Key Insights

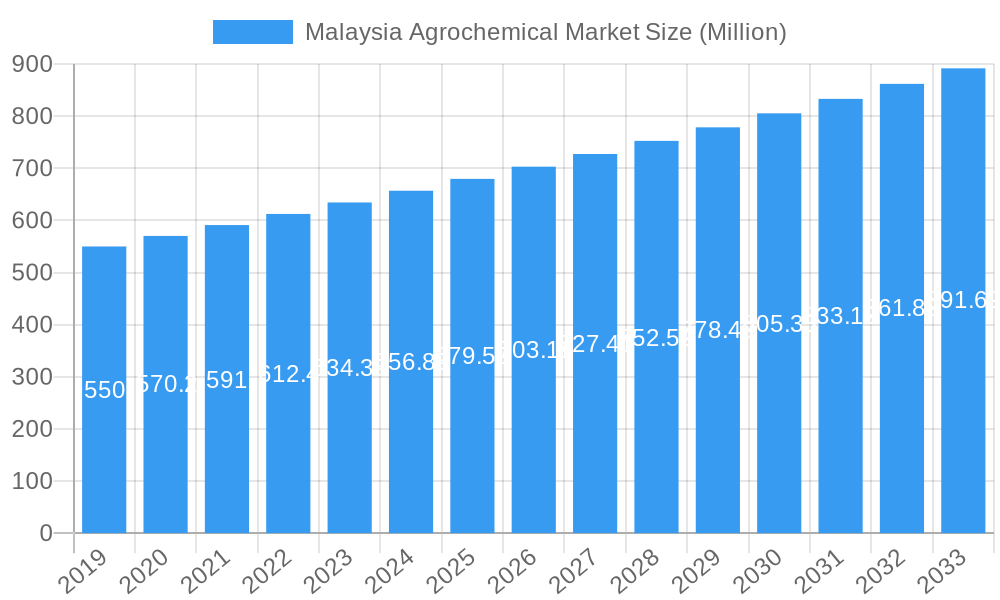

The Malaysian agrochemical market is poised for steady expansion, projected to reach approximately USD 679.59 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 4.56% extending through 2033. This growth trajectory is underpinned by several key drivers. A significant factor is the increasing demand for enhanced crop yields and improved crop protection strategies to meet the needs of a growing population and to maintain Malaysia's position as a major agricultural exporter, particularly in palm oil and rubber. Furthermore, government initiatives promoting sustainable agriculture and the adoption of advanced farming techniques are expected to stimulate the use of sophisticated agrochemical solutions. The market will also benefit from an increasing awareness among farmers regarding the efficacy of modern crop protection products in mitigating losses due to pests, diseases, and weeds, thereby safeguarding agricultural investments and boosting overall farm profitability. The continuous introduction of innovative and environmentally friendlier agrochemical formulations by leading players further contributes to market dynamism.

Malaysia Agrochemical Market Market Size (In Million)

The market segmentation provides a comprehensive view of the agrochemical landscape in Malaysia. Production analysis reveals robust domestic manufacturing capabilities, while consumption analysis highlights increasing adoption across various crop types. The import and export market analysis indicates a healthy trade balance, with Malaysia both importing specialized agrochemicals and exporting its own manufactured products. Price trend analysis suggests a stable to moderately increasing price environment, influenced by raw material costs, technological advancements, and regulatory frameworks. Key players such as PK Fertilizers, Halex Group, and Hextar Group are instrumental in shaping the market through their diverse product portfolios and strategic expansions. Trends like the growing preference for bio-pesticides and precision agriculture solutions are shaping the future demand, while the increasing stringency of environmental regulations and the potential for pest resistance to existing chemicals represent potential restraints that market participants must proactively address through research and development.

Malaysia Agrochemical Market Company Market Share

Unlock actionable insights into the dynamic Malaysia Agrochemical Market with this in-depth report. Covering the period from 2019 to 2033, with a base year of 2025, this comprehensive analysis delves into Malaysia's agricultural chemicals market, crop protection solutions, fertilizer market in Malaysia, and pesticide market trends. We provide detailed Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis to equip industry stakeholders with strategic intelligence. Explore key market drivers, emerging opportunities, and challenges shaping the future of Malaysian agriculture.

Malaysia Agrochemical Market Market Concentration & Innovation

The Malaysia Agrochemical Market exhibits a moderate level of market concentration, with a mix of large multinational corporations and established domestic players vying for market share. Key companies like PK Fertilizers, Central Minerals & Chemicals Sdn Bhd (CMC), Halex Group, Hextar Group, Farmcochem Group, Agri Fer, Advansia Sdn Bhd, Agricultural Chemicals (M) Sdn Bhd (ACM), Biovista Lifesciences Sdn Bhd, Sin Seng Huat, Kenso Corporation, Nufarm Ltd, and Crop Protection (M) Sdn Bhd are actively involved. Innovation is a critical driver, fueled by the demand for more effective, sustainable, and environmentally friendly crop protection and nutrient solutions. Research and development efforts are focused on enhancing product efficacy, reducing environmental impact, and addressing evolving pest resistance. The regulatory framework, overseen by agencies like the Department of Agriculture, plays a significant role in approving new products and ensuring their safe use, often requiring extensive testing and data submission. Product substitutes, such as biopesticides and organic fertilizers, are gaining traction, influencing the competitive landscape. End-user trends are shifting towards integrated pest management (IPM) strategies and precision agriculture, demanding agrochemical solutions that can be precisely applied and integrated into broader farm management systems. Mergers and acquisition (M&A) activities, while not extensively documented with specific deal values in the public domain for this region, are a strategic avenue for companies to expand their product portfolios, geographical reach, and technological capabilities. For instance, strategic partnerships and increased investments, as seen with Nufarm's expansion with Enko, underscore the drive for innovation and market consolidation.

Malaysia Agrochemical Market Industry Trends & Insights

The Malaysia Agrochemical Market is poised for robust growth, driven by several interconnected trends. A primary catalyst is the increasing demand for food security to feed a growing population, necessitating higher agricultural productivity. This translates directly into a greater need for effective crop protection chemicals and advanced fertilizers. The Malaysian agriculture sector, a significant contributor to the nation's economy, relies heavily on these inputs to maximize yields and maintain crop quality. Technological advancements are continuously reshaping the industry. The adoption of precision agriculture techniques, including drone-based spraying and sensor technologies, allows for more targeted application of agrochemicals, optimizing usage and reducing waste. This trend is supported by government initiatives promoting modernization and efficiency in agriculture. Furthermore, there is a growing consumer and regulatory push towards sustainable agricultural practices. This is fostering the development and adoption of bio-agrochemicals, including biopesticides and biofertilizers, which offer environmentally friendlier alternatives to conventional chemical products. Companies are investing heavily in research and development to create these novel solutions, targeting critical pests and weeds through innovative pathways. Consumer preferences are also evolving, with an increasing awareness of food safety and the environmental impact of agricultural practices. This is creating a demand for residue-free produce and agrochemical products with lower toxicity profiles. The competitive dynamics within the Malaysia Agrochemical Market are characterized by a blend of global players and local manufacturers, each competing on product innovation, pricing, distribution networks, and technical support. The market penetration of advanced agrochemical solutions is gradually increasing as farmers become more educated about their benefits and as these products become more accessible. The CAGR for the Malaysia Agrochemical Market is projected to be substantial, reflecting the ongoing demand for both conventional and next-generation agricultural inputs. The influence of government policies and subsidies plays a crucial role in shaping the market, encouraging the adoption of specific types of agrochemicals or sustainable practices. Supply chain efficiencies and the development of localized manufacturing capabilities are also key aspects influencing competitive advantage.

Dominant Markets & Segments in Malaysia Agrochemical Market

The Malaysia Agrochemical Market demonstrates distinct dominance across various segments, influenced by economic policies, agricultural infrastructure, and regional crop cultivation patterns.

Production Analysis:

- Dominant Segment: The production of fertilizers, particularly nitrogenous and phosphatic fertilizers, historically dominates Malaysia's agrochemical production landscape due to widespread demand from key agricultural sectors like palm oil and rice cultivation.

- Key Drivers:

- Government Support: Policies aimed at bolstering domestic food production and agricultural self-sufficiency encourage local fertilizer manufacturing.

- Raw Material Availability: Access to key raw materials and established industrial infrastructure supports large-scale production.

- Export Demand: Significant export markets for Malaysian agricultural produce indirectly fuel domestic production capabilities.

Consumption Analysis:

- Dominant Segment: Crop protection chemicals, including insecticides, herbicides, and fungicides, represent the largest segment in terms of consumption, driven by the need to safeguard high-value crops from pests and diseases.

- Key Drivers:

- Palm Oil Industry: The vast acreage dedicated to palm oil cultivation, a staple of the Malaysian economy, creates immense demand for herbicides and insecticides to manage weeds and pests that threaten yield.

- Rice Cultivation: As a staple food, rice farming also requires significant application of pesticides and herbicides.

- Horticulture and Other Crops: Growing demand for fruits, vegetables, and other cash crops further contributes to consumption.

Import Market Analysis (Value & Volume):

- Dominant Categories: While domestic production is strong for certain fertilizers, Malaysia remains a net importer of specialized agrochemicals, particularly advanced formulations of pesticides, herbicides, and novel fertilizer types.

- Key Drivers:

- Technological Gap: Imports often fulfill the demand for cutting-edge agrochemical products that may not be manufactured domestically.

- Specialty Formulations: The import market caters to niche requirements and specific crop needs not adequately addressed by local production.

- Global Supply Chains: Malaysia's integration into global trade networks facilitates the import of a wide range of agrochemical products.

Export Market Analysis (Value & Volume):

- Dominant Categories: Malaysia is a notable exporter of certain agrochemical products, particularly fertilizers and generic pesticide formulations, primarily to regional markets in Southeast Asia.

- Key Drivers:

- Competitive Pricing: Malaysian manufacturers often leverage economies of scale and cost efficiencies to offer competitive pricing for export markets.

- Regional Demand: Neighboring countries with developing agricultural sectors represent significant export destinations.

- Free Trade Agreements: Trade agreements within ASEAN facilitate easier market access for Malaysian agrochemical products.

Price Trend Analysis:

- Key Trends: Prices for agrochemicals in Malaysia are influenced by global commodity prices for raw materials (e.g., natural gas for nitrogen fertilizers, phosphates, petrochemicals for pesticides), currency exchange rates, and domestic supply-demand dynamics.

- Key Drivers:

- Global Input Costs: Fluctuations in the cost of raw materials like ammonia, phosphate rock, and petrochemicals directly impact production costs and subsequent market prices.

- Seasonal Demand: Prices can exhibit seasonal variations based on planting and harvesting cycles for major crops.

- Regulatory Changes: New environmental regulations or import/export duties can also influence pricing structures.

Malaysia Agrochemical Market Product Developments

Product development in the Malaysia Agrochemical Market is increasingly focused on sustainable solutions and enhanced efficacy. Innovations include the formulation of biopesticides derived from natural sources, offering targeted pest control with minimal environmental impact. Advanced slow-release fertilizers are being developed to improve nutrient uptake efficiency and reduce leaching, thus minimizing environmental pollution and maximizing crop yields. The integration of digital technologies, such as smart delivery systems and IoT-enabled sensors, is also driving product innovation, enabling precise application and real-time monitoring of crop health. Companies are investing in R&D to create herbicide resistance management solutions and fungicides that combat evolving plant diseases, ensuring long-term crop protection and farmer profitability. These developments aim to align with global trends towards sustainable agriculture and food safety.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Malaysia Agrochemical Market, segmented across Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis. The Production Analysis segment will detail the manufacturing capabilities and output of key agrochemicals within Malaysia. Consumption Analysis will provide insights into the demand patterns for various agrochemical products across different agricultural sectors. The Import Market Analysis will quantify the value and volume of agrochemicals entering Malaysia, highlighting key import sources and product types. Conversely, the Export Market Analysis will detail Malaysia's outward trade in agrochemicals, identifying key destination markets and product categories. Finally, the Price Trend Analysis will track historical and projected price movements for major agrochemical products, considering factors such as raw material costs and market dynamics. Each segment will include growth projections and market size estimates for the forecast period.

Key Drivers of Malaysia Agrochemical Market Growth

The Malaysia Agrochemical Market growth is propelled by several key drivers. Foremost is the sustained demand for increased agricultural output driven by food security imperatives and a growing population. Technological advancements, including precision agriculture and the development of more effective and eco-friendly crop protection solutions, are significantly boosting market growth. Government support through policies, subsidies, and initiatives promoting agricultural modernization further fuels expansion. The increasing adoption of advanced farming practices and the rising awareness among farmers regarding the benefits of modern agrochemicals also play a crucial role. Furthermore, the robust export market for Malaysian agricultural commodities indirectly stimulates the demand for these essential inputs.

Challenges in the Malaysia Agrochemical Market Sector

Despite its growth potential, the Malaysia Agrochemical Market faces several challenges. Stringent and evolving regulatory frameworks for pesticide registration and environmental impact assessment can pose hurdles for new product introductions. Fluctuations in the global prices of raw materials, such as oil and gas, directly impact production costs and can lead to price volatility for finished products. Supply chain disruptions, exacerbated by geopolitical events or logistical complexities, can affect the availability and cost of both raw materials and finished agrochemicals. Furthermore, increasing competition from both domestic and international players, coupled with a growing demand for sustainable and organic alternatives, necessitates continuous innovation and adaptation by market participants.

Emerging Opportunities in Malaysia Agrochemical Market

Emerging opportunities in the Malaysia Agrochemical Market are centered around sustainability and advanced technologies. The growing global and domestic demand for bio-agrochemicals, including biopesticides and biofertilizers, presents a significant growth avenue. The adoption of digital agriculture solutions, such as AI-powered crop diagnostics and precision application technologies, offers new market segments. Expansion into niche crops and high-value horticulture also presents opportunities for specialized agrochemical formulations. Furthermore, government initiatives promoting sustainable farming practices and the development of integrated pest management (IPM) solutions are creating a conducive environment for companies offering innovative and environmentally responsible products.

Leading Players in the Malaysia Agrochemical Market Market

- PK Fertilizers

- Central Minerals & Chemicals Sdn Bhd (CMC)

- Halex Group

- Hextar Group

- Farmcochem Group

- Agri Fer

- Advansia Sdn Bhd

- Agricultural Chemicals (M) Sdn Bhd (ACM)

- Biovista Lifesciences Sdn Bhd

- Sin Seng Huat

- Kenso Corporation

- Nufarm Ltd

- Crop Protection (M) Sdn Bhd

Key Developments in Malaysia Agrochemical Market Industry

- July 2022: Nufarm increased its investment and expanded its partnership with crop health company, Enko. These funds enable Enko to advance its product pipeline of crop protection chemistries that target critical pests and weeds through novel pathways.

- January 2022: The Malaysian Ministry of Agriculture and Food Industries (MAFI) was requested by Pesticide Action Network Asia Pacific (PANAP) to consider providing paddy farmers with help for safer, non-chemical pesticide alternatives that can benefit farmers' health.

Strategic Outlook for Malaysia Agrochemical Market Market

The strategic outlook for the Malaysia Agrochemical Market remains highly positive, driven by the persistent need for enhanced agricultural productivity and the global shift towards sustainable farming. Growth catalysts include continued government support for the agricultural sector, increasing adoption of precision agriculture technologies, and the rising demand for innovative and environmentally conscious agrochemical solutions. Companies that can successfully navigate the evolving regulatory landscape and invest in research and development for bio-based and digitally-enabled products are well-positioned for future success. The focus on food security, coupled with Malaysia's role as a significant agricultural exporter, will continue to underpin demand for effective crop protection and nutrient management solutions.

Malaysia Agrochemical Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Malaysia Agrochemical Market Segmentation By Geography

- 1. Malaysia

Malaysia Agrochemical Market Regional Market Share

Geographic Coverage of Malaysia Agrochemical Market

Malaysia Agrochemical Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Decreasing Arable Land and Increasing Demand for Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Agrochemical Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PK Fertilizers

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Central Minerals & Chemicals Sdn Bhd (CMC)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Halex Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hextar Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Farmcochem Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Agri Fer

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Advansia Sdn Bhd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Agricultural Chemicals (M) Sdn Bhd (ACM)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Biovista Lifesciences Sdn Bhd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sin Seng Huat

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Kenso Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Nufarm Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Crop Protection (M) Sdn Bhd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 PK Fertilizers

List of Figures

- Figure 1: Malaysia Agrochemical Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Malaysia Agrochemical Market Share (%) by Company 2025

List of Tables

- Table 1: Malaysia Agrochemical Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Malaysia Agrochemical Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Malaysia Agrochemical Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Malaysia Agrochemical Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Malaysia Agrochemical Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Malaysia Agrochemical Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Malaysia Agrochemical Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Malaysia Agrochemical Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Malaysia Agrochemical Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Malaysia Agrochemical Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Malaysia Agrochemical Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Malaysia Agrochemical Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Agrochemical Market?

The projected CAGR is approximately 4.56%.

2. Which companies are prominent players in the Malaysia Agrochemical Market?

Key companies in the market include PK Fertilizers, Central Minerals & Chemicals Sdn Bhd (CMC), Halex Group, Hextar Group, Farmcochem Group, Agri Fer, Advansia Sdn Bhd, Agricultural Chemicals (M) Sdn Bhd (ACM), Biovista Lifesciences Sdn Bhd, Sin Seng Huat, Kenso Corporation, Nufarm Ltd, Crop Protection (M) Sdn Bhd.

3. What are the main segments of the Malaysia Agrochemical Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 679.59 Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Decreasing Arable Land and Increasing Demand for Food.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

July 2022: Nufarm increased its investment and expanded its partnership with crop health company, Enko. These funds enable Enko to advance its product pipeline of crop protection chemistries that target critical pests and weeds through novel pathways.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Agrochemical Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Agrochemical Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Agrochemical Market?

To stay informed about further developments, trends, and reports in the Malaysia Agrochemical Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence