Key Insights

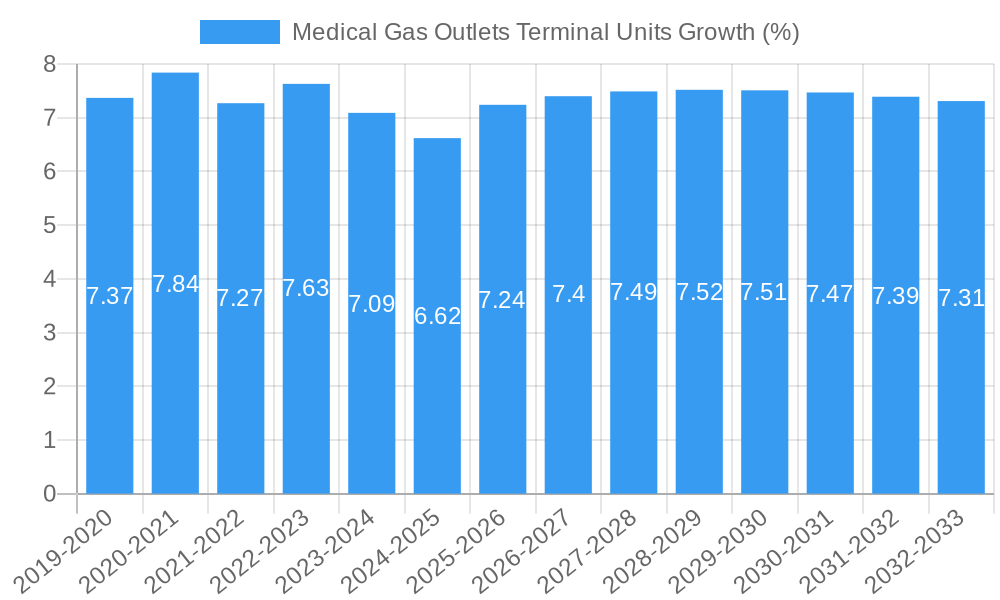

The Medical Gas Outlets Terminal Units market is poised for substantial growth, projected to reach approximately $1.5 billion by 2025 and expand at a Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This robust expansion is primarily driven by the increasing global healthcare expenditure and the rising demand for advanced medical infrastructure, particularly in emerging economies. Key applications within hospitals and clinics are experiencing significant adoption of these terminal units, crucial for the safe and efficient delivery of essential medical gases like oxygen, medical air, and nitrous oxide. The growing prevalence of chronic diseases and the aging global population further bolster the need for sophisticated patient care, necessitating reliable gas supply systems. Technological advancements in manufacturing and the development of more compact and user-friendly designs are also contributing to market momentum. The focus on patient safety and infection control in healthcare settings is a paramount driver, as compliant medical gas outlets are integral to preventing cross-contamination and ensuring proper gas delivery.

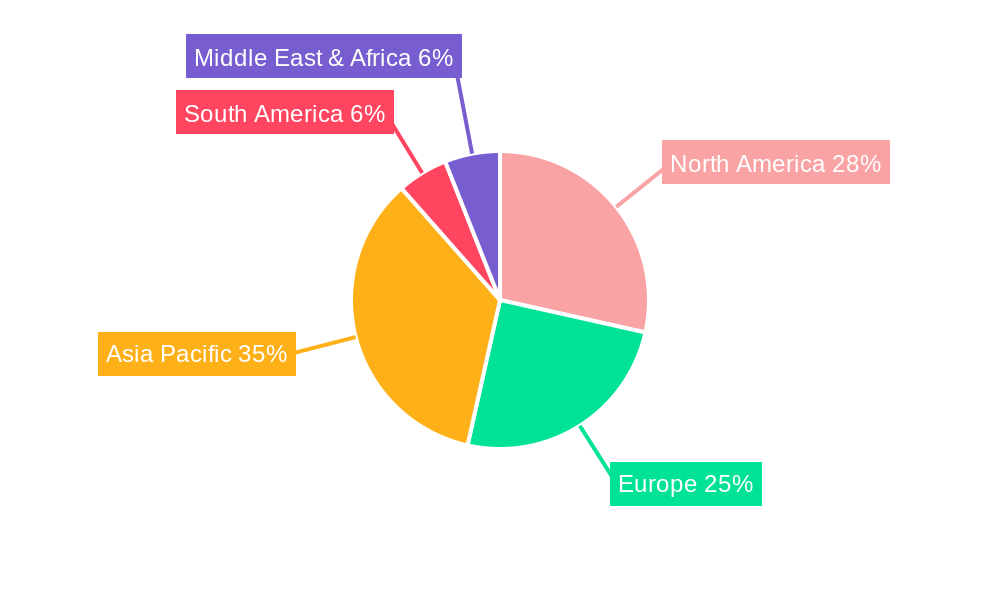

Despite the promising growth trajectory, the market faces certain restraints. The high initial cost of sophisticated medical gas outlet systems and the stringent regulatory compliance requirements in various regions can pose challenges for smaller healthcare facilities. Furthermore, the availability of counterfeit or substandard products can undermine market trust and necessitate increased vigilance from regulatory bodies and manufacturers. However, these challenges are being addressed by an increasing number of market participants focusing on cost-effective solutions and robust quality control measures. Key market trends include the shift towards integrated medical gas supply systems, the development of smart terminal units with diagnostic capabilities, and a growing emphasis on sustainability in healthcare infrastructure. Leading companies such as Draeger, BeaconMedaes, and Amico Corporation are actively innovating to meet the evolving demands of the healthcare sector, focusing on enhanced safety features, improved ergonomics, and compatibility with diverse medical equipment. The Asia Pacific region is expected to witness the fastest growth, driven by significant investments in healthcare infrastructure and a burgeoning patient population.

Medical Gas Outlets Terminal Units Market Concentration & Innovation

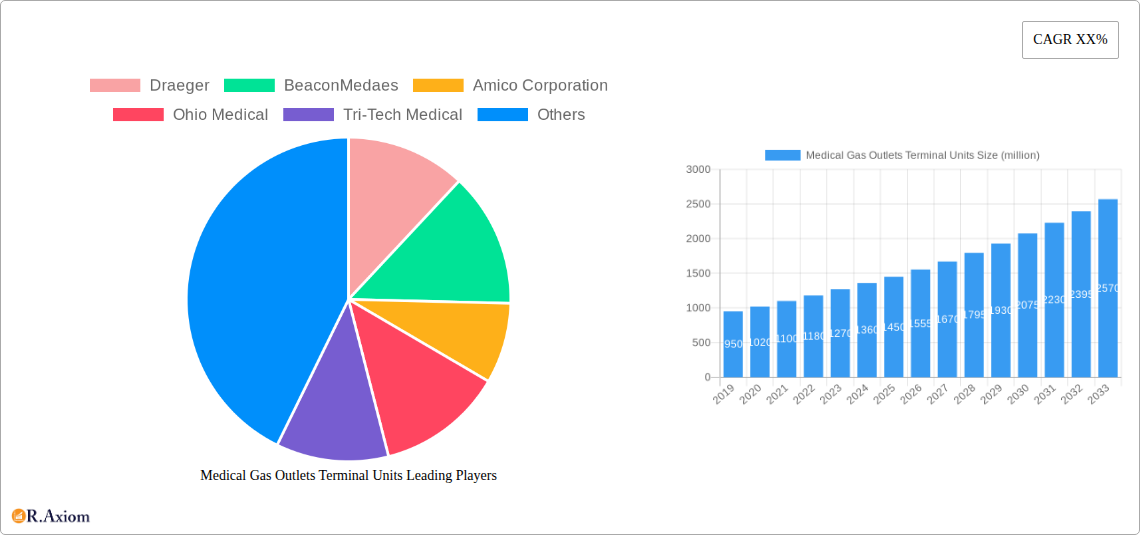

The medical gas outlets terminal units market is characterized by moderate to high concentration, with leading players such as Draeger, BeaconMedaes, Amico Corporation, Ohio Medical, and Tri-Tech Medical holding significant market share. Innovation is a key driver, fueled by the increasing demand for advanced healthcare infrastructure, the need for enhanced patient safety, and the integration of smart technologies for better monitoring and control of medical gases. Regulatory frameworks, including ISO and CSA standards, play a crucial role in shaping product development and ensuring quality and safety. The threat of product substitutes is relatively low due to the specialized nature of these critical medical devices. End-user trends are shifting towards modular and integrated solutions, with a growing preference for units that offer ease of installation, maintenance, and compatibility with diverse medical gas systems. Mergers and acquisitions (M&A) are present, although less frequent, with significant deals aiming to consolidate market presence and expand product portfolios. For instance, a hypothetical M&A deal value could range from $50 million to $200 million, signifying strategic consolidations. The market share of the top five players is estimated to be around 70% of the total market value.

Medical Gas Outlets Terminal Units Industry Trends & Insights

The global medical gas outlets terminal units market is poised for substantial growth, driven by several interconnected trends and insights. A primary growth driver is the escalating global healthcare expenditure, projected to reach trillions of dollars in the coming years, which directly translates to increased investment in hospital infrastructure and medical equipment. This upward trajectory is further bolstered by the increasing prevalence of chronic diseases and the aging global population, necessitating advanced and reliable medical gas supply systems for patient care, life support, and surgical procedures. The market is experiencing a Compound Annual Growth Rate (CAGR) of approximately 6.5%, indicating robust expansion throughout the forecast period (2025–2033).

Technological disruptions are continuously reshaping the market. The integration of smart technologies, such as IoT-enabled sensors and remote monitoring capabilities, is a significant trend. These advancements allow for real-time tracking of gas pressure, flow rates, and outlet status, enhancing patient safety and operational efficiency within healthcare facilities. Furthermore, there's a growing emphasis on antimicrobial coatings and materials for terminal units, addressing concerns about hospital-acquired infections. The development of modular and standardized outlet designs is also gaining traction, facilitating easier installation, maintenance, and upgrades, thereby reducing downtime and associated costs.

Consumer preferences are evolving towards solutions that offer enhanced safety, reliability, and user-friendliness. Healthcare providers are increasingly demanding outlets that are easy to connect and disconnect, minimizing the risk of accidental disconnection and ensuring a secure supply of medical gases. The demand for high-purity medical gas outlets, crucial for sensitive medical applications like anesthesia and respiratory support, is also on the rise.

Competitive dynamics are characterized by intense rivalry among established players and emerging manufacturers. Companies are focusing on product differentiation through advanced features, superior quality, and competitive pricing. Strategic collaborations and partnerships are becoming common to leverage R&D capabilities and expand market reach. The market penetration of advanced medical gas outlet systems, particularly in developing economies, is expected to increase significantly as healthcare infrastructure improves. The overall market size is projected to exceed several billion dollars by the end of the forecast period.

Dominant Markets & Segments in Medical Gas Outlets Terminal Units

The medical gas outlets terminal units market exhibits strong dominance in specific regions and segments, driven by a confluence of economic policies, robust healthcare infrastructure, and evolving patient care demands.

Leading Region: North America currently dominates the global medical gas outlets terminal units market, largely attributed to its advanced healthcare infrastructure, high per capita healthcare spending, and a strong emphasis on patient safety and quality of care. The region benefits from a well-established network of hospitals and clinics, coupled with significant investments in healthcare technology upgrades. Economic policies in the US and Canada, such as the Affordable Care Act and its subsequent iterations, have spurred the expansion and modernization of healthcare facilities, creating sustained demand for medical gas systems.

Dominant Country: Within North America, the United States stands out as the leading country. Its vast number of healthcare institutions, including large metropolitan hospitals and specialized clinics, coupled with a proactive approach to adopting new medical technologies, solidifies its position. Government initiatives aimed at improving healthcare accessibility and quality further propel the market.

Dominant Application Segment: The Hospital segment is the most dominant application for medical gas outlets terminal units. Hospitals are the primary consumers, requiring a comprehensive array of medical gases for various critical care, surgical, and diagnostic procedures. The sheer volume of patient admissions and complex medical interventions in hospitals necessitates a vast network of reliable and accessible medical gas outlets. Key drivers for this dominance include:

- High Volume of Procedures: Hospitals perform the highest number of surgical procedures, anesthesia administrations, and critical care interventions, all of which heavily rely on medical gases.

- Advanced Infrastructure: Hospitals are equipped with sophisticated central gas supply systems that require numerous terminal units at patient bedsides, operating rooms, and intensive care units.

- Regulatory Compliance: Strict healthcare regulations and accreditation standards mandate the use of safe and compliant medical gas outlets in hospitals.

- Technological Adoption: Hospitals are quick to adopt advanced medical technologies, including those related to medical gas delivery, to improve patient outcomes.

Dominant Type Segment: Wall-Mounted Units represent the dominant type of medical gas outlets terminal units. Their widespread adoption is driven by several factors:

- Space Efficiency: Wall-mounted units are ideal for conserving valuable space in patient rooms, operating theaters, and other clinical areas, which are often densely equipped.

- Ease of Installation and Maintenance: They are relatively straightforward to install and integrate into existing wall infrastructure, simplifying the setup process and facilitating routine maintenance.

- Accessibility: Their placement on walls ensures easy accessibility for healthcare professionals at the point of care.

- Cost-Effectiveness: Compared to some other mounting options, wall-mounted units often present a more cost-effective solution for outfitting large healthcare facilities.

- Versatility: They can be configured to deliver multiple medical gases and are compatible with a wide range of medical equipment and accessories.

Medical Gas Outlets Terminal Units Product Developments

Recent product developments in medical gas outlets terminal units focus on enhancing patient safety, operational efficiency, and integration capabilities. Innovations include the introduction of smart outlets with embedded sensors for real-time monitoring of gas pressure and flow, ensuring critical supply integrity. Antimicrobial coatings are increasingly being applied to surfaces, reducing the risk of healthcare-associated infections. Furthermore, manufacturers are developing modular and standardized outlet designs for easier installation, maintenance, and future upgrades, catering to the demand for flexible and adaptable healthcare infrastructure. These advancements provide significant competitive advantages by addressing evolving clinical needs and regulatory requirements.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global medical gas outlets terminal units market, segmented by Application and Type. The Application segments include Hospital, Clinic, and Others (including emergency medical services, home healthcare, and research laboratories). The Hospital segment, projected to experience robust growth due to increasing patient volumes and infrastructure development, holds the largest market share. The Clinic segment is also expected to see steady expansion, driven by the rise of outpatient care facilities. The Others segment, while smaller, offers niche growth opportunities.

The segmentation by Type includes Wall-Mounted Units and Ceiling-Mounted Units. The Wall-Mounted Units segment is currently dominant, owing to its widespread applicability, cost-effectiveness, and ease of installation in diverse healthcare settings. Ceiling-Mounted Units, offering advanced functionality and space-saving benefits in operating rooms and ICUs, are projected to witness significant growth as healthcare facilities adopt more sophisticated infrastructure.

Key Drivers of Medical Gas Outlets Terminal Units Growth

The medical gas outlets terminal units market is propelled by several key drivers. The burgeoning global healthcare expenditure, coupled with an aging population and the increasing prevalence of chronic diseases, fuels the demand for advanced medical infrastructure. Technological advancements, such as the integration of smart sensors for real-time monitoring and the development of antimicrobial surfaces, enhance patient safety and operational efficiency. Furthermore, stringent regulatory frameworks mandating the use of high-quality, compliant medical gas delivery systems play a pivotal role. The expansion of healthcare facilities in emerging economies, driven by government initiatives and rising healthcare awareness, also contributes significantly to market growth.

Challenges in the Medical Gas Outlets Terminal Units Sector

Despite the positive growth outlook, the medical gas outlets terminal units sector faces several challenges. Stringent and evolving regulatory compliance requirements across different regions can be a significant hurdle, demanding continuous investment in product design and testing. Supply chain disruptions, particularly for specialized components and raw materials, can impact production timelines and costs. Intense competition among numerous manufacturers, leading to price pressures, also poses a challenge for profitability. Furthermore, the high initial cost of investing in advanced and compliant medical gas infrastructure can be a restraint for smaller healthcare facilities, especially in developing economies.

Emerging Opportunities in Medical Gas Outlets Terminal Units

Emerging opportunities in the medical gas outlets terminal units market are diverse and promising. The increasing adoption of modular and integrated medical gas pipeline systems presents a significant growth avenue. The demand for specialized outlets for new and emerging medical gases used in advanced therapies also offers potential. Furthermore, the growing trend of telemedicine and remote patient monitoring creates opportunities for smart outlets with connectivity features. The expansion of healthcare infrastructure in underserved regions and the increasing focus on hospital-acquired infection prevention are also key areas for opportunity.

Leading Players in the Medical Gas Outlets Terminal Units Market

- Draeger

- BeaconMedaes

- Amico Corporation

- Ohio Medical

- Tri-Tech Medical

- Oxyone Medical

- QMT-Tech

- MIM Medical

- GCE Group

- Air Liquide Medical

- flow-meter

- SkyFavor Medical

- Silbermann Medical

- Esco Medicon

- Delta P

- Connect Medical Systems

- Muller Medical

- Medicop

Key Developments in Medical Gas Outlets Terminal Units Industry

- 2023: Launch of new modular medical gas outlets with integrated diagnostic capabilities by Draeger, enhancing real-time monitoring.

- 2022: BeaconMedaes announces strategic partnership with a leading medical gas supplier to streamline product distribution.

- 2021: Amico Corporation introduces enhanced antimicrobial surface technology for its entire range of terminal units.

- 2020: Ohio Medical expands its product line with specialized outlets for novel therapeutic gases.

- 2019: Tri-Tech Medical acquires a smaller competitor to strengthen its market presence in the Asia-Pacific region.

Strategic Outlook for Medical Gas Outlets Terminal Units Market

The strategic outlook for the medical gas outlets terminal units market is exceptionally positive, driven by sustained demand for reliable and safe medical gas supply in healthcare settings worldwide. Growth catalysts include the continuous expansion of healthcare infrastructure, particularly in emerging economies, and the increasing adoption of advanced medical technologies. Manufacturers will likely focus on innovation in smart connectivity, antimicrobial features, and modular designs to meet evolving clinical needs and regulatory standards. Strategic collaborations and targeted market penetration in underserved regions will be crucial for sustained competitive advantage, ensuring the market continues to grow and innovate to support critical patient care.

Medical Gas Outlets Terminal Units Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Clinic

- 1.3. Others

-

2. Types

- 2.1. Wall-Mounted Units

- 2.2. Ceiling-Mounted Units

Medical Gas Outlets Terminal Units Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Medical Gas Outlets Terminal Units REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Gas Outlets Terminal Units Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Clinic

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Wall-Mounted Units

- 5.2.2. Ceiling-Mounted Units

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Medical Gas Outlets Terminal Units Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Clinic

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Wall-Mounted Units

- 6.2.2. Ceiling-Mounted Units

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Medical Gas Outlets Terminal Units Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Clinic

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Wall-Mounted Units

- 7.2.2. Ceiling-Mounted Units

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Medical Gas Outlets Terminal Units Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Clinic

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Wall-Mounted Units

- 8.2.2. Ceiling-Mounted Units

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Medical Gas Outlets Terminal Units Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Clinic

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Wall-Mounted Units

- 9.2.2. Ceiling-Mounted Units

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Medical Gas Outlets Terminal Units Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Clinic

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Wall-Mounted Units

- 10.2.2. Ceiling-Mounted Units

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Draeger

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BeaconMedaes

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Amico Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ohio Medical

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Tri-Tech Medical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Oxyone Medical

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 QMT-Tech

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 MIM Medical

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 GCE Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Air Liquide Medical

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 flow-meter

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 SkyFavor Medical

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Silbermann Medical

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Esco Medicon

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Delta P

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Connect Medical Systems

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Muller Medical

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Medicop

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Draeger

List of Figures

- Figure 1: Global Medical Gas Outlets Terminal Units Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Medical Gas Outlets Terminal Units Revenue (million), by Application 2024 & 2032

- Figure 3: North America Medical Gas Outlets Terminal Units Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Medical Gas Outlets Terminal Units Revenue (million), by Types 2024 & 2032

- Figure 5: North America Medical Gas Outlets Terminal Units Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Medical Gas Outlets Terminal Units Revenue (million), by Country 2024 & 2032

- Figure 7: North America Medical Gas Outlets Terminal Units Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Medical Gas Outlets Terminal Units Revenue (million), by Application 2024 & 2032

- Figure 9: South America Medical Gas Outlets Terminal Units Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Medical Gas Outlets Terminal Units Revenue (million), by Types 2024 & 2032

- Figure 11: South America Medical Gas Outlets Terminal Units Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Medical Gas Outlets Terminal Units Revenue (million), by Country 2024 & 2032

- Figure 13: South America Medical Gas Outlets Terminal Units Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Medical Gas Outlets Terminal Units Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Medical Gas Outlets Terminal Units Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Medical Gas Outlets Terminal Units Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Medical Gas Outlets Terminal Units Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Medical Gas Outlets Terminal Units Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Medical Gas Outlets Terminal Units Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Medical Gas Outlets Terminal Units Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Medical Gas Outlets Terminal Units Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Medical Gas Outlets Terminal Units Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Medical Gas Outlets Terminal Units Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Medical Gas Outlets Terminal Units Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Medical Gas Outlets Terminal Units Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Medical Gas Outlets Terminal Units Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Medical Gas Outlets Terminal Units Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Medical Gas Outlets Terminal Units Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Medical Gas Outlets Terminal Units Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Medical Gas Outlets Terminal Units Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Medical Gas Outlets Terminal Units Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Medical Gas Outlets Terminal Units Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Medical Gas Outlets Terminal Units Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Medical Gas Outlets Terminal Units Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Medical Gas Outlets Terminal Units Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Medical Gas Outlets Terminal Units Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Medical Gas Outlets Terminal Units Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Medical Gas Outlets Terminal Units Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Medical Gas Outlets Terminal Units Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Medical Gas Outlets Terminal Units Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Medical Gas Outlets Terminal Units Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Medical Gas Outlets Terminal Units Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Medical Gas Outlets Terminal Units Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Medical Gas Outlets Terminal Units Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Medical Gas Outlets Terminal Units Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Medical Gas Outlets Terminal Units Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Medical Gas Outlets Terminal Units Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Medical Gas Outlets Terminal Units Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Medical Gas Outlets Terminal Units Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Medical Gas Outlets Terminal Units Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Medical Gas Outlets Terminal Units Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Gas Outlets Terminal Units?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Medical Gas Outlets Terminal Units?

Key companies in the market include Draeger, BeaconMedaes, Amico Corporation, Ohio Medical, Tri-Tech Medical, Oxyone Medical, QMT-Tech, MIM Medical, GCE Group, Air Liquide Medical, flow-meter, SkyFavor Medical, Silbermann Medical, Esco Medicon, Delta P, Connect Medical Systems, Muller Medical, Medicop.

3. What are the main segments of the Medical Gas Outlets Terminal Units?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Gas Outlets Terminal Units," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Gas Outlets Terminal Units report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Gas Outlets Terminal Units?

To stay informed about further developments, trends, and reports in the Medical Gas Outlets Terminal Units, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence