Key Insights

The global Medical Nutrition market is poised for significant expansion, projected to reach USD 72.29 billion, driven by a robust Compound Annual Growth Rate (CAGR) of 8.05%. This growth is fueled by increasing awareness of the critical role of specialized nutrition in managing chronic diseases, post-operative recovery, and age-related health concerns. The rising prevalence of malnutrition, metabolic disorders, gastrointestinal conditions, and the nutritional demands of cancer patients are key application areas propelling market demand. Furthermore, advancements in product formulations and delivery systems, alongside a growing elderly population requiring enhanced nutritional support, are substantial market drivers. The expansion of healthcare infrastructure in emerging economies and favorable reimbursement policies also contribute to this optimistic outlook.

Medical Nutrition Industry Market Size (In Million)

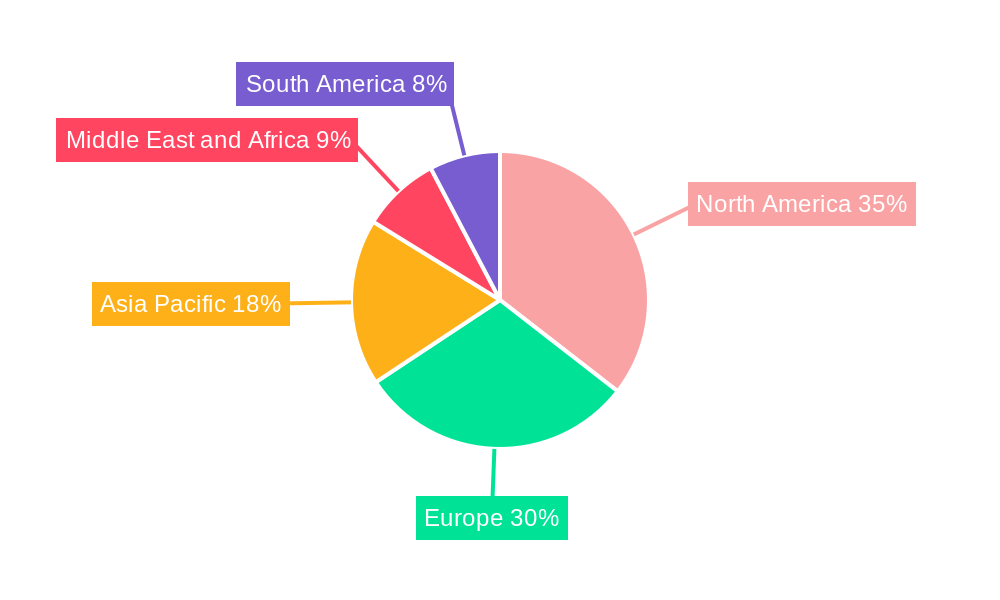

The market is characterized by a diverse range of products catering to specific needs, with oral and enteral routes of administration dominating due to their convenience and cost-effectiveness. However, parenteral nutrition is gaining traction for patients with severe gastrointestinal issues. Pediatric and adult segments are both experiencing healthy growth, reflecting the universal importance of medical nutrition. Key players like Abbott Laboratories, Fresenius Kabi, and Nestle Health Science are actively investing in research and development to introduce innovative solutions and expand their global reach. Geographically, North America and Europe currently lead the market, but the Asia Pacific region is anticipated to witness the fastest growth due to its large population, increasing healthcare expenditure, and rising incidence of lifestyle-related diseases.

Medical Nutrition Industry Company Market Share

Here is a detailed, SEO-optimized report description for the Medical Nutrition Industry:

Medical Nutrition Industry Market Concentration & Innovation

The Medical Nutrition Industry is characterized by a dynamic market concentration, driven by significant innovation and evolving regulatory landscapes. Key players such as Abbott Laboratories (Abbott Nutrition), Fresenius Kabi, and Nestle Health Science hold substantial market shares, contributing to a moderately consolidated market structure. Innovation is a critical differentiator, spurred by advancements in personalized nutrition, novel delivery systems, and the development of specialized formulations for various medical conditions. The regulatory framework, overseen by bodies like the FDA and EFSA, plays a pivotal role in product approval and market access, influencing R&D priorities and go-to-market strategies. The threat of product substitutes, while present in the form of conventional dietary supplements, is mitigated by the specific clinical efficacy and evidence-based formulations of medical nutrition products. End-user trends are increasingly focused on tailored solutions for chronic diseases and age-related nutritional deficiencies, creating significant demand. Mergers and acquisitions (M&A) are a recurring theme, with deal values often in the hundreds of millions of dollars, as companies seek to expand their product portfolios, geographical reach, and technological capabilities. For example, recent M&A activities have seen market leaders strategically acquiring smaller, innovative firms to integrate cutting-edge technologies and expand into niche therapeutic areas, consolidating their market positions.

Medical Nutrition Industry Industry Trends & Insights

The global Medical Nutrition Industry is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. This expansion is fueled by a confluence of critical trends, including the increasing prevalence of chronic diseases such as diabetes, cardiovascular conditions, and gastrointestinal disorders, which necessitate specialized dietary interventions. The aging global population is another significant growth driver, as elderly individuals often experience age-related malnutrition, sarcopenia, and increased nutritional needs requiring targeted medical nutrition products. Technological advancements are revolutionizing the industry, with a growing emphasis on personalized nutrition solutions. This includes the development of AI-driven platforms that analyze individual patient data to create customized nutritional plans, as seen in the strategic partnership between Hologram Sciences and Maeil Health Nutrition to deliver personalized nutrition solutions to the Korean market. Furthermore, innovations in formulation science and delivery methods, such as improved bioavailability and novel oral and enteral formulations, are enhancing product efficacy and patient compliance. Glanbia Nutritionals' launch of TechVantage, a functionally optimized nutrient technology platform, exemplifies this trend towards advanced ingredient solutions.

Consumer preferences are also shifting, with a greater demand for evidence-based, clinically proven nutritional products. Patients and healthcare professionals are increasingly seeking medical nutrition solutions backed by rigorous scientific research and clinical trials. This growing awareness and demand are driving market penetration for specialized medical foods and formulas. The competitive landscape is intensifying, with both established multinational corporations and agile biotechnology startups vying for market share. Companies are focusing on strategic collaborations, product diversification, and geographical expansion to gain a competitive edge. The market penetration of advanced medical nutrition therapies for critical care, oncology, and neurological conditions is steadily increasing, driven by improved healthcare infrastructure and a greater understanding of the role of nutrition in patient recovery and management. The integration of digital health technologies, such as remote patient monitoring and telehealth platforms, is also creating new avenues for the delivery and management of medical nutrition, further contributing to market expansion and improved patient outcomes. The focus on preventative healthcare and the management of lifestyle-related diseases is creating a sustained demand for medical nutrition products that can support long-term health and well-being.

Dominant Markets & Segments in Medical Nutrition Industry

The Medical Nutrition Industry exhibits distinct dominance across various segments, driven by a complex interplay of demographic shifts, disease prevalence, healthcare policies, and technological advancements. The Oral and Enteral route of administration consistently commands the largest market share, estimated at approximately 65-70% of the total medical nutrition market. This dominance is attributed to its widespread application in managing malnutrition, gastrointestinal diseases, and post-operative recovery, where direct oral or tube feeding is the primary and most cost-effective method of nutritional delivery. The convenience and established efficacy of oral nutritional supplements and enteral formulas make them the preferred choice for a broad spectrum of patient populations.

Within the applications segment, Nutritional Support for Malnutrition represents the leading category, accounting for an estimated 30-35% of the market. This is driven by the global burden of malnutrition, particularly in elderly populations, hospitalized patients, and individuals with chronic illnesses, leading to a continuous demand for clinical nutrition products designed to address protein-energy deficits and micronutrient deficiencies.

The Adult end-user segment is the largest, contributing approximately 70-75% to the overall market revenue. This is primarily due to the higher prevalence of chronic diseases, critical illnesses, and age-related nutritional needs in adults, as well as the larger proportion of the global population in this demographic. Economic policies in developed nations that support accessible healthcare and reimbursement for specialized medical nutrition products further bolster this segment's growth.

Geographically, North America consistently leads the medical nutrition market, holding an estimated market share of over 35%. This leadership is propelled by a well-established healthcare infrastructure, high disposable incomes, a strong emphasis on clinical research and development, and a high prevalence of chronic diseases. The region's advanced regulatory framework also facilitates the early adoption of innovative medical nutrition products.

Specific applications like Nutritional Support for Gastrointestinal Diseases and Nutritional Support for Cancer are rapidly growing segments, each estimated to be valued in the billions of dollars. The increasing incidence of inflammatory bowel disease (IBD), irritable bowel syndrome (IBS), and the rising cancer rates worldwide necessitate specialized nutritional interventions to manage symptoms, improve treatment tolerance, and support recovery. Technological advancements in formulating gut-friendly products and targeted cancer nutrition are key drivers in these segments.

The Pediatric end-user segment, while smaller in overall market size compared to adults, is experiencing significant growth, driven by advancements in neonatal care, increasing awareness of pediatric malnutrition, and the availability of specialized formulas for conditions like allergies, metabolic disorders, and prematurity. The market for pediatric medical nutrition is projected to grow at a CAGR of over 8% during the forecast period.

Medical Nutrition Industry Product Developments

Product developments in the Medical Nutrition Industry are sharply focused on enhancing clinical efficacy, patient convenience, and addressing unmet needs. Innovations include the development of specialized formulations for critical care patients, enriched protein and energy supplements for sarcopenia prevention in the elderly, and advanced formulations for managing metabolic disorders like diabetes and phenylketonuria (PKU). The trend towards personalized nutrition is driving the creation of modular nutrition systems and ingredient technologies that can be customized based on individual patient profiles, genetic predispositions, and specific health conditions. Technological advancements in encapsulation and delivery systems are improving nutrient absorption and palatability, while the focus on natural ingredients and reduced sugar content caters to evolving consumer preferences. These developments aim to offer clear competitive advantages by providing evidence-based solutions with demonstrable patient outcomes.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Medical Nutrition Industry, segmented by Route of Administration, Application, and End User. The Route of Administration segment is divided into Oral and Enteral, and Parenteral. The Oral and Enteral segment, estimated at over $20 Billion, is expected to grow at a CAGR of 7.0%, driven by its broad applicability and cost-effectiveness. The Parenteral segment, valued at approximately $10 Billion, is projected to grow at a CAGR of 6.5%, catering to patients unable to utilize their gastrointestinal tract.

The Application segment includes Nutritional Support for Malnutrition, Metabolic Disorders, Gastrointestinal Diseases, Cancer, Neurological Diseases, and Other Diseases. Nutritional Support for Malnutrition is the largest segment, expected to reach over $25 Billion with a CAGR of 7.2%. Nutritional Support for Cancer is a rapidly expanding segment, projected to grow at a CAGR of 8.0%, reflecting the increasing demand for adjunctive therapies.

The End User segment encompasses Pediatric and Adult populations. The Adult segment, estimated at over $45 Billion, is projected to grow at a CAGR of 7.3%, driven by an aging population and chronic disease prevalence. The Pediatric segment, valued at around $10 Billion, is expected to exhibit a CAGR of 7.8%, fueled by advancements in neonatal care and specialized formulas.

Key Drivers of Medical Nutrition Industry Growth

The Medical Nutrition Industry is propelled by several key drivers. The increasing global prevalence of chronic diseases such as diabetes, cardiovascular disorders, and cancer directly fuels the demand for specialized nutritional interventions. An aging global population necessitates medical nutrition products to combat age-related conditions like malnutrition, sarcopenia, and cognitive decline. Advancements in healthcare, including improved diagnostic tools and a better understanding of the role of nutrition in disease management and recovery, are expanding the application scope for medical nutrition. Technological innovations in product formulation, delivery systems, and personalized nutrition solutions are creating new market opportunities and enhancing product efficacy. Furthermore, supportive government initiatives and reimbursement policies in many regions encourage the adoption of medical nutrition therapies in clinical settings, driving market growth.

Challenges in the Medical Nutrition Industry Sector

Despite robust growth, the Medical Nutrition Industry faces several challenges. Stringent regulatory approval processes for new products can lead to extended timelines and increased development costs. High research and development expenses associated with formulating specialized medical nutrition products can be a significant barrier, particularly for smaller companies. Price sensitivity among healthcare providers and payers can impact market penetration, especially in cost-constrained healthcare systems. Counterfeit products and the availability of less regulated dietary supplements pose a threat to market integrity and consumer trust. Supply chain disruptions, as witnessed during global events, can impact the availability and cost of essential raw materials. Intense competition among established players and emerging entrants also necessitates continuous innovation and strategic pricing.

Emerging Opportunities in Medical Nutrition Industry

Emerging opportunities in the Medical Nutrition Industry are diverse and promising. The growing demand for personalized nutrition solutions, leveraging big data and AI, presents a significant avenue for growth. Expansion into emerging economies with improving healthcare infrastructure and rising awareness of clinical nutrition offers substantial untapped market potential. Innovations in plant-based and sustainable medical nutrition products cater to evolving consumer preferences and environmental concerns. The development of medical foods for rare diseases and orphan conditions represents a niche but high-value opportunity. Furthermore, the integration of medical nutrition with digital health platforms and telehealth services allows for remote patient monitoring and tailored nutritional guidance, enhancing patient engagement and adherence. The focus on preventative healthcare and proactive health management also creates opportunities for medical nutrition to play a role beyond disease treatment.

Leading Players in the Medical Nutrition Industry Market

- Abbott Laboratories (Abbott Nutrition)

- Fresenius Kabi

- Nestle Health Science

- Danone (Nutricia)

- Perrigo Company PLC

- Medifood International Ltd

- Ajinomoto Cambrooke Inc (Nualtra Ltd)

- AYMES International Ltd

- Baxter Healthcare

- B Braun SE

- Reckitt Benckiser

Key Developments in Medical Nutrition Industry Industry

- October 2022: Hologram Sciences and Maeil Health Nutrition entered into a strategic partnership to deliver personalized nutrition solutions to the Korean market.

- April 2022: Glanbia Nutritionals launched TechVantage a functionally optimized nutrient technology platform, which will provide customers with nutrient solutions.

Strategic Outlook for Medical Nutrition Industry Market

The strategic outlook for the Medical Nutrition Industry is exceptionally positive, driven by a sustained increase in demand for evidence-based nutritional interventions across diverse patient populations. The ongoing convergence of healthcare and nutrition science, coupled with rapid technological advancements in personalized medicine and digital health, will continue to shape market dynamics. Key strategies for future growth will involve investing in R&D for novel formulations targeting complex diseases, expanding geographical reach into high-growth emerging markets, and forging strategic partnerships to enhance product portfolios and market access. The industry's ability to adapt to evolving regulatory landscapes and consumer preferences for sustainable and natural products will be crucial for long-term success. Ultimately, the focus will remain on delivering clinically superior, patient-centric solutions that improve health outcomes and quality of life.

Medical Nutrition Industry Segmentation

-

1. Route of Administration

- 1.1. Oral and Enteral

- 1.2. Parenteral

-

2. Application

- 2.1. Nutritional Support for Malnutrition

- 2.2. Nutritional Support for Metabolic Disorders

- 2.3. Nutritional Support for Gastrointestinal Diseases

- 2.4. Nutritional Support for Cancer

- 2.5. Nutritional Support in Neurological Diseases

- 2.6. Nutritional Support in Other Diseases

-

3. End User

- 3.1. Pediatric

- 3.2. Adult

Medical Nutrition Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Medical Nutrition Industry Regional Market Share

Geographic Coverage of Medical Nutrition Industry

Medical Nutrition Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Metabolic Disorders; High Spending on Healthcare; Growing Geriatric Population

- 3.3. Market Restrains

- 3.3.1. Imprecise Perception About Clinical Nutrition; Reduction in Birth Rates

- 3.4. Market Trends

- 3.4.1. Oral and Enteral Segment is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Nutrition Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 5.1.1. Oral and Enteral

- 5.1.2. Parenteral

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Nutritional Support for Malnutrition

- 5.2.2. Nutritional Support for Metabolic Disorders

- 5.2.3. Nutritional Support for Gastrointestinal Diseases

- 5.2.4. Nutritional Support for Cancer

- 5.2.5. Nutritional Support in Neurological Diseases

- 5.2.6. Nutritional Support in Other Diseases

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Pediatric

- 5.3.2. Adult

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 6. North America Medical Nutrition Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Route of Administration

- 6.1.1. Oral and Enteral

- 6.1.2. Parenteral

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Nutritional Support for Malnutrition

- 6.2.2. Nutritional Support for Metabolic Disorders

- 6.2.3. Nutritional Support for Gastrointestinal Diseases

- 6.2.4. Nutritional Support for Cancer

- 6.2.5. Nutritional Support in Neurological Diseases

- 6.2.6. Nutritional Support in Other Diseases

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Pediatric

- 6.3.2. Adult

- 6.1. Market Analysis, Insights and Forecast - by Route of Administration

- 7. Europe Medical Nutrition Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Route of Administration

- 7.1.1. Oral and Enteral

- 7.1.2. Parenteral

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Nutritional Support for Malnutrition

- 7.2.2. Nutritional Support for Metabolic Disorders

- 7.2.3. Nutritional Support for Gastrointestinal Diseases

- 7.2.4. Nutritional Support for Cancer

- 7.2.5. Nutritional Support in Neurological Diseases

- 7.2.6. Nutritional Support in Other Diseases

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Pediatric

- 7.3.2. Adult

- 7.1. Market Analysis, Insights and Forecast - by Route of Administration

- 8. Asia Pacific Medical Nutrition Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Route of Administration

- 8.1.1. Oral and Enteral

- 8.1.2. Parenteral

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Nutritional Support for Malnutrition

- 8.2.2. Nutritional Support for Metabolic Disorders

- 8.2.3. Nutritional Support for Gastrointestinal Diseases

- 8.2.4. Nutritional Support for Cancer

- 8.2.5. Nutritional Support in Neurological Diseases

- 8.2.6. Nutritional Support in Other Diseases

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Pediatric

- 8.3.2. Adult

- 8.1. Market Analysis, Insights and Forecast - by Route of Administration

- 9. Middle East and Africa Medical Nutrition Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Route of Administration

- 9.1.1. Oral and Enteral

- 9.1.2. Parenteral

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Nutritional Support for Malnutrition

- 9.2.2. Nutritional Support for Metabolic Disorders

- 9.2.3. Nutritional Support for Gastrointestinal Diseases

- 9.2.4. Nutritional Support for Cancer

- 9.2.5. Nutritional Support in Neurological Diseases

- 9.2.6. Nutritional Support in Other Diseases

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Pediatric

- 9.3.2. Adult

- 9.1. Market Analysis, Insights and Forecast - by Route of Administration

- 10. South America Medical Nutrition Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Route of Administration

- 10.1.1. Oral and Enteral

- 10.1.2. Parenteral

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Nutritional Support for Malnutrition

- 10.2.2. Nutritional Support for Metabolic Disorders

- 10.2.3. Nutritional Support for Gastrointestinal Diseases

- 10.2.4. Nutritional Support for Cancer

- 10.2.5. Nutritional Support in Neurological Diseases

- 10.2.6. Nutritional Support in Other Diseases

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Pediatric

- 10.3.2. Adult

- 10.1. Market Analysis, Insights and Forecast - by Route of Administration

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Medifood International Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Abbott Laboratories (Abbott Nutrition)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fresenius Kabi

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Danone (Nutricia)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Perrigo Company PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nestle Health Science

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ajinomoto Cambrooke Inc (Nualtra Ltd)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AYMES International Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Baxter Healthcare

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 B Braun SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Reckitt Benckiser

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Medifood International Ltd

List of Figures

- Figure 1: Global Medical Nutrition Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Medical Nutrition Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Medical Nutrition Industry Revenue (Million), by Route of Administration 2025 & 2033

- Figure 4: North America Medical Nutrition Industry Volume (K Unit), by Route of Administration 2025 & 2033

- Figure 5: North America Medical Nutrition Industry Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 6: North America Medical Nutrition Industry Volume Share (%), by Route of Administration 2025 & 2033

- Figure 7: North America Medical Nutrition Industry Revenue (Million), by Application 2025 & 2033

- Figure 8: North America Medical Nutrition Industry Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Medical Nutrition Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Medical Nutrition Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Medical Nutrition Industry Revenue (Million), by End User 2025 & 2033

- Figure 12: North America Medical Nutrition Industry Volume (K Unit), by End User 2025 & 2033

- Figure 13: North America Medical Nutrition Industry Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Medical Nutrition Industry Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Medical Nutrition Industry Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Medical Nutrition Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Medical Nutrition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Medical Nutrition Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Medical Nutrition Industry Revenue (Million), by Route of Administration 2025 & 2033

- Figure 20: Europe Medical Nutrition Industry Volume (K Unit), by Route of Administration 2025 & 2033

- Figure 21: Europe Medical Nutrition Industry Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 22: Europe Medical Nutrition Industry Volume Share (%), by Route of Administration 2025 & 2033

- Figure 23: Europe Medical Nutrition Industry Revenue (Million), by Application 2025 & 2033

- Figure 24: Europe Medical Nutrition Industry Volume (K Unit), by Application 2025 & 2033

- Figure 25: Europe Medical Nutrition Industry Revenue Share (%), by Application 2025 & 2033

- Figure 26: Europe Medical Nutrition Industry Volume Share (%), by Application 2025 & 2033

- Figure 27: Europe Medical Nutrition Industry Revenue (Million), by End User 2025 & 2033

- Figure 28: Europe Medical Nutrition Industry Volume (K Unit), by End User 2025 & 2033

- Figure 29: Europe Medical Nutrition Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Medical Nutrition Industry Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe Medical Nutrition Industry Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Medical Nutrition Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Medical Nutrition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Medical Nutrition Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Medical Nutrition Industry Revenue (Million), by Route of Administration 2025 & 2033

- Figure 36: Asia Pacific Medical Nutrition Industry Volume (K Unit), by Route of Administration 2025 & 2033

- Figure 37: Asia Pacific Medical Nutrition Industry Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 38: Asia Pacific Medical Nutrition Industry Volume Share (%), by Route of Administration 2025 & 2033

- Figure 39: Asia Pacific Medical Nutrition Industry Revenue (Million), by Application 2025 & 2033

- Figure 40: Asia Pacific Medical Nutrition Industry Volume (K Unit), by Application 2025 & 2033

- Figure 41: Asia Pacific Medical Nutrition Industry Revenue Share (%), by Application 2025 & 2033

- Figure 42: Asia Pacific Medical Nutrition Industry Volume Share (%), by Application 2025 & 2033

- Figure 43: Asia Pacific Medical Nutrition Industry Revenue (Million), by End User 2025 & 2033

- Figure 44: Asia Pacific Medical Nutrition Industry Volume (K Unit), by End User 2025 & 2033

- Figure 45: Asia Pacific Medical Nutrition Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Pacific Medical Nutrition Industry Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Pacific Medical Nutrition Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Medical Nutrition Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Medical Nutrition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Medical Nutrition Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Medical Nutrition Industry Revenue (Million), by Route of Administration 2025 & 2033

- Figure 52: Middle East and Africa Medical Nutrition Industry Volume (K Unit), by Route of Administration 2025 & 2033

- Figure 53: Middle East and Africa Medical Nutrition Industry Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 54: Middle East and Africa Medical Nutrition Industry Volume Share (%), by Route of Administration 2025 & 2033

- Figure 55: Middle East and Africa Medical Nutrition Industry Revenue (Million), by Application 2025 & 2033

- Figure 56: Middle East and Africa Medical Nutrition Industry Volume (K Unit), by Application 2025 & 2033

- Figure 57: Middle East and Africa Medical Nutrition Industry Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa Medical Nutrition Industry Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa Medical Nutrition Industry Revenue (Million), by End User 2025 & 2033

- Figure 60: Middle East and Africa Medical Nutrition Industry Volume (K Unit), by End User 2025 & 2033

- Figure 61: Middle East and Africa Medical Nutrition Industry Revenue Share (%), by End User 2025 & 2033

- Figure 62: Middle East and Africa Medical Nutrition Industry Volume Share (%), by End User 2025 & 2033

- Figure 63: Middle East and Africa Medical Nutrition Industry Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East and Africa Medical Nutrition Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Middle East and Africa Medical Nutrition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East and Africa Medical Nutrition Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: South America Medical Nutrition Industry Revenue (Million), by Route of Administration 2025 & 2033

- Figure 68: South America Medical Nutrition Industry Volume (K Unit), by Route of Administration 2025 & 2033

- Figure 69: South America Medical Nutrition Industry Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 70: South America Medical Nutrition Industry Volume Share (%), by Route of Administration 2025 & 2033

- Figure 71: South America Medical Nutrition Industry Revenue (Million), by Application 2025 & 2033

- Figure 72: South America Medical Nutrition Industry Volume (K Unit), by Application 2025 & 2033

- Figure 73: South America Medical Nutrition Industry Revenue Share (%), by Application 2025 & 2033

- Figure 74: South America Medical Nutrition Industry Volume Share (%), by Application 2025 & 2033

- Figure 75: South America Medical Nutrition Industry Revenue (Million), by End User 2025 & 2033

- Figure 76: South America Medical Nutrition Industry Volume (K Unit), by End User 2025 & 2033

- Figure 77: South America Medical Nutrition Industry Revenue Share (%), by End User 2025 & 2033

- Figure 78: South America Medical Nutrition Industry Volume Share (%), by End User 2025 & 2033

- Figure 79: South America Medical Nutrition Industry Revenue (Million), by Country 2025 & 2033

- Figure 80: South America Medical Nutrition Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: South America Medical Nutrition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Medical Nutrition Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Medical Nutrition Industry Revenue Million Forecast, by Route of Administration 2020 & 2033

- Table 2: Global Medical Nutrition Industry Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 3: Global Medical Nutrition Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Medical Nutrition Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Medical Nutrition Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Medical Nutrition Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Global Medical Nutrition Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Medical Nutrition Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Medical Nutrition Industry Revenue Million Forecast, by Route of Administration 2020 & 2033

- Table 10: Global Medical Nutrition Industry Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 11: Global Medical Nutrition Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Medical Nutrition Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: Global Medical Nutrition Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global Medical Nutrition Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Global Medical Nutrition Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Medical Nutrition Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Medical Nutrition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Medical Nutrition Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Medical Nutrition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Medical Nutrition Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Medical Nutrition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Medical Nutrition Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global Medical Nutrition Industry Revenue Million Forecast, by Route of Administration 2020 & 2033

- Table 24: Global Medical Nutrition Industry Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 25: Global Medical Nutrition Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Global Medical Nutrition Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 27: Global Medical Nutrition Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 28: Global Medical Nutrition Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 29: Global Medical Nutrition Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Medical Nutrition Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Germany Medical Nutrition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Medical Nutrition Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: United Kingdom Medical Nutrition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom Medical Nutrition Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: France Medical Nutrition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: France Medical Nutrition Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Italy Medical Nutrition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Italy Medical Nutrition Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Spain Medical Nutrition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Spain Medical Nutrition Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Medical Nutrition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Medical Nutrition Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Global Medical Nutrition Industry Revenue Million Forecast, by Route of Administration 2020 & 2033

- Table 44: Global Medical Nutrition Industry Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 45: Global Medical Nutrition Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 46: Global Medical Nutrition Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 47: Global Medical Nutrition Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 48: Global Medical Nutrition Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 49: Global Medical Nutrition Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global Medical Nutrition Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: China Medical Nutrition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: China Medical Nutrition Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Japan Medical Nutrition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan Medical Nutrition Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: India Medical Nutrition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: India Medical Nutrition Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Australia Medical Nutrition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Australia Medical Nutrition Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: South Korea Medical Nutrition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Korea Medical Nutrition Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific Medical Nutrition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific Medical Nutrition Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Medical Nutrition Industry Revenue Million Forecast, by Route of Administration 2020 & 2033

- Table 64: Global Medical Nutrition Industry Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 65: Global Medical Nutrition Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 66: Global Medical Nutrition Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 67: Global Medical Nutrition Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 68: Global Medical Nutrition Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 69: Global Medical Nutrition Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global Medical Nutrition Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: GCC Medical Nutrition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: GCC Medical Nutrition Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: South Africa Medical Nutrition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Africa Medical Nutrition Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Medical Nutrition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Medical Nutrition Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Global Medical Nutrition Industry Revenue Million Forecast, by Route of Administration 2020 & 2033

- Table 78: Global Medical Nutrition Industry Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 79: Global Medical Nutrition Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 80: Global Medical Nutrition Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 81: Global Medical Nutrition Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 82: Global Medical Nutrition Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 83: Global Medical Nutrition Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 84: Global Medical Nutrition Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 85: Brazil Medical Nutrition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: Brazil Medical Nutrition Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: Argentina Medical Nutrition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: Argentina Medical Nutrition Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 89: Rest of South America Medical Nutrition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Rest of South America Medical Nutrition Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Nutrition Industry?

The projected CAGR is approximately 8.05%.

2. Which companies are prominent players in the Medical Nutrition Industry?

Key companies in the market include Medifood International Ltd, Abbott Laboratories (Abbott Nutrition), Fresenius Kabi, Danone (Nutricia), Perrigo Company PLC, Nestle Health Science, Ajinomoto Cambrooke Inc (Nualtra Ltd), AYMES International Ltd, Baxter Healthcare, B Braun SE, Reckitt Benckiser.

3. What are the main segments of the Medical Nutrition Industry?

The market segments include Route of Administration, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 72.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Metabolic Disorders; High Spending on Healthcare; Growing Geriatric Population.

6. What are the notable trends driving market growth?

Oral and Enteral Segment is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Imprecise Perception About Clinical Nutrition; Reduction in Birth Rates.

8. Can you provide examples of recent developments in the market?

October 2022: Hologram Sciences, and Maeil Health Nutrition entered into a strategic partnership to deliver personalized nutrition solutions to the Korean market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Nutrition Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Nutrition Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Nutrition Industry?

To stay informed about further developments, trends, and reports in the Medical Nutrition Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence