Key Insights

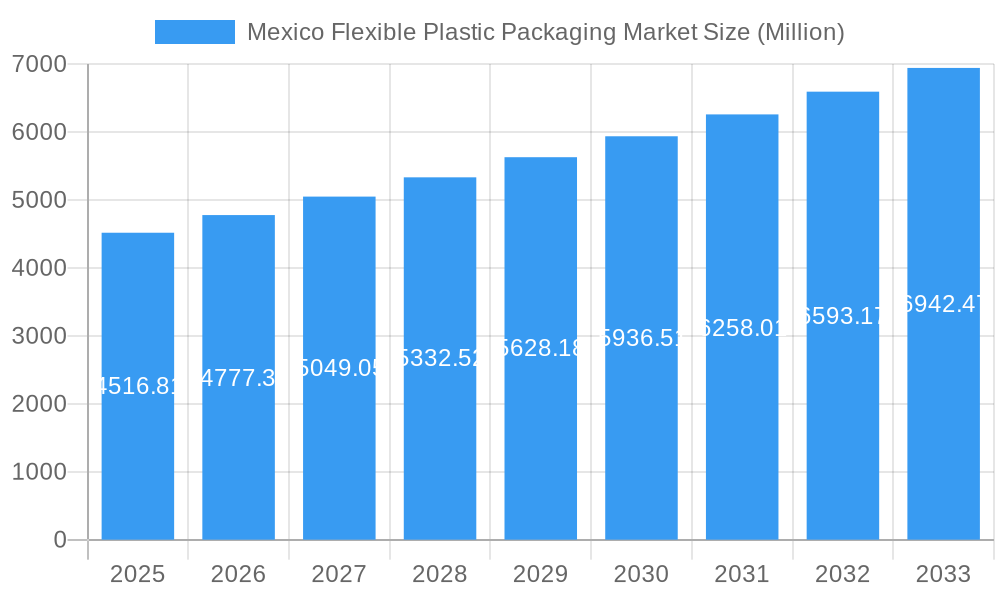

The Mexican flexible plastic packaging market is poised for robust growth, projected to reach USD 4516.81 million by 2025, driven by an estimated Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period of 2025-2033. This expansion is fueled by a confluence of factors, including the increasing demand from the food and beverage sectors, which represent a significant portion of the market's end-user base. The growing preference for convenient and portable packaging solutions, coupled with evolving consumer lifestyles, is further propelling the adoption of flexible plastic packaging. Furthermore, advancements in material science and manufacturing technologies are leading to the development of innovative and sustainable packaging options, catering to a wider range of applications across various industries.

Mexico Flexible Plastic Packaging Market Market Size (In Billion)

Key drivers shaping this dynamic market include the rising disposable incomes in Mexico, leading to increased consumer spending on packaged goods, and the expanding e-commerce landscape, which necessitates durable and efficient packaging. The medical and pharmaceutical sector is also a notable contributor, driven by the need for sterile and protective packaging for sensitive products. While the market is experiencing strong upward momentum, potential restraints such as fluctuating raw material prices and growing environmental concerns regarding plastic waste need to be strategically managed. However, the industry's focus on recyclability, biodegradability, and the increasing use of bioplastics is expected to mitigate these challenges, ensuring sustained growth and innovation in the Mexican flexible plastic packaging market.

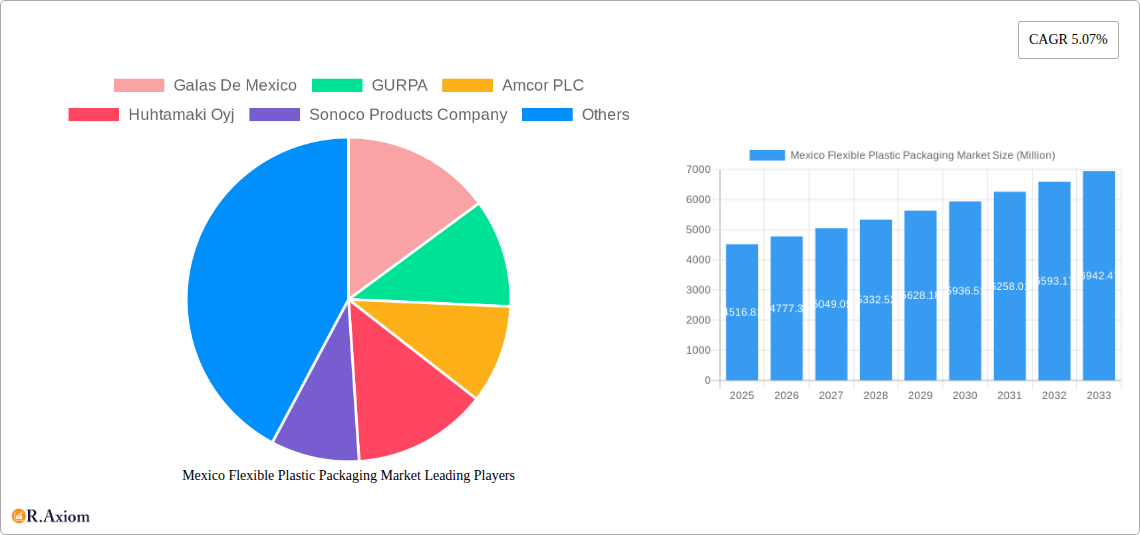

Mexico Flexible Plastic Packaging Market Company Market Share

This in-depth report provides a definitive analysis of the Mexico Flexible Plastic Packaging Market, exploring its dynamic landscape, key growth drivers, emerging trends, and competitive strategies. Covering the historical period from 2019 to 2024, the base year of 2025, and a robust forecast period extending to 2033, this research offers invaluable insights for stakeholders seeking to capitalize on the burgeoning opportunities within this vital sector. With an estimated market size of over 5,000 million in 2025, the market is poised for significant expansion, driven by evolving consumer preferences, technological advancements, and a growing demand across diverse end-user industries.

The report employs meticulous segmentation analysis, examining the market by Material Type (Polyethene (PE), Bi-oriented Polypropylene (BOPP), Cast Polypropylene (CPP), Polyvinyl Chloride (PVC), Ethylene Vinyl Alcohol (EVOH), Other Materials), Product Type (Pouches, Bags, Films and Wraps, Other Product Types like Blister Packs, Liners), and End-User Industry (Food, Beverage, Medical and Pharmaceutical, Personal Care and Household Care, Others). Utilizing advanced analytical methodologies, including a Heat Map Analysis for 7 major sub-segments, this report delivers actionable intelligence for strategic decision-making.

Mexico Flexible Plastic Packaging Market Market Concentration & Innovation

The Mexico Flexible Plastic Packaging Market exhibits a moderate to high level of market concentration, with a few key players dominating a significant portion of the market share. Major companies like Amcor PLC, Huhtamaki Oyj, Sonoco Products Company, and Berry Global Inc. hold substantial sway through their extensive product portfolios, established distribution networks, and continuous investment in research and development. Innovation is a critical differentiator, fueled by the increasing demand for sustainable packaging solutions, enhanced barrier properties, and advanced functionalities like active and intelligent packaging. Regulatory frameworks, while generally supportive of industrial growth, are increasingly focusing on environmental sustainability, pushing manufacturers towards recyclable and biodegradable materials. Product substitutes, such as rigid packaging and paper-based alternatives, pose a competitive threat, necessitating continuous innovation in flexible packaging to maintain its market leadership. End-user trends, particularly in the food and beverage sectors, are demanding lighter, more convenient, and visually appealing packaging. Mergers and acquisitions (M&A) activities are a significant aspect of market dynamics, with companies strategically acquiring smaller players or complementary businesses to expand their geographical reach, technological capabilities, and product offerings. For instance, Sonoco Products Company's acquisition of RTS Packaging in September 2023, integrating 15 facilities across the US, Mexico, and Latin America, underscores this trend.

Mexico Flexible Plastic Packaging Market Industry Trends & Insights

The Mexico Flexible Plastic Packaging Market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.8% between 2025 and 2033, reaching an estimated market valuation of over 8,500 million by 2033. This upward trajectory is primarily propelled by escalating demand from the food and beverage industries, which constitute the largest end-user segments. The convenience factor associated with flexible packaging, coupled with its cost-effectiveness and superior product protection capabilities, makes it an attractive choice for a wide array of consumer goods. Technological disruptions are playing a pivotal role, with advancements in material science leading to the development of high-performance films offering enhanced barrier properties, extended shelf life, and improved recyclability. The rising consumer consciousness regarding environmental sustainability is a significant trend, compelling manufacturers to invest in eco-friendly alternatives, including bio-based plastics and advanced recycling technologies. This shift is not only driven by consumer preference but also by evolving government regulations aimed at reducing plastic waste. Competitive dynamics are characterized by intense rivalry, with established global players vying for market share alongside emerging local manufacturers. Companies are focusing on product differentiation through innovative designs, customization, and the integration of smart features in their packaging solutions. The increasing adoption of e-commerce has also boosted the demand for lightweight and durable flexible packaging that can withstand the rigors of shipping and handling, further contributing to market penetration.

Dominant Markets & Segments in Mexico Flexible Plastic Packaging Market

The Food industry is undeniably the dominant end-user segment in the Mexico Flexible Plastic Packaging Market, accounting for an estimated 45% of the total market share in 2025, valued at over 2,250 million. Within the food sector, sub-segments such as Dry Foods and Candy & Confectionery are particularly strong due to the extensive use of pouches and bags for extended shelf life and portion control.

Material Type: Polyethene (PE) is the most prevalent material, capturing an estimated 38% of the market share, valued at over 1,900 million in 2025. Its versatility, cost-effectiveness, and good moisture barrier properties make it ideal for a wide range of applications. Bi-oriented Polypropylene (BOPP) follows closely, valued at over 1,250 million, prized for its clarity, stiffness, and excellent printability.

- Key Drivers for PE Dominance: Widespread availability, diverse grades for specific applications (LDPE, LLDPE, HDPE), and robust domestic production infrastructure.

- BOPP Growth Factors: Increasing demand for high-clarity packaging in snack foods and confectionery, and its suitability for lamination with other materials to achieve enhanced barrier properties.

Product Type: Pouches are the leading product type, representing approximately 30% of the market share, valued at over 1,500 million in 2025. Stand-up pouches, retort pouches, and zipper pouches are highly favored for their convenience and shelf appeal. Films and Wraps also hold a significant share, valued at over 1,375 million, essential for product protection and branding across various industries.

- Dominance of Pouches: Driven by the food industry's preference for resealable and easy-to-open packaging, and their suitability for single-serve portions.

- Films & Wraps Significance: Crucial for fresh produce, dairy products, and general product overwrapping, offering cost-effective containment and preservation.

End-User Industry: As mentioned, the Food industry is the leader. However, the Beverage sector is also a substantial contributor, with flexible packaging used for pouches and specialized containers. The Personal Care and Household Care industry is another significant segment, utilizing flexible packaging for detergents, soaps, and cosmetic products.

- Food Industry Drivers: Growing population, increasing disposable incomes, demand for convenience foods, and the need for extended shelf life.

- Beverage Market Dynamics: Shift towards lighter and more portable packaging formats, and growth in the ready-to-drink (RTD) beverage market.

Mexico Flexible Plastic Packaging Market Product Developments

Product developments in the Mexico Flexible Plastic Packaging Market are increasingly focused on enhancing sustainability, functionality, and consumer appeal. Innovations include the introduction of mono-material flexible packaging solutions designed for improved recyclability, catering to the growing demand for circular economy principles. Advanced barrier technologies are being integrated to extend product shelf life and reduce food waste. Furthermore, the market is witnessing the development of smart packaging features, such as indicators for freshness and tamper-evident seals, enhancing consumer trust and product safety. These developments provide a competitive advantage by meeting evolving regulatory demands and consumer preferences for eco-conscious and high-performance packaging.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Mexico Flexible Plastic Packaging Market across key segmentation dimensions.

- Material Type: The market is segmented into Polyethene (PE), Bi-oriented Polypropylene (BOPP), Cast Polypropylene (CPP), Polyvinyl Chloride (PVC), Ethylene Vinyl Alcohol (EVOH), and Other Materials. PE is projected to retain its dominance, driven by its broad applicability and cost-effectiveness. BOPP is expected to witness substantial growth due to its high clarity and printability.

- Product Type: Segments include Pouches, Bags, Films and Wraps, and Other Product Types (Blister Packs, Liners, etc.). Pouches are anticipated to lead, fueled by convenience and the food industry's demand. Films and Wraps will continue to be a staple across various applications, with steady growth projected.

- End-User Industry: The market is segmented into Food, Beverage, Medical and Pharmaceutical, Personal Care and Household Care, and Other End-User Industries. The Food industry is expected to remain the largest segment, with significant contributions from confectionery, frozen foods, and dry foods. The Medical and Pharmaceutical sector is poised for robust growth due to increasing demand for sterile and protective packaging.

Key Drivers of Mexico Flexible Plastic Packaging Market Growth

The growth of the Mexico Flexible Plastic Packaging Market is underpinned by several key drivers. The expanding food and beverage sector, driven by a growing population and evolving consumer lifestyles, is a primary catalyst. Increased urbanization and a rising middle class are fueling demand for convenient and packaged goods. Technological advancements in material science, leading to improved barrier properties and enhanced sustainability features, are also crucial. Furthermore, supportive government initiatives promoting manufacturing and foreign investment, coupled with the inherent cost-effectiveness and versatility of flexible packaging, contribute significantly to market expansion.

Challenges in the Mexico Flexible Plastic Packaging Market Sector

Despite its promising growth, the Mexico Flexible Plastic Packaging Market faces several challenges. Stricter environmental regulations concerning plastic waste and the push for sustainable alternatives can pose compliance hurdles. Fluctuations in raw material prices, particularly crude oil, can impact production costs and profitability. Intense competition from both domestic and international players necessitates continuous innovation and price optimization. Furthermore, the need for specialized infrastructure for recycling and waste management remains a concern, potentially hindering the widespread adoption of certain eco-friendly packaging solutions.

Emerging Opportunities in Mexico Flexible Plastic Packaging Market

Emerging opportunities in the Mexico Flexible Plastic Packaging Market lie in the growing demand for sustainable and biodegradable packaging solutions. The increasing consumer preference for eco-friendly products presents a significant avenue for growth. The expansion of e-commerce also creates opportunities for lightweight, durable, and protective flexible packaging. Furthermore, advancements in flexible electronics and smart packaging offer potential for innovative applications in product tracking and consumer engagement. The rising demand from the medical and pharmaceutical sectors for high-barrier, sterile, and tamper-evident packaging also presents a lucrative segment.

Leading Players in the Mexico Flexible Plastic Packaging Market Market

- Galas De Mexico

- GURPA

- Amcor PLC

- Huhtamaki Oyj

- Sonoco Products Company

- Sealed Air Corporation

- Berry Global Inc

- Innovia Films

- Finpak Flexibles

- Zubex

Key Developments in Mexico Flexible Plastic Packaging Market Industry

- June 2024: EXPO Pack Mexico 2024 marked a historic milestone as Latin America's largest packaging and processing trade show. The expo had more than 20,000 packaging and processing buyers over 40 verticals and featured 700 exhibitors. The event featured nine international pavilions from Brazil, Canada, China, France, Italy, Spain, Taiwan, Turkey, and the United States.

- September 2023: Sonoco Products Company, a US-based entity, finalized its acquisition of RTS Packaging. This strategic move broadened Sonoco's reach and integrated a network of 15 facilities and a substantial workforce across the United States, Mexico, and Latin America.

Strategic Outlook for Mexico Flexible Plastic Packaging Market Market

The strategic outlook for the Mexico Flexible Plastic Packaging Market remains highly positive, driven by innovation and sustained demand across key sectors. The market is expected to witness continued growth fueled by the increasing adoption of sustainable packaging materials and technologies. Investments in advanced manufacturing processes and research into novel barrier films will be crucial for companies to maintain a competitive edge. Strategic collaborations and M&A activities are likely to shape the competitive landscape, enabling companies to expand their portfolios and market reach. The growing emphasis on recyclability and the circular economy will necessitate a focus on designing for recyclability and investing in collection and recycling infrastructure.

Mexico Flexible Plastic Packaging Market Segmentation

-

1. Material Type

- 1.1. Polyethene (PE)

- 1.2. Bi-oriented Polypropylene (BOPP)

- 1.3. Cast Polypropylene (CPP)

- 1.4. Polyvinyl Chloride (PVC)

- 1.5. Ethylene Vinyl Alcohol (EVOH)

- 1.6. Other Ma

-

2. Product Type

- 2.1. Pouches

- 2.2. Bags

- 2.3. Films and Wraps

- 2.4. Other Product Types (Blister Packs, Liners, etc)

-

3. End-User Industry

-

3.1. Food

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Fo

- 3.2. Beverage

- 3.3. Medical and Pharmaceutical

- 3.4. Personal Care and Household Care

- 3.5. Other En

-

3.1. Food

Mexico Flexible Plastic Packaging Market Segmentation By Geography

- 1. Mexico

Mexico Flexible Plastic Packaging Market Regional Market Share

Geographic Coverage of Mexico Flexible Plastic Packaging Market

Mexico Flexible Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growing Food and Beverage Sector is Expected to Propel the Demand for Flexible Plastic Packaging; Boost in Demand for Stand-up Pouches in the Country

- 3.3. Market Restrains

- 3.3.1. The Growing Food and Beverage Sector is Expected to Propel the Demand for Flexible Plastic Packaging; Boost in Demand for Stand-up Pouches in the Country

- 3.4. Market Trends

- 3.4.1. The Polyethylene (PE) Segment is Expected to Witness Strong Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Flexible Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Polyethene (PE)

- 5.1.2. Bi-oriented Polypropylene (BOPP)

- 5.1.3. Cast Polypropylene (CPP)

- 5.1.4. Polyvinyl Chloride (PVC)

- 5.1.5. Ethylene Vinyl Alcohol (EVOH)

- 5.1.6. Other Ma

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Pouches

- 5.2.2. Bags

- 5.2.3. Films and Wraps

- 5.2.4. Other Product Types (Blister Packs, Liners, etc)

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Fo

- 5.3.2. Beverage

- 5.3.3. Medical and Pharmaceutical

- 5.3.4. Personal Care and Household Care

- 5.3.5. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Galas De Mexico

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GURPA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Amcor PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Huhtamaki Oyj

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sonoco Products Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sealed Air Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Berry Global Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Innovia Films

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Finpak Flexibles

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zubex*List Not Exhaustive 7 2 Heat Map Analysi

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Galas De Mexico

List of Figures

- Figure 1: Mexico Flexible Plastic Packaging Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Mexico Flexible Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Flexible Plastic Packaging Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 2: Mexico Flexible Plastic Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 3: Mexico Flexible Plastic Packaging Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 4: Mexico Flexible Plastic Packaging Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Mexico Flexible Plastic Packaging Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 6: Mexico Flexible Plastic Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 7: Mexico Flexible Plastic Packaging Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 8: Mexico Flexible Plastic Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Flexible Plastic Packaging Market?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the Mexico Flexible Plastic Packaging Market?

Key companies in the market include Galas De Mexico, GURPA, Amcor PLC, Huhtamaki Oyj, Sonoco Products Company, Sealed Air Corporation, Berry Global Inc, Innovia Films, Finpak Flexibles, Zubex*List Not Exhaustive 7 2 Heat Map Analysi.

3. What are the main segments of the Mexico Flexible Plastic Packaging Market?

The market segments include Material Type, Product Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

The Growing Food and Beverage Sector is Expected to Propel the Demand for Flexible Plastic Packaging; Boost in Demand for Stand-up Pouches in the Country.

6. What are the notable trends driving market growth?

The Polyethylene (PE) Segment is Expected to Witness Strong Growth.

7. Are there any restraints impacting market growth?

The Growing Food and Beverage Sector is Expected to Propel the Demand for Flexible Plastic Packaging; Boost in Demand for Stand-up Pouches in the Country.

8. Can you provide examples of recent developments in the market?

June 2024: EXPO Pack Mexico 2024 marked a historic milestone as Latin America's largest packaging and processing trade show. The expo had more than 20,000 packaging and processing buyers over 40 verticals and featured 700 exhibitors. The event featured nine international pavilions from Brazil, Canada, China, France, Italy, Spain, Taiwan, Turkey, and the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Flexible Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Flexible Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Flexible Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the Mexico Flexible Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence