Key Insights

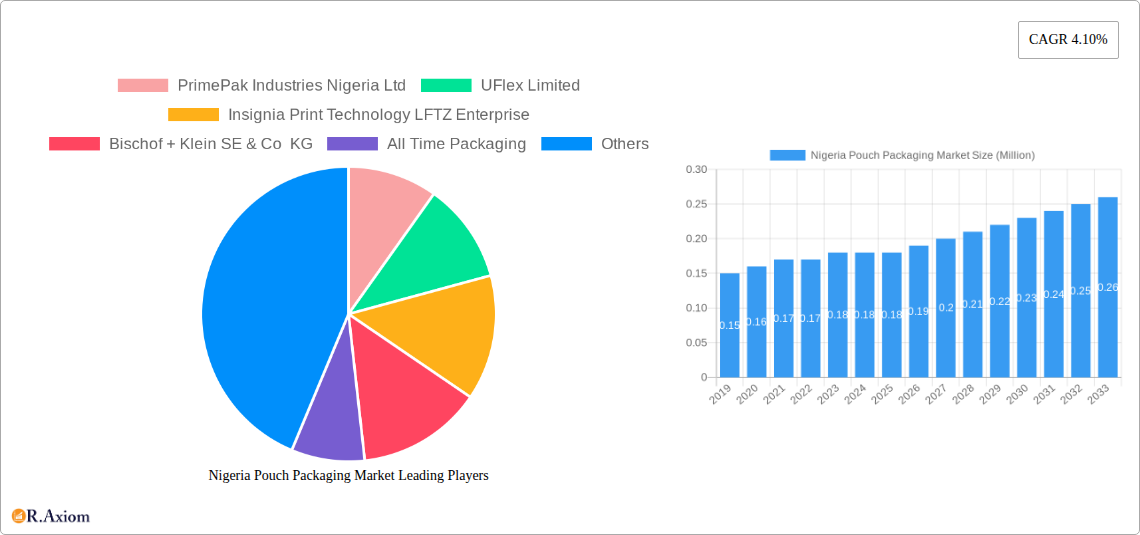

The Nigeria Pouch Packaging Market is poised for significant expansion, with a current estimated market size of $0.18 million. This growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of 4.10%, indicating a steady and consistent upward trend in demand for flexible pouch solutions. This expansion is primarily fueled by the increasing consumer demand for convenience, extended shelf life, and attractive packaging across various end-user industries, most notably food and beverages. The burgeoning middle class in Nigeria, coupled with a growing preference for pre-packaged goods and ready-to-eat meals, directly translates into a higher requirement for versatile pouch packaging. Furthermore, advancements in material science, leading to the development of more sustainable and functional packaging options like advanced plastics (Polyethylene, Polypropylene, PET, EVOH) and multi-layer structures, are also contributing to market dynamism. The medical and pharmaceutical sector, along with the personal care and household care segments, are also showing increasing adoption of pouch packaging due to its hygiene, portability, and cost-effectiveness.

Nigeria Pouch Packaging Market Market Size (In Million)

While the market is experiencing strong growth, certain restraints could influence the pace of expansion. These may include fluctuating raw material costs, particularly for plastics and aluminum, and potential challenges in the supply chain for advanced packaging materials. However, the inherent advantages of pouch packaging – lightweight nature, reduced material usage, and excellent barrier properties – continue to drive its adoption. The market is segmented by material into Plastic (encompassing various resins like Polyethylene, Polypropylene, PET, PVC, EVOH, and Other Resins), Paper, and Aluminum. The product segmentation highlights Flat (Pillow & Side-Seal) and Stand-up pouches as key formats. The end-user industry landscape is dominated by Food (with sub-segments including Candy & Confectionery, Frozen Foods, Fresh Produce, Dairy Products, Dry Foods, Meat, Poultry, And Seafood, Pet Food, and Others), followed by Beverage, Medical and Pharmaceutical, Personal Care and Household Care, and Other Industries. Key players such as PrimePak Industries Nigeria Ltd, UFlex Limited, and Insignia Print Technology LFTZ Enterprise are actively shaping the market through innovation and expanded production capacities. The focus on sustainable packaging solutions is also a growing trend that will likely influence future market developments.

Nigeria Pouch Packaging Market Company Market Share

Here's an SEO-optimized, detailed report description for the Nigeria Pouch Packaging Market, incorporating high-traffic keywords and adhering to your specified structure and constraints:

Nigeria Pouch Packaging Market Size, Share & Trends Analysis Report 2019-2033

This comprehensive report delves into the dynamic Nigeria pouch packaging market, offering in-depth analysis and strategic insights for stakeholders. Examining the period from 2019 to 2033, with a base year of 2025 and a detailed forecast period of 2025–2033, this report provides critical data on market size, growth drivers, segmentation, and competitive landscape. Our analysis is crucial for businesses seeking to capitalize on the burgeoning demand for flexible packaging solutions in Nigeria, covering key segments including plastic (Polyethylene, Polypropylene, PET, PVC, EVOH, Other Resins), paper, and aluminum materials; flat (pillow & side-seal) and stand-up product types; and end-user industries such as food (candy & confectionery, frozen foods, fresh produce, dairy products, dry foods, meat, poultry, and seafood, pet food, other food), beverage, medical and pharmaceutical, personal care and household care, and other end-user segments.

Nigeria Pouch Packaging Market Market Concentration & Innovation

The Nigeria pouch packaging market exhibits a moderate level of concentration, driven by a growing number of domestic and international players vying for market share. Innovation in this sector is primarily focused on enhancing barrier properties, sustainability, and functionality of pouch packaging to meet evolving consumer demands and regulatory requirements. Key innovation drivers include the demand for extended shelf-life products, convenience packaging, and eco-friendly materials. The regulatory framework, while evolving, plays a role in dictating packaging standards, particularly for food and pharmaceutical applications. Product substitutes, such as rigid containers, are present but face challenges in terms of cost-effectiveness and convenience compared to the growing adoption of flexible pouches. End-user trends are significantly shaping the market, with a strong emphasis on food and beverage applications, driven by population growth and changing lifestyles. Merger and acquisition (M&A) activities, though not yet at peak levels, are anticipated to increase as larger players seek to consolidate their market position and expand their capabilities. The estimated market share of leading players is approximately 35-45% consolidated, with M&A deal values projected to grow by 10-15% over the forecast period, indicating a strategic push for expansion and integration within the Nigerian pouch packaging industry.

Nigeria Pouch Packaging Market Industry Trends & Insights

The Nigeria pouch packaging market is experiencing robust growth, propelled by a confluence of economic, demographic, and technological factors. A significant CAGR of approximately 7.5% is estimated for the forecast period 2025–2033, reflecting the increasing adoption of flexible packaging solutions across various industries. Market penetration is steadily rising, particularly within the food and beverage sectors, where the demand for convenient, durable, and shelf-stable packaging solutions is paramount. Technological advancements in printing, material science, and barrier technologies are enabling the development of innovative pouch designs with superior product protection and extended shelf life. Consumer preferences are increasingly leaning towards single-serving pouches, resealable options, and sustainable packaging materials, all of which are driving product development and market expansion. Competitive dynamics are characterized by a mix of established local manufacturers and international players, leading to a dynamic market environment focused on price competitiveness, product quality, and customer service. The growing middle class and urbanization trends in Nigeria are further fueling the demand for packaged goods, directly translating to increased consumption of pouch packaging. Furthermore, the expansion of the e-commerce sector also necessitates reliable and protective packaging, further bolstering the market's growth trajectory. The overall trend points towards a market that is not only expanding in volume but also in sophistication and value-added offerings.

Dominant Markets & Segments in Nigeria Pouch Packaging Market

Within the Nigeria pouch packaging market, the Plastic segment, particularly Polyethylene (PE) and Polypropylene (PP), dominates due to its versatility, cost-effectiveness, and excellent barrier properties. These materials are widely employed across various applications, from everyday consumer goods to specialized industrial products. The Food end-user industry stands as the largest and most influential segment, accounting for over 50% of the market share. Within food, Dry Foods, Candy & Confectionery, and Dairy Products represent significant sub-segments, driven by consistent consumer demand and the need for extended shelf life.

- Dominant Material:

- Plastic (Polyethylene, Polypropylene): These materials offer a superior balance of cost, durability, and protection, making them the go-to choice for a wide range of products. Their adaptability in printing and sealing further enhances their appeal.

- Dominant Product Type:

- Flat (Pillow & Side-Seal) Pouches: These are widely used for their cost-effectiveness and efficiency in high-volume production, particularly for snacks, dry goods, and single-serve portions.

- Dominant End-User Industry:

- Food:

- Dry Foods: Essential for staples like rice, beans, flour, and pasta, where moisture and pest protection are critical.

- Candy & Confectionery: Eye-catching designs and barrier properties preserve freshness and appeal.

- Dairy Products: Pouches offer a safe and convenient alternative to traditional packaging for milk, yogurt, and cheese.

- Food:

- Key Drivers of Dominance:

- Economic Policies: Government initiatives supporting local manufacturing and agricultural processing boost demand for packaging materials.

- Infrastructure Development: Improved logistics and cold chain infrastructure facilitate the wider distribution of packaged food products.

- Consumer Demographics: A young and growing population with increasing disposable income drives demand for convenience and packaged goods.

- Food Safety Regulations: Stringent food safety standards necessitate the use of high-quality, protective packaging solutions.

- Technological Advancements: Innovations in plastic films and printing technologies allow for more sophisticated and appealing pouch designs.

The Beverage industry is the second-largest end-user, with a growing demand for convenient, portable, and safe packaging solutions, especially for juices and ready-to-drink beverages. The Medical and Pharmaceutical sector, while smaller, is a high-value segment driven by the critical need for sterile, tamper-evident, and high-barrier packaging to ensure product integrity and patient safety. The Personal Care and Household Care segment also contributes significantly, with pouches being used for detergents, soaps, and cosmetic products due to their cost-effectiveness and lightweight nature.

Nigeria Pouch Packaging Market Product Developments

Recent product developments in the Nigeria pouch packaging market are focused on enhancing sustainability, functionality, and consumer appeal. Innovations include the introduction of recyclable and compostable pouch materials, addressing growing environmental concerns. Advances in multi-layer film technology are providing superior barrier properties against oxygen, moisture, and light, thereby extending product shelf life, particularly for food and pharmaceutical applications. Stand-up pouches with resealable zippers and spouts are gaining traction for their convenience and consumer-friendliness. Enhanced printing technologies allow for vibrant graphics and high-resolution branding, crucial for shelf appeal in a competitive retail environment. The development of specialized pouches for specific applications, such as heat-sealable pouches for frozen foods and barrier pouches for sensitive pharmaceutical ingredients, highlights the market's responsiveness to niche demands.

Report Scope & Segmentation Analysis

This report offers an exhaustive segmentation of the Nigeria pouch packaging market. The Material segmentation covers Plastic (Polyethylene, Polypropylene, PET, PVC, EVOH, Other Resins), Paper, and Aluminum, with plastic expected to lead market share at approximately 65-70% in 2025. The Product segmentation includes Flat (Pillow & Side-Seal) and Stand-up pouches, with flat pouches currently holding a larger market share but stand-up pouches projected for higher growth. The End-User Industry segmentation encompasses Food (Candy & Confectionery, Frozen Foods, Fresh Produce, Dairy Products, Dry Foods, Meat, Poultry, and Seafood, Pet Food, Other Food), Beverage, Medical and Pharmaceutical, Personal Care and Household Care, and Other End-User Industries. The Food segment is projected to grow at a CAGR of 8.2% during the forecast period, with a market size of roughly $450 Million in 2025.

Key Drivers of Nigeria Pouch Packaging Market Growth

The Nigeria pouch packaging market's growth is significantly propelled by several key drivers. A rapidly expanding population and increasing urbanization are leading to a surge in demand for packaged goods, particularly convenience foods and beverages. Economic growth and a rising middle class are enhancing disposable incomes, enabling consumers to purchase more packaged products. Government support for local manufacturing and agriculture, through initiatives aimed at boosting domestic production and reducing import reliance, directly stimulates the demand for packaging solutions. Technological advancements in flexible packaging materials and printing capabilities are enabling manufacturers to offer more innovative, cost-effective, and visually appealing pouches. Furthermore, the growing e-commerce sector necessitates robust and secure packaging to ensure product integrity during transit.

Challenges in the Nigeria Pouch Packaging Market Sector

Despite the promising growth trajectory, the Nigeria pouch packaging market faces several challenges. Volatility in raw material prices, particularly for petroleum-based plastics, can impact manufacturing costs and profitability. Inadequate infrastructure, including inconsistent power supply and underdeveloped logistics networks, can lead to production disruptions and increased operational expenses. Limited access to advanced processing technology and skilled labor can hinder innovation and quality control for some manufacturers. Intense competition from both domestic and international players can put pressure on pricing and profit margins. Furthermore, evolving environmental regulations and the increasing demand for sustainable packaging solutions present both an opportunity and a challenge, requiring significant investment in research and development for eco-friendly alternatives.

Emerging Opportunities in Nigeria Pouch Packaging Market

The Nigeria pouch packaging market is ripe with emerging opportunities. The growing demand for sustainable and eco-friendly packaging presents a significant avenue for innovation, with opportunities in biodegradable and recyclable materials. The expansion of the processed food industry, driven by changing consumer lifestyles and a desire for convenience, offers substantial growth potential. The increasing adoption of e-commerce is creating a demand for specialized protective and tamper-evident pouch packaging. Opportunities also lie in catering to the burgeoning medical and pharmaceutical sectors with high-barrier, sterile packaging solutions. Furthermore, the development of customized and value-added packaging, such as those with smart features or enhanced shelf appeal, can unlock premium market segments.

Leading Players in the Nigeria Pouch Packaging Market Market

- PrimePak Industries Nigeria Ltd

- UFlex Limited

- Insignia Print Technology LFTZ Enterprise

- Bischof + Klein SE & Co KG

- All Time Packaging

- Packageit ng

- JC Packaging Ltd

- Radiant Packaging LLC

List Not Exhaustive

Key Developments in Nigeria Pouch Packaging Market Industry

- April 2024: Lagos, Nigeria, hosted the AgroFood and PlastPrintPack International Trade Show and Conference. The event drew participants from companies in China, Belgium, South Africa, and India, offering a platform that bolstered opportunities for Nigeria's agriculture packaging sector.

- March 2024: UFlex Limited, an Indian packaging company with operations in Nigeria, took part in Aahar 2024, a prominent food and hospitality fair in India. UFlex highlighted its prowess by exhibiting its range of food-grade flexible packaging pouches at the event.

Strategic Outlook for Nigeria Pouch Packaging Market Market

The strategic outlook for the Nigeria pouch packaging market is one of sustained growth and increasing sophistication. Key growth catalysts include the continued expansion of the food and beverage industries, driven by demographic shifts and evolving consumer preferences for convenience and quality. Investments in advanced manufacturing technologies and sustainable material development will be crucial for players seeking to maintain a competitive edge. The Nigerian government's focus on industrialization and local content development presents a favorable environment for domestic packaging manufacturers. Strategic partnerships and collaborations will likely emerge as companies seek to leverage expertise and expand their market reach. The increasing adoption of e-commerce and the growing demand for specialized packaging solutions for medical and pharmaceutical products represent significant future growth avenues. Overall, the market is poised for continued expansion, characterized by innovation, sustainability, and responsiveness to diverse end-user needs.

Nigeria Pouch Packaging Market Segmentation

-

1. Material

-

1.1. Plastic

- 1.1.1. Polyethylene

- 1.1.2. Polypropylene

- 1.1.3. PET

- 1.1.4. PVC

- 1.1.5. EVOH

- 1.1.6. Other Resins

- 1.2. Paper

- 1.3. Aluminum

-

1.1. Plastic

-

2. Product

- 2.1. Flat (Pillow & Side-Seal)

- 2.2. Stand-up

-

3. End-User Industry

-

3.1. Food

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Fo

- 3.2. Beverage

- 3.3. Medical and Pharmaceutical

- 3.4. Personal Care and Household Care

- 3.5. Other En

-

3.1. Food

Nigeria Pouch Packaging Market Segmentation By Geography

- 1. Niger

Nigeria Pouch Packaging Market Regional Market Share

Geographic Coverage of Nigeria Pouch Packaging Market

Nigeria Pouch Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Food Industry Growth in Nigeria to Drive Market Expansion; High Demand for Flexible Packaging Solutions to Drive Growth

- 3.3. Market Restrains

- 3.3.1. Food Industry Growth in Nigeria to Drive Market Expansion; High Demand for Flexible Packaging Solutions to Drive Growth

- 3.4. Market Trends

- 3.4.1. Standard Pouch Segment to Register the Fastest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria Pouch Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.1.1. Polyethylene

- 5.1.1.2. Polypropylene

- 5.1.1.3. PET

- 5.1.1.4. PVC

- 5.1.1.5. EVOH

- 5.1.1.6. Other Resins

- 5.1.2. Paper

- 5.1.3. Aluminum

- 5.1.1. Plastic

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Flat (Pillow & Side-Seal)

- 5.2.2. Stand-up

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Fo

- 5.3.2. Beverage

- 5.3.3. Medical and Pharmaceutical

- 5.3.4. Personal Care and Household Care

- 5.3.5. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PrimePak Industries Nigeria Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 UFlex Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Insignia Print Technology LFTZ Enterprise

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bischof + Klein SE & Co KG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 All Time Packaging

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Packageit ng

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 JC Packaging Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Radiant Packaging LLC*List Not Exhaustive 8 2 Heat Map Analysi

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 PrimePak Industries Nigeria Ltd

List of Figures

- Figure 1: Nigeria Pouch Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Nigeria Pouch Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Nigeria Pouch Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Nigeria Pouch Packaging Market Volume Billion Forecast, by Material 2020 & 2033

- Table 3: Nigeria Pouch Packaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 4: Nigeria Pouch Packaging Market Volume Billion Forecast, by Product 2020 & 2033

- Table 5: Nigeria Pouch Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Nigeria Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 7: Nigeria Pouch Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Nigeria Pouch Packaging Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Nigeria Pouch Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 10: Nigeria Pouch Packaging Market Volume Billion Forecast, by Material 2020 & 2033

- Table 11: Nigeria Pouch Packaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 12: Nigeria Pouch Packaging Market Volume Billion Forecast, by Product 2020 & 2033

- Table 13: Nigeria Pouch Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 14: Nigeria Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 15: Nigeria Pouch Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Nigeria Pouch Packaging Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria Pouch Packaging Market?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the Nigeria Pouch Packaging Market?

Key companies in the market include PrimePak Industries Nigeria Ltd, UFlex Limited, Insignia Print Technology LFTZ Enterprise, Bischof + Klein SE & Co KG, All Time Packaging, Packageit ng, JC Packaging Ltd, Radiant Packaging LLC*List Not Exhaustive 8 2 Heat Map Analysi.

3. What are the main segments of the Nigeria Pouch Packaging Market?

The market segments include Material, Product, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Food Industry Growth in Nigeria to Drive Market Expansion; High Demand for Flexible Packaging Solutions to Drive Growth.

6. What are the notable trends driving market growth?

Standard Pouch Segment to Register the Fastest Growth.

7. Are there any restraints impacting market growth?

Food Industry Growth in Nigeria to Drive Market Expansion; High Demand for Flexible Packaging Solutions to Drive Growth.

8. Can you provide examples of recent developments in the market?

April 2024: Lagos, Nigeria, hosted the AgroFood and PlastPrintPack International Trade Show and Conference. The event drew participants from companies in China, Belgium, South Africa, and India, offering a platform that bolstered opportunities for Nigeria's agriculture packaging sector.March 2024: UFlex Limited, an Indian packaging company with operations in Nigeria, took part in Aahar 2024, a prominent food and hospitality fair in India. UFlex highlighted its prowess by exhibiting its range of food-grade flexible packaging pouches at the event.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria Pouch Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria Pouch Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria Pouch Packaging Market?

To stay informed about further developments, trends, and reports in the Nigeria Pouch Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence