Key Insights

The Middle East Smart Grid Network Market is projected for significant expansion, anticipated to reach $54.48 million by 2024, demonstrating a robust Compound Annual Growth Rate (CAGR) of 22.24% through 2033. This growth is propelled by substantial investments in upgrading power generation and transmission infrastructure, alongside escalating demand for efficient electricity distribution throughout the region. Key catalysts include governmental smart city initiatives, energy efficiency mandates, and the integration of renewable energy sources, all necessitating advanced grid capabilities. The market is further energized by the increasing adoption of smart meters and sophisticated grid management software, enhancing operational efficiency, minimizing transmission losses, and bolstering grid reliability. Leading market participants such as Siemens AG, Hitachi Energy Ltd, and General Electric Company are driving this expansion through strategic alliances and the implementation of pioneering technologies, reinforcing their positions in this dynamic sector.

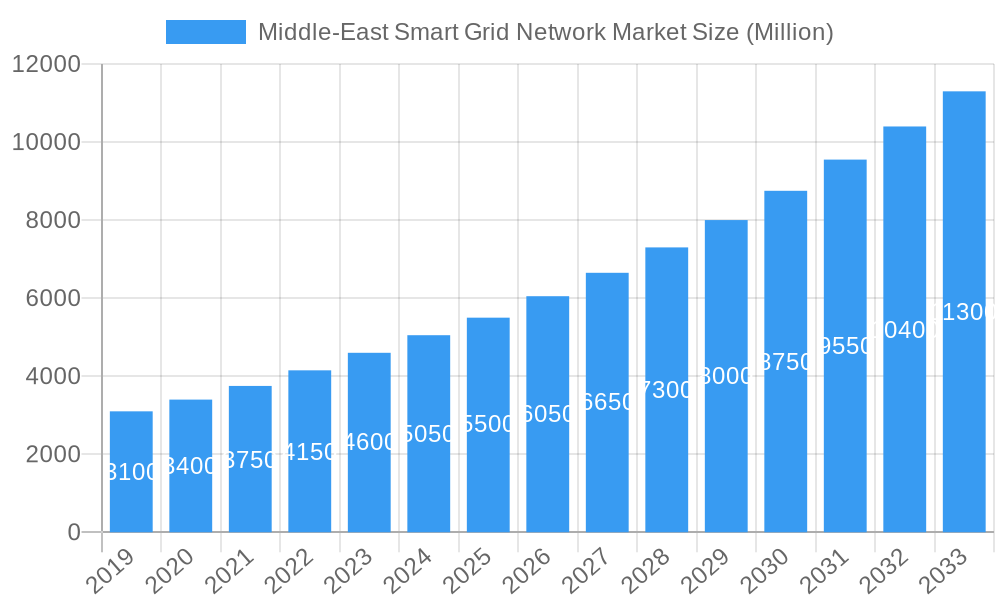

Middle-East Smart Grid Network Market Market Size (In Million)

The competitive environment features a mix of established global technology leaders and influential regional utilities. Companies including Alfanar Group, EDMI Limited, and Honeywell International Inc are introducing innovative hardware and software solutions specifically designed for the Middle East's energy sector demands. Market segmentation highlights a strong focus on software and hardware components, with applications covering power generation, transmission, and distribution networks. Geographically, the United Arab Emirates, Saudi Arabia, and Qatar are at the forefront of smart grid technology adoption, supported by their ambitious national objectives for economic diversification and sustainable energy infrastructure. While strong growth drivers are evident, potential challenges may encompass the substantial upfront investment required for large-scale implementations and the need for skilled personnel to manage and maintain these sophisticated systems. Nevertheless, the overarching shift towards digitalization and the critical need for a stable, efficient energy supply forecast sustained and substantial growth for the Middle East Smart Grid Network Market.

Middle-East Smart Grid Network Market Company Market Share

Discover in-depth market insights with this comprehensive, SEO-optimized report on the Middle-East Smart Grid Network Market.

Middle-East Smart Grid Network Market Market Concentration & Innovation

The Middle-East smart grid network market is characterized by a moderate to high level of concentration, driven by significant investments from government-backed utilities and a handful of global technology giants. Innovation is a critical differentiator, fueled by the region's ambitious digital transformation agendas and the increasing demand for reliable, efficient, and sustainable energy infrastructure. Key innovation drivers include the adoption of Artificial Intelligence (AI) and Machine Learning (ML) for predictive maintenance and demand forecasting, the integration of Internet of Things (IoT) devices for real-time data collection, and the deployment of advanced cybersecurity solutions to protect critical infrastructure. Regulatory frameworks are evolving, with governments actively promoting smart grid initiatives through supportive policies and incentives, encouraging technology adoption and standardization. While direct product substitutes are limited for core smart grid functionalities, incremental advancements in existing technologies and the emergence of decentralized energy solutions present indirect competitive pressures. End-user trends are shifting towards greater consumer engagement, with smart meters enabling personalized energy consumption insights and demand-response programs becoming more prevalent. Mergers and acquisitions (M&A) are expected to play a significant role in market consolidation, allowing key players to expand their portfolios, gain market share, and acquire specialized technologies. For instance, the strategic acquisition of smaller, innovative solution providers by larger conglomerates is anticipated to be a prevalent M&A activity. The market share of leading companies, such as Siemens AG and Hitachi Energy Ltd, is substantial, with smaller players focusing on niche solutions and regional expansion. Expected M&A deal values are projected to be in the hundreds of millions, reflecting the strategic importance of these acquisitions in shaping the future of the Middle East smart grid landscape.

Middle-East Smart Grid Network Market Industry Trends & Insights

The Middle-East smart grid network market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 12.5% over the forecast period of 2025–2033. This upward trajectory is primarily propelled by several interconnected industry trends and insights. A significant growth driver is the escalating demand for reliable and efficient energy distribution, particularly in light of rapid population growth and industrial expansion across the GCC nations. Governments are heavily investing in modernizing their electrical infrastructure to meet these demands and reduce transmission and distribution losses, which currently stand at an estimated 15% in some parts of the region. Technological disruptions are rapidly reshaping the market. The widespread adoption of IoT sensors, advanced metering infrastructure (AMI), and sophisticated data analytics platforms is enabling utilities to gain unprecedented visibility into their networks. This enhanced visibility allows for proactive identification of potential faults, optimized load balancing, and improved energy management. The integration of renewable energy sources, such as solar and wind power, into the national grids necessitates the deployment of smart grid technologies for seamless integration and grid stability. Consumer preferences are also evolving; end-users are increasingly demanding greater control over their energy consumption, seeking features like real-time billing, remote monitoring, and access to energy-saving programs. This shift is directly stimulating the demand for smart meters and customer engagement platforms. The competitive dynamics within the market are intensifying, with both established global players and emerging regional technology providers vying for market share. Strategic partnerships and collaborations are becoming common as companies aim to leverage each other's expertise and expand their service offerings. The market penetration of smart grid technologies is still in its early to mid-stages in several countries, offering substantial room for expansion. The total market size for Middle East smart grids is estimated to reach over $7,000 million by 2033, up from an estimated $3,000 million in 2025, underscoring the significant investment and adoption anticipated.

Dominant Markets & Segments in Middle-East Smart Grid Network Market

The United Arab Emirates (UAE) and Saudi Arabia are emerging as the dominant markets within the Middle East smart grid network sector, driven by their ambitious national visions for economic diversification and technological advancement. The UAE, in particular, has been at the forefront of smart grid implementation, with Dubai Electricity and Water Authority (DEWA) setting a benchmark for smart city initiatives. Saudi Arabia's Vision 2030 includes significant investments in modernizing its energy infrastructure, making it a key growth engine for the market.

United Arab Emirates (UAE):

- Key Drivers: Proactive government initiatives like the Dubai Smart City Agenda, substantial investments in renewable energy integration, and the high adoption rate of smart meters by utilities such as DEWA. The country's focus on creating a sustainable and technologically advanced urban environment directly fuels smart grid deployment.

- Dominance Analysis: DEWA's comprehensive smart grid strategy and successful implementation of millions of smart meters exemplify the UAE's leadership. The country's commitment to digital transformation and smart infrastructure has created a fertile ground for advanced smart grid solutions, including sophisticated grid automation and demand-side management systems. The market size for smart grid solutions in the UAE is projected to exceed $1,500 million by 2033.

Saudi Arabia:

- Key Drivers: The ambitious Vision 2030 plan, which prioritizes infrastructure development and the modernization of utilities, alongside significant investments in smart city projects like NEOM. The Kingdom's commitment to electrifying its vast territory and integrating renewable energy sources necessitates robust smart grid capabilities.

- Dominance Analysis: Saudi Arabia's sheer scale and planned infrastructure development present immense opportunities. The government's focus on enhancing energy efficiency and reliability is driving demand for smart grid components and applications across power generation, transmission, and distribution networks. The market size for smart grid solutions in Saudi Arabia is forecast to surpass $2,000 million by 2033.

Component: Hardware is currently the dominant segment, driven by the foundational need for smart meters, sensors, communication devices, and grid automation equipment. The deployment of AMI systems, which underpin much of the smart grid functionality, relies heavily on advanced hardware solutions.

- Key Drivers: The ongoing rollout of smart meters across the region, the installation of grid automation devices, and the need for robust communication infrastructure for data transmission.

- Dominance Analysis: The sheer volume of physical devices required for a comprehensive smart grid network makes hardware the largest segment. Utility companies are prioritizing the replacement of traditional meters with smart alternatives and investing in substations and grid edge devices to enhance operational efficiency and resilience. The hardware segment is expected to account for over 50% of the total market share.

Application: Power Generation and Transmission Networks is another critical segment experiencing significant growth. As grids become more complex with the integration of renewables and bi-directional power flow, advanced solutions are needed to manage these networks effectively.

- Key Drivers: The need to manage variable renewable energy sources, optimize power flow, enhance grid stability, and reduce transmission losses.

- Dominance Analysis: Investments in supervisory control and data acquisition (SCADA) systems, energy management systems (EMS), and wide-area monitoring systems (WAMS) are crucial for efficient operation of generation and transmission networks. These applications enable utilities to monitor grid health in real-time, respond to disturbances, and ensure a stable power supply. The market size for this segment is projected to reach over $2,500 million by 2033.

Middle-East Smart Grid Network Market Product Developments

Product developments in the Middle East smart grid network market are increasingly focused on leveraging advanced digital technologies. Innovations in AI and ML are enabling predictive analytics for equipment failure, optimizing grid operations, and enhancing demand-side management. The integration of IoT sensors is providing real-time data for granular monitoring of energy consumption and grid status. Furthermore, advancements in communication technologies, such as 5G and LPWAN (Low-Power Wide-Area Network), are facilitating faster and more reliable data transmission across the network. Cybersecurity solutions are also a key area of development, with companies offering robust protection against cyber threats to critical energy infrastructure.

Report Scope & Segmentation Analysis

This report provides an in-depth analysis of the Middle-East Smart Grid Network Market, segmented across key areas to offer comprehensive insights.

Component Segmentation:

- Software: This segment includes grid management software, analytics platforms, cybersecurity solutions, and customer engagement applications. Growth is driven by the increasing need for data-driven decision-making and enhanced grid intelligence. Projected market size: approximately $2,000 million by 2033.

- Hardware: This encompasses smart meters, sensors, communication modules, grid automation devices, and control systems. Its dominance is fueled by widespread deployment of smart metering infrastructure and grid modernization efforts. Projected market size: approximately $3,500 million by 2033.

Application Segmentation:

- Power Generation and Transmission Networks: This segment covers solutions for optimizing power generation, managing transmission lines, and ensuring grid stability. Key drivers include renewable energy integration and the need for enhanced grid reliability. Projected market size: approximately $2,500 million by 2033.

- Distribution Networks: This includes smart grid solutions for managing electricity distribution, reducing losses, and improving outage management. The increasing complexity of distribution networks and the need for efficient last-mile delivery are key growth factors. Projected market size: approximately $2,200 million by 2033.

- Other Applications: This encompasses smart grid solutions for water management, street lighting, and electric vehicle charging infrastructure, reflecting the expanding scope of smart utility services. Projected market size: approximately $500 million by 2033.

Geographical Segmentation:

- United Arab Emirates: A leading market with strong government support for smart city initiatives and advanced infrastructure. Projected market size: approximately $1,500 million by 2033.

- Saudi Arabia: A rapidly growing market driven by Vision 2030 and large-scale infrastructure projects. Projected market size: approximately $2,000 million by 2033.

- Kuwait: Investing in grid modernization to enhance reliability and efficiency. Projected market size: approximately $700 million by 2033.

- Qatar: Focusing on smart grid deployment to support its growing population and hosting of major events. Projected market size: approximately $800 million by 2033.

- Rest of the Middle East: Includes markets like Oman, Bahrain, and Jordan, all showing increasing adoption of smart grid technologies. Projected market size: approximately $1,500 million by 2033.

Key Drivers of Middle-East Smart Grid Network Market Growth

The Middle-East smart grid network market is propelled by a confluence of factors. Government initiatives and investments are paramount, with countries like the UAE and Saudi Arabia prioritizing smart infrastructure development as part of their national visions. The increasing demand for energy efficiency and reliability to support growing populations and industrial sectors is a significant driver. Furthermore, the integration of renewable energy sources necessitates advanced grid management capabilities. Technological advancements, including AI, IoT, and advanced analytics, are enabling more sophisticated and efficient grid operations. Finally, the need to reduce energy losses in transmission and distribution networks, which can be as high as 15% in some areas, presents a strong economic incentive for smart grid adoption.

Challenges in the Middle-East Smart Grid Network Market Sector

Despite its strong growth potential, the Middle-East smart grid network market faces several challenges. High initial investment costs for deploying smart grid infrastructure can be a barrier for some utilities. Cybersecurity concerns remain a critical issue, as the interconnected nature of smart grids makes them vulnerable to sophisticated cyber-attacks, necessitating robust security protocols and ongoing investment. Lack of standardization in some areas can lead to interoperability issues between different vendors' solutions. Skilled workforce shortage in specialized areas like data analytics and cybersecurity is another constraint. Finally, regulatory hurdles and policy gaps in certain countries can slow down the pace of adoption and implementation.

Emerging Opportunities in Middle-East Smart Grid Network Market

The Middle-East smart grid network market presents numerous emerging opportunities. The rapid growth of electric vehicle (EV) charging infrastructure creates demand for smart charging solutions and grid integration. Decentralized energy systems and microgrids offer opportunities for enhanced resilience and localized power generation. The increasing adoption of smart home technologies presents avenues for greater consumer engagement and demand-side management programs. Furthermore, the expansion of smart city initiatives across the region will continue to drive demand for integrated smart grid solutions. The development of advanced analytics and AI-powered predictive maintenance offers opportunities for utilities to optimize asset management and reduce operational costs.

Leading Players in the Middle-East Smart Grid Network Market Market

- Alfanar Group

- EDMI Limited

- Hitachi Energy Ltd

- Landis+Gyr Group AG

- Siemens AG

- Qatar General Water & Electricity Corporation (Kahramaa)

- Dubai Electricity and Water Authority (DEWA)

- General Electric Company

- Abu Dhabi National Energy Company PJSC (Taqa)

- Honeywell International Inc

Key Developments in Middle-East Smart Grid Network Market Industry

- April 2022: Israel Electric Corporation commenced a significant smart meter installation initiative, aiming to deploy one million smart meters over the next five years, with an annual rollout target of approximately 200,000 meters. Installations are planned across Rishon LeZion, Herzliya, Petah Tikva, Hadera, and Ashdod, enhancing grid visibility and consumer engagement.

- March 2022: Dubai Electricity and Water Authority (DEWA) announced the successful completion of its short-term objectives under its Smart Grid Strategy 2014–2035. Between 2015 and 2020, DEWA replaced over 2 million electricity and water meters with smart meters. In 2017, the company achieved a significant milestone by automating its transmission network and deploying a multi-application RF Mesh network across the UAE, improving grid management and reliability.

Strategic Outlook for Middle-East Smart Grid Network Market Market

The strategic outlook for the Middle-East smart grid network market is exceptionally positive, driven by sustained government commitment to modernization and sustainability. Key growth catalysts include the ongoing investments in renewable energy integration, which necessitates sophisticated grid management technologies. The continued expansion of smart city projects across the region will further fuel the demand for interconnected smart grid solutions. Opportunities arising from the burgeoning electric vehicle market and the development of microgrids will also play a crucial role. Companies that can offer integrated solutions encompassing advanced analytics, cybersecurity, and seamless IoT connectivity are poised to capture significant market share. Strategic partnerships and the development of localized expertise will be vital for navigating the evolving landscape and capitalizing on the region's vast smart grid potential.

Middle-East Smart Grid Network Market Segmentation

-

1. Component

- 1.1. Software

- 1.2. Hardware

-

2. Application

- 2.1. Power Generation and Transmission Networks

- 2.2. Distribu

- 2.3. Other

-

3. Geography

- 3.1. United Arab Emirates

- 3.2. Saudi Arabia

- 3.3. Kuwait

- 3.4. Qatar

- 3.5. Rest of the Middle East

Middle-East Smart Grid Network Market Segmentation By Geography

- 1. United Arab Emirates

- 2. Saudi Arabia

- 3. Kuwait

- 4. Qatar

- 5. Rest of the Middle East

Middle-East Smart Grid Network Market Regional Market Share

Geographic Coverage of Middle-East Smart Grid Network Market

Middle-East Smart Grid Network Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Number of Offshore Operations 4.; Demand Coming for Unconventional Energy Sources

- 3.3. Market Restrains

- 3.3.1. 4.; Demand for Renewable Energy

- 3.4. Market Trends

- 3.4.1. Software Component Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East Smart Grid Network Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Software

- 5.1.2. Hardware

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Power Generation and Transmission Networks

- 5.2.2. Distribu

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United Arab Emirates

- 5.3.2. Saudi Arabia

- 5.3.3. Kuwait

- 5.3.4. Qatar

- 5.3.5. Rest of the Middle East

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.4.2. Saudi Arabia

- 5.4.3. Kuwait

- 5.4.4. Qatar

- 5.4.5. Rest of the Middle East

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. United Arab Emirates Middle-East Smart Grid Network Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Software

- 6.1.2. Hardware

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Power Generation and Transmission Networks

- 6.2.2. Distribu

- 6.2.3. Other

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United Arab Emirates

- 6.3.2. Saudi Arabia

- 6.3.3. Kuwait

- 6.3.4. Qatar

- 6.3.5. Rest of the Middle East

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Saudi Arabia Middle-East Smart Grid Network Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Software

- 7.1.2. Hardware

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Power Generation and Transmission Networks

- 7.2.2. Distribu

- 7.2.3. Other

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United Arab Emirates

- 7.3.2. Saudi Arabia

- 7.3.3. Kuwait

- 7.3.4. Qatar

- 7.3.5. Rest of the Middle East

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Kuwait Middle-East Smart Grid Network Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Software

- 8.1.2. Hardware

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Power Generation and Transmission Networks

- 8.2.2. Distribu

- 8.2.3. Other

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United Arab Emirates

- 8.3.2. Saudi Arabia

- 8.3.3. Kuwait

- 8.3.4. Qatar

- 8.3.5. Rest of the Middle East

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Qatar Middle-East Smart Grid Network Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Software

- 9.1.2. Hardware

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Power Generation and Transmission Networks

- 9.2.2. Distribu

- 9.2.3. Other

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United Arab Emirates

- 9.3.2. Saudi Arabia

- 9.3.3. Kuwait

- 9.3.4. Qatar

- 9.3.5. Rest of the Middle East

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Rest of the Middle East Middle-East Smart Grid Network Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Software

- 10.1.2. Hardware

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Power Generation and Transmission Networks

- 10.2.2. Distribu

- 10.2.3. Other

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. United Arab Emirates

- 10.3.2. Saudi Arabia

- 10.3.3. Kuwait

- 10.3.4. Qatar

- 10.3.5. Rest of the Middle East

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Alfanar Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 EDMI Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hitachi Energy Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Landis+Gyr Group AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Siemens AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Qatar General Water & Electricity Corporation (Kahramaa)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dubai Electricity and Water Authority (DEWA)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 General Electric Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Abu Dhabi National Energy Company PJSC (Taqa)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Honeywell International Inc 6 4 Market Ranking Analysis (for Major Utility Companies

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Alfanar Group

List of Figures

- Figure 1: Middle-East Smart Grid Network Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Middle-East Smart Grid Network Market Share (%) by Company 2025

List of Tables

- Table 1: Middle-East Smart Grid Network Market Revenue million Forecast, by Component 2020 & 2033

- Table 2: Middle-East Smart Grid Network Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: Middle-East Smart Grid Network Market Revenue million Forecast, by Geography 2020 & 2033

- Table 4: Middle-East Smart Grid Network Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Middle-East Smart Grid Network Market Revenue million Forecast, by Component 2020 & 2033

- Table 6: Middle-East Smart Grid Network Market Revenue million Forecast, by Application 2020 & 2033

- Table 7: Middle-East Smart Grid Network Market Revenue million Forecast, by Geography 2020 & 2033

- Table 8: Middle-East Smart Grid Network Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: Middle-East Smart Grid Network Market Revenue million Forecast, by Component 2020 & 2033

- Table 10: Middle-East Smart Grid Network Market Revenue million Forecast, by Application 2020 & 2033

- Table 11: Middle-East Smart Grid Network Market Revenue million Forecast, by Geography 2020 & 2033

- Table 12: Middle-East Smart Grid Network Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: Middle-East Smart Grid Network Market Revenue million Forecast, by Component 2020 & 2033

- Table 14: Middle-East Smart Grid Network Market Revenue million Forecast, by Application 2020 & 2033

- Table 15: Middle-East Smart Grid Network Market Revenue million Forecast, by Geography 2020 & 2033

- Table 16: Middle-East Smart Grid Network Market Revenue million Forecast, by Country 2020 & 2033

- Table 17: Middle-East Smart Grid Network Market Revenue million Forecast, by Component 2020 & 2033

- Table 18: Middle-East Smart Grid Network Market Revenue million Forecast, by Application 2020 & 2033

- Table 19: Middle-East Smart Grid Network Market Revenue million Forecast, by Geography 2020 & 2033

- Table 20: Middle-East Smart Grid Network Market Revenue million Forecast, by Country 2020 & 2033

- Table 21: Middle-East Smart Grid Network Market Revenue million Forecast, by Component 2020 & 2033

- Table 22: Middle-East Smart Grid Network Market Revenue million Forecast, by Application 2020 & 2033

- Table 23: Middle-East Smart Grid Network Market Revenue million Forecast, by Geography 2020 & 2033

- Table 24: Middle-East Smart Grid Network Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East Smart Grid Network Market?

The projected CAGR is approximately 22.24%.

2. Which companies are prominent players in the Middle-East Smart Grid Network Market?

Key companies in the market include Alfanar Group, EDMI Limited, Hitachi Energy Ltd, Landis+Gyr Group AG, Siemens AG, Qatar General Water & Electricity Corporation (Kahramaa), Dubai Electricity and Water Authority (DEWA), General Electric Company, Abu Dhabi National Energy Company PJSC (Taqa), Honeywell International Inc 6 4 Market Ranking Analysis (for Major Utility Companies.

3. What are the main segments of the Middle-East Smart Grid Network Market?

The market segments include Component, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 54.48 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Number of Offshore Operations 4.; Demand Coming for Unconventional Energy Sources.

6. What are the notable trends driving market growth?

Software Component Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Demand for Renewable Energy.

8. Can you provide examples of recent developments in the market?

On 21st April 2022, Israel Electric Corporation has started a one million smart meter installation in the next five years. This company aims to roll out around 200,000 new smart meters installed annually. The smart meters installation is expected to be done in the Rishon LeZion, Herzliya, Petah Tikva, Hadera, and Ashdod.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East Smart Grid Network Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East Smart Grid Network Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East Smart Grid Network Market?

To stay informed about further developments, trends, and reports in the Middle-East Smart Grid Network Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence