Key Insights

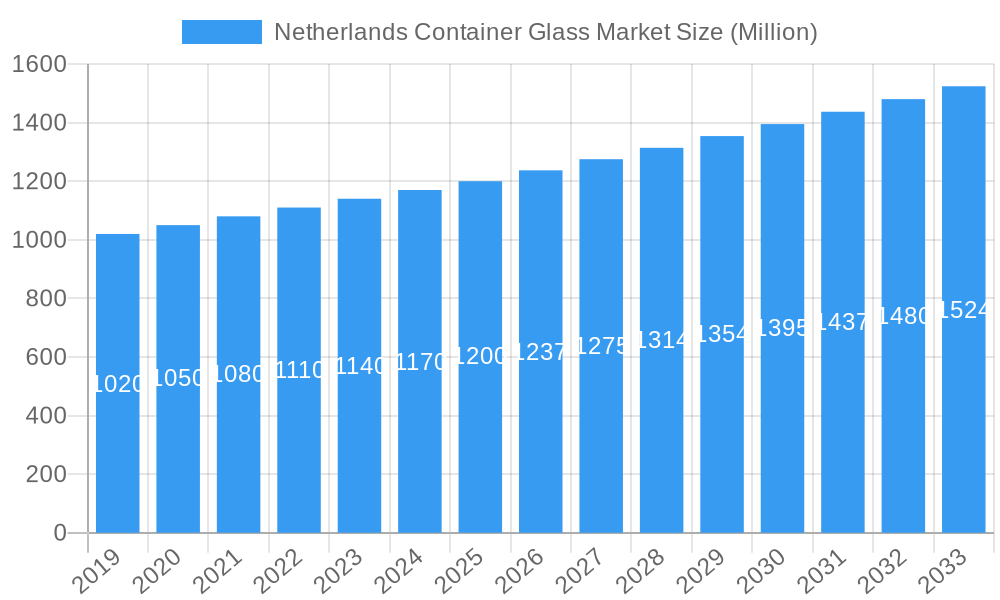

The Netherlands container glass market is forecast to reach 67.86 billion by 2024, expanding at a Compound Annual Growth Rate (CAGR) of 5.15% through 2033. This growth is driven by robust demand from the beverage sector, encompassing both alcoholic and non-alcoholic drinks, and increasing consumer preference for premium, sustainable packaging. Key factors include the beverage industry's focus on product differentiation and the eco-friendly, infinitely recyclable nature of glass. The food industry also contributes significantly due to the need for safe, inert, and aesthetically pleasing packaging.

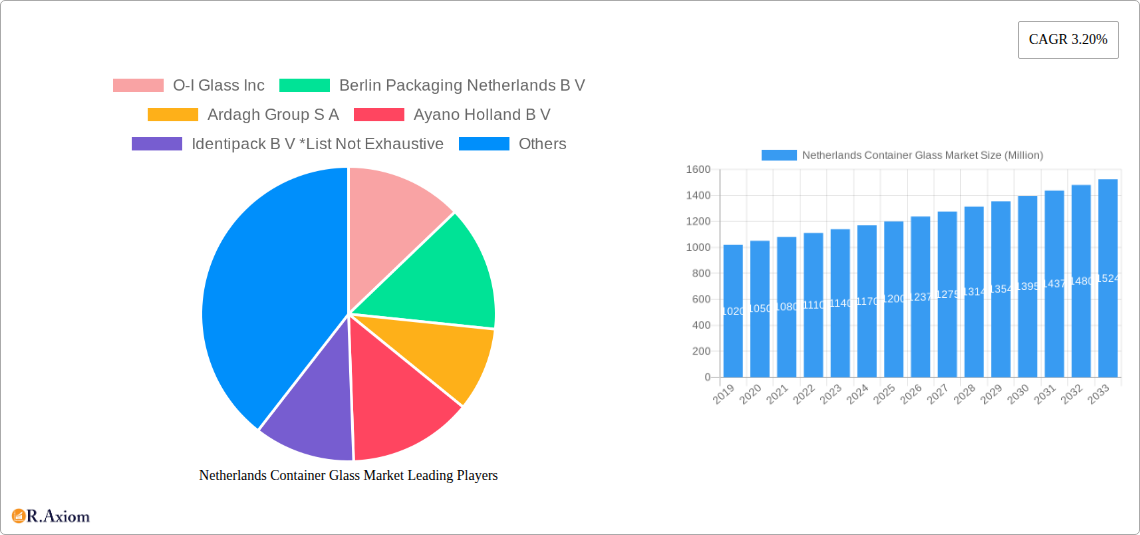

Netherlands Container Glass Market Market Size (In Billion)

While the market shows positive momentum, it faces restraints from rising raw material costs and intense competition from alternative packaging materials such as plastic and metal. However, advancements in glass manufacturing, resulting in lighter, stronger containers and innovative designs, are mitigating these challenges. The cosmetics and pharmaceutical sectors further support market growth by utilizing glass's inert properties and premium appeal for high-value products. Leading companies like O-I Glass Inc. and Ardagh Group S.A. are actively shaping the market through innovation and strategic expansion.

Netherlands Container Glass Market Company Market Share

This comprehensive report offers a detailed analysis of the Netherlands container glass market, covering the period from 2019 to 2033. It incorporates historical data from 2019 to 2024, with 2024 as the base year. Utilizing high-traffic keywords such as "container glass Netherlands," "glass packaging market," "sustainable packaging solutions," "beverage bottles," "food jars," and "cosmetic glass packaging," the report enhances search visibility. Actionable insights are delivered through clear paragraphs and bullet points, providing a thorough overview for manufacturers, suppliers, investors, and end-users.

Netherlands Container Glass Market Market Concentration & Innovation

The Netherlands container glass market exhibits a moderate level of concentration, with a few dominant players holding significant market share. Key companies actively shaping this landscape include O-I Glass Inc., Berlin Packaging Netherlands B.V., Ardagh Group S.A., Ayano Holland B.V., and Identipack B.V., though this list is not exhaustive. Innovation is primarily driven by the increasing demand for sustainable and eco-friendly packaging solutions, advancements in glass manufacturing technologies, and the desire for premium, brand-enhancing packaging. Regulatory frameworks in the Netherlands, such as those promoting recycling and reducing single-use plastics, further influence innovation. Product substitutes, including plastic and metal packaging, pose a constant challenge, but the unique benefits of glass – its inertness, recyclability, and perceived premium quality – continue to drive demand. End-user trends are shifting towards aesthetically pleasing and environmentally conscious packaging. Mergers and acquisitions (M&A) activities, while not extensively detailed in public domain for this specific market, are likely to play a role in consolidating market share and expanding capabilities. For instance, a significant M&A event could involve a major player acquiring a smaller, innovative company to gain access to new technologies or customer bases, potentially impacting market share by several percentage points.

Netherlands Container Glass Market Industry Trends & Insights

The Netherlands container glass market is on a robust growth trajectory, driven by a confluence of evolving consumer preferences, stringent environmental regulations, and technological advancements. The projected Compound Annual Growth Rate (CAGR) for the forecast period is estimated at xx%, reflecting a steady increase in demand for glass packaging solutions. Market penetration of sustainable packaging alternatives is steadily rising, with glass increasingly favored for its inherent recyclability and inert properties, making it ideal for preserving product integrity, particularly in the food and beverage sectors. Technological disruptions are at the forefront, with manufacturers investing in energy-efficient production methods, lightweighting techniques for reduced material consumption, and decorative technologies to enhance brand appeal. Consumer preferences are increasingly leaning towards premium, aesthetically pleasing, and environmentally responsible packaging. This trend is particularly evident in the alcoholic beverage, cosmetics, and gourmet food segments, where glass packaging contributes significantly to brand perception and perceived quality. Competitive dynamics are characterized by a focus on operational efficiency, product customization, and sustainable sourcing. Companies are actively seeking to differentiate themselves through innovative designs, improved functionality, and a reduced environmental footprint. The growing emphasis on circular economy principles is fostering collaborations across the value chain, from glass manufacturers to recyclers and end-users, aiming to enhance collection and recycling rates, thereby reinforcing the sustainability credentials of container glass. The market is expected to witness substantial growth in the coming years as these trends continue to shape consumer choices and industry practices.

Dominant Markets & Segments in Netherlands Container Glass Market

The Beverage end-user industry stands out as the dominant segment within the Netherlands container glass market. This dominance is fueled by a strong and growing demand for both alcoholic and non-alcoholic beverages, where glass packaging is often the preferred choice for premiumization, preservation, and perceived quality.

Beverage (Alcoholic & Non-Alcoholic): This segment accounts for a significant share of the market, estimated at over xx% of the total market volume.

- Key Drivers:

- Consumer Preference for Premiumization: Glass bottles are intrinsically linked with premium alcoholic beverages like wine, spirits, and craft beers, as well as high-quality non-alcoholic options like artisanal juices and sparkling waters.

- Health and Safety Concerns: The inert nature of glass ensures no leaching of chemicals into beverages, a critical factor for health-conscious consumers.

- Recyclability and Sustainability: Glass is infinitely recyclable without loss of quality, aligning with the growing demand for eco-friendly packaging.

- Brand Image and Aesthetics: Glass packaging offers superior visual appeal and tactile experience, enhancing brand perception and shelf presence.

- Technological Advancements: Innovations in bottle design and lightweighting are making glass packaging more competitive and efficient.

- Economic Policies: Supportive government policies promoting recycling and sustainable packaging further bolster the use of glass in this sector.

- Dominance Analysis: The strong cultural association of certain beverages with glass containers, coupled with ongoing trends towards healthier lifestyles and a growing disposable income among consumers, directly translates into increased demand for glass bottles and jars. The alcoholic beverage sector, in particular, relies heavily on glass for its traditional appeal and the perception of superior quality. Non-alcoholic beverages, especially premium juices and functional drinks, are also increasingly adopting glass to convey health and naturalness. The market penetration of glass in these sub-segments remains high and is expected to grow as consumers prioritize quality and sustainability.

- Key Drivers:

Food: The food segment represents another substantial market for container glass, encompassing a wide array of products from jams and preserves to sauces, baby food, and gourmet ingredients.

- Key Drivers:

- Preservation and Shelf Life: Glass jars are excellent for preserving the freshness and extending the shelf life of food products without the need for artificial preservatives.

- Consumer Trust: The transparency of glass allows consumers to see the product, fostering trust and confidence in its quality and freshness.

- Aesthetic Appeal: Glass packaging is favored for visually appealing food products, enhancing their marketability.

- Growth in Specialty and Organic Foods: The burgeoning market for specialty, organic, and artisanal food products often opts for glass packaging to communicate premium quality and naturalness.

- Dominance Analysis: The food industry's reliance on glass for its inertness and transparency is a fundamental driver. The growing trend of home cooking and the demand for convenient yet healthy food options further contribute to the market's strength. Economic policies supporting local produce and food safety standards indirectly benefit glass packaging.

- Key Drivers:

Cosmetics: While a smaller segment compared to beverages and food, the cosmetics industry increasingly utilizes glass for its premium appeal and perceived purity.

- Key Drivers:

- Luxury and Premium Branding: Glass bottles and jars are synonymous with high-end cosmetics and skincare products, conveying exclusivity and quality.

- Product Stability: Glass protects cosmetic formulations from UV light and chemical reactions, ensuring product integrity.

- Recyclability: As sustainability becomes a key consideration in the beauty industry, glass offers a more environmentally friendly packaging option.

- Dominance Analysis: The cosmetics sector leverages glass for its aesthetic and tactile qualities, essential for luxury branding. As the industry pivots towards more sustainable practices, glass is gaining traction as a preferred material.

- Key Drivers:

Pharmaceuticals: Glass holds a critical role in the pharmaceutical industry due to its inertness and impermeability, ensuring the stability and safety of medications.

- Key Drivers:

- Chemical Inertness: Glass does not react with pharmaceutical compounds, preventing contamination and degradation.

- Barrier Properties: Glass provides an excellent barrier against moisture, gases, and other contaminants.

- Sterilization: Glass containers can be easily sterilized, crucial for pharmaceutical applications.

- Dominance Analysis: The stringent requirements for drug safety and efficacy make glass an indispensable material in pharmaceutical packaging, particularly for high-value or sensitive medications.

- Key Drivers:

Other End-user Industries: This category may include niche applications such as lighting, home décor, and specialty industrial products where glass packaging offers unique benefits in terms of durability, aesthetics, or chemical resistance.

Netherlands Container Glass Market Product Developments

Product development in the Netherlands container glass market is increasingly focused on enhancing sustainability and functionality. Innovations include the development of lighter-weight glass bottles and jars to reduce material usage and transportation emissions, contributing to a lower carbon footprint. Advanced coating technologies are being employed to improve scratch resistance and impact strength, thereby reducing breakage during transit and handling. Furthermore, there's a growing trend towards customizable designs and decorative finishes, allowing brands to create unique packaging that stands out on the shelf and reinforces their brand identity. The integration of recycled glass (cullet) in manufacturing processes is a key development, significantly reducing energy consumption and raw material dependency. These developments offer competitive advantages by meeting evolving consumer demands for eco-friendly and aesthetically pleasing packaging.

Report Scope & Segmentation Analysis

This report segments the Netherlands container glass market by End-user Industry: Beverage (Alcoholic, Non-Alcoholic), Food, Cosmetics, and Pharmaceuticals.

Beverage (Alcoholic, Non-Alcoholic): This segment is projected to witness a CAGR of xx% during the forecast period, driven by rising demand for premium alcoholic beverages and healthy non-alcoholic options. Market size is estimated to reach xx Million by 2033.

Food: The food segment is anticipated to grow at a CAGR of xx%, supported by the increasing consumption of packaged foods, specialty items, and the preference for glass for its preservation qualities. Projected market size is xx Million by 2033.

Cosmetics: Expected to grow at a CAGR of xx%, this segment is driven by the premiumization trend in beauty products and a growing emphasis on sustainable packaging. Market size is forecast to reach xx Million by 2033.

Pharmaceuticals: This segment is expected to expand at a CAGR of xx%, attributed to the critical need for inert and safe packaging for medicines and healthcare products. Projected market size is xx Million by 2033.

Key Drivers of Netherlands Container Glass Market Growth

The Netherlands container glass market is propelled by several key drivers:

- Growing Consumer Preference for Sustainable Packaging: An increasing awareness and demand for eco-friendly packaging solutions strongly favor glass due to its infinite recyclability and lower environmental impact compared to some alternatives.

- Premiumization Trends in Food and Beverages: Consumers are increasingly willing to pay more for products packaged in glass, associating it with higher quality, better taste, and a superior brand experience.

- Health and Safety Concerns: The inert nature of glass, preventing chemical leaching into products, is a significant factor, especially in the food, beverage, and pharmaceutical sectors.

- Technological Advancements in Manufacturing: Innovations leading to lightweight glass, reduced energy consumption in production, and enhanced design capabilities are making glass more cost-effective and versatile.

- Supportive Regulatory Frameworks: Government initiatives promoting recycling, waste reduction, and the circular economy indirectly benefit the container glass industry.

Challenges in the Netherlands Container Glass Market Sector

Despite its strengths, the Netherlands container glass market faces several challenges:

- Competition from Alternative Packaging Materials: Plastic, metal, and other novel packaging materials offer competitive pricing and convenience, posing a significant challenge to glass.

- Energy-Intensive Production: The manufacturing of glass is energy-intensive, leading to higher production costs and environmental concerns related to carbon emissions, although advancements are mitigating this.

- Logistical Costs and Fragility: The inherent weight and fragility of glass can lead to higher transportation costs and a greater risk of breakage throughout the supply chain.

- Recycling Infrastructure and Contamination: While highly recyclable, the effectiveness of the recycling process depends on efficient collection systems and minimizing contamination of the glass stream.

Emerging Opportunities in Netherlands Container Glass Market

The Netherlands container glass market presents several promising opportunities:

- Growth in Sustainable and Circular Economy Initiatives: Further integration into circular economy models, including advanced recycling technologies and refillable glass systems, offers significant growth potential.

- Expansion in Niche and Premium Markets: Capitalizing on the demand for artisanal foods, craft beverages, and high-end cosmetics where glass packaging is a key differentiator.

- Development of Smart Packaging Solutions: Incorporating features like traceability or temperature indication within glass packaging to add value for consumers and manufacturers.

- Focus on Lightweighting and Eco-Design: Continued innovation in reducing glass weight and optimizing designs will enhance cost-competitiveness and environmental appeal.

Leading Players in the Netherlands Container Glass Market Market

- O-I Glass Inc.

- Berlin Packaging Netherlands B.V.

- Ardagh Group S.A.

- Ayano Holland B.V.

- Identipack B.V.

Key Developments in Netherlands Container Glass Market Industry

- July 2022: O-I Glass, Inc. announced plans to construct a new greenfield glass plant in Bowling Green, Kentucky. This expansion is in response to growing consumer demand for healthy, recyclable, and sustainable food and beverage packaging. The company aims to increase its capacity to provide customers with brand-building premium glass containers. Over time, O-I Glass intends to invest up to USD 240 million in multiple expansion waves.

Strategic Outlook for Netherlands Container Glass Market Market

The strategic outlook for the Netherlands container glass market is positive, driven by the enduring appeal of glass as a premium, sustainable, and safe packaging material. Growth catalysts include the increasing consumer demand for environmentally friendly products, the rising trend of premiumization across various consumer goods sectors, and ongoing technological innovations in glass manufacturing and design. The market is expected to benefit from supportive government policies promoting circular economy principles and waste reduction. Strategic focus will likely remain on enhancing production efficiency, expanding the use of recycled content, and developing innovative packaging solutions that cater to evolving consumer preferences for aesthetics, functionality, and sustainability. Investments in advanced recycling technologies and the exploration of new applications for glass packaging will be crucial for sustained growth and market leadership.

Netherlands Container Glass Market Segmentation

-

1. End-user Industry

-

1.1. Beverage

- 1.1.1. Alcoholic

- 1.1.2. Non-Alcoholic

- 1.2. Food

- 1.3. Cosmetics

- 1.4. Pharmaceuticals

- 1.5. Other End-user Industries

-

1.1. Beverage

Netherlands Container Glass Market Segmentation By Geography

- 1. Netherlands

Netherlands Container Glass Market Regional Market Share

Geographic Coverage of Netherlands Container Glass Market

Netherlands Container Glass Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Shift Toward Sustainable Packaging; Increasing Demand from the Food and Beverage Market

- 3.3. Market Restrains

- 3.3.1. Environmental Risks Associated with Container Glass Manufacturing

- 3.4. Market Trends

- 3.4.1. Pharmaceutical Industry to Create Demand During Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Container Glass Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Beverage

- 5.1.1.1. Alcoholic

- 5.1.1.2. Non-Alcoholic

- 5.1.2. Food

- 5.1.3. Cosmetics

- 5.1.4. Pharmaceuticals

- 5.1.5. Other End-user Industries

- 5.1.1. Beverage

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 O-I Glass Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Berlin Packaging Netherlands B V

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ardagh Group S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ayano Holland B V

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Identipack B V *List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 O-I Glass Inc

List of Figures

- Figure 1: Netherlands Container Glass Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Netherlands Container Glass Market Share (%) by Company 2025

List of Tables

- Table 1: Netherlands Container Glass Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 2: Netherlands Container Glass Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Netherlands Container Glass Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Netherlands Container Glass Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Container Glass Market?

The projected CAGR is approximately 5.15%.

2. Which companies are prominent players in the Netherlands Container Glass Market?

Key companies in the market include O-I Glass Inc, Berlin Packaging Netherlands B V, Ardagh Group S A, Ayano Holland B V, Identipack B V *List Not Exhaustive.

3. What are the main segments of the Netherlands Container Glass Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 67.86 billion as of 2022.

5. What are some drivers contributing to market growth?

Rapid Shift Toward Sustainable Packaging; Increasing Demand from the Food and Beverage Market.

6. What are the notable trends driving market growth?

Pharmaceutical Industry to Create Demand During Forecast Period.

7. Are there any restraints impacting market growth?

Environmental Risks Associated with Container Glass Manufacturing.

8. Can you provide examples of recent developments in the market?

July 2022 - O-I Glass, Inc. plans to construct a new greenfield glass plant in Bowling Green, Kentucky. In response to growing consumer demand for healthy, recyclable, and sustainable food and beverage packaging, the company is expanding its capacity to provide its customers with brand-building premium glass containers. Over time, the company intends to invest up to USD 240 million in multiple expansion waves.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Container Glass Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Container Glass Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Container Glass Market?

To stay informed about further developments, trends, and reports in the Netherlands Container Glass Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence