Key Insights

The Mexican telecommunications market, valued at approximately $19.04 billion in 2025, is projected for significant expansion. The market is forecast to grow at a Compound Annual Growth Rate (CAGR) of 3.41% from 2025 to 2033. Key growth drivers include escalating smartphone adoption, increased data consumption, and the burgeoning demand for mobile broadband services. The proliferation of Over-the-Top (OTT) platforms and pay-TV services is creating new revenue opportunities while simultaneously reshaping traditional telecommunication models. Government initiatives focused on enhancing digital infrastructure and expanding broadband access nationwide are further propelling market growth. Challenges include intense competition from new market entrants and the imperative for sustained investment in advanced technologies like 5G to meet evolving consumer expectations. Market segmentation reveals a strong emphasis on voice services (wired and wireless), data services, and the rapidly expanding OTT and pay-TV sectors. Leading industry players, including América Móvil, Telmex, AT&T Mexico, and Totalplay, are engaged in vigorous competition for market share, fostering dynamic pricing and service innovation.

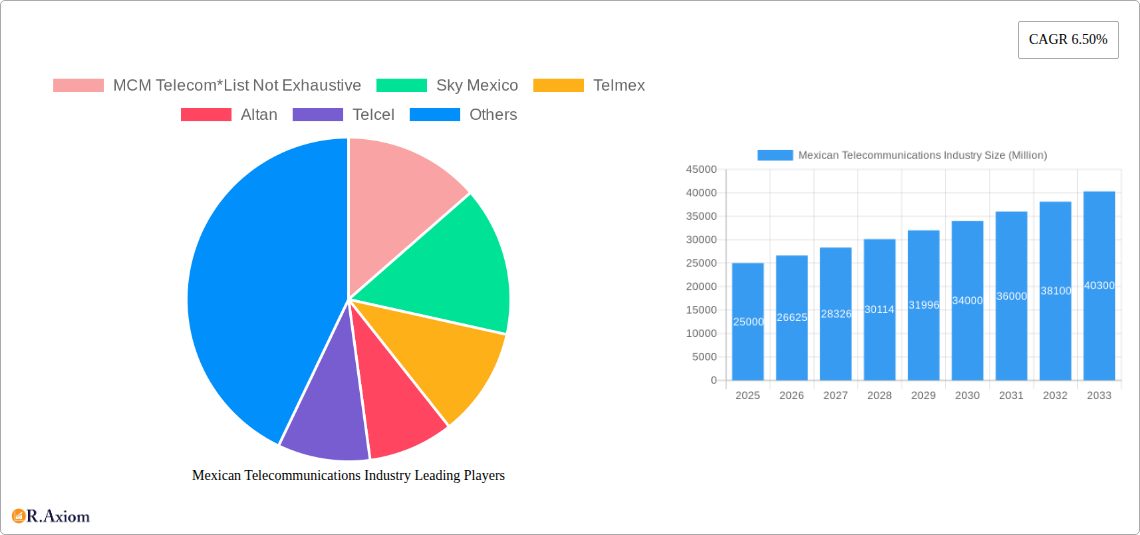

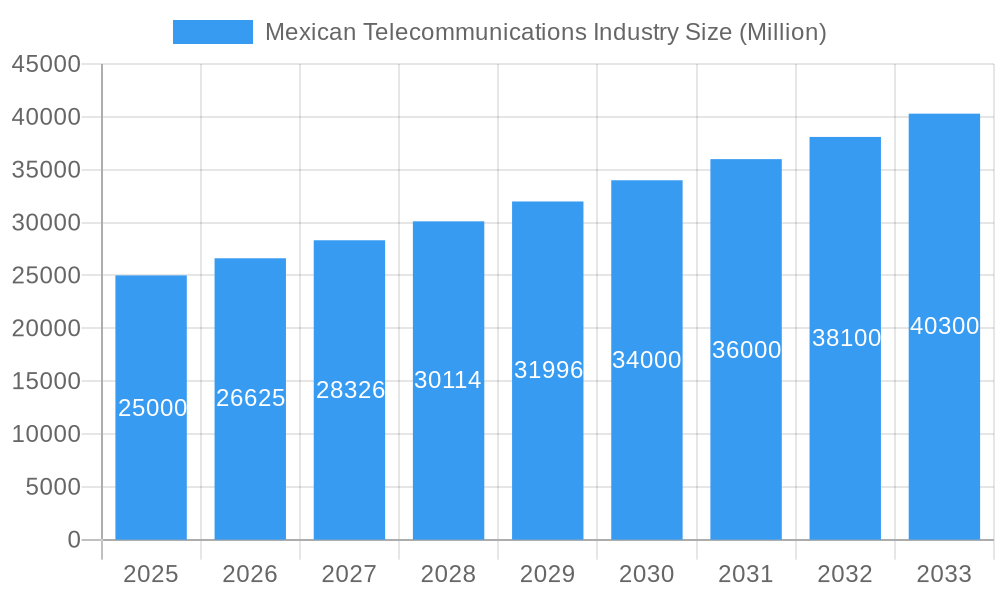

Mexican Telecommunications Industry Market Size (In Billion)

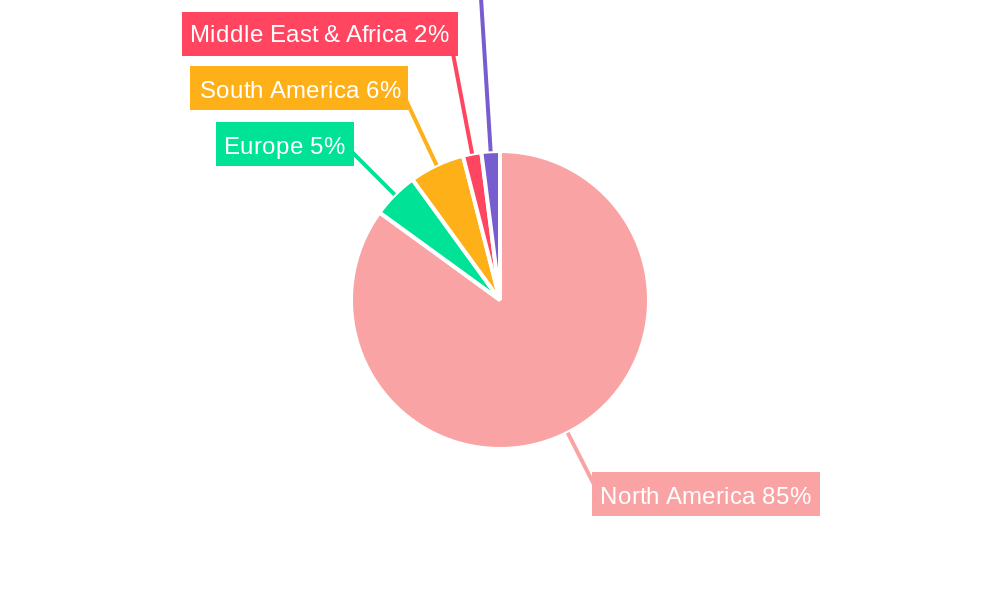

While the primary market focus is Mexico, this analysis considers a broader geographical scope encompassing North and South America, Europe, the Middle East & Africa, and Asia Pacific. International technological advancements and market trends significantly influence Mexico's telecommunications landscape. The forecast period indicates a sustained growth trajectory, supported by Mexico's ongoing digital transformation and the increasing adoption of advanced technologies by both consumers and businesses. Potential impacts on the projected growth rate may arise from regulatory shifts and economic volatility, necessitating continuous monitoring for accurate market analysis and strategic decision-making.

Mexican Telecommunications Industry Company Market Share

This comprehensive report offers an in-depth examination of the Mexican telecommunications industry, detailing market dynamics, the competitive environment, technological progress, and future growth opportunities. Leveraging extensive data analysis, the study provides actionable insights for stakeholders, investors, and prospective market entrants. The study covers the period from 2019 to 2033, with 2025 designated as the base and estimated year. The forecast period spans 2025-2033, with the historical period covering 2019-2024.

Mexican Telecommunications Industry Market Concentration & Innovation

The Mexican telecommunications market exhibits a high degree of concentration, with a few dominant players commanding significant market share. America Movil, through its subsidiaries Telcel and Telmex, holds a substantial portion of the market, particularly in mobile and fixed-line services. Other key players like AT&T Mexico, Totalplay, and Izzi Mexico compete intensely, driving innovation and investment in network infrastructure. The market is characterized by ongoing mergers and acquisitions (M&A) activity, with deal values reaching billions of dollars in recent years. For example, the xx Million deal between [Company A] and [Company B] in [Year] significantly reshaped the competitive landscape.

- Market Concentration: America Movil holds approximately xx% market share; AT&T Mexico holds approximately xx%; Totalplay holds approximately xx%; Others hold approximately xx%.

- Innovation Drivers: Increased mobile penetration, demand for high-speed internet, and the rise of OTT services are key drivers.

- Regulatory Framework: The regulatory environment plays a crucial role, impacting competition and investment.

- Product Substitutes: Over-the-top (OTT) services like Netflix and YouTube are emerging as substitutes for traditional pay-TV.

- End-User Trends: Consumers are increasingly demanding higher bandwidth, greater data allowances, and bundled services.

- M&A Activity: Significant M&A activity has shaped market consolidation, with xx Million in total deal value recorded between 2019-2024.

Mexican Telecommunications Industry Industry Trends & Insights

The Mexican telecommunications market is experiencing robust growth, driven by factors such as rising smartphone adoption, increasing internet penetration, and the growing demand for data services. The Compound Annual Growth Rate (CAGR) for the industry is projected to be xx% during the forecast period (2025-2033). Technological disruptions, particularly the rollout of 5G networks, are transforming the industry's capabilities and creating new opportunities. Consumer preferences are shifting towards bundled services, offering greater value and convenience. The competitive dynamics are intense, with major players investing heavily in network infrastructure and service innovation to maintain their market positions. Market penetration for mobile broadband services is estimated at xx% in 2025. The shift towards digital consumption and the increasing demand for affordable data plans are key factors influencing market growth. Furthermore, the government's focus on expanding digital infrastructure significantly impacts the market's evolution.

Dominant Markets & Segments in Mexican Telecommunications Industry

The Mexican telecommunications market demonstrates significant dominance in the mobile and fixed broadband segments. While the geographical distribution is relatively even across the country, urban areas tend to exhibit higher penetration rates across all services.

- Voice Services (Wired & Wireless): Mobile voice services dominate, driven by high mobile penetration. Wired voice services are declining but maintain a presence in certain segments.

- Data Services: This segment is experiencing rapid growth due to increasing internet usage and the proliferation of mobile devices. The expansion of 4G and the deployment of 5G infrastructure are driving this growth.

- OTT and Pay-TV Services: This sector is highly competitive, with established players facing pressure from new entrants and changing consumer preferences. Growth is being driven by increasing access to high-speed internet.

Key Drivers:

- Economic Policies: Government incentives for infrastructure investment and digital inclusion initiatives.

- Infrastructure: Investment in fiber optic networks and mobile infrastructure is expanding capacity and coverage.

Mexican Telecommunications Industry Product Developments

The Mexican telecommunications industry is witnessing significant product innovation, with companies introducing advanced services and technologies to cater to evolving consumer needs. The focus is on high-speed data services, including 5G technology, and sophisticated bundled packages that integrate fixed-line, mobile, and OTT services. Companies are leveraging technological advancements to enhance network performance, security, and customer experience. The integration of AI and machine learning is playing a growing role in network optimization and customer service automation. This trend aims to provide superior service at competitive prices and capture a larger market share.

Report Scope & Segmentation Analysis

This report segments the Mexican telecommunications market into:

Voice Services (Wired & Wireless): This segment includes fixed-line and mobile voice services. Growth projections are moderate for mobile and declining for fixed-line. Competitive dynamics are intense due to market saturation in mobile voice, but there are opportunities in specialized niche markets within fixed-line.

Data Services: This encompasses mobile broadband, fixed broadband, and other data services. High growth is projected due to the growing adoption of smartphones and the increasing demand for data. The competitive landscape is highly dynamic, with companies vying for market share through network upgrades and innovative data packages.

OTT and Pay-TV Services: This covers subscription-based video streaming and traditional pay-TV services. Growth is projected to be substantial, driven by rising internet penetration and consumer preference for streaming services. The competitive intensity is very high, with both established players and new entrants vying for subscribers.

Key Drivers of Mexican Telecommunications Industry Growth

The growth of the Mexican telecommunications industry is propelled by several factors:

- Technological Advancements: The deployment of 5G technology and fiber optic networks is expanding capacity and improving data speeds.

- Economic Growth: Rising disposable incomes are increasing demand for telecommunications services, particularly in data services and bundled packages.

- Government Policies: The government's initiatives to promote digital inclusion and expand internet access are creating growth opportunities.

Challenges in the Mexican Telecommunications Industry Sector

The Mexican telecommunications industry faces several challenges:

- Regulatory Hurdles: Complex regulations can impede investment and innovation.

- Infrastructure Gaps: Uneven infrastructure coverage across the country limits access to high-speed internet in certain regions.

- Competitive Pressures: Intense competition among established and emerging players puts pressure on pricing and profitability. This results in approximately xx Million in lost revenue annually due to price wars.

Emerging Opportunities in Mexican Telecommunications Industry

Emerging opportunities include:

- Expansion of 5G Networks: This creates opportunities for innovative services and applications.

- Growth of IoT: The increasing adoption of IoT devices will generate demand for new connectivity solutions.

- Demand for Cloud Services: Businesses are increasingly relying on cloud-based services, creating opportunities for telecom providers.

Leading Players in the Mexican Telecommunications Industry Market

- MCM Telecom

- Sky Mexico

- Telmex

- Altan

- Telcel

- America Movil

- AT&T Mexico

- Izzi Mexico

- MegaCable MCM

- Grupo Televisa

- Totalplay

- Axtel

- TV Azteca Mexico

Key Developments in Mexican Telecommunications Industry Industry

- October 2022: Formula 1 partnered with Telcel and Telmex to offer F1TV Pro to Mexican subscribers.

- October 2022: Grupo Televisa and Sky Mexico launched new mobile phone services on the AT&T network.

Strategic Outlook for Mexican Telecommunications Industry Market

The Mexican telecommunications market presents significant growth opportunities. Continued investment in infrastructure, particularly 5G and fiber optics, will be crucial. The focus on bundled services, innovative data packages, and the expansion of digital services will be key strategies for success. The market is poised for continued expansion, driven by increasing digital adoption and the government's ongoing initiatives to expand connectivity across the nation. The potential for substantial growth remains high, especially considering the rising demand for faster, more reliable internet and mobile communication.

Mexican Telecommunications Industry Segmentation

-

1. Segmenta

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and

- 1.3. OTT and Pay-tv Services

-

1.1. Voice Services

Mexican Telecommunications Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Mexican Telecommunications Industry Regional Market Share

Geographic Coverage of Mexican Telecommunications Industry

Mexican Telecommunications Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Penetration of Mobile Phone Usage; IoT for Telecom Sustainability

- 3.3. Market Restrains

- 3.3.1. Managing Regulatory and Compliance Needs Across the World

- 3.4. Market Trends

- 3.4.1. Increased Use of Mobile Phones

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mexican Telecommunications Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Segmenta

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and

- 5.1.3. OTT and Pay-tv Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Segmenta

- 6. North America Mexican Telecommunications Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Segmenta

- 6.1.1. Voice Services

- 6.1.1.1. Wired

- 6.1.1.2. Wireless

- 6.1.2. Data and

- 6.1.3. OTT and Pay-tv Services

- 6.1.1. Voice Services

- 6.1. Market Analysis, Insights and Forecast - by Segmenta

- 7. South America Mexican Telecommunications Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Segmenta

- 7.1.1. Voice Services

- 7.1.1.1. Wired

- 7.1.1.2. Wireless

- 7.1.2. Data and

- 7.1.3. OTT and Pay-tv Services

- 7.1.1. Voice Services

- 7.1. Market Analysis, Insights and Forecast - by Segmenta

- 8. Europe Mexican Telecommunications Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Segmenta

- 8.1.1. Voice Services

- 8.1.1.1. Wired

- 8.1.1.2. Wireless

- 8.1.2. Data and

- 8.1.3. OTT and Pay-tv Services

- 8.1.1. Voice Services

- 8.1. Market Analysis, Insights and Forecast - by Segmenta

- 9. Middle East & Africa Mexican Telecommunications Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Segmenta

- 9.1.1. Voice Services

- 9.1.1.1. Wired

- 9.1.1.2. Wireless

- 9.1.2. Data and

- 9.1.3. OTT and Pay-tv Services

- 9.1.1. Voice Services

- 9.1. Market Analysis, Insights and Forecast - by Segmenta

- 10. Asia Pacific Mexican Telecommunications Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Segmenta

- 10.1.1. Voice Services

- 10.1.1.1. Wired

- 10.1.1.2. Wireless

- 10.1.2. Data and

- 10.1.3. OTT and Pay-tv Services

- 10.1.1. Voice Services

- 10.1. Market Analysis, Insights and Forecast - by Segmenta

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 MCM Telecom*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sky Mexico

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Telmex

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Altan

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Telcel

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 America Movil

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AT&T Mexico

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Izzi Mexico

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MegaCable MCM

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Grupo Televisa

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Totalplay

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Axtel

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 TV Azteca Mexico

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 MCM Telecom*List Not Exhaustive

List of Figures

- Figure 1: Global Mexican Telecommunications Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Mexican Telecommunications Industry Revenue (billion), by Segmenta 2025 & 2033

- Figure 3: North America Mexican Telecommunications Industry Revenue Share (%), by Segmenta 2025 & 2033

- Figure 4: North America Mexican Telecommunications Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Mexican Telecommunications Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Mexican Telecommunications Industry Revenue (billion), by Segmenta 2025 & 2033

- Figure 7: South America Mexican Telecommunications Industry Revenue Share (%), by Segmenta 2025 & 2033

- Figure 8: South America Mexican Telecommunications Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: South America Mexican Telecommunications Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Mexican Telecommunications Industry Revenue (billion), by Segmenta 2025 & 2033

- Figure 11: Europe Mexican Telecommunications Industry Revenue Share (%), by Segmenta 2025 & 2033

- Figure 12: Europe Mexican Telecommunications Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Mexican Telecommunications Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Mexican Telecommunications Industry Revenue (billion), by Segmenta 2025 & 2033

- Figure 15: Middle East & Africa Mexican Telecommunications Industry Revenue Share (%), by Segmenta 2025 & 2033

- Figure 16: Middle East & Africa Mexican Telecommunications Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa Mexican Telecommunications Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Mexican Telecommunications Industry Revenue (billion), by Segmenta 2025 & 2033

- Figure 19: Asia Pacific Mexican Telecommunications Industry Revenue Share (%), by Segmenta 2025 & 2033

- Figure 20: Asia Pacific Mexican Telecommunications Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific Mexican Telecommunications Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Mexican Telecommunications Industry Revenue billion Forecast, by Segmenta 2020 & 2033

- Table 2: Global Mexican Telecommunications Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Mexican Telecommunications Industry Revenue billion Forecast, by Segmenta 2020 & 2033

- Table 4: Global Mexican Telecommunications Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Mexican Telecommunications Industry Revenue billion Forecast, by Segmenta 2020 & 2033

- Table 9: Global Mexican Telecommunications Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Mexican Telecommunications Industry Revenue billion Forecast, by Segmenta 2020 & 2033

- Table 14: Global Mexican Telecommunications Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Mexican Telecommunications Industry Revenue billion Forecast, by Segmenta 2020 & 2033

- Table 25: Global Mexican Telecommunications Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Mexican Telecommunications Industry Revenue billion Forecast, by Segmenta 2020 & 2033

- Table 33: Global Mexican Telecommunications Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Mexican Telecommunications Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexican Telecommunications Industry?

The projected CAGR is approximately 3.41%.

2. Which companies are prominent players in the Mexican Telecommunications Industry?

Key companies in the market include MCM Telecom*List Not Exhaustive, Sky Mexico, Telmex, Altan, Telcel, America Movil, AT&T Mexico, Izzi Mexico, MegaCable MCM, Grupo Televisa, Totalplay, Axtel, TV Azteca Mexico.

3. What are the main segments of the Mexican Telecommunications Industry?

The market segments include Segmenta.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.04 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Penetration of Mobile Phone Usage; IoT for Telecom Sustainability.

6. What are the notable trends driving market growth?

Increased Use of Mobile Phones.

7. Are there any restraints impacting market growth?

Managing Regulatory and Compliance Needs Across the World.

8. Can you provide examples of recent developments in the market?

In October 2022, Formula 1 confirmed the beginning of a new strategic partnership with Telcel and Telmex, delivering F1TV Pro to its Mexican subscribers. Customers who had existing subscriptions with Telcel or Telmex for mobile or internet services would be able to add an F1TV Pro subscription.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexican Telecommunications Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexican Telecommunications Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexican Telecommunications Industry?

To stay informed about further developments, trends, and reports in the Mexican Telecommunications Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence