Key Insights

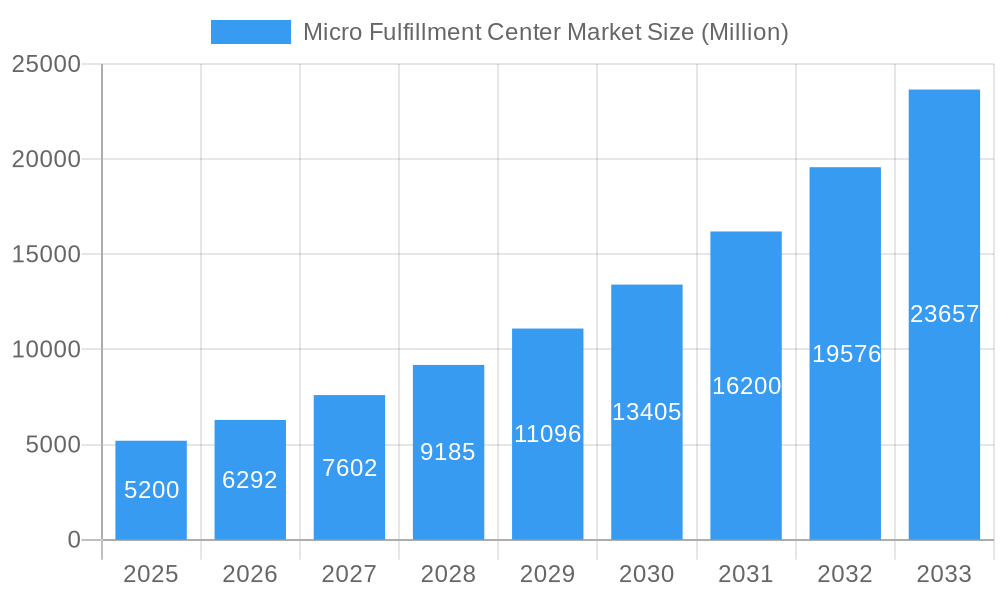

The Micro Fulfillment Center (MFC) market is poised for significant expansion, driven by the escalating demand for faster and more convenient delivery options across diverse retail sectors. With a current market size estimated at $5.20 billion and a projected compound annual growth rate (CAGR) of 21.00%, the MFC landscape is set to experience robust growth throughout the forecast period of 2025-2033. This surge is primarily fueled by the increasing adoption of MFCs by traditional retailers seeking to compete with e-commerce giants by offering same-day or even hourly delivery services. The integration of advanced automation and robotics within these compact fulfillment centers is a key driver, enabling retailers to optimize inventory management, reduce operational costs, and enhance last-mile delivery efficiency. E-commerce businesses and manufacturers are also increasingly leveraging MFCs to shorten delivery times, improve customer satisfaction, and gain a competitive edge in a rapidly evolving market. The growth is further supported by innovations in software solutions that streamline order processing and warehouse management, ensuring seamless integration of MFCs into existing supply chain networks.

Micro Fulfillment Center Market Market Size (In Billion)

The market is segmented across various components, including hardware, software, and services, with hardware and software playing crucial roles in enabling the operational efficiency of MFCs. The "Type" segment highlights the diversification with Standalone MFCs, Store-Integrated MFCs, and Dark Stores catering to specific fulfillment needs. End-users, predominantly Traditional Retailers and Distributors, are at the forefront of MFC adoption, alongside E-commerce players and Manufacturers. Geographically, while North America is expected to lead, significant growth is anticipated in Europe and Asia, driven by similar consumer expectations for rapid fulfillment. Restraints, such as the initial investment cost and the need for skilled labor to manage advanced automation, are being mitigated by the falling costs of technology and the development of user-friendly systems. The continuous evolution of MFC technology, coupled with strategic investments from key companies like Walmart, Dematic, and Honeywell, underscores the market's potential for sustained and substantial expansion in the coming years.

Micro Fulfillment Center Market Company Market Share

This in-depth Micro Fulfillment Center (MFC) Market report provides a detailed analysis of the global MFC landscape, encompassing market size, segmentation, key trends, growth drivers, and competitive strategies. With a study period from 2019 to 2033, a base year of 2025, and a forecast period of 2025–2033, this report offers actionable insights for industry stakeholders, including retailers, e-commerce giants, logistics providers, and technology developers. The MFC market growth is propelled by the accelerating demand for faster delivery, omnichannel strategies, and efficient inventory management. Explore how leading players like Walmart Advanced Systems & Robotics, Dematic, and Honeywell International Inc. are shaping the future of warehouse automation and last-mile delivery.

Micro Fulfillment Center Market Market Concentration & Innovation

The Micro Fulfillment Center Market exhibits moderate to high concentration, with a significant presence of established automation solution providers and emerging technology disruptors. Innovation is a key differentiator, driven by the relentless pursuit of enhanced speed, accuracy, and cost-efficiency in order fulfillment. Companies are heavily investing in advanced robotics, AI-powered software, and modular automation systems to optimize MFC operations. Regulatory frameworks, while evolving, primarily focus on safety standards and urban planning considerations for MFC deployment. Product substitutes, such as traditional distribution centers and larger fulfillment hubs, are being increasingly outpaced by the agility and proximity benefits offered by MFCs. End-user trends highlight a strong preference for faster delivery windows and seamless omnichannel experiences, compelling retailers to adopt MFC solutions. Mergers and acquisitions (M&A) are prevalent, with deal values reaching into the hundreds of millions. For instance, acquisitions aimed at integrating advanced robotics or expanding geographic reach are common. The market anticipates significant M&A activity in the coming years as companies seek to consolidate their offerings and expand market share.

- Market Share: Leading players collectively hold over 50% of the market share.

- M&A Deal Values: Transactions range from tens of millions to over one hundred million.

- Innovation Focus: Robotics, AI, IoT integration, and scalable automation solutions.

Micro Fulfillment Center Market Industry Trends & Insights

The Micro Fulfillment Center Market is experiencing robust growth, projected to reach approximately $15,000 million by 2033, with a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This expansion is primarily fueled by the surging consumer demand for rapid last-mile delivery and the strategic imperative for retailers to offer enhanced omnichannel retail experiences. The digital transformation sweeping across various industries, particularly retail and e-commerce, necessitates agile and localized fulfillment capabilities, making MFCs an indispensable part of the supply chain. Technological advancements in warehouse automation, including sophisticated robotics, artificial intelligence for inventory management, and advanced sorting systems, are continuously improving the operational efficiency and cost-effectiveness of MFCs. Consumer preferences have dramatically shifted towards speed and convenience; a significant percentage of consumers now expect same-day or next-day delivery, a demand that traditional, geographically dispersed warehouses struggle to meet cost-effectively. The competitive dynamics within the MFC market are characterized by intense innovation and strategic partnerships. Companies are differentiating themselves through specialized automation solutions, software integration capabilities, and flexible deployment models. The rise of dark stores as dedicated MFC hubs further exemplifies the adaptation of retail infrastructure to meet evolving fulfillment needs. The market penetration of MFCs is steadily increasing as more retailers, both large and small, recognize their value in reducing delivery times, lowering logistics costs, and improving customer satisfaction. The economic viability of MFCs, particularly in densely populated urban areas, is a significant trend, offering a more sustainable and efficient alternative to traditional fulfillment models.

Dominant Markets & Segments in Micro Fulfillment Center Market

The Micro Fulfillment Center Market is witnessing significant dominance across various segments, driven by distinct economic, technological, and consumer-driven factors.

Component Dominance:

- Hardware: The Hardware segment is currently the largest and most dominant, comprising sophisticated robotics, automated storage and retrieval systems (AS/RS), conveyors, and other physical automation infrastructure. The substantial upfront investment required for these components, coupled with their critical role in enabling automated operations, positions hardware as a cornerstone of MFC development. Key drivers include the increasing adoption of autonomous mobile robots (AMRs) and shuttle systems, crucial for optimizing space utilization and picking efficiency within compact MFC footprints. The value of the hardware segment is estimated to be over $7,000 million by 2025.

- Software: While currently smaller, the Software segment is experiencing the highest growth rate. This includes Warehouse Management Systems (WMS), Order Management Systems (OMS), Artificial Intelligence (AI) for predictive analytics and demand forecasting, and integration platforms. As MFCs become more complex, sophisticated software is essential for orchestrating operations, optimizing inventory, and ensuring seamless integration with existing retail systems. The market value for software is projected to be around $4,000 million by 2025, with a CAGR of XX%.

- Services: The Services segment, encompassing installation, maintenance, consulting, and system integration, plays a vital supporting role and is growing steadily. The complexity of MFC deployment necessitates expert services to ensure optimal performance and longevity.

Type Dominance:

- Standalone MFCs: These dedicated facilities are gaining significant traction, particularly in urban and suburban areas where space is at a premium. Their ability to be strategically located closer to end consumers makes them ideal for rapid last-mile delivery. The market value for standalone MFCs is projected to be in excess of $9,000 million by 2025, driven by the increasing need for dedicated fulfillment capacity independent of existing retail store operations.

- Store-Integrated MFCs: Integrating MFCs within existing retail stores offers a cost-effective way to leverage existing real estate. This model allows retailers to fulfill online orders using store inventory, enhancing the efficiency of both online and in-store operations. The flexibility and reduced capital expenditure make this a highly attractive option.

- Dark Stores: As a specialized form of MFC, dark stores are becoming increasingly important. These are retail locations repurposed solely for online order fulfillment, offering optimized layouts for picking and packing. Their prevalence is growing as e-commerce sales continue to surge.

End User Dominance:

- Traditional Retailers and Distributors: This segment remains the largest and most dominant end-user group. Retailers are increasingly adopting MFCs to compete with online giants and meet evolving customer expectations for faster delivery and convenient pickup options. Their established customer base and physical store networks provide a strong foundation for MFC implementation. The market share for this segment is estimated to be over 60% of the total MFC market value.

- E-commerce: Pure-play e-commerce companies are also significant adopters, leveraging MFCs to reduce shipping times and costs associated with online shopping. The rapid growth of online retail continues to drive demand for localized fulfillment solutions.

- Manufacturers: While a smaller segment, manufacturers are increasingly exploring MFCs for direct-to-consumer (DTC) fulfillment and to optimize their supply chains.

Micro Fulfillment Center Market Product Developments

Product developments in the Micro Fulfillment Center Market are characterized by increasing automation, AI integration, and modularity. Companies are launching advanced robotics capable of handling a wider range of SKUs and improving picking accuracy, such as OrionStar Robotics' CarryBot designed for compact logistics settings. Software innovations focus on predictive analytics for optimized inventory management and dynamic routing to enhance delivery efficiency. Modular designs allow for scalable and adaptable MFC solutions, catering to varying space constraints and operational needs. These developments provide competitive advantages by reducing operational costs, increasing throughput, and improving overall fulfillment speed and accuracy, directly addressing the core demands of the rapid delivery market.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Micro Fulfillment Center Market, segmented by Component (Hardware, Software, Services), Type (Standalone MFCs, Store-Integrated MFCs, Dark Stores), and End User (Traditional Retailers and Distributors, E-commerce, Manufacturers). The Hardware segment, valued at approximately $7,000 million in 2025, includes robotics and automation systems critical for MFC operations. The Software segment, estimated at $4,000 million in 2025, encompasses WMS, AI, and integration platforms, showing the highest projected growth. The Services segment, covering installation and maintenance, offers steady growth. Standalone MFCs, projected to exceed $9,000 million in 2025, lead due to their strategic placement. Store-Integrated MFCs offer cost-effectiveness, while Dark Stores cater to the surge in online retail. Traditional Retailers and Distributors represent the largest end-user segment, valued at over $9,000 million in 2025, followed by E-commerce. Manufacturers are an emerging user base.

Key Drivers of Micro Fulfillment Center Market Growth

Several key drivers are propelling the Micro Fulfillment Center Market forward. The insatiable consumer demand for faster delivery times, including same-day and next-day options, is a primary catalyst. Retailers' strategic shift towards omnichannel retail models necessitates localized fulfillment capabilities to bridge the gap between online and physical stores. Technological advancements in warehouse automation, such as robotics and AI, are making MFCs more efficient and cost-effective. Furthermore, the increasing urbanization and rising real estate costs in densely populated areas make smaller, strategically located MFCs a more viable and sustainable fulfillment solution compared to large, remote distribution centers. The economic benefits of reduced transportation costs and improved inventory management also contribute significantly to MFC adoption.

Challenges in the Micro Fulfillment Center Market Sector

Despite robust growth, the Micro Fulfillment Center Market faces several challenges. High initial capital investment for automation and infrastructure can be a barrier, particularly for smaller businesses. Integrating new MFC systems with existing legacy IT infrastructure can be complex and time-consuming. Finding and retaining skilled labor to operate and maintain these advanced facilities is also a growing concern. Regulatory hurdles related to urban zoning and building codes can impede the deployment of MFCs in prime urban locations. Additionally, the intense competition among MFC providers and the constant need for technological innovation require significant ongoing investment, posing a challenge for maintaining profitability.

Emerging Opportunities in Micro Fulfillment Center Market

Emerging opportunities within the Micro Fulfillment Center Market are abundant. The expansion of MFCs into new geographic regions, particularly in emerging economies with growing e-commerce penetration, presents significant growth potential. The integration of advanced AI and machine learning for hyper-personalized inventory management and predictive demand forecasting offers a pathway to enhanced efficiency. The development of specialized MFC solutions for niche product categories, such as pharmaceuticals or fresh produce, is another promising avenue. Furthermore, the increasing focus on sustainability and the circular economy is creating opportunities for MFCs designed for efficient returns processing and localized reverse logistics. Partnerships between technology providers and retailers are also creating new business models and deployment strategies.

Leading Players in the Micro Fulfillment Center Market Market

- Walmart Advanced Systems & Robotics

- Dematic

- Honeywell International Inc.

- OPEX Corp

- Swisslog Holding AG

- AutoStore Holdings

- Exotec SAS

- Takeoff Technologies Inc

- TGW Logistic Group GmbH

- Get Fabric Inc

- KPI Solutions

- Instacart

Key Developments in Micro Fulfillment Center Market Industry

- September 2024: OrionStar Robotics introduced CarryBot, a logistics robot specifically designed for microfulfillment centers (MFCs), enhancing transport capabilities, adaptability, and safety.

- April 2024: Dematic inaugurated its new office in the Kingdom of Saudi Arabia, reinforcing its commitment to the Middle East market with innovative solutions.

- January 2024: Giant Eagle opened its first automated micro fulfillment center in Pittsburgh, stocking a variety of goods for curbside pickup orders and creating new employment opportunities.

Strategic Outlook for Micro Fulfillment Center Market Market

The strategic outlook for the Micro Fulfillment Center Market remains exceptionally strong, driven by an evolving retail landscape and persistent consumer demand for speed and convenience. The integration of advanced AI and robotics will continue to be a focal point, enabling greater automation and efficiency. Standalone MFCs and store-integrated MFCs will both play crucial roles in expanding fulfillment networks. The growth of dark stores will accelerate as e-commerce continues its upward trajectory. Strategic partnerships and collaborations among technology providers, retailers, and logistics companies will be essential for unlocking new growth avenues and optimizing supply chain operations. The market is poised for continued innovation, with a focus on creating more sustainable, agile, and cost-effective fulfillment solutions to meet the ever-increasing expectations of the modern consumer.

Micro Fulfillment Center Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Type

- 2.1. Standalone MFCs

- 2.2. Store-Integrated MFCs

- 2.3. Dark Stores

-

3. End User

- 3.1. Traditional Retailers and Distributors

- 3.2. E-commerce

- 3.3. Manufacturers

Micro Fulfillment Center Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Micro Fulfillment Center Market Regional Market Share

Geographic Coverage of Micro Fulfillment Center Market

Micro Fulfillment Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. An Increase in the Demand for Online Shopping will Drive the Market Growth; Rising Urbanisation will Support the Market Growth

- 3.3. Market Restrains

- 3.3.1. An Increase in the Demand for Online Shopping will Drive the Market Growth; Rising Urbanisation will Support the Market Growth

- 3.4. Market Trends

- 3.4.1. The E-commerce Segment is Expected to Hold Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Micro Fulfillment Center Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Standalone MFCs

- 5.2.2. Store-Integrated MFCs

- 5.2.3. Dark Stores

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Traditional Retailers and Distributors

- 5.3.2. E-commerce

- 5.3.3. Manufacturers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Micro Fulfillment Center Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Standalone MFCs

- 6.2.2. Store-Integrated MFCs

- 6.2.3. Dark Stores

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Traditional Retailers and Distributors

- 6.3.2. E-commerce

- 6.3.3. Manufacturers

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Micro Fulfillment Center Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Standalone MFCs

- 7.2.2. Store-Integrated MFCs

- 7.2.3. Dark Stores

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Traditional Retailers and Distributors

- 7.3.2. E-commerce

- 7.3.3. Manufacturers

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Micro Fulfillment Center Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Standalone MFCs

- 8.2.2. Store-Integrated MFCs

- 8.2.3. Dark Stores

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Traditional Retailers and Distributors

- 8.3.2. E-commerce

- 8.3.3. Manufacturers

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Australia and New Zealand Micro Fulfillment Center Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Services

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Standalone MFCs

- 9.2.2. Store-Integrated MFCs

- 9.2.3. Dark Stores

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Traditional Retailers and Distributors

- 9.3.2. E-commerce

- 9.3.3. Manufacturers

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Latin America Micro Fulfillment Center Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Hardware

- 10.1.2. Software

- 10.1.3. Services

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Standalone MFCs

- 10.2.2. Store-Integrated MFCs

- 10.2.3. Dark Stores

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Traditional Retailers and Distributors

- 10.3.2. E-commerce

- 10.3.3. Manufacturers

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Middle East and Africa Micro Fulfillment Center Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Component

- 11.1.1. Hardware

- 11.1.2. Software

- 11.1.3. Services

- 11.2. Market Analysis, Insights and Forecast - by Type

- 11.2.1. Standalone MFCs

- 11.2.2. Store-Integrated MFCs

- 11.2.3. Dark Stores

- 11.3. Market Analysis, Insights and Forecast - by End User

- 11.3.1. Traditional Retailers and Distributors

- 11.3.2. E-commerce

- 11.3.3. Manufacturers

- 11.1. Market Analysis, Insights and Forecast - by Component

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Walmart Advanced Systems & Robotics

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Dematic

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Honeywell International Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 OPEX Corp

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Swisslog Holding AG

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 AutoStore Holdings

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Exotec SAS

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Takeoff Technologies Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 TGW Logistic Group GmbH

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Get Fabric Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 KPI Solutions

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Instacart*List Not Exhaustive

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Walmart Advanced Systems & Robotics

List of Figures

- Figure 1: Global Micro Fulfillment Center Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Micro Fulfillment Center Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Micro Fulfillment Center Market Revenue (Million), by Component 2025 & 2033

- Figure 4: North America Micro Fulfillment Center Market Volume (Billion), by Component 2025 & 2033

- Figure 5: North America Micro Fulfillment Center Market Revenue Share (%), by Component 2025 & 2033

- Figure 6: North America Micro Fulfillment Center Market Volume Share (%), by Component 2025 & 2033

- Figure 7: North America Micro Fulfillment Center Market Revenue (Million), by Type 2025 & 2033

- Figure 8: North America Micro Fulfillment Center Market Volume (Billion), by Type 2025 & 2033

- Figure 9: North America Micro Fulfillment Center Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Micro Fulfillment Center Market Volume Share (%), by Type 2025 & 2033

- Figure 11: North America Micro Fulfillment Center Market Revenue (Million), by End User 2025 & 2033

- Figure 12: North America Micro Fulfillment Center Market Volume (Billion), by End User 2025 & 2033

- Figure 13: North America Micro Fulfillment Center Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Micro Fulfillment Center Market Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Micro Fulfillment Center Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Micro Fulfillment Center Market Volume (Billion), by Country 2025 & 2033

- Figure 17: North America Micro Fulfillment Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Micro Fulfillment Center Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Micro Fulfillment Center Market Revenue (Million), by Component 2025 & 2033

- Figure 20: Europe Micro Fulfillment Center Market Volume (Billion), by Component 2025 & 2033

- Figure 21: Europe Micro Fulfillment Center Market Revenue Share (%), by Component 2025 & 2033

- Figure 22: Europe Micro Fulfillment Center Market Volume Share (%), by Component 2025 & 2033

- Figure 23: Europe Micro Fulfillment Center Market Revenue (Million), by Type 2025 & 2033

- Figure 24: Europe Micro Fulfillment Center Market Volume (Billion), by Type 2025 & 2033

- Figure 25: Europe Micro Fulfillment Center Market Revenue Share (%), by Type 2025 & 2033

- Figure 26: Europe Micro Fulfillment Center Market Volume Share (%), by Type 2025 & 2033

- Figure 27: Europe Micro Fulfillment Center Market Revenue (Million), by End User 2025 & 2033

- Figure 28: Europe Micro Fulfillment Center Market Volume (Billion), by End User 2025 & 2033

- Figure 29: Europe Micro Fulfillment Center Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Micro Fulfillment Center Market Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe Micro Fulfillment Center Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Micro Fulfillment Center Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Europe Micro Fulfillment Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Micro Fulfillment Center Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Micro Fulfillment Center Market Revenue (Million), by Component 2025 & 2033

- Figure 36: Asia Micro Fulfillment Center Market Volume (Billion), by Component 2025 & 2033

- Figure 37: Asia Micro Fulfillment Center Market Revenue Share (%), by Component 2025 & 2033

- Figure 38: Asia Micro Fulfillment Center Market Volume Share (%), by Component 2025 & 2033

- Figure 39: Asia Micro Fulfillment Center Market Revenue (Million), by Type 2025 & 2033

- Figure 40: Asia Micro Fulfillment Center Market Volume (Billion), by Type 2025 & 2033

- Figure 41: Asia Micro Fulfillment Center Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: Asia Micro Fulfillment Center Market Volume Share (%), by Type 2025 & 2033

- Figure 43: Asia Micro Fulfillment Center Market Revenue (Million), by End User 2025 & 2033

- Figure 44: Asia Micro Fulfillment Center Market Volume (Billion), by End User 2025 & 2033

- Figure 45: Asia Micro Fulfillment Center Market Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Micro Fulfillment Center Market Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Micro Fulfillment Center Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Micro Fulfillment Center Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Asia Micro Fulfillment Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Micro Fulfillment Center Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Australia and New Zealand Micro Fulfillment Center Market Revenue (Million), by Component 2025 & 2033

- Figure 52: Australia and New Zealand Micro Fulfillment Center Market Volume (Billion), by Component 2025 & 2033

- Figure 53: Australia and New Zealand Micro Fulfillment Center Market Revenue Share (%), by Component 2025 & 2033

- Figure 54: Australia and New Zealand Micro Fulfillment Center Market Volume Share (%), by Component 2025 & 2033

- Figure 55: Australia and New Zealand Micro Fulfillment Center Market Revenue (Million), by Type 2025 & 2033

- Figure 56: Australia and New Zealand Micro Fulfillment Center Market Volume (Billion), by Type 2025 & 2033

- Figure 57: Australia and New Zealand Micro Fulfillment Center Market Revenue Share (%), by Type 2025 & 2033

- Figure 58: Australia and New Zealand Micro Fulfillment Center Market Volume Share (%), by Type 2025 & 2033

- Figure 59: Australia and New Zealand Micro Fulfillment Center Market Revenue (Million), by End User 2025 & 2033

- Figure 60: Australia and New Zealand Micro Fulfillment Center Market Volume (Billion), by End User 2025 & 2033

- Figure 61: Australia and New Zealand Micro Fulfillment Center Market Revenue Share (%), by End User 2025 & 2033

- Figure 62: Australia and New Zealand Micro Fulfillment Center Market Volume Share (%), by End User 2025 & 2033

- Figure 63: Australia and New Zealand Micro Fulfillment Center Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Australia and New Zealand Micro Fulfillment Center Market Volume (Billion), by Country 2025 & 2033

- Figure 65: Australia and New Zealand Micro Fulfillment Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Australia and New Zealand Micro Fulfillment Center Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Latin America Micro Fulfillment Center Market Revenue (Million), by Component 2025 & 2033

- Figure 68: Latin America Micro Fulfillment Center Market Volume (Billion), by Component 2025 & 2033

- Figure 69: Latin America Micro Fulfillment Center Market Revenue Share (%), by Component 2025 & 2033

- Figure 70: Latin America Micro Fulfillment Center Market Volume Share (%), by Component 2025 & 2033

- Figure 71: Latin America Micro Fulfillment Center Market Revenue (Million), by Type 2025 & 2033

- Figure 72: Latin America Micro Fulfillment Center Market Volume (Billion), by Type 2025 & 2033

- Figure 73: Latin America Micro Fulfillment Center Market Revenue Share (%), by Type 2025 & 2033

- Figure 74: Latin America Micro Fulfillment Center Market Volume Share (%), by Type 2025 & 2033

- Figure 75: Latin America Micro Fulfillment Center Market Revenue (Million), by End User 2025 & 2033

- Figure 76: Latin America Micro Fulfillment Center Market Volume (Billion), by End User 2025 & 2033

- Figure 77: Latin America Micro Fulfillment Center Market Revenue Share (%), by End User 2025 & 2033

- Figure 78: Latin America Micro Fulfillment Center Market Volume Share (%), by End User 2025 & 2033

- Figure 79: Latin America Micro Fulfillment Center Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Latin America Micro Fulfillment Center Market Volume (Billion), by Country 2025 & 2033

- Figure 81: Latin America Micro Fulfillment Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Latin America Micro Fulfillment Center Market Volume Share (%), by Country 2025 & 2033

- Figure 83: Middle East and Africa Micro Fulfillment Center Market Revenue (Million), by Component 2025 & 2033

- Figure 84: Middle East and Africa Micro Fulfillment Center Market Volume (Billion), by Component 2025 & 2033

- Figure 85: Middle East and Africa Micro Fulfillment Center Market Revenue Share (%), by Component 2025 & 2033

- Figure 86: Middle East and Africa Micro Fulfillment Center Market Volume Share (%), by Component 2025 & 2033

- Figure 87: Middle East and Africa Micro Fulfillment Center Market Revenue (Million), by Type 2025 & 2033

- Figure 88: Middle East and Africa Micro Fulfillment Center Market Volume (Billion), by Type 2025 & 2033

- Figure 89: Middle East and Africa Micro Fulfillment Center Market Revenue Share (%), by Type 2025 & 2033

- Figure 90: Middle East and Africa Micro Fulfillment Center Market Volume Share (%), by Type 2025 & 2033

- Figure 91: Middle East and Africa Micro Fulfillment Center Market Revenue (Million), by End User 2025 & 2033

- Figure 92: Middle East and Africa Micro Fulfillment Center Market Volume (Billion), by End User 2025 & 2033

- Figure 93: Middle East and Africa Micro Fulfillment Center Market Revenue Share (%), by End User 2025 & 2033

- Figure 94: Middle East and Africa Micro Fulfillment Center Market Volume Share (%), by End User 2025 & 2033

- Figure 95: Middle East and Africa Micro Fulfillment Center Market Revenue (Million), by Country 2025 & 2033

- Figure 96: Middle East and Africa Micro Fulfillment Center Market Volume (Billion), by Country 2025 & 2033

- Figure 97: Middle East and Africa Micro Fulfillment Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 98: Middle East and Africa Micro Fulfillment Center Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Micro Fulfillment Center Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Micro Fulfillment Center Market Volume Billion Forecast, by Component 2020 & 2033

- Table 3: Global Micro Fulfillment Center Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Micro Fulfillment Center Market Volume Billion Forecast, by Type 2020 & 2033

- Table 5: Global Micro Fulfillment Center Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Micro Fulfillment Center Market Volume Billion Forecast, by End User 2020 & 2033

- Table 7: Global Micro Fulfillment Center Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Micro Fulfillment Center Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global Micro Fulfillment Center Market Revenue Million Forecast, by Component 2020 & 2033

- Table 10: Global Micro Fulfillment Center Market Volume Billion Forecast, by Component 2020 & 2033

- Table 11: Global Micro Fulfillment Center Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Micro Fulfillment Center Market Volume Billion Forecast, by Type 2020 & 2033

- Table 13: Global Micro Fulfillment Center Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global Micro Fulfillment Center Market Volume Billion Forecast, by End User 2020 & 2033

- Table 15: Global Micro Fulfillment Center Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Micro Fulfillment Center Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global Micro Fulfillment Center Market Revenue Million Forecast, by Component 2020 & 2033

- Table 18: Global Micro Fulfillment Center Market Volume Billion Forecast, by Component 2020 & 2033

- Table 19: Global Micro Fulfillment Center Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Micro Fulfillment Center Market Volume Billion Forecast, by Type 2020 & 2033

- Table 21: Global Micro Fulfillment Center Market Revenue Million Forecast, by End User 2020 & 2033

- Table 22: Global Micro Fulfillment Center Market Volume Billion Forecast, by End User 2020 & 2033

- Table 23: Global Micro Fulfillment Center Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Micro Fulfillment Center Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Micro Fulfillment Center Market Revenue Million Forecast, by Component 2020 & 2033

- Table 26: Global Micro Fulfillment Center Market Volume Billion Forecast, by Component 2020 & 2033

- Table 27: Global Micro Fulfillment Center Market Revenue Million Forecast, by Type 2020 & 2033

- Table 28: Global Micro Fulfillment Center Market Volume Billion Forecast, by Type 2020 & 2033

- Table 29: Global Micro Fulfillment Center Market Revenue Million Forecast, by End User 2020 & 2033

- Table 30: Global Micro Fulfillment Center Market Volume Billion Forecast, by End User 2020 & 2033

- Table 31: Global Micro Fulfillment Center Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global Micro Fulfillment Center Market Volume Billion Forecast, by Country 2020 & 2033

- Table 33: Global Micro Fulfillment Center Market Revenue Million Forecast, by Component 2020 & 2033

- Table 34: Global Micro Fulfillment Center Market Volume Billion Forecast, by Component 2020 & 2033

- Table 35: Global Micro Fulfillment Center Market Revenue Million Forecast, by Type 2020 & 2033

- Table 36: Global Micro Fulfillment Center Market Volume Billion Forecast, by Type 2020 & 2033

- Table 37: Global Micro Fulfillment Center Market Revenue Million Forecast, by End User 2020 & 2033

- Table 38: Global Micro Fulfillment Center Market Volume Billion Forecast, by End User 2020 & 2033

- Table 39: Global Micro Fulfillment Center Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Micro Fulfillment Center Market Volume Billion Forecast, by Country 2020 & 2033

- Table 41: Global Micro Fulfillment Center Market Revenue Million Forecast, by Component 2020 & 2033

- Table 42: Global Micro Fulfillment Center Market Volume Billion Forecast, by Component 2020 & 2033

- Table 43: Global Micro Fulfillment Center Market Revenue Million Forecast, by Type 2020 & 2033

- Table 44: Global Micro Fulfillment Center Market Volume Billion Forecast, by Type 2020 & 2033

- Table 45: Global Micro Fulfillment Center Market Revenue Million Forecast, by End User 2020 & 2033

- Table 46: Global Micro Fulfillment Center Market Volume Billion Forecast, by End User 2020 & 2033

- Table 47: Global Micro Fulfillment Center Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Micro Fulfillment Center Market Volume Billion Forecast, by Country 2020 & 2033

- Table 49: Global Micro Fulfillment Center Market Revenue Million Forecast, by Component 2020 & 2033

- Table 50: Global Micro Fulfillment Center Market Volume Billion Forecast, by Component 2020 & 2033

- Table 51: Global Micro Fulfillment Center Market Revenue Million Forecast, by Type 2020 & 2033

- Table 52: Global Micro Fulfillment Center Market Volume Billion Forecast, by Type 2020 & 2033

- Table 53: Global Micro Fulfillment Center Market Revenue Million Forecast, by End User 2020 & 2033

- Table 54: Global Micro Fulfillment Center Market Volume Billion Forecast, by End User 2020 & 2033

- Table 55: Global Micro Fulfillment Center Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global Micro Fulfillment Center Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Micro Fulfillment Center Market?

The projected CAGR is approximately 21.00%.

2. Which companies are prominent players in the Micro Fulfillment Center Market?

Key companies in the market include Walmart Advanced Systems & Robotics, Dematic, Honeywell International Inc, OPEX Corp, Swisslog Holding AG, AutoStore Holdings, Exotec SAS, Takeoff Technologies Inc, TGW Logistic Group GmbH, Get Fabric Inc, KPI Solutions, Instacart*List Not Exhaustive.

3. What are the main segments of the Micro Fulfillment Center Market?

The market segments include Component, Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.20 Million as of 2022.

5. What are some drivers contributing to market growth?

An Increase in the Demand for Online Shopping will Drive the Market Growth; Rising Urbanisation will Support the Market Growth.

6. What are the notable trends driving market growth?

The E-commerce Segment is Expected to Hold Significant Share in the Market.

7. Are there any restraints impacting market growth?

An Increase in the Demand for Online Shopping will Drive the Market Growth; Rising Urbanisation will Support the Market Growth.

8. Can you provide examples of recent developments in the market?

September 2024: OrionStar Robotics introduced CarryBot, a logistics robot for microfulfillment centers (MFCs). CarryBot is meticulously designed to address the unique requirements of these compact and efficient logistics settings. Its transport capabilities, adaptability, and safety features represent a notable progression in warehouse automation, enhancing efficiency and flexibility in logistics and delivery.April 2024: Dematic announced the inauguration of its new office in the Kingdom of Saudi Arabia. This strategic move reinforces Dematic's commitment to the Middle East and demonstrates its dedication to offering innovative solutions that cater to the specific needs of the local market.January 2024: Giant Eagle announced the opening of its first automated micro fulfillment center in Pittsburgh. This facility will stock various items, including center store goods and chilled and frozen products, to serve curbside pickup orders. To support the operation of the MFC, Giant Eagle is seeking candidates for several positions and will host an open house for interested individuals at the facility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Micro Fulfillment Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Micro Fulfillment Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Micro Fulfillment Center Market?

To stay informed about further developments, trends, and reports in the Micro Fulfillment Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence