Key Insights

The Machine-to-Machine (M2M) Connections Industry is experiencing robust growth, projected to reach a market size of $37.30 million with a Compound Annual Growth Rate (CAGR) of 7.24% from 2025 to 2033. This expansion is fundamentally driven by the increasing adoption of connected devices across diverse sectors, fueling demand for seamless data exchange. Key growth catalysts include the burgeoning Internet of Things (IoT) landscape, the need for enhanced operational efficiency through automation, and the critical role of M2M in real-time monitoring and data analytics. The expanding integration of M2M solutions in smart city initiatives, industrial automation (Industry 4.0), and the automotive sector, particularly in telematics and autonomous driving, are significant contributors. Furthermore, the continuous evolution of communication technologies, such as 5G and LPWA networks, is enabling more reliable, secure, and cost-effective M2M connectivity, further stimulating market penetration.

M2M Connections Industry Market Size (In Million)

The M2M market is characterized by a dynamic segmentation that reflects its widespread applicability. Wired and wireless connection types are both crucial, with wireless technologies like Cellular Connections and Low Power Wide Area (LPWA) networks experiencing particularly rapid adoption due to their flexibility and scalability. Key end-user industries driving this growth include the Retail Sector, where M2M facilitates inventory management and customer experience enhancements; Banking and Financial Institutions, for secure transaction processing and remote monitoring; the Telecom and IT Industry, for network management and infrastructure optimization; Healthcare, enabling remote patient monitoring and efficient medical device management; Automotive, for connected vehicle services and fleet management; and the Oil & Gas and Transportation sectors, for asset tracking and operational safety. While the market presents immense opportunities, potential restraints may include data security concerns, the complexity of integrating disparate M2M systems, and the need for standardized protocols to ensure interoperability. Addressing these challenges will be critical for sustained and accelerated market development.

M2M Connections Industry Company Market Share

M2M Connections Industry Market Concentration & Innovation

The M2M (Machine-to-Machine) connections industry is characterized by moderate market concentration, driven by significant investments in IoT infrastructure and a growing demand for connected devices across various sectors. Key players like Vodafone Group, Gemalto NV (Thales Group), and Cisco Systems Inc. hold substantial market share, estimated to be in the hundreds of millions of dollars. Innovation is primarily fueled by advancements in cellular connectivity (5G, LPWA), edge computing, and data analytics. Regulatory frameworks are evolving to support IoT deployment, focusing on data privacy and security. Product substitutes are limited, with proprietary solutions being the main competition. End-user trends indicate a strong preference for seamless, secure, and scalable M2M solutions. Mergers and acquisitions (M&A) are active, with reported deal values in the hundreds of millions of dollars, as companies aim to expand their portfolios and geographic reach.

- Market Share Leaders: Vodafone Group, Gemalto NV (Thales Group), Cisco Systems Inc.

- Innovation Drivers: 5G deployment, LPWA technologies, AI integration, cloud platforms.

- Regulatory Focus: Data security, network interoperability, spectrum allocation.

- M&A Activity: Consolidation for comprehensive service offerings, acquisition of specialized IoT technologies.

M2M Connections Industry Industry Trends & Insights

The M2M Connections Industry is poised for substantial growth, with an estimated compound annual growth rate (CAGR) of xx% during the forecast period of 2025–2033. This expansion is driven by the escalating adoption of the Internet of Things (IoT) across a myriad of sectors, including industrial automation, smart cities, connected vehicles, and remote healthcare. The proliferation of affordable sensors and connected devices, coupled with the increasing demand for real-time data analytics and operational efficiency, forms the bedrock of this growth trajectory. Technological disruptions, particularly the widespread rollout of 5G networks, are significantly enhancing M2M capabilities by offering higher bandwidth, lower latency, and the ability to connect a vastly larger number of devices. This enables more sophisticated applications, such as autonomous systems and large-scale IoT deployments. Low Power Wide Area (LPWA) technologies like LoRaWAN and NB-IoT are crucial for enabling long-range, low-power communication, making them ideal for applications in remote asset tracking, smart agriculture, and environmental monitoring, contributing significantly to market penetration in these niche areas.

Consumer preferences are increasingly leaning towards connected experiences, driving demand for smart home devices, wearables, and connected vehicles. Businesses are leveraging M2M connections to optimize supply chains, improve customer service, enhance safety, and develop new revenue streams. The competitive dynamics within the M2M connections industry are intense, with established telecommunication companies, technology giants, and specialized IoT solution providers vying for market dominance. Strategic partnerships and collaborations are becoming commonplace as companies seek to offer end-to-end solutions, from device connectivity to data management and application development. The ongoing evolution of Artificial Intelligence (AI) and Machine Learning (ML) is further augmenting M2M capabilities, enabling predictive maintenance, intelligent automation, and data-driven decision-making. The projected market size for the M2M connections industry is expected to reach several hundred billion dollars by the end of the forecast period, underscoring its critical role in the digital transformation of global industries.

Dominant Markets & Segments in M2M Connections Industry

The M2M Connections Industry is experiencing significant dominance across several key segments, driven by a confluence of technological advancements, economic policies, and evolving end-user demands.

Connection Type Dominance:

- Wireless Connections: This segment holds the largest market share due to the inherent flexibility and broad applicability of wireless communication. The exponential growth in cellular networks, particularly the expansion of 5G, is a primary driver. Wireless solutions facilitate mobility and remote access, crucial for applications in logistics, fleet management, and field services. The ease of deployment without extensive cabling infrastructure makes it the preferred choice for many industrial and consumer IoT deployments.

Technology Dominance:

- Cellular Connections: Cellular technologies (2G, 3G, 4G LTE, and increasingly 5G) are the backbone of a vast majority of M2M deployments. They offer reliable, wide-area coverage and support for a diverse range of applications, from telematics in the automotive sector to remote monitoring in the oil and gas industry. The continuous evolution of cellular standards provides higher speeds and lower latency, enabling more advanced M2M use cases.

- Low Power Wide Area (LPWA): Technologies like NB-IoT and LoRaWAN are rapidly gaining traction, especially for applications requiring long-range communication with minimal power consumption. This dominance is evident in smart metering, environmental monitoring, and smart agriculture where devices need to operate for years on battery power. The cost-effectiveness and extended coverage offered by LPWA are key to its widespread adoption.

End User Industry Dominance:

- Automotive: The automotive sector is a leading adopter of M2M connections, driven by the rise of connected cars, autonomous driving features, and advanced driver-assistance systems (ADAS). Telematics for vehicle tracking, diagnostics, and infotainment services represent substantial M2M applications. The push for vehicle-to-everything (V2X) communication further solidifies its dominant position.

- Telecom and IT Industry: This sector is both a provider and a significant consumer of M2M solutions. Telecommunication companies are investing heavily in network infrastructure to support the growing number of connected devices, while IT departments are leveraging M2M for network management, remote device provisioning, and enhanced cybersecurity. The foundational role of IT in enabling and managing M2M ecosystems ensures its continued dominance.

- Transportation: Beyond automotive, the broader transportation sector, including logistics, public transit, and supply chain management, heavily relies on M2M for real-time tracking, fleet optimization, and predictive maintenance of vehicles and infrastructure. This ensures operational efficiency and enhances safety.

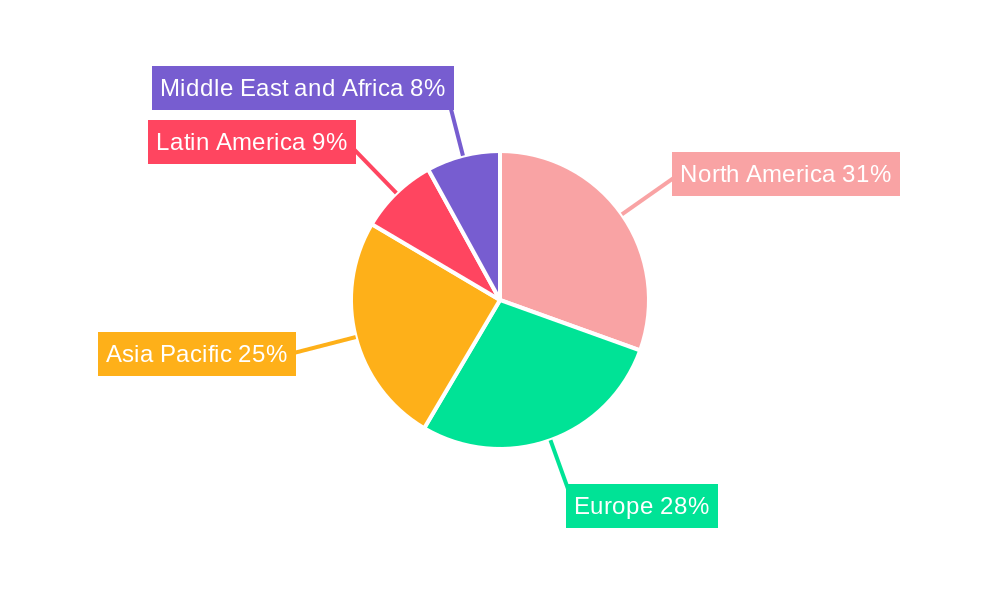

Regional Dominance:

- North America and Europe are currently leading markets, owing to robust technological infrastructure, significant investment in smart city initiatives, and a mature industrial base. However, the Asia-Pacific region is exhibiting the fastest growth, driven by rapid industrialization, government support for IoT adoption, and a large consumer base.

M2M Connections Industry Product Developments

Product development in the M2M connections industry is characterized by a focus on enhanced connectivity, robust security, and seamless integration. Innovations are centered around miniaturization of devices, improved power efficiency for long-duration deployments, and the integration of AI at the edge for real-time data processing. Companies are offering sophisticated platforms that enable easy deployment, management, and analysis of M2M data. The competitive advantage lies in providing end-to-end solutions that offer secure, reliable, and scalable connectivity tailored to specific industry needs, such as ruggedized devices for harsh environments or specialized sensors for industrial automation.

Report Scope & Segmentation Analysis

This report meticulously analyzes the M2M Connections Industry across various dimensions, providing granular insights into its multifaceted landscape.

Connection Type: The market is segmented into Wired and Wireless connections. Wireless connections are projected to dominate, driven by the flexibility and widespread adoption of cellular and LPWA technologies, with an estimated market size of hundreds of billions of dollars by 2033. Wired connections will maintain a significant presence in industrial settings where a stable, high-bandwidth connection is paramount.

Technology: Key technologies examined include Cellular Connections, Low Power Wide Area (LPWA), Short Range, MAN, Wide Area Fixed, and Satellite. Cellular connections are expected to lead, followed closely by LPWA technologies, which are crucial for low-power, long-range applications. Growth projections for cellular connections are in the hundreds of billions of dollars, while LPWA is anticipated to show significant CAGR in the double digits.

End User Industry: The report provides in-depth analysis of the Retail Sector, Banking and Financial Institution, Telecom and IT Industry, Healthcare, Automotive, Oil & Gas, Transportation, and Other End User Industries. The Automotive and Telecom & IT industries are poised for substantial growth, projected to collectively contribute hundreds of billions of dollars to the market by 2033. Healthcare and Transportation are also exhibiting robust expansion due to increasing demand for remote monitoring and efficient logistics.

Key Drivers of M2M Connections Industry Growth

The M2M Connections Industry is propelled by a robust ecosystem of growth drivers. The relentless advancement in IoT technology, including the widespread deployment of 5G networks, significantly boosts connectivity speeds and capacity, enabling more complex M2M applications. Economic factors such as the increasing need for operational efficiency, cost reduction through automation, and the development of new service-based business models are significant catalysts. Regulatory support for smart city initiatives and industrial digitalization further accelerates adoption. Moreover, the growing consumer demand for connected devices and services fosters a market ripe for M2M integration.

- Technological Advancements: 5G deployment, IoT sensor evolution, AI integration.

- Economic Imperatives: Demand for operational efficiency, cost optimization, new revenue streams.

- Regulatory Support: Smart city initiatives, industrial digitalization mandates.

- Consumer Demand: Proliferation of connected devices and services.

Challenges in the M2M Connections Industry Sector

Despite its promising growth, the M2M Connections Industry faces several hurdles. Security remains a paramount concern, with the increasing number of connected devices creating a larger attack surface for cyber threats. Data privacy regulations, while necessary, can add complexity to deployments. Interoperability issues between different M2M platforms and devices can hinder seamless integration, leading to higher implementation costs. The lack of standardization in certain areas of M2M communication also poses a challenge. Furthermore, the need for skilled personnel capable of managing and analyzing M2M data presents a talent gap that needs to be addressed. The upfront investment for robust M2M infrastructure can also be a barrier for some smaller enterprises.

- Cybersecurity Threats: Protecting a vast network of connected devices.

- Data Privacy Concerns: Navigating complex regulatory landscapes.

- Interoperability Issues: Ensuring seamless communication between diverse platforms.

- Lack of Standardization: Hindering broad adoption and integration.

- Talent Gap: Shortage of skilled M2M and IoT professionals.

Emerging Opportunities in M2M Connections Industry

The M2M Connections Industry is ripe with emerging opportunities driven by innovation and evolving market needs. The expansion of the Industrial Internet of Things (IIoT) presents significant potential in sectors like manufacturing, energy, and agriculture for predictive maintenance, process optimization, and remote asset management. The ongoing development of smart cities worldwide is creating demand for M2M solutions in areas such as traffic management, public safety, and utility monitoring. The burgeoning healthcare sector is leveraging M2M for remote patient monitoring, telemedicine, and efficient hospital management. Furthermore, advancements in edge computing are enabling localized data processing, reducing latency and bandwidth requirements, and opening new avenues for real-time M2M applications. The integration of AI and machine learning with M2M data analytics is creating opportunities for intelligent automation and personalized services across industries.

- Industrial IoT (IIoT): Predictive maintenance, process optimization in manufacturing and energy.

- Smart Cities: Traffic management, public safety, smart utilities.

- Healthcare Tech: Remote patient monitoring, telemedicine, efficient hospital operations.

- Edge Computing: Real-time data processing and localized M2M applications.

- AI/ML Integration: Intelligent automation and personalized services.

Leading Players in the M2M Connections Industry Market

- Vodafone Group

- Gemalto NV (Thales Group)

- Cisco Systems Inc

- VMWare Inc

- Telit Communication

- Huawei Technologies Co Ltd

- Texas Instruments Incorporated

- Duetsche Telecom AG

- Siera Wireless

- AT&T Inc

- China Mobile Ltd

- Intel Corporation

- Telefonica SA

Key Developments in M2M Connections Industry Industry

- October 2023: O2 Telefónica and Transatel formed a strategic partnership in Germany, granting Transatel access to O2 Telefónica's 5G network. This collaboration aims to enhance connectivity solutions, particularly for the automotive sector, enabling Transatel to offer IoT and M2M applications for industrial companies via the O2 Telefónica mobile network. Transatel also expanded its Ubigi brand's data roaming services.

- October 2023: M2M Services and Alula merged, signaling a significant development in smart security solutions. This union is expected to combine their expertise to redefine quality, engineering, and innovative security offerings, opening new horizons for Alula and enhancing their market position.

Strategic Outlook for M2M Connections Industry Market

The strategic outlook for the M2M Connections Industry is exceptionally positive, driven by continuous technological innovation and an expanding application landscape. The ongoing rollout of 5G networks will be a critical growth catalyst, enabling lower latency, higher bandwidth, and massive device connectivity, thereby unlocking more sophisticated M2M use cases, particularly in areas like autonomous systems and real-time industrial control. The increasing adoption of AI and edge computing will further empower M2M solutions with enhanced intelligence and real-time processing capabilities, leading to greater efficiency and new service offerings. The growing emphasis on data analytics derived from M2M interactions will also fuel demand for robust platforms and services. Strategic collaborations and acquisitions are expected to continue, as companies aim to offer comprehensive end-to-end solutions and gain a competitive edge in this dynamic market. Emerging opportunities in sustainability, smart grids, and enhanced supply chain visibility will also contribute significantly to future market potential.

M2M Connections Industry Segmentation

-

1. Connection Type

- 1.1. Wired

- 1.2. Wireless

-

2. Technology

- 2.1. Cellular Connections

- 2.2. Low Power Wide Area (LPWA)

- 2.3. Short Range

- 2.4. MAN

- 2.5. Wide Area Fixed

- 2.6. Satellite

-

3. End User Industry

- 3.1. Retail Sector

- 3.2. Banking and Financial Institution

- 3.3. Telecom and IT Industry

- 3.4. Healthcare

- 3.5. Automotive

- 3.6. Oil & Gas

- 3.7. Transportation

- 3.8. Other End User Industries

M2M Connections Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

M2M Connections Industry Regional Market Share

Geographic Coverage of M2M Connections Industry

M2M Connections Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Augmenting Applications Telematics; Growing Usage of Internet; Increasing Number of Mobile Connections

- 3.3. Market Restrains

- 3.3.1. Privacy and Security Issues; Lack of Standardization

- 3.4. Market Trends

- 3.4.1. Growing Usage of Internet is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global M2M Connections Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Connection Type

- 5.1.1. Wired

- 5.1.2. Wireless

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Cellular Connections

- 5.2.2. Low Power Wide Area (LPWA)

- 5.2.3. Short Range

- 5.2.4. MAN

- 5.2.5. Wide Area Fixed

- 5.2.6. Satellite

- 5.3. Market Analysis, Insights and Forecast - by End User Industry

- 5.3.1. Retail Sector

- 5.3.2. Banking and Financial Institution

- 5.3.3. Telecom and IT Industry

- 5.3.4. Healthcare

- 5.3.5. Automotive

- 5.3.6. Oil & Gas

- 5.3.7. Transportation

- 5.3.8. Other End User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Connection Type

- 6. North America M2M Connections Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Connection Type

- 6.1.1. Wired

- 6.1.2. Wireless

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Cellular Connections

- 6.2.2. Low Power Wide Area (LPWA)

- 6.2.3. Short Range

- 6.2.4. MAN

- 6.2.5. Wide Area Fixed

- 6.2.6. Satellite

- 6.3. Market Analysis, Insights and Forecast - by End User Industry

- 6.3.1. Retail Sector

- 6.3.2. Banking and Financial Institution

- 6.3.3. Telecom and IT Industry

- 6.3.4. Healthcare

- 6.3.5. Automotive

- 6.3.6. Oil & Gas

- 6.3.7. Transportation

- 6.3.8. Other End User Industries

- 6.1. Market Analysis, Insights and Forecast - by Connection Type

- 7. Europe M2M Connections Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Connection Type

- 7.1.1. Wired

- 7.1.2. Wireless

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Cellular Connections

- 7.2.2. Low Power Wide Area (LPWA)

- 7.2.3. Short Range

- 7.2.4. MAN

- 7.2.5. Wide Area Fixed

- 7.2.6. Satellite

- 7.3. Market Analysis, Insights and Forecast - by End User Industry

- 7.3.1. Retail Sector

- 7.3.2. Banking and Financial Institution

- 7.3.3. Telecom and IT Industry

- 7.3.4. Healthcare

- 7.3.5. Automotive

- 7.3.6. Oil & Gas

- 7.3.7. Transportation

- 7.3.8. Other End User Industries

- 7.1. Market Analysis, Insights and Forecast - by Connection Type

- 8. Asia Pacific M2M Connections Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Connection Type

- 8.1.1. Wired

- 8.1.2. Wireless

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Cellular Connections

- 8.2.2. Low Power Wide Area (LPWA)

- 8.2.3. Short Range

- 8.2.4. MAN

- 8.2.5. Wide Area Fixed

- 8.2.6. Satellite

- 8.3. Market Analysis, Insights and Forecast - by End User Industry

- 8.3.1. Retail Sector

- 8.3.2. Banking and Financial Institution

- 8.3.3. Telecom and IT Industry

- 8.3.4. Healthcare

- 8.3.5. Automotive

- 8.3.6. Oil & Gas

- 8.3.7. Transportation

- 8.3.8. Other End User Industries

- 8.1. Market Analysis, Insights and Forecast - by Connection Type

- 9. Latin America M2M Connections Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Connection Type

- 9.1.1. Wired

- 9.1.2. Wireless

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Cellular Connections

- 9.2.2. Low Power Wide Area (LPWA)

- 9.2.3. Short Range

- 9.2.4. MAN

- 9.2.5. Wide Area Fixed

- 9.2.6. Satellite

- 9.3. Market Analysis, Insights and Forecast - by End User Industry

- 9.3.1. Retail Sector

- 9.3.2. Banking and Financial Institution

- 9.3.3. Telecom and IT Industry

- 9.3.4. Healthcare

- 9.3.5. Automotive

- 9.3.6. Oil & Gas

- 9.3.7. Transportation

- 9.3.8. Other End User Industries

- 9.1. Market Analysis, Insights and Forecast - by Connection Type

- 10. Middle East and Africa M2M Connections Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Connection Type

- 10.1.1. Wired

- 10.1.2. Wireless

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Cellular Connections

- 10.2.2. Low Power Wide Area (LPWA)

- 10.2.3. Short Range

- 10.2.4. MAN

- 10.2.5. Wide Area Fixed

- 10.2.6. Satellite

- 10.3. Market Analysis, Insights and Forecast - by End User Industry

- 10.3.1. Retail Sector

- 10.3.2. Banking and Financial Institution

- 10.3.3. Telecom and IT Industry

- 10.3.4. Healthcare

- 10.3.5. Automotive

- 10.3.6. Oil & Gas

- 10.3.7. Transportation

- 10.3.8. Other End User Industries

- 10.1. Market Analysis, Insights and Forecast - by Connection Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Vodafone Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Gemalto NV(Thales Group)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cisco Systems Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 VMWare Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Telit Communication

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Huawei Technologies Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Texas Instruments Incorporated

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Duetsche Telecom AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Siera Wireless

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 AT&T Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 China Mobile Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Intel Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Telefonica SA

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Vodafone Group

List of Figures

- Figure 1: Global M2M Connections Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America M2M Connections Industry Revenue (Million), by Connection Type 2025 & 2033

- Figure 3: North America M2M Connections Industry Revenue Share (%), by Connection Type 2025 & 2033

- Figure 4: North America M2M Connections Industry Revenue (Million), by Technology 2025 & 2033

- Figure 5: North America M2M Connections Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America M2M Connections Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 7: North America M2M Connections Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 8: North America M2M Connections Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America M2M Connections Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe M2M Connections Industry Revenue (Million), by Connection Type 2025 & 2033

- Figure 11: Europe M2M Connections Industry Revenue Share (%), by Connection Type 2025 & 2033

- Figure 12: Europe M2M Connections Industry Revenue (Million), by Technology 2025 & 2033

- Figure 13: Europe M2M Connections Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 14: Europe M2M Connections Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 15: Europe M2M Connections Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 16: Europe M2M Connections Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe M2M Connections Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific M2M Connections Industry Revenue (Million), by Connection Type 2025 & 2033

- Figure 19: Asia Pacific M2M Connections Industry Revenue Share (%), by Connection Type 2025 & 2033

- Figure 20: Asia Pacific M2M Connections Industry Revenue (Million), by Technology 2025 & 2033

- Figure 21: Asia Pacific M2M Connections Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Asia Pacific M2M Connections Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 23: Asia Pacific M2M Connections Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 24: Asia Pacific M2M Connections Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific M2M Connections Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America M2M Connections Industry Revenue (Million), by Connection Type 2025 & 2033

- Figure 27: Latin America M2M Connections Industry Revenue Share (%), by Connection Type 2025 & 2033

- Figure 28: Latin America M2M Connections Industry Revenue (Million), by Technology 2025 & 2033

- Figure 29: Latin America M2M Connections Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Latin America M2M Connections Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 31: Latin America M2M Connections Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 32: Latin America M2M Connections Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America M2M Connections Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa M2M Connections Industry Revenue (Million), by Connection Type 2025 & 2033

- Figure 35: Middle East and Africa M2M Connections Industry Revenue Share (%), by Connection Type 2025 & 2033

- Figure 36: Middle East and Africa M2M Connections Industry Revenue (Million), by Technology 2025 & 2033

- Figure 37: Middle East and Africa M2M Connections Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 38: Middle East and Africa M2M Connections Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 39: Middle East and Africa M2M Connections Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 40: Middle East and Africa M2M Connections Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa M2M Connections Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global M2M Connections Industry Revenue Million Forecast, by Connection Type 2020 & 2033

- Table 2: Global M2M Connections Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: Global M2M Connections Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 4: Global M2M Connections Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global M2M Connections Industry Revenue Million Forecast, by Connection Type 2020 & 2033

- Table 6: Global M2M Connections Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 7: Global M2M Connections Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 8: Global M2M Connections Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global M2M Connections Industry Revenue Million Forecast, by Connection Type 2020 & 2033

- Table 10: Global M2M Connections Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 11: Global M2M Connections Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 12: Global M2M Connections Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global M2M Connections Industry Revenue Million Forecast, by Connection Type 2020 & 2033

- Table 14: Global M2M Connections Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 15: Global M2M Connections Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 16: Global M2M Connections Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global M2M Connections Industry Revenue Million Forecast, by Connection Type 2020 & 2033

- Table 18: Global M2M Connections Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 19: Global M2M Connections Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 20: Global M2M Connections Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global M2M Connections Industry Revenue Million Forecast, by Connection Type 2020 & 2033

- Table 22: Global M2M Connections Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 23: Global M2M Connections Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 24: Global M2M Connections Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the M2M Connections Industry?

The projected CAGR is approximately 7.24%.

2. Which companies are prominent players in the M2M Connections Industry?

Key companies in the market include Vodafone Group, Gemalto NV(Thales Group), Cisco Systems Inc, VMWare Inc, Telit Communication, Huawei Technologies Co Ltd, Texas Instruments Incorporated, Duetsche Telecom AG, Siera Wireless, AT&T Inc, China Mobile Ltd, Intel Corporation, Telefonica SA.

3. What are the main segments of the M2M Connections Industry?

The market segments include Connection Type, Technology, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 37.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Augmenting Applications Telematics; Growing Usage of Internet; Increasing Number of Mobile Connections.

6. What are the notable trends driving market growth?

Growing Usage of Internet is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Privacy and Security Issues; Lack of Standardization.

8. Can you provide examples of recent developments in the market?

October 2023 - O2 Telefónica and the European mobile communications provider Transatel would work closely in Germany in the future. The two companies signed an agreement incl. mid-term access to O2 Telefónica's strong 5G network. They together, expanded the range of connectivity solutions in the German market, e.g., for the automotive sector. Transatel, a subsidiary of NTT Group, will offer Internet-of-Things (IoT) and machine-to-machine (M2M) applications for industrial companies via the O2 Telefónica mobile network. Transatel also offers a data roaming service for residential and business customers under the Ubigi brand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "M2M Connections Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the M2M Connections Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the M2M Connections Industry?

To stay informed about further developments, trends, and reports in the M2M Connections Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence