagout Solution Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Lockout Tagout Solution REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lockout Tagout Solution Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Construction

- 5.1.2. Chemical

- 5.1.3. Food Industry

- 5.1.4. Automobile Industry

- 5.1.5. Electronics Industry

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Equipment

- 5.2.2. Software

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Lockout Tagout Solution Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Construction

- 6.1.2. Chemical

- 6.1.3. Food Industry

- 6.1.4. Automobile Industry

- 6.1.5. Electronics Industry

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Equipment

- 6.2.2. Software

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Lockout Tagout Solution Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Construction

- 7.1.2. Chemical

- 7.1.3. Food Industry

- 7.1.4. Automobile Industry

- 7.1.5. Electronics Industry

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Equipment

- 7.2.2. Software

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Lockout Tagout Solution Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Construction

- 8.1.2. Chemical

- 8.1.3. Food Industry

- 8.1.4. Automobile Industry

- 8.1.5. Electronics Industry

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Equipment

- 8.2.2. Software

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Lockout Tagout Solution Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Construction

- 9.1.2. Chemical

- 9.1.3. Food Industry

- 9.1.4. Automobile Industry

- 9.1.5. Electronics Industry

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Equipment

- 9.2.2. Software

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Lockout Tagout Solution Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Construction

- 10.1.2. Chemical

- 10.1.3. Food Industry

- 10.1.4. Automobile Industry

- 10.1.5. Electronics Industry

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Equipment

- 10.2.2. Software

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Brady Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Master Lock

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SafetyCulture

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Reece Safety

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 VectorSolutions

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rockwell Automation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CONFORMiT

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Socket & See

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 EyevexSafety

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Arco

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 JJ Keller

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 IMEC Technologies

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Locksafe

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Miles Data

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Jabac

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 ABUS padlocks

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Total Lockout

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Lotomaster

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Sphera

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Lockout Tagout Safety

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Globalite Safety Solution

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 GOARC

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Pro-Lock

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 SafeTE

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.1 Brady Corporation

List of Figures

- Figure 1: Global Lockout Tagout Solution Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Lockout Tagout Solution Revenue (million), by Application 2024 & 2032

- Figure 3: North America Lockout Tagout Solution Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Lockout Tagout Solution Revenue (million), by Types 2024 & 2032

- Figure 5: North America Lockout Tagout Solution Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Lockout Tagout Solution Revenue (million), by Country 2024 & 2032

- Figure 7: North America Lockout Tagout Solution Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Lockout Tagout Solution Revenue (million), by Application 2024 & 2032

- Figure 9: South America Lockout Tagout Solution Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Lockout Tagout Solution Revenue (million), by Types 2024 & 2032

- Figure 11: South America Lockout Tagout Solution Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Lockout Tagout Solution Revenue (million), by Country 2024 & 2032

- Figure 13: South America Lockout Tagout Solution Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Lockout Tagout Solution Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Lockout Tagout Solution Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Lockout Tagout Solution Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Lockout Tagout Solution Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Lockout Tagout Solution Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Lockout Tagout Solution Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Lockout Tagout Solution Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Lockout Tagout Solution Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Lockout Tagout Solution Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Lockout Tagout Solution Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Lockout Tagout Solution Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Lockout Tagout Solution Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Lockout Tagout Solution Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Lockout Tagout Solution Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Lockout Tagout Solution Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Lockout Tagout Solution Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Lockout Tagout Solution Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Lockout Tagout Solution Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Lockout Tagout Solution Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Lockout Tagout Solution Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Lockout Tagout Solution Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Lockout Tagout Solution Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Lockout Tagout Solution Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Lockout Tagout Solution Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Lockout Tagout Solution Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Lockout Tagout Solution Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Lockout Tagout Solution Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Lockout Tagout Solution Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Lockout Tagout Solution Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Lockout Tagout Solution Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Lockout Tagout Solution Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Lockout Tagout Solution Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Lockout Tagout Solution Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Lockout Tagout Solution Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Lockout Tagout Solution Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Lockout Tagout Solution Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Lockout Tagout Solution Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Lockout Tagout Solution Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lockout Tagout Solution?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Lockout Tagout Solution?

Key companies in the market include Brady Corporation, Master Lock, SafetyCulture, Reece Safety, VectorSolutions, Rockwell Automation, CONFORMiT, Socket & See, EyevexSafety, Arco, JJ Keller, IMEC Technologies, Locksafe, Miles Data, Jabac, ABUS padlocks, Total Lockout, Lotomaster, Sphera, Lockout Tagout Safety, Globalite Safety Solution, GOARC, Pro-Lock, SafeTE.

3. What are the main segments of the Lockout Tagout Solution?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lockout Tagout Solution," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lockout Tagout Solution report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lockout Tagout Solution?

To stay informed about further developments, trends, and reports in the Lockout Tagout Solution, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence