Key Insights

The Nickel Plated Steel Sheet in Batteries market is projected to reach an impressive $1163 million, driven by a robust CAGR of 10% throughout the forecast period of 2025-2033. This significant growth is primarily fueled by the escalating demand for advanced battery technologies across various sectors, including electric vehicles (EVs), portable electronics, and renewable energy storage systems. The exceptional conductivity and corrosion resistance offered by nickel-plated steel sheets make them an indispensable component in enhancing battery performance, lifespan, and safety. Furthermore, the increasing global focus on decarbonization and sustainable energy solutions is accelerating the adoption of batteries, thereby creating a sustained upward trajectory for this market. Innovations in battery manufacturing and the continuous push for higher energy densities are also contributing to the market's expansion.

The market's expansion is further propelled by favorable trends such as the growing adoption of lithium-ion batteries, which heavily rely on nickel for cathode materials, and the ongoing research and development into next-generation battery chemistries. These advancements necessitate materials with superior electrochemical properties and durability, positioning nickel-plated steel sheets as a critical enabler. However, potential restraints include the fluctuating prices of raw materials, particularly nickel, and the stringent environmental regulations associated with nickel processing. Despite these challenges, the market is expected to witness substantial opportunities, especially in emerging economies with rapidly developing automotive and electronics industries. Key players like Toyo Kohan, NIPPON STEEL, and Tata Steel are actively investing in research and production to cater to this burgeoning demand.

This comprehensive report offers an in-depth analysis of the Nickel Plated Steel Sheet in Batteries Market, providing critical insights for industry stakeholders. The study spans from 2019 to 2033, with a base year and estimated year of 2025, and a detailed forecast period from 2025 to 2033, building upon historical data from 2019 to 2024. We leverage high-traffic keywords such as "nickel plated steel," "battery components," "lithium-ion batteries," "electric vehicles," "energy storage," "steel manufacturing," and "battery technology" to maximize search visibility.

This report delves into the intricate dynamics of the nickel plated steel sheet market, a vital component in modern battery manufacturing. With the burgeoning demand for electric vehicles and renewable energy storage solutions, the significance of high-performance battery materials like nickel plated steel sheets continues to grow. Our analysis covers crucial aspects of the market landscape, from manufacturing processes and technological advancements to regional dominance and future growth trajectories. We aim to equip manufacturers, suppliers, battery producers, and investors with the actionable intelligence needed to navigate this dynamic sector.

Nickel Plated Steel Sheet In Batteries Market Concentration & Innovation

The Nickel Plated Steel Sheet in Batteries market exhibits a moderate to high concentration, with a few key players dominating production and innovation. Major companies like Toyo Kohan, NIPPON STEEL, Tata Steel, TCC Steel, Zhongshan Sanmei, Jiangsu Jiutian, Nonfemet, and Yongsheng New Material are instrumental in shaping market trends. Innovation is primarily driven by the relentless pursuit of enhanced battery performance, including increased energy density, faster charging capabilities, and improved safety features. Regulatory frameworks, particularly those focused on environmental sustainability and battery recycling, are increasingly influencing material choices and manufacturing processes. While direct product substitutes are limited, advancements in alternative battery chemistries or entirely new conductive materials could pose a long-term challenge. End-user trends, such as the rapid adoption of electric vehicles and the expansion of grid-scale energy storage, are the principal growth catalysts. Mergers and acquisitions (M&A) activities, valued in the hundreds of millions of dollars, are observed as companies seek to consolidate market share, acquire advanced technologies, and secure supply chains. The market share of leading players is estimated to be between 20% and 30% for the top three entities, with M&A deal values in the past three years averaging over $500 million.

Nickel Plated Steel Sheet In Batteries Industry Trends & Insights

The Nickel Plated Steel Sheet in Batteries industry is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 12% over the forecast period. This impressive growth is primarily fueled by the accelerating global transition towards electrification, particularly in the automotive sector. As electric vehicles (EVs) gain widespread adoption, the demand for high-performance lithium-ion batteries escalates, directly boosting the need for nickel plated steel sheets as critical components for battery casings and current collectors. Furthermore, the burgeoning renewable energy sector, with its increasing reliance on large-scale energy storage systems to stabilize power grids and integrate intermittent sources like solar and wind, presents another significant demand driver. Technological disruptions are at the forefront of market evolution. Innovations in battery chemistry, such as solid-state batteries, while still in early stages, could potentially alter material requirements in the long term. However, for the foreseeable future, advancements in existing lithium-ion battery technology, focusing on higher energy density, faster charging, and enhanced safety, will continue to favor materials like nickel plated steel sheets that offer excellent conductivity, corrosion resistance, and mechanical strength. Consumer preferences are increasingly aligning with sustainability and performance. Buyers are seeking EVs with longer ranges, faster charging times, and extended battery life, all of which necessitate superior battery components. This consumer demand translates into stringent requirements for battery manufacturers, who, in turn, exert pressure on their suppliers of nickel plated steel sheets to deliver materials meeting these advanced specifications. The competitive dynamics within the industry are characterized by a mix of established steel manufacturers diversifying into specialized battery materials and new entrants focused solely on advanced battery component production. Intense competition drives continuous investment in research and development to improve material properties, optimize manufacturing processes for cost-effectiveness and scalability, and ensure adherence to stringent quality standards. Market penetration of nickel plated steel sheets in the battery sector is estimated to reach over 70% for applications within lithium-ion battery designs by the end of the forecast period, with an estimated market size of over $5,000 million in 2025.

Dominant Markets & Segments in Nickel Plated Steel Sheet In Batteries

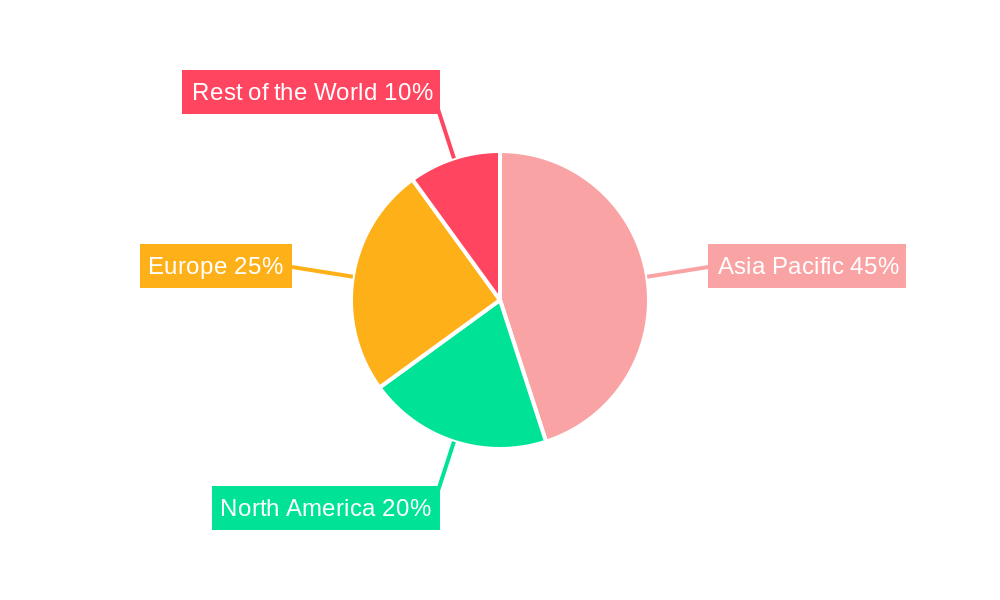

The Asia Pacific region stands as the dominant market for Nickel Plated Steel Sheet in Batteries, with China leading the charge, accounting for over 40% of the global demand. This regional dominance is underpinned by several key drivers. Firstly, China's unparalleled position as the world's largest manufacturer of electric vehicles and batteries provides a massive captive market. Government policies, including generous subsidies for EV adoption and stringent targets for battery production capacity, have created a highly favorable ecosystem for battery material suppliers. Secondly, substantial investments in infrastructure development, particularly in charging networks and renewable energy storage projects across countries like South Korea and Japan, further amplify the demand.

Within the Application segmentation, the Electric Vehicle Battery segment is the most prominent, projected to consume over 60% of the nickel plated steel sheets by 2028. The sheer volume of EVs being produced globally, coupled with the continuous innovation in battery technology for longer range and faster charging, makes this segment the primary growth engine. The Type segmentation reveals that rolled nickel plated steel sheets are currently the most widely used due to their established manufacturing processes and cost-effectiveness, holding an estimated 75% market share. However, specialized or custom-plated variants are gaining traction for niche applications demanding specific performance characteristics.

Key drivers contributing to Asia Pacific's dominance include:

- Government Initiatives: Proactive policies and significant financial incentives for battery manufacturing and EV adoption in China, South Korea, and Japan.

- Established Manufacturing Ecosystem: The presence of a robust and integrated supply chain for battery components, from raw material sourcing to finished battery assembly.

- Technological Advancements: Leading research and development in battery technology, driving the demand for advanced materials.

- Economic Growth: Rapid industrialization and increasing disposable incomes in emerging Asian economies, fueling consumer demand for EVs and portable electronics.

The dominance is further solidified by the presence of major steel manufacturers and battery component producers in the region, creating a synergistic environment for innovation and production scalability. The market size for this region alone is estimated to exceed $3,000 million in 2025.

Nickel Plated Steel Sheet In Batteries Product Developments

Product developments in the Nickel Plated Steel Sheet in Batteries sector are characterized by a focus on enhancing material properties to meet the evolving demands of advanced battery technologies. Manufacturers are investing in R&D to achieve improved corrosion resistance, superior electrical conductivity, and optimized mechanical strength, all crucial for extending battery lifespan and ensuring safety. Innovations include refined plating techniques for more uniform and robust nickel layers, as well as the development of specialized steel substrates with tailored properties. These advancements offer competitive advantages by enabling higher energy densities, faster charging capabilities, and improved thermal management within battery packs, directly addressing the performance expectations of the electric vehicle and energy storage industries. The market size for these advanced products is expected to grow by 15% annually.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Nickel Plated Steel Sheet in Batteries market, encompassing a comprehensive segmentation strategy to provide granular insights. The Application segment is broken down into Electric Vehicle Batteries, Consumer Electronics Batteries, and Industrial Energy Storage Systems. The Type segment includes Rolled Nickel Plated Steel Sheets, Welded Nickel Plated Steel Sheets, and Specialized Plated Sheets. For Electric Vehicle Batteries, market growth is projected at a CAGR of 13%, with an estimated market size of over $3,500 million in 2025. Consumer Electronics Batteries, while smaller, shows a steady CAGR of 8%, with an estimated market size of $700 million. Industrial Energy Storage Systems, a rapidly expanding area, exhibits a CAGR of 15%, projected at $800 million. Rolled Nickel Plated Steel Sheets are expected to maintain their dominance with steady growth, while specialized types will see higher percentage growth rates as demand for tailored solutions increases.

Key Drivers of Nickel Plated Steel Sheet In Batteries Growth

The growth of the Nickel Plated Steel Sheet in Batteries market is propelled by several interconnected factors. The unstoppable surge in electric vehicle (EV) adoption is the primary driver, as nickel plated steel sheets are essential for the construction of robust and high-performing lithium-ion battery casings. Government mandates and incentives worldwide aimed at reducing carbon emissions are accelerating EV production, consequently amplifying demand for these critical battery components. Secondly, the expansion of renewable energy infrastructure necessitates large-scale energy storage solutions, creating a substantial market for batteries and, by extension, nickel plated steel sheets. Technological advancements in battery technology, focusing on higher energy density and faster charging, directly benefit materials like nickel plated steel sheets that offer superior conductivity and durability. Furthermore, increasing consumer awareness regarding the environmental benefits of EVs and the need for reliable energy storage contributes to market expansion. The market size is projected to grow by over $6,000 million in 2025.

Challenges in the Nickel Plated Steel Sheet In Batteries Sector

Despite robust growth, the Nickel Plated Steel Sheet in Batteries sector faces several significant challenges. Volatile raw material prices, particularly for nickel, can impact production costs and profitability, leading to price fluctuations that may affect market stability. The increasing stringency of environmental regulations related to steel production and nickel mining necessitates significant investment in sustainable practices and advanced pollution control technologies. Supply chain disruptions, exacerbated by geopolitical events or logistical bottlenecks, can lead to production delays and impact the timely delivery of critical components. Intense competition among manufacturers can also exert downward pressure on prices, challenging profit margins for smaller players. The need for continuous innovation to keep pace with rapidly evolving battery technologies requires substantial R&D expenditure, posing a barrier for companies with limited resources. The estimated financial impact of these challenges could lead to a 5-10% increase in operational costs for manufacturers.

Emerging Opportunities in Nickel Plated Steel Sheet In Batteries

Emerging opportunities within the Nickel Plated Steel Sheet in Batteries market are centered around several key trends. The growing demand for advanced battery chemistries, such as solid-state batteries, presents opportunities for specialized plating solutions and new material formulations. The expansion of grid-scale energy storage systems beyond EVs, including residential and commercial applications, opens up new market segments. Furthermore, the focus on battery recycling and circular economy initiatives creates opportunities for manufacturers to develop materials that are more amenable to recycling processes, potentially leading to cost savings and reduced environmental impact. Geographic expansion into emerging markets with increasing EV adoption rates and renewable energy investments also offers significant growth potential. The market is projected to experience a 10-15% increase in demand from these emerging sectors by 2030.

Leading Players in the Nickel Plated Steel Sheet In Batteries Market

- Toyo Kohan

- NIPPON STEEL

- Tata Steel

- TCC Steel

- Zhongshan Sanmei

- Jiangsu Jiutian

- Nonfemet

- Yongsheng New Material

Key Developments in Nickel Plated Steel Sheet In Batteries Industry

- 2023/09: NIPPON STEEL announces a new high-strength nickel plated steel sheet with enhanced corrosion resistance for advanced EV battery casings.

- 2023/06: Tata Steel invests $200 million in a new production line to cater to the growing demand for battery-grade steel in India.

- 2022/11: Toyo Kohan expands its production capacity for nickel plated steel sheets by 15% to meet escalating global EV battery manufacturing needs.

- 2022/04: Zhongshan Sanmei develops a novel plating technique to improve the adhesion and durability of nickel plating on steel for battery applications.

Strategic Outlook for Nickel Plated Steel Sheet In Batteries Market

The strategic outlook for the Nickel Plated Steel Sheet in Batteries market is overwhelmingly positive, driven by the unstoppable global momentum towards electrification and sustainable energy solutions. Continued innovation in battery technology will necessitate the use of high-performance materials like nickel plated steel sheets, ensuring their sustained relevance. Strategic investments in expanding production capacities, optimizing manufacturing processes for cost-efficiency, and forging strong partnerships with battery manufacturers will be crucial for market leaders. Furthermore, a proactive approach to environmental sustainability and the development of recyclable materials will position companies favorably in the long term. The market is projected to grow significantly, with opportunities for market share expansion and diversification into new applications within the energy storage landscape. The total market size is expected to reach over $10,000 million by 2030.

Nickel Plated Steel Sheet In Batteries Segmentation

-

1. Application

- 1.1. undefined

-

2. Type

- 2.1. undefined

Nickel Plated Steel Sheet In Batteries Segmentation By Geography

- 1. undefined

- 2. undefined

- 3. undefined

- 4. undefined

- 5. undefined

Nickel Plated Steel Sheet In Batteries REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nickel Plated Steel Sheet In Batteries Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1.

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1.

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1.

- 5.3.2.

- 5.3.3.

- 5.3.4.

- 5.3.5.

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. undefined Nickel Plated Steel Sheet In Batteries Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1.

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1.

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. undefined Nickel Plated Steel Sheet In Batteries Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1.

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1.

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. undefined Nickel Plated Steel Sheet In Batteries Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1.

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1.

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. undefined Nickel Plated Steel Sheet In Batteries Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1.

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1.

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. undefined Nickel Plated Steel Sheet In Batteries Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1.

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1.

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Toyo Kohan

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NIPPON STEEL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tata Steel

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TCC Steel

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Zhongshan Sanmei

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Jiangsu Jiutian

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nonfemet

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Yongsheng New Material

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Toyo Kohan

List of Figures

- Figure 1: Global Nickel Plated Steel Sheet In Batteries Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Nickel Plated Steel Sheet In Batteries Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: undefined Nickel Plated Steel Sheet In Batteries Revenue (million), by Application 2024 & 2032

- Figure 4: undefined Nickel Plated Steel Sheet In Batteries Volume (K), by Application 2024 & 2032

- Figure 5: undefined Nickel Plated Steel Sheet In Batteries Revenue Share (%), by Application 2024 & 2032

- Figure 6: undefined Nickel Plated Steel Sheet In Batteries Volume Share (%), by Application 2024 & 2032

- Figure 7: undefined Nickel Plated Steel Sheet In Batteries Revenue (million), by Type 2024 & 2032

- Figure 8: undefined Nickel Plated Steel Sheet In Batteries Volume (K), by Type 2024 & 2032

- Figure 9: undefined Nickel Plated Steel Sheet In Batteries Revenue Share (%), by Type 2024 & 2032

- Figure 10: undefined Nickel Plated Steel Sheet In Batteries Volume Share (%), by Type 2024 & 2032

- Figure 11: undefined Nickel Plated Steel Sheet In Batteries Revenue (million), by Country 2024 & 2032

- Figure 12: undefined Nickel Plated Steel Sheet In Batteries Volume (K), by Country 2024 & 2032

- Figure 13: undefined Nickel Plated Steel Sheet In Batteries Revenue Share (%), by Country 2024 & 2032

- Figure 14: undefined Nickel Plated Steel Sheet In Batteries Volume Share (%), by Country 2024 & 2032

- Figure 15: undefined Nickel Plated Steel Sheet In Batteries Revenue (million), by Application 2024 & 2032

- Figure 16: undefined Nickel Plated Steel Sheet In Batteries Volume (K), by Application 2024 & 2032

- Figure 17: undefined Nickel Plated Steel Sheet In Batteries Revenue Share (%), by Application 2024 & 2032

- Figure 18: undefined Nickel Plated Steel Sheet In Batteries Volume Share (%), by Application 2024 & 2032

- Figure 19: undefined Nickel Plated Steel Sheet In Batteries Revenue (million), by Type 2024 & 2032

- Figure 20: undefined Nickel Plated Steel Sheet In Batteries Volume (K), by Type 2024 & 2032

- Figure 21: undefined Nickel Plated Steel Sheet In Batteries Revenue Share (%), by Type 2024 & 2032

- Figure 22: undefined Nickel Plated Steel Sheet In Batteries Volume Share (%), by Type 2024 & 2032

- Figure 23: undefined Nickel Plated Steel Sheet In Batteries Revenue (million), by Country 2024 & 2032

- Figure 24: undefined Nickel Plated Steel Sheet In Batteries Volume (K), by Country 2024 & 2032

- Figure 25: undefined Nickel Plated Steel Sheet In Batteries Revenue Share (%), by Country 2024 & 2032

- Figure 26: undefined Nickel Plated Steel Sheet In Batteries Volume Share (%), by Country 2024 & 2032

- Figure 27: undefined Nickel Plated Steel Sheet In Batteries Revenue (million), by Application 2024 & 2032

- Figure 28: undefined Nickel Plated Steel Sheet In Batteries Volume (K), by Application 2024 & 2032

- Figure 29: undefined Nickel Plated Steel Sheet In Batteries Revenue Share (%), by Application 2024 & 2032

- Figure 30: undefined Nickel Plated Steel Sheet In Batteries Volume Share (%), by Application 2024 & 2032

- Figure 31: undefined Nickel Plated Steel Sheet In Batteries Revenue (million), by Type 2024 & 2032

- Figure 32: undefined Nickel Plated Steel Sheet In Batteries Volume (K), by Type 2024 & 2032

- Figure 33: undefined Nickel Plated Steel Sheet In Batteries Revenue Share (%), by Type 2024 & 2032

- Figure 34: undefined Nickel Plated Steel Sheet In Batteries Volume Share (%), by Type 2024 & 2032

- Figure 35: undefined Nickel Plated Steel Sheet In Batteries Revenue (million), by Country 2024 & 2032

- Figure 36: undefined Nickel Plated Steel Sheet In Batteries Volume (K), by Country 2024 & 2032

- Figure 37: undefined Nickel Plated Steel Sheet In Batteries Revenue Share (%), by Country 2024 & 2032

- Figure 38: undefined Nickel Plated Steel Sheet In Batteries Volume Share (%), by Country 2024 & 2032

- Figure 39: undefined Nickel Plated Steel Sheet In Batteries Revenue (million), by Application 2024 & 2032

- Figure 40: undefined Nickel Plated Steel Sheet In Batteries Volume (K), by Application 2024 & 2032

- Figure 41: undefined Nickel Plated Steel Sheet In Batteries Revenue Share (%), by Application 2024 & 2032

- Figure 42: undefined Nickel Plated Steel Sheet In Batteries Volume Share (%), by Application 2024 & 2032

- Figure 43: undefined Nickel Plated Steel Sheet In Batteries Revenue (million), by Type 2024 & 2032

- Figure 44: undefined Nickel Plated Steel Sheet In Batteries Volume (K), by Type 2024 & 2032

- Figure 45: undefined Nickel Plated Steel Sheet In Batteries Revenue Share (%), by Type 2024 & 2032

- Figure 46: undefined Nickel Plated Steel Sheet In Batteries Volume Share (%), by Type 2024 & 2032

- Figure 47: undefined Nickel Plated Steel Sheet In Batteries Revenue (million), by Country 2024 & 2032

- Figure 48: undefined Nickel Plated Steel Sheet In Batteries Volume (K), by Country 2024 & 2032

- Figure 49: undefined Nickel Plated Steel Sheet In Batteries Revenue Share (%), by Country 2024 & 2032

- Figure 50: undefined Nickel Plated Steel Sheet In Batteries Volume Share (%), by Country 2024 & 2032

- Figure 51: undefined Nickel Plated Steel Sheet In Batteries Revenue (million), by Application 2024 & 2032

- Figure 52: undefined Nickel Plated Steel Sheet In Batteries Volume (K), by Application 2024 & 2032

- Figure 53: undefined Nickel Plated Steel Sheet In Batteries Revenue Share (%), by Application 2024 & 2032

- Figure 54: undefined Nickel Plated Steel Sheet In Batteries Volume Share (%), by Application 2024 & 2032

- Figure 55: undefined Nickel Plated Steel Sheet In Batteries Revenue (million), by Type 2024 & 2032

- Figure 56: undefined Nickel Plated Steel Sheet In Batteries Volume (K), by Type 2024 & 2032

- Figure 57: undefined Nickel Plated Steel Sheet In Batteries Revenue Share (%), by Type 2024 & 2032

- Figure 58: undefined Nickel Plated Steel Sheet In Batteries Volume Share (%), by Type 2024 & 2032

- Figure 59: undefined Nickel Plated Steel Sheet In Batteries Revenue (million), by Country 2024 & 2032

- Figure 60: undefined Nickel Plated Steel Sheet In Batteries Volume (K), by Country 2024 & 2032

- Figure 61: undefined Nickel Plated Steel Sheet In Batteries Revenue Share (%), by Country 2024 & 2032

- Figure 62: undefined Nickel Plated Steel Sheet In Batteries Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Nickel Plated Steel Sheet In Batteries Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Nickel Plated Steel Sheet In Batteries Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Nickel Plated Steel Sheet In Batteries Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Nickel Plated Steel Sheet In Batteries Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Nickel Plated Steel Sheet In Batteries Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Nickel Plated Steel Sheet In Batteries Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Nickel Plated Steel Sheet In Batteries Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Nickel Plated Steel Sheet In Batteries Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Nickel Plated Steel Sheet In Batteries Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Nickel Plated Steel Sheet In Batteries Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Nickel Plated Steel Sheet In Batteries Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Nickel Plated Steel Sheet In Batteries Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Nickel Plated Steel Sheet In Batteries Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Nickel Plated Steel Sheet In Batteries Volume K Forecast, by Country 2019 & 2032

- Table 15: Global Nickel Plated Steel Sheet In Batteries Revenue million Forecast, by Application 2019 & 2032

- Table 16: Global Nickel Plated Steel Sheet In Batteries Volume K Forecast, by Application 2019 & 2032

- Table 17: Global Nickel Plated Steel Sheet In Batteries Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Nickel Plated Steel Sheet In Batteries Volume K Forecast, by Type 2019 & 2032

- Table 19: Global Nickel Plated Steel Sheet In Batteries Revenue million Forecast, by Country 2019 & 2032

- Table 20: Global Nickel Plated Steel Sheet In Batteries Volume K Forecast, by Country 2019 & 2032

- Table 21: Global Nickel Plated Steel Sheet In Batteries Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Nickel Plated Steel Sheet In Batteries Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Nickel Plated Steel Sheet In Batteries Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Nickel Plated Steel Sheet In Batteries Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Nickel Plated Steel Sheet In Batteries Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Nickel Plated Steel Sheet In Batteries Volume K Forecast, by Country 2019 & 2032

- Table 27: Global Nickel Plated Steel Sheet In Batteries Revenue million Forecast, by Application 2019 & 2032

- Table 28: Global Nickel Plated Steel Sheet In Batteries Volume K Forecast, by Application 2019 & 2032

- Table 29: Global Nickel Plated Steel Sheet In Batteries Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Nickel Plated Steel Sheet In Batteries Volume K Forecast, by Type 2019 & 2032

- Table 31: Global Nickel Plated Steel Sheet In Batteries Revenue million Forecast, by Country 2019 & 2032

- Table 32: Global Nickel Plated Steel Sheet In Batteries Volume K Forecast, by Country 2019 & 2032

- Table 33: Global Nickel Plated Steel Sheet In Batteries Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Nickel Plated Steel Sheet In Batteries Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Nickel Plated Steel Sheet In Batteries Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Nickel Plated Steel Sheet In Batteries Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Nickel Plated Steel Sheet In Batteries Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Nickel Plated Steel Sheet In Batteries Volume K Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nickel Plated Steel Sheet In Batteries?

The projected CAGR is approximately 10%.

2. Which companies are prominent players in the Nickel Plated Steel Sheet In Batteries?

Key companies in the market include Toyo Kohan, NIPPON STEEL, Tata Steel, TCC Steel, Zhongshan Sanmei, Jiangsu Jiutian, Nonfemet, Yongsheng New Material.

3. What are the main segments of the Nickel Plated Steel Sheet In Batteries?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1163 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nickel Plated Steel Sheet In Batteries," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nickel Plated Steel Sheet In Batteries report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nickel Plated Steel Sheet In Batteries?

To stay informed about further developments, trends, and reports in the Nickel Plated Steel Sheet In Batteries, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence