Key Insights

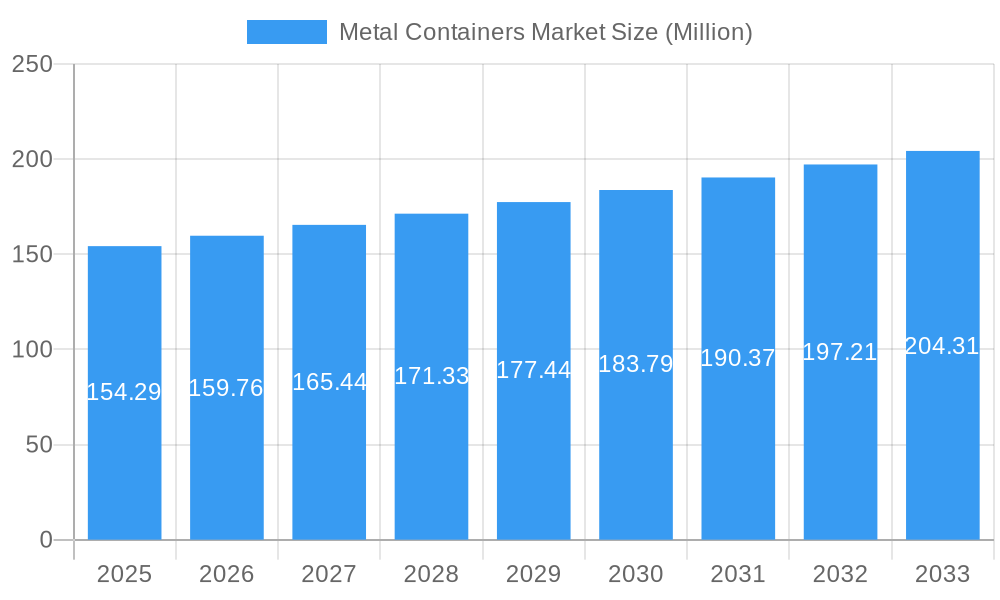

The global Metal Containers Market is poised for steady growth, projected to reach an estimated market size of $154.29 million with a Compound Annual Growth Rate (CAGR) of 3.54% between 2025 and 2033. This expansion is fueled by a confluence of factors, primarily driven by the enduring demand from the beverage and food industries, which represent significant end-user segments. The inherent durability, recyclability, and protective qualities of metal packaging continue to make it a preferred choice for preserving product integrity and ensuring safe transportation. Emerging trends such as the increasing preference for sustainable packaging solutions, coupled with advancements in manufacturing technologies that enhance efficiency and reduce environmental impact, are further propelling market momentum. The market's segmentation showcases a diverse range of product types, including various cans (food, beverage, aerosol), bulk containers, shipping barrels, drums, caps, and closures, catering to a broad spectrum of industrial and consumer needs.

Metal Containers Market Market Size (In Million)

Despite the robust growth trajectory, certain restraints are observed within the Metal Containers Market. Volatility in raw material prices, particularly for aluminum and steel, can impact production costs and subsequently influence market pricing strategies. Furthermore, the growing competition from alternative packaging materials like plastics and advanced composites, especially in specific applications where lighter weight or greater design flexibility is prioritized, poses a challenge. However, the market's resilience lies in its adaptability and continuous innovation. Companies are actively investing in research and development to create more lightweight yet equally strong metal containers, explore novel coatings for enhanced product protection, and develop more sustainable production processes. Key players like Ball Corporation, Crown Holdings Inc., and Ardagh Metal Packaging SA are at the forefront of these innovations, strategizing to capitalize on evolving consumer preferences and regulatory landscapes to maintain and expand their market share across major regions including North America, Europe, and Asia.

Metal Containers Market Company Market Share

This in-depth report provides a comprehensive analysis of the global Metal Containers Market, offering critical insights into market dynamics, key trends, and future projections. Covering the period from 2019 to 2033, with a base year of 2025, this research is essential for industry stakeholders seeking to understand the competitive landscape, identify growth opportunities, and strategize for sustained success. The report details the market's evolution through historical data (2019-2024) and forecasts significant growth in the upcoming forecast period (2025-2033).

Metal Containers Market Market Concentration & Innovation

The Metal Containers Market exhibits a moderate level of market concentration, with a few dominant players holding substantial market share, particularly in the aluminum beverage can segment. Companies like Ball Corporation, Crown Holdings Inc., and Ardagh Metal Packaging SA are key contributors to market consolidation and innovation. Innovation drivers include the increasing demand for sustainable packaging solutions, the pursuit of lighter-weight and more durable metal containers, and advancements in printing and decorative technologies. Regulatory frameworks, such as those promoting recyclability and reducing single-use plastics, significantly influence product development and material choices. Product substitutes, primarily rigid plastics and cartons, pose a constant competitive threat, necessitating continuous innovation in metal packaging to maintain market share. End-user trends, such as the growing preference for convenience and premium packaging in the beverage and food sectors, are also shaping product designs and functionalities. Mergers and acquisitions (M&A) activities are prevalent, with estimated deal values in the hundreds of millions to billions of dollars, as larger companies aim to expand their geographical reach, product portfolios, and technological capabilities. For instance, Crown Holdings Inc.'s acquisition of Helvetia Packaging AG exemplifies this trend, aiming to bolster its European beverage can capacity.

Metal Containers Market Industry Trends & Insights

The Metal Containers Market is experiencing robust growth, driven by a confluence of factors that underscore its enduring appeal and adaptability. The escalating global demand for sustainable and recyclable packaging materials serves as a primary growth catalyst. Consumers and regulatory bodies alike are increasingly favoring metal packaging, especially aluminum and steel, due to their high recyclability rates and lower environmental impact compared to many plastic alternatives. This trend is particularly pronounced in the beverage sector, where the iconic aluminum can continues to dominate. The convenience factor associated with metal containers, offering portability, durability, and excellent barrier properties, further fuels their adoption across various end-user industries, including food, cosmetics, and household products.

Technological disruptions are playing a pivotal role in shaping the market. Innovations in manufacturing processes, such as advanced printing techniques and lighter-weight metal alloys, are enhancing the aesthetic appeal and functional performance of metal containers. Digital printing technologies, as exemplified by Hart Print's expansion, are allowing for greater customization and shorter lead times, catering to brand owners seeking unique packaging designs. Furthermore, advancements in sealing technologies and structural integrity are enabling metal containers to effectively protect a wider range of products, from sensitive food items to hazardous chemicals.

Consumer preferences are evolving, with a growing appreciation for premium packaging that communicates quality and sustainability. Brands are leveraging metal containers to convey a sense of value and eco-consciousness, aligning with the desires of an increasingly environmentally aware consumer base. The food and beverage industries, in particular, are witnessing a surge in demand for visually appealing and tactile metal packaging that stands out on retail shelves.

Competitive dynamics within the Metal Containers Market are characterized by intense rivalry, with established players continuously investing in capacity expansion, research and development, and strategic acquisitions to maintain their market leadership. The market penetration of metal containers is expected to rise steadily, particularly in developing economies where disposable incomes and consumer demand for packaged goods are on the upswing. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 4.5% to 5.5% during the forecast period, reflecting strong underlying growth drivers and a positive outlook for the industry. The increasing focus on a circular economy and the inherent recyclability of metals position the Metal Containers Market for sustained expansion in the coming years.

Dominant Markets & Segments in Metal Containers Market

The Metal Containers Market demonstrates significant regional dominance and segmentation across various product types and end-user industries. North America and Europe currently represent the largest geographical markets, driven by established industrial bases, high consumer spending, and stringent environmental regulations that favor recyclable packaging. Within these regions, countries such as the United States, Germany, and the United Kingdom are major contributors to market revenue. Economic policies supporting sustainable manufacturing and robust infrastructure for collection and recycling further bolster market performance.

Material Type Dominance:

- Aluminum: This material type is particularly dominant in the beverage can segment due to its lightweight properties, excellent barrier characteristics, and high recyclability. The growing demand for canned beverages, from soft drinks to craft beers, fuels aluminum's market leadership.

- Steel: Steel containers hold a strong position in the food industry, especially for canned goods like soups, vegetables, and pet food, owing to their strength, durability, and cost-effectiveness. They are also crucial for bulk containers and shipping barrels and drums used in industrial applications.

Product Type Dominance:

- Cans (Beverage Cans, Food Cans): These segments collectively represent the largest share of the Metal Containers Market. Beverage cans are driven by the ubiquitous nature of the soft drink and beer industries, while food cans remain essential for preservation and convenience.

- Caps and Closures: This segment is critical for maintaining product integrity and freshness across numerous industries, including food, beverage, and pharmaceuticals.

- Bulk Containers, Shipping Barrels and Drums: These are vital for the safe and efficient transport and storage of industrial chemicals, paints, and lubricants, contributing significantly to the industrial segment of the market.

End-User Industry Dominance:

- Beverage: This is the leading end-user industry, with a perpetual demand for cans and closures. The shift towards sustainable packaging in this sector significantly benefits metal containers.

- Food: The preservation and convenient packaging of a vast array of food products ensure the continued dominance of metal containers in this sector.

- Cosmetics and Personal Care: This industry increasingly utilizes metal packaging for its premium appeal, durability, and ability to protect product formulations, especially for aerosols and specialty containers.

- Paints and Varnishes: Steel drums and cans are indispensable for the storage and transportation of paints, coatings, and solvents due to their robustness and resistance to chemical reactions.

The growth drivers for these dominant segments include increasing urbanization, rising disposable incomes, evolving consumer lifestyles favoring convenience, and a growing awareness of environmental sustainability. The recyclability and inherent durability of metal packaging position it favorably to meet these evolving market demands.

Metal Containers Market Product Developments

Innovations in the Metal Containers Market are primarily focused on enhancing sustainability, functionality, and aesthetic appeal. The development of lighter-weight aluminum and steel alloys is reducing material usage and carbon footprint. Advanced coatings and barrier technologies are improving product preservation and shelf life, particularly for sensitive food and beverage products. Digital printing and sophisticated graphic capabilities are enabling brands to create highly customized and eye-catching packaging, increasing consumer engagement. These developments provide competitive advantages by offering cost savings, improved environmental performance, and superior brand differentiation in a crowded marketplace.

Report Scope & Segmentation Analysis

This report offers a granular segmentation of the Metal Containers Market across several key dimensions.

Material Type: The market is analyzed based on Aluminum and Steel, evaluating the distinct applications, growth drivers, and market shares of each material. Aluminum dominates beverage packaging, while steel is prevalent in food and industrial applications.

Product Type: Segmentation includes Cans (further divided into Food Cans, Beverage Cans, and Aerosol Cans), Bulk Containers, Shipping Barrels and Drums, and Caps and Closures. Each product type serves specific industry needs and exhibits unique growth trajectories and competitive landscapes. For instance, beverage cans are projected to witness substantial growth due to increasing consumption and sustainability trends.

End-user Industry: The analysis covers Beverage, Food, Cosmetics and Personal Care, Household, and Paints and Varnishes. The beverage and food industries represent the largest end-users, with growing contributions from cosmetics and personal care sectors seeking premium and sustainable packaging. The Paints and Varnishes sector relies on the durability and safety of steel containers. Growth projections and market sizes are detailed for each segment, highlighting competitive dynamics and the influence of specific industry trends.

Key Drivers of Metal Containers Market Growth

The Metal Containers Market is propelled by several critical growth drivers. The escalating global demand for sustainable and recyclable packaging solutions is a primary impetus, as metal's inherent recyclability aligns with circular economy principles. The convenience and durability offered by metal containers, particularly in the beverage and food sectors, continue to drive adoption. Technological advancements in manufacturing, such as lightweighting and improved barrier properties, enhance product performance and cost-effectiveness. Furthermore, favorable government regulations promoting recycling and reduced plastic usage are creating a more conducive environment for metal packaging. Growing disposable incomes in emerging economies are also increasing the demand for packaged goods, further benefiting the metal containers sector.

Challenges in the Metal Containers Market Sector

Despite strong growth prospects, the Metal Containers Market faces several challenges. Fluctuations in raw material prices, particularly for aluminum and steel, can impact production costs and profitability. Intense competition from alternative packaging materials, such as flexible plastics and cartons, necessitates continuous innovation and cost optimization. Regulatory hurdles related to product safety, labeling, and environmental compliance can add complexity and cost to operations. Supply chain disruptions, including logistics and availability of essential components, can affect production schedules and delivery times. Moreover, significant capital investment is required for establishing and upgrading manufacturing facilities, posing a barrier to entry for smaller players.

Emerging Opportunities in Metal Containers Market

The Metal Containers Market is poised for significant growth driven by emerging opportunities. The increasing consumer preference for sustainable and eco-friendly products presents a substantial opportunity for metal packaging. The expansion of the ready-to-drink (RTD) beverage market, including hard seltzers and cold brew coffee, is creating new demand for aluminum cans. Innovations in smart packaging technologies, such as embedded sensors and augmented reality features, offer avenues for enhanced consumer engagement and supply chain traceability. The growing e-commerce sector also presents opportunities for robust and protective metal packaging for various goods. Furthermore, the development of new alloy compositions and manufacturing techniques can lead to lighter, stronger, and more cost-effective metal containers, opening up new application areas.

Leading Players in the Metal Containers Market Market

- CANPACK SA (CANPACK Group)

- TUBEX Packaging GmbH

- Nampak Limited

- Ball Corporation

- Greif Inc

- Crown Holdings Inc

- Ardagh Metal Packaging SA (Ardagh Group)

- Mauser Packaging Solutions

- Silgan Holdings Inc

- Colep Packaging (RAR Group Company)

Key Developments in Metal Containers Market Industry

- February 2024: Hart Print, a subsidiary of Ardagh Metal Packaging, expanded its digital printing capabilities on aluminum cans by opening its third production facility in Maryland, USA. This expansion aims to increase annual printing capacity by at least 100 million cans to meet regional demand.

- October 2023: Crown Holdings Inc. successfully completed the acquisition of Helvetia Packaging AG, a beverage can and end manufacturing facility located in Saarlouis, Germany. This acquisition includes Helvetia's customer base, contracts, and approximately 200 employees, significantly expanding Crown's European beverage can platform and adding nearly one billion tonnes of annual capacity to meet growing customer demand for recyclable beverage cans.

Strategic Outlook for Metal Containers Market Market

The strategic outlook for the Metal Containers Market remains highly optimistic, fueled by the persistent global shift towards sustainable packaging. Companies are expected to prioritize investments in advanced manufacturing technologies that reduce environmental impact and enhance efficiency, such as lightweighting and improved recyclability. The ongoing consolidation through mergers and acquisitions will likely continue as key players seek to achieve economies of scale, expand their geographical footprint, and diversify their product offerings. Innovations in product design and functionality will be crucial for capturing market share in burgeoning sectors like RTD beverages and cosmetics. Furthermore, a strong focus on circular economy principles and robust recycling infrastructure will be paramount for long-term growth and market leadership in the evolving landscape of packaging solutions.

Metal Containers Market Segmentation

-

1. Material Type

- 1.1. Aluminum

- 1.2. Steel

-

2. Product Type

-

2.1. Cans

- 2.1.1. Food Cans

- 2.1.2. Beverage Cans

- 2.1.3. Aerosol Cans

- 2.2. Bulk Containers

- 2.3. Shipping Barrels and Drums

- 2.4. Caps and Closures

-

2.1. Cans

-

3. End-user Industry

- 3.1. Beverage

- 3.2. Food

- 3.3. Cosmetics and Personal Care

- 3.4. Household

- 3.5. Paints and Varnishes

Metal Containers Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Italy

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Australia and New Zealand

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Argentina

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

Metal Containers Market Regional Market Share

Geographic Coverage of Metal Containers Market

Metal Containers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Recyclability Rates of Metal Packaging; Convenience and Lower Price Offered by Canned Food and Beverage

- 3.3. Market Restrains

- 3.3.1. Presence of Alternate Packaging Solutions

- 3.4. Market Trends

- 3.4.1. Beverage Cans are Expected to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Metal Containers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Aluminum

- 5.1.2. Steel

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Cans

- 5.2.1.1. Food Cans

- 5.2.1.2. Beverage Cans

- 5.2.1.3. Aerosol Cans

- 5.2.2. Bulk Containers

- 5.2.3. Shipping Barrels and Drums

- 5.2.4. Caps and Closures

- 5.2.1. Cans

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Beverage

- 5.3.2. Food

- 5.3.3. Cosmetics and Personal Care

- 5.3.4. Household

- 5.3.5. Paints and Varnishes

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America Metal Containers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Aluminum

- 6.1.2. Steel

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Cans

- 6.2.1.1. Food Cans

- 6.2.1.2. Beverage Cans

- 6.2.1.3. Aerosol Cans

- 6.2.2. Bulk Containers

- 6.2.3. Shipping Barrels and Drums

- 6.2.4. Caps and Closures

- 6.2.1. Cans

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Beverage

- 6.3.2. Food

- 6.3.3. Cosmetics and Personal Care

- 6.3.4. Household

- 6.3.5. Paints and Varnishes

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Europe Metal Containers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Aluminum

- 7.1.2. Steel

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Cans

- 7.2.1.1. Food Cans

- 7.2.1.2. Beverage Cans

- 7.2.1.3. Aerosol Cans

- 7.2.2. Bulk Containers

- 7.2.3. Shipping Barrels and Drums

- 7.2.4. Caps and Closures

- 7.2.1. Cans

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Beverage

- 7.3.2. Food

- 7.3.3. Cosmetics and Personal Care

- 7.3.4. Household

- 7.3.5. Paints and Varnishes

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Asia Metal Containers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Aluminum

- 8.1.2. Steel

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Cans

- 8.2.1.1. Food Cans

- 8.2.1.2. Beverage Cans

- 8.2.1.3. Aerosol Cans

- 8.2.2. Bulk Containers

- 8.2.3. Shipping Barrels and Drums

- 8.2.4. Caps and Closures

- 8.2.1. Cans

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Beverage

- 8.3.2. Food

- 8.3.3. Cosmetics and Personal Care

- 8.3.4. Household

- 8.3.5. Paints and Varnishes

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Latin America Metal Containers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Aluminum

- 9.1.2. Steel

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Cans

- 9.2.1.1. Food Cans

- 9.2.1.2. Beverage Cans

- 9.2.1.3. Aerosol Cans

- 9.2.2. Bulk Containers

- 9.2.3. Shipping Barrels and Drums

- 9.2.4. Caps and Closures

- 9.2.1. Cans

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Beverage

- 9.3.2. Food

- 9.3.3. Cosmetics and Personal Care

- 9.3.4. Household

- 9.3.5. Paints and Varnishes

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Middle East and Africa Metal Containers Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Aluminum

- 10.1.2. Steel

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Cans

- 10.2.1.1. Food Cans

- 10.2.1.2. Beverage Cans

- 10.2.1.3. Aerosol Cans

- 10.2.2. Bulk Containers

- 10.2.3. Shipping Barrels and Drums

- 10.2.4. Caps and Closures

- 10.2.1. Cans

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Beverage

- 10.3.2. Food

- 10.3.3. Cosmetics and Personal Care

- 10.3.4. Household

- 10.3.5. Paints and Varnishes

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CANPACK SA (CANPACK Group)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TUBEX Packaging GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nampak Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ball Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Greif Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Crown Holdings Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ardagh Metal Packaging SA (Ardagh Group)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mauser Packaging Solutions

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Silgan Holdings Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Colep Packaging (RAR Group Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 CANPACK SA (CANPACK Group)

List of Figures

- Figure 1: Global Metal Containers Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Metal Containers Market Revenue (Million), by Material Type 2025 & 2033

- Figure 3: North America Metal Containers Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: North America Metal Containers Market Revenue (Million), by Product Type 2025 & 2033

- Figure 5: North America Metal Containers Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Metal Containers Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Metal Containers Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Metal Containers Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Metal Containers Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Metal Containers Market Revenue (Million), by Material Type 2025 & 2033

- Figure 11: Europe Metal Containers Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 12: Europe Metal Containers Market Revenue (Million), by Product Type 2025 & 2033

- Figure 13: Europe Metal Containers Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: Europe Metal Containers Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Europe Metal Containers Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Metal Containers Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Metal Containers Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Metal Containers Market Revenue (Million), by Material Type 2025 & 2033

- Figure 19: Asia Metal Containers Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 20: Asia Metal Containers Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Asia Metal Containers Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Asia Metal Containers Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Asia Metal Containers Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Metal Containers Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Metal Containers Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Metal Containers Market Revenue (Million), by Material Type 2025 & 2033

- Figure 27: Latin America Metal Containers Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 28: Latin America Metal Containers Market Revenue (Million), by Product Type 2025 & 2033

- Figure 29: Latin America Metal Containers Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Latin America Metal Containers Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Latin America Metal Containers Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Latin America Metal Containers Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Metal Containers Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Metal Containers Market Revenue (Million), by Material Type 2025 & 2033

- Figure 35: Middle East and Africa Metal Containers Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 36: Middle East and Africa Metal Containers Market Revenue (Million), by Product Type 2025 & 2033

- Figure 37: Middle East and Africa Metal Containers Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Middle East and Africa Metal Containers Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Metal Containers Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Metal Containers Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Metal Containers Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Metal Containers Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Global Metal Containers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Global Metal Containers Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Metal Containers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Metal Containers Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 6: Global Metal Containers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Global Metal Containers Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Metal Containers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Metal Containers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Metal Containers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Metal Containers Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 12: Global Metal Containers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 13: Global Metal Containers Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Metal Containers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Metal Containers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Metal Containers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Metal Containers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Metal Containers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Metal Containers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Metal Containers Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 21: Global Metal Containers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Global Metal Containers Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Metal Containers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Metal Containers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: India Metal Containers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Metal Containers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: South Korea Metal Containers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Australia and New Zealand Metal Containers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Metal Containers Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 30: Global Metal Containers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 31: Global Metal Containers Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 32: Global Metal Containers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Brazil Metal Containers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Mexico Metal Containers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Argentina Metal Containers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global Metal Containers Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 37: Global Metal Containers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 38: Global Metal Containers Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 39: Global Metal Containers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: United Arab Emirates Metal Containers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Saudi Arabia Metal Containers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: South Africa Metal Containers Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Metal Containers Market?

The projected CAGR is approximately 3.54%.

2. Which companies are prominent players in the Metal Containers Market?

Key companies in the market include CANPACK SA (CANPACK Group), TUBEX Packaging GmbH, Nampak Limited, Ball Corporation, Greif Inc, Crown Holdings Inc, Ardagh Metal Packaging SA (Ardagh Group), Mauser Packaging Solutions, Silgan Holdings Inc, Colep Packaging (RAR Group Company.

3. What are the main segments of the Metal Containers Market?

The market segments include Material Type, Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 154.29 Million as of 2022.

5. What are some drivers contributing to market growth?

High Recyclability Rates of Metal Packaging; Convenience and Lower Price Offered by Canned Food and Beverage.

6. What are the notable trends driving market growth?

Beverage Cans are Expected to Witness Major Growth.

7. Are there any restraints impacting market growth?

Presence of Alternate Packaging Solutions.

8. Can you provide examples of recent developments in the market?

February 2024 - Hart Print, a subsidiary of Ardagh Metal Packaging engaged in digital printing on aluminum cans, expanded its presence in the United States by opening its third production facility in Maryland. The company aims to increase the annual printing capacity by at least 100 million cans to cater to the demand in the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Metal Containers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Metal Containers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Metal Containers Market?

To stay informed about further developments, trends, and reports in the Metal Containers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence