Key Insights

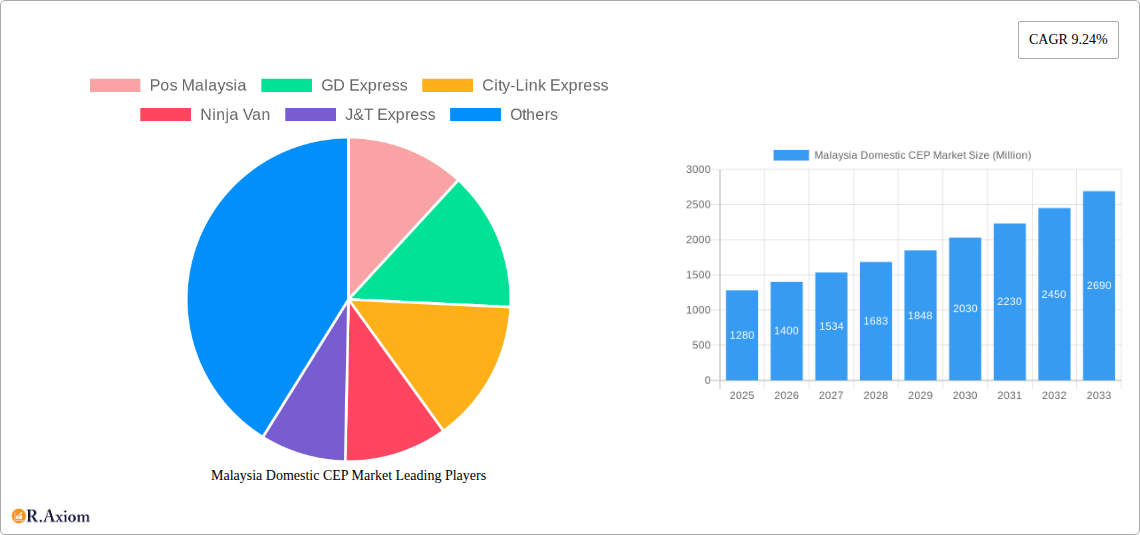

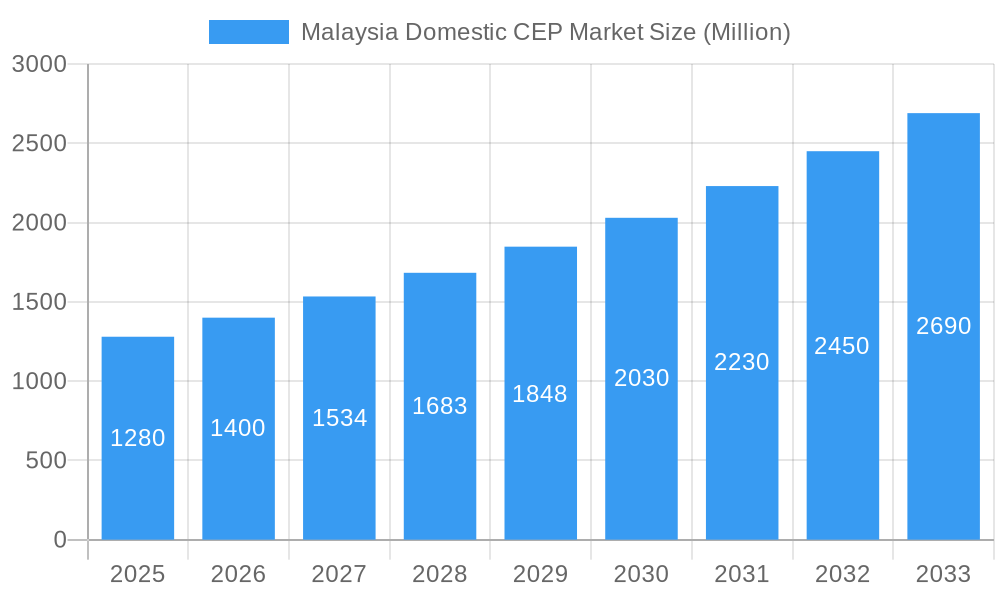

The Malaysia domestic courier, express, and parcel (CEP) market exhibits robust growth, with a market size of RM 1.28 billion in 2025 and a projected Compound Annual Growth Rate (CAGR) of 9.24% from 2025 to 2033. This expansion is driven primarily by the burgeoning e-commerce sector, fueled by increasing internet and smartphone penetration, coupled with a preference for online shopping among Malaysian consumers. The rise of mobile commerce and the increasing adoption of digital payment methods further accelerate market growth. Key players like Pos Malaysia, GD Express, City-Link Express, Ninja Van, J&T Express, and DHL E-commerce are fiercely competitive, constantly innovating to improve delivery speeds, enhance tracking capabilities, and expand service coverage to reach even remote areas. Growth is also spurred by the increasing demand for same-day and next-day delivery options, as well as specialized services catering to temperature-sensitive goods and bulky items. While challenges exist, such as infrastructure limitations in certain regions and fluctuations in fuel prices, the overall market outlook remains positive, projecting significant expansion over the forecast period.

Malaysia Domestic CEP Market Market Size (In Billion)

The competitive landscape is characterized by a mix of established national players and agile international entrants. Established players leverage their extensive network infrastructure and brand recognition, while newer entrants focus on technology-driven solutions and competitive pricing to gain market share. Consolidation and strategic partnerships are likely to continue, further shaping the market dynamics. Future growth will be significantly influenced by government initiatives aimed at improving logistics infrastructure, investments in technological advancements within the sector (such as automation and AI-driven route optimization), and adapting to evolving consumer expectations regarding speed, reliability, and convenience of delivery services. The market is expected to see further segmentation, with specialized services catering to niche industries and customer segments emerging.

Malaysia Domestic CEP Market Company Market Share

This in-depth report provides a comprehensive analysis of the Malaysian domestic courier, express, and parcel (CEP) market from 2019 to 2033. It offers actionable insights into market trends, competitive dynamics, growth drivers, and emerging opportunities, equipping stakeholders with the knowledge to navigate this rapidly evolving landscape. The report covers market size estimations, forecasts, and segmentation, along with detailed profiles of key players. The study period spans 2019-2033, with 2025 as the base and estimated year.

Malaysia Domestic CEP Market Market Concentration & Innovation

The Malaysian domestic CEP market exhibits a moderately concentrated structure, with several major players commanding significant market share. Pos Malaysia, GD Express, City-Link Express, Ninja Van, J&T Express, and DHL E-commerce are some of the key players, but the market also includes numerous smaller regional and niche players. Market share data for 2024 suggests Pos Malaysia holds approximately xx% market share, followed by Ninja Van at xx%, J&T Express at xx%, and others distributing the remaining xx%. The precise figures vary based on segment and service type.

Innovation is a key driver within the market, fueled by the increasing adoption of technology. This includes investment in automated sorting facilities, route optimization software, and the development of mobile tracking and delivery applications. The regulatory framework, while generally supportive of market growth, continues to evolve, impacting operational efficiency and compliance. Product substitution is minimal, with the primary competition stemming from differentiation in service speed, reliability, and pricing. End-user trends reveal a growing preference for speed and convenience, driving demand for same-day and next-day delivery options. M&A activity has been relatively modest in recent years, with deal values averaging approximately xx Million annually, suggesting a preference for organic growth over consolidation. However, increased investment and expansion from international players might alter this trend in the coming years.

- Market Share (2024, estimated): Pos Malaysia (xx%), Ninja Van (xx%), J&T Express (xx%), Others (xx%)

- Average Annual M&A Deal Value (2019-2024): xx Million

- Key Innovation Drivers: Technological advancements (automation, software), regulatory changes, evolving consumer preferences

Malaysia Domestic CEP Market Industry Trends & Insights

The Malaysian domestic CEP market has experienced robust growth throughout the historical period (2019-2024), driven primarily by the expansion of e-commerce and the rising adoption of online shopping. The Compound Annual Growth Rate (CAGR) during this period was approximately xx%, reaching a market size of xx Million in 2024. This growth is expected to continue, albeit at a slightly moderated pace, throughout the forecast period (2025-2033), with a projected CAGR of xx% leading to a market value of xx Million by 2033. Market penetration has increased significantly, with a greater proportion of the population now using CEP services for both business and personal needs. Technological disruptions, particularly the use of AI and big data analytics, are enhancing efficiency and improving delivery times, significantly influencing customer satisfaction and competitive dynamics. Consumer preferences, such as the need for real-time tracking and flexible delivery options, are also shaping the services offered by CEP providers. The competitive landscape is characterized by intense rivalry, with companies constantly striving to differentiate themselves through improved service quality, technological innovation, and competitive pricing strategies.

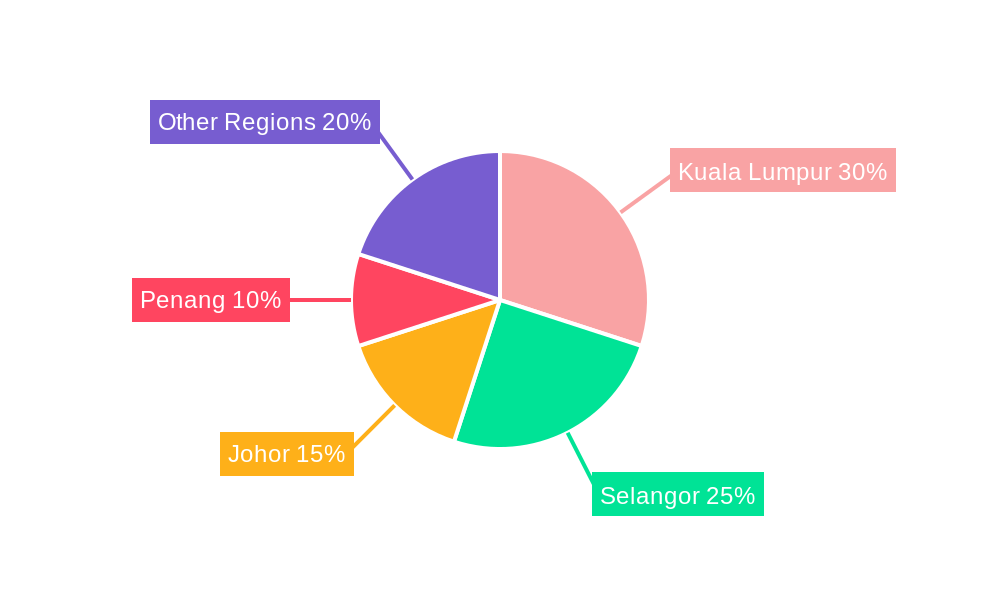

Dominant Markets & Segments in Malaysia Domestic CEP Market

The Klang Valley region (Kuala Lumpur and surrounding areas) remains the dominant market segment within Malaysia’s domestic CEP market. This is driven by several key factors:

- High Population Density: The Klang Valley is the most populous region in Malaysia, generating high volumes of parcels and shipments.

- Economic Activity: A significant concentration of businesses and commercial activity within the Klang Valley creates high demand for CEP services.

- Developed Infrastructure: The area boasts a well-established transportation network, facilitating efficient delivery operations.

- E-commerce Hub: The Klang Valley serves as a major hub for e-commerce activity in Malaysia.

Other significant segments include major urban centers such as Johor Bahru, Penang, and Ipoh, which contribute a substantial portion of the overall market volume. These regions benefit from similar driving factors such as growing populations, increased economic activity, and rising e-commerce penetration, though at a slightly lower scale than the Klang Valley.

Malaysia Domestic CEP Market Product Developments

Recent product innovations include the expansion of service offerings to accommodate specialized needs, like temperature-controlled transportation for perishable goods as demonstrated by Ninja Van's April 2024 announcement. This addresses the growth of online grocery and fresh food delivery services. Companies are increasingly utilizing technology to enhance tracking accuracy, delivery optimization, and customer communication, improving operational efficiency and the overall customer experience. Competitive advantages are achieved through speed, reliability, pricing strategies, and specialized services tailored to niche market segments.

Report Scope & Segmentation Analysis

This report segments the Malaysian domestic CEP market based on several key parameters:

By Service Type: Express, Same-day, Next-day, Standard delivery. Growth projections vary across these segments, with express and same-day delivery exhibiting the highest growth rates due to increasing demand for speed and convenience. Market sizes are significantly influenced by e-commerce growth and consumer purchasing behavior. Competitive dynamics are intense, with companies vying for market share through pricing and service differentiation.

By Customer Type: Business-to-business (B2B), Business-to-consumer (B2C), Consumer-to-consumer (C2C). The B2C segment is currently the largest, driven by the exponential growth in e-commerce. Competitive dynamics within each segment vary, with specialized solutions targeting specific customer needs.

By Region: Klang Valley, other major cities (e.g., Johor Bahru, Penang, Ipoh), and rural areas. Growth is most pronounced in urban centers, driven by factors outlined previously.

Key Drivers of Malaysia Domestic CEP Market Growth

The growth of the Malaysian domestic CEP market is fueled by several key factors:

- E-commerce Boom: The rapid expansion of online shopping significantly drives demand for CEP services for both businesses and consumers.

- Improved Infrastructure: Investments in transportation networks and logistics infrastructure enhance delivery efficiency and reach.

- Technological Advancements: Innovations in tracking systems, route optimization, and automation improve service quality and reduce operational costs.

- Government Support: Supportive government policies and initiatives foster a favorable business environment for CEP providers.

Challenges in the Malaysia Domestic CEP Market Sector

The Malaysian domestic CEP market faces several challenges:

- Competition: Intense competition among established and emerging players creates pressure on pricing and margins.

- Infrastructure Limitations: Inefficient infrastructure in certain areas can hamper delivery times and costs.

- Regulatory Hurdles: Compliance with evolving regulations can increase operational complexity and costs.

- Fuel Price Volatility: Fluctuations in fuel prices directly impact operational expenses.

Emerging Opportunities in Malaysia Domestic CEP Market

Several emerging opportunities are shaping the future of the Malaysian domestic CEP market:

- Last-Mile Delivery Solutions: Optimizing last-mile delivery efficiency through innovations such as drone delivery and automated lockers.

- Specialized Services: Meeting growing demand for specialized services, such as temperature-controlled delivery for perishable goods and secure handling of high-value items.

- Cross-border E-commerce: Capitalizing on increasing cross-border e-commerce activity within the ASEAN region.

Leading Players in the Malaysia Domestic CEP Market Market

- Pos Malaysia

- GD Express

- City-Link Express

- Ninja Van

- J&T Express

- DHL E-commerce

- Skynet

- ABX Express

- Nationwide Express

- Ta-Q-Bin

- 6 Other Companies

- 3 Other Companies

Key Developments in Malaysia Domestic CEP Market Industry

- January 2024: DTDC enters the Malaysian market, establishing an office in Kuala Lumpur, focusing on trans-shipment services within Southeast Asia and the Australian peninsula. This development increases competition and introduces advanced trans-shipment capabilities.

- April 2024: Ninja Van expands services to include perishable goods delivery, reflecting the growing demand for fresh food delivery services. This broadens their service offering and potentially attracts new customers within the food and beverage sector.

Strategic Outlook for Malaysia Domestic CEP Market Market

The Malaysian domestic CEP market is poised for sustained growth, driven by the continued expansion of e-commerce, technological advancements, and supportive government policies. Opportunities abound for companies that can adapt to changing consumer preferences, invest in technological innovation, and effectively manage operational challenges. The market will continue to witness increased competition and consolidation, with the most agile and adaptable companies likely to emerge as leaders in the coming years. Focus on specialization, technological advancements, and optimized last-mile delivery will be crucial for success.

Malaysia Domestic CEP Market Segmentation

-

1. Business Model

- 1.1. Business-to-business (B2B)

- 1.2. Customer-to-customer (C2C)

- 1.3. Business-to-consumer(B2C)

-

2. Type

- 2.1. E-commerce

- 2.2. Non-e-commerce

-

3. End User

- 3.1. Service

- 3.2. Wholesale and Retail

- 3.3. Healthcare

- 3.4. Industrial Manufacturing

- 3.5. Other End Users

Malaysia Domestic CEP Market Segmentation By Geography

- 1. Malaysia

Malaysia Domestic CEP Market Regional Market Share

Geographic Coverage of Malaysia Domestic CEP Market

Malaysia Domestic CEP Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand for Fast and Reliable Delivery Services4.; Rise of E-commerce

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Demand for Fast and Reliable Delivery Services4.; Rise of E-commerce

- 3.4. Market Trends

- 3.4.1. Booming Smartphone Sales in E-Commerce Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Domestic CEP Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Business Model

- 5.1.1. Business-to-business (B2B)

- 5.1.2. Customer-to-customer (C2C)

- 5.1.3. Business-to-consumer(B2C)

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. E-commerce

- 5.2.2. Non-e-commerce

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Service

- 5.3.2. Wholesale and Retail

- 5.3.3. Healthcare

- 5.3.4. Industrial Manufacturing

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Business Model

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Pos Malaysia

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GD Express

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 City-Link Express

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ninja Van

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 J&T Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DHL E-commerce

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Skynet

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ABX Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nationwide Express

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ta-Q-Bin**List Not Exhaustive 6 3 Other Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Pos Malaysia

List of Figures

- Figure 1: Malaysia Domestic CEP Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Malaysia Domestic CEP Market Share (%) by Company 2025

List of Tables

- Table 1: Malaysia Domestic CEP Market Revenue Million Forecast, by Business Model 2020 & 2033

- Table 2: Malaysia Domestic CEP Market Volume Billion Forecast, by Business Model 2020 & 2033

- Table 3: Malaysia Domestic CEP Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Malaysia Domestic CEP Market Volume Billion Forecast, by Type 2020 & 2033

- Table 5: Malaysia Domestic CEP Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Malaysia Domestic CEP Market Volume Billion Forecast, by End User 2020 & 2033

- Table 7: Malaysia Domestic CEP Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Malaysia Domestic CEP Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Malaysia Domestic CEP Market Revenue Million Forecast, by Business Model 2020 & 2033

- Table 10: Malaysia Domestic CEP Market Volume Billion Forecast, by Business Model 2020 & 2033

- Table 11: Malaysia Domestic CEP Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Malaysia Domestic CEP Market Volume Billion Forecast, by Type 2020 & 2033

- Table 13: Malaysia Domestic CEP Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Malaysia Domestic CEP Market Volume Billion Forecast, by End User 2020 & 2033

- Table 15: Malaysia Domestic CEP Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Malaysia Domestic CEP Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Domestic CEP Market?

The projected CAGR is approximately 9.24%.

2. Which companies are prominent players in the Malaysia Domestic CEP Market?

Key companies in the market include Pos Malaysia, GD Express, City-Link Express, Ninja Van, J&T Express, DHL E-commerce, Skynet, ABX Express, Nationwide Express, Ta-Q-Bin**List Not Exhaustive 6 3 Other Companie.

3. What are the main segments of the Malaysia Domestic CEP Market?

The market segments include Business Model, Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.28 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand for Fast and Reliable Delivery Services4.; Rise of E-commerce.

6. What are the notable trends driving market growth?

Booming Smartphone Sales in E-Commerce Segment.

7. Are there any restraints impacting market growth?

4.; Growing Demand for Fast and Reliable Delivery Services4.; Rise of E-commerce.

8. Can you provide examples of recent developments in the market?

April 2024: Ninja Van, a local express logistics company, broadened its services to transport perishable items, such as fresh fruit and sashimi, alongside its traditional parcel and online order deliveries.January 2024: DTDC, an express logistics company, announced its foray into the Malaysian market. This move was facilitated by its subsidiary, DTDC Global Express PTE Ltd, which inaugurated an office in Kuala Lumpur. The newly minted office, bolstering DTDC's presence in Southeast Asia, will primarily focus on providing advanced trans-shipment services to clients in Southeast Asia and the Australian peninsula, as per DTDC's official statement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Domestic CEP Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Domestic CEP Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Domestic CEP Market?

To stay informed about further developments, trends, and reports in the Malaysia Domestic CEP Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence