Key Insights

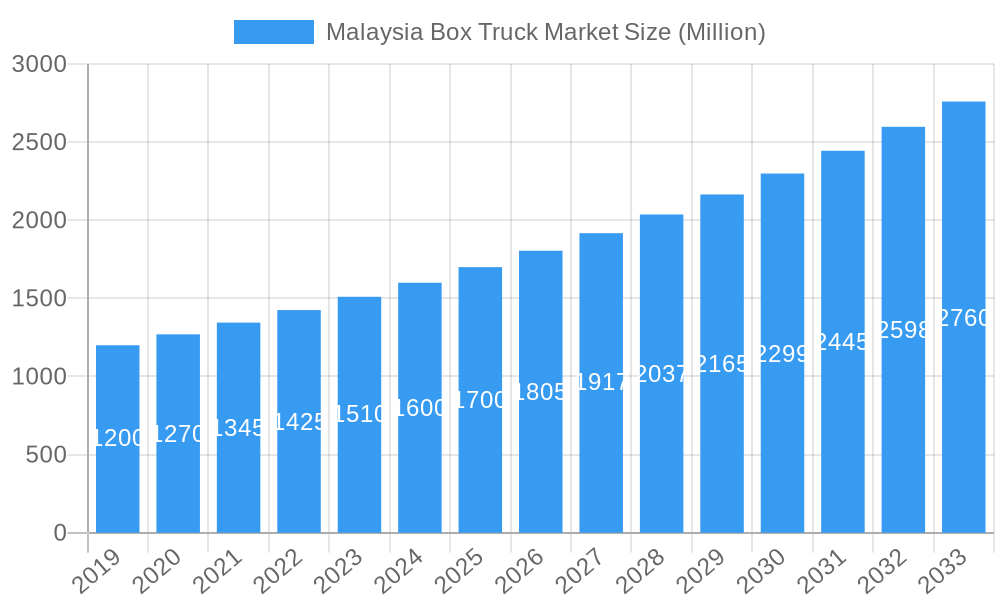

The Malaysian box truck market is projected to experience substantial growth, reaching an estimated market size of USD 2.4 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.8% anticipated through 2033. This expansion is primarily fueled by the increasing need for specialized and efficient logistics solutions across diverse industries. Key growth catalysts include the thriving e-commerce sector, which demands rapid last-mile delivery, and the growing importance of temperature-controlled supply chains for essential goods like food and pharmaceuticals. Government initiatives aimed at improving logistics infrastructure and trade further support market expansion. Additionally, the adoption of advanced, fuel-efficient, and low-emission vehicle technologies will contribute to the market's upward trend. Shifting consumer preferences for convenience and speed directly increase demand for specialized box trucks, including refrigerated units, to address logistical challenges.

Malaysia Box Truck Market Market Size (In Billion)

Market segmentation highlights diverse vehicle types, propulsion systems, and applications. Non-refrigerated trucks currently lead market share, but the refrigerated truck segment is poised for significant growth, driven by the expanding cold chain logistics sector. Internal Combustion Engine (ICE) trucks remain dominant in propulsion, though a transition towards electric propulsion is expected due to stricter environmental regulations and improved electric vehicle cost-effectiveness. Food and last-mile delivery are major application drivers, with "Others" covering various commercial and industrial transport needs. Leading companies such as Hino Motors, Tata Motors, Isuzu Motors, and Mitsubishi Fuso Truck and Bus Corporation are actively innovating and expanding their product lines, introducing advanced features and sustainable logistics solutions to meet the evolving demands of the Malaysian economy.

Malaysia Box Truck Market Company Market Share

Malaysia Box Truck Market: Comprehensive Analysis and Forecast (2019-2033)

This detailed report offers an in-depth analysis of the Malaysia Box Truck Market, providing critical insights into market dynamics, growth drivers, challenges, and opportunities. Covering the historical period from 2019 to 2024 and projecting growth until 2033, with a base year of 2025, this report is an indispensable resource for industry stakeholders, including manufacturers, logistics providers, fleet managers, and investors. We delve into market segmentation by Vehicle Type, Propulsion Type, and Application Type, highlighting key industry developments and competitive strategies shaping the future of commercial logistics in Malaysia.

Malaysia Box Truck Market Market Concentration & Innovation

The Malaysia Box Truck Market exhibits a moderate level of market concentration, with a few dominant players and a scattering of smaller, specialized manufacturers. Innovation is a key differentiator, driven by the increasing demand for efficient, sustainable, and technologically advanced logistics solutions. Regulatory frameworks, such as emissions standards and evolving import/export policies, significantly influence product development and market entry strategies. Product substitutes, primarily panel vans and larger articulated trucks for specific hauling needs, present a competitive pressure, necessitating continuous product improvement. End-user trends are strongly focused on cost-effectiveness, payload capacity, fuel efficiency, and increasingly, the adoption of electric vehicles (EVs) for last-mile delivery. Mergers and Acquisitions (M&A) activities are anticipated to increase as larger players seek to consolidate market share and acquire innovative technologies. For instance, M&A deal values are projected to see an upward trend, estimated at over $50 Million in the forecast period. Market share for leading players like Isuzu Motors Ltd and Hino Motors Ltd is substantial, contributing to the overall market concentration.

- Market Concentration: Moderate, with a few key players dominating.

- Innovation Drivers: Demand for efficiency, sustainability, advanced technology, and EV adoption.

- Regulatory Frameworks: Emissions standards, trade policies, and safety regulations.

- Product Substitutes: Panel vans, articulated trucks.

- End-User Trends: Cost-effectiveness, payload, fuel efficiency, EV adoption.

- M&A Activities: Expected to rise, with projected deal values exceeding $50 Million.

Malaysia Box Truck Market Industry Trends & Insights

The Malaysia Box Truck Market is poised for significant growth, driven by robust economic expansion and the burgeoning e-commerce sector. The overall Compound Annual Growth Rate (CAGR) is estimated at 7.5% for the forecast period. This growth is underpinned by increasing consumer demand for goods and services, necessitating more efficient and widespread distribution networks. Technological advancements are a major disruptor, with the introduction of smarter, more connected box trucks featuring advanced telematics, GPS tracking, and fleet management systems. These technologies enhance operational efficiency, reduce downtime, and improve delivery accuracy. Consumer preferences are shifting towards faster delivery times and greater transparency in the supply chain, which directly impacts the requirements for box truck fleets. The competitive dynamics are intensifying, with manufacturers focusing on offering a diverse range of vehicles, from fuel-efficient internal combustion engine (IC Engine) models to an increasing number of electric propulsion options. Market penetration of modern logistics solutions is steadily increasing, especially in urban centers, as businesses strive to optimize their delivery operations. The government's focus on improving logistics infrastructure and promoting green transportation further fuels market expansion. The growing adoption of electric box trucks for last-mile delivery in urban areas is a key trend, driven by environmental concerns and potential cost savings in the long run.

Dominant Markets & Segments in Malaysia Box Truck Market

The Non-Refrigerated segment is currently the dominant segment within the Malaysia Box Truck Market, accounting for approximately 70% of the total market share. This dominance is largely attributed to its broader applicability across various industries, including general cargo, manufacturing, and e-commerce deliveries. The IC Engine propulsion type continues to lead, representing over 85% of the market, owing to established infrastructure, lower upfront costs, and a wider range of available models. However, the Electric propulsion segment is projected to witness the highest growth rate, driven by government incentives for green transportation and increasing corporate sustainability goals. In terms of application, Last Mile Delivery is a rapidly expanding segment, fueled by the e-commerce boom and the need for agile, efficient urban logistics solutions. The Food Delivery segment also shows consistent growth, with specialized refrigerated box trucks playing a crucial role. The dominance of these segments is influenced by several factors:

- Economic Policies: Government initiatives supporting logistics and e-commerce significantly boost demand for non-refrigerated box trucks for general cargo and last-mile delivery.

- Infrastructure Development: Investments in road networks and logistics hubs facilitate the efficient operation of box truck fleets across the country, particularly for last-mile delivery.

- Consumer Behavior: The growing preference for online shopping and rapid delivery services directly drives the demand for box trucks in the food and last-mile delivery applications.

- Technological Adoption: The increasing affordability and performance of electric vehicles are slowly but surely propelling the electric propulsion segment.

- Industry Growth: Expansion in sectors like manufacturing and retail, which rely heavily on the transportation of goods, solidifies the dominance of non-refrigerated box trucks.

Malaysia Box Truck Market Product Developments

Product developments in the Malaysia Box Truck Market are increasingly focused on enhancing efficiency, sustainability, and safety. Manufacturers are introducing lighter-weight materials to improve fuel economy and payload capacity. Advanced telematics systems are becoming standard, offering real-time tracking, diagnostics, and driver behavior monitoring. The significant trend is the development of electric box trucks, addressing growing environmental concerns and regulatory push towards greener logistics. These new models often feature improved battery technology for extended range and faster charging capabilities, aiming to match the operational flexibility of their IC engine counterparts. The competitive advantage lies in offering a combination of cost-effectiveness, reliability, and innovative features tailored to specific application needs like last-mile delivery or temperature-controlled transport.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the Malaysia Box Truck Market across key categories to offer granular insights. The Vehicle Type segmentation includes Refrigerated and Non-Refrigerated box trucks, with the non-refrigerated segment holding a larger market share currently but refrigerated units showing strong growth potential due to increased demand for cold chain logistics. The Propulsion Type is analyzed into IC Engine and Electric. While IC engines dominate, electric vehicles are projected for rapid expansion. The Application Type covers Food Delivery, Last Mile Delivery, and Others. Last Mile Delivery and Food Delivery are expected to exhibit the highest growth rates, driven by e-commerce and evolving consumer habits.

- Vehicle Type:

- Refrigerated: Expected market growth of 8.2% CAGR, driven by cold chain expansion.

- Non-Refrigerated: Current market leader, projected 6.8% CAGR.

- Propulsion Type:

- IC Engine: Dominant share, projected 6.5% CAGR.

- Electric: Fastest growing segment, projected 15% CAGR.

- Application Type:

- Food Delivery: Strong growth, projected 7.8% CAGR.

- Last Mile Delivery: Significant expansion, projected 9% CAGR.

- Others: Stable growth, projected 5.5% CAGR.

Key Drivers of Malaysia Box Truck Market Growth

The Malaysia Box Truck Market's growth is propelled by several key factors. The burgeoning e-commerce sector necessitates robust last-mile delivery solutions, directly increasing demand for agile box trucks. Government initiatives promoting logistics efficiency and sustainable transportation, including incentives for EV adoption, are significant growth catalysts. Urbanization and population growth lead to increased consumption and the demand for goods, requiring expanded distribution networks. Furthermore, the advancement in electric vehicle technology is making EVs a more viable and cost-effective option for businesses, driving their adoption for reduced operational costs and environmental compliance.

- E-commerce growth and last-mile delivery demand.

- Government incentives for logistics and green transportation.

- Urbanization and increased consumerism.

- Technological advancements in EV batteries and performance.

Challenges in the Malaysia Box Truck Market Sector

Despite robust growth prospects, the Malaysia Box Truck Market faces several challenges. The high initial cost of electric box trucks remains a significant barrier to widespread adoption, despite potential long-term savings. Inadequate charging infrastructure for EVs, particularly outside major urban centers, can limit operational flexibility. Fluctuations in fuel prices for IC engine vehicles create uncertainty for fleet operators. Stringent emission regulations necessitate costly upgrades for older fleets. Supply chain disruptions, as seen globally, can impact the availability of raw materials and vehicle components, leading to production delays and increased costs.

- High upfront cost of electric box trucks.

- Limited charging infrastructure for EVs.

- Volatility in fuel prices.

- Strict emission standards and compliance costs.

- Global supply chain disruptions affecting manufacturing.

Emerging Opportunities in Malaysia Box Truck Market

The Malaysia Box Truck Market presents several emerging opportunities. The transition to electric mobility offers a significant opportunity for manufacturers and fleet operators to embrace sustainable practices and potentially reduce operational expenditures. The growth of cold chain logistics, driven by increased demand for perishable goods and pharmaceuticals, opens avenues for specialized refrigerated box trucks. The expansion of logistics hubs and industrial zones across Malaysia creates new markets for efficient transportation solutions. Furthermore, innovations in telematics and IoT integration present opportunities for value-added services, such as predictive maintenance and optimized route planning, enhancing overall fleet management.

- Growing demand for electric box trucks and related infrastructure.

- Expansion of the cold chain logistics sector.

- Development of new logistics hubs and industrial areas.

- Integration of telematics and IoT for advanced fleet management.

Leading Players in the Malaysia Box Truck Market Market

- Hino Motors Ltd

- EMAC Power Ltd

- Swift Haulage Bhd

- Wong Brothers Refrigeration Sdn Bhd

- NCE Auto Trading Sdn Bhd

- JK Schelkis offShore Sdn Bhd

- Traton Group

- Tata Motors Limited

- Mitsubishi Fuso Truck and Bus Corporation

- T R K Bangkok Industry & Exporter Co Ltd

- UD Trucks Corp

- A-Plus Manufacturing Sdn Bhd

- Isuzu Motors Ltd

- Chop Yong Cheong (CYC)

Key Developments in Malaysia Box Truck Market Industry

- August 2022: Swift Haulage Bhd, a major logistics service provider, announced international cooperation and MoU with Volvo Trucks Malaysto to introduce electric commercial vehicles in the country.

- December 2021: Swift Haulage Bhd announced the expansion and strengthening of its business operation in the country. The company announced its plans to expand its facilities and warehouses to propel the logistics business in the country.

Strategic Outlook for Malaysia Box Truck Market Market

The strategic outlook for the Malaysia Box Truck Market is characterized by a strong emphasis on sustainability, technological integration, and operational efficiency. The ongoing shift towards electric propulsion, supported by government policies and increasing environmental consciousness, presents a significant growth catalyst. Investments in advanced telematics and AI-driven fleet management solutions will be crucial for optimizing operations and reducing costs. The expansion of e-commerce and the demand for faster, more reliable deliveries will continue to drive the need for agile and specialized box truck solutions. Companies that can offer a blend of cost-effectiveness, advanced technology, and sustainable options are well-positioned for success in this dynamic market. Strategic partnerships and M&A activities are likely to shape the competitive landscape, fostering consolidation and innovation.

Malaysia Box Truck Market Segmentation

-

1. Vehicle Type

- 1.1. Refrigerated

- 1.2. Non-Refrigerated

-

2. Propulsion Type

- 2.1. IC Engine

- 2.2. Electric

-

3. Application Type

- 3.1. Food Delivery

- 3.2. Last Mile Delivery

- 3.3. Others

Malaysia Box Truck Market Segmentation By Geography

- 1. Malaysia

Malaysia Box Truck Market Regional Market Share

Geographic Coverage of Malaysia Box Truck Market

Malaysia Box Truck Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumption of Fast Food is Expected to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Increase in the Online Food Deliveries May Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Demand for Sustainable Transport to Propel the Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Box Truck Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Refrigerated

- 5.1.2. Non-Refrigerated

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. IC Engine

- 5.2.2. Electric

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Food Delivery

- 5.3.2. Last Mile Delivery

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hino Motors Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 EMAC Power Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Swift Haulage Bhd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wong Brothers Refrigeration Sdn Bhd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 NCE Auto Trading Sdn Bhd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JK Schelkis offShore Sdn Bhd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Traton Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tata Motors Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mitsubishi Fuso Truck and Bus Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 T R K Bangkok Industry & Exporter Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 UD Trucks Corp

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 A-Plus Manufacturing Sdn Bhd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Isuzu Motors Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Chop Yong Cheong (CYC)

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Hino Motors Ltd

List of Figures

- Figure 1: Malaysia Box Truck Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Malaysia Box Truck Market Share (%) by Company 2025

List of Tables

- Table 1: Malaysia Box Truck Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Malaysia Box Truck Market Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 3: Malaysia Box Truck Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 4: Malaysia Box Truck Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Malaysia Box Truck Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: Malaysia Box Truck Market Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 7: Malaysia Box Truck Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 8: Malaysia Box Truck Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Box Truck Market?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Malaysia Box Truck Market?

Key companies in the market include Hino Motors Ltd, EMAC Power Ltd, Swift Haulage Bhd, Wong Brothers Refrigeration Sdn Bhd, NCE Auto Trading Sdn Bhd, JK Schelkis offShore Sdn Bhd, Traton Group, Tata Motors Limited, Mitsubishi Fuso Truck and Bus Corporation, T R K Bangkok Industry & Exporter Co Ltd, UD Trucks Corp, A-Plus Manufacturing Sdn Bhd, Isuzu Motors Ltd, Chop Yong Cheong (CYC).

3. What are the main segments of the Malaysia Box Truck Market?

The market segments include Vehicle Type, Propulsion Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumption of Fast Food is Expected to Drive the Market.

6. What are the notable trends driving market growth?

Demand for Sustainable Transport to Propel the Demand.

7. Are there any restraints impacting market growth?

Increase in the Online Food Deliveries May Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

August 2022: Swift Haulage Bhd, a major logistics service provider, announced international cooperation and MoU with Volvo Trucks Malaysto to introduce electric commercial vehicles in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Box Truck Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Box Truck Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Box Truck Market?

To stay informed about further developments, trends, and reports in the Malaysia Box Truck Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence