Key Insights

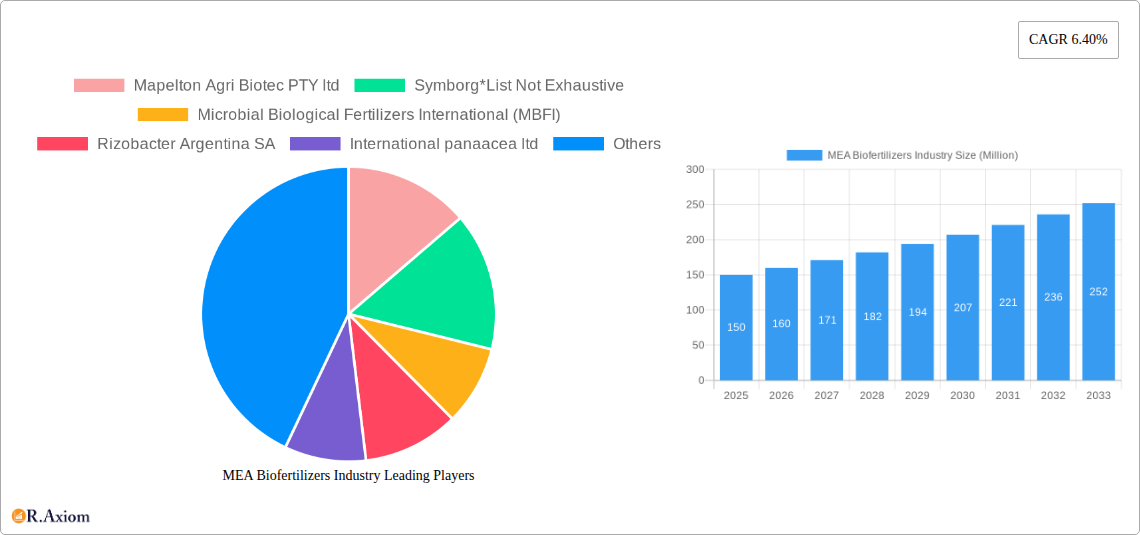

The MEA biofertilizers market, while currently smaller than other regions like Asia-Pacific or Europe, exhibits significant growth potential fueled by increasing agricultural activities and a growing awareness of sustainable farming practices. The region's diverse agricultural landscape, encompassing various crops like grains, pulses, and commercial crops, presents a substantial demand for biofertilizers as a cost-effective and environmentally friendly alternative to chemical fertilizers. The adoption of biofertilizers is being driven by factors such as government initiatives promoting sustainable agriculture, rising concerns about soil health degradation, and the need for enhanced crop yields in a climate-changing environment. While the exact market size for MEA in 2025 is unavailable, considering the global CAGR of 6.40% and the burgeoning agricultural sector in the region, a reasonable estimation would place the MEA biofertilizer market value at approximately $150 million in 2025. This figure is derived by extrapolating from regional growth trends in similar markets and considering the substantial agricultural output of key MEA nations. The market is segmented by crop type, microorganism type, technology, and application, offering various opportunities for different players in the value chain.

MEA Biofertilizers Industry Market Size (In Million)

Growth in the MEA biofertilizer market is likely to be driven by the increasing adoption of advanced biofertilizer technologies like liquid biofertilizers and carrier-enriched biofertilizers. These technologies offer improved efficacy and ease of application compared to traditional methods. However, challenges such as limited awareness among farmers about the benefits of biofertilizers, lack of access to quality products, and insufficient investment in research and development could hinder market growth. Overcoming these challenges through educational campaigns, government support programs, and private sector investment is crucial for realizing the full potential of the MEA biofertilizer market. The forecast period of 2025-2033 promises substantial growth, potentially exceeding $300 million by 2033, as the market matures and broader adoption takes root. Key players in the market are focusing on innovation, product diversification, and strategic partnerships to enhance their market share and cater to the evolving demands of farmers.

MEA Biofertilizers Industry Company Market Share

MEA Biofertilizers Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the MEA biofertilizers industry, offering valuable insights for stakeholders seeking to understand market dynamics, growth opportunities, and competitive landscapes. Covering the period 2019-2033, with a focus on 2025, this report presents a detailed segmentation analysis, competitive landscape overview, and future growth projections. The report uses Million (M) as the unit for all values.

MEA Biofertilizers Industry Market Concentration & Innovation

This section analyzes the MEA biofertilizers market concentration, highlighting key players and their market share. We examine innovation drivers, regulatory landscapes, and the impact of mergers and acquisitions (M&A) activities. The study period covers 2019-2033, with 2025 as the base and estimated year.

Market Concentration: The MEA biofertilizers market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. For example, Symborg and Mapelton Agri Biotec PTY ltd hold a combined xx% market share in 2025 (estimated). Smaller players, including Microbial Biological Fertilizers International (MBFI), Rizobacter Argentina SA, International panacea ltd, and Agrilife, compete for the remaining market share.

Innovation Drivers: Growing awareness of sustainable agriculture practices, increasing demand for higher crop yields, and stringent regulations on chemical fertilizers are key drivers of innovation. Companies are investing in research and development to create novel biofertilizers with enhanced efficacy and broader application.

Regulatory Frameworks: Government policies promoting sustainable agriculture and reducing reliance on chemical fertilizers are shaping the market. Varying regulatory frameworks across MEA countries present both opportunities and challenges.

Product Substitutes: Chemical fertilizers remain the primary substitute for biofertilizers. However, the increasing awareness of environmental concerns and the limitations of chemical fertilizers is driving a shift towards biofertilizers.

End-User Trends: Farmers are increasingly adopting biofertilizers driven by factors like improved soil health, cost-effectiveness in the long term, and reduced environmental impact.

M&A Activities: The MEA biofertilizers market has witnessed several M&A activities in recent years, with larger companies acquiring smaller firms to expand their product portfolio and geographic reach. The total value of M&A deals in the period 2019-2024 is estimated to be $xx Million.

MEA Biofertilizers Industry Industry Trends & Insights

This section delves into the key trends and insights shaping the MEA biofertilizers market, analyzing growth drivers, technological disruptions, consumer preferences, and competitive dynamics.

The MEA biofertilizers market is experiencing robust growth, driven by increasing demand for sustainable agricultural practices and the rising adoption of biofertilizers among farmers. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of $xx Million by 2033. This growth is fueled by several factors, including government initiatives promoting sustainable agriculture, rising awareness of the environmental benefits of biofertilizers, and increasing crop yields in the region. Technological advancements in biofertilizer production and application methods further contribute to market expansion. The market penetration rate of biofertilizers in MEA is expected to increase from xx% in 2025 to xx% by 2033. Competitive dynamics are characterized by both established players and new entrants, leading to increased product innovation and competitive pricing. Consumer preferences are shifting towards biofertilizers with superior efficacy, ease of application, and cost-effectiveness.

Dominant Markets & Segments in MEA Biofertilizers Industry

This section identifies the leading regions, countries, and segments within the MEA biofertilizers market.

Leading Regions/Countries: [Specify the leading region/country based on market size and growth rate. For example: "The X region dominates the MEA biofertilizers market, accounting for xx% of the total market value in 2025. This dominance is attributed to factors such as favorable climatic conditions, supportive government policies, and high agricultural output."]

Dominant Crop Types:

- Grains and Cereals: High demand for grains and cereals in MEA drives significant biofertilizer usage in this segment.

- Pulses and Oilseeds: Growing popularity of pulses and oilseeds contributes to substantial biofertilizer consumption.

- Commercial Crops: The commercial crops segment shows significant growth due to increased focus on quality and yield.

- Fruits and Vegetables: Demand for high-quality fruits and vegetables fuels growth in this segment.

- Other Crop Types: This segment shows a steady growth rate.

Dominant Microorganism Types:

- Rhizobium: Widely used for legume crops, leading to substantial demand.

- Phosphate Solubilizing Bacteria: Significant demand due to its role in phosphorus uptake.

- Other Microorganism Types: Shows steady growth driven by innovation.

Dominant Technology Types:

- Liquid Biofertilizers: Ease of application and effectiveness contributes to high market share.

- Carrier-enriched Biofertilizers: Enhanced shelf life and application efficiency drive its adoption.

Dominant Application Types:

- Soil Treatment: Traditional method of application, remains the dominant segment.

- Seed Treatment: Increasing adoption due to its efficiency and cost-effectiveness.

Key Drivers: Factors contributing to the dominance of specific segments include favorable climatic conditions, government support for specific crops, existing agricultural infrastructure, and farmer awareness and adoption rates.

MEA Biofertilizers Industry Product Developments

Recent product developments in the MEA biofertilizers industry focus on enhancing efficacy, ease of application, and shelf life. Companies are developing advanced biofertilizers formulations tailored to specific crops and soil conditions. Technological advancements include using nanotechnology to improve nutrient delivery and developing biofertilizers with multiple functionalities. These innovations address the needs of farmers by increasing crop yields, reducing input costs, and promoting sustainable agriculture. The market is also witnessing the emergence of biofertilizers combined with other agricultural inputs, such as biopesticides and biostimulants, offering integrated solutions for crop management.

Report Scope & Segmentation Analysis

This report segments the MEA biofertilizers market based on crop type (Grains and Cereals, Pulses and Oilseeds, Commercial Crops, Fruits and Vegetables, Other Crop Types), microorganism type (Rhizobium, Aztobacter, Azospirillum, Blue-green Algae, Phosphate Solubilizing Bacteria, Mycorrhiza, Other Microorganisms), technology type (Carrier-enriched Biofertilizers, Liquid Biofertilizers, Other Technologies), and application (Soil Treatment, Seed Treatment, Other Applications). Each segment's growth projection, market size, and competitive dynamics are analyzed within the report. The market is expected to grow significantly across all segments driven by factors such as increasing demand for sustainable agricultural practices and advancements in biofertilizer technology.

Key Drivers of MEA Biofertilizers Industry Growth

The MEA biofertilizers market is propelled by several factors: growing awareness of sustainable agriculture among farmers, increasing demand for higher crop yields, government support through subsidies and incentives, stringent regulations on chemical fertilizers, and technological advancements in biofertilizer production and application. The rising adoption of precision agriculture techniques further boosts the market.

Challenges in the MEA Biofertilizers Industry Sector

Despite the significant growth potential, the MEA biofertilizers industry faces several challenges. These include the high initial investment cost for farmers, lack of awareness about the benefits of biofertilizers among a segment of farmers, inconsistent product quality across different manufacturers, limited access to credit and finance, and the presence of counterfeit products in the market. Furthermore, the complex regulatory landscape in some countries presents barriers to entry for new players. These challenges impact market growth and require attention to ensure sustainable market development.

Emerging Opportunities in MEA Biofertilizers Industry

Emerging opportunities include the development of biofertilizers tailored to specific crop varieties and soil conditions, the integration of biofertilizers with other agricultural inputs such as biopesticides, the expansion into untapped markets, and the adoption of innovative distribution and marketing strategies. The increasing adoption of digital agriculture technologies and precision farming techniques offer potential avenues for growth. The development of climate-smart biofertilizers, tailored to withstand harsh conditions, represents a major opportunity.

Leading Players in the MEA Biofertilizers Industry Market

- Mapelton Agri Biotec PTY ltd

- Symborg

- Microbial Biological Fertilizers International (MBFI)

- Rizobacter Argentina SA

- International panacea ltd

- Agrilife

Key Developments in MEA Biofertilizers Industry Industry

- [Date]: Symborg launched a new biofertilizer formulation for maize.

- [Date]: Mapelton Agri Biotec PTY ltd announced a strategic partnership with a local distributor in [Country].

- [Date]: Rizobacter Argentina SA secured a significant investment for research and development.

- (Add more bullet points with specific dates and details of relevant industry developments.)

Strategic Outlook for MEA Biofertilizers Industry Market

The MEA biofertilizers market is poised for significant growth driven by increased demand for sustainable agriculture, favorable government policies, and technological advancements. Future market potential lies in developing specialized biofertilizers, expanding into new geographic markets, and strengthening partnerships with agricultural stakeholders. Companies focused on innovation and sustainable practices are well-positioned to capture significant market share. The market’s growth will also be influenced by consumer adoption, regulatory changes, and technological advancements in both production and application methodologies.

MEA Biofertilizers Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

MEA Biofertilizers Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

MEA Biofertilizers Industry Regional Market Share

Geographic Coverage of MEA Biofertilizers Industry

MEA Biofertilizers Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Increased Food Demand and Need for Sustainable Agricultural Development

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Biofertilizers Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America MEA Biofertilizers Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America MEA Biofertilizers Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe MEA Biofertilizers Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa MEA Biofertilizers Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific MEA Biofertilizers Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Mapelton Agri Biotec PTY ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Symborg*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Microbial Biological Fertilizers International (MBFI)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rizobacter Argentina SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 International panaacea ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Agrilife

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Mapelton Agri Biotec PTY ltd

List of Figures

- Figure 1: Global MEA Biofertilizers Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America MEA Biofertilizers Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 3: North America MEA Biofertilizers Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America MEA Biofertilizers Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 5: North America MEA Biofertilizers Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America MEA Biofertilizers Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America MEA Biofertilizers Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America MEA Biofertilizers Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America MEA Biofertilizers Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America MEA Biofertilizers Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 11: North America MEA Biofertilizers Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America MEA Biofertilizers Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America MEA Biofertilizers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America MEA Biofertilizers Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 15: South America MEA Biofertilizers Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America MEA Biofertilizers Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 17: South America MEA Biofertilizers Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America MEA Biofertilizers Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America MEA Biofertilizers Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America MEA Biofertilizers Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America MEA Biofertilizers Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America MEA Biofertilizers Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 23: South America MEA Biofertilizers Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America MEA Biofertilizers Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America MEA Biofertilizers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe MEA Biofertilizers Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 27: Europe MEA Biofertilizers Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe MEA Biofertilizers Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 29: Europe MEA Biofertilizers Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe MEA Biofertilizers Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe MEA Biofertilizers Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe MEA Biofertilizers Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe MEA Biofertilizers Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe MEA Biofertilizers Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe MEA Biofertilizers Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe MEA Biofertilizers Industry Revenue (undefined), by Country 2025 & 2033

- Figure 37: Europe MEA Biofertilizers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa MEA Biofertilizers Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa MEA Biofertilizers Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa MEA Biofertilizers Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa MEA Biofertilizers Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa MEA Biofertilizers Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa MEA Biofertilizers Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa MEA Biofertilizers Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa MEA Biofertilizers Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa MEA Biofertilizers Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa MEA Biofertilizers Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa MEA Biofertilizers Industry Revenue (undefined), by Country 2025 & 2033

- Figure 49: Middle East & Africa MEA Biofertilizers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific MEA Biofertilizers Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific MEA Biofertilizers Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific MEA Biofertilizers Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific MEA Biofertilizers Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific MEA Biofertilizers Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific MEA Biofertilizers Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific MEA Biofertilizers Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific MEA Biofertilizers Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific MEA Biofertilizers Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific MEA Biofertilizers Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific MEA Biofertilizers Industry Revenue (undefined), by Country 2025 & 2033

- Figure 61: Asia Pacific MEA Biofertilizers Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: United States MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Canada MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Mexico MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 17: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: Brazil MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Argentina MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 26: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: United Kingdom MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Germany MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: France MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Italy MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Spain MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Russia MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Benelux MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Nordics MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 41: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: Turkey MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Israel MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: GCC MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: North Africa MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: South Africa MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 53: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global MEA Biofertilizers Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 58: China MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 59: India MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: Japan MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 61: South Korea MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: ASEAN MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 63: Oceania MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific MEA Biofertilizers Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Biofertilizers Industry?

The projected CAGR is approximately 11.1%.

2. Which companies are prominent players in the MEA Biofertilizers Industry?

Key companies in the market include Mapelton Agri Biotec PTY ltd, Symborg*List Not Exhaustive, Microbial Biological Fertilizers International (MBFI), Rizobacter Argentina SA, International panaacea ltd, Agrilife.

3. What are the main segments of the MEA Biofertilizers Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Increased Food Demand and Need for Sustainable Agricultural Development.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Biofertilizers Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Biofertilizers Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Biofertilizers Industry?

To stay informed about further developments, trends, and reports in the MEA Biofertilizers Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence