Key Insights

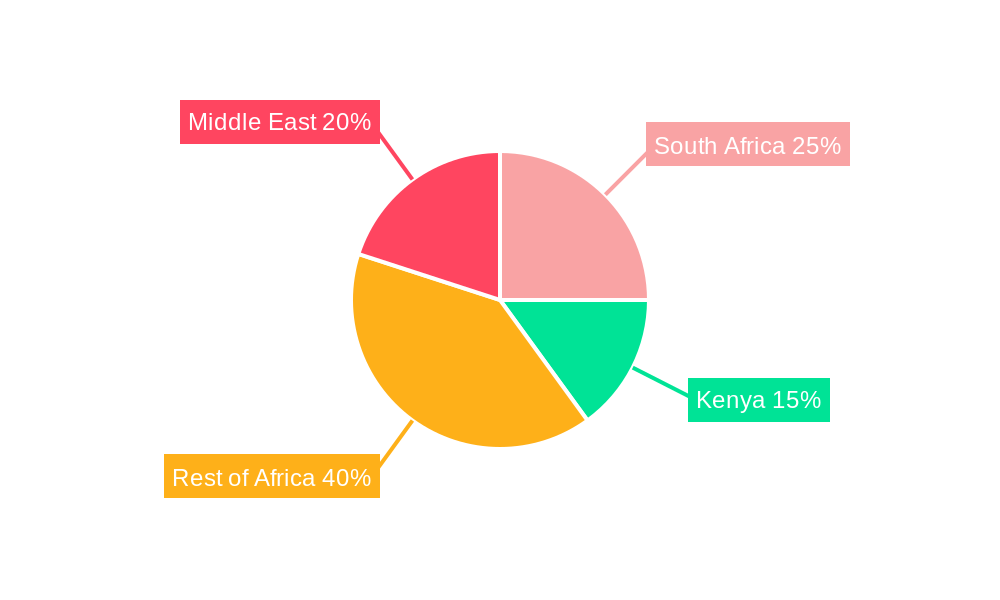

The Middle East and Africa Non-Alcoholic Beverages market, valued at $77 million in 2022, is projected for substantial growth. This expansion is fueled by rising disposable incomes, heightened health consciousness, and a growing regional population. Key drivers include urbanization, evolving lifestyles, and the strengthening of off-trade distribution channels, such as retail stores and supermarkets. Consumer demand for healthier options, including functional beverages and naturally flavored drinks, is shaping product innovation and marketing strategies. While economic volatility and the presence of dominant international players may present challenges, the market outlook is positive. The functional beverages and bottled water segments are anticipated to lead growth, driven by health awareness and convenience. Intense competition necessitates strategic investments in product diversification and distribution by major companies like Coca-Cola, PepsiCo, and Nestlé. Regional disparities exist, with South Africa and Kenya demonstrating robust growth due to higher per capita income and advanced retail infrastructure. The forecast period anticipates a compound annual growth rate (CAGR) of 7.4%, underscoring significant market potential. The on-trade sector, including restaurants and hotels, is also expected to grow, albeit at a slower pace than off-trade, reflecting evolving consumption patterns.

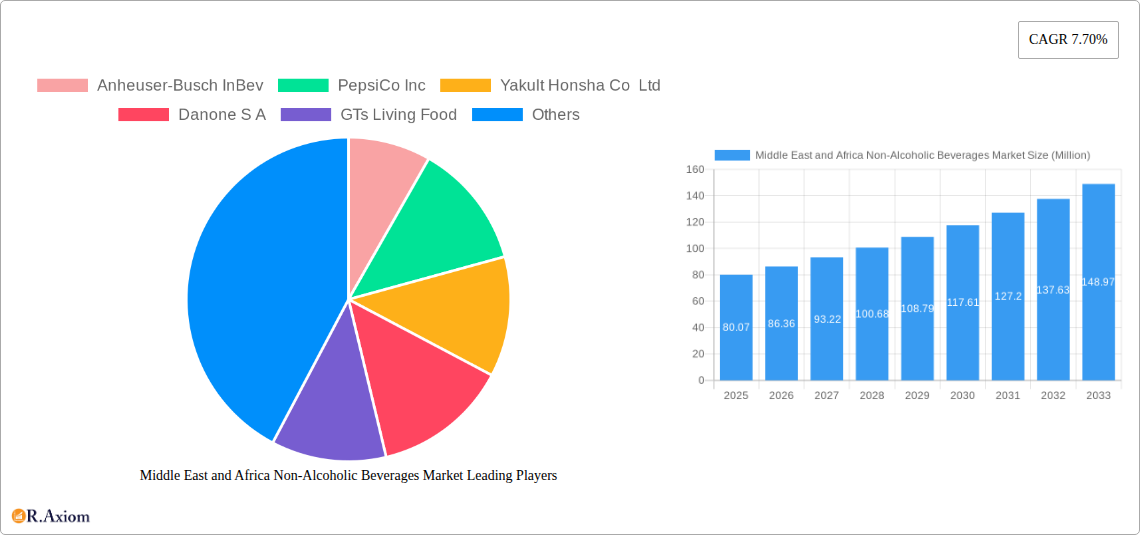

Middle East and Africa Non-Alcoholic Beverages Market Market Size (In Million)

Market growth in the Middle East and Africa Non-Alcoholic Beverages sector is further boosted by increasing tourism and the introduction of innovative product formats tailored to evolving consumer preferences. Companies are prioritizing sustainable packaging and local sourcing to attract environmentally conscious consumers. Increased investment in research and development for new products and improved distribution channels is enhancing beverage availability in previously underserved areas. The diverse product landscape, encompassing carbonated soft drinks, juices, ready-to-drink teas, and sports drinks, offers ample opportunities for both established and emerging brands. Strategic collaborations between local and international entities are expanding market reach, introducing advanced technologies, and enhancing brand recognition.

Middle East and Africa Non-Alcoholic Beverages Market Company Market Share

Middle East and Africa Non-Alcoholic Beverages Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East and Africa Non-Alcoholic Beverages market, covering the period from 2019 to 2033. It offers actionable insights for industry stakeholders, investors, and businesses seeking to understand and capitalize on the dynamic growth opportunities within this sector. The report leverages rigorous market research methodologies and incorporates data from the base year 2025, with estimations for 2025 and forecasts extending to 2033. Key players profiled include Anheuser-Busch InBev, PepsiCo Inc, Yakult Honsha Co Ltd, Danone S.A, GTs Living Food, Diageo plc, Gulf Safa Dairies (ADH) Company L L C, Al Rabie Saudi Foods Co, The Coca-Cola Company, and Nestlé S.A., though the list is not exhaustive.

Middle East and Africa Non-Alcoholic Beverages Market Concentration & Innovation

The Middle East and Africa non-alcoholic beverage market exhibits a moderately concentrated landscape, dominated by multinational corporations and established regional players. The market share of the top five players in 2025 is estimated at xx%, indicating room for both consolidation and the emergence of niche players. Innovation is a key driver, fueled by evolving consumer preferences towards healthier options, functional beverages, and premiumization. Regulatory frameworks vary across the region, influencing product formulations and labeling requirements. The increasing availability of product substitutes, such as fruit juices and water, presents a competitive challenge. End-user trends showcase a growing demand for convenient, on-the-go options and personalized experiences. M&A activities have been relatively modest in recent years, with a total deal value of approximately $xx Million in the period 2019-2024. Future M&A activity is anticipated to increase as companies seek to expand their market share and product portfolios.

- Market Concentration: Top 5 players hold xx% market share (2025 est.).

- Innovation Drivers: Healthier options, functional beverages, premiumization.

- Regulatory Landscape: Varying regulations across the region impacting product formulations and labeling.

- M&A Activity (2019-2024): Total deal value: $xx Million.

Middle East and Africa Non-Alcoholic Beverages Market Industry Trends & Insights

The Middle East and Africa non-alcoholic beverage market is experiencing robust growth, driven by factors such as rising disposable incomes, urbanization, and a burgeoning young population. The market's CAGR from 2025 to 2033 is projected to be xx%, exceeding the global average. Technological advancements, including improved packaging and distribution techniques, enhance market penetration. Consumer preferences are shifting towards healthier, natural, and functional beverages, presenting opportunities for brands that cater to these demands. Competitive dynamics are shaped by intense rivalry between multinational corporations and local players, with price competition and product differentiation playing key roles. Market penetration for ready-to-drink teas is expected to increase by xx% between 2025 and 2033.

Dominant Markets & Segments in Middle East and Africa Non-Alcoholic Beverages Market

The report identifies [Specific Country/Region, e.g., Egypt or South Africa] as the dominant market within the Middle East and Africa region for non-alcoholic beverages. This dominance is driven by a combination of factors:

- Economic Policies: Favorable investment climates, supportive government initiatives for the food and beverage sector, and robust economic growth in this specific region contribute significantly.

- Infrastructure: Well-developed distribution networks, efficient logistics systems, and a larger consumer base enhance market penetration.

The off-trade channel dominates the distribution segment, owing to the high consumption of non-alcoholic beverages at home and through retail channels. Within the type segment, carbonated soft drinks maintain a significant share, though the market is witnessing an upsurge in demand for healthier options like bottled water, fruit juices, and functional beverages.

Middle East and Africa Non-Alcoholic Beverages Market Product Developments

Recent product innovations focus on healthier formulations, convenient packaging, and unique flavor profiles. Companies are leveraging technological advancements in processing and packaging to enhance product shelf life and appeal. The market is also witnessing increased adoption of sustainable packaging practices and the introduction of organic and natural ingredients. This trend reflects a broader shift in consumer preferences toward health-conscious and environmentally friendly products.

Report Scope & Segmentation Analysis

This report segments the Middle East and Africa non-alcoholic beverages market based on type (carbonated soft drinks, bottled water, fruit juices, ready-to-drink teas, other non-alcoholic beverages) and distribution channel (on-trade, off-trade). Each segment's market size, growth projections, and competitive dynamics are comprehensively analyzed. The off-trade channel is expected to exhibit a higher CAGR than the on-trade channel owing to its wider reach and affordability. The bottled water segment is projected to experience significant growth, driven by rising health consciousness.

Key Drivers of Middle East and Africa Non-Alcoholic Beverages Market Growth

Several factors contribute to the growth of the Middle East and Africa non-alcoholic beverages market: rising disposable incomes, expanding population, increasing urbanization, changing lifestyles, and a growing preference for convenience and on-the-go consumption. Furthermore, government initiatives promoting local production and investment in the food and beverage industry play a crucial role.

Challenges in the Middle East and Africa Non-Alcoholic Beverages Market Sector

Challenges include fluctuating raw material prices, supply chain disruptions, intense competition from both established and emerging players, varying regulatory landscapes across different countries in the region, and the impact of economic instability in certain areas. These factors can negatively impact market growth and profitability.

Emerging Opportunities in Middle East and Africa Non-Alcoholic Beverages Market

Emerging opportunities lie in the growing demand for healthier, functional beverages, premium products, and sustainable packaging. There is significant potential for growth in untapped markets and regional expansion. The adoption of e-commerce and digital marketing strategies offers promising avenues for brand building and sales growth.

Leading Players in the Middle East and Africa Non-Alcoholic Beverages Market Market

- Anheuser-Busch InBev

- PepsiCo Inc

- Yakult Honsha Co Ltd

- Danone S.A

- GTs Living Food

- Diageo plc

- Gulf Safa Dairies (ADH) Company L L C

- Al Rabie Saudi Foods Co

- The Coca-Cola Company

- Nestlé S.A

Key Developments in Middle East and Africa Non-Alcoholic Beverages Market Industry

- January 2023: PepsiCo launches a new line of functional beverages targeting health-conscious consumers in [Specific Country].

- June 2022: Nestlé invests in a new production facility in [Specific Country] to increase its local manufacturing capacity.

- November 2021: A major merger between two regional beverage companies results in increased market share. (Further details would be added here in the full report)

Strategic Outlook for Middle East and Africa Non-Alcoholic Beverages Market Market

The Middle East and Africa non-alcoholic beverage market presents significant growth potential driven by favorable demographic trends, expanding economies, and evolving consumer preferences. Companies can leverage this growth by focusing on innovation, product diversification, strategic partnerships, and targeted marketing campaigns. The adoption of sustainable practices and digital technologies will be crucial for long-term success in this dynamic and competitive market.

Middle East and Africa Non-Alcoholic Beverages Market Segmentation

-

1. Type

- 1.1. Alcoholic Beverages

-

1.2. Non-Alcoholic Beverages

- 1.2.1. Kombucha

- 1.2.2. Kefir

- 1.2.3. Others

-

2. Distribution Channel

- 2.1. On-Trade

-

2.2. Off-Trade

- 2.2.1. Grocery Stores

- 2.2.2. Specialty Stores

- 2.2.3. Online Stores

- 2.2.4. Other Distribution Channels

-

3. Geography

- 3.1. United Arab Emirates

- 3.2. Saudi Arabia

- 3.3. South Africa

- 3.4. Rest of Middle East and Africa

Middle East and Africa Non-Alcoholic Beverages Market Segmentation By Geography

- 1. United Arab Emirates

- 2. Saudi Arabia

- 3. South Africa

- 4. Rest of Middle East and Africa

Middle East and Africa Non-Alcoholic Beverages Market Regional Market Share

Geographic Coverage of Middle East and Africa Non-Alcoholic Beverages Market

Middle East and Africa Non-Alcoholic Beverages Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations and Product Guidelines

- 3.4. Market Trends

- 3.4.1. Non-Alcoholic Beverages Remained the Most Promising Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Non-Alcoholic Beverages Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Alcoholic Beverages

- 5.1.2. Non-Alcoholic Beverages

- 5.1.2.1. Kombucha

- 5.1.2.2. Kefir

- 5.1.2.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.2.2.1. Grocery Stores

- 5.2.2.2. Specialty Stores

- 5.2.2.3. Online Stores

- 5.2.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United Arab Emirates

- 5.3.2. Saudi Arabia

- 5.3.3. South Africa

- 5.3.4. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.4.2. Saudi Arabia

- 5.4.3. South Africa

- 5.4.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United Arab Emirates Middle East and Africa Non-Alcoholic Beverages Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Alcoholic Beverages

- 6.1.2. Non-Alcoholic Beverages

- 6.1.2.1. Kombucha

- 6.1.2.2. Kefir

- 6.1.2.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-Trade

- 6.2.2. Off-Trade

- 6.2.2.1. Grocery Stores

- 6.2.2.2. Specialty Stores

- 6.2.2.3. Online Stores

- 6.2.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United Arab Emirates

- 6.3.2. Saudi Arabia

- 6.3.3. South Africa

- 6.3.4. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Saudi Arabia Middle East and Africa Non-Alcoholic Beverages Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Alcoholic Beverages

- 7.1.2. Non-Alcoholic Beverages

- 7.1.2.1. Kombucha

- 7.1.2.2. Kefir

- 7.1.2.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-Trade

- 7.2.2. Off-Trade

- 7.2.2.1. Grocery Stores

- 7.2.2.2. Specialty Stores

- 7.2.2.3. Online Stores

- 7.2.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United Arab Emirates

- 7.3.2. Saudi Arabia

- 7.3.3. South Africa

- 7.3.4. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. South Africa Middle East and Africa Non-Alcoholic Beverages Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Alcoholic Beverages

- 8.1.2. Non-Alcoholic Beverages

- 8.1.2.1. Kombucha

- 8.1.2.2. Kefir

- 8.1.2.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-Trade

- 8.2.2. Off-Trade

- 8.2.2.1. Grocery Stores

- 8.2.2.2. Specialty Stores

- 8.2.2.3. Online Stores

- 8.2.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United Arab Emirates

- 8.3.2. Saudi Arabia

- 8.3.3. South Africa

- 8.3.4. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Middle East and Africa Middle East and Africa Non-Alcoholic Beverages Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Alcoholic Beverages

- 9.1.2. Non-Alcoholic Beverages

- 9.1.2.1. Kombucha

- 9.1.2.2. Kefir

- 9.1.2.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-Trade

- 9.2.2. Off-Trade

- 9.2.2.1. Grocery Stores

- 9.2.2.2. Specialty Stores

- 9.2.2.3. Online Stores

- 9.2.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United Arab Emirates

- 9.3.2. Saudi Arabia

- 9.3.3. South Africa

- 9.3.4. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Anheuser-Busch InBev

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 PepsiCo Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Yakult Honsha Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Danone S A

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 GTs Living Food

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Diageo plc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Gulf Safa Dairies (ADH) Company L L C *List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Al Rabie Saudi Foods Co

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 The Coca-Cola Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Nestlé S.A.

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Anheuser-Busch InBev

List of Figures

- Figure 1: Middle East and Africa Non-Alcoholic Beverages Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Non-Alcoholic Beverages Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Non-Alcoholic Beverages Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Middle East and Africa Non-Alcoholic Beverages Market Volume liter Forecast, by Type 2020 & 2033

- Table 3: Middle East and Africa Non-Alcoholic Beverages Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Middle East and Africa Non-Alcoholic Beverages Market Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 5: Middle East and Africa Non-Alcoholic Beverages Market Revenue million Forecast, by Geography 2020 & 2033

- Table 6: Middle East and Africa Non-Alcoholic Beverages Market Volume liter Forecast, by Geography 2020 & 2033

- Table 7: Middle East and Africa Non-Alcoholic Beverages Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: Middle East and Africa Non-Alcoholic Beverages Market Volume liter Forecast, by Region 2020 & 2033

- Table 9: Middle East and Africa Non-Alcoholic Beverages Market Revenue million Forecast, by Type 2020 & 2033

- Table 10: Middle East and Africa Non-Alcoholic Beverages Market Volume liter Forecast, by Type 2020 & 2033

- Table 11: Middle East and Africa Non-Alcoholic Beverages Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Middle East and Africa Non-Alcoholic Beverages Market Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 13: Middle East and Africa Non-Alcoholic Beverages Market Revenue million Forecast, by Geography 2020 & 2033

- Table 14: Middle East and Africa Non-Alcoholic Beverages Market Volume liter Forecast, by Geography 2020 & 2033

- Table 15: Middle East and Africa Non-Alcoholic Beverages Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Middle East and Africa Non-Alcoholic Beverages Market Volume liter Forecast, by Country 2020 & 2033

- Table 17: Middle East and Africa Non-Alcoholic Beverages Market Revenue million Forecast, by Type 2020 & 2033

- Table 18: Middle East and Africa Non-Alcoholic Beverages Market Volume liter Forecast, by Type 2020 & 2033

- Table 19: Middle East and Africa Non-Alcoholic Beverages Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 20: Middle East and Africa Non-Alcoholic Beverages Market Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 21: Middle East and Africa Non-Alcoholic Beverages Market Revenue million Forecast, by Geography 2020 & 2033

- Table 22: Middle East and Africa Non-Alcoholic Beverages Market Volume liter Forecast, by Geography 2020 & 2033

- Table 23: Middle East and Africa Non-Alcoholic Beverages Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Middle East and Africa Non-Alcoholic Beverages Market Volume liter Forecast, by Country 2020 & 2033

- Table 25: Middle East and Africa Non-Alcoholic Beverages Market Revenue million Forecast, by Type 2020 & 2033

- Table 26: Middle East and Africa Non-Alcoholic Beverages Market Volume liter Forecast, by Type 2020 & 2033

- Table 27: Middle East and Africa Non-Alcoholic Beverages Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 28: Middle East and Africa Non-Alcoholic Beverages Market Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 29: Middle East and Africa Non-Alcoholic Beverages Market Revenue million Forecast, by Geography 2020 & 2033

- Table 30: Middle East and Africa Non-Alcoholic Beverages Market Volume liter Forecast, by Geography 2020 & 2033

- Table 31: Middle East and Africa Non-Alcoholic Beverages Market Revenue million Forecast, by Country 2020 & 2033

- Table 32: Middle East and Africa Non-Alcoholic Beverages Market Volume liter Forecast, by Country 2020 & 2033

- Table 33: Middle East and Africa Non-Alcoholic Beverages Market Revenue million Forecast, by Type 2020 & 2033

- Table 34: Middle East and Africa Non-Alcoholic Beverages Market Volume liter Forecast, by Type 2020 & 2033

- Table 35: Middle East and Africa Non-Alcoholic Beverages Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 36: Middle East and Africa Non-Alcoholic Beverages Market Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 37: Middle East and Africa Non-Alcoholic Beverages Market Revenue million Forecast, by Geography 2020 & 2033

- Table 38: Middle East and Africa Non-Alcoholic Beverages Market Volume liter Forecast, by Geography 2020 & 2033

- Table 39: Middle East and Africa Non-Alcoholic Beverages Market Revenue million Forecast, by Country 2020 & 2033

- Table 40: Middle East and Africa Non-Alcoholic Beverages Market Volume liter Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Non-Alcoholic Beverages Market?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the Middle East and Africa Non-Alcoholic Beverages Market?

Key companies in the market include Anheuser-Busch InBev, PepsiCo Inc, Yakult Honsha Co Ltd, Danone S A, GTs Living Food, Diageo plc, Gulf Safa Dairies (ADH) Company L L C *List Not Exhaustive, Al Rabie Saudi Foods Co, The Coca-Cola Company , Nestlé S.A.:.

3. What are the main segments of the Middle East and Africa Non-Alcoholic Beverages Market?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 77 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend.

6. What are the notable trends driving market growth?

Non-Alcoholic Beverages Remained the Most Promising Segment.

7. Are there any restraints impacting market growth?

Stringent Government Regulations and Product Guidelines.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Non-Alcoholic Beverages Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Non-Alcoholic Beverages Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Non-Alcoholic Beverages Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Non-Alcoholic Beverages Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence