Key Insights

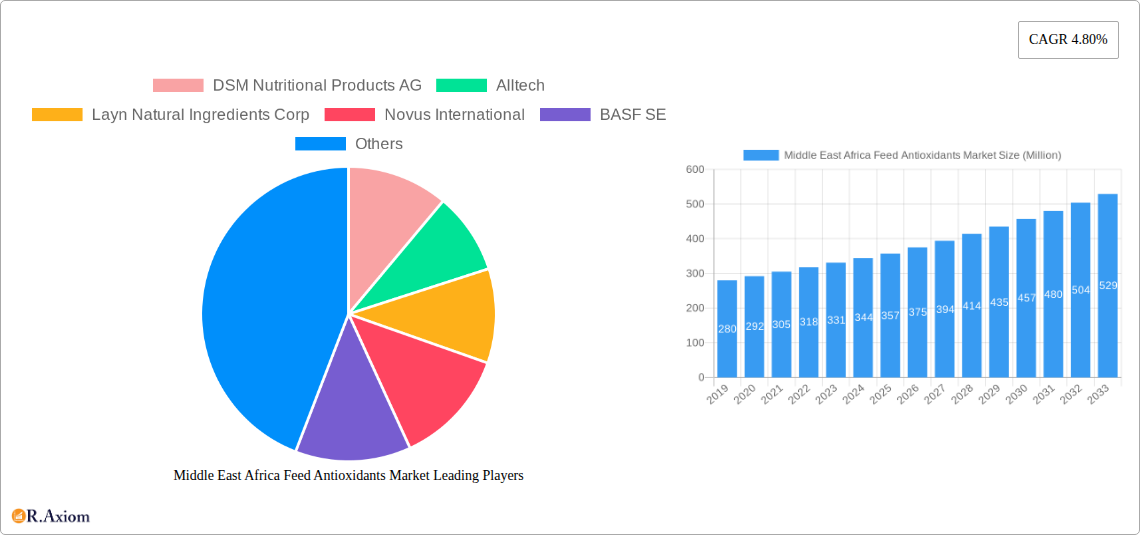

The Middle East and Africa feed antioxidants market is poised for robust expansion, projected to reach an estimated market size of approximately USD 350 million by 2025 and grow at a Compound Annual Growth Rate (CAGR) of 4.80% through 2033. This growth is primarily fueled by the escalating demand for high-quality animal feed, driven by the expanding livestock and poultry sectors across the region. The increasing awareness among feed producers and livestock owners regarding the detrimental effects of oxidation on feed quality, nutrient degradation, and animal health is a significant catalyst. Antioxidants are crucial for preserving the nutritional value of feed, preventing spoilage, and ultimately enhancing animal productivity and well-being. Key growth drivers include the increasing adoption of modern farming practices, the rising per capita consumption of meat and dairy products, and government initiatives aimed at improving animal husbandry and food security. The market is witnessing a growing preference for natural antioxidants over synthetic ones due to consumer demand for safer and healthier animal products, although synthetic options like BHA and BHT continue to hold a significant share.

Middle East Africa Feed Antioxidants Market Market Size (In Million)

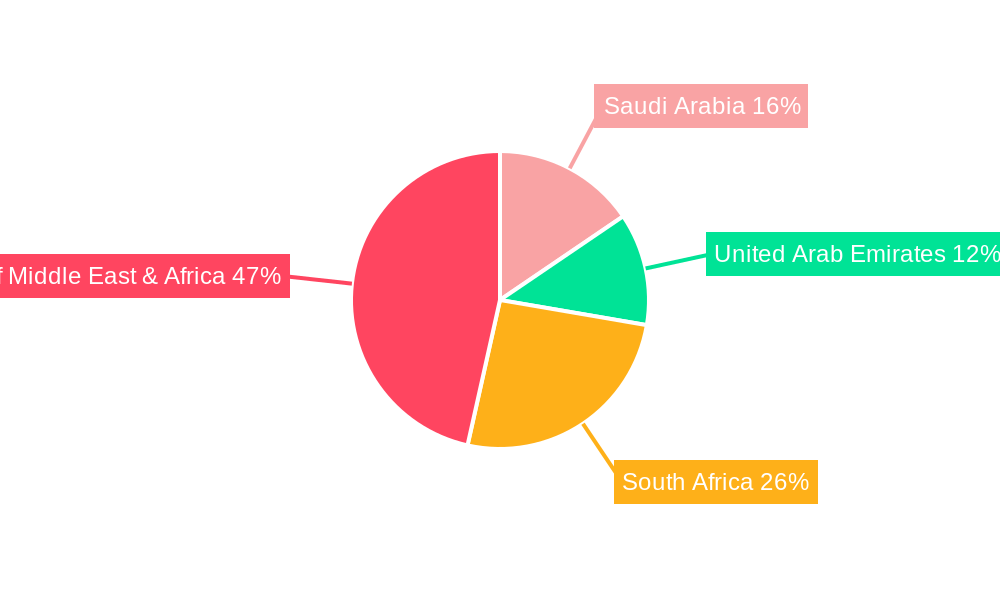

Segmentation analysis reveals that poultry and ruminants are the dominant animal types in terms of feed antioxidant consumption, reflecting the substantial size of these industries in the Middle East and Africa. Aquaculture is also emerging as a significant segment, with its rapid growth trajectory contributing to increased demand for specialized feed additives. Geographically, South Africa and the Rest of Middle East & Africa are expected to be key growth regions, driven by their expanding agricultural outputs and increasing investments in animal nutrition. Saudi Arabia and the United Arab Emirates, with their well-established and modern livestock sectors, also represent substantial markets. However, challenges such as the fluctuating prices of raw materials for antioxidant production, stringent regulatory landscapes in certain countries, and the potential for the development of feed alternatives could pose restraints to market growth. Nonetheless, the overall outlook remains optimistic, with continuous innovation in antioxidant formulations and a growing emphasis on sustainable and efficient animal production practices expected to propel the market forward.

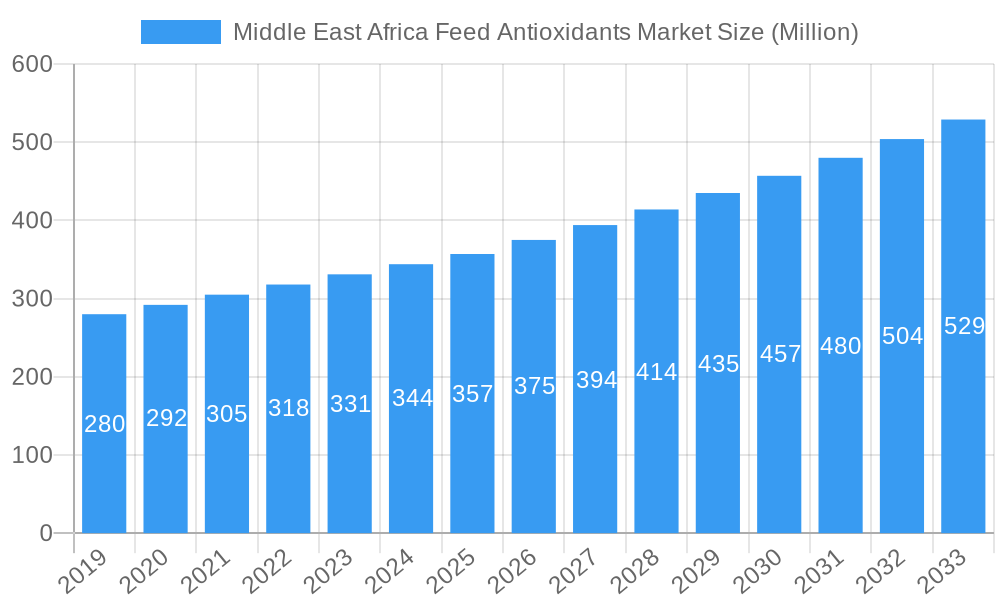

Middle East Africa Feed Antioxidants Market Company Market Share

This comprehensive report provides an in-depth analysis of the Middle East Africa Feed Antioxidants Market, a rapidly evolving sector crucial for animal health, feed preservation, and the overall growth of the region's livestock industry. The study covers the historical period from 2019 to 2024, the base year of 2025, and forecasts market performance through 2033. With a projected market size of $2,500 Million in 2025 and an anticipated CAGR of 6.5% during the forecast period, this report offers critical insights for industry stakeholders.

Middle East Africa Feed Antioxidants Market Market Concentration & Innovation

The Middle East Africa Feed Antioxidants Market exhibits a moderate to high concentration, with key players like DSM Nutritional Products AG, Alltech, Layn Natural Ingredients Corp, Novus International, BASF SE, Cargill Inc, Biomi, and Perstorp holding significant market shares. Innovation remains a pivotal driver, fueled by increasing demand for effective and safe animal nutrition solutions, stringent regulatory oversight, and the growing awareness of the economic benefits of preventing feed spoilage. Companies are investing in research and development for natural and synthetic antioxidants with enhanced efficacy and broader application profiles. Regulatory frameworks across various Middle Eastern and African nations are progressively aligning with international standards, influencing product approvals and market access. The threat of product substitutes, while present, is mitigated by the established efficacy and cost-effectiveness of traditional feed antioxidants. End-user trends indicate a strong preference for solutions that improve animal performance, reduce mortality rates, and contribute to sustainable livestock farming practices. Mergers and acquisitions (M&A) activities, with estimated deal values reaching $300 Million in the past few years, are anticipated to continue as larger players seek to expand their product portfolios and geographic reach, consolidating market power and driving further innovation.

Middle East Africa Feed Antioxidants Market Industry Trends & Insights

The Middle East Africa Feed Antioxidants Market is poised for substantial growth, driven by a confluence of factors including the burgeoning demand for animal protein, a rising global population, and an increasing emphasis on food security across the region. The market penetration of feed antioxidants is steadily increasing as livestock producers, particularly in poultry and aquaculture segments, recognize their critical role in preserving feed quality, preventing oxidative damage, and enhancing the nutritional value of animal feed. This directly translates into improved animal health, reduced mortality rates, and better feed conversion ratios, all contributing to enhanced profitability for farmers. Technological advancements are playing a transformative role, with a growing interest in natural antioxidants derived from plant extracts and essential oils. These alternatives are gaining traction due to consumer preferences for cleaner labels and a perceived lower environmental impact compared to synthetic counterparts. However, synthetic antioxidants like BHA (Butylated Hydroxyanisole), BHT (Butylated Hydroxytoluene), and Ethoxyquin continue to hold a significant market share due to their proven efficacy and cost-effectiveness, especially in large-scale commercial operations. The competitive landscape is characterized by intense R&D efforts to develop novel formulations with extended shelf life, improved stability, and synergistic effects. Market players are also focusing on expanding their distribution networks and offering technical support to end-users to foster greater adoption. The rising disposable incomes in several Middle Eastern and African countries are also contributing to increased per capita meat consumption, thereby stimulating demand for feed and, consequently, feed antioxidants. The ongoing efforts to modernize the livestock sector through improved farming practices and the adoption of advanced feed technologies are further solidifying the growth trajectory of this market. The market is expected to reach approximately $3,500 Million by 2033, exhibiting a compound annual growth rate (CAGR) of 6.5% from 2025.

Dominant Markets & Segments in Middle East Africa Feed Antioxidants Market

Within the Middle East Africa Feed Antioxidants Market, the Poultry segment emerges as a dominant force, driven by its significant contribution to regional protein supply and its inherent susceptibility to oxidative degradation in feed. The substantial volume of poultry production across countries like Saudi Arabia and the United Arab Emirates, coupled with a growing consumer preference for poultry products due to their affordability and perceived health benefits, fuels the demand for effective feed antioxidants. The BHA (Butylated Hydroxyanisole) segment within the 'Type' classification is a leading contributor to market revenue due to its widespread use and proven efficacy in preventing lipid peroxidation in feed. Saudi Arabia, with its substantial investments in expanding its poultry sector to achieve food self-sufficiency, stands out as a key geographical market. Economic policies supporting agricultural development, coupled with the establishment of modern feed milling infrastructure, further bolster the demand for feed antioxidants in the kingdom.

- Poultry Segment Dominance: The rapid growth of the poultry industry across the Middle East and Africa, driven by population growth and rising demand for animal protein, makes poultry the largest animal type segment.

- BHA as a Leading Type: BHA is widely adopted for its cost-effectiveness and proven ability to inhibit rancidity in feed fats, a critical concern in poultry diets.

- Saudi Arabia's Market Leadership: Government initiatives focused on enhancing food security and promoting livestock farming, alongside significant investments in feed production, position Saudi Arabia as a dominant geographical market.

- Rest of Middle East & Africa Growth Potential: While specific countries lead, the collective "Rest of Middle East & Africa" segment shows immense untapped potential, with emerging economies increasingly investing in their agricultural sectors.

- Ethoxyquin's Niche: Ethoxyquin, despite facing some regulatory scrutiny in certain regions, continues to be a significant player, particularly where cost-effectiveness and broad-spectrum protection are paramount.

- Ruminants and Swine Segments: These segments, while smaller than poultry, are experiencing steady growth due to increasing demand for red meat and pork, necessitating improved feed preservation.

- Aquaculture Expansion: The growing aquaculture sector presents a burgeoning opportunity, as the need for high-quality feed to support fish and shrimp growth becomes increasingly critical.

- Infrastructure Development: Investments in modern feed mills and improved logistics across the region are crucial for efficient distribution and utilization of feed antioxidants.

- Regulatory Harmonization: The gradual alignment of regulatory frameworks across different countries is simplifying market access for antioxidant manufacturers and promoting standardized product usage.

Middle East Africa Feed Antioxidants Market Product Developments

Product innovation in the Middle East Africa Feed Antioxidants Market is centered on developing enhanced formulations that offer superior oxidative stability, improved bioavailability, and broader application spectrums. Manufacturers are focusing on synergistic blends of natural and synthetic antioxidants to cater to diverse feed types and animal needs. The development of microencapsulated antioxidants is gaining traction, providing controlled release and extended shelf-life protection against spoilage. These advancements aim to improve animal health outcomes, reduce feed wastage, and meet the growing demand for sustainable and effective animal nutrition solutions.

Report Scope & Segmentation Analysis

This report comprehensively segments the Middle East Africa Feed Antioxidants Market by Type, Animal Type, and Geography. The Type segmentation includes BHA, BHT, Ethoxyquin, and Others, with BHA and Ethoxyquin expected to dominate the market share in the near term, projected to reach approximately $1,000 Million and $700 Million respectively by 2025, respectively. The Animal Type segmentation covers Ruminants, Poultry, Swine, Aquaculture, and Other Animal Types. The Poultry segment is projected to hold the largest market share, estimated at $900 Million in 2025, driven by substantial regional production. Geographically, the market is divided into Saudi Arabia, United Arab Emirates, South Africa, and the Rest of Middle East & Africa. Saudi Arabia is anticipated to lead the market, with an estimated market size of $500 Million in 2025, owing to its significant investments in livestock and feed production. The Rest of Middle East & Africa segment is expected to exhibit the highest growth rate.

Key Drivers of Middle East Africa Feed Antioxidants Market Growth

Several key drivers are propelling the growth of the Middle East Africa Feed Antioxidants Market. The rising demand for animal protein, fueled by population growth and increasing disposable incomes, is a primary driver. Technological advancements in feed manufacturing and formulation are leading to the adoption of more sophisticated antioxidant solutions. Furthermore, growing awareness among livestock producers regarding the economic benefits of preventing feed spoilage and improving animal health is a significant catalyst. Stringent government regulations promoting food safety and animal welfare are also encouraging the use of quality feed additives, including antioxidants.

Challenges in the Middle East Africa Feed Antioxidants Market Sector

Despite the positive growth trajectory, the Middle East Africa Feed Antioxidants Market faces several challenges. Volatility in raw material prices can impact the cost-effectiveness of antioxidant production. Regulatory complexities and varying standards across different countries can pose market access barriers for some products. Furthermore, limited awareness and adoption of advanced feed preservation techniques in certain smaller agricultural economies can hinder market penetration. Intense price competition among manufacturers also presents a challenge to profitability.

Emerging Opportunities in Middle East Africa Feed Antioxidants Market

Emerging opportunities within the Middle East Africa Feed Antioxidants Market lie in the increasing demand for natural and sustainable antioxidant solutions. The expanding aquaculture sector presents a significant untapped market, requiring specialized feed preservation. Growing investments in precision livestock farming and smart feed management technologies create opportunities for innovative antioxidant delivery systems. Furthermore, the potential for market expansion in rapidly developing African nations, with their increasing focus on modernizing agriculture, offers substantial long-term growth prospects.

Leading Players in the Middle East Africa Feed Antioxidants Market Market

- DSM Nutritional Products AG

- Alltech

- Layn Natural Ingredients Corp

- Novus International

- BASF SE

- Cargill Inc

- Biomi

- Perstorp

Key Developments in Middle East Africa Feed Antioxidants Market Industry

- 2024: Launch of a new natural antioxidant blend by a key player targeting the poultry segment in the GCC region, addressing demand for cleaner labels.

- 2023: Acquisition of a regional feed additive distributor by a multinational company to expand its market reach in North Africa.

- 2022: Increased R&D investment in bio-based antioxidants by several leading manufacturers, driven by evolving consumer preferences and sustainability goals.

- 2021: Harmonization of feed additive regulations in several East African Community (EAC) member states, facilitating cross-border trade and market access.

- 2020: Introduction of microencapsulated feed antioxidants in the South African market, offering enhanced stability and efficacy.

Strategic Outlook for Middle East Africa Feed Antioxidants Market Market

The strategic outlook for the Middle East Africa Feed Antioxidants Market remains robust, characterized by sustained growth and evolving product demands. The market will likely witness continued innovation, with a strong emphasis on natural antioxidants and customized solutions for specific animal types and regional needs. Strategic partnerships and M&A activities are expected to shape the competitive landscape, leading to market consolidation. Investments in expanding production capacities and distribution networks will be crucial for capitalizing on the burgeoning demand, particularly in rapidly developing African economies. The focus on improving feed quality and animal health will continue to be the primary growth catalyst.

Middle East Africa Feed Antioxidants Market Segmentation

-

1. Type

- 1.1. BHA

- 1.2. BHT

- 1.3. Ethoxyquin

- 1.4. Others

-

2. Animal Type

- 2.1. Ruminants

- 2.2. Poultry

- 2.3. Swine

- 2.4. Aquaculture

- 2.5. Other Animal Types

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. South Africa

- 3.4. Rest of Middle East & Africa

Middle East Africa Feed Antioxidants Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. South Africa

- 4. Rest of Middle East

Middle East Africa Feed Antioxidants Market Regional Market Share

Geographic Coverage of Middle East Africa Feed Antioxidants Market

Middle East Africa Feed Antioxidants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Preference Towards Animal Based Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Africa Feed Antioxidants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. BHA

- 5.1.2. BHT

- 5.1.3. Ethoxyquin

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminants

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Aquaculture

- 5.2.5. Other Animal Types

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. South Africa

- 5.3.4. Rest of Middle East & Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. South Africa

- 5.4.4. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Saudi Arabia Middle East Africa Feed Antioxidants Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. BHA

- 6.1.2. BHT

- 6.1.3. Ethoxyquin

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminants

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Aquaculture

- 6.2.5. Other Animal Types

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. South Africa

- 6.3.4. Rest of Middle East & Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Arab Emirates Middle East Africa Feed Antioxidants Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. BHA

- 7.1.2. BHT

- 7.1.3. Ethoxyquin

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminants

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Aquaculture

- 7.2.5. Other Animal Types

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. South Africa

- 7.3.4. Rest of Middle East & Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. South Africa Middle East Africa Feed Antioxidants Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. BHA

- 8.1.2. BHT

- 8.1.3. Ethoxyquin

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminants

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Aquaculture

- 8.2.5. Other Animal Types

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. South Africa

- 8.3.4. Rest of Middle East & Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Middle East Middle East Africa Feed Antioxidants Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. BHA

- 9.1.2. BHT

- 9.1.3. Ethoxyquin

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Ruminants

- 9.2.2. Poultry

- 9.2.3. Swine

- 9.2.4. Aquaculture

- 9.2.5. Other Animal Types

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. South Africa

- 9.3.4. Rest of Middle East & Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 DSM Nutritional Products AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Alltech

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Layn Natural Ingredients Corp

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Novus International

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 BASF SE

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Cargill Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Biomi

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Perstorp

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 DSM Nutritional Products AG

List of Figures

- Figure 1: Middle East Africa Feed Antioxidants Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East Africa Feed Antioxidants Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Africa Feed Antioxidants Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Middle East Africa Feed Antioxidants Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 3: Middle East Africa Feed Antioxidants Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Middle East Africa Feed Antioxidants Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Middle East Africa Feed Antioxidants Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Middle East Africa Feed Antioxidants Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 7: Middle East Africa Feed Antioxidants Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Middle East Africa Feed Antioxidants Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Middle East Africa Feed Antioxidants Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Middle East Africa Feed Antioxidants Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 11: Middle East Africa Feed Antioxidants Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Middle East Africa Feed Antioxidants Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Middle East Africa Feed Antioxidants Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Middle East Africa Feed Antioxidants Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 15: Middle East Africa Feed Antioxidants Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Middle East Africa Feed Antioxidants Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Middle East Africa Feed Antioxidants Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Middle East Africa Feed Antioxidants Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 19: Middle East Africa Feed Antioxidants Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Middle East Africa Feed Antioxidants Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Africa Feed Antioxidants Market?

The projected CAGR is approximately 4.80%.

2. Which companies are prominent players in the Middle East Africa Feed Antioxidants Market?

Key companies in the market include DSM Nutritional Products AG, Alltech, Layn Natural Ingredients Corp, Novus International, BASF SE, Cargill Inc, Biomi, Perstorp.

3. What are the main segments of the Middle East Africa Feed Antioxidants Market?

The market segments include Type, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Rising Preference Towards Animal Based Products.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Africa Feed Antioxidants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Africa Feed Antioxidants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Africa Feed Antioxidants Market?

To stay informed about further developments, trends, and reports in the Middle East Africa Feed Antioxidants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence