Key Insights

The Mexican packaging market is poised for significant expansion, driven by a dynamic consumer goods sector and a growing need for secure, convenient packaging. Projected to reach $47.5 billion by 2024, the market is forecast to achieve a CAGR of 8.57% over the forecast period (2025-2033). Key growth drivers include the surge in e-commerce, an increasing preference for ready-to-eat meals, and heightened consumer awareness regarding product integrity and environmental sustainability. The robust performance of the food & beverage, personal care, and pharmaceutical industries is fueling demand for a wide array of packaging materials such as plastics, metals, and glass, utilized in formats including flexible packaging, rigid tubes, and containers. While plastic packaging currently leads due to its economic viability and adaptability, escalating environmental concerns are accelerating the adoption of sustainable alternatives like biodegradable and recyclable materials. This strategic pivot towards eco-conscious packaging is a defining trend, necessitating innovation and strategic investment in sustainable solutions.

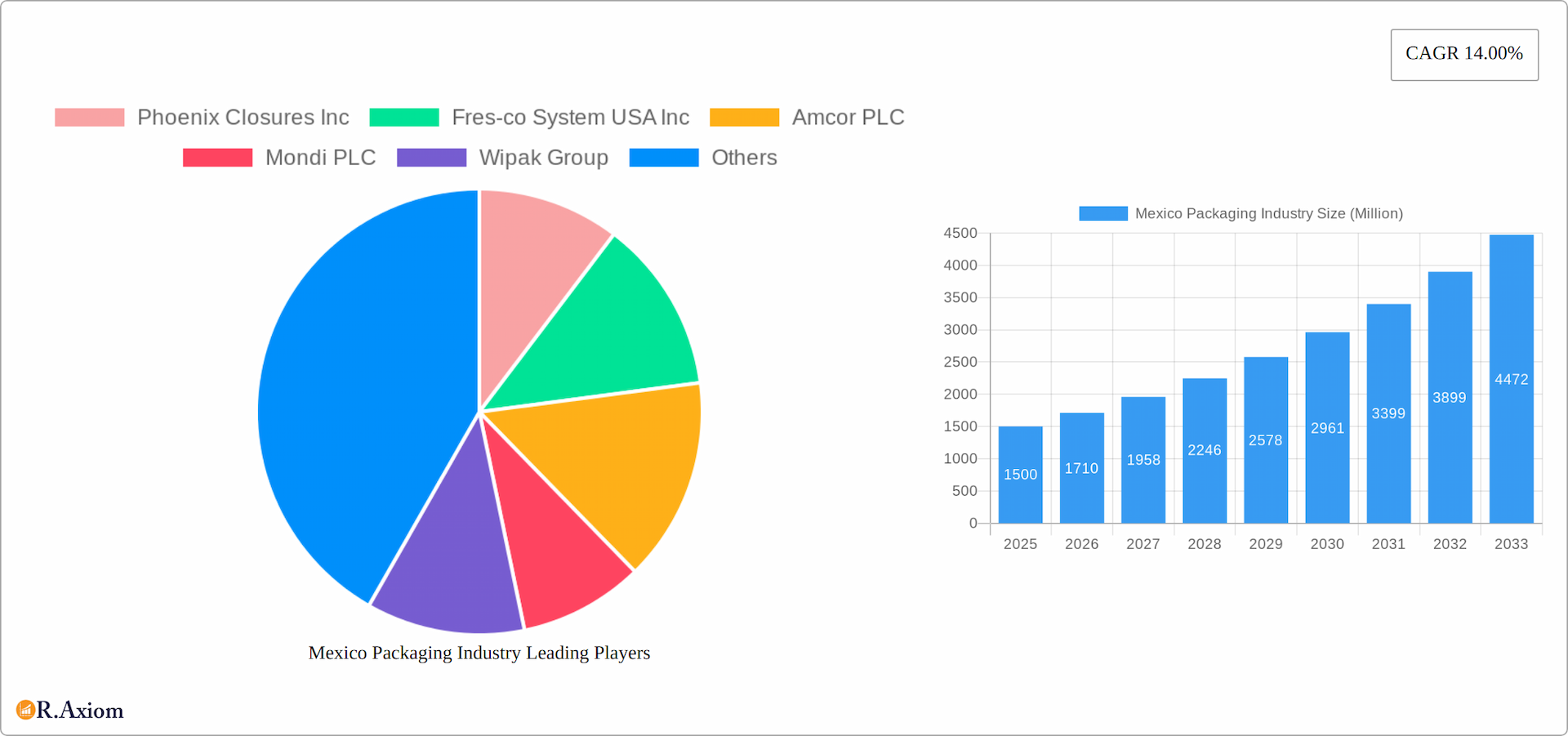

Mexico Packaging Industry Market Size (In Billion)

Prominent market segments fueling this growth encompass flexible packaging, valued for its lightweight properties and cost-efficiency, and rigid packaging, chosen for its superior protection and extended product shelf life. Among end-use industries, the food and beverage sector is anticipated to retain its leadership position, driven by sustained consumer demand for processed and packaged food products. The automotive and pharmaceutical sectors, while currently smaller, are expected to experience consistent growth, influenced by evolving logistical requirements and stringent regulations governing product safety and hygiene. Despite facing challenges such as raw material price volatility and evolving regulatory landscapes, the Mexican packaging industry presents a compelling outlook with substantial growth prospects for both established companies and emerging players.

Mexico Packaging Industry Company Market Share

Mexico Packaging Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Mexico packaging industry, covering market size, segmentation, key players, growth drivers, challenges, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is an invaluable resource for industry stakeholders, investors, and businesses seeking to understand and navigate this dynamic market.

Mexico Packaging Industry Market Concentration & Innovation

The Mexico packaging industry exhibits a moderately concentrated market structure, with a few multinational corporations holding significant market share. While precise market share figures for individual players are proprietary data, Amcor PLC, Mondi PLC, and other global players like Wipak Group and Constantia Flexibles Group are estimated to collectively control a substantial portion (xx%) of the market. Smaller, domestic players account for the remaining share. Innovation is driven by consumer demand for sustainable packaging solutions, stringent regulatory frameworks focusing on recyclability, and the adoption of advanced materials and technologies. The industry witnesses a moderate level of M&A activity, with deal values varying significantly depending on the size and strategic importance of the target company. For example, Smurfit Kappa's USD 23.5 Million investment in its Nuevo Laredo plant signifies substantial investment in the Mexican market. Recent years have also seen a rise in strategic partnerships focused on enhancing supply chain efficiency and expanding product portfolios. Regulatory changes, particularly concerning plastic waste reduction, are driving innovation in biodegradable and compostable packaging materials.

- Market Concentration: Moderately concentrated, with global players holding significant market share (xx%).

- Innovation Drivers: Sustainability, regulations, technological advancements, consumer preferences.

- M&A Activity: Moderate, with deal values varying considerably (examples: Smurfit Kappa’s USD 23.5 Million investment).

- Regulatory Framework: Increasing focus on sustainable and recyclable packaging materials.

- Product Substitutes: Growing adoption of eco-friendly alternatives to traditional materials.

Mexico Packaging Industry Industry Trends & Insights

The Mexico packaging market is experiencing robust growth, driven by factors such as a growing population, rising disposable incomes, and a burgeoning e-commerce sector. The increasing demand for packaged goods across various end-use verticals, including food and beverages, personal care, and pharmaceuticals, fuels this growth. The market exhibits a strong CAGR (Compound Annual Growth Rate) of xx% during the forecast period (2025-2033). Technological disruptions, such as the increasing adoption of automation and digital printing, enhance efficiency and customization options. Consumer preferences are shifting towards sustainable packaging made from recyclable and biodegradable materials, placing pressure on manufacturers to innovate and meet these demands. Competitive dynamics are characterized by both price competition and differentiation through innovative product offerings and sustainable practices. Market penetration of advanced packaging technologies like active and intelligent packaging is increasing steadily, driven by the need for improved product preservation and enhanced consumer experience.

Dominant Markets & Segments in Mexico Packaging Industry

The Mexican packaging market is a dynamic landscape, with the food and beverage sector standing as the undisputed leader, driven by high domestic consumption and evolving consumer preferences. Following closely are the significant contributions from the personal care and pharmaceutical sectors, reflecting robust demand for safe and appealing product presentation. Within the material breakdown, plastics continue to command the largest market share, owing to their inherent versatility, cost-effectiveness, and adaptability across a wide array of applications. Paperboard and other innovative materials are also playing increasingly important roles. Both flexible packaging, offering convenience and extended shelf life, and rigid packaging, providing structural integrity and premium appeal, are substantial and vital segments of the overall market.

- By Packaging Material:

- Plastics: Remains the dominant segment, leveraging its exceptional versatility, cost-effectiveness, and diverse range of resin options for numerous applications.

- Metal: Holds a significant presence, particularly in the preservation of food products (canned goods) and beverages, where its barrier properties are essential.

- Glass: While a more niche market, glass packaging is experiencing renewed growth, especially for premium and artisanal products in the food, beverage, and cosmetic industries, valued for its inertness and aesthetic appeal.

- Other Packaging Material: This segment is experiencing robust growth, driven by the accelerating adoption of sustainable and biodegradable materials, innovative composites, and advanced barrier films to meet environmental mandates and consumer demand.

- By Packaging Type:

- Flexible Packaging: Commands a large market share due to its inherent flexibility, cost-effectiveness, and superior performance in various applications, including pouches, films, and bags, crucial for extending product shelf life and convenience.

- Rigid Packaging: Constitutes a significant portion of the market, driven by the demand for protective and premium packaging in categories like food and beverages (bottles, jars, trays), cosmetics, and pharmaceuticals.

- Tubes: Represents a specialized segment, primarily concentrated in the personal care (toothpaste, creams) and pharmaceutical (ointments) industries, where their dispensing and containment properties are paramount.

- By End-user Vertical:

- Food and Beverage: The largest and most influential segment, directly reflecting Mexico's substantial domestic consumption, evolving dietary habits, and the constant need for safe, appealing, and convenient packaged goods.

- Personal Care: Exhibits steady and consistent growth, fueled by rising disposable incomes, increasing consumer spending on beauty and grooming products, and continuous product innovation requiring diverse packaging solutions.

- Pharmaceutical: A growing and critical segment, driven by the imperative for safe, secure, and tamper-evident packaging to ensure product integrity, efficacy, and patient safety, alongside regulatory compliance.

- Automotive: A smaller but growing segment, representing packaging needs for lubricants, spare parts, and accessories, with potential for expansion as the automotive manufacturing sector thrives.

- Home Care: Similar to the automotive sector, this segment is characterized by steady growth, encompassing packaging for cleaning supplies, detergents, and household goods, influenced by consumer lifestyle trends.

Key Drivers: Mexico's robust economic trajectory, the continuous expansion of its middle class, and proactive government initiatives aimed at fostering industrial development are pivotal contributors to the packaging industry's market dominance. Furthermore, the country's strategic geographic positioning, coupled with its well-established and efficient manufacturing capabilities, solidifies its standing as a significant and influential packaging hub within the North American region.

Mexico Packaging Industry Product Developments

Recent product innovations include the introduction of sustainable and recyclable packaging options to align with global trends and local regulations. Amcor's DairySeal packaging, utilizing ClearCor PET barrier technology, exemplifies this trend. The focus is on enhancing barrier properties while maintaining recyclability. This innovative approach meets increasing consumer demand for environmentally friendly solutions without compromising product quality or shelf life. The development of lighter-weight packaging materials is another notable trend, optimizing resource usage and reducing transportation costs.

Report Scope & Segmentation Analysis

This comprehensive report offers an in-depth analysis of the Mexico packaging market, meticulously segmenting it by packaging material (including plastics, metal, glass, and emerging other materials), packaging type (covering flexible, rigid, and tubes), and end-user vertical (encompassing food & beverage, personal care, home care, automotive, pharmaceutical, and other pertinent sectors). Each segment is thoroughly examined in terms of its current market size, projected future growth trajectories, and the competitive landscape that shapes it. The forecast period for this analysis extends from 2025 to 2033, providing valuable strategic insights into the anticipated evolution of each segment. The report also integrates crucial historical data spanning from 2019 to 2024 to establish a foundational understanding of market trends and performance.

Key Drivers of Mexico Packaging Industry Growth

The growth of the Mexico packaging industry is fueled by several key factors: increasing consumer spending, expanding e-commerce sector boosting demand for robust packaging, rising investments in the food processing and manufacturing sectors, and the government's focus on improving infrastructure. Furthermore, technological advancements in packaging materials and manufacturing processes are driving efficiency and innovation. These factors collectively contribute to the substantial market expansion anticipated during the forecast period.

Challenges in the Mexico Packaging Industry Sector

The Mexican packaging industry navigates a complex terrain marked by several significant challenges. Escalating raw material costs present a persistent concern, directly impacting production expenses. Fluctuating exchange rates introduce volatility, affecting import and export activities and the overall cost-competitiveness of products. Furthermore, increasingly stringent environmental regulations are compelling a rapid transition towards sustainable packaging solutions, necessitating substantial investment and innovation. The intricacies of global supply chain disruptions, coupled with heightened domestic and international competition, add further layers of complexity. Moreover, persistent concerns regarding product counterfeiting require robust and secure packaging strategies. Addressing these multifaceted challenges demands agile strategic planning, significant investments in operational efficiency, the adoption of cutting-edge sustainable materials, and the development of resilient business models.

Emerging Opportunities in Mexico Packaging Industry

The Mexican packaging industry is ripe with emerging opportunities, primarily driven by a growing global and domestic consciousness for sustainability. The pronounced demand for sustainable and eco-friendly packaging solutions is creating significant growth avenues for biodegradable, recyclable, and compostable materials. The increasing adoption of active and intelligent packaging, which enhances product preservation and provides real-time information, represents another key growth frontier. Furthermore, there is considerable potential for expansion into specialized and niche markets, particularly those catering to the burgeoning e-commerce sector and the specialized requirements of premium and artisanal food packaging. Strategic investments in advanced manufacturing technologies, innovative material science, and a strong focus on circular economy principles will be instrumental in unlocking these opportunities and securing a competitive edge in the evolving market landscape.

Leading Players in the Mexico Packaging Industry Market

- Phoenix Closures Inc

- Fres-co System USA Inc

- Amcor PLC

- Mondi PLC

- Wipak Group

- Constantia Flexibles Group

- Glenroy Inc

- Printpack Inc

- Belmark Inc

- JL Packaging Corporation

- Innovia Films Mexico S A de C V

- Sit Group SpA

Key Developments in Mexico Packaging Industry Industry

- September 2022: Amcor Rigid Packaging launched its innovative DairySeal line of packaging, incorporating ClearCor advanced PET barrier technology. This development significantly enhances recyclability and product performance for dairy applications, aligning with sustainability goals.

- June 2022: Smurfit Kappa made a substantial investment of USD 23.5 Million to upgrade its manufacturing facility in Nuevo Laredo. This strategic expansion doubled production capacity and is projected to reduce CO2 emissions by up to 40%, underscoring a commitment to efficiency and environmental responsibility.

Strategic Outlook for Mexico Packaging Industry Market

The Mexico packaging industry is poised for sustained growth, driven by favorable economic conditions, expanding consumer base, and increasing demand for innovative and sustainable packaging solutions. Companies that embrace sustainability, invest in advanced technologies, and adapt to evolving consumer preferences will be best positioned to capitalize on the market’s future potential. The focus on lightweighting, recyclability, and eco-friendly materials will define the future landscape.

Mexico Packaging Industry Segmentation

-

1. Packaging Material

- 1.1. Plastics

- 1.2. Metal

- 1.3. Glass

- 1.4. Other Packaging Material

-

2. Packaging Type

-

2.1. Flexible Packaging

- 2.1.1. Pouches & Bags

- 2.1.2. Films and wraps

- 2.1.3. Tubes

-

2.2. Rigid Packaging

- 2.2.1. Bottles and Jars

- 2.2.2. Trays and Containers

- 2.2.3. Other Rigid Packaging Types

-

2.1. Flexible Packaging

-

3. End-user Vertical

- 3.1. Personal Care

- 3.2. Home Care

- 3.3. Automotive

- 3.4. Pharmaceutical

- 3.5. Food and Beverage

- 3.6. Other End-user Verticals

Mexico Packaging Industry Segmentation By Geography

- 1. Mexico

Mexico Packaging Industry Regional Market Share

Geographic Coverage of Mexico Packaging Industry

Mexico Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Longer Product Shelf Life and Changing Lifestyle of People; New Innovative Products

- 3.3. Market Restrains

- 3.3.1. Concerns about the Environment and Recycling

- 3.4. Market Trends

- 3.4.1. Plastics to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Material

- 5.1.1. Plastics

- 5.1.2. Metal

- 5.1.3. Glass

- 5.1.4. Other Packaging Material

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Flexible Packaging

- 5.2.1.1. Pouches & Bags

- 5.2.1.2. Films and wraps

- 5.2.1.3. Tubes

- 5.2.2. Rigid Packaging

- 5.2.2.1. Bottles and Jars

- 5.2.2.2. Trays and Containers

- 5.2.2.3. Other Rigid Packaging Types

- 5.2.1. Flexible Packaging

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Personal Care

- 5.3.2. Home Care

- 5.3.3. Automotive

- 5.3.4. Pharmaceutical

- 5.3.5. Food and Beverage

- 5.3.6. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Packaging Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Phoenix Closures Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fres-co System USA Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Amcor PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mondi PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wipak Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Constantia Flexibles Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Glenroy Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Printpack Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Belmark Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 JL Packaging Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Innovia Films Mexico S A de C V *List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Sit Group SpA

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Phoenix Closures Inc

List of Figures

- Figure 1: Mexico Packaging Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Mexico Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Mexico Packaging Industry Revenue billion Forecast, by Packaging Material 2020 & 2033

- Table 2: Mexico Packaging Industry Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 3: Mexico Packaging Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 4: Mexico Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Mexico Packaging Industry Revenue billion Forecast, by Packaging Material 2020 & 2033

- Table 6: Mexico Packaging Industry Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 7: Mexico Packaging Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 8: Mexico Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Packaging Industry?

The projected CAGR is approximately 8.57%.

2. Which companies are prominent players in the Mexico Packaging Industry?

Key companies in the market include Phoenix Closures Inc, Fres-co System USA Inc, Amcor PLC, Mondi PLC, Wipak Group, Constantia Flexibles Group, Glenroy Inc, Printpack Inc, Belmark Inc, JL Packaging Corporation, Innovia Films Mexico S A de C V *List Not Exhaustive, Sit Group SpA.

3. What are the main segments of the Mexico Packaging Industry?

The market segments include Packaging Material, Packaging Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 47.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Longer Product Shelf Life and Changing Lifestyle of People; New Innovative Products.

6. What are the notable trends driving market growth?

Plastics to Drive the Market.

7. Are there any restraints impacting market growth?

Concerns about the Environment and Recycling.

8. Can you provide examples of recent developments in the market?

September 2022: Amcor Rigid Packaging introduced the DairySeal line of packaging that features ClearCor, an advanced PET barrier. The ClearCor PET barrier technology is a concentrated capsulation in the preform center that allows more flexibility and resin options. This technology positively impacts the overall performance of the barrier in the packaging and maintains recyclability. The DairySeal line of packaging can be made with up to 80 percent of recyclable material while maintaining superior taste and performance for the brand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Packaging Industry?

To stay informed about further developments, trends, and reports in the Mexico Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence