Key Insights

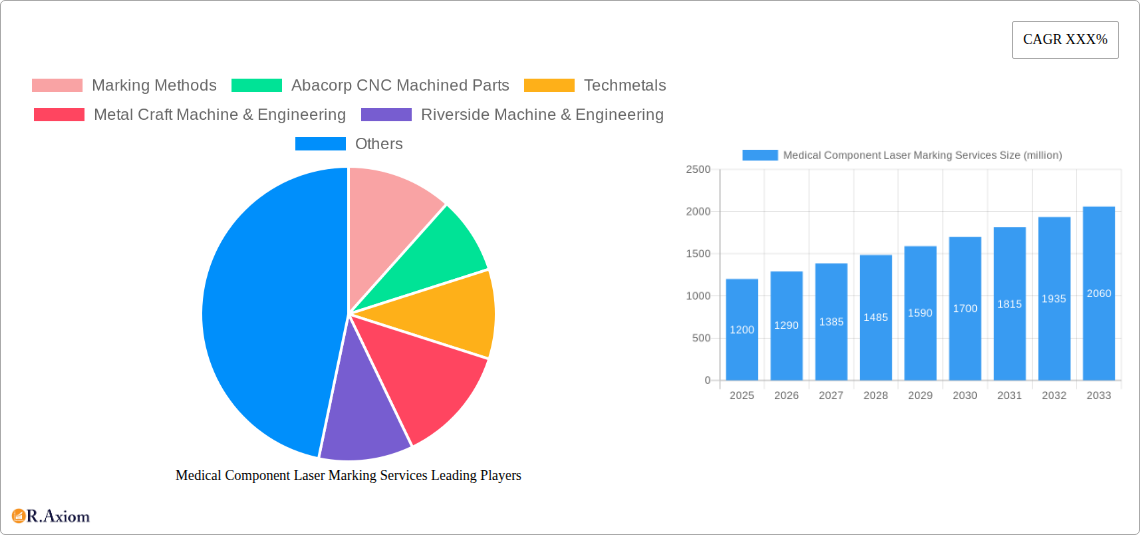

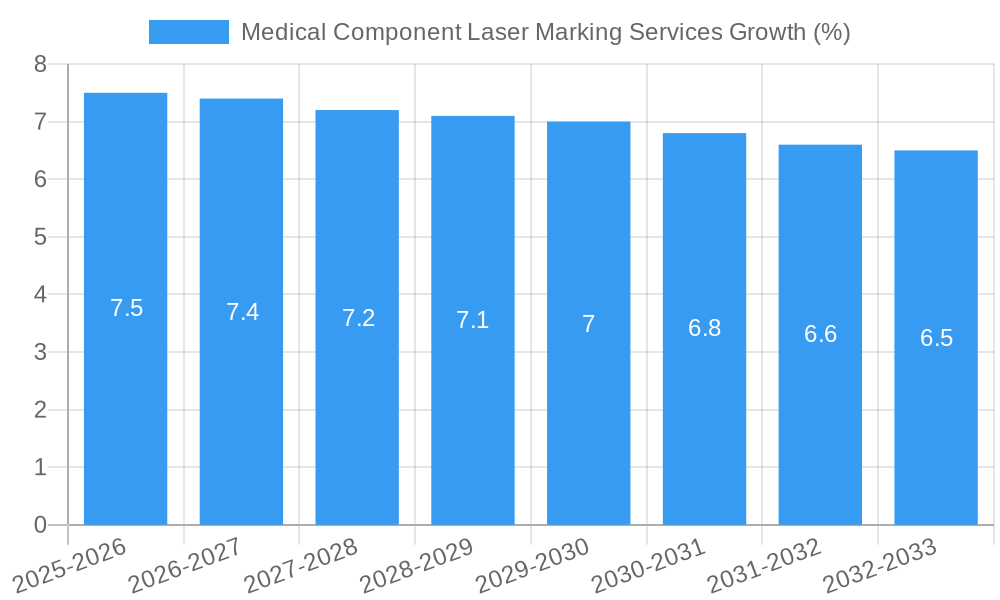

The Medical Component Laser Marking Services market is poised for significant expansion, projected to reach a substantial market size by 2033, driven by an estimated Compound Annual Growth Rate (CAGR) of approximately 7.5%. This robust growth is fueled by the increasing demand for highly precise and permanent marking solutions in the medical device industry. Key drivers include stringent regulatory requirements for traceability and identification of medical implants, surgical instruments, and diagnostic equipment, as well as the burgeoning healthcare sector's adoption of advanced materials. Laser marking offers unparalleled accuracy, durability, and the ability to mark intricate designs on a wide range of materials, from sensitive metals to advanced non-metals, making it indispensable for critical medical applications. The continuous innovation in laser technology, leading to faster, more efficient, and cost-effective marking solutions, further bolsters market momentum.

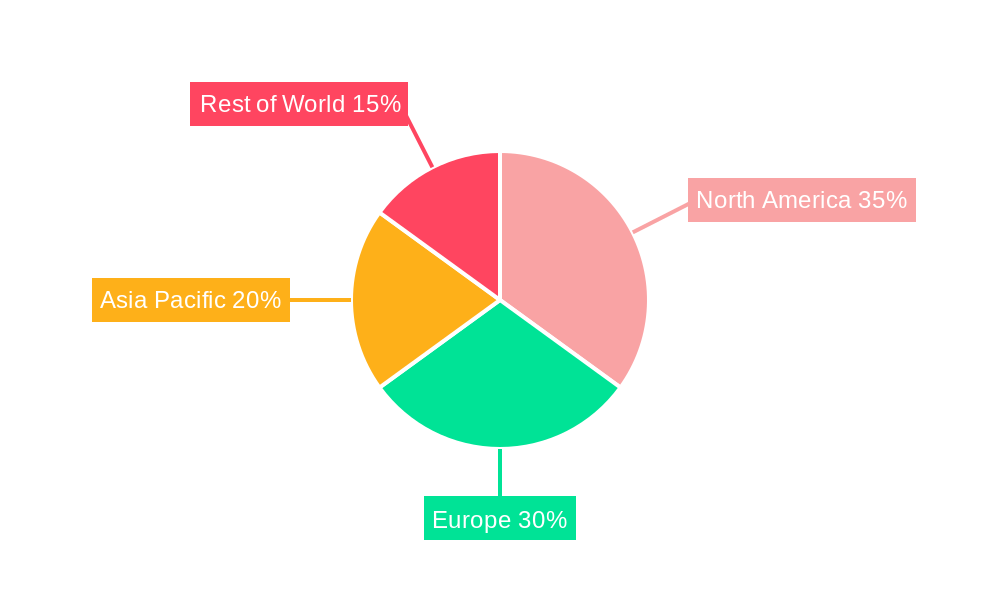

The market's trajectory is further shaped by critical trends such as the integration of laser marking with automated manufacturing processes and the growing emphasis on serialization and unique device identification (UDI) mandated by global health authorities. While the market benefits from these advancements, certain restraints could influence its pace. These may include the initial capital investment required for advanced laser marking systems and the need for specialized training for operators. However, the long-term benefits of enhanced product safety, improved supply chain management, and reduced counterfeiting are expected to outweigh these challenges. The market is segmented by application into Metal and Non-metal, and by type into Infrared Laser and Green Laser, with the Metal segment likely dominating due to the widespread use of metals in medical devices. Geographically, North America and Europe are anticipated to lead, owing to their developed healthcare infrastructures and stringent regulatory landscapes, while Asia Pacific is expected to exhibit the highest growth potential.

Here is a detailed, SEO-optimized report description for Medical Component Laser Marking Services, designed for immediate use without modification.

Medical Component Laser Marking Services Market Concentration & Innovation

The medical component laser marking services market is characterized by a moderate concentration, with key players like Abacorp CNC Machined Parts, Techmetals, Metal Craft Machine & Engineering, Riverside Machine & Engineering, Component Engineers, Astro Manufacturing & Design, Laserage, Peoria Production Solutions, Fabri-Tech, Accumet Engineering, Arrow Cryogenics, Mac Machine Company, Vita Needle, CED Services, Serviscreen Corporation, MicroGroup, Omni Components, Acceleron, Brinkman Precision, and Grace Manufacturing holding significant shares. Innovation is a primary driver, fueled by the increasing demand for high-precision, permanent marking solutions in the medical device industry. Advancements in laser technology, particularly in infrared and green laser types, enable superior marking on a wider range of materials, including metals and non-metals, without compromising component integrity. Regulatory frameworks, such as FDA guidelines for device traceability and unique device identification (UDI), are compelling manufacturers to adopt advanced marking technologies. Product substitutes, like inkjet and dot peen marking, exist but often fall short in terms of durability, legibility, and material compatibility for critical medical components. End-user trends lean towards miniaturization, biocompatibility, and enhanced traceability, pushing service providers to offer more sophisticated laser marking solutions. Mergers and acquisitions (M&A) are a growing trend, with deal values potentially reaching millions of dollars as larger companies seek to expand their service portfolios and geographical reach. For instance, a recent acquisition in Q4 2023 of a niche laser marking specialist by a diversified manufacturing group was valued at approximately $50 million, underscoring the strategic importance of these services.

Medical Component Laser Marking Services Industry Trends & Insights

The global medical component laser marking services market is poised for robust expansion, driven by an escalating demand for advanced traceability solutions within the healthcare sector. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. This impressive growth trajectory is underpinned by several critical factors. The increasing complexity and miniaturization of medical devices necessitate marking techniques that can deliver high-resolution, indelible identification without damaging sensitive materials. Laser marking, with its precision and non-contact nature, is ideally suited for these applications. Furthermore, stringent regulatory mandates worldwide, including the EU's Medical Device Regulation (MDR) and the U.S. FDA's UDI system, are compelling manufacturers to implement robust marking and traceability systems, directly boosting the demand for specialized laser marking services. The market penetration of advanced laser marking technologies is expected to rise significantly, moving from an estimated 60% in 2025 to over 85% by 2033 for high-value medical components.

Technological disruptions are continuously shaping the industry landscape. Innovations in fiber lasers and ultrafast laser technologies are enabling faster marking speeds, finer details, and the ability to mark a broader array of exotic materials commonly used in medical implants and surgical instruments. The development of specialized laser wavelengths, such as green lasers, offers enhanced marking capabilities on plastics and organic tissues, opening new avenues for application in areas like personalized medicine and bio-implants. Consumer preferences are also evolving, with an increasing focus on patient safety and device provenance. Healthcare providers and patients alike are demanding greater transparency regarding the origin and lifecycle of medical devices, making clear and permanent marking a critical feature. This demand for accountability further solidifies the importance of reliable laser marking services.

The competitive dynamics within the market are intensifying. Established players are investing heavily in research and development to enhance their technological capabilities and service offerings. Simultaneously, new entrants with specialized expertise are emerging, particularly in niche applications like marking of biodegradable implants or complex robotic surgical tools. Companies are also focusing on vertical integration and strategic partnerships to offer end-to-end solutions, from component manufacturing to final marking and serialization. The shift towards on-demand manufacturing and personalized medicine also presents a significant trend, requiring flexible and agile laser marking services capable of handling small batch sizes and unique identification requirements. The value chain is becoming increasingly sophisticated, with service providers offering not just marking but also data management and integration services related to UDI compliance.

Dominant Markets & Segments in Medical Component Laser Marking Services

The medical component laser marking services market exhibits distinct dominance across various segments, driven by technological advancements and specific industry needs.

Application: Metal

The Metal application segment currently holds the largest market share, estimated to be over 65% in 2025, and is projected to maintain its lead throughout the forecast period. This dominance is attributed to the widespread use of metals like stainless steel, titanium, cobalt-chrome, and aluminum in a vast array of medical devices, including surgical instruments, orthopedic implants, dental prosthetics, and cardiovascular devices. The inherent durability and biocompatibility of these metals, coupled with their resistance to sterilization processes, make them ideal for critical medical applications.

- Key Drivers for Metal Segment Dominance:

- Material Properties: Metals offer superior strength, corrosion resistance, and biocompatibility, making them indispensable for implants, surgical tools, and devices that come into contact with bodily fluids.

- Regulatory Requirements: UDI mandates and traceability regulations specifically require durable markings on metallic components to ensure identification and tracking throughout the device's lifecycle.

- Technological Suitability: Infrared lasers are highly effective for marking a wide range of metals, offering high contrast, fine detail, and permanent adhesion without altering the material's structural integrity.

- Established Manufacturing Base: The medical device industry has a long-standing reliance on metallic components, creating a substantial existing market for laser marking services.

- Sterilization Compatibility: Laser marks on metal components are highly resistant to various sterilization methods, including autoclaving, gamma irradiation, and ethylene oxide (EtO), ensuring the longevity and legibility of the mark.

The dominance of the metal segment is further bolstered by the extensive application of infrared laser technology, which provides precise and high-contrast markings on these materials. Companies like Abacorp CNC Machined Parts and Metal Craft Machine & Engineering are prominent providers of laser marking services for metallic medical components, leveraging their expertise in precision machining and material handling. The market size for laser marking of metallic medical components is estimated to be around $850 million in 2025.

Application: Non-metal

The Non-metal segment, while currently smaller at an estimated 35% market share in 2025, is experiencing rapid growth. This segment encompasses a diverse range of materials such as plastics (e.g., PEEK, UHMWPE, silicone), ceramics, and specialized polymers used in catheters, diagnostic equipment, drug delivery systems, and biocompatible coatings. The increasing use of advanced polymers and composites in medical device innovation is fueling the expansion of this segment.

- Key Drivers for Non-metal Segment Growth:

- Material Innovation: The development of novel biocompatible and high-performance polymers for medical applications is expanding the scope for laser marking.

- Miniaturization and Complex Geometries: Non-metals are often preferred for smaller and more intricate device designs, where laser marking offers superior precision.

- Specialized Laser Technologies: Green lasers are becoming increasingly crucial for marking plastics and certain organic materials, offering better absorption and reduced risk of material degradation compared to infrared lasers.

- Biocompatibility Concerns: Laser marking on non-metals can be optimized to ensure no leachable byproducts are created, crucial for implantable devices.

- Aesthetics and Functionality: In some non-metal applications, laser marking can also serve aesthetic purposes or be integrated with functional features.

The market size for laser marking of non-metallic medical components is projected to grow from approximately $450 million in 2025 to over $1.2 billion by 2033, with a CAGR of approximately 10.5%.

Type: Infrared Laser

Infrared Laser technology is the most prevalent type of laser marking service for medical components, commanding an estimated 70% market share in 2025. This dominance is primarily due to its versatility and effectiveness in marking a broad spectrum of materials, especially metals, which form the backbone of many critical medical devices. Infrared lasers, particularly fiber lasers, offer high power density, excellent beam quality, and deep marking capabilities, ensuring permanent and legible identification.

- Key Drivers for Infrared Laser Dominance:

- Material Versatility: Highly effective on metals (stainless steel, titanium, aluminum) and many plastics.

- High Throughput: Capable of high-speed marking for mass production of components.

- Durability of Marks: Produces robust, indelible marks resistant to harsh environments and sterilization.

- Cost-Effectiveness: Generally more cost-effective for a wide range of applications compared to other laser types.

- Established Infrastructure: Widely available and supported by a mature ecosystem of equipment manufacturers and service providers.

The market size for medical component laser marking using infrared lasers is estimated at $900 million in 2025.

Type: Green Laser

Green Laser technology represents a growing segment, projected to capture around 30% of the market by 2025, with significant growth potential. Green lasers are particularly advantageous for marking heat-sensitive materials, brittle substances, and certain plastics where infrared lasers might cause excessive thermal damage. Their shorter wavelength allows for better absorption by these materials, enabling precise and delicate marking without compromising material integrity.

- Key Drivers for Green Laser Growth:

- Marking of Heat-Sensitive Materials: Ideal for plastics, polymers, and certain biocompatible coatings where heat input needs to be minimized.

- High Precision on Delicate Materials: Enables fine detailing on complex geometries and fragile components.

- Reduced Material Degradation: Minimizes the risk of charring, melting, or structural changes.

- Emerging Applications: Crucial for new materials in fields like flexible electronics, advanced drug delivery systems, and personalized medicine.

- Improved Contrast on Specific Materials: Offers better mark contrast on certain colors and types of plastics.

The market size for medical component laser marking using green lasers is estimated at $400 million in 2025, with projected substantial growth in the coming years.

Medical Component Laser Marking Services Product Developments

Innovations in medical component laser marking services are primarily focused on enhancing precision, speed, and material compatibility. Companies are developing advanced laser marking systems capable of producing ultra-fine marks for complex traceability on miniature components, crucial for UDI compliance. Developments include integrated vision systems for real-time quality control and specialized laser sources, such as picosecond and femtosecond lasers, that offer non-thermal processing for highly sensitive biomaterials and plastics. These advancements provide a competitive advantage by enabling the marking of a wider range of materials, including challenging polymers and coated surfaces, without compromising their structural integrity or biocompatibility. The focus is on providing robust, indelible, and highly legible marks that withstand stringent sterilization processes.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the medical component laser marking services market, segmenting it by application into Metal and Non-metal, and by laser type into Infrared Laser and Green Laser. The metal segment, encompassing devices made from stainless steel, titanium, and other alloys, is projected for steady growth driven by implantable devices and surgical instruments. The non-metal segment, covering plastics, ceramics, and polymers, is expected to exhibit higher growth rates due to the increasing use of advanced materials in drug delivery systems and diagnostics. Within laser types, infrared lasers currently dominate due to their versatility on metals, while green lasers are gaining traction for their precision on heat-sensitive non-metals. Growth projections vary, with the non-metal and green laser segments anticipating higher CAGRs. Competitive dynamics within each segment are influenced by technological specialization and adoption rates of new laser systems.

Key Drivers of Medical Component Laser Marking Services Growth

The growth of the medical component laser marking services market is propelled by several key factors. Foremost among these is the stringent regulatory landscape, with global mandates for Unique Device Identification (UDI) driving the need for permanent, traceable marking solutions. Technological advancements in laser technology, including higher precision, faster speeds, and the ability to mark a broader range of materials, are also critical enablers. The increasing complexity and miniaturization of medical devices demand marking methods that are non-intrusive and highly detailed. Furthermore, a growing emphasis on patient safety and device provenance by healthcare providers and consumers alike underscores the importance of reliable identification. The expanding global medical device market and the continuous innovation in materials science are also contributing significantly to market expansion.

Challenges in the Medical Component Laser Marking Services Sector

Despite robust growth, the medical component laser marking services sector faces several challenges. High initial investment costs for advanced laser marking equipment and skilled personnel can be a barrier for smaller companies. Stringent regulatory compliance and the need for continuous validation of marking processes add complexity and operational overhead. Supply chain disruptions, particularly for specialized laser components, can impact service delivery timelines and costs. Additionally, the competitive pressure from established players and the emergence of new technologies require constant adaptation and innovation, which can be resource-intensive. Ensuring the long-term durability and legibility of marks across various sterilization cycles and material degradation scenarios remains a technical challenge.

Emerging Opportunities in Medical Component Laser Marking Services

Emerging opportunities within the medical component laser marking services market are abundant. The increasing demand for personalized medicine and bespoke implants creates a niche for high-precision, low-volume laser marking services. Advancements in biocompatible coatings and smart materials offer new frontiers for laser marking applications, potentially integrating functional capabilities into the marks themselves. The growth of the robotics and minimally invasive surgery sectors necessitates advanced marking solutions for intricate instrument components. Furthermore, the integration of AI and machine learning in laser marking systems for process optimization and quality assurance presents a significant opportunity for service providers to enhance efficiency and offer added value. Expansion into emerging geographical markets with growing healthcare infrastructure also offers substantial growth potential.

Leading Players in the Medical Component Laser Marking Services Market

- Abacorp CNC Machined Parts

- Techmetals

- Metal Craft Machine & Engineering

- Riverside Machine & Engineering

- Component Engineers

- Astro Manufacturing & Design

- Laserage

- Peoria Production Solutions

- Fabri-Tech

- Accumet Engineering

- Arrow Cryogenics

- Mac Machine Company

- Vita Needle

- CED Services

- Serviscreen Corporation

- MicroGroup

- Omni Components

- Acceleron

- Brinkman Precision

- Grace Manufacturing

Key Developments in Medical Component Laser Marking Services Industry

- Q1 2024: Launch of new ultra-fast laser marking systems capable of marking sensitive bioresorbable polymers with zero thermal damage.

- Q4 2023: Strategic partnership formed between a leading medical device manufacturer and a laser marking service provider to enhance UDI compliance for implantable devices.

- Q3 2023: Significant investment of approximately $15 million by a major player in expanding its green laser marking capabilities for advanced plastics.

- Q2 2023: Development of integrated machine vision systems for real-time quality verification of laser marks on surgical instruments, valued at an estimated $8 million.

- Q1 2023: Acquisition of a specialized medical component laser etching firm by a larger contract manufacturer for an undisclosed sum, aiming to broaden service offerings.

- 2022: Introduction of advanced fiber laser marking solutions offering up to 30% increase in marking speed for metallic medical components.

- 2021: Emergence of AI-driven laser parameter optimization tools to reduce marking defects and improve efficiency, with early adoption projects in the millions of dollars range.

Strategic Outlook for Medical Component Laser Marking Services Market

The strategic outlook for the medical component laser marking services market is highly optimistic, driven by the persistent need for enhanced traceability and patient safety. Key growth catalysts include the ongoing digitization of healthcare, the increasing adoption of advanced materials in medical device design, and the continuous evolution of regulatory requirements. Service providers that invest in cutting-edge laser technologies, particularly green lasers for non-metals, and develop expertise in complex material marking will be well-positioned for success. Strategic collaborations with medical device manufacturers and a focus on offering integrated solutions beyond just marking, such as serialization and data management, will further unlock market potential. The market is set to benefit from innovations in bio-integrated devices and personalized medical solutions, demanding highly specialized and precise marking services.

Medical Component Laser Marking Services Segmentation

-

1. Application

- 1.1. Metal

- 1.2. Non-metal

-

2. Type

- 2.1. Infrared Laser

- 2.2. Green Laser

Medical Component Laser Marking Services Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Medical Component Laser Marking Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Component Laser Marking Services Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Metal

- 5.1.2. Non-metal

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Infrared Laser

- 5.2.2. Green Laser

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Medical Component Laser Marking Services Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Metal

- 6.1.2. Non-metal

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Infrared Laser

- 6.2.2. Green Laser

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Medical Component Laser Marking Services Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Metal

- 7.1.2. Non-metal

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Infrared Laser

- 7.2.2. Green Laser

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Medical Component Laser Marking Services Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Metal

- 8.1.2. Non-metal

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Infrared Laser

- 8.2.2. Green Laser

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Medical Component Laser Marking Services Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Metal

- 9.1.2. Non-metal

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Infrared Laser

- 9.2.2. Green Laser

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Medical Component Laser Marking Services Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Metal

- 10.1.2. Non-metal

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Infrared Laser

- 10.2.2. Green Laser

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Marking Methods

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Abacorp CNC Machined Parts

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Techmetals

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Metal Craft Machine & Engineering

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Riverside Machine & Engineering

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Component Engineers

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Astro Manufacturing & Design

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Laserage

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Peoria Production Solutions

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fabri-Tech

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Accumet Engineering

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Arrow Cryogenics

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Mac Machine Company

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Vita Needle

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 CED Services

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Serviscreen Corporation

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 MicroGroup

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Omni Components

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Acceleron

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Brinkman Precision

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Grace Manufacturing

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.1 Marking Methods

List of Figures

- Figure 1: Global Medical Component Laser Marking Services Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Medical Component Laser Marking Services Revenue (million), by Application 2024 & 2032

- Figure 3: North America Medical Component Laser Marking Services Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Medical Component Laser Marking Services Revenue (million), by Type 2024 & 2032

- Figure 5: North America Medical Component Laser Marking Services Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Medical Component Laser Marking Services Revenue (million), by Country 2024 & 2032

- Figure 7: North America Medical Component Laser Marking Services Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Medical Component Laser Marking Services Revenue (million), by Application 2024 & 2032

- Figure 9: South America Medical Component Laser Marking Services Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Medical Component Laser Marking Services Revenue (million), by Type 2024 & 2032

- Figure 11: South America Medical Component Laser Marking Services Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Medical Component Laser Marking Services Revenue (million), by Country 2024 & 2032

- Figure 13: South America Medical Component Laser Marking Services Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Medical Component Laser Marking Services Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Medical Component Laser Marking Services Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Medical Component Laser Marking Services Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Medical Component Laser Marking Services Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Medical Component Laser Marking Services Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Medical Component Laser Marking Services Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Medical Component Laser Marking Services Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Medical Component Laser Marking Services Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Medical Component Laser Marking Services Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Medical Component Laser Marking Services Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Medical Component Laser Marking Services Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Medical Component Laser Marking Services Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Medical Component Laser Marking Services Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Medical Component Laser Marking Services Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Medical Component Laser Marking Services Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Medical Component Laser Marking Services Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Medical Component Laser Marking Services Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Medical Component Laser Marking Services Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Medical Component Laser Marking Services Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Medical Component Laser Marking Services Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Medical Component Laser Marking Services Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Medical Component Laser Marking Services Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Medical Component Laser Marking Services Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Medical Component Laser Marking Services Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Medical Component Laser Marking Services Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Medical Component Laser Marking Services Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Medical Component Laser Marking Services Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Medical Component Laser Marking Services Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Medical Component Laser Marking Services Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Medical Component Laser Marking Services Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Medical Component Laser Marking Services Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Medical Component Laser Marking Services Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Medical Component Laser Marking Services Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Medical Component Laser Marking Services Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Medical Component Laser Marking Services Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Medical Component Laser Marking Services Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Medical Component Laser Marking Services Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Medical Component Laser Marking Services Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Component Laser Marking Services?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Medical Component Laser Marking Services?

Key companies in the market include Marking Methods, Abacorp CNC Machined Parts, Techmetals, Metal Craft Machine & Engineering, Riverside Machine & Engineering, Component Engineers, Astro Manufacturing & Design, Laserage, Peoria Production Solutions, Fabri-Tech, Accumet Engineering, Arrow Cryogenics, Mac Machine Company, Vita Needle, CED Services, Serviscreen Corporation, MicroGroup, Omni Components, Acceleron, Brinkman Precision, Grace Manufacturing.

3. What are the main segments of the Medical Component Laser Marking Services?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Component Laser Marking Services," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Component Laser Marking Services report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Component Laser Marking Services?

To stay informed about further developments, trends, and reports in the Medical Component Laser Marking Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence