Key Insights

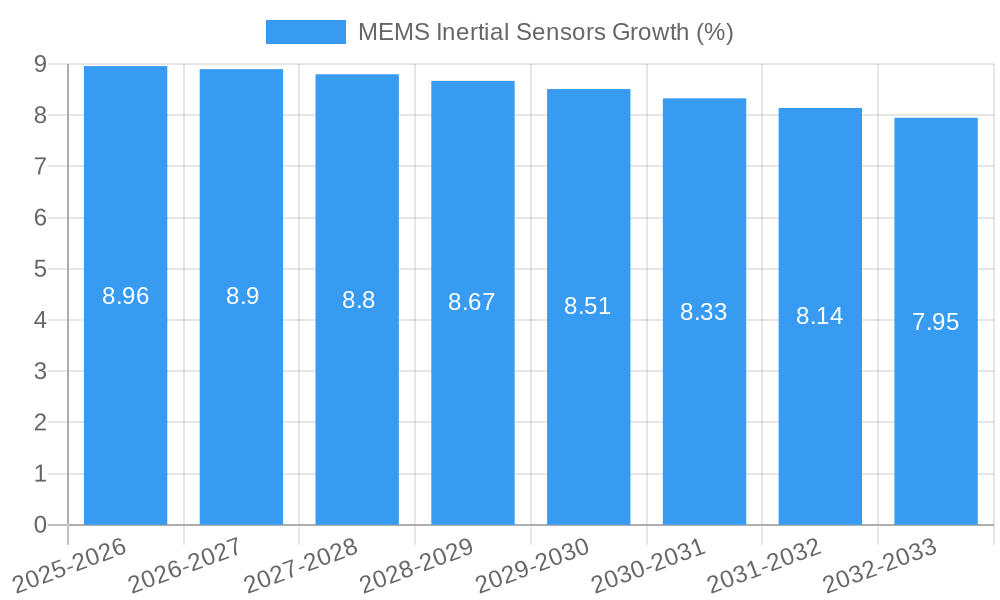

The global MEMS inertial sensors market is poised for significant expansion, projected to reach a valuation of approximately $12,500 million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of around 8.5%. This growth is primarily propelled by the escalating demand for miniaturized, high-performance, and energy-efficient sensing solutions across a myriad of industries. Key drivers include the ubiquitous integration of inertial sensors in automotive applications for advanced driver-assistance systems (ADAS), electronic stability control, and navigation. The burgeoning consumer electronics sector, with its insatiable appetite for smartphones, wearables, and gaming devices, further fuels this expansion. Medical devices, such as implantable sensors and patient monitoring systems, and industrial applications, including robotics, automation, and drone technology, also represent substantial growth avenues. The market's trajectory is characterized by continuous innovation in sensor accuracy, size reduction, and power efficiency, enabling sophisticated functionalities and new use cases.

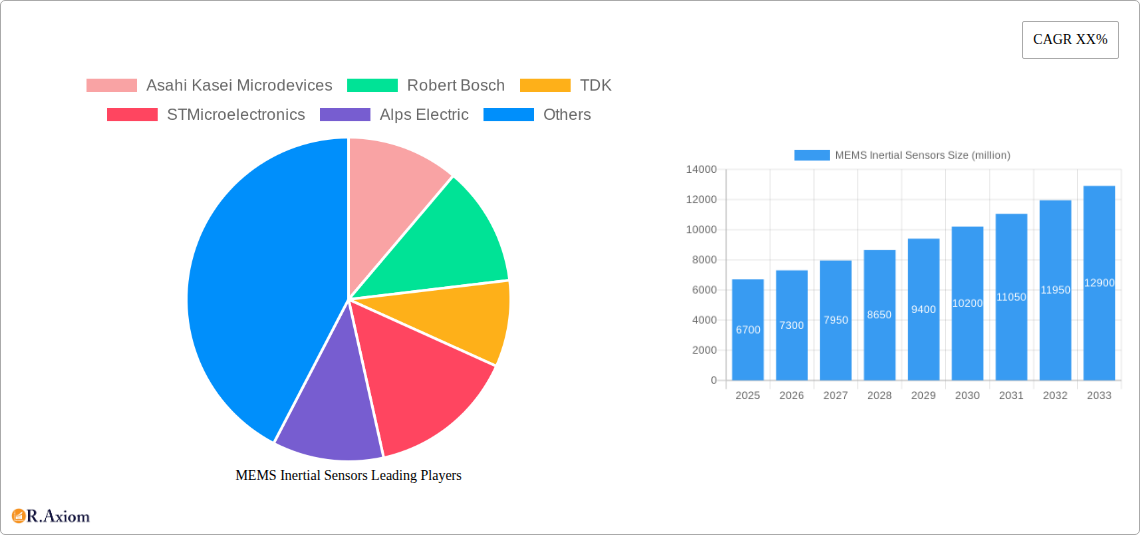

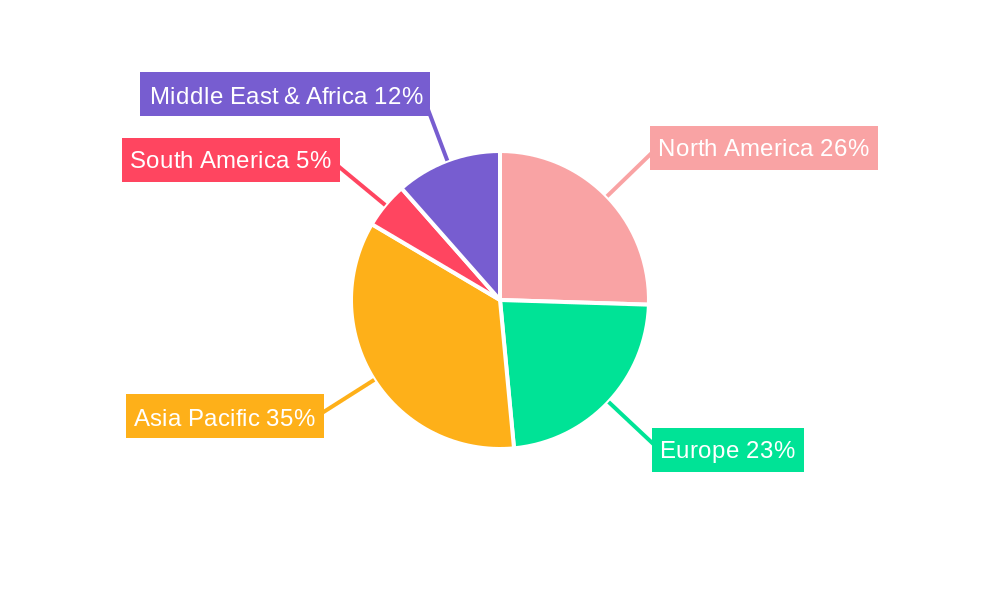

The MEMS inertial sensors market is segmented into distinct types, with accelerometers and gyroscopes dominating the landscape due to their widespread adoption in motion detection and orientation sensing. Magnetometers, while also integral, often complement these core sensors. The diverse applications span Automotive, Consumer Electronics, Medical, and Industrial sectors, each contributing uniquely to market dynamics. Geographically, the Asia Pacific region is expected to lead in terms of market share and growth, driven by the robust manufacturing capabilities of China and India, coupled with strong demand from their expanding consumer electronics and automotive industries. North America and Europe also represent significant markets, propelled by technological advancements and stringent safety regulations mandating the use of inertial sensors in vehicles and critical industrial machinery. While the market is characterized by a competitive landscape with established players like Robert Bosch, TDK, and STMicroelectronics, emerging players and technological breakthroughs continue to shape its evolution. Restraints such as high initial investment costs for R&D and manufacturing, along with the need for continuous technological upgrades to stay competitive, are factors the industry navigates.

MEMS Inertial Sensors Market: Comprehensive Growth Analysis and Forecast (2019-2033)

This in-depth market research report provides a thorough analysis of the global MEMS inertial sensors market, covering historical trends, current dynamics, and future projections. With an estimated market size of 20 million in the base year 2025 and projected to reach 35 million by 2033, this study is essential for stakeholders seeking to understand the trajectory of this rapidly evolving sector. The report delves into market concentration, key industry developments, dominant segments, product innovations, growth drivers, challenges, and emerging opportunities, offering actionable insights for strategic decision-making. The study period spans from 2019 to 2033, with a detailed examination of the historical period (2019-2024) and a comprehensive forecast period (2025-2033).

MEMS Inertial Sensors Market Concentration & Innovation

The MEMS inertial sensors market exhibits a moderate level of concentration, with key players like Robert Bosch, STMicroelectronics, and TDK holding significant market shares, estimated at approximately 15%, 12%, and 10% respectively in 2025. Innovation is primarily driven by advancements in miniaturization, power efficiency, and enhanced accuracy, fueled by increasing demand for sophisticated navigation and motion tracking across various applications. Regulatory frameworks, particularly those related to automotive safety standards and medical device certifications, play a crucial role in shaping product development and market entry. Product substitutes, such as GPS and vision-based systems, are present but often complement rather than fully replace MEMS inertial sensors due to their intrinsic advantages in indoor navigation and high-frequency motion sensing. End-user trends are strongly influenced by the proliferation of smart devices, autonomous systems, and wearable technology. Mergers and acquisition (M&A) activities, though moderate, are strategically aimed at acquiring complementary technologies or expanding market reach. For instance, a hypothetical M&A deal in 2022 involving a prominent sensor manufacturer and a specialized algorithm developer was valued at 50 million. Future innovation will likely focus on AI integration for sensor fusion and predictive maintenance.

MEMS Inertial Sensors Industry Trends & Insights

The MEMS inertial sensors industry is experiencing robust growth, driven by a confluence of technological advancements and expanding application landscapes. The global market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 8% between 2025 and 2033, reaching an estimated value of 35 million. Key growth drivers include the escalating demand for enhanced automotive safety features, such as advanced driver-assistance systems (ADAS) and autonomous driving technologies, which rely heavily on accurate inertial data for vehicle positioning and stability control. In the consumer electronics segment, the proliferation of smartphones, smartwatches, gaming consoles, and virtual/augmented reality (VR/AR) devices continues to fuel demand for sophisticated motion sensing capabilities for intuitive user interfaces and immersive experiences. The medical industry is witnessing increasing adoption of MEMS inertial sensors in wearable health monitors, implantable devices, and surgical robots, enabling precise patient monitoring and minimally invasive procedures. Industrial applications, including robotics, drones, asset tracking, and predictive maintenance, are also significant contributors to market expansion. Technological disruptions, such as the development of ultra-low-power MEMS sensors and advanced signal processing algorithms, are enhancing performance and enabling new use cases. Consumer preferences are increasingly leaning towards smaller, more power-efficient, and highly integrated inertial sensing solutions. Competitive dynamics are characterized by intense R&D efforts, strategic partnerships, and a focus on cost optimization to maintain market share. Market penetration is expected to deepen across emerging economies as the adoption of smart technologies accelerates.

Dominant Markets & Segments in MEMS Inertial Sensors

The Automotive segment is a dominant force within the MEMS inertial sensors market, driven by stringent safety regulations and the rapid advancement of autonomous driving technologies. In 2025, the automotive sector is estimated to account for 40% of the global market value.

- Key Drivers for Automotive Dominance:

- ADAS Adoption: The increasing mandatory implementation of ADAS features like electronic stability control, lane keeping assist, and adaptive cruise control necessitates reliable inertial sensing for precise vehicle dynamics monitoring.

- Autonomous Driving Development: The pursuit of fully autonomous vehicles relies heavily on accurate and robust inertial measurement units (IMUs) for dead reckoning, sensor fusion, and situational awareness, projected to drive significant market expansion in this sub-segment.

- Stringent Safety Standards: Global automotive safety regulations, such as those from NHTSA and Euro NCAP, mandate the use of advanced safety systems, directly boosting the demand for MEMS inertial sensors.

- Vehicle Navigation Systems: Enhanced GPS integration with inertial navigation systems provides seamless navigation even in GPS-denied environments like tunnels or urban canyons.

Among the types of MEMS inertial sensors, Accelerometers hold the largest market share, estimated at 50% in 2025, due to their widespread application across all major segments and their foundational role in motion detection.

- Key Drivers for Accelerometer Dominance:

- Ubiquitous Integration: Found in nearly all consumer electronics for screen orientation, motion sensing, and gaming.

- Automotive Safety: Crucial for airbag deployment systems, stability control, and ADAS.

- Industrial Automation: Used in vibration monitoring, robotics, and tilt sensing.

- Medical Devices: Employed in fall detection systems and motion analysis.

Geographically, Asia-Pacific is emerging as the dominant region, driven by its robust manufacturing capabilities, rapidly growing consumer electronics market, and increasing investments in automotive and industrial automation. China, in particular, is a significant contributor due to its large production volumes and burgeoning domestic demand.

MEMS Inertial Sensors Product Developments

Recent product developments in MEMS inertial sensors are characterized by a relentless pursuit of higher accuracy, lower power consumption, and smaller form factors. Companies are introducing integrated IMUs that combine accelerometers, gyroscopes, and magnetometers with advanced algorithms for improved sensor fusion and drift correction. Enhanced performance in extreme temperature conditions and vibration environments is also a key focus, catering to demanding automotive and industrial applications. The integration of AI capabilities for intelligent motion analysis and anomaly detection is a significant emerging trend, offering competitive advantages. These innovations are driving the creation of novel applications in areas like advanced robotics, personalized healthcare, and immersive entertainment.

MEMS Inertial Sensors Report Scope & Segmentation Analysis

This report segments the MEMS inertial sensors market by Application, including Automotive, Consumer Electronics, Medical, and Industrial. The Automotive segment is projected to experience a CAGR of 9% from 2025-2033, reaching an estimated market size of 14 million by 2033. The Consumer Electronics segment, valued at 10 million in 2025, is expected to grow at a CAGR of 7%, driven by wearable technology and smart home devices. The Medical segment, though smaller, shows strong growth potential with a projected CAGR of 10%, driven by advancements in wearable health monitoring. The Industrial segment is forecast to grow at 8%, fueled by robotics and automation.

The market is further segmented by Type, including Accelerometers, Gyroscopes, and Magnetometers. Accelerometers are the largest segment, with an estimated market size of 17.5 million in 2025 and a projected CAGR of 8%. Gyroscopes are expected to grow at 9%, while Magnetometers will see a CAGR of 6%.

Key Drivers of MEMS Inertial Sensors Growth

The MEMS inertial sensors market is propelled by several key drivers. Technological advancements in miniaturization and power efficiency enable wider adoption in portable and battery-operated devices. The burgeoning automotive industry, with its increasing demand for ADAS and autonomous driving capabilities, represents a significant growth catalyst. The expanding consumer electronics market, fueled by the proliferation of smartphones, wearables, and AR/VR devices, further bolsters demand. Furthermore, the increasing application of MEMS inertial sensors in industrial automation, robotics, and drone technology contributes to market expansion. Government initiatives promoting smart cities and IoT deployments also indirectly drive growth.

Challenges in the MEMS Inertial Sensors Sector

Despite its robust growth, the MEMS inertial sensors sector faces several challenges. Intense competition among manufacturers leads to price pressures and thin profit margins. Supply chain disruptions, particularly for critical raw materials and manufacturing components, can impact production and lead times. Evolving regulatory landscapes in different regions require continuous compliance efforts and can add to development costs. The high cost of R&D for developing next-generation sensors and the need for specialized expertise also present barriers. Furthermore, the emergence of alternative sensing technologies for specific applications, such as advanced GPS or vision-based systems, poses a competitive threat.

Emerging Opportunities in MEMS Inertial Sensors

Emerging opportunities in the MEMS inertial sensors market are vast and diverse. The rapidly growing demand for sophisticated navigation and motion tracking in the metaverse and immersive entertainment is creating new avenues for growth. The expansion of the Internet of Things (IoT) ecosystem, particularly in smart homes, smart cities, and industrial IoT, provides a continuous stream of opportunities for inertial sensing solutions. Advancements in AI and machine learning are enabling more intelligent sensor fusion and predictive analytics, opening doors for new applications in areas like predictive maintenance and advanced robotics. The healthcare sector's increasing reliance on wearable devices for remote patient monitoring and diagnostics presents a significant growth opportunity. Furthermore, the development of ultra-high-precision inertial sensors is paving the way for applications in scientific research and high-end industrial instrumentation.

Leading Players in the MEMS Inertial Sensors Market

- Asahi Kasei Microdevices

- Robert Bosch

- TDK

- STMicroelectronics

- Alps Electric

- Analog Devices

- NXP Semiconductors

- Kionix

- Memsic

- Texas Instruments

- Epson Electronics America

- ON Semiconductor

- Honeywell

- Colibrys

- Murata Manufacturing

Key Developments in MEMS Inertial Sensors Industry

- 2023 Q4: Robert Bosch introduces a new generation of automotive-grade IMUs with enhanced accuracy and extended temperature range for ADAS applications.

- 2023 Q3: STMicroelectronics launches a miniaturized, low-power 6-axis IMU targeting wearable devices and IoT applications.

- 2023 Q2: TDK expands its portfolio of inertial sensors with advanced algorithms for improved motion recognition in consumer electronics.

- 2023 Q1: Analog Devices announces a strategic partnership with a leading automotive Tier 1 supplier to develop next-generation inertial sensing solutions for autonomous vehicles.

- 2022 Q4: Alps Electric releases a new multi-axis sensor module with integrated pressure sensing capabilities for enhanced environmental awareness.

- 2022 Q3: Kionix introduces a highly robust accelerometer designed for harsh industrial environments and high-vibration applications.

- 2022 Q2: Memsic unveils an ultra-low-power gyroscope for extended battery life in mobile and wearable devices.

- 2022 Q1: Texas Instruments showcases advancements in its digital output accelerometers with improved noise performance.

- 2021 Q4: Honeywell announces the development of a new high-performance inertial measurement unit for defense and aerospace applications.

- 2021 Q3: Epson Electronics America showcases its commitment to miniaturization with a compact and power-efficient IMU for consumer products.

Strategic Outlook for MEMS Inertial Sensors Market

The strategic outlook for the MEMS inertial sensors market is highly optimistic, driven by continuous technological innovation and the expanding adoption of smart technologies across diverse sectors. The increasing demand for autonomous systems, both in automotive and industrial applications, will continue to be a primary growth catalyst. The convergence of AI and MEMS sensing presents a significant opportunity for developing intelligent and adaptive solutions. Investments in research and development for miniaturization, power efficiency, and enhanced performance will remain crucial for market leaders. Strategic collaborations and potential M&A activities will likely shape the competitive landscape, enabling companies to acquire new capabilities or expand their market reach. The growing emphasis on personalized healthcare and the burgeoning IoT ecosystem further solidify the long-term growth prospects for the MEMS inertial sensors market.

MEMS Inertial Sensors Segmentation

-

1. Application

- 1.1. Automotive

- 1.2. Consumer Electronics

- 1.3. Medical

- 1.4. Industrial

-

2. Types

- 2.1. Accelerometers

- 2.2. Gyroscopes

- 2.3. Magnetometers

MEMS Inertial Sensors Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

MEMS Inertial Sensors REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEMS Inertial Sensors Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Automotive

- 5.1.2. Consumer Electronics

- 5.1.3. Medical

- 5.1.4. Industrial

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Accelerometers

- 5.2.2. Gyroscopes

- 5.2.3. Magnetometers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America MEMS Inertial Sensors Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Automotive

- 6.1.2. Consumer Electronics

- 6.1.3. Medical

- 6.1.4. Industrial

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Accelerometers

- 6.2.2. Gyroscopes

- 6.2.3. Magnetometers

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America MEMS Inertial Sensors Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Automotive

- 7.1.2. Consumer Electronics

- 7.1.3. Medical

- 7.1.4. Industrial

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Accelerometers

- 7.2.2. Gyroscopes

- 7.2.3. Magnetometers

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe MEMS Inertial Sensors Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Automotive

- 8.1.2. Consumer Electronics

- 8.1.3. Medical

- 8.1.4. Industrial

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Accelerometers

- 8.2.2. Gyroscopes

- 8.2.3. Magnetometers

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa MEMS Inertial Sensors Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Automotive

- 9.1.2. Consumer Electronics

- 9.1.3. Medical

- 9.1.4. Industrial

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Accelerometers

- 9.2.2. Gyroscopes

- 9.2.3. Magnetometers

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific MEMS Inertial Sensors Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Automotive

- 10.1.2. Consumer Electronics

- 10.1.3. Medical

- 10.1.4. Industrial

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Accelerometers

- 10.2.2. Gyroscopes

- 10.2.3. Magnetometers

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Asahi Kasei Microdevices

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Robert Bosch

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TDK

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 STMicroelectronics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alps Electric

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Analog Devices

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NXP Semiconductors

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kionix

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Memsic

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Texas Instruments

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Epson Electronics America

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 ON Semiconductor

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Honeywell

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Colibrys

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Asahi Kasei Microdevices

List of Figures

- Figure 1: Global MEMS Inertial Sensors Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America MEMS Inertial Sensors Revenue (million), by Application 2024 & 2032

- Figure 3: North America MEMS Inertial Sensors Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America MEMS Inertial Sensors Revenue (million), by Types 2024 & 2032

- Figure 5: North America MEMS Inertial Sensors Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America MEMS Inertial Sensors Revenue (million), by Country 2024 & 2032

- Figure 7: North America MEMS Inertial Sensors Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America MEMS Inertial Sensors Revenue (million), by Application 2024 & 2032

- Figure 9: South America MEMS Inertial Sensors Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America MEMS Inertial Sensors Revenue (million), by Types 2024 & 2032

- Figure 11: South America MEMS Inertial Sensors Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America MEMS Inertial Sensors Revenue (million), by Country 2024 & 2032

- Figure 13: South America MEMS Inertial Sensors Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe MEMS Inertial Sensors Revenue (million), by Application 2024 & 2032

- Figure 15: Europe MEMS Inertial Sensors Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe MEMS Inertial Sensors Revenue (million), by Types 2024 & 2032

- Figure 17: Europe MEMS Inertial Sensors Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe MEMS Inertial Sensors Revenue (million), by Country 2024 & 2032

- Figure 19: Europe MEMS Inertial Sensors Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa MEMS Inertial Sensors Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa MEMS Inertial Sensors Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa MEMS Inertial Sensors Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa MEMS Inertial Sensors Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa MEMS Inertial Sensors Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa MEMS Inertial Sensors Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific MEMS Inertial Sensors Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific MEMS Inertial Sensors Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific MEMS Inertial Sensors Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific MEMS Inertial Sensors Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific MEMS Inertial Sensors Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific MEMS Inertial Sensors Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global MEMS Inertial Sensors Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global MEMS Inertial Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global MEMS Inertial Sensors Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global MEMS Inertial Sensors Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global MEMS Inertial Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global MEMS Inertial Sensors Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global MEMS Inertial Sensors Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global MEMS Inertial Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global MEMS Inertial Sensors Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global MEMS Inertial Sensors Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global MEMS Inertial Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global MEMS Inertial Sensors Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global MEMS Inertial Sensors Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global MEMS Inertial Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global MEMS Inertial Sensors Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global MEMS Inertial Sensors Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global MEMS Inertial Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global MEMS Inertial Sensors Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global MEMS Inertial Sensors Revenue million Forecast, by Country 2019 & 2032

- Table 41: China MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific MEMS Inertial Sensors Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEMS Inertial Sensors?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the MEMS Inertial Sensors?

Key companies in the market include Asahi Kasei Microdevices, Robert Bosch, TDK, STMicroelectronics, Alps Electric, Analog Devices, NXP Semiconductors, Kionix, Memsic, Texas Instruments, Epson Electronics America, ON Semiconductor, Honeywell, Colibrys.

3. What are the main segments of the MEMS Inertial Sensors?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEMS Inertial Sensors," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEMS Inertial Sensors report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEMS Inertial Sensors?

To stay informed about further developments, trends, and reports in the MEMS Inertial Sensors, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence