Key Insights

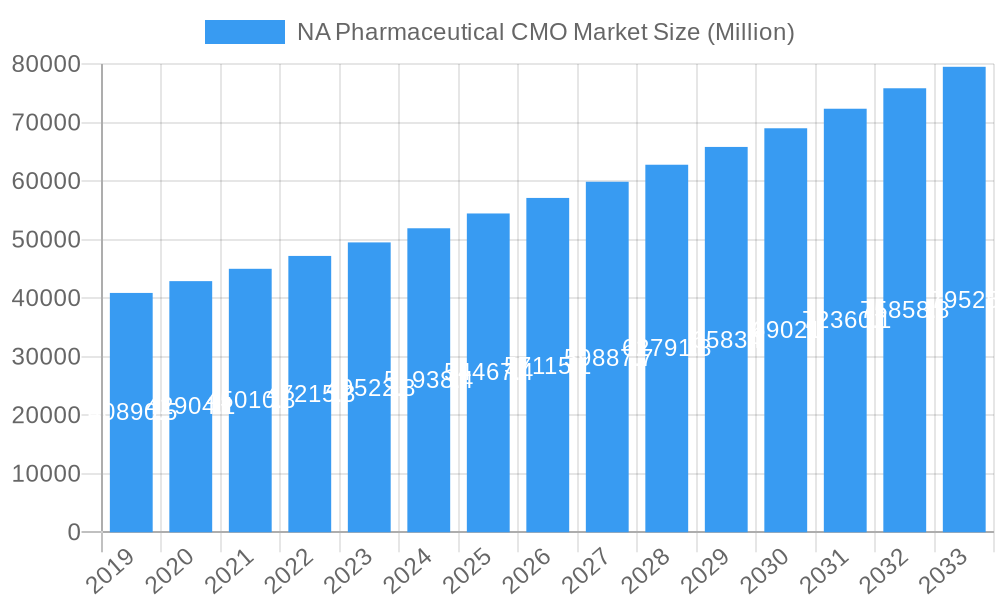

The North American pharmaceutical contract manufacturing organization (CMO) market is poised for significant expansion, projected to reach an estimated $55,189.1 million in 2025 with a robust Compound Annual Growth Rate (CAGR) of 5.20% through 2033. This growth is propelled by several key drivers, including the increasing demand for complex drug formulations, particularly small molecules and large molecules, and the rising prevalence of high potency Active Pharmaceutical Ingredients (HPAPIs) requiring specialized handling and manufacturing capabilities. The industry is witnessing a pronounced trend towards outsourcing by pharmaceutical companies seeking to reduce operational costs, gain access to specialized expertise and advanced technologies, and accelerate time-to-market for their drug products. Furthermore, the growing complexity of drug development and the need for efficient supply chain management are compelling more firms to leverage the services of experienced CMOs. The market is segmented across various service types, with Active Pharmaceutical Ingredient (API) manufacturing (including small molecule, large molecule, and HPAPI) and Finished Dosage Formulations (solid dose, liquid dose, and injectable) representing key growth areas. Secondary packaging services also contribute to the overall market demand as manufacturers focus on product differentiation and regulatory compliance.

NA Pharmaceutical CMO Market Market Size (In Billion)

The North American pharmaceutical CMO landscape is characterized by the presence of major players such as Thermo Fisher Scientific Inc. (Patheon Inc.), Pfizer CentreSource (Pfizer Inc.), Lonza Group AG, and Catalent Inc., alongside other significant entities like Siegfried AG, Aenova Group, AbbVie Inc., Jubilant Life Sciences Ltd, Boehringer Ingelheim Group, Reciphlum AB, and Baxter Biopharma Solutions (Baxter International Inc.). These companies are actively investing in expanding their capabilities and capacities to meet the evolving needs of the pharmaceutical industry. Restraints to market growth include stringent regulatory hurdles, the need for significant capital investment in advanced manufacturing technologies, and potential supply chain disruptions. However, the continued focus on innovation, the pursuit of biologics manufacturing, and the increasing outsourcing trends are expected to outweigh these challenges, ensuring sustained market growth across the United States, Canada, and Mexico. The forecast period of 2025-2033 will likely see continued consolidation and strategic partnerships as companies strive to offer comprehensive end-to-end manufacturing solutions.

NA Pharmaceutical CMO Market Company Market Share

This comprehensive report delves into the dynamic North America Pharmaceutical Contract Manufacturing Organization (CMO) market, offering in-depth analysis and actionable insights for industry stakeholders. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market concentration, innovation, industry trends, dominant segments, product developments, key drivers, challenges, emerging opportunities, leading players, and strategic outlook.

NA Pharmaceutical CMO Market Market Concentration & Innovation

The North America Pharmaceutical CMO market is characterized by moderate to high concentration, with a significant share held by a few key players. Innovation is a critical differentiator, driven by advancements in complex drug modalities like biologics and high-potency APIs (HPAPIs). Regulatory frameworks, particularly stringent FDA guidelines, shape operational standards and investment in quality control. Product substitutes, while present in the form of in-house manufacturing capabilities, are increasingly less competitive against the specialized expertise and economies of scale offered by CMOs. End-user trends favor outsourcing for cost efficiency, speed to market, and access to specialized technologies. Mergers and acquisitions (M&A) remain a strategic imperative for market consolidation and capability expansion. Recent M&A activities have seen deal values ranging from hundreds of millions to billions of dollars, as companies seek to bolster their service offerings and geographical reach. For instance, strategic acquisitions in the areas of sterile injectables and advanced drug delivery systems are prominent.

NA Pharmaceutical CMO Market Industry Trends & Insights

The North America Pharmaceutical CMO market is poised for robust growth, driven by several interconnected trends. The increasing complexity of drug development, coupled with a growing pipeline of biologics and personalized medicines, necessitates specialized manufacturing capabilities that many pharmaceutical companies opt to outsource. This trend is amplified by the rising cost of drug research and development, pushing companies to focus on core competencies and leverage external expertise for manufacturing. Technological disruptions, such as the adoption of advanced analytics, artificial intelligence (AI) in process optimization, and continuous manufacturing technologies, are transforming the CMO landscape, enabling greater efficiency, quality, and flexibility. Consumer preferences for targeted therapies and novel drug delivery systems are also indirectly influencing CMO demand, as manufacturers seek partners capable of producing these specialized formulations.

Competitive dynamics are intensifying, with CMOs differentiating themselves through specialized services, integrated offerings (from development to commercialization), and robust quality and regulatory compliance. The growing emphasis on supply chain resilience, particularly post-pandemic, has also made reliable and geographically diverse CMO partners more attractive. Furthermore, the increasing prevalence of chronic diseases and an aging global population are fueling the demand for pharmaceuticals, creating a consistent need for manufacturing capacity. The market penetration of outsourcing services is expected to deepen as more pharmaceutical companies, including mid-sized and emerging biotech firms, recognize the strategic advantages of partnering with CMOs. The estimated Compound Annual Growth Rate (CAGR) for the North America Pharmaceutical CMO market is projected to be around XX% during the forecast period, reflecting sustained demand and industry expansion.

Dominant Markets & Segments in NA Pharmaceutical CMO Market

Within the North America Pharmaceutical CMO market, the Injectable Dose Formulation segment is projected to exhibit the most significant dominance, driven by the escalating demand for biologics, vaccines, and complex injectable therapeutics. The economic policies in North America, particularly favorable investment climates and government initiatives supporting pharmaceutical innovation and manufacturing, further bolster this segment's growth. Infrastructure advancements, including the development of state-of-the-art manufacturing facilities equipped with advanced aseptic processing capabilities, are crucial enablers.

The Active Pharmaceutical Ingredient (API) Manufacturing segment, specifically Large Molecule and High Potency API (HPAPI), is another area of considerable strength. The increasing complexity of biologics and the rise in targeted cancer therapies requiring HPAPIs have created substantial demand for specialized CMO expertise in these niches. Regulatory frameworks that encourage local manufacturing and supply chain security also contribute to the growth of domestic API production by CMOs.

The Solid Dose Formulation segment continues to be a significant contributor, given its widespread application across various therapeutic areas. However, its growth is relatively steadier compared to the more dynamic injectable and HPAPI segments. The Liquid Dose Formulation segment also maintains a steady presence, catering to specific dosage requirements and patient populations. Secondary Packaging services are integral to the entire supply chain, with demand closely tied to the overall output of finished dosage forms.

Key drivers for dominance in these segments include:

- Technological Advancements: Investment in advanced manufacturing technologies for biologics, sterile filling, and HPAPI containment.

- Regulatory Expertise: CMOs with proven track records in navigating complex FDA regulations for specific dosage forms and APIs.

- Capacity and Scale: Availability of large-scale manufacturing capacity to meet growing market demand.

- Specialized Capabilities: Expertise in handling highly potent compounds, sterile products, and complex biologics.

NA Pharmaceutical CMO Market Product Developments

Product developments in the North America Pharmaceutical CMO market are increasingly focused on enhancing manufacturing efficiency, ensuring product quality, and expanding service offerings. Innovations in continuous manufacturing processes, advanced analytical techniques for quality control, and specialized containment solutions for high-potency APIs are key technological trends. CMOs are also developing expertise in novel drug delivery systems and complex formulations, such as long-acting injectables and antibody-drug conjugates (ADCs), providing significant competitive advantages. This proactive approach to embracing cutting-edge technologies and specialized capabilities allows CMOs to meet the evolving needs of pharmaceutical clients and secure market share.

Report Scope & Segmentation Analysis

This report segments the North America Pharmaceutical CMO market by Service Type, encompassing Active Pharmaceutical Ingredient (API) manufacturing (further divided into Small Molecule, Large Molecule, and High Potency API (HPAPI)), Finished Dosage Form manufacturing (including Solid Dose Formulation, Liquid Dose Formulation, and Injectable Dose Formulation), and Secondary Packaging.

The API Manufacturing segment is expected to witness substantial growth, particularly for Large Molecules and HPAPIs, driven by the rising demand for biologics and targeted therapies. Market sizes in this segment are projected to reach billions of dollars, with significant contributions from specialized CMOs.

The Finished Dosage Form segment, especially Injectable Dose Formulation, is anticipated to exhibit the highest growth trajectory, reflecting the increasing pipeline of complex injectable drugs. Market penetration for outsourced sterile manufacturing is expected to deepen.

Secondary Packaging services, while a supporting segment, will experience consistent growth, closely mirroring the expansion of finished product manufacturing. Competitive dynamics across all segments are characterized by a focus on quality, regulatory compliance, and specialized capabilities.

Key Drivers of NA Pharmaceutical CMO Market Growth

The North America Pharmaceutical CMO market's growth is propelled by several key factors. The escalating costs and complexities associated with in-house drug manufacturing are compelling pharmaceutical companies to outsource. This allows them to focus on core research and development activities. The increasing pipeline of biologics, biosimilars, and highly potent APIs (HPAPIs) requires specialized manufacturing expertise and infrastructure that many companies lack, driving demand for CMOs with these capabilities. Advancements in manufacturing technologies, such as continuous manufacturing and single-use technologies, offer efficiency and flexibility, encouraging adoption by CMOs and subsequently by their clients. Furthermore, regulatory pressures and the increasing complexity of global pharmaceutical supply chains encourage companies to partner with experienced CMOs to ensure compliance and product integrity.

Challenges in the NA Pharmaceutical CMO Market Sector

Despite robust growth, the North America Pharmaceutical CMO market faces several challenges. Stringent and evolving regulatory landscapes, particularly from the FDA, necessitate significant investment in compliance and quality systems, potentially increasing operational costs. Supply chain disruptions, as witnessed in recent global events, can impact raw material availability and lead times, posing risks to production schedules. Intense competition among CMOs can lead to pricing pressures and a demand for highly differentiated services. The high capital investment required for advanced manufacturing technologies, such as those for biologics and HPAPIs, can be a barrier to entry for smaller CMOs. Moreover, the risk of intellectual property (IP) infringement and the need for robust data security measures are constant concerns for clients when outsourcing sensitive manufacturing processes.

Emerging Opportunities in NA Pharmaceutical CMO Market

The North America Pharmaceutical CMO market is ripe with emerging opportunities. The burgeoning field of cell and gene therapies presents a significant growth avenue, requiring specialized manufacturing capabilities for viral vectors and personalized treatments. The increasing demand for biosimilars, driven by patent expirations of blockbuster biologic drugs, creates opportunities for CMOs with expertise in large-molecule manufacturing. Furthermore, the growing trend of personalized medicine and advanced drug delivery systems, such as mRNA vaccines and targeted therapies, requires agile and innovative CMO partners. The expansion of the biologics pipeline, including monoclonal antibodies and therapeutic proteins, continues to fuel demand for specialized CMO services. CMOs that invest in and offer expertise in these cutting-edge areas are well-positioned for substantial growth.

Leading Players in the NA Pharmaceutical CMO Market Market

- Thermo Fisher Scientific Inc (Patheon Inc )

- Siegfried AG

- Aenova Group

- Lonza Group AG

- Pfizer CentreSource (Pfizer Inc )

- AbbVie Inc

- Jubilant Life Sciences Ltd

- Catalent Inc

- Boehringer Ingelheim Group

- Recipharm AB

- Baxter Biopharma Solutions (Baxter International Inc )

Key Developments in NA Pharmaceutical CMO Market Industry

- 2023: Thermo Fisher Scientific Inc. expanded its sterile drug product manufacturing capabilities with significant investments in its Patheon sites.

- 2023: Lonza Group AG announced strategic partnerships to bolster its mRNA manufacturing services.

- 2022: Catalent Inc. acquired a new facility to enhance its biologics drug substance manufacturing capacity.

- 2022: Pfizer CentreSource (Pfizer Inc ) invested in expanding its high-potency API (HPAPI) development and manufacturing services.

- 2021: Recipharm AB acquired a specialized sterile injectable manufacturing facility to broaden its European and North American footprint.

Strategic Outlook for NA Pharmaceutical CMO Market Market

The strategic outlook for the North America Pharmaceutical CMO market is overwhelmingly positive, driven by persistent trends in pharmaceutical outsourcing and the increasing complexity of drug development. Key growth catalysts include the unwavering demand for biologics and specialized APIs, the rapid advancement of novel therapeutic modalities like cell and gene therapies, and the continued pursuit of operational efficiency and speed to market by pharmaceutical innovators. CMOs that proactively invest in advanced technologies, expand their capacity for complex manufacturing, and maintain an impeccable track record in regulatory compliance will be best positioned to capitalize on future market potential. Strategic partnerships, targeted acquisitions, and a focus on providing integrated, end-to-end services will be critical for sustained success and market leadership.

NA Pharmaceutical CMO Market Segmentation

-

1. Service Type

-

1.1. Active P

- 1.1.1. Small Molecule

- 1.1.2. Large Molecule

- 1.1.3. High Potency API (HPAPI)

-

1.2. Finished

- 1.2.1. Solid Dose Formulation

- 1.2.2. Liquid Dose Formulation

- 1.2.3. Injectable Dose Formulation

- 1.3. Secondary Packaging

-

1.1. Active P

NA Pharmaceutical CMO Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

NA Pharmaceutical CMO Market Regional Market Share

Geographic Coverage of NA Pharmaceutical CMO Market

NA Pharmaceutical CMO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing emphasis on drug discovery and outsourcing of manufacturing; Strong R&D Investments

- 3.3. Market Restrains

- 3.3.1. Increasing Lead Time and Logistics Costs; Stringent Regulatory Requirements; Capacity Utilization Issues Affecting the Profitability of CMOs

- 3.4. Market Trends

- 3.4.1. Finished Dosage Formulation (FDF) Development and Manufacturing is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global NA Pharmaceutical CMO Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Active P

- 5.1.1.1. Small Molecule

- 5.1.1.2. Large Molecule

- 5.1.1.3. High Potency API (HPAPI)

- 5.1.2. Finished

- 5.1.2.1. Solid Dose Formulation

- 5.1.2.2. Liquid Dose Formulation

- 5.1.2.3. Injectable Dose Formulation

- 5.1.3. Secondary Packaging

- 5.1.1. Active P

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Thermo Fisher Scientific Inc (Patheon Inc )

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Siegfried AG*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aenova Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lonza Group AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pfizer CentreSource (Pfizer Inc )

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AbbVie Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jubilant Life Sciences Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Catalent Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Boehringer Ingelheim Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Recipharm AB

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Baxter Biopharma Solutions (Baxter International Inc )

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Thermo Fisher Scientific Inc (Patheon Inc )

List of Figures

- Figure 1: Global NA Pharmaceutical CMO Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America NA Pharmaceutical CMO Market Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America NA Pharmaceutical CMO Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America NA Pharmaceutical CMO Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America NA Pharmaceutical CMO Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global NA Pharmaceutical CMO Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global NA Pharmaceutical CMO Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global NA Pharmaceutical CMO Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Global NA Pharmaceutical CMO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States NA Pharmaceutical CMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada NA Pharmaceutical CMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico NA Pharmaceutical CMO Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the NA Pharmaceutical CMO Market?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the NA Pharmaceutical CMO Market?

Key companies in the market include Thermo Fisher Scientific Inc (Patheon Inc ), Siegfried AG*List Not Exhaustive, Aenova Group, Lonza Group AG, Pfizer CentreSource (Pfizer Inc ), AbbVie Inc, Jubilant Life Sciences Ltd, Catalent Inc, Boehringer Ingelheim Group, Recipharm AB, Baxter Biopharma Solutions (Baxter International Inc ).

3. What are the main segments of the NA Pharmaceutical CMO Market?

The market segments include Service Type .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing emphasis on drug discovery and outsourcing of manufacturing; Strong R&D Investments.

6. What are the notable trends driving market growth?

Finished Dosage Formulation (FDF) Development and Manufacturing is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Increasing Lead Time and Logistics Costs; Stringent Regulatory Requirements; Capacity Utilization Issues Affecting the Profitability of CMOs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "NA Pharmaceutical CMO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the NA Pharmaceutical CMO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the NA Pharmaceutical CMO Market?

To stay informed about further developments, trends, and reports in the NA Pharmaceutical CMO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence